Modern banking system plays an important role for a nation’s economic development. Over the last few years the banking world has been undergoing a lot of changes due to deregulation, technological innovations, globalization, environmental situation etc. These changes also made revolutionary changes of a country’s economy as well as our economic development. Present world is changing rapidly to face the challenge of competitive free market economy. It is well recognized that there is an urgent need for better-qualified management and better-trained staff in the dynamic global financial market. Bangladesh is no exceptions of this trend. Banking Sector in Bangladesh is facing challenges from different requirements though its prospect is bright in the future.

Human beings become human resources when their skills and abilities are developed to undertake some productive activities which are useful to them and their society. In an organization, administrative or managerial development occurs through training, education and development of the personnel. The need for effective human resources management is seen vastly in large organizations. National Bank Ltd follows a very effective Human Resources Policy which is mostly reliable in case of recruiting, training, developing, motivating, and retaining good employees. The Bank has a Human Resource Development & Research Department to develop human resources internally. The Academy is equipped with professional library, modern training aids professional faculty and other facility. It is now under Personnel & Human Resource Development & Research Division.

This paper is titled “Analyzing the Recruitment and Selection Process of National Bank Limited” originated from the fulfilment of the BBA program. For the internship program, each student is attached with an organization. My internship was at The National Bank Ltd., Asad Gate Branch, and Dhaka

Origin of the Study:

This report is a Completion of requirement of the internship program which is an important part of the BBA degree requirement. Before the degree, a student must undergo the internship program. Internship program is a perfect blend of the theoretical and practical knowledge. As the supervisor has advised me to develop a thorough understanding of the recruitment and selection processes of National Bank Limited (NBL) Asad Gate Branch I was assigned in the General Banking, credit Division, Foreign Exchange Division and HR practices of NBL. Under the guidance of Nazneen Fatema to meet the requirement of the internship program of BBA. I tried my best to get as much information as possible and complete this report in due time.

Purpose of the study:

This is the most essential part of BBA program. This is prepared as the final term paper of the degree.

Objectives of the report:

A report must have some objectives. In this internee report has also some specific objectives. These objectives are divided into two parts.

- Broad objective:

To identify the Recruitment and Selection process of the National Bank Ltd.

Specific objective:

- To evaluate the current recruitment selection policy and process of NBL

- To unfold the theoretical analysis of recruitment and selection

- To explore the recruitment and selection criteria of the National Bank Ltd.

- To identify the recruitment and selection steps of the National Bank Ltd.

- To know about the interview methods and tests of Bank Ltd.

- To get knowledge, bank, customer, environment etc.

Methodology

Methodology includes direct observation ,face to face discussion with employees of different departments ,study of files , circulars ,etc .and practical work .To conduct the overall study, at first I explored the sources of Primary and Secondary information and data. And other information has been collected from the web site of the NBL .After collecting this information; I have prepared the report, which provides the detail information of Human Resource practices of NBL.

To obtain the data and information of this report, following methods are applied:

Source of Data

In order to make the report more meaningful and presentable, two sources of data and information have been used widely. Sometimes the customers gave some important information regarding the services of the Bank:

Primary source Data

- Face to face conversation with the bank officers & staffs.

- Personal observation – Observing the procedure of banking activities followed by each department

- Practical work exposures from the different desks of the departments of the Branch covered.

- Direct conversation with the clients or customers.

Secondary Data

- Organizations official website (asadgate@nbibd.com)

- Annual report of National Bank ltd.

- Monthly Statement of NBL.

- Different papers of National Bank Ltd

- Various reports,articles,journals,newspapers and different textbooks etc

- Other manual information.

- Web base support from the internet

Rational of the Study

Banking sector is one of the strongest economic sectors in our country. Banks provide necessary funds for executing various programs underway in the process of economic development. They collect savings of large masses of people scattered throughout the country, which in the absence of banks would have remained idle and unproductive. These scattered amounts are collected, pooled together and made available to commerce and industry for meeting the requirements. Economy of Bangladesh is in the group of world’s most undeveloped economies.

One of the reasons may be its undeveloped banking system. Government as well as different international organizations have also identified that undeveloped banking system causes some obstacles to the process of economic development. So, one county must be efficient in banking if it wants to be developed. My study on the bank has created an edge on my professional learning. So, the importance of my study on Recruitment and selection process of NBL is beyond description.

Scope of the Study:

The presentation of the organizational structure and policy of NBL Human Resource Development are considered as the scope of this report. Human Resource Department is most confidential department for any organization as well as Human Resource Division in NBL. Here as an intern I am allowed to get limited information for my study .I am not allowed to get the information which is too much confidential for the organization .So in my report all the information that I give that I am allowed to take the information and I have learnt my work.

Limitations

The main objectives of my short time practical learning were basically to get introduced with related laws, principles, documentations, procedures and practical knowledge regarding Export and Import business of Bangladesh. Since it was a very short period of time, I was not able to collect more data to acquire deep understanding.

Since this topic is related to export import policy order, guidelines issued by Bangladesh Bank and practical information based on National Bank Limited, It was not easy to collect all the data easily within the short span of time. There are some specific limitations that I faced while doing my internship. These are as follows:

- To get a total view of the banking function in three months is very short time.

- Supply of more practical and contemporary data is another shortcoming.

- The study was not done very successfully due to inexperience.

- Most recent annual information was not available due to time limitations

- Since the bank personals were very busy, they could provide me very little

I entered in their web site in the HR related information and it was very limited .So I took face –to-face interview of different employees of NBL, Asad Gate Branch

Background of the study

In the age of globalization, the importance of banking sector is beyond description. Banking sector is going ahead with the improvement of new technological innovation. Introduction of modern technology has made banking sector user friendly and more competitive. The banks of Bangladesh are not lagging behind in this regard. As a first generation bank, National Bank limited is competing with other government and non-government banks. Banks need sufficient tools and techniques to perform its banking activities. Department of Finance, International Islamic University Chittagong, (Dhaka campus) is innovatively providing the business sense, skills and expertise in regard to human resources to perform the business job including banking activities. As a mandatory part of the BBA Program, all the students of the faculty of Business Studies, International Islamic University Chittagong have to undergo a three month long internship program with an objective of gaining practical knowledge about current business world. Recruitment and selection process is an important issue in modern day business which is conducted by banks and other HRD department. So, I am lucky that I have been assigned with the HRD department to work in and I decided to prepare a report on “Recruitment and selection process” of National Bank Limited. The internship program on a bank like NBL has certainly improved my professional learning. The preparation of the report has strengthened my analytical ability.

History of National Bank Limited

National Bank Limited has its prosperous past, glorious present, prospective future and under processing projects and activities. Established as the first private sector Bank fully owned by Bangladeshi entrepreneurs, NBL has been flourishing as the largest private sector bank with the passage of time after facing many stress and strain. The member of the board of directors is creative businessman and international economist. For rendering all modern services, NBL, as a financial institution automated all its branches with computer network in accordance with the competitive commercial demand of time.

The emergence of National Bank Limited in the private sector is an important event in the banking area of Bangladesh. When the nation was in the grip of severe recession, Govt. took the farsighted decision to allow in the private sector to revive the economy of the country. Several dynamic entrepreneurs came forward for establishing a bank with a motto to revitalize the economy of the country.

The President of the People’s Republic of Bangladesh Justice Ahsanuddin Chowdhury inaugurated the bank formally on March 28, 1983 but the first branch at 48, Dilkusha Commercial Area, Dhaka started functioning on March 23, 1983. The 2nd Branch was opened on 11th May 1983 at Khatungonj, Chittagong. At present NBL is extending its service to people through total 167 branches and 15 SME/Agri branches all over the country.

National Bank Limited is one of the leading private commercial bank having a spread network of total 167 service locations across Bangladesh and plans to open few more branches to cover the important commercial areas in Dhaka, Chittagong, Sylhet and other areas in 2013

National Bank Limited has been licensed by the Government of Bangladesh as a Scheduled commercial bank in the private sector in pursuance of the policy of liberalisation of banking and financial services and facilities in Bangladesh. In view of the above, the Bank within a period of 25 years of its operation achieved a remarkable success and met up capital adequacy requirement of Bangladesh Bank.

A representative office was established in Yangon, Myanmar in October, 1996 by the bank and obtained permission from the government of Bangladesh to handle border trade with Myanmar opportunities is being explored for further business avenues there.

Now NBL is on line to establish trade and communication with the prime international banking companies of the world. As a result NBL will be able to build a strong root in international banking horizon. It has been drawing arrangement with well conversant money transfer service agency “Western union”. It has full time arrangement for speedy transfer of money all over the world.

A team of highly qualified and experiment professional headed by the managing Director of the bank who has vast banking experience of operating bank and at the top three is an efficient Board of Directors for making policies.

- Core Values

NBL’s core values of 6 key elements. These values bind our people together with an emphasis that our people are essential to everything in the Bank.

- For customers

Become the most caring Bank by providing the most courteous and efficient services to the customer.

- For employees

Providing many financial benefits to the employees and making a employee friendly environment.

- For shareholders

Ensuring fair return to the stockholder on their investment

- slogan

Our slogan, ‘Your Hometown Bank‘, embodies the spirit of every point in this Mission Statement so that each of us knows our high calling of serving people to the best of our abilities.

Company Profile:

Bank Name: National Bank Limited.

Address: Dhaka Branch Location

48, Dilkusha Commercial Area, Dhaka – 1000.

Phone: +880-2-956-3081 begin_of_the_skype_highlighting +880-2-956-3081 end_of_the_skype_highlighting

Fax: +880-2-956-3953, 966-9404

Email: ho@nblbd.com

Website: http://www.nblbd.com/

Year of incorporation: March 28, 1983

NBL’S Vision

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing NBL’s firmly at home and abroad as a front ranking bank of the country have been its cherished vision.

NBL’S Mission

NBL’s mission is to continue its support for expansion of activities at home and abroad by adding new dimensions to our banking services which have been ongoing in an unabated manner. Alongside, it is also putting highest priority in ensuring transparency, account ability, improved clientele service, as well as our commitment to serve the society through which we want to get closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of its clientele services in line with national and international requirements is the desired goal it wants to reach.

Objectives of NBL

The objectives of this plan are:

- To ensure that maximum possible service levels are maintained

- To ensure that we recover from interruptions as quickly as possible

- To minimize the likelihood and impact (risk) of interruptions

Mission Statement

“A bank for performing with potential ”

Principles

The principles behind this plan are:

- Disaster Recovery is just part of Business Continuity

- Risks are assessed for both probability and business impact

- Business continuity plans must be reasonable, practical and achievable

- In other words, we are not planning for every possibility

- Diminishing returns affect the benefits of planning for extreme cases.

Business Goal

To patronize, sponsor and encouraged games and sports, entertainment and other socio-economic activities alongside providing the best services to the client.

Mission statement- First National Bank

The First National Bank is a locally owned community bank committed to providing quality, personal, caring service to all the people in the towns and communities that make up our service area.

These services are provided to all persons without regard to race, colour, creed, religion

It is essential that all Hometown Bank Team Members be dedicated to providing Golden Rule, caring banking to all customers. The mission of our Board of Directors, management, and staff is to develop quality growth and to maintain the strength and integrity of the institution so that the community continues to be impacted positively by the Bank. In order to stay in business as an independent commercial banking institution, and to compete effectively and to provide needed services, the bank must earn an adequate profit

Services of NBL

- Credit & Debit cards

National Bank presented its International Master Card service before any other local bank here. In the meantime it has also introduced Visa and Power Cards (Debit card).

- Saving insurance scheme

Saving insurance scheme of NBL gives our family protection against the insecurities of the word .It combines the benefits of regular savings and insurance scheme. The nature and regulations of this scheme as follows:

Operational Network:

National Bank has one of the largest operational networks. They have lot of branches around the country. Now they are not only conducting business in Bangladesh but around many foreign countries like Singapore, Oman, Malaysia, Maldives etc. The principal activities of the bank are banking and related businesses. The banking businesses include taking deposits, extending credit to corporate organizations, retail and small & medium enterprises, trade financing, project financing, international credit card etc. National Bank Limited provides a full range of products and services to its customers.

National Bank & its offshore unit at a Glance in 2011

| Operating Result & Assets | 2011 | 2010 |

| 21932m | 18511m |

| 9592m | 8941m |

| Total Assets | 169,037m | 134,732m |

| Return on assets | 4.01% | 6.05% |

| Share value | 2011 | 2010 |

| Earnings per share | 7.07 | 7.97 |

| Marker value per share | 66.80 | 191.60 |

| Price Earnings ratio | 9.45 | 24.04 |

| Foreign Trade | 2011 | 2010 |

| Import | 104,571m | 96,443m |

| Export | 60,894m | 47,812m |

| Remittance | 54,469 | 49,145m |

| Staff & logistic | 2011 | 2010 |

| No. of employees | 3,758 | 3,442 |

| branch & SME centre | 154 | 145 |

| Foreign Subsidiary | 3 | 2 |

Table -Glance of NBL

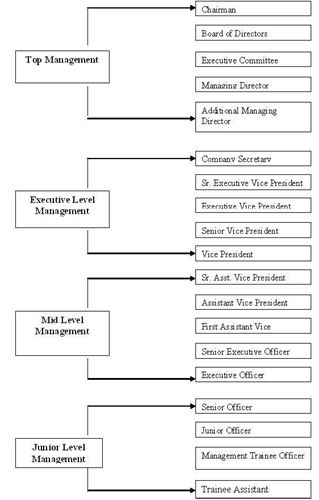

Organ gram of NBL Bank Limited:

Management Hierarchy of National Bank Limited:

Theoretical analysis of recruitment and Selection process

Once an organization identifies its human resource needs through employment planning, it can begin recruiting candidates for actual or anticipated vacancies.

Stept1

In human Resource management (HRM) cycle as well as in any organization, Recruitment and selection plays an important and vital role in achieving the organizational vision ,mission, goals and objectives .

Step 2

Organizations today consider human resources as the critical resource of the organization.

Step 3

Recruitment and selection is the staffing function in organizations.

Recruitment

Recruitment refers to the process of attracting, screening, and selecting qualified people for a job at an organization or firm. For some components of the recruitment process, mid- and large-size organizations often retain professional recruiters or outsource some of the process to recruitment agencies.

Candidates for employment and stimulating them to apply for jobs in the organization. Recruitment is the activity that links the employers and the job seekers.

Recruitment of candidates is the function preceding the selection, which helps create a pool of prospective employees for the organization so that the management can select the right candidate for the right job from this pool. The main objective of the recruitment process is to expedite the selection process. Recruitment is the process of attracting right persons at the right place at the right time

Purpose & importance of recruitment

The Purpose and Importance of Recruitment are given below:

Attract and encourage more and more candidates to apply in the organization.

Create a talent pool of candidates to enable the selection of best candidates for the organization.

Determine present and future requirements of the organization in conjunction with its personnel planning and job analysis activities.

Recruitment is the process which links the employers with the employees.

Increase the pool of job candidates at minimum cost.

Begin identifying and preparing potential job applicants who will be appropriate candidates.

Increase organization and individual effectiveness of various recruiting techniques and sources for all types of job applicants

Sources of Recruitment

According to Snell & Bohlander (2007), every organization has the option of choosing the candidates for its recruitment processes from two kinds of sources: internal and external sources. The sources within the organization itself (like transfer of employees from one department to other, promotions) to fill a position are known as the internal sources of recruitment. Recruitment candidates from all the other sources (like outsourcing agencies etc.) are known as the external sources of the recruitment.

Human resource planning

Effective human resource planning helps in determining the gaps present in the existing manpower of the organization. It also helps in determining the number of employees to be recruited and what qualification they must possess.

- Size of the firm

The size of the firm is an important factor in recruitment process. If the organization is planning to increase its operations and expand its business, it will think of hiring more personnel, which will handle its operations.

- Cost:

Recruitment incur cost to the employer, therefore, organizations try to employ that source of recruitment which will bear a lower cost of recruitment to the organization for each candidate.

- Growth & expansion:

Organization will employ or think of employing more personnel if it is expanding its operations.

External Factors Affecting Recruitment

The external factors which affecting recruitment is the forces which cannot be controlled by the organization. The major external forces are:

1. Supply & demand:

2. Labour market:

3. Image/goodwill:

4. Political, social & legal environment:

5. Unemployment rate:

6. Competitors:

The recruitment process

The recruitment process involves:

Advertising the job

Advertising is the shop window that attracts a potential applicant to find out more about the job. It should provide enough information to make the job sound appealing and encourage a potential applicant to take action. Care must be taken not to put too many barriers in the way of application, for example having to prepare a CV could be a barrier to some people applying.

Writing and advertisement

Newspaper advertising is the most common form of recruitment; therefore this fact sheet will focus on that process.

Components of a good advertisement

There is clear evidence that qualified applications are less likely to reply to vaguely worded or ill-defined advertisements, whereas unsuitable applicants are more likely to apply.

A common advertising format is as follows:

- Advert title

- Sales pitch

- Job title and property

- Description

- Description of the job

- Type of person required

- Contact details and closing

- Date

Giving the job

Before an effective sale pitch can be designed, the employer should:

Review the terms and conditions for the role

Check the farm budget

Prepare an information pack if one is to be sent out.

Selection

Selection is a process of measurement, decision making, and evaluation.

It is the process by which right persons at the right place at the time can be recruited.

The goal of a personnel selection system is to bring in to an organization the individuals who will perform well on the job.

A good selection system must also be fair to minorities and other protected classes.

Overview of selection techniques

Evidence –based best practice for three of the most commonly used selection techniques is outlined below.

Curriculum vitas /resumes and written applications

A curriculum vitae (CV)/ resume provides valuable information relating to a person’s professional qualifications and experience. All information in the CV should be verified where appropriate (e.g., asking applicants to explain gaps in employment history). Requesting job applicants to address specific selection criteria (I, e., essential and desirable) can improve the efficiency of reviewing CVs.

Conducting interviews

Structured interviews are recommended. A structured Interview involves asking each candidate the same set of questions and assessing their responses on the basis of pre-determined criteria.Qustions and assessment criteria should be based on accurate, updated job descriptions.

Two common types of structured interview questions are:

Situational questions

Experienced-based questions

Reference checks

Referees are useful for identifying past employment problems and clarifying the accuracy of information presented in an interview or CV. therefore, it is often difficult to differentiate between candidates on the basis of reference checks alone.

Acknowledging applicants

Where CVs are requested, it is polite to acknowledge their receipt with an email, letter or a phone call

The selection process

The selections process has the following components:

- Initial screening of applicants

- First interview

- Reference checking

- Second interview

- Job offer.

Who should be involved in the interview?

Using two people to conduct the interview is a good idea as they will both take different points from it .Make sure roles of the interviewers are clearly defined. Where possible, the direct manager of the job applicant should be involved.

Objective of selection:

The objective is to pick up the right candidate who would meet the requirements of the job and the organization best. To meet this goal the company obtains and assesses information about the applicants in terms of qualifications, skills, experience etc.

Selection Process

Selection involves a series of hurdles or steps. Each one must be successfully cleared before the applicant proceeds to the next. Tests are useful selection tools in that they uncover skills and talents that can’t be detected otherwise. they can be used to predict how well one would perform if hired, why one behave the way one does, what situational factors influence employee productivity etc. tests also provide reliable information that can be put to scientific and statistical analysis.

- Reception of Applicants

- Preliminary Interview

- Filling an application blank

- Employment tests

- Intelligence tests:

- Aptitude tests:

- Achievement tests

- Personality tests

Recruitment

Recruitment refers to the process of attracting, screening, and selecting qualified people for a job at an organization or firm. For some components of the recruitment process, mid-and large –size organization often retain professional recruiters or outsource some of the process to recruitment agencies.

Recruiting is the discovering of potential applicants for actual or anticipated organizational vacancies.

Types of Recruitment

NBL practices two types of recruitment

- Yearly recruitment: this is done each year, according to the HR plan

- Need-based recruitments: this is done when there is a sudden vacancy

Recruitment Sources and Methods

NBL usually promotes from within the organization. But it also recruits from external sources. The external sources are:

Different universities

Competitors and other organizations

Unsolicited applicants

Recruitment form campus generally handled by the HR division and the planning for this has done based on the annual manpower plan. At first the respective department makes a shortlist of candidate. National Bank recruits from campus for entry level positions. The plan for campus

Recruitment will have to tie up with the placement season of various universities that are targeted for recruitment. . The HR Division needs to identify a set of campuses based on the courses conducted there, any past experience of candidates from these campuses and the emerging requirements of the bank. The HR Division will need to take a decision regarding the source of external recruiting considering variables like –

Available spread of candidates

Cost Impact

Time needed

And the external recruitment methods include:

Advertising in newspaper and company website

Employee referral

Internship

Recruitment of officers at entry Level

The company will recruit following categories of officers at entry level:

I. Probationary officer

II. Junior officer (Gen.)

III. Junior officer(cash)

On recruitment, probationary officer, junior officer (Gen.) and junior officer (cash) will be paid a consolidated remuneration till they are confirmed on completion of probationary / temporary period.

After successful completion of probation period a “probationary officer’’ will be confirmed as “officer’ ,a “junior officer(Gen)’’will be confirmed as “ Assistant officer (Gen)’’and an “junior officer (cash)’’ will be confirmed as “Assistant officer(cash)’’.

Qualification for probationary officer

a) Candidate must BBA/MBA/MBM from public universities or some renowned private universities like NSU ,BRAC ,AIUB, IUB ,EWU , etc.

b) Candidates must have at least first division or grade equivalent to 3.50 each exam.

c) Having qualified the criteria candidates can apply through online, websites: www.nbIbd. Com.

d) Preference will be given to computer literate candidates.

e) Time is given while is fixed.

Qualification for junior officer

a) Candidates must BBA/MBA/MBM from public universities or some renowned private universities like NSU, BRAC, AIUB, IUB, EWU etc.

b) Candidates must have at least first division or grade equivalent to 3.50 each exam

c) Having qualified the criteria candidates can apply through online, websites: www.nbIbd. Com.

d) Preference will be given to computer literate candidates.

e) Time is given while is fixed.

Recruitment of Executives /officers

The bank may experience executives/officers from other banks /financial institutions from time to time. Their suitability or otherwise may be assessed by an Interview Board to be appointed by the Board of Directors. HRD of head office, NBL gives advertisement in daily newspaper for the recruitment of Executive /officer. Some time executives are selected by direct recruitment. The candidates should have the qualification and experience as shown below:

- Criteria for recruitment of Executives /officers

a) Candidates have must high qualification, at least master degree.

b) Candidates must have at least first division in each exam.

c) Candidates have must experience at least 3 years.

Recruitment of Staff

The managing director will be empowered to make these selections .All the above appointments will be recommended by a committee which will be constituted by him headed by an executive not bellow the rank of executive vice president. The committee may called selection committee (management) . Selection of such staff in the branch level may be made by the zone head with the concurrence of managing director by following the approved procedural guidelines and within the framework of approved organ gram. The final appointment shall be made subject to the approval of the board/committee.

Category of Staff

- Despatcher/Godown inspector (Godown inspector both regular and casual)

- Receptionist.

- Computer operator

- Telephone operator

- Electrician

- A C technician

- Driver

- Security guard

- Peon

- Lift man

- Plumber

- Mali/cook

- Tea-Boy

- Cleaner

- Sweeper

Criterial/ Recruitments for Employment of Staff

The criteria followed by the management selection committee formed at Head office for recruitment of Non –officer/Staff in NBL are as follows:

| SL. | Name of the post. | Recruitment. | Maximum Age |

| 01 | Despatcher/Godown Inspector | Graduate with any Division | 25 years |

| O2 | Receptionist | Graduate with any Division | 25 years |

| 03 | Computer operator | Graduate with any division must be computer literacy typing speed 40 WPM in English and 25 WPM in Bengali | 25 years |

| 04 | Telephone operator | Graduate with any division and 3 years experience in this line. | 25 years |

| 05 | Electrician | SSC with technical certificate as electrician having minimum 3 years experience in this line. | 25 years |

| 06 | A C Technician | S S C with technical certificate as A C Technician having minimum 3 years experience in this line. | 25 up years |

| 07 | Diver | Minimum education qualification class-VIII and at least 5 tears driving experience. | 25 years |

| 08 | Security Guard | Ex-Army /BDR/Ansar /Police or persons with Ansar Training having minimum education qualification of class – VIII (pass) | 25 up years |

| 09 | peon | Minimum education qualification S S C | 25 years |

| 10 | Lift Man | Minimum education qualification S S C with 3 years experience in this line. | 25 years |

| 11 | Plumber | Minimum education qualification S S C with 3 years experience in this line. He may be engaged on daily basis with the approval from the competent authority. | 25 years |

| 12 | Mail/Cook | Minimum education qualification Class-VII with experience. | 25 years |

| 13 | Tea-Boy | Minimum education qualification Class-V. He may be engaged on daily wage basis with the approval from the authority. | 25 years |

| 15 | sweeper | Minimum education qualification class –V. He may be engaged on daily wage basis with the approval from the authority. | 25 years |

Table-Criterial/ Recruitments for Employment of Staff

Selection

Suitability for a job is typically assessed by looking for skills, e.g. communication, typing, and computer skills. Qualifications may be shown through resumes, job applications, interviews, educational or professional experience, the testimony of reference, or in-house testing, such as for software knowledge, typing skills, numeric, and literacy. Other resume screening criteria may include length of service, job titles and length of time at a job. In some countries, employers are legally mandated to provide equal opportunity in hiring. May recruiters and agencies are using an applicant tracking system to perform may of the filtering tasks, along with tools for psychometric testing.

Selection is the process of choosing from among candidates within organization or outside, the most suitable person or for future positions. Selection activities typically follow a standard pattern, beginning with an initial screening interview and concluding with the final employment decision.

National Bank limited also follow a standard pattern for selection and identifying the best possible person for join with them .The selection system of NBL is discussing below:

Receipt of Application

This is the first selection step to join NBL. Candidates either send their CVs in application for a specific vacancy, or they send unsolicited CVs for any suitable position. There is a box in front of the HR division where interested person drop their unsolicited CV. The HR division collects job applications against each job vacancy. In case of newspaper advertisements, the applicants are given at least 3 weeks to apply. After a specific period, each and every job is closed for applying.

Sorting out Applications

The next step is the short listing of CVs. Usually the HR division is occupied in the short listing. But the HR division may hand over this step to the respective divisions to save time. To recruit experienced bankers, CVs may be sorted out from the collection of unsolicited CVs received. Or, another possibility is to find out experienced and competent bankers in other banks. Once potential candidates are thus found out, they are contacted and called for an interview

Informing Candidates

After short listing of the CV and choosing the suitable candidates, HR division inform the candidate over phone about written test (Entry level) or interview (Mid level). For written tests, the bank issues admit cards through courier services seven to ten days prior to the exam.

Written Test

As mentioned before, every candidate will appear for a written test for 100 marks. The subject matter of test should be general knowledge oriented with mathematical bass. For this purpose NBL may take the help of outside experts for setting the questions, supervision the examination work and making the scripts. Code number should be used to protect secrecy and to avoid lobbing .The head office HRD division arranges & conducts the written

Interview

The members of the selection committee considers the candidates’ appearance, personality ,communicating ability ,presence of mind , manner ,general & common sense and award marks individually which are totalled and averaged for determining interview performance score. The following criteria for interview are usually followed:

- Appearance & personality :10 marks

- Assessment : 10marks

- General & common sense : 10 marks

- General knowledge :10 marks

- Expression & presentation capacity : 10 marks

Total : 50 marks

Medical & Physical test

After completing the stage of background checking and verification, a candidate must be send to the authorized doctor for medical and physical National Bank Limited has their own medical team who check the selected candidates.

In medical and physical test, psychological fitness, physical ability, drug testing, stamina etc are checked. After completing every test, doctor gives the medical report to the management and then management take the final decision.

Final decision

Management takes the final decision based on the interview result, medical & physical report, smartness, personality, communication skill of the candidate. It is very difficult for the management to take the final decision because every candidate comes to this stage through a tough comet

Selection of candidates for the entry level officers – probationary officers, junior officers (both Gen.and cash ) shall be made on the basis of written test, mcq, interview.

Total marks shall be 200 as per break up shown below:

- Written test : 100 marks

- MCQ : 50 marks

- Interview : 50 marks

- Total : 200 mark

Analysis of the Recruitment and selection process of NBL

Human resource planning is the stage of an effective recruitment and selection process .It is not only a matter of satisfying the present HR needs of an organization ,but also an activity that influences the shape of the organization’s future. In National Bank limited (NBL)the total recruitment and selection processes mainly maintain by Head office and organized by Human Resource Management of NBL .As internal recruitment ,in case of promotion ,transfer ,separation are happened by this way .As external recruitment they attract not only experience candidate but also fresh graduate.

The strengths of Recruitment and selection process of NBL

The management of NBL cares for the quality of service as well as the quality of its human resources .As a result,NBL

The recruitment and selection is quite fair and square. Everyone at the HR Division is honest and impartial which promotes the environment of accountability.

Internal growth creates an attachment between the employees and the organization. Moreover, internal growth has increased the recruitment and selection efficiency of the HR division, since it has better knowledge about the applicants’ knowledge, skills, abilities and other qualifications.

The recruitment and selection process of NBL emphasizes more on who fits the organization, rather than who fits the job. Thus, it has created a unique organizational culture and the whole HR Division has ensured a friendly and caring working environment.

The written test is very effective because in written test they use both aptitude test and intelligence test. Through this type of written test they measure the candidate’s ability, intelligence, ability to handle the tough situation, ability to take decision etc.

A structured interview has a set of standardized questions and an established set of answers against which applicant responses can be rated. It provides a more consistent basis for evaluating job candidates.

The weaknesses of Recruitment and Selection process of NBL

NBL’s HR planning can be made more effective if it is revised more often according to the change in this fast moving industry.

Statistical measures such as correlation analysis and regression analysis are not applied to predict and analyze the recruitment and selection requirements more precisely.

Quantitative methods are not practiced in determining utility in recruitment and selection .There is no feedback system established to find out the efficiency of the system and correct its drawbacks.

No study is conducted to justify the effectiveness of the recruitment tests.

Regret letter are not sent to the candidates who are not selected after joining of the finally selected candidates.

NBL does not always check references properly ,which may lead to a grave problem for the organization

Problems

The main vision of National Bank Limited has been successful by increasing its revenue, deposit and branch in Bangladesh .Although there are no major problems at NBL some of the problems observe as follow:

Technological advancements

NBL has equipped its branches will all major IT tools in the industry like ATM’s Fax machine ,photocopies ,printers, Latest computers and good connective architecture. However it has been observed that when it’s time to work, there are many facilities seen in the different device used by NBL. Especially its connectivity architecture and remains office with the main server, the creates problems to the customers. Number of ATM booths is not sufficient.

Job Advancement

There is no advancement procedures for lower staff members or junior executives that have join recently at NBL. The main problem was observed that the lower staff should be trained about the operations of the bank and also the junior should be given promotions by defining the criteria’s like performance etc.

Training and Developments

There is no effective training center of NBL Bangladesh. The problem with Training and Development is that it is only available for the high level officer and not for lower staff members.

Lack of employees in some departments

Although National Bank Limited is a very good employer of talent professionals at different branches, however it was observed that there were some departments in the bank lacked the number of professional in it that resulted in efficiencies in that department

Amenities at Branch

Providing amenities like separate room for prayers because the currently of employees pray in the conference room of the branches .Also separate room should be made for the account department for storing of the vouchers at it is done in the conference room.

Incentive schemes

There is no scheme for employees for National Bank Limited. Like scholarship schemes for employees that want to push higher education .NBL although give a number if incentives to an employees, like personal loans at normal mark-up but they are only provide to employees that are in higher ranks. Education fees are also returned by NBL to its employees after having finished their studies

Recommendation

It was an interesting experience to do internship in the National Bank ltd., Asad Gate branch .The employee was highly cooperative and with their help I learned a lot about modern banking .Here I am putting some suggestion regarding operational activities of the Bank .On the basis of my observation, I would like to recommend the following:

- Skilled manpower (human resources) in the most important tool to develop any organization. As are service – oriented organization, efficient management of human resources is an important aspect.

- All the computers and other machineries should be well maintained. Sometimes customer service related works were hampered due to technical problem in computers .That’s why, each branch should have skilled technical person.

- Files and documents must be kept in proper manner. So that, at the time of need, it doesn’t take much time to find it out. Vouchers should be shorted in a regular manner.

- Numbers of employees are not sufficient to serve the huge amount of clients, so it should be increased.

- The Bank should increase the number of depositing product as the customers want new product.

- A philosophy of working for the customers instead of working for boss must be introduced .

- Due to IT problems sometimes customers become hopeless and as it is an online banking system. So the IT draw bank should be removed.

In unstructured part candidate can give own opinion about the specific situation. By this interview, management can measure the candidate’s intelligence

- NBL should create an online job server, which provides online application facility. This will ease the hassle of sending hard copy of CV to office.

- The bank should maintain a database of CVs of all applicants, which would be easier if applying online is encouraged NBL

- A primary advantage of a job knowledge

- Test is that it is by definition job-related. A test for any specific organizational job can be designed based on the data gathered from an in-depth job analysis. These tests may require written

Conclusion

One of the most important resources of an organization is its people. Employees supply the talent, skills, and creativity and exert the effort and leadership that contribute to the level of performance of the organization. Effective use of human resources management leads to a number of consequences like helping the firm to achieve its objectives, increasing employees job satisfaction, providing the firm with well-trained and motivated employees and developing quality of work life which makes employment personally and socially desirable. National Bank Limited has a human resource department and they conduct every activities of human resource management. The main and important part is recruitment and selection of employees. So recruitment and selection plays a vital role in the Human Resources Department. In recruitment and selection, there is a process and the necessary steps are required to follow. Through every steps candidates skill, knowledge, abilities, personal appearance, intelligence, smartness, behaviour, mental and physical fitness everything can be judged. The result of this judgment is to recruitment perfect and eligible personnel. National Bank Limited follows the whole process of recruitment and selection for the post of Probationary Officer. But for the other post they do not follow the overall process. Though there are some positive factors and strengths in their recruitment and selection process but also some negative sight. Biasness is one of the most important negative elements. Here reference creates biasness. Strong reference prefer first because there are lots of internal and external factors those manipulate the business in many ways. For controlling those factors and doing this business they prefer the references. Another thing is they do not follow the whole process for recruiting other posts except the Probationary Officer. In very few cases they take the written test, they only take the interview and viva. But they should take the every step for recruiting every level of employees. Their recruitment and selection process is good if they can follow it properly. If they can able to recruit perfect and eligible employees their output will be better in the market.