Maturity transformation refers to the practice of financial institutions, such as banks, using short-term funding sources, such as deposits, to fund long-term investments, such as loans or mortgages. It refers to financial institutions’ practice of borrowing money on shorter timeframes than they lend it out. The aim of maturity transformation is to generate a profit by earning a higher interest rate on long-term investments than the interest rate paid on short-term funding sources.

This process can be risky because if there is a sudden increase in demand for the short-term funding source, such as a bank run, the financial institution may not be able to meet its obligations to depositors. This is known as a liquidity crisis.

Financial markets also have the maturity transformation effect, which means that investors such as shareholders and bondholders can sell their shares and bonds in the secondary market (i.e. the majority of the stock market) at any time without affecting the company that issued the shares or bonds. As a result, the company can be a long-term borrower in a market dominated by short-term lenders. Short-term lenders simply buy and sell ownership of shares or bonds on the stock exchange. The company maintains a register of owners and changes the name whenever a sale occurs.

To manage this risk, financial institutions typically engage in asset-liability management, which involves carefully matching the maturity and cash flows of their assets and liabilities. They may also hold reserves or have access to emergency funding sources to manage liquidity during times of stress. Regulators may also require financial institutions to maintain certain levels of liquidity and capital to mitigate the risk of a liquidity crisis.

A bank’s primary function is to serve as a safe deposit box for its customers’ funds, and then to use these funds to make loans to customers. When a customer makes a deposit at a bank, the bank must ensure that the funds are instantly available to it. When a customer obtains a loan from a bank, there will be a set date on which the loan will be fully repaid.

Maturity transformation is the act of accepting deposits that may be required back by the customer at any time, but may also be left with the bank for many years while using these same funds to make loans that will not be repaid for many years.

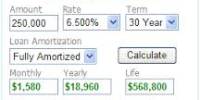

Maturity transformation involves some risks, as the interest rates on long-term loans can fluctuate over time, while the interest rates on short-term borrowings can change quickly. If the interest rate on long-term loans rises suddenly, financial intermediaries may find it difficult to attract new borrowers, or may have to pay more to attract them. If interest rates on short-term borrowings rise unexpectedly, financial intermediaries may have difficulty rolling over their borrowings at the same rate, which could lead to a liquidity crisis.