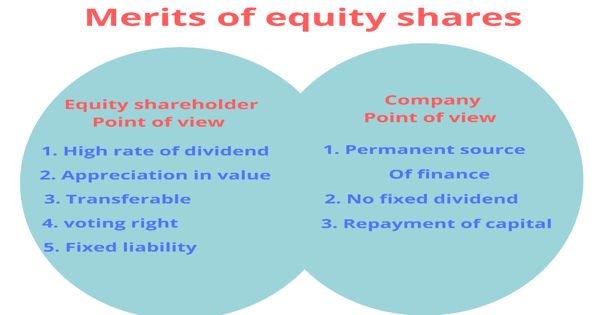

Benefits of equity share investment are dividend entitlement, capital gains, limited liability, control, claim over income and assets, right shares, bonus shares, liquidity, etc. Equity share is looked at from different perspectives by different stakeholders. An investor is entitled to receive a dividend from the company. It is one of the two main sources of return on his investment. Liability of shareholder or investor is limited to the extent of the investment made. If the company goes into losses, the share of loss over and above the capital investment would not be borne by the investor.

Merits of Equity Shares Capital

- Equity capital is the foundation of the capital of a company. It stands last in the list of claims and it provides a cushion for creditors.

- Equity Shares Capital does not create a sense of obligation and accountability to pay a rate of dividend that is fixed.

- It provides creditworthiness to the company and confidence to prospective loan providers.

- Equity Shares Capital can be circulated even without establishing any extra charges over the assets of an enterprise.

- Investors who are willing to take a bigger risk for higher returns prefer equity shares.

- It is a perpetual source of funding, and the enterprise has to pay back; exceptional case – under liquidation.

- There is no burden on the company, as payment of dividend to the equity shareholders is not compulsory.

- Equity shareholders are the authentic owners of the enterprise who possess the voting rights

- Equity issue raises funds without creating any charge on the assets of the company.

- Voting rights of equity shareholders make them have democratic control over the management of the company.

Advantages from the Shareholders’ Point of View

(a) Equity shares are very liquid and can be easily sold in the capital market.

(b) In case of high profit, they get dividend at higher rate.

(c) Equity shareholders have the right to control the management of the company.

Advantages from the Company’s Point of View:

(a) They are a permanent source of capital and as such; do not involve any repayment liability.

(b) They do not have any obligation regarding payment of dividend.

(c) Larger equity capital base increases the creditworthiness of the company among the creditors and investors.