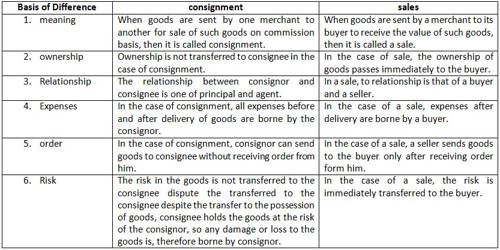

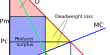

General objective of this presentation is to present on Tax. Tax is to impose a financial charge or other levy upon a taxpayer by way of a state or the functional equivalent of an state such that failure to pay is punishable by legislation. Compulsory monetary contribution to the state’s revenue, assessed and imposed by way of a government on the routines, enjoyment, expenditure, income, profession, privilege, property, etc. of people and organizations. Here analysis two type of tax: Direct and Indirect. Finally explain four main purposes or effects of taxation: Revenue, Redistribution, Reprising and Representation.

Presentation on Tax