The key rate is a particular interest rate that is used to set bank lending rates and borrowers’ credit costs. The Bank of Canada sets the interest rate to control short-term borrowing between financial institutions in Canada. The two key interest costs in the U.S. are the rebate rate and the government subsidizes rate. These are rates that are set, either straightforwardly or in a roundabout way, by the Federal Reserve, to impact loaning and the stockpile of cash and credit in the economy.

The key rate has been known by several names over time, including bank rate, policy interest rate, and overnight rate target. The key rate was previously known as the “bank rate.” It is currently used interchangeably with the terms “policy interest rate” and “overnight rate goal.” It will decide the rate at which banks can get to keep up with their save levels. The Federal Reserve can impact the rate at which banks can acquire cash to grow or get the public economy.

The key rate is at the 50 basis point operating band’s midpoint. It’s the interest rate at which banks can borrow money if they don’t have enough reserves. They can borrow for a limited length of time from other banks or directly from the Federal Reserve. The federal funds rate is the rate at which banks can borrow money from other banks. The discount rate is the rate at which banks borrow money from the Federal Reserve.

Uses of the Key Rate:

Reserve Requirements: Since the key rate is the objective pace of acquiring between monetary foundations, it is additionally a critical part utilized in gathering the hold necessity. The hold necessity is a predetermined level of money that monetary establishments should keep on deck to address liquidity issues, for example, client solicitations to pull out reserves. The reserve requirement was put in place to keep the company from going bankrupt. Financial institutions utilize the key rate to borrow money if they fall below the reserve requirement.

Monetary Policy: Another essential feature of the key rate is that it is the central bank’s principal tool for implementing monetary policy. Consumers’ credit card rates, personal loans, home loans, and other interest rates are all influenced by the key rate.

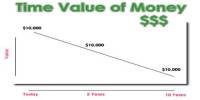

Loan costs impact the economy through impetuses for acquiring and saving. In the event that financing costs are high, individuals have a motivating force to set aside cash. On the other hand, if financing costs are low, individuals have a motivating force to get and go through cash. As a result of this relationship, financing costs are utilized in money-related arrangements to shape the full-scale economy.

When a significant number of account holders remove money from a bank, the bank may experience liquidity problems or inadequate cash. This implies that not all customers will be able to withdraw their money when they need it since the bank owes them money. The key rate has been minimally changed since the Bank of Canada was established in 1935. The key rate was originally known as the bank rate, and it was a fixed rate established by the bank.

Between 1935-1996, the key rate was changed between a skimming rate and a decent rate on numerous occasions. The Federal Reserve keeps a fragmentary save banking framework, which expects banks to keep just a little level of their stores in real money otherwise called the hold necessity. From 1996 to the present, the bank rate has gradually lost relevance as the bank’s main rate has been transferred to the overnight rate goal (or policy interest rate).

This “new” key rate is a fixed rate established by the Bank of Canada on eight dates each year, roughly in the middle of a 50-basis-point operational band. The Federal Reserve System uses key rates as one of its primary tools for implementing monetary policy. At the point when the Federal Reserve needs to extend the cash supply in the economy, it will regularly purchase securities on the open market with recently made cash utilizing the government assets’ rater to check the volume and speed of security bought required.

Because the Bank of Canada can only influence the key rate directly eight times a year, their alternate method is to influence it indirectly through treasury securities, which is referred to as open market operations in monetary policy. Because the prime rate is based on the key rate, the Federal Reserve may regulate the money supply by altering the key rate. The prime rate is the interest rate that banks provide to their customers.

When in doubt of thumb, the public prime rate is as a rule around 3 rate focuses over the fed finances rate. On the off chance that the fed subsidizes rate increments after the markdown rate builds, banks will adjust their excellent rates to mirror this change. As a result, interest rates on consumer borrowing, such as mortgages and credit cards, would rise. Lowering key rates lowers borrowing costs, which leads to less saving and more spending, which expands the economy.

Information Sources: