Executive Summary: Through this Internship report an attempt has been made to assess the performance of Al-Arafah Islami Bank Limited (AIBL). Basically this report has been developed from the basis of secondary data. The sources of information are annual report of the bank, internet, newspaper, magazine etc. My experience also helps me to establish this report.

Banking is a system of intermediation. Modern commercials banks since their early days had been doing two main functions. These are Acceptance of deposits from the public and lending money to the people.

In addition, they also involved themselves in investment. Apart from the principal function, they also have to render various services to the people. The ever-changing demands of the society, business and industry have led the banks to undertake such services for enhancing their utility to the society at large. Based on nature of these services, they may be classified as under (a) agency services: collection and payment of cheques, payment on behalf of customs, purchase and sale of stocks, acting as trustees, acting as agency (b) General services: opening letter of credit, safe custody, dealing in foreign exchange, providing Investment reports, underwriting of loans, providing remittance facilities, complete service in foreign trade.

The structure of the banking system has changed substantially over the last few years. NCBs’ role has gone down. Their share in total assets went down from 54 percent in 1998 to 34 percent in 2006. On the other hand, PCBs’ share went up from 27 percent in 1998 to 65 percent in 2006. The change reflects adoption and implementation of new policies for the banking sector.

It is unlikely true that default culture in our banking sector is a common phenomenon which hampers the strength of the banking sector. But arrival of private bank in our economy has rapidly change this environment. The classified loan over the total loan of our private bank is between 5%-8% whereas it is more than 25% in our government bank. As a private commercial bank we are very much conscious in this regards.

One important challenge that the banking sector is facing is the introduction of information technology in the banking system in an aggressive manner. This is required to improve management efficiency, reduce operational cost, improve customer services, and increase transparency.

The earning and profitability of the banking sector have also improved in recent years and it is generally measured by return on assets (ROA) and return on equity (ROE).

Hence, the banking sector would play a vital role in the development of the country and efficient and sound banking management would led the country to reach at the highest peak of success.

AIBL aims at maintain in effective relationship with the customers, marketing of Investment products, exploring new business opportunities etc. AIBL takes well calculative business risk while safeguarding it’s capital, financial resources and profitability from various risk.

Presently, Al-Arafah Islami Bank Ltd. has got 46 braches and a total of 784 employees working in AIBL (as of June 2006). Its authorized capital is Taka 250 crores and the paid-up capital is Taka 85.40 crores

The bank conducts its business on the principles of islami sarih. Musharaka, Bai-Murabaha, Bai-Muajjal and Hire Purchase investment modes are approved by Bangladesh Bank. Naturally, its mode and operations are substantially different from those of other conventional commercial banks. There is a Shariah Council in the bank who maintains constant vigilance to ensure that the activities of the bank are being conducted on the precepts of Islam.

The Al-Arafah Islami bank has an Asset Liability Committee (ALCO) that reviews liquidity requirement of the bank, the maturity of assets and liabilities, deposit and lending pricing strategy and the liquidity contingency plan. The prime objective of the ALCO is to monitor and avert significant volatility in net profit income, investment value and exchange earnings.

AIBL strives hard to optimize profit through conduction of transparent business operations with in the legal and social framework with malice to none and justice for all.

To achieve the maximum benefit from the investment both funded and non funded the major issue is select the sound ones. In this regard project appraisal as well as evaluation should be considered most. Before financing in any project the quantities and qualitative judgment is essential. The financial strength, management structure, business size, business line, nature of business, competitor etc. should be identified. After financing strong monitoring is also required. As a member of the banking family we are bound to follow the rules and regulation of the government. So we are conscious enough to conduct our operation abiding by direction of Bangladesh Bank. For this reason we have to serve different information in the credit information bureau of Bangladesh Bank.

1.01 Introduction:

The Jews in Jerusalem introduced a kind of banking in the form of money lending before the birth of Christ. The word ‘bank’ was probably derived from the word ‘bench’ as during ancient time Jews used to do money -lending business sitting on long benches.

First modern banking was introduced in 1668 in Stockholm as ‘Svingss Pis Bank’, which opened up a new era of banking activities throughout the European Mainland.

In the South Asian region, early banking system was introduced by the Afgan traders popularly known as Kabuliwallas. Muslim businessmen from Kabul, Afganistan came to India and started money-lending business in exchange of interest sometime in 1312 A.D. They were known as ‘Kabuliawallas’.

The financial system of Bangladesh consists of Bangladesh Bank (BB) as the central bank, 4 nationalized commercial banks (NCB), and 5 government owned specialized banks, 30 domestic private banks, 10 foreign banks and 28 non-bank financial institutions. The financial system also embraces insurance companies, stock exchanges and co-operative banks

The structure of the banking system has changed substantially over the last few years. NCBs’ role has gone down. Their share in total assets went down from 54 percent in 1998 to 40 percent in 2006. On the other hand, PCBs’ share went up from 27 percent in 1998 to 43 percent in 2006. The change reflects adoption and implementation of new policies for the banking sector.

One important challenge that the banking sector is facing is the introduction of information technology in the banking system in an aggressive manner. This is required to improve management efficiency, reduce operational cost, improve customer services, and increase transparency.

Hence, the banking sector would play a vital role in the development of the country and efficient and sound banking management would led the country to reach at the highest peak of success.

1.02 Rational of the study:

With the rapid growing competition (due to free market economy) among nationalized, foreign and private commercial banks as to how the banks operates its banking operation and how customer service can be made more attractive, the expectation of the customers has immensely increased. Reciprocating the sentiment, commercial/private banks are trying to elevate their traditional banking service to a better standard, to meet the challenging needs, demands. Side by side these banks have now concentrated their attention towards diversification of their products for better performances and existence. For the above circumstances, it has become necessary for Al-Arafah Islami Bank Ltd, one of the leading commercial banks, to focus its attention towards the improvement of the customer service. That’s why it is quite justified to make an in-depth study about its operation and evaluate the service provided by this bank and scope for its improvement. The study may help formulating policy regarding the ideas relating to the feelings of the customers and bankers.

Further more, Al-Arafah Islami Bank Ltd executives who are actually executing the policies undertaken by the top management will have a chance to communicate their feelings and will have the feedback about their dealing from the customers.

1.03 Scope of the Study:

The scope of this report is to analyze the operation of all departments and to evaluate the performance of the different departments of Al-Arafah Islami Bank Ltd

1.04 Methodology:

The methodology of the report is stated below, which was appropriately exercised in achieving the above stated objective.

1.05 Time period of the study:

For the fulfillment of the desired purpose following working days are spend to various department:

Al-Arafah Islami Bank Ltd. Motijheel Branch, RahmanMansion, 161, Motijheel C/A, Dhaka, Bangladesh.

1.06 Sources of Data collection:

The inputs are collected from two sources:

a) Primary Sources:

ª Discussion with Bank Officers.

ª Personal observation.

ª Desk work in different sections/departments.

b) Secondary Sources:

ª Annual report of the Bank.

ª Consultation of related book and publications.

ª Different Statements.

ª File, Balance sheet and various documents.

c) Data Processing:

Collected information is processed by the use of computer system. Detailed analysis, working variables and working definitions are embodied in the report

1.08 Objectives of the Report:

The primary objectives of the report are:

- To submit a report, for the fulfillment of my BBA practical.

- The main objective of this report is to find out the “Overall Branch Banking and A Comprehensive Review on Investment of Al-Arafah Islami Bank Limited.”.

- To gather comprehensive knowledge on overall banking functions and the expectations of the customers regarding the service level of the bank.

- Identify the factors contributing to the attractive and operative performance of the local branch of the bank.

- To make a study of the facts in order to arrive at certain conclusion about overall banking operation.

- Identify the main objectives of AIBL Investment Disbursement.

- To find out the sector in which AIBL provides Investment.

- To evaluate financial affairs of the Bank

- To visualize the quantitative and qualitative aspects of AIBL

To identify policy recommendations for further improvement

2.01 Organizational Overview of Al-Arafah Islami Bank Ltd:

Al-Arafah Islami Bank Ltd. as the name implies a newly formed commercial bank in Bangladesh. It has been incorporated in Dhaka, Bangladesh as a public limited company and its Head Office of the Bank is located at RahmanMansion, 161, Motijheel C/A, Dhaka- 1000.

In the world of consumerism the business organization of the world strive for the consumers satisfaction as a number one business strategy whatever may be the product of the organization, either service or non service. Service is the product of bank. There is a saying that customer service starts rights right from the stairs of the bank building. The guard at the door is first person pep resents of the bank, receives a customer with wishes in smiling face.

2.02 Historical Background of Al-Arafah Islami Bank Limited:

Al-Arafah Islami Bank Ltd. (AIBL) was incorporated on 18 June,1995 with authorized capital of Tk.1000 million (100 Crore) and paid up capital of Tk.10.12 Crore paid up by the Sponsors/Directors and Tk.10.12 Crore was offered to the public for subscribed portion of public issue of shares. The Bank was formally inaugurated on 27th September, 2005 with Motijheel Branch (Principal Branch).The Management of the Bank is vested in a Board of Directors consisting of 24 members including the Managing Director of the Bank. Among 24 Directors 2 (two) Directors came from the public shareholders. Managing Director is the chief executive of the Bank. There is a Shariah council of 7 (seven) members in Al-Arafah Islami Bank Ltd. to monitor the investments whether it invests in Shariah allowed sectors or not .Since its establishment, AIBL opened 5 branches in 1995, 5 in 1996,10 in 1997, 10 in 1998, 5 in 1999, 2 in 2000, 3 in 2001, 1 in 2005, & 5 in 2006 i.e. at the end of 2006 the Bank Branch reaches to 46.Total number of employees of the Bank was 771 in 1995 and reached to 912 in 2006 and during the short period of its activities the Bank has made remarkable progress in various activities. Since commencement of its activities on 18 June ,1995 the Bank has mobilized the deposit of Tk.6415.79 million and 16775.33 million at the end of the year 1999 and 2006. Foreign exchange business handled by the Bank during the year 1999 to 2006 were Tk.7859.72 million and 11314.18 million respectively and investment was Tk.3793.71 million and 17423.18 million at the end of the year 1999 and 2006 respectively. The bank earned a profit of Tk.31.70 million in the year 1999 compared to Tk.470.02 million (profit after tax and provision) in the year 2006.

Al-Arafah Islami Bank Ltd. was established not only to earn profit and to develop economy of the country but also it had an ultimate goal to get reward in the Heaven by banning interest in business. Since its commencement the Bank has been trying to achieve this goal. The Islam loving people specially who are not interested with interest, should help this Bank giving deposit and taking investment from this Bank.

2.03 Mission of Al-Arafah Islami Bank Limited:

By establishing an interest free atmosphere in day to day business transactions, the Promoters, Sponsors & Directors expect the Shafayat from our beloved Prophet Hadrat Muhammad (S) and the ultimate emancipation in the Afterwards.

2.04 Vision of Al-Arafah Islami Bank Limited:

To establish an interest free transaction in the economy

2.05 Special feature of the bank:

i) All activities of the bank are conducted according to Islamic Sharia where profit is the legal alternative to interest.

ii) The Bank’s investment policy follows different modes approved by Islamic Shariah based on Quran & Sunnah.

iii) The Bank is committed towards establishing a welfare oriented banking system, economic upliftment of the low-income group of people, create employment opportunities.

iv) According to the needs and demands of the society and the country as a whole the Bank invests money to different Halal business. The bank participates in different activities aiming at creating jobs, implementing development projects taken by the Government and developing infrastructure.

v) The Bank is committed to establish an economic system through social justice and equal distribution of wealth.

vii) The Bank is contributing to economic and philanthropic activities side by side. Al Arafah English Medium Madrasha and AIBL Library are among mention worthy. (Source-Annual Report-2005, P-24)

2.06 Objectives of AIBL:

►To establish an interest free economy.

►To establish an modern banking system for all kinds of people

►To take part in the economic growth of the country.

►To eradicate the poverty and to do social services by establishing Schools, Madrashas, University, Hospitals, Public Library etc.

►Finally to achieve ultimate goal i.e. Nazat in Akhirat.

2.07 Auditors:

In terms of Article 149 of the Articles of Association of the Bank M/S Pinaki and Co. Chartered Accountants were re-appointed as external auditors for conducting the audit of accounts as 31st December, 2000. The Auditor M/S Pinaki & Co. Chartered Accountants being eligible offered themselves for re-appointment for the year 2001. But now M/s Rahman Rahman Hoq becomes the auditor in the year 2005.

2.08 Training and Motivation:

Training and Motivation are utmost important to bring about positive change in the outlook of the manpower and to increase efficiency. Set of trained and efficient workforce is indispensable for any commercial bank and they are the fundamental strength of the bank.

2.11.1 Al-Arafah English Medium Madrasah:

Al-Arafah English Medium Madrasah has been established by the Al-Arafah Bank Foundation with a view to building next generation according to the ideals of peace and equality of Islam and to establishing banking and other aspects of life in the way

2.12 Branches of AIBL:

AIBL started its working at 161, Motijheel C/A with a Branch named Motijheel Branch on 27th September,1995 was the first & main Branch of AIBL and has been operating throughout the country. The Head Office of the Bank was situated at the same holding of Motijheel Branch since its establishment but from 11 January, 2007 it has started its working at its own premises 36, Dilkusha (6th, 7th, 8th & 9th floor), Dhaka-1000. The age of the Bank is only 11 years and during this short period of time, the Bank has established total 46 Branches over the country and made a smooth network inside the country. The number of Branches as Division wise is mentioned in the following table:

| Division | No. of Br. |

| Dhaka Division | 22 |

| Chittagong Division | 10 |

| Rajshahi Division | 4 |

| Khulna Division | 4 |

| Sylhet Division | 5 |

| Barisal Division | 1 |

| Total | 46 |

2.14 Form of Organization:

►Board of Directors

►Executive Committee

►Audit Committee

►Management Committee

►Shariah council

2.15 Environment of Al- Arafa Islami Bank:

“Al- Arafa Islami Bank shall bear the mark of the Sunnah of our prophet Muhammad (S), of our faith and conviction, our values and attitudes towards life and that the entire environment of Al- Arafa Islami Bank shall be in conformity with Sunnah, simple in style, noble and rich in thought, but dynamic and far reaching in impact, exemplary in efficiency and service to the customers.”

3.01.1 Mudaraba Terms Savings Deposit:

Deposit in monthly installment @Tk.300/-, Tk.500/-, Tk.1000/-Tk.1500/- & Tk.2000/- is obtained under the aforesaid scheme for a tenure of 5,8,10 and 12 years and the same is withdrawal with

profit at the end of the tenure.

3.01.2 Monthly Profit based Term Deposit:

Under the above scheme, deposit of Tk. 1.00 lac and multiple thereof are accepted for a term of 5 (five) years and the bank gave profit thereon Tk. 885 per month per lac and proportionately on the rest amount of deposit under the category during the year under review. The aforesaid rate shall, however, be adjustable at the close of calendar year on finalization of accounts.

3.01.3 Monthly Haj Deposit:

Hajj deposit at monthly installment from 1 (one) year to 20(twenty) years are accepted under the above scheme to enable the account holder to perform Hajj out of the accumulated saving with profit.

3.01.4 Onetime Haj Deposit:

Under the above scheme, fixed amount of Hajj deposits are accepted from the clients for particular term and as per rules profit is accumulated thereon per year in this regard. As and when the fixed deposit is matured, Hajj expenses are defrayed by the same. Under the scheme, the guardians may also open Hajj account to enable their successors to perform Hajj. Highest amount of profit is paid in the above types of deposit by the bank.

3.01.5 Savings Investment Deposit:

Deposit under the scheme is accepted by monthly installment and after expiry of the term, double amount of such savings is given as investment in feasible sectors by the bank as per choice of the depositors without any collateral security. Any one by saving under the scheme can take business venture on utilization the amount saved under the scheme as well as availing bank investment.

3.01.6 Marriage Savings Deposit:

Fixed monthly installment for a particular period is to be deposited to defray the expenses of marriage and the bank allows double of saving or Tk.30,000/- which is higher as investment to procure ornaments, furniture, fixture etc., repayable in 24 monthly installment without any collateral security.

3.01.7 Savings Bond Deposit:

Under this scheme the bank has introduced saving bonds for Tk. 10,000/-, Tk.25,000/- and Tk. 100,000/- for 3,5 and 8 years. After the completion of the tenure the depo

3.02 Investment:

The Total investment of the bank stood at Tk.5079.21 million against Tk.3728.41 million during the corresponding period of last year. The percentage of increase is 36.23% as against 13.00% in banking sector. The bank extends investments to the clients under the following modes of investment under Islamic Shariah:

3.02.1 Bai-Murabaha or simply Murabaha:

The terms “Bai-Murabaha” have derived form Arabic words Bai and Ribhum. The word “Bai” means purchase and sale and the word ‘Ribhum’ means an agreed upon profit. So Bai-Murabaha means sale for an agreed upon profit. It may be defined as a contract between a Buyers and a Seller under which the seller sells certain specific goods permissible under Islamic Shariah and the word Law of the land to the Buyer at a cost plus and agreed upon profit payable today or on some date in the future in lump-sum or by installments. The profit may be either a fixed sum or based on a percentage of the price of the goods.

3.02.2 Musharaka:

The word Musharaka is derived from the Arabic word Sharikah meaning partnership. Islamic jurists point out that the legality and permissibility of Musharakah is based on the injunctions of the Holy Qura’n, Sunnah and Ijma (consensus) of the scholars.

Musharaka transaction may be conducted in the following manner:

One, two or more entrepreneurs approach an Islamic Bank to request the financing required for a project. The bank, along with other partners, provides the necessary capital for the project. All partners including the Bank have the right to participate in the project. The profit is distributed according to an agreed ratio. However, losses are shared in exactly the same proportion in which the different partners have provided the finance for the project.

3.02.3 Mudarabah:

The term Mudarabah refers to a contract between two parties in which one party supplies capital to the other party for the purpose of engaging in a business activity with the understanding that any profits will be shared in a mutually agreed upon. Losses, on the other hand, are the sole responsibility of the provider of the capital. The first party provides capital and the other party provides the expertise with the purpose of earning lawful profit (approved by Islamic law) which will be shared in a mutually agreed upon proportion.

3.02.4 Bai-Muajjal:

The term ‘Bai’ and ‘Muajjal’ are derived from the Arabic words ‘Bai’ and ‘Ajal’ where ‘Bai’ means purchase and sale and ‘Ajal’ means a fixed time or a fixed period. So Bai-Muajjal is a sale for which payment is made at a future fixed date or within a fixed period. In short, it is a sale on Credit. It is basically a contract between a buyer and seller under which the seller sells certain specific goods, permissible under Shariah and law of the country to the buyer at an agreed fixed price payable at a certain fixed future date in lump-sum or in fixed installments.

3.02.5 Bai-Salam:

The term Bai-Salam is used to define a sale in which the buyer makes advance payment, but delivery is delayed until some time in the future. Usually the seller is an individual or business and the buyer is the bank.

4.01 General Banking practices in Al-Arafah Islami:

Bangladesh is one of the less developed countries. So the economic development of the country depends largely on the activities of commercial banks. So we need to

emphasis whether these commercial banks are effectively and honestly performing their functions, assigned duties and responsibilities. In thus respect we need to kno

The cash section of Al-Arafah Islami Bank Ltd deals with all types of negotiable instruments, cash and other instruments and treated as a sensitive section of the bank. It includes the vault that is used as the beyond this limit, the excess cash is then transferred to Bangladesh Bank. This section performs the following functions:

1. Cash Packing:

After the banking hour cash is packed according to the denomination. Notes are counted and packed in bundles and stamped with initial.

2. Allocation of Currency:

Before starting the Banking hour all tellers give requisition of money through “ Teller cash proof sheet”. The head Teller writes the number of the packet denomination wise in “Reserve sheet” at the end of the day, all the notes remained are recorded in the sheet.

4.03 Procedure for Opening of Accounts:

Before opening of a currents or savings account, the following formalities must be completed by the customer:

ü Submit application on the prescribed form.

ü Furnishing photographs- 2 (Two) copies.

ü Introduction by an account holder.

ü Putting specimen signatures in the specimen card.

ü Mandate, if necessary.

After fulfilling above formalities, opens an account for the client and provide the customer with a pay-in-slip book and a checkbook in case of savings account and currents account.

4.04 Types of Deposit Accounts and Their Formalities:

A. Current Account

In this kind of account a customer can deposit his money and can write one or more check to withdraw their money. For doing this notice is not required. He can deposit it whenever he/ she wants to and also can withdraw it whenever he/ she wants to

v In The Name of Individual:

The client has to fill up a light green account opening form. Terms and conditions are printed on the back of the form. The form contains the declaration clause, special instructions etc. two copies of passport size photograph duly attested by the introducer are affixed with the form.

v In Joint Name:

In this type, the formality is same as individual account, but in the special instruction clause, either or ‘survivor’ or ‘former or survivor’ clause is marked.

v Proprietorship:

In addition the customer has to submit the valid Trade License and Tax Paying Identification Number (TIN) along with the application.

v Partnership:

In case of partnership account, the bank asks for,

Ä A copy of the partnership agreement (Partnership Deed)

Ä A letter signed by all the partners containing the following particulars.

Ä The name and addresses of all partners

Ä The nature of the firm’s business

Ä The name of the partner authorized to operate the account in the name of the firm, including the authority to draw, endorse and accepting the bills and mortgage and sell the properties belonging to the firm.

v Limited Company:

On having the desire to open an account from a limited company, an EXIM Bank Officer asks for the following documents:

Ä Registration Certificate from the Registrar of Joint Stock of Companies

Ä Certificate of Incorporation

Ä Certificate of Commencement of Business

Ä Memorandum of Association

Ä Articles of Association

Ä Copies of Annual Accounts

Ä Copies of the Board’s resolution, which contains

a). The name of the persons who have been authorized to operate the bank account on behalf of the company.

b). The name of the persons who are authorized to execute documents with the bank on company’s behalf.

v Societies, Clubs and Associations:

In case of these sorts of accounts Al-Arafah Islami Bank Ltd requires the following documents:

Ä Registration Certificate Under the Societies Registration Act, 1962

Ä Copies of Memorandum, Articles of Association

Ä Resolution of the Managing Committee.

Ä Power of Attorney to Borro

v Non-government Organization (NGO):

The account opening procedure is same but in exception is that the Registration Certificate from the Social Welfare Department of Government must be enclosed with the application.

v Joint Account in The Name of Minor:

A minor cannot open an account in his own name due to the incapacity to enter into a contract. He can open an account in Al-Arafah Islami Bank Ltd in Joint name of another person who will be guardian of him.

B. Savings Bank Account:

This deposit is basically meant for small-scale savers. There is restriction on withdrawals in a month. Heavy withdrawals are permitted only against prior notice. Interest is paid on these types of accounts.

v Short-term Deposit (STD):

In Short-term Deposit, the deposit should be kept for at least seven days to get interest. The interest offered for STD is less than that of savings deposit. In Al-Arafah Islami Bank Ltd various big companies, Organizations, Government Departments keep money in STD accounts. Frequent withdrawal is discouraged and requires prior notice.

v Fixed Deposit:

They are also known as time liabilities or term deposits. These are deposits, which are made with the bank for a fixed period specified in advance. The bank need not maintain cash reserves against these deposits and therefore, the bank offers high are of interest on such deposits.

In Al-Arafah Islami Bank Ltd, fixed deposit account is opened in two forms- Midterm (MTD), which is less then one year & the other is Term Deposit, which is more than one year.

v Opening of Fixed Deposit Account:

The depositor has to fill an application form where in he mentions the amount of deposit, the period for which deposit is to be made & the name/ names is which the fixed deposit receipt is to be issued. In case of a deposit in Joint name Al-Arafah Islami Bank Ltd. also takes the instructions regarding payment of money maturity of the deposit. The banker also takes the instructions regarding payment of money on maturity of the deposit. The banker also takers the instructions regarding payment of money on maturity of the deposit. The banker also taker specimen signatures of the depositors.

A fixed deposit account is then issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest & the date on which the deposit will fall due for payment.

v Payment of Interest:

It is usually paid on maturity of the fixed deposit. Al-Arafah Islami Bank Ltd calculates interest at each maturity date and provision is made on that “Miscellaneous creditor expenditure payable accounts” is debited for the accrued interest.

v Encashment of F.D.R:

In case of premature FDR, Al-Arafah Islami Bank Ltd is not bound to accept surrender of the deposit before its maturity date. In order to deter such a tendency the interest on such a fixed deposit is made cut a certain percentage less a the agreed rate. Normally savings bank deposit interest rate is allowed.

v Loss of FDR:

In case of a lost FDR, the customer is asked to record a GD (General Diary) in the nearest Police Station. After that the customer has to furnish an Indemnity Bond to Al-Arafah Islami Bank Ltd a duplicate FDR is then issued to the customer by the bank.

4.02 Cash:

The cash section of Al-Arafah Islami Bank Ltd deals with all types of negotiable instruments, cash and other instruments and treated as a sensitive section of the bank. It includes the vault that is used as the beyond this limit, the excess cash is then transferred to Bangladesh Bank. This section performs the following functions:

1. Cash Packing:

After the banking hour cash is packed according to the denomination. Notes are counted and packed in bundles and stamped with initial.

2. Allocation of Currency:

Before starting the Banking hour all tellers give requisition of money through “ Teller cash proof sheet”. The head Teller writes the number of the packet denomination wise in “Reserve sheet” at the end of the day, all the notes remained are recorded in the sheet.

4.03 Procedure for Opening of Accounts:

Before opening of a currents or savings account, the following formalities must be completed by the customer:

ü Submit application on the prescribed form.

ü Furnishing photographs- 2 (Two) copies.

ü Introduction by an account holder.

ü Putting specimen signatures in the specimen card.

ü Mandate, if necessary.

After fulfilling above formalities, opens an account for the client and provide the customer with a pay-in-slip book and a checkbook in case of savings account and currents account.

4.04 Types of Deposit Accounts and Their Formalities:

A. Current Account:

In this kind of account a customer can deposit his money and can write one or more check to withdraw their money. For doing this notice is not required. He can deposit it whenever he/ she wants to and also can withdraw it whenever he/ she wants to.

v In The Name of Individual:

The client has to fill up a light green account opening form. Terms and conditions are printed on the back of the form. The form contains the declaration clause, special instructions etc. two copies of passport size photograph duly attested by the introducer are affixed with the form.

v In Joint Name:

In this type, the formality is same as individual account, but in the special instruction clause, either or ‘survivor’ or ‘former or survivor’ clause is marked.

v Proprietorship:

In addition the customer has to submit the valid Trade License and Tax Paying Identification Number (TIN) along with the application.

v Partnership:

In case of partnership account, the bank asks for,

Ä A copy of the partnership agreement (Partnership Deed)

Ä A letter signed by all the partners containing the following particulars.

Ä The name and addresses of all partners

Ä The nature of the firm’s business

Ä The name of the partner authorized to operate the account in the name of the firm, including the authority to draw, endorse and accepting the bills and mortgage and sell the properties belonging to the firm.

v Limited Company:

On having the desire to open an account from a limited company, an EXIM Bank Officer asks for the following documents:

Ä Registration Certificate from the Registrar of Joint Stock of Companies

Ä Certificate of Incorporation

Ä Certificate of Commencement of Business

Ä Memorandum of Association

Ä Articles of Association

Ä Copies of Annual Accounts

Ä Copies of the Board’s resolution, which contains

a). The name of the persons who have been authorized to operate the bank account on behalf of the company.

b). The name of the persons who are authorized to execute documents with the bank on company’s behalf.

v Societies, Clubs and Associations:

In case of these sorts of accounts Al-Arafah Islami Bank Ltd requires the following documents:

Ä Registration Certificate Under the Societies Registration Act, 1962

Ä Copies of Memorandum, Articles of Association

Ä Resolution of the Managing Committee.

Ä Power of Attorney to Borro

v Non-government Organization (NGO):

The account opening procedure is same but in exception is that the Registration Certificate from the Social Welfare Department of Government must be enclosed with the application.

v Joint Account in The Name of Minor:

A minor cannot open an account in his own name due to the incapacity to enter into a contract. He can open an account in Al-Arafah Islami Bank Ltd in Joint name of another person who will be guardian of him.

B. Savings Bank Account:

This deposit is basically meant for small-scale savers. There is restriction on withdrawals in a month. Heavy withdrawals are permitted only against prior notice. Interest is paid on these types of accounts.

v Short-term Deposit (STD):

In Short-term Deposit, the deposit should be kept for at least seven days to get interest. The interest offered for STD is less than that of savings deposit. In Al-Arafah Islami Bank Ltd various big companies, Organizations, Government Departments keep money in STD accounts. Frequent withdrawal is discouraged and requires prior notice.

v Fixed Deposit:

They are also known as time liabilities or term deposits. These are deposits, which are made with the bank for a fixed period specified in advance. The bank need not maintain cash reserves against these deposits and therefore, the bank offers high are of interest on such deposits.

In Al-Arafah Islami Bank Ltd, fixed deposit account is opened in two forms- Midterm (MTD), which is less then one year & the other is Term Deposit, which is more than one year.

The banker also taker specimen signatures of the depositors:

A fixed deposit account is then issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest & the date on which the deposit will fall due for payment.

v Payment of Interest:

It is usually paid on maturity of the fixed deposit. Al-Arafah Islami Bank Ltd calculates interest at each maturity date and provision is made on that “Miscellaneous creditor expenditure payable accounts” is debited for the accrued interest.

v Encashment of F.D.R:

In case of premature FDR, Al-Arafah Islami Bank Ltd is not bound to accept surrender of the deposit before its maturity date. In order to deter such a tendency the interest on such a fixed deposit is made cut a certain percentage less a the agreed rate. Normally savings bank deposit interest rate is allowed.

v Loss of FDR:

In case of a lost FDR, the customer is asked to record a GD (General Diary) in the nearest Police Station. After that the customer has to furnish an Indemnity Bond to Al-Arafah Islami Bank Ltd a duplicate FDR is then issued to the customer by the bank.

v Renewal of F.R.D.:

In Al-Arafah Islami Bank Ltd, the instrument is automatically renewed within seven days after the date of its maturity if the customer does not come to en-cash the FDR. The period for renewal is determined as the previous one.

4.05 Remittance:

Remittance can be done by telegraph transfer, mail transfer, traveler’s Cheque and drafts and Cheque. There are two steps of remittance:

- Inland Remittance:

By using ways we can do it. When one bank sends these T.T, M.T, T.C or Cheque to another bank than it will be called inland remittance. It is done within the country from one bank to another.

- Foreign Remittance:

When a bank got this T.T, M.T, T.C and cheque from outside bank, which is not situated in the home country than it will be called foreign remittance. Using these methods also has done it.

v Types of Remittance:

a) Between banks and non-banks customers.

b) Between banks in the same country.

c) Between banks in the different centers.

d) Between banks and central bank in the same country.

e) Between central bank of different customers.

û Administration/ Monitoring:

The administration of the loan process shall ensure, compliance with all laws and regulations at both local and global levels including bank policy as set out in this document and the Bank’s credit manual/circulars.

v Types of Credit Activities:

Depending on the various nature of financing all the lending activities have been brought under the following major heads:

1. Loan (General):

Short term and long term loans allowed to individual/ firms/ industries for a specific purpose but a definite period and generally repayable by installments fall under this head these types of lending are mainly allowed to accommodate financing under the categories.

a). Large and Medium Scale Industries.

b). Small and Cottage Industries. Very often term financing for agriculture and others are also included here.

2. House Building Loan (General):

Loans allowed to individual/enterprises construction of house (residential or commercial) fall under this type of advance. The amount is repayable by monthly installment within a specified period, advances are known as Loan (HBL‑GEN).

Ñ Introduction:

HouseBuilding loan is one of the common credit policies of banking sector. There was only one institution in our country, which is specified in HBFC, Bangladesh House Building Finance Corporation. Now days, besides this bank many commercial banks and Leasing Company provides house-building loan to the customers.

Ñ Interest rate:

Currently the interest rate is 16%. But it may changes from time to time depending on the market interest rate. From the customers point of view this changes have an adverse impact on the customers. Some times if they have to bear a higher interest on the principal amount which causes a great burden on them.

But from the bank’s point of view this is very good to maintain the markup. Because when the market interest rate raises 1% than they are getting 1% less markup. So for this clause of increasing interest rate they can have the same markup by increasing the

interest rate changing on the clients. So this is very effective for the Bank to maintain markup.

Ñ Disbursement Procedure:

The disbursement procedure or timing of disbursement depends on the client or the progress of work of the construction. The disbursement can be made two or three stages or more depending on the above conditions.

Ñ Mode of repayment:

The loan shall be adjusted by monthly installment basis. The repayment will start from 6(six) months of the date of first disbursement (it may change according to the terms and conditions of the agreement)

Ñ Collateral:

The land and the construction on the land are normally given as collateral. It may changes‑‑

The documents to be obtained:

i. DP note.

ii. Letter of disbursement.

iii. Letter of installment.

iv. Letter of guarantee.

v. Letter of undertaking.

vi. Letter of agreement,

vii. Irrevocable general power of attorney.

viii. Memorandum of deposit of title deed.

ix. Any other documents if considered.

v House Building Loan (Staff):

Loans allowed to the Bank employees for purchase/construction of house shall be known as Staff Loan (HBFC‑STAFF).

Other Loans to Staff:

Loans allowed to employees other than for HouseBuilding shall be grouped under head staff Loan (general).

Cash Credit (Hypo)

Advances allowed to individual/ firm for trading as well as wholesale purpose or to industries to meet up the working capital requirements against hypothecation of goods as primary security fall under this type of lending. It is a continuous credit. It is allowed under the categories:0

“Commercial lending” when the customer is other than an industry and “Working Capital” when the customer is an industry.

v Consumers Credit Scheme of Al-Arafah Islami Bank Ltd.

Introduction:

Consumer Credit Scheme is a major program of Al-Arafah Islami Bank Ltd. In CCS the bank engage an agent who works on behalf of the Bank. This agent performs all the works prior to the sanction of the CCS. They do the inspection and make all the documents necessary for CCS. For this purpose they get commission.

Clients :

The clients are Service Holders and Businessman. Service holders can be Government and Private. In case of Government officer, the client must be an officer in rank.

Products:

Electronic goods, cars, jeeps, microbuses, Mobile telephone, T&T telephone etc.

Profit Rate:

Down payment

Down payment is 20% of the CCS amount. It is considered as equity. The payment is 50% for vehicles.

Advance allowed for retirement of shipping documents w d release of goods imported through LIC falls under trust with the arrangement that sale proceeds should be deposited to liquidate the advances within a given period. This is also a temporary advance connected with import and known as post‑Import finance and falls under the category “Commercial Banking.

v IBP (inland bill purchased):

Payment made through purchase of inland bills/cheques to meet urgent requirement of the customer falls under this type of credit facility. This temporary advance is adjustable from the proceeds of bill/ Cheques purchased for Collection. It falls under the category “Commercial Lending”.

v Credit Administration

The principle elements of bank credit administration are as follows:

- Credit approval.

- Credit file maintenance.

- Facility evidence maintenance.

- Credit monitoring and review.

v Credit Approval:

The primary factor determining the quality of the Bank’s credit portfolio is the ability of each borrower to honor, on a timely basis, all credit commitments made to the Bank. The authorizing credit personnel period to credit approval must accurately determine this.

The credit approval process shall be governed by the Bank Credit Policy framework, which can be summarized under the following:

Asstt. Vice President

The amount and scope of each Officer’s lending authority is a function of the amount and extent of authority required by the officer to carry out his /her responsibilities to the Bank and its clients ma prudent, effective and efficient manner.

v Approval under Dual Signature:

All approval of credit facilities must be conveyed under dual signature, and ideally both he signatures must have the required lending authority. If however, two lending officers of the required lending authority are not available, one of the signatories must have the lending authority.

4.07 Formalities for Opening Foreign Currency (FC) Account:

The AD may without prior approval of the Bangladesh Bank open Foreign Currency (FC) account in the name of:

- Bangladesh national residing abroad.

- Foreign nationals residing abroad/ in Bangladesh and also foreign firms registered abroad and operating in Bangladesh and abstract.

- Foreign Missions and their expatriate employees.

- Resident of Bangladesh nationals working with the foreign/ international organizations operating in Bangladesh provided their salary in paid in foreign currency.

v Rate of Exchange:

It means the price of one currency expressed in terms of another currency. Rate of exchange is the rate by which the relation among different foreign currencies is established in terms of local currency of that country. Value at which one country’s currency can be converted into another’s currency.

4.08 Import Procedure:

To import a person should be competent to be an “Importer”. According to Import and Export control Act 1950, the office of Chief Controller of Import and Export provides the registration (IRC) to the importer. After obtaining this person has to secure a letter of credit authorization from Bangladesh Bank. And then a person becomes a qualified importer. He is the person who requests or instructs to open an L/C. he is also called opener or applicant of the credit

v Importer’s Application for L/C Limit Margin:

To have an import L/C limit, an importer submits an application to the Department of Al-Arafah Islami Bank Ltd furnishing the following information:

- Full particulars of bank account.

- Nature of business.

- Required amount of limit.

- Payment terms and conditions.

- Goods to be imported.

- Offered security.

- Repayment schedule.

Now if the officer thinks the application to open an L/C in not fit, the following entries are given to realize the L/C, Charges, Postage and L/C margin.

v Presentation of the Documents:

The seller being satisfied with the terms and the conditions of the credit proceeds to dispatch the required goods to the buyer and after that has to present the documents evidencing dispatching of goods to the negotiating bank. After receiving all the documents the negotiation bank then checks the documents against the credit

- Invoice.

- Bill of Lading

- Certificate of Deposit

- Packing List.

- Weight List.

- Shipping Advice.

- Non-negotiable copy of bill of lading

- Bill of Exchange

- Pre-Shipment inspection report

- Shipment Certificate.

v Following Paper Required for New Imported While Opening on L/C:

The following papers are required when opening a new L/C:

Ä Valid Import Registration Certificate (IRC).

Ä Trade License.

Ä TIN Certificate.

Ä VAT Certificate.

Ä Three (3) copies declaration by the importer that they have paid/ submitted return of income tax of proceeding last year.

Ä Membership Certificate of Chamber of Commerce Industry.

Ä According to be maintained with the bank.

Ä Membership Certificate BGMEA (Incase of GarmentInd.)

Ä Banded warehouse license (Incase of Export Oriented Industry).

Ä LCA From.

Ä Insurance cover note.

Ä Proforma Invoice/ Indent.

Ä Application for opening of L/C duly billed in and signed.

Ä IMP form duly signed.

v Payment Procedure of The Import Documents:

This is the most sensitive task of the import department. The officials have to be very much careful while making payment. This task constitutes the following:

- Date of payment: Usually payment is made within seven days after the document have been received. If the payment is become deferred the negotiating bank may claim interest for making delay.

v Advising a L/C:

It is customary to advise a credit to the seller through an advising bank. Advising through a bank is a proof of apparent authenticity of the credit to the beneficiary to whom it is addressed. Before forwarding/ advising the credit to the seller under appropriate forwarding coverage, the advising bank have to verify the signature of the officer of the opening bank and ensure that the terms and conditions of the credit are not violation of the existing exchange control regulations and other regulations relating to export. Very often advising bank receives requests from issuing ban to add their confirmation while advising credit to the beneficiary.

v Import Financing:

A) Letter of Credit (L/C) Facility:

Bank in favor of exporter on behalf of the importer issue L/C. L/C is issued to import goods for trading and manufacturing process.

B) Loan Against Import Merchandise (LIM):

Loan Against Import Merchandise (LIM) is post import finance, which is granted in favor of the importer to retire shipping documents against import of goods. This is generally repaid within 30 days.

C) Loan Against Trust Receipt (LTR):

Loan Against Trust Receipt (LTR) is post import finance extended to the importer of goods. Importer issues a trust receipt favor of Bank and takes possession of the goods markets and sells the products and repay within the stipulated period.

4.09 Export Procedure:

The exports form Bangladesh is subject to export trade control exercise by the Ministry of Commerce through Chief Controller of Export and Imports (CCI & E). no exporter is allowed to export any commodity permissible for export from Bangladesh unless he is registered with CCI & E and holds valid Export Registration Certificate (ERC). The Export Registration Certificate (ERC) is required to be renewed every year. The Export Registration Certificate (ERC) is to be incorporated on EXP forms and other documents connected with exports.

4.12 Foreign Exchange:

Foreign exchange can simply be defined as a process of conversion of one currency into another. A well know author of some popular books on foreign exchange, Dr. Paul Einzig tells that foreign exchange means “a system or process of conversion of one national currency into another and of transferring money from one country into another”. In ordinary sense “Foreign Exchange” means Foreign Currency, which refers to the rate of exchange the price of one unit of foreign exchange in terms of another currency. But in its complete sense, foreign exchange means the mechanism or the media used and the rate at which these media are exchange with another.

Foreign Exchange department is divided into two parts, the first one is the Export Department and the second part is the Import Department.

4.12.1 Export Department:

When any organization wants to export any product to other country than that particular organization usually opens an Export Letter of Credit (L/C) from this department.

v Foreign Exchange Operation (Export Financing):

Exporter means any person lawfully exporting goods from Bangladesh to any other country in the world. After shipment the exporter has to tender the documents to the Bank within the stipulated period for the negotiation of the documents are drawn Incentives are as follows:

Ó Export Finance:

Ä Interest Rate.

Ä Incremental Incentive on Interest for Interest Based Bank.

Ä Extent of Export Credit.

v Checking and Advising of Export Letter of Credit:

On receipt of Export letter of Credit it is to be recorded in the Banks inward register and then the signature of a Bank and finally it is to be forwarded to the beneficiary under forwarding schedule.

v Processing and Opening of Back-to-Back Letter of Credit:

An exporter desired to have an Import L/C limit under Back-to-Back arrangement. In that case the following papers & documents are required:

? Full Particulars of Bank Account.

? Balance Sheet.

? Statement of Assets & Liability.

? Trade License.

? Valid Bonded Warehouse License.

? Membership Certificate.

? Income Tax Declaration.

v ACU Letter of Credit (L/C):

This types of L/C as same as Case L/C. reimbursement must be made on ACU NOCTRO A/C countries. Reimbursement authority should be sending on the same day of the Letter of Credit (L/C) is sent.

¹ Procedure for Transferable Letter of Credit (L/C):

The original beneficiary when request the banker in writing to effect transfer the Letter of Credit (L/C) to the second beneficiary, the signature of the original beneficiary on the letter of request must be verified by his banker. The Letter of Credit (L/C) can be transferred only on the terms and conditions specified in the original credit.

4.15 Procedure for Opening Letter of Credit (L/C):

An importer desirous to have an import Letter of Credit (L/C) limit must have applied to the designated bank in prescribed form for sanction of margin, Letter of Credit (L/C) limit it etc.

v L/C Opening flow chart in case of BTB L/C:

v Letter of Credit (L/C) Application:

For opening Letter of Credit (L/C) the client is to submit to the bank an application in the printed format of the designated bank. This is called Letter of Credit (L/C) application form, which is also an agreement between the importer and the bank. The form is to be stamped under stamp Act. The importer must submit the LCA and IMP and Indent or contract / purchase order/ proforma invoice (duly accepted by the importer) along with Letter of Credit (L/C) application.

The Letter of Credit (L/C) application must be completed/ filled in and signed by the authorized person of the importer giving the following particulars.

Ä Full name and address of the supplier or beneficiary and importer.

Ä Brief description of the goods.

Ä Last date of shipment and negotiation time (must not be beyond 30 days from the shipment date).

v Examination of Letter of Credit (L/C) Application:

On receipt of Letter of Credit (L/C) application an officer of L/C section must check it very careful by the following manner.

> That the terms and conditions as stipulated in the L/C application are consistent with the exchange control and import trade regulation and UCPDC 500.

> That all the information mentioned in above column have been furnished.

> That the terms to be imported are eligible according to importers entitlement.

> That the goods are not being imported or originated form South Africa or Israel.

> If the goods are imported form any member countries of ACU.

> That the validity of the L/C must not exceed the validity of LCA.

> L/C is opened within the validity period permitted in the License.

For Letter of Credit (L/C) limit following information are to be furnished by the applicant.

v Preparation of Credit Report:

Bank prepares credit report in prescribed forms. Character, Capacity and Capital, which are known as the three C’s of credit. Instead of the three C’s some mentions the three R’s i.e. reliability, responsibility and resources. To these three C’s we may add two more C’s i.e. collateral and conditions.

v Position of Letter of Credit (L/C):

Import section will see whether there is sufficient fund available in the account to cover the margin to be sanctioned, commission, postage, cable or telex charge etc. If it is found O.K, Letter of Credit (L/C) will be sanctioned.

In all cases the sanction must be informed to the importer for acceptance. On receiving confirmation from the client then the terms and conditions of the sanctioned are acceptable, the subsequent documentation/ charge document are taken up.

Following papers/ documents submitted by the importer before opening of the L/C:

ð Memorandum of (In case of partnership firm).

ð Resolution.

ð Photo One Copy.

ð VAT Registration Certificate.

Bank will supply the following papers/ documents before opening of the L/C:

ð Letter of Credit (L/C) Application Form.

ð LCA Form.

ð IMP Form.

ð Charge Documents Paper.

ð Guarantee Form.

The above papers must be completed duly filled in and signed by the party and verified the signature.

v Maintenance of Register:

The sanction must be recorded in the following registers:

¹ Document Execution Registers. All the charge documents must be recorded in this register.

¹ Limit Register.

¹ Liability Ledger.

v Confidential Report of Beneficiary of Letter of Credit (L/C):

According to exchange control regulations bankers are required to obtain confidential report of the beneficiary of Letter of Credit (L/C) before opening the same, if the amount of Letter of Credit (L/C) exceeds Tk. 5 lac. Bank can open Letter of Credit (L/C) below Tk. 5 lac without obtaining C.R.

Banker can write to their foreign correspondents to supply the C.R. But from practical experience foreign correspondents of different country are not supplied timely.

To overcome the above situation bankers can conduit reference book i.e. MUWN/ DUNN/ BRADSTREET/ Trade directory of various chambers of commerce of different countries in the world.

On receipt of C.R. form any source the banker can accumulate the same in one master file.

v LCA Registration:

Letter of Credit (L/C) authorization forms consisting of six copies. 1st copy for exchange control purposes, 2nd copy for the licensing authority, 3rd and 4th copies for the CCI and

v Procedure or Preparation and Dispatch:

Amendment is to be typed in the Banks printed format. The copies of the amendment must be dispatched to all concerned as done in dispatching the L/C. Amendment can be done either by cable/ telex or airmail.

Each and every amendment of L/C must be noted in the L/C file and copies of each amendment are kept in the L/C file chronologically (date wise).

v Bank Charge:

Amendment commission is to be realized from the party as per instruction of Bangladesh Bank F.C. circulars.

v Accounting Procedure:

Dr. Party’s Account.

Cr. Commission Account.

Cr. P & T Account.

4.16 Clearing House & Collections of Bill:

According to the Article 37(2) of Bangladesh Bank Order 1972, the banks, which are the member of the clearinghouse, are called as Scheduled Banks. The scheduled banks clear the cheques drawn upon one another through the clearinghouse. This is an arrangement by the central bank where everyday the representative of the member banks gathers to clear the cheques. Banks for credit of the proceeds to the customer’s accounts accept cheques and other similar instruments.

Procedures for Collection:

The following procedures are taken for collection,

- Procedure for Outward Bills for Collection:

5.01 Definition of Investment:

Investment, transaction between two parties in which one ( the creditor or lender) supplies money, goods, services or securities in return for a promised future payment by the other ( the debtor or borrower). Such Transaction normally includes the payment of interest to the lender. Investment may be extended by the public or private institutions to finance business activities, agricultural operation, consumer expenditures or government projects.

5.02 Introduction of Investment:

Modern Investment management is extended through specialized financial institutions of which commercial banks are the oldest and most important. In present days of industrial economics, the banks are able to extend and increase the supply of Investment by the creation of Investment management for their loan customers. The lender must judge each loan he makes on the basis of the charter of the borrower (his intention to pay), (his capacity to pay), (based on his potential for earning) and his collateral pledged in case of default on the loan. The terms of Investment transactions may be publicly regulated to prevent abuses by customers and lenders as well as to channel Investment in to particular sectors of the economy.

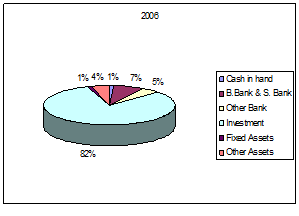

5.03 AIBL 2006 Deposit, Investment and Asset Information:

Deposit:

The total deposit of the bank was Tk. 16775.33 million at 31st December 2006, of which bank deposit was 611.72 million taka and general deposit was 16163.61 million taka. At the same time in the last year, the amount was total deposit was 11643.66 million taka. In this area the growth rate is 44.07%.

investment:

At the end of the year 2006, the amount of investment of the bank was Tk. 17423.19 million in comparison to Tk. 11474.41 million of the last year 2005. the amount of investment has increased 5948.78 million taka within this period, which is around 51.84%

Total Assets:

- Cash in hand 1%

- B.Bank & S.Bank 7%

- Other Bank 5%

- Investment 82%

- Fixed Assets 1%

- Other Assets 4%

7.01 Role of CIB in Bangladesh:

Due to irregular and insufficient flow of credit information in the banking system the proportion of classified loan in relation to total credit is very high. This proportion of classified loan operated a bad culture in the Banking sector. In order to eliminate the bad culture & to equip the banks with proper credit information for loan application processing, proposal for relation of CIB was put forward by different committee and organizations and it was established in 1992.

7.02 Functions of CIB:

i) To standardize information flow on loans/credits within the Bangladesh Banking system.

ii) To increase the speed & accuracy with which the credit information is made available to banker assessing credit role.

iii) To combine the information gathered on classified loans with the information on newly sanctioned loans to the borrowers thereby making available on integrated information package.

iv) To integrate the default loan information in the CIB its timely submission to the banks for loan application processing.

v) To collect credit information on quarterly basis from banks.

8.01 Credit Risk Grading:

Credit risk grading is an important tool for credit risk management as it helps the Banks & financial institutions to understand various dimensions of risk involved in different credit transactions. The aggregation of such grading across the borrowers, activities and the lines of business can provide better assessment of the quality of credit portfolio of a bank or a branch. The credit risk grading system is vital to take decisions both at the pre-sanction stage as well as post-sanction stage.

At the pre-sanction stage, credit grading helps the sanctioning authority to decide whether to lend or not to lend, what should be the loan price, what should be the extent of exposure, what should be the appropriate credit facility, what are the various facilities, what are the various risk mitigation tools to put a cap on the risk level.

8.04 Use of Credit Risk Grading:

- As evident, the CRG outputs would be relevant for individual credit selection, wherein either a borrower or a particular exposure/facility is rated.

- Risk grading would also be relevant for surveillance and monitoring, internal MIS and assessing the aggregate risk profile of a Bank. It is also relevant for portfolio level analysis.

8.05. Numbers & Short names of graders used in the CRG:

The proposed CRG scale consists of 8 categories with Short names and Numbers are provided as follows:

| GRADING | SHORT NAME | NUMBER |

| Superior | SUP | 1 |

| Good | GD | 2 |

| Acceptable | ACCPT | 3 |

| Marginal/Watch List | MG/WL | 4 |

| Special Mention | SM | 5 |

| Sub standard | SS | 6 |

| Doubtful | DF | 7 |

| Bad & Loss | BL | 8 |

8.06 Regulatory Definition on Grading of Classified Accounts:

Irrespective of credit score obtained by a particular obligor, grading of the classified names should be in line with Bangladesh Bank guidelines on classified accounts, which is extracted from “PRUDENTIAL REGULATIONS FOR BANKS: SELECTED ISSUES” (updated till August 07, 2005) by Bangladesh Bank are presently as follows:

8.07 Basis of Loan Classification:

A. Objective Criteria:

Any Continuous Loan if not repaid/renewed within the fixed expiry date for repayment will be treated as irregular just from the following day of the expiry date. This loan will be classified as Sub-standard if it is kept irregular for 6 months or beyond but less than 9 months, as `Doubtful’ if for 9 months or beyond but less than 12 months and as `Bad & Loss’ if for 12 months or beyond.

In case any installment(s) or part of installment(s) of a Fixed Term Loan is not repaid within the due date, the amount of unpaid installment(s) will be termed as `defaulted installment’.

B. Qualitative Judgment:

If any uncertainty or doubt arises in respect of recovery of any Continuous Loan, Demand Loan or Fixed Term Loan, the same will have to be classified on the basis of qualitative judgment be it classifiable or not on the basis of objective criteria.

Note:

a) Any change in classification criteria provided by the Bangladesh Bank shall supersede this grading system for classified accounts.

b) An account may also be classified based on qualitative judgment in line with Bangladesh Bank guidelines.

c) A particular bank may have classification criteria stricter than Bangladesh Bank guidelines.

a) Evaluation of Security Risk:

Risk that the bank might be exposed due to poor quality or strength of the security in case of default.

b) Evaluation of Relationship Risk:

These risk areas cover evaluation of limits utilization, account performance, conditions/ covenants compliance by the borrower and deposit relationship.

According to the importance of risk profile, the following weightages are proposed for corresponding principal risks.

Principal Risk Components: Weight:

- Financial Risk 50%

- Business/Industry Risk 18%

- Management Risk 12%

- Security Risk 10%

- Relationship Risk 10%

Principal Risk Components: Key Parameters:

- Financial Risk Leverage, Liquidity, Profitability & Coverage ratio.

- Business/Industry Risk Size of Business, Age of Business, Business Outlook,

- Industry Growth, Competition & Barriers to Business

- Management Risk Experience, Succession & Team Work.

- Security Risk Security Coverage, Collateral Coverage and Support.

- Relationship Risk Account Conduct ,Utilization of Limit, Compliance of

covenants/conditions & Personal Deposit.

Principal Risk Components: Key Parameters: Weight:

- Financial Risk 50%

Þ Leverage 15%

Þ Liquidity 15%

Þ Profitability 15%

Þ Coverage 5%

- Business/Industry Risk 18%

Þ Size of Business 5%

Þ Age of Business 3%

Þ Business Outlook 3%

Þ Industry growth 3%

Þ Market Competition 2%

Þ Entry/Exit Barriers 2%

- Management Risk 12%

Þ Experience 5%

Þ Succession 4%

Þ Team Work 3%

- Security Risk 10%

Þ Security coverage 4%

Þ Collateral coverage 4%

Þ Support 2%

- Relationship Risk: 10%

Þ Account conduct 5%

Þ Utilization of limit 2%

Þ Compliance of covenants

/condition 2%

Þ Personal deposit 1%

After the risk identification & weightage assignment process (as mentioned above), the next steps will be to input actual parameter in the score sheet to arrive at the scores corresponding to the actual parameters.

a) Open the MS XL file named, CRG_SCORE_SHEET

b) The entire XL sheet named, CRG is protected except the particular cells to input data.

c) Input data accurately in the cells which are BORDERED & are colored YELLOW.

d) Some input cells contain DROP DOWN LIST for some criteria corresponding to the Key Parameters. Click to the input cell and select the appropriate parameters from the DROP DOWN LIST as shown below.

e) All the cells provided for input must be filled in order to arrive at accurate risk grade.

f) We have also enclosed the MS Excel file named, CRG_Score_Sheet in CD ROM for use.

The following is the proposed Credit Risk Grade matrix based on the total score obtained by an obligor.

| Number | Risk Grading | Short Name | Score |

| 1 | Superior | SUP |

|

| 2 | Good | GD | 85+ |

| 3 | Acceptable | ACCPT | 75-84 |

| 4 | Marginal/Watchlist | MG/WL | 65-74 |

| 5 | Special Mention | SM | 55-64 |

| 6 | Sub-standard | SS | 45-54 |

| 7 | Doubtful | DF | 35-44 |

| 8 | Bad & Loss | BL | <35 |

9.01 Investment Assessment:

Relationship Manager(s) \ Investment Officer(s) shall conduct a thorough assessment of investment requirement before recommending any new proposal. There after all investment at least annually at the time of renewal and enhancement. The assessment procedure shall include the following issues:

- mode of Investment

- investment limit

- Purpose of investment

- Rate of profit

- Primary Security

- Collateral Security- its acceptability, its coverage, its control and genuine etc

- Margin

- Repayment capacity and repayment schedule

- Period of investment

- Other terns and conditions in case of necessity

In addition the RM (Relationship Manager ) \ Investment officers shall address the fallowing issues which assessing investment proposal:

- Customer analysis :

ü Capital structure of the company

ü Authorized capital and paid up capital

ü Reserve and retained earnings

ü Share holdings of the share holders

ü Management team

ü Group and affiliate companies

ü Ability to comply investment convent

ü Security

ü Ability and integrity

- Industry analysis:

- Contribution to GDP of the concern industry

- Key risk factors of the industry

- Growth of the industry

- Domestic market of the industry

- International market of the industry

- SWOT of the industry

- Domestic

- International

- Potentiality of the buyer or supplier

- Strength and weakness of the buyer or supplier

- Supplier \ Buyer analysis :

- Historical Financial analysis :

q Minimum three years Financial Statement (FSS) analysis

q Guarantor (s) \ Corporate guarantor (s) Financial Statement analysis

q Quality and sustainability of the borrower’s

q Cash flow statement

q Strength of the borrower’s balance sheet

q Leverage

q Profitability

- Project Financial Performance:

Where term investment facilities are being proposed in favor of any new industrial unit an expertise team comprising RM. Engineer in the concern field and financial analyst. The team will prepare a feasibility study as per current industrial policy.

- Account Conduct :

► Trade payment

► Cheques payment

► Timely payments

► Irregular payment

► Bank’s investment payment with profit

► Excess over limit drawings

► Excess over DP drawing

► Bank’s commission and charges payment

- Mitigating Factor : Following risk mitigating factors to be identified in the investment assessment

q Margin

q Volatility

q High debt load ( Leverage\Gearing )

q Overstocking or debtor issues

q Repaid growth, acquisition or expansion

q Management changes or succession issues

q Customer or Supplier concentration

q Lack of transparency or industry issues.

- Investment Structure:

ª Amount of investment

ª Tenors of investment

ª Justification of investment

ª Based on the project repayment ability installment to be determined

ª Proposed investment an oust and tenor is not excessive

- Security:

E Primary security should be acceptable, marketable & legal items

E Slow, perishable, obsolete, banned, expired items not to be taken as security

E A current valuation of collateral security shall be obtained

10.01 Summary of Findings:

The 2 (two) months internship program has been going to be finished through writing a report. During the time of internship I have tried with my best to acquire theoretical and practical knowledge Banking business and the Management of Credit. Being an employee of Al- Arafah Islami bank Ltd.

Chapter-1: Introduction is illustrated in chapter one. Here I have tried to find out the scope of and the limitations of the study by discussing the background of the program. This is just an introductory discussion.

Chapter-2: In chapter two I have tried to familiarize the organization with educated society.

Chapter-3: In this chapter I tried to discuses in brief all types of AIBL Product and Service.

Chapter-4: Bangladesh is one of the less developed countries. So the economic development of the country depends largely on the activities of commercial banks.

Chapter-5: This chapter about Investment and information of Deposit, investment and Asset of AIBL (2006)

Chapter-6: Chapter for helps us taking decision about any kind of Investment and on what basis we will take decision are discussed here.

Chapter-7: Chapter seven plays an important role in financial sector. Credit Information Bureau (CIB) of Bangladesh Bank helps to us detect any defaulter client of any financial institution because all financial organizations send their defaulter client list to the CIB.

Chapter-8: Chapter eight discusses investment proposal with an another angle. Here risk is firstly measured and on the basis of calculated Risk investment proposal is rejected or accepted.

Chapter-9: Chapter nine helps us to know how to asses Different types of customer. It helps to select a good customer.

Chapter-10: Chapter ten is a concluding part of this report. Here problems & limitations of AIBL for making investment are discussed and I have given recommendations for rectifying these problems

10.02 Problems & Limitations:

During collecting of information and data from AIBL & making report for this project the following problems have been followed:

i) Decision making process is very lengthy and sometimes it creates problems, which is unexpected to the customers. Most of the cases Head Office controls the decision making and it is centralized.

ii) The total number of employees in comparison with needed is very short. this is hampering the daily operation of the Bank. For an example, Motijheel Branch General Banking is suffering from shortage of employee.

iii) Lack of proper explanation of records and document records keeping system

10.3 Recommendations:

i) Decision Making: Decision making power should be decentralized effectively so that business can promptly be enhanced.

ii)Number of Employees: A handsome number of qualified employees & staffs should be appointed very soon for maintaining the normal flow of work.

iii) Records keeping system: Filing and record keeping system of the bank should me modernized .At present operation system is partially computerized and on line banking should be started very soon.

iv) Effective information system: Effectiveness of credit policy largely depends on Bank’s branch, divisional & national level information system.

v) Development of manpower: Effective implementation of credit policy and recovery tare depends on higher educated, trained and skilled personnel. Bank should procure and develop such types of employees for its credit wings.

10.4 SWOT Analysis in AIBL:

Every organization is composed of some internal strengths and weaknesses and also has some external opportunities and threats in its whole life cycle.

10.4.1 Strengths:

-AIBL provides its customer excellent and consistent quality is every service.

-AIBL is financially sound company.

– AIBL utilizes state of the art technology to ensure consistent quality and operation.

-AIBL provides its works force an excellent place to work

-AIBL already achieved a good will among the cli

-AIBL has research and training division.

10.4.2 Weaknesses:

-AIBL lacks well trained human resource in some area.

-AIBL lacks aggressive advertising.

-The procedure of credit facility is to long compare to other banks.

-Employees are not motivated in some areas.

10.4.3 Opportunities:

-Emergence of on line banking will open more scope for AIBL.

-AIBL can introduce more innovative and modern customer service.

-Many branches can be opened in local remote area as its high demand.

-AIBL can recruit experienced, efficient and knowledgeable officers and staffs as it offers good working environment.

10.4.4 Threats:

-The worldwide trend of mergers and acquisition in financial institutions is causing problems.

-Frequency taka devaluation and foreign exchange rate fluctuation is causing problem.

-lots of new banks are coming in the scenario with new service.

– Local competitors can capture huge market share by offering similar products

10.5 Conclusion: