Introduction

Uttara Bank Limited is one of the largest and oldest private-sector commercial Bank of Bangladesh. The Bank was formally known as the Eastern Banking Corporation Limited which started journey on & from 28/ 1/1965. From that period of time, it has been expanding its operation with years of experience to serve the clients as well as the country. Now with 207 fully computerized branches worldwide created a strong network in Bangladesh. Besides, to create a strong connection with the globe 600 affiliates worldwide create efficient networking and reach capability are active to support the Bank. Uttara is a bank that serves both clients and country.

1.2: Formation of UBL:

Eastern Banking Corporation was formed in the year of 1965 that is after a long history known as Uttara Bank Limited. Under the Bangladesh Bank (Nationalization) order 1972, UBL had been a nationalized Bank in the name of Uttara Bank but it was converted as a public limited company named “Uttara Bank limited” in the year of 1983 upon the amendment of Bangladesh bank (Nationalization) order. The Bank was incorporated as a banking company on 29/06/1983 and obtained business commencement certificate on 21/ 08/ 1983. Only within one year the Bank floated its share & now the Bank is listed in the DSE & CSE for trading share.

1.3: UBL at Glance:

1. Business name: Uttara Bank Limited (UBL)

2. .It is one of the oldest private commercial Bank in Bangladesh.

3. It was formally known as Eastern Banking Corporation.

4. It has been working as private commercial Bank from the year of 1983.

5. Currently it is operating with 207 branches in home & 600 international correspondents.

6. All the branches of UBL are fully computerized with changing environment.

7. About 3,562 employees are in the winning team of UBL.

8. The Head Office is located at Bank’s own 18-storied building at Motijheel, the commercial center of the capital, Dhaka.

Registered Office:

90, Motijheel Commercial Area, Dhaka-1000, Bangladesh

GPO Box- 217 & 818

Corporate Offices : 02 (Corporate Branch & Local Office)

Regional Office : 13

Authorized Branches : 38 ( Dealer Branches)

Treasury & Dealing Room : 01

Training Institute : 01

Paid-up capital : 399.3 million (2007), 99.8 million (2003)

Total Assets : 52,860.3 million (2007), 36,671.0 million (2003)

Income Per Share : 102.56 (2007), 197.41 (2003)

Telephone : PABX 9551162

Telefax : 88-02-7168376, 88-02-9572102

E-mail :uttara@citecho.net, ublmis@citcho.net

Web : www.uttarabank-bd.com

Chairman :Mr. Azaharul Islam

Vice Chairman : Mr. Md. Asaduzzaman.

Managing Director : Mr. Md. Shamsuddin Ahmed.

Auditors : M/S Ata Khan & Co.

Chartered Accountants

Legal Adviser : Mr. M. Moniruzzaman Khan

Barrister at law

Secretary : Mr. Md. Fazlur Rahman.

1.5: Human Resources:

The Bank gives preference for the development of its employees. For that reason, the bank undertakes different training program & ‘Research & Development (R&D)’ time to time. Development of human resources is going on in the following ways-

Bank’s own training institute has been striving to bring about a qualitative change and improvement in human resources of the bank by imparting continuous different training throughout the whole year.

Guest speakers specialized in banking participate in each training program of the Bank in addition to highly educated faculty members of the staff of the Bank participated.

A member of executives and officials are sent to various training institutions including “Bangladesh Institute of Bank Management (BIBM) and abroad for higher training.

• Total Human resource of the Bank as on 31 December, 2008 was as follows-

1.5.2: Board of Directors:

• Chairman Azaharul Islam

• Vice Chairman Md. Asaduzzaman

• Directors Badrunnesa (Sharmin) Islam

Md. Mahfuzus Subhan

Abul Barq Alvi

Faruque Alamgir

Col. Engineer M.S. Kamal (Retd.) Independent Director

Prof. Mirza Mazharul Islam

Prof. Sharif Md. Shahjahan

Sayes A. N. Wahed

Shah Habibul Haque

Sk. Amanullah

Major General Prof. M.A. Mohaiemen (Retd.)

• Managing Director Shamsuddin Ahmed

• Secretary Md. Fazlur Rahman

1.6: Development of Branches:

UBL opened six new branches to expand its network in the year of 2008. As a result it has 207 branches all over the country. New six branches are-

Mohakhali Branch;

BKSP branch & Panthopath branch, Dhaka;

Chakbazar & Lohagara branch, Chittagong;

Chatak branch, Sunamgonj.

At present international division of head office and 38 branches is under SWIFT operation & for that reason the Bank has been able to transmit letter of credit, fund and message instantly throughout the world at low cost. Now all the branches of the Bank are well decorated & operations run by computer technology.

1.7: Transportation:

In the year of 2008, total vehicles of the Bank were 107. The vehicles are being used to transport the Bank’s employees & to transfer money from feeding branches to other branches.

1.8: Location of Bank:

UBL has its own building of 18 stored that is using as head office located at Motijheel Commercial Area of Dhaka city. Bank has also its own building in the following locations-

• Local office,

• Eastern Plaza branch,

• Hotel Isakha branch,

• Dar-us-salam road branch,

• Lease financing unit in Eastern Tower Building,

• Training institute of the Bank at Eastern plus (145, shantinagar), Dhaka,

• Nabagram branch in Manikgonj,

• Zonal office and KDA branch in Khulna and Shaheb Bazar branch in Rajshahi.

1.9: UBL in the Competitive Marketplace:

Uttara Bank Limited successfully completed the year of 2008 with the position where rivalry among competitors was very high. At the same time the overall macroeconomic scenario of the country was destructive because of political & natural calamities. There is the existence of substitute products of such private commercial Bank like different finance companies, micro credit by NGOs (Non Government Organizations) & money market existing in the country. Bargaining power of customers is very high as customers have the opportunity to switch into other financial organization easily. In the mentioned year of 2008, the Bank achieved excellent performance in connection with deposit & credit expansion, compliance on corporate Governance, tremendous success on foreign trade & in managing of risk. Considering the overall perspective of the market & the performance of overall banking activities of UBL, it can be proved that the performance of the Bank was quite satisfactory.

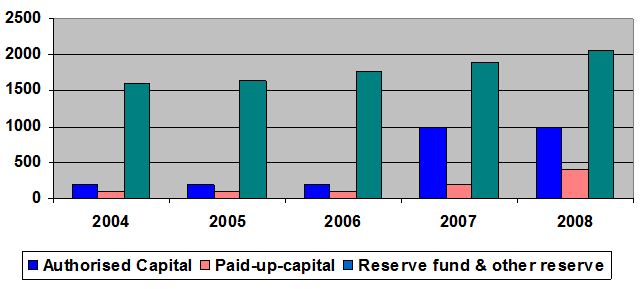

1.9.1: Capital & Reserve Fund:

Authorized capital of the bank remained at taka 1,000.0 million during the year of 2008where paid-up-capital has been raised to taka 399.3 million from taka 199.7 million in the year of 2007. The reserve fund of the Bank also increased to taka 2,054.2 million during the year.

1.9.2: Capital Adequacy:

Bangladesh Bank sets the capital adequacy ratio of a private commercial Bank as 10% where UBL has 10.5 %. Capital adequacy of the bank is measured by the ratio of Bank’s capital to risk weighted assets. So, it is indicating sound capital adequacy of the Bank.

1.9.3: Improvement of Assets:

In the year of 2008, total assets of the Bank raised at 52,860.3 million that was 16.9% more than previous year. The achievement was because of the sector wise improvement of loans & advances, investment, cash & reserve balance kept with Bangladesh Bank.

1.9.4: Collection of Deposits:

In the financial year of 2008, deposit of UBL increased by 10.74 percent. With the incremental rate of deposit collection, the Bank was very strict to abide by the Money Laundering Prevention Act 2002.

1.9.5: Sector Wise Position of Loans & Advances:

UBL achieved tremendous success to provide loans & advances in 2008 that had the growth rate of 13.17 percent. The Bank had the loans & advances in the sector of agriculture, industrial lending as term basis & as working capital, commercial lending in export, import & internal trade, special loan in the sector of consumer credit scheme (Uttaran), personal loan scheme, small business loan scheme, & Uttaran House Repairing and Renovation scheme, housing loan as general house building loan & staff house building loan, lease financing & bills discounted and purchased in Bangladesh & outside Bangladesh. Considering these entire mentioned sector, total loans & advances in the financial year of 2007 28,477.4 taka in million in both public & private sector.

1.9.6: Special Loan Scheme:

UBL provides special loan scheme only in the private sector. Special loan scheme includes the following heads-

Personal Loan Scheme;

Uttaran House Building repairing and Renovation Scheme.

Consumer Credit Scheme (Uttaran);

Small Business Loan Scheme;

1.9.6.1: Personal Loan Scheme:

UBL offers special loan scheme for the service holder for the purpose of marriage, medical services, education for their children etc. who find it difficult to meet all of these expenses properly. The Bank provides this special loan only to the salaried officials in the head of “Personal Loan Scheme of Salaried Officials”.

• Purpose of the loan:

The main purpose of the loan is to give support to the limited wage earner officials to run their life properly.

• Scope:

Under this head, the Bank provides loan to the salaried officials for the following aspects:

To meet own or dependent expenses for marriage ;

To provide emergency medical & operation expenses;

To pay educational expenses for admission, books, tuition fees etc. for their children;

Other expenses recognized & accepted by the Bank.

• Things to remember:

Maximum amount of BDT 1, 00,000 is paid under this scheme with the interest rate of 16.5% compounded quarterly;

Repayment must be under the Bank’s specific period but not more than 3 years;

Documents related to applicant’s job to prove him, two copies passport size photographs & photograph of nominee (if any) duly attested by the account holder is required to get the loan.

1.9.6.2: Uttaran House Building Repairing and Renovation Scheme:

UBL provides loan for repairing & renovation of building for the period of one to eight years. Special features of this scheme are:

The loan is for one to eight years;

Minimum amount of loan is BDT 1,00,000 & not more than BDT 25,00,000;

Loans repayment are collected as monthly installment;

Installment must be paid between 1 to 10th day of the month;

Bank charges 14% interest rate on this scheme;

Two percent interest rate is applicable for any late payment as penalty;

Installment must be paid in cheque.

1.9.6.3: Consumer Credit Scheme (Uttaran):

UBL has been providing ‘Uttaran Consumer Credit Scheme’ from the year of 1996.

Following heads are included under this scheme-

Baby Taxi, Tempo/Microbus (For self employed persons)

Cellular Telephone.

Motor cycle/car- New or re-conditioned.

Refrigerator/ Deep Freeze.

Personal Computer/ UPS/ Printer/ Type writer

Sewing Machine.

House hold furniture- Wooden & Steel.

Television/ VCR /VCP/VCD

Radio/ Two-in-one/ Three – in – one

Air-Conditioner/ Water Cooler/ Water Pump

Washing Machine.

Bi-Cycle

Dish Antenna.

Fax

Photocopier.

Electric Fan- Ceiling/ Pedestal/ Table.

Kitchen articles such as Oven, Micro-oven, Toaster, Pressure Cooker etc.

1.10: Risk Management of UBL:

The main goal of any financial institution is to maximize its return. This often comes, however, at the cost of increased risk. Bangladesh Bank has identified five core risks of management of Banks and has provided necessary guidelines for prevention thereof.

The five core risks are:

Credit Risk Management;

Asset Liability management;

Foreign Risk management;

Prevention of Money Laundering;

Internal control & Compliance.

1.10.1: Credit Risk Management:

Credit risk arises because of the possibility that promised cash flows on financial claims held by any financial institution, such as loans or bonds, will not be paid in full or more specifically, it is the risk that the promised cash flows from loans and securities held by financial institutions may not be paid in full. To minimize the credit risk, UBL follows the lending policy as directed from the Bangladesh Bank & the Government. The assessment process of loan application commences from the branch level by Relationship Managers (RM) through zonal office and ends at the “Credit risk management approval unit”. In line with lending policy of the Bank, CRM unit examines the proposal from different perspectives. Then if the proposal is found business worthy, CRM unit places it to the credit committee.

1.10.2: Asset Liability Management:

For the purpose of asset liability management, UBL formed “Assets Liability Management Committee (ALCOM) with the combination of following members-

Managing Director & CEO;

Additional Managing Director;

Deputy Managing Director;

Head of treasury;

Head of MIS & computer division;

Head of marketing division;

Head of credit & Head of central accounts.

Asset Liability Committee (ALCO) get together at least once in a month to review mainly about the aspects of economic & money market status, different risks like transfer pricing risk, risks related to interest rate on deposits and advances, liquidity risk relating to the balance sheet and various important issues.

1.10.3: Foreign Exchange Risk Management:

Foreign exchange risk is the risk that exchange rate changes can affect the value of a financial institution’s assets and liabilities located abroad. To reduce this category of risk, a strong management system control is required. The front office of the Bank’s treasury department continues to determine foreign exchange rate & tries to reduce the associated risk while the back office settles all foreign exchange transactions & reconciliation.

1.11: Accounts offered by UBL:

1.11.1: Savings Account

Any Bangladeshi National residing home or abroad may open savings account with UBL.

The account may be opened in single/joint name.

The account holder may nominate his nominee in this account.

The nominee can get the balance amount without submitting succession certificate after the death of account holder.

• Things to Concentrate :

Minimum amount to be kept in account : BDT 1,000.00

Cheque-book facility at negligible cost.

Opportunity to apply for – safe deposit locker facility

Collect foreign remittance in both T.C. & Taka draft.

Transfer of fund from one branch to another by

o Demand Draft

o Mail Transfer

o Telegraphic Transfer

Transfer of fund on standing instruction arrangement

Collection of cheques through clearing house.

Issuance of Payment Order / Call Deposit.

• Things to be Carried on & Special Guidelines to Open SB Account:

Account opening form delivered by UBL.

The account opening form and signature card are to be filled in and duly signed.

Two copies passport size photographs of the account holder.

Photograph of nominee (if any) duly attested by the account holder.

Photocopy of the 1st 7 pages of the passport for non-resident Bangladeshi national.

Signature in the account opening form/card must be same with the signature of the passport.

Details have been discussed in chapter three.

1.11.2: STD Account:

Government, semi government, autonomous organizations and an individual may open STD Account with UBL. The Bank offers attractive & competitive rate of interest in STD Account. But, 7 days notice is required to withdraw large amount from the STD Account.

1.11.3: FDR Account

Any Bangladeshi national residing home or abroad may open FDR with UBL.

FDR may be opened single/joint name for a period of 3, 6, 12, 24 and 36 months.

UBL offers attractive/competitive rate of interest in FDR.

Details have been discussed in chapter three.

1.12: International Banking:

1.12.1: Foreign Currency Account:

• For Private Individual/Firm/Organization:

Any person/firm/organization who earns foreign currency can open Foreign Currency Account with UBL.

Payments in foreign currency may be made freely abroad from this account and local payment in BDT may also be made from this account.

Bank pay interest provided the accounts are maintained in the form of term deposit for minimum period of 90 days.

The account opening form and signature card are to be filled in and duly signed.

Two copies passport size photographs of the account holder duly attested by remitter’s Bank/Embassies

Photo copies of the first 7 pages of the passport duly attested by the remitters bank/exchange

• For Bangladeshi Nationals Working and Earning Abroad:

No initial deposit is required.

A/c holder may nominate his nominee to operate the account.

The account holder can freely transfer entire amount in foreign currency anywhere he chooses or can convert into Bangladesh Taka currency.

Funds from this account may also be issued to the account holder up to his entitlement for the purpose of his foreign travels in usual manner.

The account opening form and signature card to be filled in and duly signed.

Two copies passport size photographs of the account holder are required to carry.

Copies of employer’s certificate/work permit are also required.

One copy of the passport size photograph of the nominee if any to be attested by the account holder.

Photocopies of the first 7 pages of the passport of the account holder to be carried.

1.12.2: Non-Resident Foreign Currency Deposit Account (NFCD):

All non-resident Bangladesh nationals and persons of Bangladesh origin including those having dual nationality ordinarily residing abroad may open this account with any ‘Authorized Dealer (AD)’ branches of Uttara Bank Ltd.

The NFCD account may be opened in single/joint name for a period of 1, 3, 6, 12 months.

This account may be maintained as long as account holder desires.

On maturity the account holder can encase it in local currency or can transfer the amount including accrued interest anywhere he likes.

Initial deposit US$ 1000 or GBP 500 sterling or equivalent currency.

The account offers attractive interest Payable in foreign and tax free.

The account with accrued interest can be renewed either of the instruction of the account holder or be renewed automatically if there is no instruction otherwise.

No interest is given o n premature encashment.

The account opening form and signature card to be filled in and duly signed.

Two copies passport size photographs of the account holder to be carried.

Photocopies of the first 7 pages of the passport duly attested by the remitters bank/exchange companies having drawing arrangement with UBL or by Bangladesh Mission

1.12.3: Resident Foreign Currency Deposit Account (RFCD):

Persons ordinarily resident in Bangladesh may open and maintain RFCD Account with foreign exchange brought in at the time of his return from travel abroad.

Any amount brought in with declaration to customs authorities in the form FMJ and up to US$ 5000 brought in without any declaration can be deposited in this account.

Balance in this account can be freely transferred abroad.

Funds from this account may also be issued to the account holder for the purpose of his foreign travels in the usual manner.

Interest in foreign currency is paid in this account if the deposits are for a term of not less than one month and the balance is not less than US$ 1000 or GBP 500 or its equivalent.

The account opening form and signature card to be filled in and duly signed.

Two copies of passport size photograph of the account holder are the must.

Photocopies of the passport and the relevant pages showing evidences of traveling abroad are compulsory.

1.13: Implementation of BASEL-2: Bangladesh bank is going to implement BASEL-2 by the year of 2009 & already the Bank has taken various steps on the ground of international banking settlement guideline on risk weighted capital & made it compulsory to get themselves credit rated by a ‘Credit Rating Agency (CRA)’ approved by Bangladesh Bank. This credit rating will have to be updated in each & every year. UBL has its own training institute where with the help of “Credit Rating Information & Service Ltd. (CRISL)” the Bank made a workshop in the last financial year on this important issue.

Part-2

Chapter Two

Introduction to the Project

2.1: Introduction to the project:

Now a day, banking organization has become essential for almost every person to deal with banks somehow in their bread & better life. As a result, bank has become essential for every person to have some idea on the bank and banking procedure. The necessity of foreign exchange activities cannot be ignored in any ways because of its dependency in the banking sector. It provides the opportunity to its foreign & local clients and at the same time attractive services are ensured as per the customer needs, wants & demands with the changing environment and competition.

At present time, the banking procedure is becoming faster, easier and the banking arena is becoming wider. As the competitive field of the banking sector, the banking organizations are coming with innovative ideas. Foreign exchange activities of a bank deals with the letter of credit, procedures & document to open an import & export L/C, issue foreign demand draft (FDD), traveler’s cheques (TC), endorsement of cash, opening a foreign accounts, endorsement of foreign currencies in the passport. Sale of foreign currencies, FDD & TC payable, purchase foreign currencies, telegraphic transfer, mail transfer, receive cheques for clearing etc. The bank also offers the customer to deposit money for FDR (Fixed Deposit Receipts) with attractive interest rate at maturity. Though all the operations are started from the general banking but all of these are based on the monetary transaction. As a result, recording of all monetary transaction has become compulsory in the modern business sector. Not only recording, but also it includes the process of communicating, summarizing and explaining the economic events of a bank within a specific period of time.

So a part of this report has been developed concentration this matter. I have chosen the “A study on foreign exchange businesses of Uttara bank limited” as my internship topic. I strongly believe that any business graduate ought to have the basic understanding about foreign exchange as it can show the ways for economic development in business world because of its strong relation with all of the financial activities. In all of my internship report I will try of my best to provide almost all of the basic idea of foreign exchange activities in all of the branches of UBL. I will also concern about the performance evaluation from different perspective.

2.2: Objectives of the Report:

2.2.1: Broad Objective:

To identify the pattern of Foreign Trade in terms of quantitative and qualitative in relation to the categories like Import, Export and Remittance and the earnings from these three categories of Foreign exchange businesses.

2.2.2: Specific Objectives:

To determine and how a Bank deals international trade and the trade mechanism.

Trend analysis of the earnings from Foreign Trade of UTTARA Bank Limited.

To learn about the benefits and incentives provides to the export proceeds.

Some recommendations and suggestions to improve both the pattern of Foreign Trade and the trend of earnings from Foreign Trade.

2.3: Scope and Limitation of the Report:

Uttara Bank Limited is one of the traditional banks of Bangladesh. The scope of the report covers the organizational overview & structure, background, basic functions, transaction procedure, customer dealings & performance of the bank. With a view to completing the whole report, it is required to concentrate on the overall banking process. However, in this report I have been trying to present the basic functions & process of foreign exchange with the basic financial practice that the bank is following and also to show different analysis & comparison to evaluate the performance of the bank. But to complete all of these mentioned above, I have the following limitations:

Time was not enough to concentrate on all of the investigations was required.

All sufficient data & information were not enough for the purpose of study & assumptions were made in some cases.

The website of the Bank was not that much rich to collect data.

This report has been prepared on the activities of all branches, but visiting all the branches to collect data & information was not possible.

Sometimes such kinds of tasks were given in the Bank that was no way related to my topic & really it was responsible to break my concentration in my major area of investigation.

2.4: Methodology: Data Sources:

For teaming up the data & information collected through primary & secondary sources I have used both qualitative & quantitative method. During my study I followed some methodology to find out the fact & feature of the Bank which are given as follows:

2.4.1: Area of Study:

My project is the operational mechanism in Foreign Exchange Business through Import, Export & Foreign Remittance of UTTARA Bank Limited.

2.4.2: Sources of Data/Information:

I have collected my information/data from the following sources, which helped me to make this report. The source has divided by two parts. Such as,

2.4.3: Primary Sources:

Primary sources of information are face-to-face conversation and interview with high officials of data from Central Accounts Division, Board Division and International Division of, Computer generated database etc. And also I will prepare the questionnaire for my survey.

2.4.4: Secondary Sources:

Secondary sources of information have also been used for the research study that can be presented like the following:

Internal Sources

Annual Report and brochures of UBL.

Various publication of the bank.

Various type of Journals

Various circulars issued by head office

Any information regarding the Banking sector

Various types of banking websites.

External Sources

Different books and periodicals related to the banking sector

AIUB library

Magazines & newspapers

Chapter Three

Topic Analysis

Foreign Exchange Business of Uttara Bank Limited

3.0: Foreign Exchange:

Today’s world market is globalizing. For these reason import and export plays vital role for the control of economy of any country. No country is self-dependent thus every country ahs to depend on other country due to geographical, environmental and some other reasons. As Bangladesh is a developing country; she has to import so many things for the development of its economic structure and to meet up basic needs. Again Bangladesh is not export oriented country but every year it exports so many things and earn a lot of foreign currency. Day by day it increases its export volume and helps its economy. These transactions are the basis upon which international trade is made.

Foreign Exchange means the rate of exchange at which one currency is changed against another. It means foreign currency and includes all departs and balances payable in foreign currencies as well as drafts, travelers checks, letter of credit, bill of exchange drawn in local currency but payable in foreign currency. The term ‘Foreign Exchange’ has three principal meanings. Firstly it is a term used referring to the currencies of other countries in terms of any single one currency. To a Bangladeshi, Dollar, Euro, Pound Sterling, etc. are foreign currencies and as such foreign exchanges. Secondly, the term also commonly refer to some instruments used in international trade, such as Bill of Exchange, drafts, travelers cheque and other means of international remittance. Thirdly the term foreign exchange is also quite often referred to the balance in foreign currencies held by a country.

Foreign Exchange Regulation Act 47 Sec 22 (d) states that foreign exchange means foreign currency and including any instrument drawn, accepted, made or issued under clause 13 of section 16 of Bangladesh Bank order 1972 all deposits, credits and balances payable in any foreign currency, and any drafts traveler Cheques, letter of credit and bills of exchange express or drawn in Bangladesh currency but payable in foreign currency.

In exercise of the powers conferred by sec. 3 of the Foreign Exchange Regulations-1947, Bangladesh Bank issues license to scheduled banks to deal with foreign exchange. These banks are known as Authorized Dealers (AD). Licenses are also issued by Bangladesh Bank to persons or firms to exchange foreign currency instruments such as T.C., Currency notes and coins. They are known as Authorized Money Changers.

3.1: Sections

Foreign exchange department of UBL, Main Branch is divided into two sections:

• L/C Operation

• Foreign Remittance

3.2: L/C Operation:

Letter of Credit (L/C) can be defined as a “Credit Contract” whereby the buyer’s bank is committed (on behalf of the buyers) to place an agreed amount of money at the seller’s disposal under some agreed conditions. Since the agreed conditions include amongst other things, the presentation of some specified documents, the letter of credit is called Documentary letter of credit. The Uniform Customs And Practices for Documentary Credit (UCPDC) published by International Chamber of Commerce (1993) publication no 500 defines Documentary Credit:

a) Any arrangement however named or described whereby a bank (the issuing bank) acting at the request and on the instructions of a customs (the Applicant) or on its own behalf,

b) Is to make a payment to or to the order of a third party(the beneficiary) or is to accept and pay bills of exchange(Drafts)drawn by the beneficiary or

c) Authorize another bank to effect such payment or to accept and pay such bills of exchange (Drafts).

d) Authorize another bank to negotiate against stipulated documents provide that terms and conditions are complied with.

3.3: Types of Documentary Letter of Credit:

Types of letter of credit:

There are various types of documentary Letter of Credit:

• Revolving L/C

• Irrevocable L/C

• Confirmed Irrevocable L/C

• Revolving L/C

• Back to Back L/C

• Transferable L/C

• Red Clause L/C

• Green Clause L/C

• Stand by L/C

• Performance L/C

There are various types of documentary letter of credit.

1. Revocable Credit:

This type of credit can be revoked or cancel at any time without the consent of, or notice of the beneficiary. As per Article 8 (a) of UCPDC 500 “A revocable credit may be amended or cancelled by the Issuing Bank at any moment and without prior notice to the Beneficiary”.

2. Irrevocable Credit:

The Irrevocable Credit is a commonly used type of documentary credit. The Credit which cannot be revoked, varied or changed/amended without the consent of all parties – buyer (Applicant), seller (Beneficiary), Issuing Bank and Confirming Bank (in case of confirmed LC).

3. Confirmed Irrevocable Credit:

It is a credit of issuing Bank, which is opened at the request of buyer/importer upon a seller/exporter abroad through an advising Bank with a request to add confirmation. Advising Bank, the agent/correspondent of issuing Bank add their confirmation under credit line arrangement already existing between issuing Bank and advising Bank, i.e. in addition to the commitment of the issuing Bank the advising Bank makes its own, independent payment commitment when it add its confirmation. (Article 9 b, UCPDC 500).

4. Revolving Credit:

A Revolving Credit is one where, under the terms and conditions thereof, the amount of the Credit is renewed or reinstated without specific amendment to the Credit being needed. Revolving Credit may be revocable or irrevocable. It can revolve in relation to time or value. But credit that revolves in relation to value is not in common use.

5. Back to Back Credit:

One credit backs another. It may so happen that the beneficiary/seller of an L/C is unable to supply the goods direct as specified in the Credit as a result of which he need to purchase the same and make payment to another supplier by opening a second Letter of Credit. In this case, the second Credit called a “Back to Back Credit”. These concepts involve opening of second Credit on the strength of first Credit i.e., mother L/C opened by foreign importers.

6. Transferable Credit:

A transferable Credit is one, which can be transferred by the original Beneficiary to one or more parties. In transferable Credit, the original beneficiary becomes the middleman and transferee becomes the actual supplier of the goods. It is normally used when the first beneficiary does not supply the merchandise himself, but is a middleman and thus wishes to transfer part, or all, of his rights and obligations to the actual supplier(s) as second beneficiary(s). This type of Credit can only be transferred once, i.e., the second beneficiary(s) cannot transfer to a third beneficiary. (Article 48, UCPDC 500).

7. Red Clause Credit:

A re clause Credit is a credit with a special clause incorporated into it that authorizes the advising Bank or confirming Bank to make advances to the beneficiary before presentation of documents. The clause is incorporated at the specific request of the applicant, and the wording is dependent upon his requirements. It is so called because the clause was originally written in red ink to draw attention to the unique nature of this credit. It specifies the amount of the advance that is authorized, in some instances it may be for the full amount of the credit.

8. Green Clause Credit:

A Green Clause Credit is a credit with a special clause incorporated into it that which not only authorizes the advising Bank to grant pre-shipment advances but also storage cost for storing the goods prior to shipment. It is useful in situations where shipping space is not ready available, i.e., some African countries. It is so called because the clause was originally written in green ink to draw attention to the unique nature of this Credit.

We can understand the total procedure of a Letter of Credit by the following Flow Chart:

Offer

Contract

Acceptance

3.4: Documents Used in L/C Operation:

The most commonly used documents in foreign exchange are

1. Bill of Exchange

2. Bill of Lading

3. Commercial invoice

4. Certificate of origin

5. Inspection certificate

6. Packing list

7. Insurance document

8. Pro Forma Invoice (PI)/Indent

1. Bill of Exchange:

Bill of exchange is one of the important negotiable instruments in the mercantile world and used as a vital document facilitating settlement of payments between buyer/importer and seller/exporter at home and abroad. A bill when accepted by the drawee, gives evidence of the claim as made by the drawer as well as testimony to the acceptance of the debt by the drawee. The payment is done either in accordance with the terms of sale contract or under a L/C opened by the buyer/importer in favor of the seller/exporter.

2. Bill of Lading:

A bill of lading is a document that is usually stipulated in a credit when the goods are dispatched by sea. It is evidence of a contract of carriage, is a receipt for the goods, and is a document of title to the goods. It also constitutes a document that is, or may be, needed to support an insurance claim.

The details on the bill of lading should include

• A description of the goods in general terms not inconsistent with that in the credit.

• Identifying marks and numbers.

• The name of the carrying vessel.

• Evidence that the goods have been loaded on board.

• The ports of shipment and discharge.

• The names of shipper, consignee and name and address of notifying party.

• Whether freight has been paid or is payable at destination.

• The number of original bills of lading issued.

• The date of issuance a bill of lading specifically stating that goods are loaded for ultimate destination specifically mentioned in the credit.

3. Commercial Invoice:

A commercial invoice is the accounting document by which the seller charges the goods to the buyer. A commercial invoice normally includes the following information:

i. Date

ii. Name and address of buyer and seller

iii. Order or contract number, quantity and description of the goods, unit price and the total

iv. Price

v. Weight of the goods, number of packages, and shipping marks and numbers

vi. Terms of delivery and payment

vii. Shipment details

4. Certificate of Origin:

A certificate of origin is a signed statement providing evidence of the origin of the goods.

5. Inspection of Certificate:

This is usually issued by an independent inspection company located in the exporting country certifying or describing the quality, specification or other aspects of the goods, as called for in the contract and/or the L/C. The buyer who also indicates the type of inspection he wishes the company to undertake usually nominates the inspection company.

6. Packing List:

This is a unique document and not combined with other document. This is a listing of the contents of each package, cartoon etc. and other relevant information.

7. Insurance Document:

Insurance is a contract whereby the insurer is undertaking to indemnify the assured to the agreed manner and extent against fortuitous losses. Insurance document generally contains the following information:

• The name of the insurer or his agent

• The name of the ship/carrier

• The name of assured

• The subject matter of insurance

• The time and/or voyage insured

• The peril(s) insured against

• The date and subscription

• The valuation

• The stamp etc.

8. Pro forma Invoice (PI) /Indent:

Pro Forma Invoice/indent is the sale contract between seller and buyer in import- export business. There is slight difference between indent and Proforma invoice. The sales contract, which is direct correspondence between importer and exporter, is called Proforma invoice. There is no intermediary between them. On the other hand, there may be an agent of exporter in importer’s country. In this regard, if the sale contract is occurred between the agent of exporter and importer then it is called indent.

Pro Forma Invoice is a form of quotation to a potential buyer, inviting him to buy the goods on stated terms. It should be clearly stated that it is pro forma and if it is accepted the details are normally transferred to a commercial invoice.

3.5: Different Accounts Related to Foreign Exchange Transaction:

In L/C operation different accounts are maintained which are needed for foreign exchange transaction. These are:

Nostro Account:

Nostro account means “our account with you”. A Nostro account is a foreign currency account of a bank maintained its foreign correspondents abroad. For example, US Dollar Account of UBL maintained with Citibank, N.A, New York, USA is a Nostro account of UBL.

Vostro Account:

Vostro account means “your account with us”. The account maintained with foreign correspondent in a bank of a particular country is known as Vostro account.

What is the nostro account for a bank in a particular country is a vostro account for the bank abroad maintaining the account thus the account of UBL with Citi Bank N.A, New York is regarded as it’s nostro account held with Citi Bank, while Citi Bank N.A, New York regards it as a it’s vostro account held for UBL.

Loro Account:

Loro account means “their account with you”. Account maintained by third party is known as loro account; suppose UBL is maintaining an account with Citi Bank N.A, New York and at the same time Prime Bank is also maintaining a nostro account with Citi Bank N.A, New York. From the point of view of UBL, Prime Bank’s account maintained with Citi Bank N.A New York is the loro account.

3.6: Parties Involved in L/C Operation:

The documentary credit is an essential implement for conducting world trade today. With the third party assurance the whole process is covered. Documentary credit substantially reduces payment related risks for both exporter and importer. So in the whole L/C operation there are many parties involved. They are:

1. Importer/Applicant

2. Issuing Bank/Opening Bank

3. Advising Bank

4. Beneficiary/Exporter/Seller

5. Negotiating Bank

6. Reimbursing Bank

7. Confirming Bank

1. Importer / Applicant:

An importer is one who wants to import goods from other country. In terms of the Importers (Registration) Order-1981 no person can import goods into Bangladesh unless he is with the Chief Controller of Import and Export (CCI&E). He is also called applicant. The bank opened L/C on the importer’s application. Who request his Bank to issue of Credit (L/C) in terms of the arrangement with the seller?

2. Issuing Bank/Opening Bank:

The Bank agrees to the request of the applicant and issues its Letter of Credit in terms of the instructions of the Applicant is called issuing bank. Issuing bank’s obligation is to make payment against presentation of documents drawn strictly as per terms of L/C.

3. Advising Bank:

The Bank, usually situated in the Seller’s/Beneficiary’s country (most of the time with which there exists corresponding relationship with the Buyer’s/Issuing Bank)

4. Beneficiary/Exporter/Seller:

Beneficiary is the party in whose favor the L/C is issued. Usually he is the seller or exporter.

5. Negotiating Bank:

The UBL which make payment to the Exporter after scrutiny the documents submitted by the exporter with the Original L/C then it is called Negotiating Bank, If the advising bank is also authorized to negotiate the bill drawn by the exporter, he becomes the negotiating bank.

6. Reimbursing Bank:

This is the Bank that is nominated by the Issuing Bank to Pay ( it is also known as Paying Bank ) or to accept drafts. It can be situated in another country. In this connection it is to say that American Express Bank and Nat West Bank act as Reimbursing Bank in the case of EX1M Bank. The account which maintain Uttara Bank Limited with Nat West and American Express bank is Called ‘Nostro Account’ and in rivers the account which is maintained by Nat West and American Express Bank with Uttara Bank Limited is Called Vostro Account’. And the account maintained by American Express and Nat West with each other in the context of Uttara Bank Limited is Called Loro Account’.

7. Confirming Bank:

Sometimes, Issuing bank request Advising Bank or another Bank to add confirmation to the letter of credit. When Bank do this then such Bank is called Confirming bank. So, Advising Bank can be act as Confirming Bank. It provides the credit report of the exporter of his country. If the advising bank also adds its own undertaking to honor the credit while advising the same to the beneficiary, he becomes the confirming bank, in addition, becomes liable to pay for documents in conformity with the L/C’s terms and condition.

Foreign exchange department of Standard Bank is one of the most important departments of all departments. This department handles various types of activities by three separate sections:

a) Import section

b) Export section.

c) Foreign remittance section.

Chapter Four

Import L/C Opening System

4.1: About Import:

Import means purchase of goods and services from the foreign countries into Bangladesh. Normally consumers, firms, industries and Government of Bangladesh import foreign goods materials to meet their various necessities. So, in brief, we can say that import is the flow of goods and services purchased by economic agent staying in the country from economic agent staying abroad.

4.2: Regulation of Import:

Import of goods into Bangladesh is regulated by the Ministry of Commerce in terms of the Import and Export (Control) Act-1950 with Import Policy Order issued periodically and public notices issued time to time by the office of the Chief Controller of Import and Export (CCI&E). At present, it is regulated by the Import Policy (1997-2002), which was come into effect on June14, 1998. And Import Policy directs certain Import Procedure, which administers the whole activity.

4.3: Import Procedure Followed by UBL:

Whole world has become a global village due to the dynamic change taken place in the field of finance. Foreign trade involves more than one country. It occurs between two countries or between the organizations of two different countries. Such trade normally benefits both the importer and the exporter. UBL provides Letter of Credit (L/C) facility for smooth functioning of foreign trade. These branches are called Authorized Dealer (A/D). As an Authorized Dealer, UBL, Main Branch is always committed to facilitate import of different goods into Bangladesh from the foreign countries. Import Section, which is under Foreign Exchange Department of the branch, is assigned to perform this job. And to serve its client’s demand to import goods, it always maintains required formalities that are collectively termed as The Import Procedure.

1. The importer must submit the following papers along with L/C application before opening a Letter of Credit (L/C):

i) Valid Import Registration Certificate (IRC) (commercial/industrial)

ii) Taxpayers Identification Number (TIN)/ Membership Certificate

iii) VAT Registration Certificate

iv) Proforma/Indent Invoice duly accepted by the importer.

v) Insurance Cover Note with Money Receipt covering value of goods to be imported plus 10 (Ten) percent above.

vi) IMP forms duly signed by the importer.

vii) LCA forms duly signed by the importer and incorporating New ITC number of at least 6 (six) digits under the Harmonized System as given in the Import Trade Control Schedule 1988.

viii) Credit report of the supplier / country of supplier.

ix) Poet import finance (required or not)

x) Margin for opening L/C

xi) Authority /sanction

xii) Other documents/ papers etc.

Bank will supply the following papers:

i) L/C application form (Printed format)

ii) LCA Form

iii) IMP Form

iv) Charge documents

2. Then the importer has to contact with the seller outside the country to obtain the Pro forma Invoice. Usually an indenter, local agent of the seller or foreign agent of the buyer makes this communication. Other sources are:

• Trade fair.

• Chamber of Commerce.

• Foreign Missions in Bangladesh.

• Journals etc.

3. When the importer accepts the Pro forma Invoice, he/she makes a purchase contract with the exporter detailing the terms and conditions of the import.

4. After making the purchase contract, importer settles the means of payment with the seller. And import procedure differs with different means of payment. The possible means are Cash in Advance, Open Account, Collection Method and Documentary Letter of Credit. In most cases, the Documentary Letter of Credit in our country makes import payment. Purchase Contract contains which payment procedure has to be applied.

Different Means of Payment:

a) Cash in advance: Importer pays full, partial or progressive payment by a foreign DD, MT or TT. After receiving payment, exporter will send the goods and the transport receipt to the importer. Importer will take delivery of the goods from the transport company.

b) Open Account: Exporter ships the goods and sends transport receipt to the importer. Importer will take delivery of the goods and makes payment by foreign DD, MT, or TT at some specified date.

c) Collection Method: Collection methods are either clean collection or documentary collection. Again, Documentary Collection may be Document against Payment (D/P) or Document against Acceptance(D/A). The collection procedure is that the exporter ships the goods and draws a draft/ bill on the buyer. The exporter submits the draft/bill (only or with documents) to the remitting bank for collection and the bank acknowledges this. Then the remitting bank sends the draft/bill (with or without documents) and a collection instruction letter to the collecting bank. Acting as an agent of the remitting bank, the collecting bank notifies the importer upon receipt of the draft. The title of goods is released to the importer upon full payment or acceptance of the draft/bill.

d) Letter of credit: Letter of credit is the well accepted and most commonly used means of payment. It is an undertaking for payment by the issuing bank to the beneficiary, upon submission of some stipulated documents and fulfilling the terms and conditions mentioned in the letter of credit.

Import section deals with L/C opening and post import financing i.e. LIM & LTR. Now the procedure from opening L/C to disbursement against L/C is given below:

4.4: Application for Opening L/C:

At first, an importer will request banker to open L/C along with the following documents.

• An application

• Indent or Pro forma Invoice

• Import Registration Certificate (IRC)

• Taxpayer’s Identification Number (TIN)

• Insurance cover note with money receipt

• A bank account in UBL, Main Branch

• Membership of chamber of commerce

4.5: Delivers Forms by Banker to Importer:

After scrutinizing above-mentioned documents carefully, officer delivers the following forms to be filled up by importer and the banker should check:

1. Whether the goods to be imported is permissible or not.

2. Whether the goods to be imported is demanding or not.

The forms are:

1. L/C Application Form (LCAF):

L/C Application Form is a sort of an agreement between customer and bank on the basis of which letter of credit is opened. UBL, Main Branch provides a printed form for opening of L/C to the importer. Special adhesive stamp of value Tk.150.00 is affixed on the form in accordance with Stamp Act. While opening, the stamp is cancelled. Usually the importer expresses his decision to open the L/C quoting the amount of margin in percentage

2. L/C Authorization Form (LCAF):

The Letter of Credit Authorization Form (LCAF) is the form prescribed for the authorization of opening letter of credit/payment against import and used in lieu of import license. The authorized dealers are empowered to issue LCA Forms to the importers as per basis of licensing of the Import Policy Order in force to allow import into Bangladesh. If foreign exchange is intended to be bought from the Bangladesh Bank against an LCAF, it has to be registered with Bangladesh Bank’s Registration Unit located in the concerned area office of the CCI&E. The LCA Forms available with authorized dealers are issued in set of five (05) copies each. First Copy is exchange control copy, which is used for opening of L/C and effecting remittance. Second Copy is the custom purpose copy, which is used for clearance of imported goods from custom authority. Triplicate and Quadruplicate Copy of LCAF are to be sent to concerned area of CCI&E office by authorized dealer/Registration Unit of Bangladesh Bank. Quadruplicate Copy is kept as office copy by authorized dealer/Registration Unit. The Letter of Credit Authorization Form (LCAF) contains the followings –

• Name and address of the importer

• IRC number and year of renewal

• Amount of L/C applied for (both in figure and in word)

• Description of item(s) to be imported

• HS Code number

• Signature of the importer with seal

• List of goods to be imported

Import Permit Form (IMP):

• L/C authorization form number

• Date

• Value in Taka

• Registration of LCAF

• Quantity of goods

• Invoice value

• Country of origin

• Port of shipment

• Name of the steamer

• Indentor’s adder

4.6: Preparation of L/C by Banker:

Bank’s officer prepares L/C when above-mentioned forms are to be submitted by customer or importer. Before preparing L/C, UBL officer scrutinizes the application in the following manner.

1. The terms and conditions of the L/C must be complied with UCPDC 500 and Exchange Control & Import Trade Regulation.

2. Eligibility of the goods to be imported.

3. The L/C must not be opened in favor of the importer.

4. Radioactivity report in case of food item.

Survey reports or certificate in case of old machinery is required. Bank of the importer is called ‘L/C Issuing Bank’. Then issuing bank inform its corresponding bank, called “Advising Bank’ or ‘Confirming Bank” located in exporter’s country to advise and credit forward to the exporter and simultaneously officer makes L/C opening vouchers.

4.7: The L/C Confirming Process:

1. Forwarding Documentary Credit by Advising or Confirming Bank:

There are usually two banks involved in a documentary credit operation. The issuing bank and the advising bank which is usually a bank in the seller’s country. The issuing bank asks another bank to advise or confirm the credit.

If the 2nd bank is simply “advising the credit”, it will mention that when it forwards the credit to seller, such a bank is under no commitment or obligation to pay the seller.

If the advising bank is also “confirming the credit”, this mention that the confirming bank, regardless of any other consideration, must pay accept or negotiate without recourse to seller. Then the bank is called confirming bank also.

2. Submission of Necessary Documents by Exporter to the Negotiating Bank:

As soon as the seller/exporter receives the credit and is satisfied that he can meet its terms and conditions, he is in position to load the goods and dispatch them. The seller then sends the documents evidencing the shipment to the bank

Exporter will submit those documents in accordance with the terms and conditions as mentioned in L/C. Generally the documents observed in the foreign exchange department are

• Bill of exchange

• Commercial invoice

• Bill of lading

• Certificate of origin

• Packing list

• Clean Report of Finding (CRF)

• Weight list

• Insurance cover note

• Pre-shipment certificate

3. Clean Report of Findings (CRF):

This certificate is provided by the Pre Shipment Inspection (PSI) Concerns. The entire world has been brought under the three supervision and three pre shipment inspection concerns based on different territory.

4. The Documents Sent to the Issuing Bank Through the Negotiating Bank:

The negotiating bank carefully checks the documents provided by the exporter against the credit, and if the documents meet all the requirement of the credit, the bank will pay, accept, or negotiate in accordance with the terms and conditions of the credit. Then the bank sends the documents to the L/C opening bank.

5. Making the Payment of Foreign Bill through the Reimbursing Bank:

The L/C issuing bank getting the documents checks immediately and if they are in order and meet the credit requirements; it will arrange to make payment against L/C through reimbursement bank and will send the importer the document arrival notice.

6. Scrutiny of the Documents:

First of all it must be ensured that full set of documents as mentioned in the L/C has been received.

• Documents have been negotiated within the negotiation period.

• The Bill of Lading/Air-Way Bill/By Road/ Railway receipt is not dated later than the last date of shipment mentioned in the L/C.

• The L/C has not been amended or subjected to any special instructions, which might alter the value of L/C.

• Import bills include following documents, which are to be scrutinized.

• Bill of Exchange

• Commercial Invoice

• Bill of Lading

• Certificate of Origin

• Others

Bill of Exchange:

It has to be verified that the bill of exchange has been properly drawn and signed by the beneficiary according to the terms and conditions of L/C.

The amount in the bill is identical with that mentioned in the invoice.

The amount drawn does not exceed the amount mentioned in the L/C.

The amount in words and figures should be same.

The bill of exchange should be properly endorsed.

Commercial Invoice:

It has to be verified that the commercial invoice has been properly drawn and signed by the beneficiary according to the terms and conditions of L/C.

The beneficiary should properly invoice the merchandise.

The merchandise is invoiced to the importer on whose account the L/C is opened.

The description of merchandise and the unit price correspond with that given in the L/C.

The import license or IRC number of the importer, indenter’s registration number and number of Letter of Credit Authorization number are incorporated in the Invoice.

Bill of Lading:

First of all it has to be cleared that the Bill of Lading is showing “Shipped on Board” and it has to be properly endorsed to the bank.

The B/L should include the description of the merchandise according to invoice.

The port of shipment and destination, date of shipment and the name of the consignee are in agreement with those mentioned in the L/C.

The shipping company or their authorized agents properly sign the B/L.

The date on the B/L is not ‘stale’ which means it is not dated in unreasonably long time prior to negotiation.

Certificate of Origin:

The Merchandise described in the Certificate is in accordance with the L/C.

Others:

There are some other documents, which are also attached, with the shipping documents like packing list, pre-shipment inspection certificate etc. These documents are also verified carefully before lodgment.

Documents Sent to PSI Company:

Importer sends following documents along with application to PSI Company.

• L/C copy

• Photocopy of insurance cover note

• Copy of indent/pro-forma invoice

• PSI information and other relevant papers.

Shipment of Consignment and Lodgment of Documents:

There may be two types of exporter:

i) Merchant/Trade exporter

ii) Manufacturer Exporter

If the supplier is a merchant exporter, he will immediately start packing and shipping the goods. If he is a manufacturer exporter, he will start manufacturing the item. In either case, he will ship the goods when ready and obtain full set of bill of lading etc. from the carrier company and submit the same to the negotiating Bank along with other documents that is called for in the credit.

The shipping documents usually obtained are:

i) Bill of Lading or Air Consignment Note or Post Parcel Receipt or Truck receipt.

ii) Bill of Exchange

iii) Commercial Invoice

iv) Certificate of origin

v) Packing list

vi) Weight certificate

vii) Consular Invoice where necessary

viii) A copy of declaration of shipment made to the Insurance Company (to be

submitted with original shipping documents)

ix) Pre-shipment inspection certificate from internationally reputed surveyor.

x) Analysis certificate where specification of commodity is given.

Discrepancies in Shipping Documents:

The discrepancies found in the shipping documents presented under L/C vary from document to document and from shipment to shipment.

The discrepancies usually found in shipping documents are listed below, but this is not an exhaustive or even complete list, as the discrepancies vary from document to document, though apparently discrepancies do look alike. Their impact may not be the same keeping in view the relationship and importance of each shipping document with other documents asked for by the L/C opening Bank.

Checking of Import Documents:

Import documents are checked thoroughly and some specific points receive crucial attention that delineated below:

• The Letter of Transmittal

• The Documentary Credit

• Bill of Exchange

• Commercial Invoice.

• Marine Bill of Lading

• Airway Bill

• Certificate of Origin

• Packing List

• Pre-shipment inspection

Retirement of Import Documents:

I/D branch shall issue and intimation letter to the customer to retire the documents on payment of Bank’s dues in full. Receiving Bank’s dues the branch shall pass the following entry:

a) For application of up to date interest

Debit: PAD Account

Credit: Income A/C (Interest on PAD)

b) Retirement Voucher

Debit: Importer’s Current A/C

Credit: PAD A/C along with up to date interest

The documents will be delivered to the import of his authorized representative with due endorsement on the back of the bill of Exchange.

Import Finance of Uttara Bank Limited:

Uttara Bank Limited possesses Trade Finance like import, Export and foreign remittances. UBL’s broad international customer base, professional insight and knowledge of the risks and rewards of international trade earned the bank a unique position in the industry. The bank offers world-class support across the worldwide buyer chain to minimize overall cost, maximize buyer base, and shorten administrative processes.

To enable customers to capture global opportunities, it has the extensive network of overseas banking partners and correspondents.

Uttara Bank Limited has a wide array of financing tools to ease your cash flow burden and help you grow your business.

Creation of LIM:

LIM stand for Loan against imported merchandise and LIM account is created on the same day of storage of the goods in the Bank’s go down. The branch’s authorized representative shall take delivery of goods from the representative of the C&F Agent/transport Company strictly as per invoice for storage of goods in the Bank’s go down. Goods received from C&F Agent must be good condition and in original packing without any tampering in the box/ packing is found tampered or broken, the delivery of goods be held up and the C&F agent/importer and the transport company be contacted at once and joint survey with the representative of the importer, Bank official and transport/ C&F agent shall be made before storage of the good. After storage of the goods in the Bank’s go down the branch shall create LIM in the name of customer.

At the time of creation of LIM the branch shall pass the following vouchers.

Debit: LIM A/C

Credit: PAD A/C (with up to date interest)

After creating LIM A/C, the branch shall inform the importer to take delivery of the imported goods from the Bank against full payment. The LIM Accounts shall be properly maintained by the branches and to be balanced at the end of each month with the figure of General Ledge of the branch.

Necessary Document for LIM:

Following documents are sent to CDA branch for LIM

• Bill or exchange

• Invoice Bill of lading

• Packing list

• Customer purpose copy of import license number

• Letter of credit Copy

• Insurance cover note

• Indent

• Certificate of origin

• Others

Creation of LATR:

LATR stands for Loan Against Trust Receipt in such arrangements. The import documents are delivered to importer by signing a Trust Receipt. Bank does not clear the goods from the port and does not take control of goods. Importer cleat the goods from the port and takes possession of goods under this control. On the stipulated date, importer pays the Bank’s dues and LATR is liquidated for creation of LATR the branch is to pass following entry.

Debit: LATR Account

Credit: PAD Account with up to date interest

Chapter Five

Export L/C Opening System

5.1: Export:

Creation of wealth in any country depends on the expansion of production and increasing participation in international trade. By increasing production in the export sector we can improve the employment level of such a highly populated country like Bangladesh. Bangladesh exports a large quantity of goods and services to foreign households. Readymade textile garments (both knitted and woven), Jute, Jute-made products, frozen shrimps, tea are the main goods that Bangladeshi exporters export to foreign countries. Garments sector is the largest sector that exports the lion share of the country’s export. Bangladesh exports most of its readymade garments products to U.S.A and European Community (EC) countries. Bangladesh exports about 40% of its readymade garments products to U.S.A. Most of the exporters who export through UBL are readymade garments exporters. They open export L/Cs here to export their goods, which they open against the import L/Cs opened by their foreign importers.

Export L/C operation is just reverse of the import L/C operation. For exporting goods by the local exporter, bank may act as advising banks and collecting bank (negotiable bank) for the exporter.

5.2: Export Policy:

Export policies formulated by the Ministry of Commerce, which provide the overall guideline and incentives for promotion of exports in Bangladesh. Export policies also set out commodity-wise annual target.

It has been decided to formulate these policies to cover a five-year period to make them contemporaneous with the five-year plans and to provide the policy regime.

The export-oriented private sector, through their representative bodies and chambers are consulted in the formulation of export policies and are also represented in the various export promotion bodies set up by the government.

5.3: Export Incentives:

Different incentives are:

Financial Incentives:

• Restructuring of Export Credit Guarantee Scheme;

• Convertibility of Taka in current account;

• Exporters can deposit 40% of FOB value of their export earnings in own accounts in dollar and pound sterling;

• Export Development Fund;

• Expansion of export credit period from 180 days to 270 days;

• 50% tax rebate on export earnings;

• Duty draw back;

• Bonded warehouse facilities to 100% export oriented firms;

• Duty free import of capital equipment for 100% export oriented firms.

General Incentives:

• National Export Trophy to successful exporters;

• Training course on external trade;

• Arrangement of international trade fairs, commodity-based exhibitions in the country and participation in foreign trade fairs.

Other Incentives:

• Assistance in improvement of quality and packaging of exportable items;

• Simplification of export procedures.

5.4: Export Procedures:

The import and export trade in our country are regulated by the Import and Export (Control) Act, 1950.

Under the export policy of Bangladesh the exporter has to get valid Export registration Certificate (ERC) from Chief Controller of Import & Export (CCI&E). The ERC is required to renew every year. The ERC number is to incorporate on EXP forms and other papers connected with exports.

1. Registration of Exporters:

Like any other business it needs registration. Export registration is made by the Chief Controller of Import and Export (CCI&E). For registration, prospective Exporters required to apply through Q.E.X..P from the CC1&E along with the following documents:

a) Trade License.

b) Income Tax Clearance.

c) Nationality Certificate.

d) Bank’s Solvency Certificate.

e) Asset Certificate.

f) Registered partnership deed.

g) Memorandum & Association of Articles/Certificate of incorporation.

2. Securing the Order:

After getting ERC Certificate the exporter may proceed to secure the export order. He can do this by contacting the buyers directly or through agent.

In this purpose the exporter may get help from:

• License Officer;

• Buyer’s Local Agent;

• Export Promoting Organization;

• Bangladesh Mission Abroad;

• Chamber of Commerce (local & foreign)

• Trade Fair etc.

3. Signing the Contract:

After communicating buyer, exporter has to get contracted (writing or oral) for exporting exportable items from Bangladesh detailing commodity, quantity, price, shipment, insurance and marks, inspection and arbitration etc.

4. Receiving Letter of Credit:

After getting contract for sale, exporter should ask the buyer for Letter of Credit (L/C) clearly stating terms and conditions of export and payment.

The following are the main points to be looked into for receiving/ collecting export proceeds by means of Documentary Credit:

(1) The terms of the L/C are in conformity with those of the contract;

(2) The L/C is an irrevocable one, preferably confirmed by the advising bank;

(3) The L/C allows sufficient time for shipment and negotiation.

(Here the regulatory framework is UCPDC-500, ICC publication)

Terms and conditions should be stated in the contract clearly in case of other mode of payment:

• Cash in advance;

• Open account;

• Collection basis (Documentary/ Clean)

(Here the regulatory framework is URC-525, ICC publication)

5. Procuring the Materials:

After making the deal and on having the L/C opened in his favor, the next step for the exporter is to set about the task of procuring or manufacturing the contracted merchandise.

6. Shipment of Goods:

Then the exporter should take the preparation for export arrangement for delivery of goods as per L/C and incoterms, prepare and submit shipping documents for Payment/ Acceptance/ Negotiation in due time.

Documents for shipment:

• EXP form,

• ERC (valid),

• L/C copy,

• Customer Duty Certificate,

• Shipping Instruction,

• Transport Documents,

• Insurance Documents,

• Invoice,

• Other Documents,

• Bills of Exchange (if required)

• Certificate of Origin,

• Inspection Certificate,

• Quality Control Certificate,

• G.S.P. Certificate,

7. Final Step:

Submission the documents Bank are negotiation.

5.5: Export Financing:

Financing exports constitutes an important part of a bank’s activities. Exporters require financial services at four different stages of their export operation. During each of these phases exporters need different types of financial assistance depending on the nature of the export contract.

a) Pre-shipment credit

b) Post-shipment credit

5.5.1: Pre-Shipment credit:

Pre-shipment credit, as the name suggests, is given to finance the activities of an exporter prior to the actual shipment of the goods for export. The purpose of such credit is to meet working capital needs starting from the point of purchasing of raw materials to final shipment of goods for export to foreign country. Before allowing such credit to the exporters the bank takes into consideration about the credit worthiness, export performance of the exporters, together with all other necessary information required for sanctioning the credit in accordance with the existing rules and regulations. Pre-shipment credit is given for the following purposes:

• Cash for local procurement and meeting related expenses.

• Procuring and processing of goods for export.

• Packing and transporting of goods for export.

• Payment of insurance premium.

• Inspection fees.

• Freight charges etc.

An exporter can obtain credit facilities against lien on the irrevocable, confirmed and unrestricted export letter of credit in form of the followings:

i. Export cash credit (Hypothecation)

ii. Export cash credit against trust receipt.

iii. Packing credit.

iv. Back to back letter of credit.

v. Payment of back to back L/C.

i. Export Cash Credit (Hypothecation):

Under this arrangement, a credit is sanctioned against hypothecation of the raw materials or finished goods intended for export. Such facility is allowed to the first class exporters. As the bank has got no security in this case, except charge documents and lien on exports L/C or contract, bank normally insists on the exporter in furnishing collateral security. The letter of hypothecation creates a charge against merchandise in favor of the bank. But neither the ownership nor the possession is passed to it.

ii. Export Cash Credit Against Trust Receipt:

In this case, credit limit is sanctioned against trust receipt (TR). Here also unlike pledge, the exportable goods remain in the custody of the exporter. He is required to execute a stamped export trust receipt in favor of the bank, he holds wherein a declaration is made that goods purchased with financial assistance of bank in trust for the bank. This type of credit is granted when the exporter wants to utilize the credit for processing, packing and rendering the goods in exportable condition and when it seems that exportable goods cannot be taken into bank’s custody. This facility is allowed only to the first class party and collateral security is generally obtained in this case.

iii. Packing Credit:

Packing Credit is essentially a short-term advance granted by a Bank to an exporter for assisting him to buy, process, manufacture, pack and ship the goods. Generally for movement of goods from the hinterland areas to the ports of shipment the Banks provide interim facilities by way of Packing Credit. This type of credit is sanctioned for the transitional period starting from dispatch of goods till the negotiation of the export documents. Practically except for single transaction, most of the pre-shipment credits are allowed in the form of limits duly sanctioned by Bank in favor of regular exporters for a particular period. The drawings are required to be adjusted fully once within a period of 3 to 6 months. Suiting to the breed and nature of export, sometimes an exporter may also be allowed to avail a combined Cash Credit and Packing Credit limit with fixed ceiling on revolving basis. But in no case the borrower would be allowed to exceed individual credit limit fixed for the purpose. The drawings under Export Cash Credit limits are generally adjusted by the drawing in packing credit limit, which is, in turn liquidated by the negotiation of export documents.

Charge Documents for P.C:

Banker should obtain the following charge documents duly stamped prior to disbursement:

I) Demand Promissory Note

ii) Letter of Arrangement

iii) Letter of Lien of Packing Credit (On special adhesive stamp)

iv) Letter of Disbursement

v) Packing Credit Letter

Additional Documents for P.C:

a) Letter of Partnership along with Registered Partnership Deed in case of Partnership Accounts.

b) Resolution of the Board of Directors along with Memorandum & Articles of association in case of Accounts of Limited Companies. In case of Corporation, Resolution is the Board Meeting with Charter.

c) Personal Guarantee of all the Partners in case of Partnership Accounts and of all the Directors in case of Limited Companies.

e) An undertaking from the Directors of the Public Limited Company to obtain prior clearance from the Bank before declaring any interim/final dividend.

iv. Back to Back Letter of Credit:

Bangladesh is a developing country. After receiving order from the importer, very frequently exporters face problems of scarcity of raw material. Because some raw materials are not available in the country. These have to be collected from abroad. In that case, exporter gives lien of export L/C to bank as security and opens an L/C against it for importing raw materials. This L/C is called Back To Back L/C. In back to back L/C, UBL keeps no margin.

Sometimes there is provision in the export L/C that the importer can use the certain portion of the export L/C amount for importing accessories that are necessary for the making of the product. Only in that case, BTB is opened.

v. Payment of Back to Back L/C:

Client gives the payment of the BTB L/C after receiving the payment from the importers. But in some cases, client sells the bills to the UBL. But if there is discrepancy, the UBL sends it for collection.

In case of BTB L/C, UBL gives the payment to the beneficiary after receiving the payment from the L/C of the finished product (i.e. exporter). Bank gives the payment from DFC Account (Deposit Foreign Currency Account) where Dollar is deposited in national rate.

For BTB L/C, opener has to pay interest at LIBOR rate (London Inter Bank Offering Rate). Generally LIBOR rate fluctuates from 5% to 7%.

A schedule named Payment Order; Forwarding Schedule is prepared while making the payment. This schedule is prepared when the payment of L/C is made. This schedule contains the followings:

i. Reference number of the beneficiary’s bank and date.

ii. Beneficiary’s name.

iii. Bill value.

iv. Payment order number and date.

v. Equivalent amount in Taka.

5.5.2: Post Shipment credit:

This type of credit refers to the credit facilities extended to the exporters by the banks after shipment of the goods against export documents. Necessity for such credit arises as the exporter cannot afford to wait for a long time for without paying manufacturers/suppliers. Before extending such credit, it is necessary on the part of banks to look into carefully the financial soundness of exporters and buyers as well as other relevant documents connected with the export in accordance with the rules and regulations in force. Banks in our country extend post shipment credit to the exporters through:

1. Negotiation of documents under L/C;

2. Foreign Documentary Bill Purchase (FDBP):

3. Advances against Export Bills surrendered for collection.

1. Negotiation of Documents Under L/C: