A Nominated Advisor (NOMAD) refers to a financial services firm used by a company to be placed on the Alternative Investment Market (AIM) of the London Stock Exchange (LSE). The LSE needs an AIM listing company to have a NOMAD, which the LSE itself must authorize to execute the functions. When the organization is recorded on the AIM, the named counsel is liable for managing the organization. The NOMAD keeps on observing its customer even after effectively posting on the AIM. There are some conditions that NOMADs must fulfill, including becoming a corporation and among others being interested in corporate finance.

AIM was founded by the London Stock Exchange (LSE) in 1995. The new submarket was developed to allow capital to be raised by emerging growth companies. As well as taking advantage of the lower listing criteria needed by the target, companies were able to achieve this. Well, more than 3,865 of such organizations from around the globe have exploited the lower posting necessities offered by this elective trade. Organizations’ overall rundown on the AIM and the postings keep on developing. The average amount of capital generated on target has been GBP21.5 million in the past five years. Moreover, in the past year, the average daily trading volume on the exchange was GBP2.4 billion.

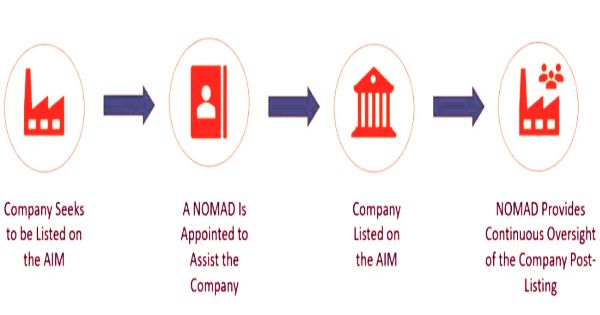

(Basic NOMAD Process)

There is however a requirement that a business must retain a NOMAD’s services to help direct it through the listing phases of the Target. An appointed advisor is a corporate finance advisor that is pre-approved to admit a business to target by the London Stock Exchange. An organization must meet the following conditions to become a NOMAD:

- Must be a firm or company a NOMAD cannot be an individual;

- Practiced corporate finance for at least the past two years;

- Acted on at least three relevant transactions in the past two years; and

- Employ at least four qualified executives.

A NOMAD is a corporate finance advisor, typically a boutique investment firm, which carries out extensive due diligence on the suitability of a Goal exchange applicant. Subsequent to being designated a NOMAD for an organization, the consultant gets liable for exhorting and controlling the organization on the obligations it expects to be admitted to the AIM. The NOMAD will assist the company in its planning and application for admission to the target; if it is pleased with the company’s business model, financial and operational track record, the competence of executives and directors, and the expected capital structure.

To sum up, the NOMAD initially starts by helping the organization in exploring the AIM posting measure. The NOMAD will at that point perform due tirelessness to guarantee the organization is an appropriate fit for the AIM and that they will be effective in the wake of posting. The NOMAD must serve as the regulator, ensuring at all times that the company complies with AIM laws. The NOMAD also has an ongoing purpose of offering company organizational or financial planning advice. A business seeking to be listed on the AIM should also employ a broker, accountant, and legal advisor in addition to employing a nominated advisor. In the following manners, they vary from a NOMAD:

- Merchants have practical experience in uniting purchasers and vendors and are not engaged with the broad duties of a NOMAD.

- Accountants are autonomous third-party analysts aimed at supplying shareholders with accurate financial information. In preparing the financial statements for distribution, they support the company.

- A lawful counselor helps with the check of explanations and gives guidance and exhortation to board individuals from the organization.

The NOMAD project handles the admission to Target of new issues and serves as the successful regulator as well. Usually, NOMAD is a company of investment bankers with expertise in the marketing of businesses.

Information Sources: