Internship program:

Internship program is the systematic process for gathering, recording and analyzing of data about the subject that a student goes to learn on the program. The aim of this Internship program is to connect practical knowledge with theoretical knowledge. Now the world is a competitive world. So everybody has to be expert in both practical knowledge and theoretical knowledge. By the grace of Almighty Allah and by the help of some related person, I have copleted my report successfully.

Now a day, education is not just limited to books and classrooms. In today’s world, education is the tool to understand the real world and apply knowledge for the betterment of the society as well as business. From education the theoretical knowledge is obtained from courses of study, which is only the half way of the subject matter. Practical knowledge has no alternative. The perfect coordination between theory and practice is of paramount importance in the context of the modern business world in order to resolve the dichotomy between these two areas. Therefore, an opportunity is offered by Dept. of Business, AsianUniversity of Bangladesh, for its potential business graduates to get three months practical experience, which is known, is as “Internship Program”. For the competition of this internship program, the author of the study was placed in a bank namely, “The Trust Bank Limited”. Internship Program brings a student closer to the real life situation and thereby helps to launch a career with some prior experience.

This paper is entitled “General Banking & Foreign Exchange Operation “originated from the fulfillment of the internship program. For the internship program, each student is attached with an organization. My internship was at Trust Bank Ltd, Dhanmondi branch. During my internship, I had to prepare a report under the Lecturer ………………………

- To exercise a significant importance as it enables a student to be accustomed with the business activities practically.

- To ensure the opportunity to work closely with the organization and learn about their capabilities, functions and limitations.

- To develop the students analytical skills, scholastic aptitude in their practical field.

- To give a real life orientation of the academic knowledge.

Objective of the study acts as a bridge between the starting point and the goals of the study. To illustrate the objectives properly, presented into two parts:

General:

The main objective of the study is to obtain a clear idea about the General banking and Foreign Exchange business of TBL’s banking operation.

Specific:

To observe the major outline of General and Foreign business.

To observe the foreign correspondents of TBL.

To observe the post import financing operations.

To analysis the expansion of Foreign Trade business of the TBL.

To identify the problems of it’s financing.

To problems faced by TBL in general banking and Foreign exchange Business.

Suggested remedial measures.

The Trust Bank Limited is one of the new generation banks in Bangladesh. The scope of the study is limited to the one branch of Trust Bank Ltd only. The Report has covered organizational structure; background, functions and the performance of the bank. Since I worked in general banking and in the foreign exchange division so my report covers all the activities of general banking and foreign exchange department of Trust Bank. While preparing this report I have taken information of the foreign exchange department and general banking department from employees and I have used both primary and secondary data which was available to me. But some information’s, which are confidential, I ignored in my report.

The study was not free of limitations. The limitations faced during the preparation of this report are given below:

There was lack of sufficient primary and secondary data.

The allotment of time for the study was limited i.e. Three months. Within this short period of time it was quite difficult for me to study properly about Trust Bank Ltd, Dhanmondi Branch and respective topic in details.

The data and information related with the topic was not easily available.

Another limitation of this report is Bank’s policy of not disclosing some date and information for obvious reason, which could be very much useful.

The Primary sources of Data:

Face to face conversation with the respective officer of the branch.

Face to face conversation with the clients.

Relevant file study as provided by the officers concerned.

Observation.

The Secondary sources of Data:

Annual Report 2007 of Trust Bank Limited.

Periodicals published by the Bangladesh Bank.

Different books, articles etc related with Foreign Exchange operations.

There are mainly three different types of researches. We should define my type from these three types of researches. The researches are:

Exploratory Research: The objective of exploratory research is to gather preliminary information that will help define the problem and suggest hypotheses.

Descriptive Research: In this type of research certain problem, operation and issue is analyzed in a descriptive manner and also fuscous on the finding and recommendations.

Causal Research: The objective of such type of research is to test hypotheses about cause and effect relationships.

After doing all the research work & analyze all those I can see that, I have done a descriptive type of research.

Report Design:

Descriptive Research:

I will try to identify the real problems and product categories for accurate description. Any source of information can be used in its strategy. More survey research and secondary source are needed.

The idea of setting up a Bank by Bangladesh Army was first conceived in 1987 and on November 29, 1999 the first branch of the Trust Bank Ltd came into operation. It was incorporated in June 1999 as a public limited company under the companies act 1994.

It started business operations in July 1999 with an authorized capital of Tk 1,000 million divided into 1 million ordinary shares of Tk 1,000 each. The bank’s initial paid up capital was Tk 200 million, 50% of which are held by Army Welfare Trust designated as group-A shareholder. The remaining 50% are held by the public designated as group-B shareholders.

The bank conducts all types of commercial banking activity. On 31 December 2000, total deposits of the bank amounted to Tk 1,111.2 million and the deposit-mix comprised savings deposit, current deposit and other accounts and fixed deposit. The bank introduced 3 deposit schemes namely Trust Target, Trust Double Deposit Scheme, and Trust Deposit Insurance Scheme. Total loans and advances of the bank stood at Tk 525.7 million in 2000. Trade finance was the main focus of lending. It had no classified loan up to the end of 2000. The foreign exchange business of the bank during the two years of its operations remained small and the estimated volume in 2000 was represented by imports financing Tk 150 million and foreign remittance Tk 150 million. The bank established correspondent relationships with 10 foreign banks.

In 2000, the value of all assets of the bank stood at Tk 1,949.3 million and the asset-mix included cash in hand, balance with other banks and financial institutions, money at call and short notice, investment in government treasury bills, loans and advances, premises and fixed assets and other assets. Assets sprung from off-balance-sheet items were valued at Tk 254.3 million. The total operating income of the bank in 2000 was Tk 107.7 million against a total operating expenditure of Tk 57 million resulting in a net profit of Tk 0.1 million.

The managing director is the chief executive of the bank. Although the bank was established under the sponsorship/auspices of the Army Welfare Trust and the members of the board of directors are from army, the bank is autonomous and it operates like other commercial banks working in Bangladesh.

The Trust Bank Limited is one of the leading private commercial Bank having a spread network of 31 branches across Bangladesh and plans to open few more branches to cover the important commercial areas of the country. In addition to ensuring quality customer services related to general banking the bank also deals in Foreign Exchange transactions. In the mean time the bank has extended credit facilities to almost all the sector of the country’s economy. The bank has plans to invest extensively in the country’s industrial and agricultural sectors in the coming days.

It has also plans to promote the agro-based industries of the country. The bank has already participated in syndicated loan agreement with other banks to promote textile sectors of the country. Such participation would continue in the future for greater interest of the overall economy. Keeping in mind the client’s financial and banking needs the bank is engaged in Islamic banking and constantly improving its services to the clients and launching new and innovative products to provide better services towards fulfillment of growing demands of its customers.

In this time the bank has already 31 branches in many different places in Bangladesh. Most of the branches are inside the cantonment area, because when they start their operation there main purpose was to serve the army. But with the current demand they try to go for vast banking. So for meeting up the demand they try to increase the number of brunches all over the Bangladesh.

Composition of the Board of TBL consists of Ex-officio Directors of in-service senior Army personnel, with the Chief of Army Staff as its Chairman and the Adjutant General as its Vice-Chairman

Chairman |

Vice Chairman |

Managing Director |

| Directors |

| Brig Gen S M Mahbubul Karim Dhaka Cantonment, Dhaka. | Brig Gen Muhammad Anisur Rahman, ndc,psc Dhaka Cantonment, Dhaka. |

| Brig Gen Md Rafiqul Islam, ndc, psc. Dhaka Cantonment, Dhaka. | Brig Gen Md Zillur Rahman, MCPS,MSC Dhaka Cantonment, Dhaka. |

| Brig Gen Md Shawkat Hossain, psc. Dhaka Cantonment, Dhaka. | Brig Gen Mohd Mahbubul Hasan, ndc,psc. Dhaka Cantonment, Dhaka. |

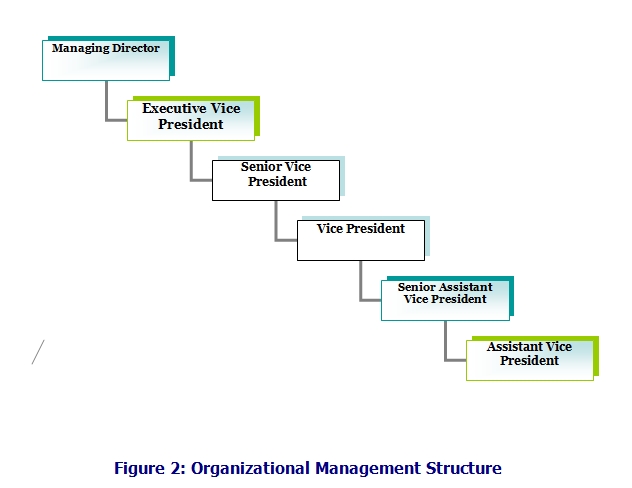

The management structure of the company has shown below through the organization structure diagram:

Bank Credit:

Outstanding bank credit (excluding foreign bills and inter-bank items) during FY2007 increased by Taka 211.63 billion or 14.7 percent as against an increase of 20.2 percent in FY2006. The rise was driven by both the growth in import & inland bills and increase in advances. Bill purchased and discounted increased by Tk. 21.57 billion or 15.1 percent in FY2007 due mainly to higher import price of crude petroleum and petroleum products. Advances increased by Tk.190.06 billion or 14.7 percent, as against an increase of 16.3 percent during FY2006.

Bank Deposits:

Bank deposits (excluding inter-bank items) increased by Tk.279.67 billion or 16.5 percent to Tk.1,969.57 billion during FY2007 against 18.5 percent increase in FY2006. The rise in total bank deposits is a result of increase in all types of deposits. The relatively higher growth rate of deposits may be attributed to upward revision of deposit rates.

Credit/Deposit Ratio:

The credit/deposit ratio of the scheduled banks, excluding the specialized banks, declined to 0.85 in May 2007 as compared to that of end June 2006.

Cash Reserve Ratio (CRR):

Cash Reserve Ratio (CRR) for the scheduled Banks with Bangladesh Bank remained same at 5 percent of their total demand and time liabilities since 1 October 2005. It may be noted that the banks are required to maintain CRR daily at the rate of 5 percent on average on bi-weekly basis, provided that CRR would not be less than 4 percent in any day with effect from 1 October 2005.

Statutory Liquidity Requirement (SLR):

Statutory Liquidity Requirement (SLR) for the scheduled banks, except banks operating under Islamic Shariah and the specialized banks, remained same at 18 percent of their total demand and time liabilities, excluding inter-bank items, since 1 October 2005. SLR for the Islamic banks remained unchanged at 10 percent.

Bank Rate:

The bank rate remained unchanged at 5.0 percent in FY2007.

Interest Rate on Deposit and Advances:

Weighted average interest rates on deposits of scheduled banks increased to 6.9 percent during FY2007 as compared to 6.7 percent in FY2006. Weighted average interest rates on advances also increased from 12.1 percent 12.8 percent. Both the increase kept pace with the tightened monetary stance of Bangladesh Bank. Spread between advance and deposit also increased to 5.9 percent in FY2007 from 5.4 percent in FY2006.

Consolidation of business and profit growth:

Bank’s overall businesses grew significantly in 2007 over that of 23006. Deposits of the Bank increased by around 42.75 percent and stood at Tk.27,102 million at the end of 2007. Loans and advances increased by 41.66 percent and stood at Tk.18,682 million at the end of the year. Import business increased by 54 percent, while export by 46 percent Both local and foreign remittances grew significantly. Increase in all the business parameters resulted in higher operating profit, which increased by 65.10 percent.

Achievement against business plan

(Figures in million taka)

| Particulars | Budget | Achievement | % of Achievement |

| Deposits | 22,500 | 27,102 | 120% |

| Loans and advances | 16,500 | 18,682 | 113% |

| Import – Local | 3,621 | 4,405 | 122% |

| Import – Foreign | 13,592 | 17,683 | 130% |

| Export – Local | 2,840 | 4,114 | 145% |

| Export – Foreign | 3,374 | 4,225 | 125% |

| Remittance – Local | 12,975 | 17,535 | 135% |

| Remittance – Foreign | 1,102 | 2,612 | 318% |

| Guarantee | 889 | 1,114 | 125% |

| Operating Profit | 700 | 854 | 122% |

Branch Expansion:

In line with our 5-year branch expansion plan, 5 new branches were opened in 2007, namely Mirpur and Karwan Bazar Branches at Dhaka. Naval Base Branch at Chittagong, Feni Branch and Joypara Branch at Dohar. The Board of Directors has planned to open 9 more branches in 2008. Since the Bank is passing through high-growth period, the Board of Directors has decided to open as many branches as possible during this high-growth period. Increase in number of branches will increase our market share in terms of deposits and loans which will ultimately enhance our profit.

Retail Banking Products:

Retail banking has enormous potential in Bangladesh. Visualizing a tremendous prospect, the Bank introduced 11 retail banking products, viz, home loan, car loan, any purpose loan, household durables loan, doctors’ loan, marriage loan, travel loan, CNG conversion loan, advance against salary, education loan and hospitalization loan. Out of the 11 products, home loan, car loan, any purpose loan and household durables loan comprise 35 percent, 30 percent, 20 percent and 11 percent respectively of the total retail loan portfolio. In order to give easy access to its products and provide best possible services at the customers’ doorsteps, our Bank introduced direct selling service by recruiting qualified and customer focused professionals. Retail loan portfolio at the end of the year stood at Tk.416 million.

SME Lending:

SME Sector has proved to be an effective vehicle for creating employment opportunity, reducing poverty and accelerating overall economic growth. With a view to ensuring balanced industrial development of the country, Bangladesh Bank has instructed to allocate tem percent of the total funds of Small and Medium Enterprises (SMEs) for women entrepreneurs which will proved them the opportunity of easy access to the institutional credit facilities under the comfortable terms and conditions. Visualizing the prospect of SME, the Bank has introduced seven (07) SME products. viz., Woman Entrepreneur Loan, Loan for Shopkeepers, Agri-business Loan, Poultry Farm Loan, Loan for Light Engineering, Entrepreneur Development Loan for Retirees, and Peak Seasons Loan. SME loan portfolio at the end of the year stood at tk.500 million.

Remittance Arrangement:

During the year the Bank signed money transfer agreement with 5 overseas exchange companies. As a result, remittance flow has increased significantly. Total remittance flow was Tk.2,612 million in 2007, as against Tk.765 million in 2006, registering as increase on 241.43 percent. But we have no room for complacency. We need more inward foreign remittance to bridge the gap between our import and export. Bank Management in continuously in touch with overseas exchange companies for remittance arrangement and getting good response.

Online Banking:

Our Bank has achieved noteworthy progress in the field of information technology during the year under review. In January 2007, the Bank successfully launched online banking services which facilitate any branch banking, ATM banking, phone banking SMS banking and internet banking. All the branches are currently using centralized banking software for their daily transaction processing and routine reporting. The Bank has subscribed to ATM VISA Debit and Credit cards, which is an important milestone in automation of our banking services. Besides, services like phone banking, SMS banking and internet banking have considerably reduced the customers’ pressure on the cash counters.

ATM and Debit Card:

The Bank has subscribed to VISA Electron (debit card), which enables the customers to withdraw money from their accounts through ATMs without turning to cash counters. The Bank is a member of Q-Cash ATM network which is a consortium of 14 member banks. At present, Q-Cash has 84 ATMs and 250 POS terminals throughout the country, out of which 8 ATMs are attached with our branches. Besides, the Bank has established itself as the settlement bank for the entire Q-Cash network.

Interface with other ATM networks:

Being the settlement bank for Q-Cash network, our Bank has played a lead role for expansion and sharing of ATM network with different banks at a competitive rate. For instance, Q-Cash has recently signed as quadr-party agreement with Duch-Bangla, Trust and Mercantile Bank to create a common transaction routing platform. Duch-Bangla Bank has 151 ATMs and 700 POS terminals nationwide. Besides, in November 2007, Q-Cash signed a similar agreement with BRAC Bank, which has a network of 64 ATMs and 500 POS terminals. Signing of these agreements will make 24-hour banking transactions flexible for the customers of all banks involved in this expanded network. By sharing the networks, participant banks will be able to eliminate per transaction toll charged by VISA, since the shared network of Q-Cash, Dutch-Bangla and BRAC Bank will be considered as a big network and transactions within this network will be settled locally.

Introduction of VISA Credit Card:

Eyeing a bright prospect, your Bank has successfully launched VISA credit cards to serve its existing and potential customers, although a very stiff competition is prevailing in the market. Presently, we are marketing five types of credit cards, viz., VISA Classic Local, VISA Classic International, VISA Gold Local, VISA Gold International and VISA Dual Card. We expect that sizable revenue will flow from credit cards.

Deposits:

In the year 2007 the deposits of the Bank shot up to Taka 27,102 million from Taka 18,986 million as recorded in the year 2006. The increase in deposits during this period was recorded as 42.75 percent. The combination of competitive interest rates, depositors’ trust in the Bank and mobilization efforts of the Bank management resulted in this growth of deposits. But there is no room for complacency; we have still a long way to go.

Loans & advance:

Total loans & advances of the Bank as on 31 December 2007 was Tk.18,682 million as against Tk.13,188 million in the year 2006, showing an increase by 41.66 percent over the preceding year. The credit portfolio of the bank is a mix of scheme loans, namely-Renovation and Reconstruction of Dwelling House (RRDH) Loan, Consumers Durable Scheme Loan (CDS), Marriage Loan, Car Loan, HBF Loan and Commercial Loan. Commercial Loans comprise Trade financing in the form of working capital and industrial loans (both large and medium scale industries) with both funded & non-funded credit facilities. The portfolio was further diversified to avoid risk of single industry concentration and remains in line with the Bank’s credit norms relating to risk quality. The classified loans & advances accounted for 2.71 percent of the total loans & advances against industry average of 5.50 percent (PCBs).

Total Assets:

Total assets of Bank stood at Tk.30,382 million in 2007 as against Tk.21,061 million in 2oo6 registering a growth of 44.26 percent . Increase in asset was

mainly driven by growth of customer deposits. The growth deposits were used for funding growth in credit and investment.

Investments:

The Banks investments grew by Tk.662 million during the year and stood at Tk.3,785 million at the end of 2007 as against Tk.3,123 million in 2006. The bank purchased government treasury bills to cover the increased SLR requirement. Out of the total investments, Tk309 million was invested in listed and unlisted shares of different companies.

Borrowing from other Banks, financial institutions:

Consolidated balance stood at Tk.244 million at the end of year, which represents Tk.230 million call loans from other banks and tk14 million refinance loans from Bangladesh Bank. The consolidated balance is much lower than that of 2006, which was tk.426 million.

Liabilities:

Consolidated liabilities of the Bank stood at Tk.28228 million at the end of 2007 as against Tk.19,906 million in 2006, registering a growth of 41.81 percent. Increase in liabilities was mainly due to about 42.75 percent increase in deposits over the corresponding year.

Capital Maintenance:

The amount of minimum capital that should be maintained by the Bank against its risk weighted assets is measured by the capital adequacy ratio laid down by Basel capital accord. capital adequacy is measured by the ratio of banks capital to risk weighted assets, both on balance sheet and off balance sheet transactions. All assets have been assigned weights from 0-100 percent. Off balance sheet items are included in the computation by converting them into balance sheet equivalents before a risk weight is allocated Banks capital has two components, Tier l (core capital) and Tier ll Supplementary Capital.

Core Capital (Tier l):

The core capital ratio (Tier l) was 10.69 percent of total risk weighted assets against standard of 5 percent. Core capital represents the paid up ordinary share capital, Share premium, statutory reserve and retained earnings. As on 31 December 2007, our core capital stood at Tk.2,093 million against Tk.1,155 million in 2006

Supplementary Capital (Tier ll):

Supplementary Capital represents asset revaluation reserve, general provision for loans and advances, preference share capital and other subordinated debt. At the close of business on 31 December 2007, our Supplementary Capital stood at tk.328 million.

Total Capital:

Therefore, our total capital stood at Tk.2,421 million against Tk.1,311 in 2006 and maintained a ratio of 12.37 percent of total risk weighted assets against the standard of 10 present. At the end of 2007, statutory Reserve of the Bank stood at tk.331 million as against Tk.215 million in 2006.

Shareholders Equity:

Total Shareholders equity increased by 86.49 percent and stood at tk 2,154 million at the end of 2007 as against Tk.1,155 million in 2006. The increase was due to conversion of sponsors share money deposit into paid up capital amounting tk 200 million , issue of primary shares to the general public amounting tk 700 million (including premium) and increase in statutory reserve. statutory reserve increased by tk 116 million.

Statutory reserve:

In accordance with the provision of bank companies Act, 20 percent of operating profit before tax is required to be transferred to statutory reserve . As such an amount of Tk. 116 million has been transferred to statutory reserve during the yeatr and the balance of the reserve stood at tk.331 million at the end of the year.

Profit and operating Result:

The bank earned operating profit of tk .854 million during 2007 as compared to tk 547 million in the immediate preceding year, registering a growth of 56.10 percent. After keeping tk.162 million as provision against calcified loans & advances, tk.63 million as against unclassified loans (1-5%) and tk 5 million as provision against special mention account (SMA), pre-tax profit stood at Tk. 580 million. After keeping income tax provision of Tk.341 million, net profit stood at Tk. 239 million. Earning per share was Tk..28.28. Accumulated retained earnings stood at Tk.362 million at the end of 2007.

Net Interest Income:

Net interest income registered a significant growth by 66.95 percent over the last year’s figure. Interest from loans and advances remained the principal component of interest income and interest pain on deposits was the main component of interest expenses.

Investment Income:

Investment income represents interest earned on treasury bills & bonds, interest on reverse repo, dividend income and capital gain from sale of listed securities. Income from investment grew significantly over that of the corresponding year; by 75.33 percent and the principal contribution came from capital gain of sale of shares.

Total Operating Expenses:

Total operating expenses increased by 59.55 percent during the year mainly due to increase in number of employees and number of branches. Increase in number of branches resulted in increase in business volume and increase in profit. Additional human resources had to be hired to support business growth.

Board of Directors:

The Board approves budget and reviews the business plan on quarterly basis to give directions as per changing economic and market environment. The Board also reviews the policies and manuals of various segments of business in order to establish effective risk management mechanism in all the operational activities of the Bank.

The Board also reviews the policies and guidelines issued by Bangladesh Bank and gives directions for their due compliance. During the year 2007 the Board met 13 times. Frequent meeting s of Board ensure better supervision and policy guidance to support the growth of business.

Executive Committee:

In order to discharge Board’s functions more effectively. the Board has constituted an Executive Committee comprising 3 Board members including the Vice Chairman. The Executive Committee scrutinizes the proposals that are sent to Board for its decision. The Executive Committee met 12 times during the year and played an instrumental role for the Board in approving the strategic plans and policy guidelines.

Audit Committee:

For ensuring transparency & accountability in the operations of the Bank, to ensure that the activities of the Bank are conducted within the framework of policies, principles and plans as laid down by the Board, as well as the guidelines of the regulatory authorities issued time to time, and Audit Committee is in place in accordance with Bangladesh Bank BPPD Circular No. 12 dated 23.12.2002. The Committee is headed by a senior Director’s The Committee has unrestricted access to all accounts, books and records to ensure that its job is conducted properly The Committee had 3 meetings during the year, boxes on which the Committee submitted its report to the Board regarding different aspects of the Bank.

Apart from the Audit Committee, the Board has appointed an independent auditor to assist both the Committee and the Board in discharging their supervisory function.

Delegation of Power:

Management enjoys absolute power in respect of recruitment, posting and promotion of manpower in accordance with Bangladesh Bank’s guidelines. In edition. Board has delegated adequate administrative, business and financial powers to Management for quick and efficient discharge of the Bank’s activities.

Compliance of Regulatory Guidelines:

Securities and Exchange Commission (SEC) issued corporate governance guidelines Notification dated 20 February 2006), on comply or explain basis, for the companies listed with stock exchanges. Through the said notification, SEC has asked the listed companies to report the compliance status of the said notification in the annual repot. Compliance report on the said corporate governance guidelines is given in annexure I, II & III.

CSR can be a key element and means for achieving greater business value in this competitive world. Trust Bank aims to be a socially responsible organization with an obligation to consider the interests of all the stakeholders in all aspects of its operation. This obligation is seen to extend beyond its statutory obligation to comply with legislation. Customers and public are very much aware of the CSR and demanding greater social accountability in these days. Recognizing this fact, business corporations, in greater number, are coming forward to perform CSR, where Trust Bank cannot lag behind.

Special reserve Fund:

As part of our CSR, the Board of Directors decided to establish a special reserve fund with contribution not exceeding 10 percent of Bank’s total income every year, in accordance with sub-section v of section 29 of income tax Ordnance, 1984. Government has already accorded its approval of the fund and hence contribution to the fund will be considered as allowable expense by the income Tax authority for determination of Bank’s tax liability. However, government has accorded its approval subject to the following conditions.

i) At least one Director from the public shareholders will have to be include in the Trustee Board of the fund; and

ii) Any contribution to the fund out of Bank’s profit, shall have to be approved by the shareholders in each cases.

The objects of the fund will be, among other things:

i) To provide stipend to the meritorious but poor students of different educational institutions;

ii) To provide medical and other assistance to the disadvantaged section of the society.

iii) To establish schools and health care centers for the underprivileged section of the society.

iv) To contribute during natural calamities.

Board of Directors proposes that 10 percent of Bank’s total income (as defined in the income Tax Ordinance) of the year 2008 may be contributed to the fund. In accordance with the conditions set by government the matter has been included on the agenda of 9th AGM for deliberation.

Humanitarian Assistance:

You are aware that two floods and one devastating cyclone (SIDR) in 2007 causes serious havoc to the country. National economy was badly affected and poor people suffered inhumanly. We had to respond to people’s call for humanitarian assistance. During the year Trust Bank contributed Tk. 2 million for the flood affected people and Tk.3 million for the SIDR affected people to Chief Adviser’s Relief Fund. Besides, employees of the Bank contributed Tk. 0.5 million to Army Relief Fund for SIDR affected people.

Promoting Sports:

In order to promote sports, Board of Directors has decided to sponsor a national sports event. Necessary fund will be allocated out of budget of 2008 after selecting the sports event.

Passport Application Processing:

In order to mitigate people’s sufferings in getting passport, the Government has decided to receive passport applications and deliver passports through banks. Trust Bank welcomed the government decision and offered to render the service at a subsidized fee, as part of its social responsibility. Initially four braces to Trust Bank were selected for the service under a pilot project. Later in nine more braces were added. People of the designated area are now getting passport without any hassle.

Credit Rating information and Services Limited (CRISL) upgraded its rating of the Bank for long term to A (pronounced as single A) in 2007 from A- (pronounced as A minus) in 2006. CRISL also upgraded short term rating of the Bank to ST-2 in 2007 from ST-3 in 2006. The up gradation was done due to Bank’s good fundamental and improvement in the areas of capital adequacy, market share, liquidity, leverage and loan loss provisioning. Financial institutions rated in this category, are adjudged to offer adequate safety for timely repayment of financial obligations. This level of safety indicates a bank entity with adequate credit profile. Risk factors are more variable and grater in periods of economic stress than those rated in the higher categories. The short term rating indicates high certainty of timely repayment. Liquidity factors a4re strong and supported by good fundamental protection factors. Risk factors are very small.

The accompanying profit and loss account depicts the operating result of the Bank for the year 2007. You are already aware that the Government has, in the mean time, amended the Bank Companies Act, 1991 requiring, among other things minimum capital plus statutory reserve to Tk.2,000 million for the Banks. Bangladesh Bank issued a circular on 5 November 2007 asking the banks to raise 50 percent of the shortfall within June 2008 and the reaming 50 percent by June 2009. Besides, Bangladesh Bank has imposed restriction on payment of cash dividend until the required capital with statutory reserve is met. Paid up capital along with statutory reserve of the Bank stood at Tk. 1,497 million as on 31 December 2007 and hence there remains a gap of Tk.503 million.

In order to bridge this gap, the Board of Directors has recommended or issuance of 10 percent bonus shares (i.e. one bonus share for every ten shares held) form the profit of 2007. The Board of Directors has also recommended for issuance of 20 percent right shares (i.e. one right share for every five shares held), subject to approval of Securities and Exchange Commission.

Figure 2: Frame of general Banking

Accepting Deposit:

Accepting deposits is one of the two classic functions of commercial banks. Most of the commercial banks view with one another to tapping the savings of the public by means of different kinds of deposits. Almost everyday a new kind of deposits is being introduced. Incase of TBL the deposits that are accepted may be classified into-

Procedures for Opening of Accounts:

Before opening of a current account or savings account, the following formalities must be completed by the customer,

Application on the prescribed form

Furnishing photographs

Introduction by an account holder

Putting specific signature in the specimen card

Mandate, if necessary.

After fulfilling the above formalities, TBL provides the customer a pay -in-slip book and cheque book.

In case of Joint account (two or more person):

- Operational instruction of the account.

- Signature(s).

In case of Partnership Firm:

- Partner’s signature.

- Partner’s name.

The following formalities along with the documents are to be completed before opening an account

- Two copies of photograph of the Account Holder(s) duly attested by the introducer.

- Account to be introduced properly.

- Introducer’s signature on Account Opening Form to be verified by an officer under full signature.

- Letter of thanks to account Holder(s) and introducer to be sent under registered post,

- In case of joint account, operational instructions are to be signed by the joint account holders.

In case of proprietorship firm:

- Declaration of proprietorship.

- Trade license from municipality.

- Account Agreement Form.

- Mandate if Operation by third party is to be allowed.

In case of limited company:

- Certified true copy of the memorandum & Article of Association of the company.

- Certificate of Incorporation of the company for inspection and return with a duly certified photocopy for bank’s record.

- Certificate from the Register of the Joint Stock Companies that the company is entitle to commence business (in case of Public Limited Co. for inspection and return) along with a duly certified photocopy for Bank’s records,

- Latest copy of company’s Income Statement.

- Extract of Resolution of the Board, General Meeting of the company for opening the account and authorization for its operation duly certified by the Chairman/Managing Director of the company.

- List of Directors with addresses (a latest photocopy of the form-xii)

- Authorized signature,

- Name.

General conditions of governing Current/Savings Account:

- Minimum Balance of to be maintained in current account TK.1000/- and in Savings account tk.5000/-

- A suitable instruction by an introducer acceptable to the Bank is required prior to opening an account.

- Recent photographs of the Account openers duly attested by the Introducer must be produced.

Issue of Duplicate Cheque Book:

Duplicate cheque book in lieu of lost one should issued only when an A/C holder personally approaches the bank with an application in the prescribed Proforma agreeing to indemnify the bank for the lost cheque book. Fresh cheque book in lieu of lost one should be issued after verification of the signature of the A/C holder from the specimen signature card and on realization of required excise duty only with prior approval of manager of the Branch. Cheque series number of the new cheque book should be recorded in ledger card and signature card as usual. Series number of lost cheque book should be recorded in the stop payment register and caution should be exercised to guard against fraudulent payment.

Closing of an Account:

The closing of an account may happen

It the customer is desirous to close the account.

If bank finds that the account is inoperative for a long duration.

If Garnishee Order is issued by the court on Bank TBL.

To close the account, the cheque book is to be returned to the bank, TBL take all charges by debiting the account and the remaining balance is then paid to the customer, necessary entries are given to the account closing register and computer.

Interest rate on deposit:

INTEREST RATES ON DEPOSITS OF THE BANK | ||

Type of Deposit | Period | Rate of Interest |

Savings Account | Any amount for any period | 8% (on minimum monthly balance) |

STD Account | Any amount for any period | 5.00% |

INTEREST RATES ON FIXED DEPOSITS | ||

Type of Deposit | Period | Rate of Interest per Annum |

FDR | 1 month (for any amount) | 11% |

FDR | 3 months (any amount) | 11.25% |

FDR | 6 months (any amount) | 11.50% |

FDR | 1 year & Above (any amount) | 12.00% |

Loan & Advance Department:

Credit policy and lending criteria:

The credit policy is a statement of basic principles that governs the extension of credit policy has two tears as follows:

Macro level: Government & Bangladesh Bank.

Micro level: Individual bank and institution.

Micro level policy is designed by the individual credit institution keeping macro level policy in mind, but looks into the greater interest of the organization.

When we talk about credit policy of TBL it provides a framework how to conduct business and also enables TBL to have long-term business plan. It is a document through which board of directors communicate the lending strategy of TBL and duties and authorities of management of lending officers.

Mission:

TBL credit mission is to actively participate in the growth and expansion of our national economy by providing credit to viable borrower, efficiently delivered and competitively priced.

Client based:

Private individual-firms,

Companies corporate and

Industrial enterprises

Product and Service:

Trade finance

Short term credit

Retail banking loan

Syndication

Corresponding banking and

Treasury services

Legal consideration:

TBL complies with the all the laws and act of the country including central banks instruction relating to banks.

General Policy Guideline:

TBL makes loan to reputed clients.

Encourages lending to socially desirable, nationally important and financially viable sector.

Satisfactory security and collateral is required including source of repayment both primary and secondary source.

TBL may consider term loans with maturity up to five year.

TBL extends credit facilities to the area, which the branch located and size and ability of its stuff to supervise and monitor the same also considered.

Maximum size of the loan port folio.

The banking corporation act 1991 restricts lending to any single obligator or a group of companies up to 15% of the capital funds of bank without having approval from Bangladesh bank. With the Bangladesh bank the maximum limit can go up to 100% of the capital of the bank.

Profitability:

The business concerns must generate profit so that they can repay the principal amount along with the interest and their charges are also recoverable by the bank.

Sources of Repayment:

It should be ensured a reliable source of repayment exists and the advance will be paid within the agreed period. May be primary sources directly relates to the relative business concern secondary source may be from others secondary concerns or from liquidation of other asset

- Character ability of borrower.

- Customer integrity honesty and personal capacity.

- Customer experience, managerial capacity.

- Past success history of the borrower.

- Borrower should have business acumen initiative and drive.

Purpose of the facility:

Purpose of the facility should be allowable sector identified by the corporate office and keeping conformity with Bangladesh bank rules and regulation.

Terms of the facility:

- Nature of the loans and advance.

- Interest rate.

- Period of the advance.

- Security agreement.

Credit Approval procedures:

Credit process and structure:

The organization structure has two levels

Branch and

Corporate office.

The credit line proposal move through various management approval levels according to its amount. There are three approval levels:-

Branch manager.

Credit committee at corporate office.

Board of directors of the bank.

Credit approval process:

In all cases the banks basic lending criteria must be satisfied and its policy of know your customer implemented in full.

While compiling credit line proposal, the following guidelines must be followed:

All required information/papers are to be obtained along with loan application form duly filled in from the client.

- Visiting the client.

- CIB report.

- Credit appraisal.

- Credit risk analysis.

- Preparation of credit line proposal with supporting documents.

- Sanction/approval by competent authority.

Documentation & Disbursement of Credit:

Loan and credit facilities must be supported by proper documentation. Documentation should be obtained prior to disbursement of any loan.

The minimum requirement for documentation of Loan or other facilities is as under

Copies of the relative office note/sanction letter indicating that the transaction has been approved by properly authorized officers of the bank.

A copy of sanction advice addressed to the customer and his acceptance there of.

All necessary documentation required meeting the terms and conditions of the facility in the manner it was approved.

Apparently there are three parts of documentation, namely-

Obtaining instrument/documents charge documents standard documentation & other specified document as specified documents as specified by bank lawyer.

- Stamping

- Execution & Registration.

Documents to be executed signed by the parties concerned competent to do so either in official or in personal capacity as the case may be in some case such documents are required to be executed in presence of witness.

Control of Credit Operation:

The credit control operation falls into two main parts-

Regular monitoring of all accounts and review all excess over limits.

Monitoring of delinquent accounts.

Delinquent advances:

Delinquent advances may be described as any advance which may have entered the doubtful category and there of requires special monitoring at branch and at corporate office.

Signals that either confirms that the borrower is in the doubtful category or indicate that he may over trading

All fall in turnover indicating that business is in decline.

Defaulting in loan repayment or in payment of bills payable at maturity date indicating that a business may be in financial difficulties.

Loan Classification & Provisioning:

Bangladesh Bank has introduced a system covering loan classification the suspension of interest due, and the making of provisions against potential loan loss, which is to be followed by all scheduled banks operating in Bangladesh. All loans and advances have been classified into four categories as under

Continuous Loan (overdraft cash credit etc)

Demand Loan (PAD,LIM FBP etc)

Fixed term Loan.

Short Agriculture and micro credit.

Assets quality ratings break down into two main categories:

- Satisfactory

- Delinquent/classified.

Delinquent/classified assets comprise:

- Sub standard

- Doubtful

- Bad and loss

- Provisions:

- Sin standard 20%

- Doubtful 50%

- Bad & loss 100%

- General provision 1%

INTEREST RATES ON LOANS AND ADVANCES OF THE BANK :

INTEREST RATES ON LOANS AND ADVANCES OF THE BANK | |

Particulars of Sector | Lending rate of Interest(Mid Rate) % P.A. |

| 1.Agricultural/Agrobased industry: | – |

| a)Loan to Primary Producer | 10.00-11.00 |

| b)Loan to Agricultural Input Traders / Fertilizer Dealers / Distributors | 10.00 |

| c.Agro processing industries/firms | 10.00 |

| 2.Large & Medium scale industries(Term loan) | 16.00 |

| 3.Working Capital : a) Jute b) Other than Jute | 11.00 (Jute) 17.00 (Other than Jute) |

| 4.Export Finance : a) Jute & Jute Products d) Other Exports | 7.00 |

| 5.Commercial Lending : a)Loan against work order and brick manufacturing b) Commercial loan (Garments) c) Commercial loan (Others) d) Small & Medium Scale Industries | 16.00(for a) 15% (for b.)& 16.50(for c.) & 17% (for d.) |

| 6.Term Loan : a) Small & Cottage Industries | 14.00 |

| b) Urban Housing (Residential) | 15.00 |

| c) Urban Housing (Commercial) | 16.00 |

| d) Loan for Dwelling house repair and reconstruction | 12.00 |

| e) Transport Loan | 17.00 |

| f)Consumer Durable Scheme | 17.00 |

| g)Car & Marriage Loan Scheme | 12.00 |

| h)House Building Scheme Loan for in service Army Officers | 11.00 |

| 7.Loan against FDR issued by TBL: | 2.50% above FDR rate |

| 8.Loan against WEDB/ Savings Certificates & other allowable Financial securities issued by TBL | 13.00 |

| 9.Loan against lien of FDR / Savings Certificates / WEDB & other allowable instruments issued by other Banks / Financial Institutions | 14.50 |

Clearing Department:

TBL is a scheduled Bank. According to the Article 37(2) of Bangladesh Bank Order, 1972, the banks which are the member of the “Clearing House” are called as Scheduled Banks. The scheduled banks clear the cheque drawn upon one another through the clearing house. This is an arrangement the central bank where everyday the representative of the member banks gathers to clear the cheque. The place where the banks meet and settle their dues is called the Clearing-House sits for two times a working day.

Performance at a Glance:

The Trust Bank Limited has diversified activities in retail banking, corporate banking and international trade. From the very beginning it has obtained a solid foundation in respect of foreign trade. The bank is now moving forward for the better future position in the field of foreign exchange and in the money market of the Bangladesh.

The performance of the Trust Bank Limited for last three years depicted a true success story of the bank. The deposits indicated the increase of its performance and reliability of the bank to the customer. It has controlled its loans and advances with a significant way of banking. The amount of investment shows the higher upscale line through the year. The final figure has projected when we look at the profit amount of those three years. The amount sharply goes double in these three years.

3 years at a glance

Particulars

2005

2006

2007

Income Statement (Taka in Million)Net Interest Income

167.07

400.00

667.80

Net Non-interest Income

129.19

146.90

185.91

Profit before provision and tax

296.26

546.90

853.71

Provision for loans and assets

69.98

39.20

273.94

Profit after provision before tax

226.29

507.70

579.77

Tax including deferred tax

105.00

244.54

340.74

Profit after tax

121.29

263.16

239.03

Balance SheetAuthorized Capital

2,000.00

2,000.00

2,000.00

Paid-up Capital

500.00

500.00

1,166.67

Total Shareholder’s equity

991.97

1,155.00

2,154.29

Deposits

12,704.90

18,985.95

27,101.59

Long-term liabilities

2,664.12

7,135.03

3,335.77

Loans and advances

9,738.32

13,188.09

18,682.16

Investments

2,447.95

3,122.81

3,785.45

Property, Plant and Equipment

110.62

146.05

194.22

Earning Assets

13,708.73

18,608.06

27,636.29

Total assets

14,782.15

21,060.77

30,382.22

Debt equity ratio

18.48%

17.23%

13.10%

Other BusinessImport

9,746.00

11,483.00

17,683.17

Export

2,911.00

2,884.00

4,224.55

Remittance

279.00

765.00

2,612.00

Guarantee Business

1,627.29

726.51

1,114.84

Capital MeasuresTotal risk weighted assets

8,925.76

14,075.99

19,573.21

Core capital (Tier-I)

991.97

1,155.00

2,092.89

Core capital (Tier-II)

123.10

155.95

328.43

Total Capital

1,115.07

1,310.95

2,421.32

Tier-I capital ratio

11.11%

8.21%

10.69%

Tier-II capital ratio

1.38%

1.11%

1.68%

Total capital ratio

12.49%

9.32%

12.37%

Credit QualityNon performing loans (NPLs)

128.97

174.37

506.65

% of NPLs to total loans and advance

1.32%

1.32%

2.71%

General Provision

118.88

152.95

264.03

Specific Provision

56.90

63.68

225.84

Share InformationMarket price per share (Taka)

–

–

929.25

Earning per share (Taka)

24.26

52.63

28.28

Net assets per share (Taka)

198.39

231.00

184.64

Price earning ratio (times)

–

–

3.04%

Operating Performance RatioNet interest margin on average earning assets

1.33%

2.48%

2.89%

Net non-interest margin on average earning assets

1.03%

0.91%

0.80%

Cost income ratio

79.49%

75.32%

73.93%

Return on average equity

13.02%

24.51%

14.45%

Other informationNo of Branches

18

26

31

No of employees

359

508

842

No of foreign correspondents

15

19

19

Average earning assets

12,559.49

16,158.39

23,122.18

Average total assets

13,420.93

1,921.46

25,721.50

Average deposits

11,009.93

15,845.43

23,043.77

Average equity

931.33

1,073.49

1,564.65

Net Interest Income:

Year | Net Interest Income (Taka) |

| 2005 | |

| 2006 | |

| 2007 |

Bar Presentation of the corresponding three years’

Net Interest Income

Foreign Remittance:

Foreign Remittance handled by the bank stood at taka 567,714 during the year 2002. Countries from which inward foreign remittances were received included USA, UK, China, Singapore etc.

Foreign Exchange Business – Remittance:

Year | Remittance (Taka) |

| 2005 | |

| 2006 | |

| 2007 |

Bar Presentation of the corresponding three years’

Foreign remittance Handling

Net Profit after Tax:

Year | Net Profit after Tax (Taka) |

| 2005 | |

| 2006 | |

| 2007 |

Bar Presentation of the corresponding three years’

Net Profit after Tax

Earning Per Share (EPS):

Year | Earning per Share (Taka) |

| 2005 | |

| 2006 | |

| 2007 |

Bar Presentation of the corresponding three years’

Earning per Share (EPS)

HIGHLIGHTS ON THE OVERALL ACTIVITIES OF THE BANK

Sl. | Particulars | Base | 2007 | 2006 |

1 | Paid up Capital | Taka | 1,166,670,000 | 500,000,000 |

2 | Total Capital | Taka | 2,421,322,741 | 1,310,210,320 |

3 | Capital surplus/ (deficit) | Taka | 464,001,641 | 44,108,286 |

4 | Total Assets | Taka | 30,382,222,281 | 21,197,592,200 |

5 | Total Deposits | Taka | 27,101,585,101 | 18,985,951,094 |

6 | Total Loans and Advances | Taka | 18,682,164,654 | 13,188,092,885 |

7 | Total Contingent Liabilities and Commitments | Taka | 8,764,455,749 | 7,885,364,349 |

8 | Credit Deposit Ratio | % | 68.93 | 69.46 |

9 | Percentage of classified loans against total loans and advances | % | 2.71 | 1.32 |

10 | Profit after tax and provision | Taka | 239,028,693 | 262,695,349 |

11 | Amount of classified loans during current year | Taka | 332,279,970 | 45,402,353 |

12 | Provisions kept against classified loan | Taka | 225,837,248 | 63,676,000 |

13 | Provision surplus/deficit | Taka | – | – |

14 | Cost of fund | % | 8.43 | 8.28 |

15 | Interest earning Assets | Taka | 27,636,293,247 | 18,608,058,132 |

16 | Non-interest earning Assets | Taka | 2,745,929,034 | 2,589,534,068 |

17 | Return on Investment (ROI) | % | 9.87 | 20.05 |

18 | Return on Asset (ROA) | % | 0.79 | 1.24 |

19 | Incomes from Investment | Taka | 299,490,240 | 170,817,002 |

20 | Earning per Share | Taka | 28.28 | 52.54 |

21 | Net income per Share | Taka | 28.28 | 52.54 |

22 | Price Earning Ratio | % | 3.04 | N/A |

Foreign trade can be easily defined as a business activity, which transcends national boundaries. These may be between parties or government ones. Trades among nations are a common occurrence and normally benefit both the exporter and importer. In many countries, international trade accounts for more than 20% of their national incomes.

Foreign trade can usually be justified on the principle of comparative advantage. According to this economic principle, it is economical profitable for a country to specialize in the production of that commodity in which the producer country has the greater comparative advantage and to allow the other country to produce that commodity in which it has the lesser comparative advantage. It includes the spectrum of goods, services, investment, technology transfer etc.

This trade among various countries causes for close linkage between the parties dealing in trade. The bank which provides such transactions is referred to as rendering international banking operations. International trade demands a flow of goods from seller to buyer and of payment from buyer to seller. And this flow of goods and payment are done through letter of credit (L/C).

Foreign Exchange transactions are being controlled by the following rules & regulation:

Local Regulation

Foreign Exchange Act 1947

Bangladesh Bank issues Foreign Exchange circular from time to time to control the export, import and remittance business

Ministries of Commerce issues export & import policy giving basic formalities for import & export business

Sometimes CCI & E issues public notice for any kind of change in foreign exchange transaction.

Bangladesh Bank published two volumes in 1996. This is compilation of the instructions to be followed by the authorized dealers in transactions related to foreign exchange.

International Regulation for Foreign Exchange

There is some international organization influencing our foreign exchange transactions. There are-

International chamber of commerce (ICC) is a world wide non-governmental organization of thousands of companies. It was founded in 1919. ICC has issued some publication like UCPDC, URC and URR etc, which are being followed by all the member countries. There is also an international court of arbitration to solve the international business disputes.

World trade organization (WTO) is another international trade organization established in 1995. General Agreement on Tariff & Trade (GATT) was established in 1948, after completion of its 8th round the origination has been abolished and replaced by WTO. This organization has role in international trade, through its 124 member countries.

Foreign Exchange Mechanism:

Foreign Exchange department plays significant roles through providing different services for the customer. Facilitating the trade with foreign country is the most important among those services the key instrument which facilitates this trade is L/C (Letter of Credit).

Letter of credit:

Letter of Credit may be defined as an arrangement or guarantee issued by a bank at the request of the customer to make payment to or order of the beneficiary or authorized another bank to effect such payment or to pay, accept or negotiate such bill of exchange against stipulated documents, provided that the terms and conditions of the L/C are complied with (UCPD-500, 1993).

The Advising Bank:

It is the bank in the Exporter’s (Normally the exporter’s bank), which is usually the foreign correspondent of Importer’s bank through which the L/C is advised to the supplier. If the intermediary bank simply advises/notifies the L/C to the exporter without any obligation on its part, it is called “Advising Bank”.

The Confirming Bank:

If the Advising Bank also adds its own undertaking to honor the credit while advising the same to the beneficiary, he becomes the Confirming Bank, in addition, becomes liable to pay for documents in conformity with the L/C’s terms and conditions.

The Negotiating Bank:

The bank that negotiates the bill of exporter drawn under the credit is known as Negotiating Bank. If the advising bank is also authorized to negotiate the bill drawn by the exporter, he becomes the Negotiating Bank.

The Accepting Bank:

A Bank that accepts time or unasked drafts on behalf of the importer is called an Accepting Bank. The issuing bank can also be the Accepting Bank.

The Paying Bank & the Reimbursing Bank:

If the Issuing Bank does not maintain any account with a bank that a bank will be negotiating the documents under a L/C, then arrangement is made to reimburse the negotiating bank for the amount to be paid under from some other bank with which the Issuing Bank maintains his account. The letter bank is know as Reimburse Bank.

Figure 3: Foreign Exchange Mechanism

As more than one currency is involved in foreign trade, it gives rise to exchange of currencies which is known as foreign exchange. The term “Foreign Exchange” has three principal meanings Firstly it is a term used referring to the currencies of the other countries in terms of any single one currency. To a Bangladeshi, Dollar, Pound sterling etc. are foreign currencies and as such foreign exchange. Secondly, the term also commonly refer to some interments used in international trade, such as bill of exchange, Drafts, Travel cheque and other means of international remittance thirdly, the terms foreign exchange is also quite of ten referred to the balance in foreign currencies held by a country.

In terms of section 2(d) of the foreign exchange regulations 1947, as adopted in Bangladesh, Foreign Exchange means foreign currency and includes any instrument drawn, accepted made or issued under clause (13) of article 16 of the Bangladesh Bank order, 1972, all the deposits, credits and balances payable in any foreign currency and draft cheque, letter of credit and bill of exchange expressed or drawn in Bangladesh currency but payable in any foreign country.

In exercise of the power conferred by section 3 of the foreign exchange regulation, 1947, Bangladesh Bank issues license to schedule bank to deal with exchange. These banks are known a Authorized Dealers. Licensees are also issued by Bangladesh Bank to persons or firms to exchange foreign currency instruments such as T.C, currency notes and coins. They are known as Authorized money changers.

Functions of Foreign Exchange Department:

Exports:

- Pre-shipment advances.

- Purchase of foreign bills.

- Negotiating of foreign bills.

- Export guarantees.

- Advising/Confirming letters – letter of credit.

- Advance for deferred payments exports.

- Advance against bills for collection

Imports:

- Opening of letter of credit (L/C)

- Advance bills.

- Bills for collection.

- Import loan and guarantees

Remittances:

- Issue of DD, MT, TT etc.

- Payment of DD, MT, TT etc.

- Issue and enhancement of traveler’s cheque.

- Sale and enhancement of foreign currency notes.

- Non-resident accounts.

The most commonly used documents in Foreign Exchange:

- Documentary Letter of Credit.

- Bill of exchange.

- Bill of Leading.

- Commercial Invoice.

- Certificate of origin of goods.

- Inspection certificate.

- Packing List.

- Insurance Policy.

- Proforma Invoice / Indent.

- Master receipt.

- GSP Certificate.

Documentary Credit:

In simple terms a documentary credit is a conditional bank undertaking a payment. Expressed more fully, it is a written undertaking by a bank (issuing bank) given to seller (beneficiary) at the request, and in accordance with the instructions of the buyer (applicant) to effect payment (that is, by making a payment, or accepting or negotiating bill of exchange) up to a stated sum of money, with in a prescribed time limit and against stipulated documents. The customary clauses contain in a L/C are the followings:

A clause authorizing the beneficiary to draw bills of exchange up to certain on the opener.

List of shipping documents, which are to accompany the bills.

Description of the goods to be shipped.

An undertaking by the opening bank that bills drawn in accordance with the conditions will be dully honored.

Instructs to the negotiating banks for obtaining reimbursement of payments under the credit.

The parties to a Letter of Credit are:

- Importer / Buyer.

- Opening Bank/Issuing Bank.

- Exporter/Seller/Beneficiary.

- Advising Bank/Notifying Bank.

- Negotiating Bank.

- Confirming Bank.

- Paying/Reimbursing Bank.

Bill of Leading:

A bill of leading is a document that is usually stipulated in a credit when the goods are dispatched by sea. It is evidence of a contract of carriage, is a receipt for the goods, and is a document of title to the goods. It also constituted a document that is, or may be, needed to support an insurance claim.

The Details on the bill of Leading should include:

- A description of the goods in general terms not inconsistent with in the credit.

- Identify marks and numbers, if any.

- The name of the carrying vessel.

- Evidence that the goods have been loaded on board.

- The ports of shipment and discharge.

- The names of shipper, consignee, and name and address of the notifying party.

- Whether freight has been [paid or is payable at destination.

- The number of original bills of lading issued.

- The date of issuance.

- A bill of lading specifically states that goods are loaded for ultimate destination specifically mentioned in the credit.

Commercial Invoice:

A Commercial Document is the accounting document by which the sellers change the goods to the buyer. A commercial invoice normally includes the following information:

Date.

Name and address of the buyer and seller.

Order of contract number, quantity and description of the goods, unit price and the total price.

Weight of the goods, number of the package, shipping marks and numbers.

Terms of delivery and payment.

Shipment details.

Certificate of Origin:

A certificate of origin is a signed statement providing evidence of the origin of the goods.

Inspection Certificate:

This is usually issued by an independent inspection company located in the exporting country certifying or describing the quality, specification or other aspects of the goods, as called for in the contract and the L/C. the inspection company is usually nominated by the buyer who also indicates the types of inspection he wishes the company to undertake.

Insurance Certificate:

- The Insurance Certificate documents must –

- Be that specified in the credit.

- Cover the risks specified in the credit.

- Be consistent with the other documents in its identification of the voyage and description of the goods.

- Unless otherwise specified in the credit.

- Be a document issued and / or signed by an insurance company or its agent, or by underwriters.

- Be dated on or before the date of the date of shipment as evidenced by the shipping documents.

- Be for an amount at least equal to the CIF value of the goods and in the currency of credit.

Importation is foreign goods and services purchased by customer, firms and Governments in Bangladesh.

An importer must have import registration certificate (IRC) given by chief controller of import and exports (CCI & E) to import any thing from other country. To obtain import registration certificate (IRC) the following certificates are required:

- Trade License.

- Income Tax clearance certificate.

- Nationality certificate.

- Banks solvency certificate.

- Asset certificate.

- Registration partnership deed (if any).

- Memorandum and Article of association.

- Certificate of incorporation (if any)

- Rent receipt of the business premises.

To import through The Trust Bank Limited a customer/client requires :

- Bank Account.

- Import registration certificate.

- Tax paying identification number.

- Proforma Invoice/Indent.

- Membership Certificate.

- L/C application form duly attested.

- One set of IMP Form.

- Insurance Cover Note with money receipt.

- Others.

To import, a person should be competent to be an importer. According to import and Export control Act, 1950, the office of chief controller of Import and Export provides the registration certificate (IRC) to the importer. After obtaining this person has to secure a letter of credit authorization (LCA) from Bangladesh Bank and then a person becomes a qualified importer.

He is the person who requests or instructs the opening bank to open an L/C. He is also called opener or applicant or the credit.

Importer’s application for L/C limit / margin:

To have an import L/C limit, an importer submits an application to the department of (TBL) furnishing the following importation:

- Full particulars of bank account.

- Nature of business.

- Required amount of limit.

- Payment terms and conditions.

- Goods to be imported.

- Offered security.

- Repayment schedule.

A credit officer scrutinizes this application and accordingly prepares a proposal (CLP) and forwards it to the head office credit committee (HOCC). The committee, if satisfied, sanctions the limit and returns back to the branch. Thus the importer is entitled for the limit.

Opening of Letter of Credit (L/C) by Bank:

Opening of L/C means, at the request of the applicant (importer) issuance of a L/C in favor of the beneficiary (Exporter) by a bank. the bank which open or issue L/C is called L/C opening bank or issuing bank.

On receipt of the importer’s L/C application supported by the firm contract (Indent / Proforma Invoice) and Insurance Cover Note the bank scrutinize the same thoroughly and fix up a margin on the basic of banker – customer relationship.

Before opening a L/C, the issuing bank must check the following:

L/C application properly stamped, signature verified and margin approved and properly retained.

Indent / Proforma Invoice signed by the importer and Indenter / supplier.

Ensure that the relevant particulars of L/C application correspond with those stipulated in Indenter/Proforma Invoice.

Validity of LCA entitlement of goods, amount etc. conforms to the L/C application.

Conversion and rate of exchange correctly applied.

Charges like commission, FCC, Postage, Telex charge, SWIFT charge, if any recovered.

Insurance Cover Note – in the name of issuing bank – A/c importer covering required risks and voyage route.

Incorporation of instruction for Negotiating Bank as per banks existing arrangement.

Reimbursement instructions for reimbursing bank.

If foreign bank confirmation is required, necessary permission should be obtained and accordingly advising bank is advised as per banks existing arrangement.

If add confirmation is required on account of the applicant charges should be recovered from the applicant.

In case of usance L/C, mention rate of interest clearly in the letter of credit.

Liability of Issuing Bank:

As per Article 9(a) of UCPDC 500, An Irrevocable Credit constitutes a definite undertaking of the issuing Bank, provided that the stipulated documents ——— comply with the terms and conditions of the credit.

Advising of Letter of Credit:

Advising means forwarding of a Documentary Letter of Credit received from the issuing bank to the beneficiary (Exporter).

Before advising a L/C the advising Bank must see the following:

Signature of Issuing Bank officials on the L/C verified with the specimen signatures book of the said bank when L/C received.

If the export L/C is intended to be an operative cable L/C Test Code on the L/C invariably be agreed and authenticated by two authorized officers.

L/C scrutinized thoroughly complying with the requisites of concerned UCPDC provisions.

Entry made in the L/C Advising Register.

L/C advised to the Beneficiary (Exporter) promptly and advising charges recovered.

Advising Bank’s Liability:

Advising bank’s liability is fixed up in uniform customs and practice for documentary credits, publication 500.

Article 7(a): A credit may be advised to a beneficiary through another bank (the “Advising Bank”) without engagement on the part of the advising bank, but that bank, if it elects to advise the credit shall take reasonable care to check the apparent authenticity of the credit which it advises. If the bank elects not to advise the credit, it must inform the issuing bank without delay.

Article 7(b): If the advising bank cannot establish such apparent authenticity it must inform, without delay, the bank from which the instructions appear to have been received that it has been unable to establish the authenticity of the credit and if it elects nonetheless to advise the credit it must inform the beneficiary that it has not been able to establish the authenticity of the credit.

Adding Confirmation:

Adding Confirmation is done by the confirming bank confirming bank is a bank which adds its confirmation to the credit and it is done at the request of the issuing bank the advising usually does not do it if there is not a prior arrangement with the issuing bank. By being involved as a confirming agent the advising bank undertakes to negotiate beneficiary’s bill without recourse to him.

- Issue L/C and request to add confirmation.

- Review the L/C terms.

- Provide reimbursement.

- Drafts to be drawn on L/C opening bank.

- Availability of credit facilities.

- Line allocation from the business and ownership units in the importer’s country.

- Confirm and advise L/C.

Amendments to Letter of Credit:

After issuance and advising of a L/C, it may be felt necessary to delete, add or alter some of the clauses of the credit. All these modifications are communicated to the beneficiary through the same advising bank of the credit. Such modifications to a credit are termed as amendment to a letter of credit.

There may be some of the conditions in a credit are not acceptable by the beneficiary. In that cases beneficiary contact applicant and request for amendment of the clauses. On receipt of such request applicant approaches his bank that is issuing bank with a written request for amendment to the credit. The issuing bank scrutinizes the proposal for the amendment and if the same is not in contravention with the exchange control regulation and bank’s interest, the bank may then process for amendment there can be more than one amendment to a credit. All the amendment forms an integral part of the original credit.

L/C amendments are to be communicated by SWIFT or mail. If there are more than one amendment to a credit, all the amendment must bear the consecutive serial number so that the missing the any amendment can be identified by the advising bank or by the beneficiary.

What is to be done by the issuing bank before advising amendments?

The issuing bank has to –

Obtain written application from the applicant of the credit duly signed and verified by the bank.

In case of increase of value, applications for amendment are to be supported by revised Indent/Proforma Invoice evidencing consent of the beneficiary.

In case of extension of shipment period, it should be ensured that relative LCA is valid/revalidated/increased up to the period of proposed extension.

Amendments an increase of credit amount and extension of shipment period both the cases amendment of Insurance Cover Note also be submitted.

Proper recording and filing of amendment is to be maintained.

Amendment charges (if an account of applicant) will be recovered and necessary voucher is to be passed.

The following clauses of L/C are generally amended:

- Increase/decrease value of L/C and increase/decrease of quality of goods.

- Extension of shipment/negotiated period.

- Terms of delivery i.e. FOB, CFR, CIF etc.

- Mode of shipment.

- Inspection clause.

- Name and address of the supplier.

- Name of the reimbursing bank.

- Name of the shipping line etc.

Settlement of Letter of Credit:

Settlement means fulfillment of issuing bank in regard to affecting payment subject to satisfying the credit terms. Settlement to may be done under three separate arrangements as stipulated in the credit.

Settlement by Payment:

Here the seller presents the documents to the nominated bank and the bank scrutinizes the documents. If satisfied, the nominated bank makes payment to the beneficiary and in case this bank is other than the issuing bank, then sends the documents to the issuing bank and claim reimbursement as per arrangement.

Settlement by Acceptance:

Under this arrangement, the seller submits the documents evidencing the shipment to the accepting bank (nominated by the issuing bank for acceptance) accompanied by draft down on the bank at the specified tenor. After being satisfied with the documents, the bank accepts the documents and the draft and if it is a bank other than issuing bank, then sends the documents to the issuing bank stating that it has accepted the draft and at maturity the reimbursement will be obtained in the pre-agreed manner.

Settlement by Negotiation:

This settlement procedure starts with the submission of documents by the seller to the negotiating bank. in a freely negotiate documents and if negotiation restricted by the issuing bank, only nominated bank can negotiate the documents. After scrutinizing that the documents meet the credit requirement, the bank may negotiate the documents and give value to the beneficiary. The negotiating bank then sends the documents to the issuing bank as usual; reimbursement will be obtained in the pre-agreed manner.

Accounting Treatment:

Sundry Deposit L/C Margin A/C Dr.

PAD A/C Cr.

(Margin amount transferred to PAD A/C)

Customer A/C Dr.

PAD A/C Cr.

(Customer A/c debited for the remaining Amount)

PAD A/C Dr.

Head Office A/C + Exchange Trading A/C Cr.

Income A/c interests on PAD Cr.

(Amount given to Head Office ID and interest credit)

Reversal Entries:

Banker’s Liability Dr.

Customer’s Liability Cr.

(When lodgment is given)

After realizing the telex charge, service charge, interest (if any), and the shipping documents is then stamped with PAD number & entered in the PAD Register. Intimation is given to the customer calling on the bank’s counter requesting retirement of the shipping documents. After passing the necessary vouchers, endorsements is made on the back of the bill of Exchange as “Receipt Payment” and the Bill of Lading is endorsed to the effect “Please deliver to the order of M/s………………………. under two authorized signatures bank’s officer’s (P.A. holder). Then the documents are delivered to importer.

Payment procedure of the Import Documents:

This is the most sensitive task of the import department. The officials have to be very much careful while making payment.

Date of Payment: Usually payment is made within 7 days after the documents have been received. If the payment is become deferred, the negotiating bank may claim interest for making delay.