Executive Summary

Bangladesh is a developing country in this competitive world whose economy is still dependent on Agriculture. The population growth of the country is too high and the productions of Agricultural products are not sufficient to meet up the regular needs. Bangladesh is a huge labor surplus country. Hence it belongs to the supply side of the global labor market. Remittance by expatriate Bangladeshis has been playing an important role in enriching the foreign exchange reserves and strengthening the current account balance of the country. Also remittance plays a vital role in this country to maximize its GDP every year. As per the mandatory part of MBA program in International Islamic University Chittagong as a student it needs to prepare an OCP report on remittance operation of BRAC Bank Ltd. The title is “Remittance and Probashi Banking Operations of BRAC Bank Limited”. The main objective of this report is to provide a scenario and operational activates of foreign remittance operation of BRAC Bank and its importance in this economy. From the July 2001 BRAC Bank is continuing its operation with four major parts, Probashi banking is one of them. The study conducted both primary and secondary data by taking interview of officials, observation and from the various web pages, annual reports. Mainly tabular analysis was the main focus with the help of various graphs. Remittance earning operation of this bank is very good rather than other commercial banks, BRAC banks earns $66.11 million this year that’s made this bank 3rd in position. They also have 962 BDP units which are not included in number of branch or SME unite center. This network makes this bank more effective and successful to this operation. Aggressive market competitor is very big threat for it. If this bank can overcome its weakness it could be move forward very soon.

INTRODUCTION

Remittance plays an extremely important role in sustaining the economy. It is the highest foreign exchange earning sector of the country. Macroeconomic growths in different sectors ranging from agriculture to service have direct correlation with migrants’ remittance. It constitutes very important source of the country’s development budget and the amount received through remittance is higher than foreign aid to Bangladesh. Studies have shown remittance has strong positive impact on GDP, and also on consumption and investment. For the migration of remittances, banking sector plays an important role. At present there are 4 NCBs, 30 PCBs, 10 foreign banks and some other banks which are acting as remittance partner. BRAC Bank is one of them and it has become one of the leading banks in remittance earning within 11 years of its operation.

ORIGIN OF THE STUDY

As a mandatory part of the MBA program, all the students of Department of Business Administration, International Islamic University Chittagong, have to undergo a three-month long internship program to gain some practical exposure about corporate world. Upon the completion of this program, the students have to submit an internship report, which reflects their knowledge as well as activities during the program. As remittance plays an important role in our economy and BRAC Bank is one of the leading Banks in this area I would like to prepare a report on “Remittance and Probashi Banking Operation of BRAC Bank Limited”.

OBJECTIVE OF THE STUDY

Broad objective

The broad objective of this report is to represent overall scenario and operational activates of foreign remittance operation of BRAC Bank Limited.

Specific objectives

The specific objectives are:

- Find out the procedures used by BBL for receiving and disbursing foreign remittance.

- Identify BBL’s position in foreign remittance operation.

- Find out the factors that affect remittance business.

- Analyzing the present condition of BBL in remittance business based on the factors.

- Recommended, necessary action to improve the condition of BBL in remittance operation.

METHODOLOGY

To complete the report I have followed the qualitative method of writing.

This report is based on the primary and secondary data. This report also bears the practical knowledge of individual worked during the statistical period. So the methodology is the mixing of primary and secondary data with practical knowledge. Practical experience, observation and conversation with the respective officials are used to describe overall operation of foreign remittance business. Remittance receiving method, transfer to the respective account all this procedures has been described through practical experience. Factors that are related in foreign remittance business have been explored through discuss with the respective officials of various banks. Current condition of BBL in foreign remittance business has been evaluated by comparing with some other banks which are doing well in remittance business.

SOURCES OF DATA

Data will be collected from two sources. These areas-

Primary Sources: For collecting primary data the following methods will be used:

Observation Method In this method, data will be collected by observing the activities of the BBL Officials.

Interview Method In this method data will be collected by-

- Discussion with officials of BBL

- Discussion with officials of other banks

Secondary Sources:

- Different websites

- Different published reports

- Data available with the BBL

- Annual report of BBL

SCOPE

I observed the head office of BRAC Bank with liabilities operation to prepare my report. This report is based on foreign remittance business of BRAC Bank Limited. This report will cover the area of remittance transfer procedure, remittance receiving procedure of BBL and the factors affecting foreign remittance business. This report also describes the present condition of BBL in foreign remittance business. BBL’s condition will be analyzed based on the factors comparing with some other banks.

LIMITATION

In all respect some limitations remain within which I failed to escape by any means which is pointed bellow:

- The tenor of the report is only three months. Since liabilities operation is a vast area, after hard working in the bank so this time is not possible to go through in depth within this short span of time.

- To collect information I was faced with some problems, because of the excessive nature of confidentiality maintained by the officials of BRAC Bank.

- Available data also could not be verified. In most cases there was simply did not have any option but to furnish with data without verification.

- It requires lot of assistance from all level officers and staff but as a Bank the officer was busy in doing their jobs.

- The study was limited by the availability of the data.

Bangladesh – Banking Sector OVERVIEW

The Economy:

From a mainly feudal agrarian base, the economy of Bangladesh has undergone rapid structural transformation towards manufacturing and services. The contribution of the agriculture sector to GDP has dwindled from 50 percent in 1972-73 to around 20 percent in 1999-2000. The agricultural sector is, however, still the main employment provider. The staple crop is rice, with paddy fields accounting for nearly 70% of all agricultural land.

Industrial production growth has averaged more than 6% over the last 5 years. The export sector has been the engine of industrial growth, with ready-made garments leading the way, having grown at an average of 30% over the last 5 years. Primary products constitute less than 10 percent of the country’s exports; the bulk of exports are manufactured/processed products, ready-made garments and knit wears in particular.

The improved political environment in the country, after a delayed period of civil disobedience brought a much-awaited economic stability during the financial year (FY) 2003-2005. During the year some positive initiative were taken in the Banking sector with improvements in the legal and regulatory environment to improve loan recovery but unfortunately the high quantum of nonperforming assets and under capitalization continued to plague the entire Banking sector thus causing a major threat to the macroeconomic stability. The size of classified loans increased significantly which contributed to lower profitability of the Banks.

Reserve of gross foreign exchange of the BB stood lower at US$3,033.88 million at the end of March, 2005 compared to US$3,179.41 million at the end of February. This was, however, higher than US$ 2,653.50 million at the end of March, 2004. The pressure on foreign exchange reserve continues due to low aid disbursement and sizeable private capital outflow, which amounted to around US$ 120 million. The official exchange rate was devaluated by 4.6% in seven steps in FY 2002 and in two steps during July-August 02 thus raising the cumulative rate of devaluation to 6.7%. The external account declined from over 5% of GDP to less than 3% (US$ 0.9 million) in FY 02 Which was mainly a result of healthy export growth (14%) and a significant increase in remittances from abroad, which in turn was due to stable political environment and a higher rate of contraction in import of food grains and capital goods.

Investment rate in FY 04 showed some increase and the declining trend in private savings was substantially reserved. The national savings rate increased from 11.9% of GDP in FY 03 to 14.6% in FY 04. This was partly due to increased inward remittances, increase in nominal interest rates and lower rate of inflation.

BREIF HISTORY OF THE BBL

BRAC Bank Limited is a scheduled commercial and also largest SME bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on 20 May 1999 under the Companies Act, 1994. The primary objective of the Bank is to provide all kinds of banking solutions. At the very beginning the Bank faced some legal obligation because the High Court of Bangladesh suspended activity of the Bank and it could fail to start its operations till 03 June 2001. Eventually, the judgment of the High Court was set aside and dismissed by the Appellate Division of the Supreme Court on 04 June 2001 and the Bank has started its operations from July 04, 2001.

The emergence of BRAC Bank Limited is an important event in the country’s financial sector at the inception of financial sector reform. The authorized capital of BBL is Tk. 1200 million and paid up capital of the same bank is Tk. 3212 million.

BRAC Bank has a unique institutional shareholding between BRAC, the largest NGO in the world, the International Finance Corporation (IFC), the commercial arm of the World Bank Group, and Shore Cap International, a concern of Shore Bank Corporation, 9 America’s first and leading community development and environmental Banking Corporation.

ORGANIZATIONAL VISION, MISSION, AND OBJECTIVE

Vision

The vision of BRAC Bank Limited is to build a profitable and socially responsible financial institution focused on Markets and Business with growth potential, thereby assist BRAC and stakeholders build a “Just, enlightened, healthy, democratic and poverty free Bangladesh.”

Mission

BRAC Bank has got a number of corporate missions –

- To maintain continuous growth in the “Small and Medium Enterprise (SME)” sector

- To have sustained low cost deposit growth with controlled growth in Retained Assets

- To fund Corporate Assets trough self-liability mobilization and the growth in assets trough Syndications and Investment in fast growing sectors

- To make an attempt to increase fee based income

- To keep our Debt Charges at 2% to maintain a steady profitable growth

- To efficiently coordinate between the bank’s Branches, SME Unit Offices and BRAC field offices for delivery of Remittance and Bank’s other products and services

- To manage various lines of business in a fully controlled environment with no compromise on service quality

- To keep a diverse, far flung team fully motivated and driven towards materializing the bank’s vision into reality

Objective

BRAC Bank will be the absolute market leader in the number of loans given to small and medium sized enterprises throughout Bangladesh. It will be a world – class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank in this part of the world.

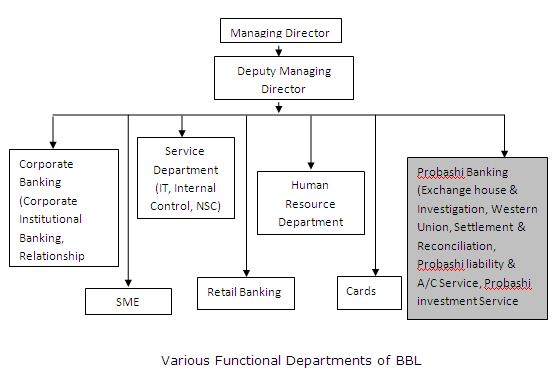

VARIOUS FUNCTIONAL DEPARTMENTS

BBL activities are performed through functional departmentalization. So, the departments are separated according to the functions they perform (HR, Personal Banking, etc.). There are 7 major functional departments at BBL: Human Resources, Services, Small and Medium Enterprises (SME), Retail, Corporate Banking, Probashi Banking, and Cards. Within these major departments there are some other subsidiary departments that allow smooth operation of their own major departmental function. A graphical presentation of all the departments is shown in the following page. A brief functional description of these departments is provided below.

Human Resources Department

The Human resource Manager heads this department. The major functions of this department are Recruitment, Training and developments, Personnel Services and Security. The HR department is much concerned with the discipline that is set up by the BBL group.

Service Department

This is an integral and vital part of the bank. The services department ensures smooth operation and functioning within and between all the departments of BBL. It also provides continuous support to the core banking activities of BBL. The services department is considered to be the backbone of all other departments. The various subsidiary divisions within this department are-

- Information Technology (IT)

- Internal Control

- Network Service Center (NSC)

Small and Medium Enterprise (SME)

BBL has established strong infrastructure for SME financing all over the country. BBL is the market leader in SME financing. Disbursement in SME financing has been increasing significantly. SME five years Business Plan provides the road map of maintaining the leadership position of BBL. At present, Government and Non-Government supports for promoting SME in Bangladesh encouraged different banks for participating more in SME financing.

Retail Banking

Retail is the most flourishing department of BBL Bangladesh. This department basically deals with the management of products and services offered to individual consumers. Within a span of only seven years, BBL Retail has grown tremendously and is still growing with its innovative products and service offerings.

Corporate Banking

This division of BBL provides financial services to organizational clients. Whether it is locally or around the nation, BBL offers a comprehensive range of services that can be tailored to the individual needs of the company. Two offices of BBL offers corporate banking services to corporate clients. These are the Dhaka Head Office and Chittagong office. These sub-divisions are discussed briefly in the following sections:

- Corporate Institutional Banking

- · Relationship Management Department

Cards

This department started its journey officially at February 6, 2007 in Bangladesh. This department has different wings – sales, customer services, credit, operations, acquiring and portfolio management. BBL Cards division is mainly operated by the senior manger and first assistant president.

Probashi Banking

Probashi Banking division of the Bank caters the NRBs (Non- Resident Bangladeshi) not only by disbursing remittance but also offering ‘One Stop Banking Solution’ by creating a favorable environment and opportunity for the NRBs to make long-term financial contributions in the socio-economic progress of the nation. To facilitate the NRBs (Non- Resident Bangladeshi) a bunch of probashi banking products and services are designed to secure expatriate Bangladeshi(s) future saving(s) and investment(s) need as well as providing a structured financial planning for future.

About Probashi Banking:

Remittance service is one of the core business areas of BRAC Bank. The Bank has introduced a highly secure, innovative and quality Remittance service based on advanced technology. Through this service any one can send money to his/her relatives from abroad even to the remotest area of the country within maximum of 72 hours. At present BRAC Bank is considered one of the top most leading Banks in serving Probashi Bangladeshis. No other banks in Bangladesh have offered such a wide range of products and quality service to the NRB segment so far. These wide ranges of product and service are backed by a very dynamic IT security and business support team of BRAC Bank. BRAC Bank’s Probashi Banking Service is also pioneering investment opportunities for NRBs into Bangladesh.

PRODUCTS OFFERED BY PROBASHI BANKING DEPARTMENT

BRAC Bank has some Probashi Banking products and services like –

a. Probashi Current Account

It is ideal for Probashi Bangladeshis / Returning Bangladeshis who do not wish to earn interest due to religious or other reasons.

b. Probashi Savings Account

Probashi Savings Account offers a regular savings account in local currency for the NRBs who are residing abroad and want to save their hard-earned money to utilize in future after coming back to Bangladesh.

c. Probashi DPS

This account provides attractive interest amount based on regular deposits of small amount. A DPS account can be opened for a monthly deposit of any amount being a multiple of Tk. 500, the lowest being Tk. 500 itself. The tenures can be for 4, 7, 11 and 14 years as per the customers’ instructions.

d. Probashi Fixed Deposit

A fixed deposit account allows you to deposit your money for a set-period of time, there by earning you a higher rate of interest in return. Fixed Deposits can be made from 3 months to 3 years. Interest is paid on the maturity at a very attractive rate.

e. Probashi Abiram

Probashi Abiram is a Fixed Deposit, which is ideal for NRB’s who want to get a return every month. If you have sufficient funds, this can be made into a fixed deposit from 1 year to 3 years and interest will be paid every month on your Savings Account automatically. This is ideal for customers who want to pay their DPS installments

f. Remitters Life Insurance

The remitters availing BRAC bank services through the exchange houses all over the world can enjoy the special life insurance coverage policy. Without any charges the remitter gets a 65 days insurance coverage. If the remitter dies due to any accident within this period, the beneficiary will receive Tk. 1-5 lac, depending on the amount of remittance. In case of normal death, the beneficiary will receive Tk. 10,000.

g. NRB Demand Draft

A remitter can send money through any of the enlisted Exchange houses of BRAC bank in the form of a Demand draft.

h. Probashi Subidha Account

Probashi Shubidha (NRB beneficiary) Account is a specialized account for Non-Resident Bangladeshis where the remitter can open an account for the Beneficiary. The beneficiary can then avail all the services offered by BRAC Bank such as: SMS Banking, Phone Banking, and Internet Banking etc.

i. Probashi Subidha FD

Any Probashi Shubidha Account Holders who have enough money to invest for a specified period of time for a better return can open this account.

j. Probashi Subidha DPS

The Probashi Shubidha Account Holders can open this account to save their hard earned in very small installments every month and get a handsome amount at maturity

k. Probashi Subidha Abiram

Any Probashi Shubidha Account Holders who want to get a return on every month can open this account.

l. Probashi ‘Interest Now’ Account

Probashi ‘Interest Now’ is a product like Fixed Deposit (FD) account which can be opened with Foreign Currency brought in by the returning Probashis, by debiting their existing FC Account with the Bank to maintain their earnings from abroad in FC (i.e. USD, GBP and Euro) and to earn interest in BDT at the beginning of the FDR term.

m. Student Education Saver

This is a package offering combination of products for both Bangladeshi Students pursuing studies abroad and/or for NRB parents who want to secure their children’s studies in future by saving little by little every month. In summary, the package has – Student file against a student a/c for Bangladeshi students and a DPS for NRB parents for their children’s future studies.

n. Probashi Wage Earners Bond

Probashi Wage Earner Development Bond (WEDB) is a product designed by Bangladesh Central bank for Bangladeshi national living abroad. The objective of this product is for NRBs to invest their hard earned deposit to buy W.E.D.Bond on which the government guarantees a fixed interest rate on the deposit amount.

o. US Dollar Investment Bond

US Dollar Investment Bond is a product designed by Bangladesh Central bank for Bangladeshi national living abroad. The objective of this product is for NRBs to invest their hard earned deposit to buy WEDB on which the government guarantees a fixed interest rate on the deposit amount. It is a product to facilitate Probashi FC (Foreign Currency) account holders (NRBs) to purchase a Wage Earner Development Bond through BRAC Bank Probashi Banking from abroad.

p. US Dollar Premium Bond

US Dollar Premium Bond is a product designed by Bangladesh Central bank for Bangladeshi national living abroad. The objective of this product is for NRBs to invest their hard earned deposit to buy WEDB on which the government guarantees a fixed interest rate on the deposit amount. It is a product to facilitate Probashi FC (Foreign Currency) account holders (NRBs) to purchase a Wage Earner Development Bond through BRAC Bank Probashi Banking from abroad.

q. Probashi Super Saver Scheme (Probashi Loan and Credits)

This product enables the customers to meet emergency cash needs against security of Fixed Deposit Receipt (FDR) of BRAC Bank Limited (BBL) issued in the name of Probashi. The applicant can avail himself of the overdraft facility up to 90% of the value of the FDR. The beneficiary will receive the benefit of the OD against the FDR duly authorized/discharged in favor of BBL by the Probashi (the holder of the FDR). Fixed Deposit Receipt under IFFD can be accepted as security. Overdraft limit will be sanctioned up to 90% of IFFD value less the amount of interest already paid in advance.

PERFORMANCE OF BBL IN LAST 5 YEARS

Table 02: Performance of BBL in last 5 years (Figures in Millions except mentioned otherwise)

| Years | 2012 | 2011 | 2010 | 2009 | 2008 |

| Authorized Capital | 12000 | 4800 | 4800 | 4800 | 2000 |

| Paid Capital | 3212 | 2677 | 2059 | 1584 | 1200 |

| Total Asset | 133201 | 117298 | 95127 | 72442 | 45383 |

| Total Deposit | 103726 | 88158 | 75220 | 58007 | 37368 |

| Total Loans & Advances | 90822 | 82461 | 64151 | 52677 | 32461 |

| Operating Income | 10135 | 9528 | 7264 | 6036 | 3543 |

| Profit before Tax | 1702 | 1670 | 1304 | 973 | 618 |

Source: BRAC Bank Annual Report

Number of Expatriate Bangladeshis and Their Earnings

Due to the increase of skilled manpower export and the creation of facilities to send remittances from abroad expatriate worker’s remittances flow has been increasing gradually. It may be noted that in FY 2009-10, the remittances from expatriate Bangladeshi workers stood at US$ 4801.88 million reflecting 24.78 percent rise over the previous year. In FY2010-11, remittances stood at US$ 5978.47 million reflecting 24.50 percent rise over the previous year.

The number stood at 2.91lac in FY 2009-10, which is 16.4 percent higher than the previous year. In FY 2010-11, manpower exports reached 5.64lac, which is 93.81 percent higher than the previous year. During 2007 to June 2011 manpower having strength of about 48.9lac has been exported. Bangladeshi workers and their remittances in Taka and Dollar are shown in Table 4.

Table 04: Number of Expatriate Bangladeshis and their Remittances

| Fiscal Year | No of employment abroad (000) | Amount of remittance | |||

| Million US$ | Percentage Change (%) | Crore Tk. | Percentage Change (%) | ||

| 2007-08 | 251 | 3060.31 | 22.25 | 17719.58 | 23.14 |

| 2008-09 | 277 | 3372.49 | 10.20 | 19872.39 | 12.15 |

| 2009-10 | 250 | 3848.30 | 14.11 | 23646.97 | 18.99 |

| 2010-11 | 291 | 4801.88 | 24.78 | 32210.87 | 36.22 |

| 2011-12 | 564 | 5978.47 | 24.50 | 41303.93 | 27.88 |

Source: Bureau of Manpower, Employment & Training and Bangladesh Bank.

Reason for Increasing Remittances in Bangladesh

The number of migrants from Bangladesh is increasing day by day. The causes of migrations are as follows:

Migrants to Western industrialized countries consider the following as their motivation:

- Better educational opportunities for their children

- Access to specialized jobs

- Better health care systems

- Wider opportunities for self-actualization

- Family reunion (for long term migration)

- Avoid political turmoil, violence, insecurity and corruption

Short-term labor migrants to the Middle East and South-East Asia migrate:

- In search of better job opportunities

- To escape unemployment and poverty

- Influenced by the available information on migration and job opportunities, the existence of social networks and the operation of recruiting agencies.

Most of the Short term migrants live abroad without family members. As a result they send money to their families and relatives for meeting the daily need. Also, many of them will come back after some period in Bangladesh. So, they also send remittance for some investment purpose. The purposes for which migrants send remittance to Bangladesh are as follows:

- Food, Clothing, Health

- Investment in Land

- Home Construction and Repair

- Repayment of Loan

- Business Investment

- Financing Migration of Other family Members

- Social Ceremonies

- Savings

- Community Development Activities

In order to increase workers’ remittances and to expand the facilities of remittance inflow through banking channel, the following important steps has been taken by the government in the recent fiscal years:

- Expansion and close observation of drawing system of Bangladeshi banks with more number of foreign exchange houses

- To increase the inflow of remittances, the annual minimum limit of remittance for the exchange houses of UK, Canada and USA have been fixed up

- Take necessary measures for quick disbursement along with develop delivery service of remittances to the beneficiary within the country

Major Remittance Sending Countries

At present, Saudi Arabia, UAE, USA, UK, Kuwait, Qatar, Oman, Bahrain, Malaysia, Singapore are some of the major countries where majority of the people went. Saudi Arabia is in the top of the list. As there is huge demand of labors in the Middle East and South East Asian countries, a good number of workers are migrated every year. In USA, UK, Australia there lived huge number professional or skilled workers who also contribute a lot to the remittance earning of the country.

Table 05: Country wise remittance flow (in million USD)

| Position | Country | 2008-09 | 2009-10 | 2010-11 | 2011-12 |

| 1 | KSA | 1562.21 | 1734.7 | 2324.23 | 894.29 |

| 2 | USA | 701.37 | 930.33 | 1380.08 | 517.87 |

| 3 | UAE | 512.64 | 804.84 | 1135.14 | 465.19 |

| 4 | UK | 517.39 | 886.9 | 896.13 | 268.88 |

| 5 | Kuwait | 454.38 | 680.7 | 863.73 | 329.67 |

| 6 | Qatar | 161.43 | 233.17 | 289.79 | 110.97 |

| 7 | Oman | 153 | 196.47 | 220.64 | 89.43 |

| 8 | Italy | 78.43 | 149.65 | 214.46 | 68.28 |

| 9 | Bahrain | 61.29 | 79.96 | 138.20 | 61.82 |

| 10 | Singapore | 61.32 | 80.24 | 130.11 | 44.38 |

Source: Bangladesh Bank

CONTRIBUTION OF REMITTANCE TO THE NATIONAL ECONOMY

Overseas employment and workers’ remittances contribute significantly to the economic development of the country through reduction of unemployment and augmenting foreign exchange reserves and income. A sizeable number of Bangladeshi professionals, skilled, semi-skilled and un-skilled labor force are employed in different countries including the Middle East. With a few exceptions, manpower export has been increasing every year. A total of 2.50 lakh Bangladeshis had gone abroad for employment in FY 2004-05, which is 9.75 percent higher than the previous year.

The Amount of Remittances in Terms of GDP and Export Earnings

The amount of remittances in terms of GDP and export earnings has also increased. In FY 2000-01 remittance as percent of GDP and export stood at 4.01 percent and 29.10percent respectively. In FY 2006-07 remittances as percent of GDP and export stood at 8.83 percent and 49.09 percent respectively. Table 6 and Figure 4 show remittances in terms GDP and export earnings for last few years.

Table 06: Remittance as Percent of GDP and Export

| Fiscal Year | As Percent of GDP | As Percent of Export |

| 2007-08 | 5.90 | 46.76 |

| 2008-09 | 5.98 | 44.35 |

| 2009-10 | 6.37 | 44.47 |

| 2010-11 | 7.75 | 45.62 |

| 2011-12 | 8.83 | 49.09 |

Source: Bangladesh Bank

FOREIGN REMITTANCE BUSINESS OF BBL

Remittance Service is one of the Core Business areas of BRAC Bank. The Bank has introduced a highly secure, innovative and quality remittance service based on advanced technology. Through this service any one can send money to his/her relatives from abroad even to the remotest area of the country within maximum 72 hours. At present BRAC Bank is considered one of the top most leading Banks in serving Nonresident Bangladeshis. No other banks in Bangladesh have offered such a wide range of products and quality service to the NRB segment so far. These wide ranges of product and services are backed by a very dynamic IT security and business support team of BRAC Bank.

REMITTANCE RECEIVING METHODS OF BBL

There are three ways BRAC Bank Ltd. receives Inward remittances from abroad: BBL receives remittance through

- Exchange Houses

- Western Union &

- SWIFT

Remittance through Exchange Houses

Currently BBL has remittance arrangement with around 51 Exchange Houses located mainly in USA, UK, Canada, Italy, Malaysia and almost all major countries of Middle East.

Most of the exchange houses send the transactions through Gmail and SRS execution. Some other exchange houses upload the transactions in their web server and BBL gets them from their web pages.

Most of the exchange houses send a bunch of transactions with a ‘test key’ which will be exactly matched in the system of BBL. Then BBL will become sure that this set of transaction is specified for BBL.

Remittance through SWIFT

SWIFT stands for (Society for World Wide Inter-bank Financial Transaction). This is the most preferred mode of money transfer between financial institutions by sending messages via a dedicated and encrypted computer network. It provides a standard format for transmitting payments, stock transactions, letters of credit and other financial messages to more than 7,500 member banks, broker-dealers and investment organizations around the world. Founded in 1973 as the Society for Worldwide Interbank Financial Telecommunication, millions of transactions worth several trillions of dollars are sent each day with an average transit time of 20 seconds. Working like a bank routing number, a SWIFT code is widely used to transfer funds between banks.

The Society for Worldwide Interbank Financial Telecommunication (“SWIFT”) runs a worldwide network by which messages concerning financial transactions are exchanged among banks and other financial institutions.

As of November 2005 SWIFT linked over 7.800 financial institutions in 202 countries and estimates that it carries payment messages averaging more than six trillion US dollars per day.

SWIFT is a cooperative society under Belgian law, owned by its member financial institutions with offices around the world. SWIFT’s headquarters are located in La Helped near Brussels.

It was founded in Brussels in 1973, supported by 239 banks in 15 countries. It started to establish a common language for financial transactions and a shared data processing system and worldwide communications network. Fundamental operating procedures, rules for liability etc., were established in 1975 and the first message was sent in 1977. SWIFT has operations centers located in Culpeper, Virginia in the United States, and also the Netherlands.

REMITTANCE DISBURSEMENT METHODS OF BBL

The payment modes that are used by BBL to disburse the remittances are:

Pay Cash

This is an instruction to BRAC Bank branches to make cash payments to clients. If the beneficiary does not have any account with BRAC Bank or other Bank, cash payment is made from BBL branches from different location.

BRAC BDP Transfer

If the instructions are to pay cash to a person at a village without a branch or BRAC Bank, the money is transmitted though BRAC BDP. After receiving the instruction and money from the money is exchange agency, BRAC Bank sands an instruction to BDP for paying to the beneficiary.

Direct Credit

When the beneficiary has any account with BRAC bank, we just credit the fund directly to his account. This is the easiest and quickest way to get remittance from abroad.

Pay Order

If the beneficiary does not have account with BRAC bank but with other bank under clearing zone of Bangladesh Bank, a Pay Order is issued favoring the beneficiary.

Demand Draft (DD)

We have direct DD (Demand Draft) arrangements with Sonali Bank, B.B.Avenue Branch, and Dhaka. When the beneficiary A/C is in Sonali Bank’s branch with which

Telegraphic Transfer

If the beneficiary bank is out of Dhaka and BRAC bank network (remote area) & has telephone facility, we execute the transaction through other bank’s TT. Accounts are credited within 24 hours. It is also the fastest non-cash method of payment.

Mail Transfers

If beneficiary bank is out of Dhaka (remote area) & does not have Telephone facility, we execute the transaction through other bank Mail Transfer (MT).

Advice & Pay

When BBL doesn’t have correspondence with Beneficiary bank and there is no BDP also, then we need to issue an ‘Advice & Pay.’

Network Coverage

Network coverage means how much area a bank can covers with its branches. The more branches a bank has the more area it can cover. From the analysis it is quite visible that network coverage is the most important issue in foreign remittance business. Most of the remittance senders’ families and relatives live in the rural areas. Again there is a chance to increase the number of deposit as the branches of a bank spreading all over the country. If the number of deposit increases earning from remittance also increase.

Corresponding Relationship

Correspondence with foreign banks in foreign country is also an important issue in foreign remittance business. If sender’s bank in foreign country is not directly related with beneficiary’s bank in the home country than the correspondent bank facilitate the remittance transferring process. The more correspondents a bank has in abroad the more area will it cover. As a result more remitters will be reached.

Number of exchange houses with arrangements:

Exchange houses are important as the exchange houses directly involved with transfer of remittance. Exchange house is an important factor in transfer of remittance. In fact, exchange houses are more important than correspondent banks as their core business involved with transferring of remittance.

Exchange House Owned by the Bank in Foreign Country:

Exchange house owned by the banks in foreign countries treated as a side business of the bank. It also helps transfer of remittance. Banks try to set up an exchange house where the concentration of Bangladesh people is higher.

Number of Subsidiaries and Overseas Branches in Foreign Country:

If a bank has subsidiaries or overseas branches in foreign country, where Bangladeshi migrant’s concentration is high, it will be able to reach more number of remitters and its remittance earnings will increases as a result.

Products Offered for Expatriates:

If a bank offers a wide range of schemes and services for the nonresidents, it will be able to earn more remittance. If there is various types of investment scheme available, the expatriates who want to invest in Bangladesh will be attracted. As a result remittance earnings will increase.

Service Provided to Remitters and Beneficiaries:

Service and goodwill of the bank is an important factor in remittance business. It is important for the banks to give fast and hassle free service to the beneficiaries. Service can be an important factor when a beneficiary has the advantage of choosing options. If a beneficiary is not treated well by a bank he/she might switch to other bank. Sometimes beneficiaries does not know the process regarding receiving remittance, the respective officers have to inform them about the process. As many of the beneficiaries are from low or middle class people from the society, bank’s officials have to treat them well. Bank’s officials have to behave with the beneficiaries in the way that they don’t feel hesitate to ask any questions about the remittance.

Transaction Time:

The delivery of service within the quickest possible time is key to attract remittance. Transaction time depends on the methods used to receive and disburse fund. If Electronic system is used, it will require less time. But if the system is manual, it will require more time.

SWOT Analysis

SWOT analysis is a very effective framework of identifying strengths and weaknesses and of examining the opportunities and threats faced and help to focus on future activities into areas where the strengths exist and the greatest opportunities lie. In this light, a SWOT matrix related to the dynamics of remittances is presented below:

Strength:

- Very strong relationships with remittance partners(Exchange Houses)

- Coverage through BRAC BDP offices located in 1100 location

- Fastest Growing branch network

- Correspondent Relationships with other banks

- Strong remittance back-office support through ELDORADO software

- Time to time execute instruction by shifting duty.

- In house software development for every team.

- Excellent leadership

- Interlink relationship between every team.

Weakness:

- Lack of Control over BDP locations

- Service issues pertaining query handling & payment delays

- IT support to BRAC BDP locations

- All the instruction is manually input to the Eldorado

- Accounting team dependence on the execution team.

- Operational Cost factors are very high through correspondence banks.

- Trade finance transaction volume is very low. For that reason, they can’t use their foreign currency properly.

- Lack of proper database of corresponding bank’s phone numbers of PSI team

- Lack of experienced employee.

- BDPs cannot keep larger amount of fund in store.

Opportunity:

- Targeting of specific location in Sylhet & Chittagong regions.

- Utilization of SME network.

- Draft Drawing arrangement with major banks.

- Product based on needs of NRB’s.

- Increasing service quality and awareness among BRAC Staff through training

- If Local remittance can be drawn under this channeling, this can turn out to be a highly profitable one.

- Trade finance transaction should be expanded to utilize their foreign currency.

Threat:

- People’s negative perception about banking channel.

- “Hundy” Business

- These days, many banks are showing greater interest in the remittance business

- Rupali bank will be the biggest threat for the remittance business

- More numbers of branches of other banks have commenced business as outlets for Western union

- EL DORADO not properly used by Ex. Houses.

PESTEL Analysis:

Political: BRAC bank is not owned by any individual ownership. It is owned by three organizations; two foreign and one local. So, political influences such as government changes do not affect BRAC Bank. In case of political instability the effect is as much as it is to the overall banking sector.

Economical: BRAC bank is one of the largest TAX paying private organizations in BANGLADESH. The invested capital of BRAC bank as per 30th June 2007 was BDT 46,567,321,639 so it has added in the economy of Bangladesh. Due to the recession in the world economy, the foreign remittance earned compared to previous years has decreased. The price of shares of BRAC bank in DSE and CSE has never been drastically affected by the ups and downs in the stock exchange. Rather, the general trend of the price of shares was always increasing.

Social: BRAC bank ensures its customers that their money is in safe hands. To do so, BRAC bank has set up a strict guideline for itself of not investing in risky projects.

Technology:

Networking system: An international software company prepared “Finacle”- the best and most advanced networking system which is specially designed for BRAC bank for its core banking operations.

Real time online banking: It uses real time online banking system which updates the database in every micro-second. This allows very efficient and the fastest online banking in Bangladesh.

Security: BRAC bank uses special 16 digit code combination for its volts which is accessible only by the respective branch manager. To ensure security at cash counters, Customer care centre, ATM booths and corporate offices, there are close-circuit cameras which are constantly monitored and saved in their database for at least six months.

Environmental: From the very beginning BRAC bank has emphasized a certain amount of focus on developing public awareness towards the environment. Small messages such as “Plant more trees” are printed on the back of receipts from ATM booths. BRAC bank has also aided in forestations in certain deforested lands and beautification in certain roads throughout the country.

Legal: Like all other private banks in Bangladesh, BRAC bank also follows rules and regulations set by Bangladesh Bank. As a result the previous interest rate of 14% has been changed to 9% on FDR, the increased interest rate on loans and restrictions on luxurious consumer goods have also been taken in effect by BRAC bank.

FINDINGS

From the above analysis the findings are as follows:

- In case of network coverage BBL has same strength like other banks, which are doing better in remittance business. Though it has few branches, it has a large network of BDPs.

- In corresponding relationship and arrangement with exchange houses, BBL is in very weak position comparing with the other banks.

- Most of the banks offer some typical products for NRBs, but BBL has a wide range of savings and investment schemes for NRBs. In this case BBL has strength than any other banks. So, it can compete with others in this area.

- BBL can disburse remittance within a short period, which is less than other banks.

- The total assets are mostly influential in determining the profit margin of the bank.

- Analysis indicates that the bank already started doing well in the market, so the management efficiency should be more emphasized.

RecommendationS

- Though BBL has few branches relatively others, but it has a strong network of BDPs. This network should be used in proper way. For this purpose trained people should be employed.

- BBL has now 81 branches excluding SME units, and the bank has planned to extend the number of branches. As huge number of beneficiary lived in rural areas, newer branches have to be opened at rural areas.

- For making arrangements with more exchange houses, various discount offers should be given to the exchange houses.

- In case of making arrangements with exchange houses, minimum charge should be imposed. Also for attracting exchange houses, no cost for cancellation and amendment should be imposed.

- Remittance service related promotional activities should be organized in abroad and there should be a representative of BRAC Bank, who will promote its service for nonresidents. Encouraging for using official channel and away from “Hundi” should be also a part of the activities.

- Promotional activities should also be organized at rural areas for the beneficiaries. As most of them are middle class or lower class people, they should be properly understood. BDPs employees will work best for this purpose.

- BBL can open Representative offices with the collaboration of foreign financial institution or exchange houses. It will be more effective for attracting remittances, where Bangladeshi migrants’ concentration is high.

- BBL can develop such types of deposit scheme for the beneficiaries which will be used in productive purpose and make these services available at BDPs.

- Beneficiaries of the remittance are mostly from middle or lower class family of the society and most of them are illiterate. As a result they cannot understand the payment process. So they have to be dealt with patience.

- Eldorado project should be implemented as soon as possible. If Eldorado project is implemented, cost and time for transaction will be reduced.

Conclusion

The banking sector of Bangladesh is composed of NCBs, PCBs, FCBs and SBs. BRAC Bank Limited (BBL), a fully operational commercial bank that had started off in 2001, has been the fastest growing bank in 2004 and 2005. Amongst all its functional divisions, BBL has 4 major business units – SME, Retail, Corporate and Probashi Banking. Due to the quicker services provided by BBL as well as the other local banks, strong monitoring system of Bangladesh Bank, and stable foreign exchange rates, remittance inflow increased gradually over the years. The potential contribution of remittance to the economy has put it into such an important position. BRAC Bank plays an important intermediary role in the foreign remittance operation. This is contributing to the county as well as BRAC Bank. It acts as a medium in delivering the hard earned foreign currencies of our millions of people living abroad to their relatives in Bangladesh. The Bank has liaison with BRAC offices all over the country and thus can deliver the remittance among the beneficiary at the remotest places. BRAC Bank has so far arrangements with around 57 exchange houses all around the world for remitting foreign currency to BRAC Bank. Most of the current business of this department comes from the Middle East. BRAC Bank does a lot of campaigning in those foreign countries where there are potential markets. The Bank publishes advertisement in local newspapers, visits. Various construction sites and dormitories and also organizes cultural programs on important Bangladeshi events to promote the secure remittance service of the Bank. BRAC Bank has alliance with Western Union. A major chunk of revenue of SRS comes from delivering remittances that are received via Western Union.

Due to the quicker services provided by BBL as well as the other local Banks, strong monitoring system of Bangladesh Bank, and stable foreign exchange rates, remittance inflow increased gradually over the years. The potential contribution of remittance to the economy has put it into such an important position.

Although remittances and migration in Bangladesh have received an increasing amount of attention in recent years, it is still not adequate to determine unambiguously the impact of remittances on the broader society. Based on the remittance dynamics, the migrant communities can be divided into three groups: temporary migrant laborers, high-income diasporas and low-income diasporas.