A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time. Unlike a call option, a put option is typically a bearish bet on the market, meaning that it profits when the price of the underlying security goes down.

In finance, a put or put option is a stock market instrument which gives the holder (i.e. the purchaser of the put option) the right to sell an asset (the underlying), at a specified price (the strike), by (or at) a specified date (the expiry or maturity) to the writer (i.e. seller) of the put. The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying stock. The term “put” comes from the fact that the owner has the right to “put up for sale” the stock or index.

Put options are traded on various underlying assets, including stocks, currencies, bonds, commodities, futures, and indexes. A put can be contrasted with a call option, which gives the holder to buy the underlying at a specified price, either on or before the expiration date of the options contract. They are key to understanding when choosing whether to perform a straddle or a strangle.

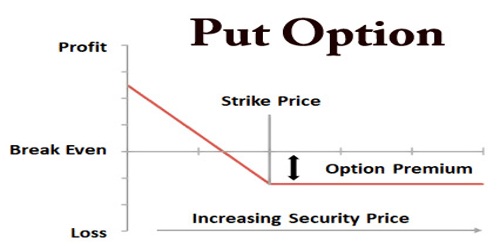

Put options are most commonly used in the stock market to protect against a fall in the price of a stock below a specified price. If the price of the stock declines below the strike price, the holder of the put has the right, but not the obligation, to sell the asset at the strike price, while the seller of the put has the obligation to purchase the asset at the strike price if the owner uses the right to do so (the holder is said to exercise the option). In this way, the buyer of the put will receive at least the strike price specified, even if the asset is currently worthless.

Most put options allow us to sell 100 shares of stock to the investor who sells us the put option, and we have to make a decision about what to do before the option expires. If the price of the stock on the open market falls below what’s called the strike price the specified price in the put option then we will usually want to exercise the option and sell the stock at the higher strike price. Conversely, if the market price of the stock is still above the strike price of the put option, then we will simply let it expire, and if we want to sell the stock, we will do it on the open market where we will get a higher price.

As we can see, put options are nice because they offer a way to profit from a stock dropping. If we own that stock, then buying a put option protects us from losses below the strike price, as we can always just exercise the option and guarantee that we will get the fixed amount specified in the option. Yet buying a put option has an advantage over selling the stock we own outright, as we can still benefit from share-price increases. If we don’t own the stock, on the other hand, then having a put option can actually help us profit from a decline in the stock price.

If the strike is K, and at time t the value of the underlying is S(t), then in an American option the buyer can exercise the put for a payout of K-S(t) any time until the option’s maturity date T. The put yields a positive return only if the underlying price falls below the strike when the option is exercised. A European option can only be exercised at time T rather than at any time until T, and a Bermudan option can be exercised only on specific dates listed in the terms of the contract. If the option is not exercised by maturity, it expires worthless. (The buyer will not usually exercise the option at an allowable date if the price of the underlying is greater than K.)

The most obvious use of a put option is as a type of insurance. In the protective put strategy, the investor buys enough puts to cover their holdings of the underlying so that if the price of the underlying falls sharply, they can still sell it at the strike price. Another use is for speculation: an investor can take a short position in the underlying stock without trading in it directly.

Puts may also be combined with other derivatives as part of more complex investment strategies, and in particular, may be useful for hedging. Holding a European put option is equivalent to holding the corresponding call option and selling an appropriate forward contract. This equivalence is called “put-call parity”.

Put Options vs. Call Option – While a put option is a contract that gives investors the right to sell shares at a later time at a specified price (the strike price), a call option is a contract that gives the investor the right to buy shares later on. Unlike put options, call options are generally a bullish bet on the particular stock and tend to make a profit when the underlying security of the option goes up in price.

Put or call options are often traded when the investor expects the stock to move in some way in a set period of time, often before or after an earnings report, acquisition, merger or other business events. When purchasing a call option, the investor believes the price of the underlying security will go up before the expiration date and can generate profits by buying the stock at a lower price than its market value.

In general, the value of a put option decreases as its time to expiration approaches because of the impact of time decay. Time decay refers to the probability of the stock falling below the specified strike price decreases. When an option loses its time value, the intrinsic value is left over, which is equivalent to the difference between the strike prices less the underlying stock price. If an option has intrinsic value, it is referred to as in the money (ITM).

Out of the money (OTM) and at the money (ATM) put options have no intrinsic value because there is no benefit in exercising the option. Investors have the option of short selling the stock at the current higher market price, rather than exercising an out of the money put option at an undesirable strike price. However, outside of the bear market, short selling is typically riskier than buying options.

The time value of a put option is essentially the probability of the underlying security’s price falling below the strike price before the expiration date of the contract. For this reason, all put options (and call options for that matter) are experiencing time decay meaning that the value of the contract decreases as it nears the expiration date. Options, therefore, become less valuable the closer they get to the expiration date.

But apart from time value, an underlying security’s volatility also affects the price of a put option. In the regular stock market with a long stock position, volatility isn’t always a good thing. However, for options, the higher the volatility (or the more dramatic the price swings) of a given stock, the more expensive the put option is. This is primarily due to how the put option is betting on the price of the underlying stock swinging in a set period of time. So, the higher the volatility of an underlying security, the higher the price of a put option on that security.

Put options, as well as many other types of options, are traded through brokerages. Some brokers have specialized features and benefits for options traders.

A put option is said to have intrinsic value when the underlying instrument has a spot price (S) below the option’s strike price (K). Upon exercise, a put option is valued at K-S if it is “in-the-money”, otherwise its value is zero. Prior to exercise, an option has time value apart from its intrinsic value. The following factors reduce the time value of a put option: shortening of the time to expire, a decrease in the volatility of the underlying, an increase of interest rates. Option pricing is a central problem of financial mathematics.

The put seller, known as the “writer,” does not need to hold an option until expiration, and neither does the option buyer. As the underlying stock price moves, the premium of the option will change to reflect the recent underlying price movements. The option buyer can sell their option and either minimize loss or realize a profit depending on how the price of the option has changed since they bought it.

Similarly, the option writer can do the same thing. If the underlying’s price is above the strike price they may do nothing because the option may expire worthlessly and they can keep the whole premium. But if the underlying’s price is approaching or dropping below the strike price, to avoid a big loss the option writer may simply buy the option back, getting them out of the position. The profit or loss is the difference between the premium collected and the premium paid to get out of the position.

Information Sources: