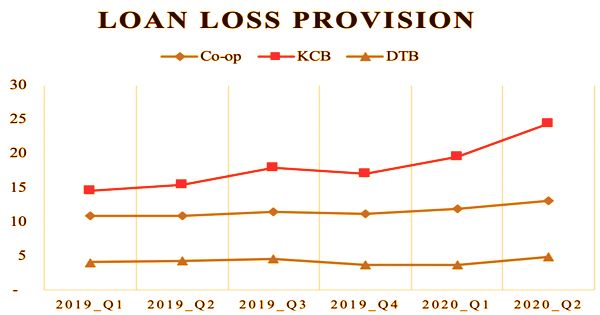

A loan loss provision alludes to reserves put aside by a bank to cover awful advances the ones that don’t get completely reimbursed on the grounds that the client defaults or those that give less revenue pay on the grounds that the borrower arranged a lower rate. This provision is used to cover various forms of loan defaults, such as non-performing loans, the bankruptcy of customers, and renegotiated loans that earn payments smaller than previously expected. There are a bank’s best gauges of what level of credit may not get repaid. When made, the gauge will be remembered for a bank’s fiscal summary as a cost so speculators to get an appropriate feeling of a bank’s budgetary wellbeing.

Loan loss provisions, a balance sheet item that reflects the total amount of loan losses subtracted from the loans of a business, are then added to the loan loss reserves. A loan loss is still a lost asset for the bank, but the purpose of the loan loss clause is to ensure that the cash flow of the bank is covered so that it still has the funds to provide other borrowers and depositors with services. By and large, banks direct their business by taking stores and setting aside credits utilizing those installments. It is a touch more muddled (for example ventures, securitization, and so on,), notwithstanding, this is the essential financial model.

(Example of Loan Loss Provision)

Banks lend to a wide variety of clients, including individuals, small firms, and large businesses. Banks must balance their loan receivables (i.e. creditors’ principal and interest repayments) with the demand for deposits (i.e. depositors’ demands for all or part of their deposits). Improved guidelines for banks coming about because of the Dodd-Frank Act zeroed in on expanding the norms for loaning, which have required higher credit quality borrowers and furthermore expanded the capital liquidity prerequisites for the bank.

Loan loss provisions are different from reserves of loan loss, which are a count of all the provisions of loan loss accumulated over many years. And while the expected loss is a loan loss clause, the true loss, when it comes, is considered a net charge-off. Banks expect there to be some loans in any category of loans that do not perform as expected. These credits might be delinquent on their reimbursements or in default of the advance altogether, making a misfortune for the bank on anticipated pay. Advance misfortune arrangements are reliably made to consolidate changing projections for misfortunes from the bank’s loaning items.

Loan loss provisions can not only be good indicators of the health of a bank, but also of the overall economy. Bank regulators require routine screening of bank loan portfolios, rating of each asset (i.e. loan) or asset category by market conditions, collateral conditions, and other business risk factors to assess the loan loss provision amounts. Loan loss provisions are continually made to refresh appraisals and figuring’s dependent on measurements for the bank’s client defaults. These assessments are determined dependent on normal recorded default rates by various degrees of borrowers.

From a monetary record point of view, a misfortune on an advance is as yet lost a resource. In any case, on a working premise, in view of the advance misfortune arrangement, income stays accessible. Advance misfortune arrangements spiked during the 2008 emergency, for instance, just as with the COVID-19 flare-up in 2020 when huge banks in both the U.S. what’s more, Canada needed to put aside billions of dollars for possible later use to cover awful credits and misfortunes from shopper obligation defaults as the worldwide pandemic shut down majors sections of the economy. Overall, banks should make sure that they present an accurate assessment of their overall financial condition by setting aside loan loss reserves and continuously updating estimates through loan loss provisions.

Information Sources: