The government of Bangladesh, circulated a law called Bangladesh Bank (temporary) Order, 1971(Acting Presidents Order No 2 of 1971). By this order the State Bank of Pakistan was declared as Bangladesh Bank and the offices, branches and assets of the said State Bank was declared to be deemed as offices, branches and assets of Bangladesh Bank.

The number of banks in all now stands at 48 in Bangladesh.

4 are Nationalized Commercial Banks (NCBs),

28 local private commercial banks,

11 foreign banks

5 are Development Financial Institutions (DFIs).

Besides the scheduled banks following banks are functioning in the financial sector,

Samabai (Cooperative) Bank,

Ansar-VDP Bank,

Karmasansthan (Employment) Bank and

Grameen bank

Background of Islami Banking

Definition of Islami banking

An Islamic bank is a financial institution which operates with the objective to implement and materialize the economic and financial principles of Islam in the arena of banking.

“An Islamic Bank is a financial institution whose status, rules and procedures expressly state its commitment to the principle of Islamic Shariah and to the banning of the receipt of interest on any of its operations”-OIC.

Movement of Islamic banking throughout the world:

The first attempt: The concept of Islamic Banking is several decades old. The first attempt to establish an Islamic financial institution took place in Pakistan in the late 1950s with the establishment of a local Islamic bank in a rural area. Some pious land lords who deposited funds at no interest, and then loaned to small landowners for agricultural development.

The second attempt: The second pioneer experiment of putting principles of Islamic banking and finance into practice was conducted in Egypt from 1963 to 1967 through the establishment of the Savings Bank in a rural area.

A successful attempt Islamic banking, contemporary to that in Egypt, emerged in Malaysia. It was a financial institution developed for the pilgrims of Malaysia. Pilgrims Savings Corporation was established in 1963, which was later on incorporated into the Pilgirims Management Fund Board in 1969.

In August 1974, Bangladesh signed the Charter of Islamic Development Bank and committed itself to reorganize its economic and financial system according to Islamic Shariah.

IBBL: An Overview and its Investment System

Islami Bank Bangladesh Limited (IBBL) was incorporated as the first shaiah based interest –free Bank in South –East Asia on the 13th March 1983 as a Public Company with limited liability under the Company Act 1913.

Investments of IBBL

Rural Development scheme.

Transport investment schemes,

Car investment scheme,

Small business investment schemes,

Doctors investment scheme,

Household Durables investment scheme,

Housing investment scheme

Agricultural implements investment scheme etc.

Besides, the bank is financing various economic groups in different sectors in both urban and rural areas.

Investment Objectives of IBBL

The objectives and principles of investment operations of the Banks are:

The investment fund strictly in accordance with the principles of Islamic Shariah.

To diversifies its portfolio by size of investment, by sectors (public and private), by economic purpose, by securities and by geographical area including industrial, commercial and agricultural.

To ensure mutual benefit both for the Bank and the investment client by professional appraisal of investment proposals, judicious sanction of investment, close and constant supervision and monitoring therefore.

To make investment keeping the socio-economic requirement of the country in view.

To increase the number of potential investors by making participatory and productive investment.

To finance various developments schemes for poverty alleviation, income and employment generation with a view to accelerating sustainable socio-economic growth and upliftment of the society.

To invest in the form of goods and commodities rather than give out cash money to the investment clients.

To avoid even highly profitable investment in fields forbidden under Islamic Shariah and is harmful for the society.

The Bank extends investments under the principles of Bai-Marabaha, Bai-Muazzal Hire purchase under Shairkatul Meilk and Musharaka. The Bank is making sincere efforts to go for investment under Mudaraba principle in near future.

Composition of the port folio

Following may be the compositions of the investment port-folio of the Bank:

a. Money Market Port-folio ( having tenor up to one year)

b. Capital Market Port-folio (having tenor above one year)

c. General Investment Port-folio.

Importance of assessing investment needs

Assessment of Investment needs is necessary for the following reasons.

To detect actual Investment limit of Bank.

To assess the quality, quantity, price and marketability of the commodities

To ensure proper follow-up supervision and monitoring of the Investment.

To ensure capacity of the client in handling Investment activities.

To ensure trading instead of lending of money.

To ensure payment against delivery of goods.

To ensure actual buying and selling of goods.

To select proper & genuine Investment client.

To ensure viability/profitability of the project.

To ensure compliance of Shariah Principles.

To secure the Investment.

To allow Investment for appropriate period.

To ensure investment for productive purpose.

To know the objective of Investment.

To ensure welfare of the society.

To ensure Business ethics.

To minimize the risk of investment.

To ensure recovery of investment in time.

Investment modes

There are three Investment Modes which are:

Trading Mode (Bai Mechanism)

1. Bai Murabaha

2. Bai Muazzle

3. Bai Salam

4. Bai Istishna’a

Leasing Mode (Ijara Mechanism)

1. Hire Purchase (Ijarah)

2. Hire Purchase under Shirkatul Malk (HPSM)

Share Mechanisms

1. Mudaraba

2. Musharakah

Description of three investment modes

Trading modes (Bai-Mechanism)

1. Bai-Murabaha

Meaning

The terms “Bai” and “Murabaha” have been derived from Arabic words Murabaha” and “Bai”. The word Bai means purchase and sale and the word Murabaha means a in cash” Bai-Murabaha means sale for which payment is in cash or in future fixed date or within a fixed period. In short, it is a sale on cash.

Definition

Bai-Murabaha may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the Law of the land), to the buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump-sum or by installments. The profit marked-up may be fixed in lump-sum or in percentage of the cost price of the goods.

Types of Murabaha

In respect of dealing parties Bai-Murabaha may be of two types.

Ordinary Bai-Murabaha

If there are only two parties, the seller and the buyer, where the seller as an ordinary trader purchases the goods from the market without depending on any order and promise to buy the same from him and sells those to a buyer for cost plus profit, then the sale is called Ordinary Bai-Murabaha.

Bai-Murabaha on Order and Promise

If there are three parties, the buyer, the seller and the Bank as an intermediary trader between the buyer and the seller, where the Bank upon receipt order from the buyer with specification and a prior outstanding promise to buy the goods from the Bank, purchases the ordered goods and sells those to the ordering buyer at a cost plus agreed profit, the sale is called “Bai-Murabaha on Order or Promise”, generally known as Murabana.

2.Bai Muajjal

Meaning

The terms “Bai” and “Muajjal” have been derived from Arabic words Ajal and Bai. The word Bai means purchase and sale and the word Ajal means a fixed time or a fixed period” Bai-Muajjal meas sale for which payment is made at a future fixed date or within a fixed period. In short, it is a sale on credit.

Definition

Bai-Muajjal may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the Law of the Country), to the buyer at a agreed fixed price payable at a certain fixed future date in lump-sum or within a fixed period by fixed installments. The seller may also sell the goods purchased by him as per order and specification of the Buyer.

3. Bai – Salam

Meaning

The terms “Bai” and “Salam” have been derived from Arabic words Bai and Salam. The word “Bai” means “sale and purchase” and the word Salam means “Advance”. “Bai-Salam” means Advance Sale and Purchase

Definition

Under this mode Bank will executive purchase contract with the client and make payment against purchase of product, which is under process of production. Bai-Salam contract will be executed after making any investment showing price, quality, quantity, time, place and mode of delivery. The profit is to be negotiated. The payment as the price of the goods is made at the time of Agreement / on the spot and the delivery of the goods is deferred.

Use of Bai-Murabaha /Bai-Muallal in Foreign Trade of IBBL:

• IBBL opens the L/C, Back-to -Back L/C against the Letter of Authority (F-219) obtained from the importer to utilize his /their License /Authority for the import and undertake to purchase the goods so imported/purchased by the Bank for ultimate manufacturing /export of the products by the buyer (exporter).

• Immediately after opening L/C, the consignment shall be sold by the Bank to the client under Bai-Murabaha /Bai-Muallal (import) Agreement and Trust Receipt (T/R) Mortgage Documents, if any, etc.

Procedure of Bai-Salam Investment in Export Oriented Industries

Bai-Salam investment may be allowed after opening of the L/C, arrival of raw materials, shipment of raw materials etc. The Bank may sell/export its goods through the seller/exporter (Client) under a separate agreement or this may be done duly incorporating in the Bai-Salam Agreement.

4. Isteshna’a

Meaning

The word istisna has been derived from the word” Istisna” which means industry or Manufacturing enterprises. Istisna means to goods manufactured by placing orders to a manufacturer.

Definition

Isteshna’a is a contract between a manufacturer/seller and a buyer under which the manufacturer/seller sells specific product(s) after having manufactured, permissible under Islamic Shariah and Law of the Country after haying manufactured at an agreed price payable in advance or by installments within a fixed period or on/within a fixed future date on the basis of the order placed by the buyer.

Leasing mode (ijara mechanism)

(i) Hire purchase /Ijarah

The term Ijarah has been derived from the Arabic works Ajr and Ujrat which means consideration, return, wages or rent. This is really the exchange value or consideration, return, wages, rent of service of an Asset. Ijarah has been defined as a contract between two parties, the Hiree and Hirer where the Hirer enjoys or reaps a specific service on benefit gainst a specified consideration or rent from the asset owned by the Hiree. It is a hire agreement under which a certain asset is hired out by the Hiree to a Hirer against fixed rent or rentals for a specified period.

(ii) Hire Purchase Under shirkatul Melk

Hire purchase under shirkatul Melk is a special type of contract which has been developed through practice. Actually, it is a synthesis of three contracts: Shirkat, Izara and sale. Shirkat means partnership. Sharikatul Melk means share an ownership. When two or more persons supply equity, purchase an asset, own the same jointly, and share the benefit as per agreement and bear the loss in proportion to their respective equity, the contract is called Shirkatul contract.

Share mechanism:

I. Mudarabah

It is a form of partnership where one party provides the funds while the other provides the expertise and management. The first party is called the Sahib-Al-Maal and the latter is referred to as the Mudarib. Any profits accrued are shared between the two parties on a pre-agreed basis, while capital loss is exclusively borne by the partner providing the capital.

Importer features:

• Bank supplies capital as Sahib-Al-Mall and the client invest if in the business with his experience.

• Administration and management is maintained by the client.

• Profit is divided as per management.

• Bank bears the actual loss alone.

• Client can not take another investment for that specific business without the permission of the Bank.

ii. Musharaka

An Islamic financial technique adopts “equity sharing” as a means of financing projects. Thus, it embraces different types of profit and loss sharing partnership. The partners (entrepreneurs, bankers) etc. share both capital and management of a project so that profits will be distributed among them as per rations, where loss is shared according to ratios of their equity participation.

Important feature:

• The investment client will normally run and manage the business.

• The Bank shall take part in the policy and decision making as well as overseeing (supervision and monitoring) the operations of the business of the client. The Bank may appoint suitable person(s) to run the business and to maintain books of accounts of the business property.

• As the investment client shall manage the enterprise, the Bank may pay more share of profit to him than that of his proportionate capital contribution.

• Loss, if any, sha/r be shared on the basis of capital ratio (Class Notes, Abul Hussain).

There are two other modes of investment which have limited impact in our country

I QUARD

The word “Quard” is Arabic word which means loan or credit on advance. The literal meaning of Quard is giving “Fungible goods” for use without any extra value returining those goods. It must follow the principle of equal for equal return with homogenious goods. Fungible goods may be rice, oil, salt, money etc. In banking sector, money is used as quard. Quard is Halal by Islam for not to pay any extra or interest in return.

II. QUARD-E-HASANA

Quard-E-Hasana is also one kind of Quard which is given with the expectation of return or not.

Special schemes under investment modes

i. Household durable scheme

ii. Investment scheme for doctors

iii. Small business investment scheme

iv. Housing investment scheme

v. Real estate investment program

vi. Transport investment program

vii. Car investment scheme

viii. Rural development scheme of IBBL

iX. Agricultural implements investment scheme

.

Operational Procedures of the Investment of IBBL

Application

Processing and appraisal

Sanction

Documentation

Purchase of goods by the Bank

Taking delivery of goods by the Bank

Sales and delivery of goods to the client

1. Application

• Obtain application in Duplicate from the cient on F-167A and record the same in the investment proposal Received and Disposal Register (B-55). Deal Application shall be obtained on F-136.

• Obtain and affix attested photograph(s) of the Proprietor /Partners /Directors /Trustee /Administrator on the top right hand corner of the application.

• Scrutinize the application of the client to see that :

A. All columns are properly filled in.

B. Particulars information given therein is complete and correct all respect.

C. All required Documents /Papers as listed in the footnote of the application are submitted.

D. The client as per specimen signature with the Bank signs it.

2. Processing and appraisal

Enter the Application in the “Investment Proposal Received and Disposal Register (B-53) and allot a Serial Number to it.

• Examine shariah permissibility of the goods. Reject the proposal outright, if not permitted by Islamic Sharah.

• Check-up Credit Restriction Schedule of Bangladesh Bank and Head Office Current Investment Policy Guidelines.

• Visit the Business establishment of the Client. Talk to the business and important personalities of the locality to ascertain the Honesty, Integrity and Business dealings of the Client.

• Request for confidential report of the client from local Bank Branches. Confident Report from Credit Information Bureau (CIB) of Bangladesh Bank through Head Office Investment Division as per Instruction Circular of Head Office in this Regard.

• Obtain Financial Statement/Balance Sheet of the Client for the last three consecutive years for Investment Proposals of Tk. 50.00 lac or above as per Head Office Instruction.

• Inspect Land, Building, other Assets and Properties proposed to be Mortgaged or Hypothecated.

• Forward Documents, Title Deeds and other relevant Papers to approve Lawyer of the Bank for examination and furnishing his opinion.

• Obtain Lawyer’s Opinion as per clause No. 8.02.

• Please study the following carefully and note down the actual findings in the Appraisal Form against each item :

Effective demand, price of the goods, short or long-term duration, quality and other specifications of the goods, availability, etc. of the said or projected goods.

• Where sale price of the goods is payable by the client at specified future date in lump sum or installments as per proposal.

• For Bai-Murabaha Commercial and Bai Murabaha Industrial Investment, prepare Appraisal Report on F-167B. For appraisal Bai-Murabaha agriculture and For Bai-Murabaha Import use special Appraisal Form devised for each of those, if any, otherwise F-167B providing the available/required supplementary information. In course of preparation of the appraisal report please ensure incorporation of all information of all information, particulars figures and statistics in Appraisal Form correctly with special attention to the following: Contact primarily with the producers/sellers/suppliers of the goods in the market, study the market price and work out the purchase and sale prices of the goods as per guidelines.

3. Sanction

• On completion of Appraisal as provided herein above, of the Proposal is found viable, issue Sanction Advice (F-188) if it is within the business power of the Branch mentioning all the terms and condition is duplicate to the Client and endorse copies to Zonal and Head Offices retaining one copy in the Clients file duly accepted by the Client.

• If the proposal is not within the Discretionary Power of the Branch, the Branch shall with Appraisal Report on F-167A and F-167B to Zonal Office/Head Office.

4. Documentation

Before purchasing the asset/property by the Bank, obtain sufficient collateral securities as mentioned in the sanction advice along with the following charges documents properly executed, i.e. duly filled in, sighed, stamped, verified and witnessed where necessary:

• Bai-Murabaha Sanction Advice deal-wise duly accepted by the Client.

• Bai-Murabaha (Deal-Wise)

• Joint and Several D.P. Note

• Single party D.P. Note if there is no guarantor.

• Double Party D.P. Note, if there is guarantor(s) to be made by the Client in favor of the guarantor and endorsed by the later to the Bank.

• D.P. Note Delivery Letter.

• Letter of Hypothecation for the asset(s) and Client’s stock in Trade /Work-in-Process.

• Letter of Disclaimer if the goods are stored in Client’s /party’ own/hired godown.

• Agreement for Pledge of Goods .

• Insurance Policy (if stored in Client’s /Party’s Godown /Yard under Bank’s effective control duly recorded insurance Register.

• Letter of Guarantee.

• Balance Confirmation Letter.

• Trust Receipt.

• Letter of Installments.

If the Investment is made collaterally secured by Mortgage of property, obtain the following:

• In case of Equitable Mortgage, Memorandum of Deposit of Title Deed (MDTD) signed by the owner of the property.

• In case of Legal Mortgage, Registered Deed should be obtained.

• Personal Guarantee of the owner(s) of the properly on.

• Original title Deed(s) with CS, RS, SA, Mutation Parcha, DCR of the property and Mutatoin record.

• Upto-date Rent Receipt.

• Non-encumbrance Certificate along with Search Fee Paid Receipt of the concerned Registry Office.

• Site Plan (Map-Naksha) of the Mortgaged Property.

• Valuation Certificate issued by a competent Engineer and physically verified by the Branch Officials.

• Lawyer’s Certificate

• An affidavit sworn.

Where the Investment is secured by Hypothecation of Stock-in-trade, Machineries etc. also obtain the following Documents:

• Letter of Hypothecation (CF-5).

• Trust Receipt (CF-11).

• Legal Mortgage of Machineries.

In case investment is collaterally secured by pledge of Shares of reputed Public Limited Company on bank’s approved list and quoted in the stock Exchange, the following additional document are to be obtained:

• Agreement for Pledge of Shares.

• Share Transfer Deed in Duplicate.

• Share Delivery Letter

• Letter to the concerned Company to register Lien in Bank’s Favor.

In case of investment to Partnership Firms, obtain the following Document:

• Letter of Partnership

• Copy of Partnership Deed

In case of investment to Private or Public Limited Company, obtain the following Documents:

• Certified copy of the Memorandum and Articles.

• Resolution of the Board of Directors.

• Personal Guarantee of all the Directors.

• Certificated of Incorporation

• Certificated of Commencement

In case of investment to a Trust Organization, obtain the following Document:

• Copy of Trust Deed.

• Resolution of the Board of Trustees

• Charge Document

• Personal Guarantee of the Office Bearer

In case of investment to Co-operative Society, obtain the following Document:

• Clearance from the Registrar

• Letter to be issued to the concerned Registrar

• Personal Guarantee of the Office Bearer

• A copy of Bye-laws of the Society.

In case of investment to Partnership Firms, obtain the following Document:

• Letter of Partnership

• Copy of Partnership Deed

In case of investment to Private or Public Limited Company, obtain the following Document:

• Certified Copy of the Memorandum and Articles.

• Resolution of the Board of Directors

• Personal Guarantee of all the Directors

• Certificated of Incorporation

• Certificated of Commencement

In case of investment to a Trust Organization, obtain the following Document:

• Copy of Trust Deed

• Resolution of the Board of Trustees

• Charge Document

• Personal Guarantee of the Office Bearer

In case of investment to Co-operative Society, obtain the following Document

• Clearance from the Registrar

• Letter to be issued to the concerned Registrar

• Personal Guarantee of the Office Bearer

• A copy of Bye-laws of the Society

5. Purchase of Goods by the Bank

Remember that Bai-Murabaha is perfectly a legitimate transaction according to the Shariah, provided:

That the goods desired by the Client are first purchased by the Bank and the ownership of the Bank on the goods is established, i.e. Bank must transform its money into goods.

That after purchase of the goods, the risk of the goods is borne by the Bank until the possession of the Merchandise has been passed on the Client.

That the specification of the goods, delivery schedule and other terms of contract are fulfilled.

• Obtain deal-wise application Order for Purchase on F-136 after due study.

• Open investment account in Investment Account Opening Register (B-102).

• Enter the Account Particulars in the Investment Ledger (B-105).

• It should be carefully noted that purchase of goods shall be made only after completion of all the Documentation formalities, including Pre-Audit memo (F215).

• In case purchase of Bai-Murabaha goods by the Bank on Credit/ deferred payment basis, the Bank shall execute a Credit Purchase Agreement with the seller to that effect mentioning date of delivery of Goods to the bank and that of payment by the Bank.

• If the goods are to be purchased from the local or outstation market and money is to be paid/remitted there of and other expenses such s TA/DA, transportation etc, shall be borne by the Bank, which shall ultimately be loaded on the cost of Goods.

6. Taking Delivery of Goods by the Bank

• After finalization of purchase of Bai-Murabaha Goods either by the Bank officials or through any Agent from the local or out station market the Bank shall request the seller to delivery the goods purchased to the Bank’s Authorized official /Agent or to the Bank godown against proper acknowledgement.

• After taking delivery of the goods by the Bank or trough and Agent, the Bank shall make payment of the price of the goods to producers /sellers /supplier through DD/TT/PO against Cash memo which will exclusively be issued in the name of the Buying Agent.

• The Bank shall not be invest in such cases where the allotting Authority will not accept the Letter of Authority and agree to deliver the goods to the Bank as per authorization of this allotted.

Shariah lapses and violations in the investment portfolio

1. In some cases cash facilities allowed to the client in different way

2. In some cases fresh investment created to adjust the previous / overdue liabilities.

3. In some cases goods has not been purchased by the buying agent and some cases goods are not physically inspected by the branch Officials. In some cases old investment A/C has been adjusted and L/C margin has been built up from the cash amount paid to the buying Agent instead of proper buying and selling of the goods.

4. Cash memo not found, cash memo obtained in the name of the clients instead of the Bank in some cases.

5. Received post dated and ante dated cash memo in some cases.

6. Amount of disbursement and amount of cash memo not agreed in some cases.

7. The client received the goods directly from the seller instead of the bank and record of receiving the goods by the bank not found in some cases.

8. Pre-determined profit realized instead of actual one in the case of Bai-Salam investment and saparate Agency agreement is not signed in some caeses.

9. Letter of authority not obtained from the client in case of MIB/MPI/Dealership

Investment Pricing Techniques

The components of the true cost of an investment are:

1. Administrative cost

2. Cost of capital

These two components add-up to the bank’s “cost”.

Administrative cost = Administrative cost (godawon rent , transport cost and godawon staff salary).

Cost of capital = Return on capital or the Rate of Return investors

Overdue

There many Causes of overdue. Some import causes are as follows:

1. Wrong in the selection of the client

2. Wrong in the selection of project / firm

3. Not to assess / appraise project properly (management, credibility, marketing and financial aspects)

4. Not to asses working capital. over estimation or under estimation must be avoided.

5. Not to finance timely

6. Diversion of fund by the client

7. Not buying and selling of the goods properly

8. Dishonesty of the client

9. Lack of supervision, monitoring and follow up

10. Not to realize required equity of the client

Loan Classifications and Provisioning

Loan classification is required to have a real picture of the loan and advances provided by the Bank. It helps to monitor and take appropriate decision regarding each loan account like other banks, all types of loans of BA fall into following four scales:

Unclassified: Repayment is regular

Substandard: Repayment is stopped or irregular but has reasonable prospect of improvement.

Doubtful debt: Unlikely to be repaid but special collection efforts may result in partial recover.

Bad / Loss: Very little chance of recovery.

CL Statement

| Loan Type | Unclassified(Month | Substandard (Month) | Doubtful (Month) | Bad (Month) |

| Continuous Loan ,Demand Loan | Expiry up to 5 months | 6 to 9 months | 9 to 12 months | 12 months+ |

| Term loan up to 5 years | 0 to 5 months | 6 to 12 months | 12 to 18 months | 18 months+ |

| Term Loan more then 5 years | 0 to 11 months | 12 to 18 months | 18 to 24 months | 24 months+ |

| Agricultural & Micro Credit | 0 to 12 months | 12 to 36 months | 36 to 60months | 60 months+ |

Loan Provisioning

A Certain amount of money is kept for the purpose of provisioning. This percentage is set following Bangladesh Bank rules.

Type of Classification Rate of Provision

Type of Classification | Rate of Provision |

| Unclassified (UC) | 1% |

| Substandard (SS) | 20% |

| Doubtful (DF) | 50% |

| Bad debt (BL) | 100% |

Eligible Security

I. Lien Marked Term Deposit-100%

II. Lien Marked Govt. Bond / Sanchay patra-100% of face value

III. Govt. B.B Gurantee-100%

IV. Gold / ornaments-100% market value

V. Easily saleable pledged goods kept under Bank’s control-50% of the market value

Vi. Mortgaged Land and Building -50% of Market value

Differences between Profit and Interest

Profit | Interest |

| 1. It’s relation with buying and selling | 1. it’s relation with time and loan |

| 2. Time and labor is considered | 2. Time and labor is not considered |

| 3. It is uncertain and not pre determined | 3. it is certain and determined (fixed) |

| 4. It has risk for losses | 4. It has no risk for losses |

| 5. Profit can determined one time | 5. Interest determined again and again |

| 6. It is permissible by Shariah (Halal) | 6. It is not permissible by Shariah (Haram) |

Problems Regarding Investment of IBBL

• Most of the people in our country have a bad impression of IBBL, operations regarding indirect generation of interest which meaning no difference between investment of IBBL loan / Credit / advance of conventional banks for this reason, they are not too much interested to make investment with IBBL.

• Islamic Banking is a new phenomenon in our country during last two decades. So majority of our people have no proper knowledge about the activities of Islamic Banking as well as its investment mechanism hamper large scope of investment of IBBL.

• IBBL which is committed to avoid interest, can’t invest the permissible part of its statutory liquidity Reserve and short Term liquidity surplus in those securities.

• This Bank can’t invest in all economic sectors which are prohibited by the law of Islam.

• Because of improper insufficient application of Islamic Banking rule in our country. The investment operations of IBBL can’t run smoothly.

• Profitable investment portfolio of IBBL requires forsightment and clear investment knowledge according to Islamic shariah . But sometimes IBBL can’t invest its assets in proper portfolio due to insufficient and unskilled manpower in these regards .As a result, there is a large amount of money being idle and thus potential profit is not increasing .

• IBBL has no strong promotional activities to increase motivate its present and potential investment client

• This Bank revalues its investment operations within limited number of investment modes and does not initiate investment modes according to changing diverse needs of people

• Sometimes investment operations of IBBL are hampered due to increase, dishonest, indiscreet, hypocritical nature of people.

In general

• There are limited scopes to deal women entrepreneurs and professionals for making investment by women interpreters.

• In rural areas for low income community, this Bank grants investment an group not individual .as a result, the mission, using invested money in income generating activities so the poor needy population can become self reliant is failed . Moreover, it enhances group dependence.

• IBBL does not grant investment portfolio for new entrepreneurs new businessmen new companies etc. Which ultimately create “Class Banking”.

ABL: An Overview and its Investment System

Historical Background of Agrani Bank Limited

• Agrani Bank emerged as a Nationalized Commercial bank in 1972, pursuant to Bangladesh bank’s (Nationalization) Order No.1972(P.O. No-26 of 1972), taking over the entire assets and liabilities of the left over parts of Habib Bank Ltd. and Commerce bank Ltd. working in the former East Pakistan.

• Later, Agrani Bank Limited has been incorporated as public limited companies on May 17, 2007 vide Joint Stock Companies and Firms’ certificate of incorporation no. E 66888 (4380)/07.

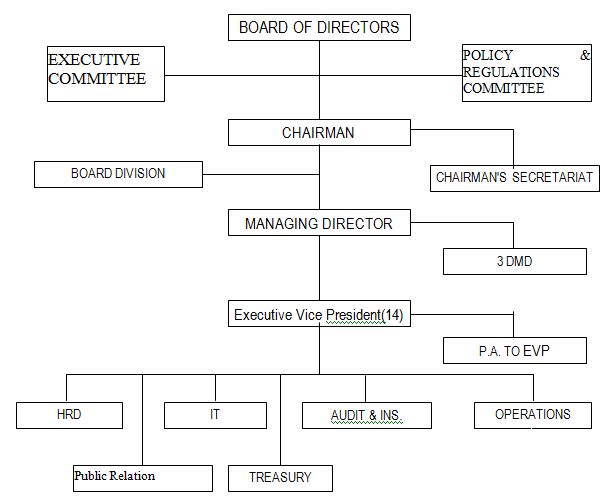

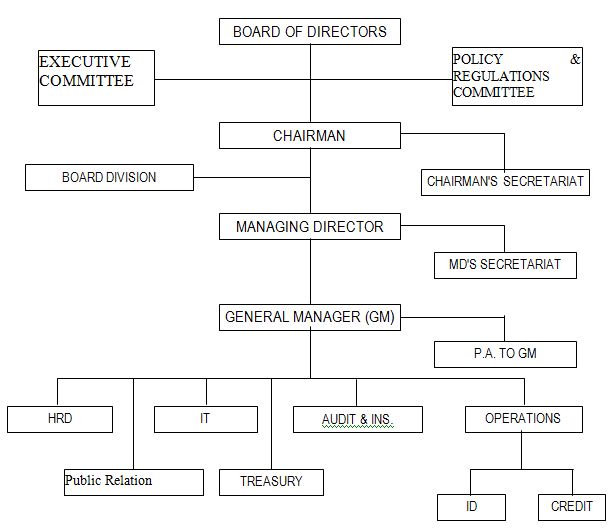

The Hierarchy (organogram) of Management of the Bank

Credit Management: An overview

Different types of Credit Products of Agrani Bank Limited:

Funded Credit

Any type of credit facility which involves direct outflow of banks fund. Funded credit may be classified into four major groups as under:

• Loans (Demand and Term Loans)

• Cash Credit (CC Pledge and CC Hypothecation)

• Overdraft (OD)

• Bill Purchase and Discount

Non Funded Credit

Any type of credit facility which does not involve direct outflow of banks fund. Non funded credit includes:

• Letter of Credit (L/C)

• Advance / Payment Guarantee etc.

Besides the above, credit facilities offered by banks can also be classified in the following ways:

On the Basis of Purpose:

• Business Credit: The credit relationship involved in purchasing goods for resale, or obtaining fund to operate, using credit as the medium of exchange.

• Consumer Credit: The use of credit as the medium of exchange for the purchase of finished goods and services by the ultimate user.

On the Basis of Security Obtained:

• Clean

• Secured

On the Basis of Classified Loan(CL):

• Continuous [CC(H), CC(P), OD(H) etc]

• Demand Loan [ PAD, LIM, PACKING CREDIT etc]

• Long term [Short and long Term

• Agricultural loan

On the Basis of Sectors:

• Private

• Public

• Agricultural etc.

Before disbursement of the loans. The bank will

a) Follow principles of sound lending

b) Comply with legal requirements of the country

c) Meet regulatory requirement of Bangladesh Bank

d) Maintain policy of transparency and accountability

e) Ensure 100% transparency in loan sanction adjudging social, economical & ethical aspect to and value to the GDP of the country specially emphasizing on earning Foreign exchange & creation of employment opportunities.

f) Keep in place sound loan monitoring and supervision including loan risk grading and early alert system.

Agrani Bank’s lending activities may be classified into following broad segments:

01. Trade & Commerce

02. Industries (Small, Medium & large)

03. Agriculture and Agro based ventures

04. Consumer financing

05. Real Estate and Civil construction

Loan Pricing Policies

The bank’s loan pricing will be calculated in line with the following basic formula:

Loan Yield = (A) Cost of Funds + (B) Admin. Cost + (C) Loan Loss Reserve + (D) Profit

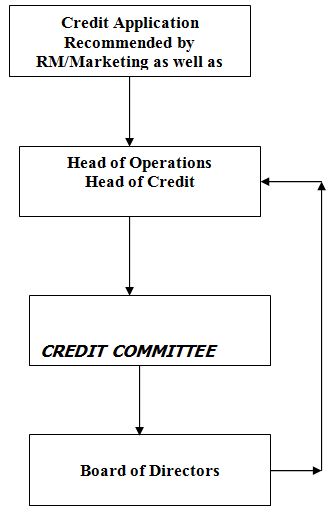

Credit Management Process:

Credit Approval process

Determine the Eligibility of Client by CRG

Credit Administration process

Credit Approval Process

The following diagram illustrates the approval process:

Credit Risk Grading:

Definition of Credit Risk Grading (CRG):

• Credit Risk Grading is the basic module for developing a Credit Risk Management system.

• A Credit Risk Grading deploys a number/alphabet/symbol as a primary summary indicator of risks associated with a credit exposure.

Use of Credit Risk Grading:

The credit risk grading system is vital to take decisions both at the pre-sanction stage as well as post-sanction stage.

At the pre-sanction stage, credit grading helps the sanctioning authority to decide whether to lend or not to lend.

At the post-sanction stage, the bank can decide about the depth of the review or renewal, frequency of review, periodicity of the grading, and other precautions to be taken.

Background:

The Lending Risk Analysis (LRA) manual introduced in 1993 by the Bangladesh Bank has been in practice for mandatory use by the Banks & financial institutions for loan size of BDT 1.00 crore and above. Meanwhile, in 2003 end Bangladesh Bank provided guidelines for credit risk management of Banks(CRG).

CREDIT RISK GRADING SCORE SHEET

| Reference No.: |

| Date: | ||||

| Borrower | ||||||

| Group Name (if any) | Aggregate Score: | |||||

| Branch: | ||||||

| Industry/Sector | Risk Grading: | |||||

| Date of Financials | ||||||

| Completed by | ||||||

| Approved by | ||||||

Number | Grading | Short | Score |

| ||

1 | Superior | SUP | Fully cash secured, secured by government guarantee/international bank guarantee | |||

2 | Good | GD | 85+ | |||

3 | Acceptable | ACCPT | 75-84 | |||

4 | Marginal/Watchlist | MG/WL | 65-74 | |||

5 | Special Mention A/C | SMA | 55-64 | |||

6 | Substandard | SS | 45-54 | |||

7 | Doubtful | DF | 35-44 | |||

8 | Bad/Loss | BL | <35 | |||

Criteria Weight | Parameter | Score | Actual Parameter | Score Obtained | ||

A. Financial Risk 50% | ||||||

1. Leverage: (15%) | Less than 0.25× | 15 | 0.53 |

| ||

Debt Equity Ratio (×) – Times | 0.26× to 0.35 x | 14 |

| |||

Total Liabilities to Tangible Net worth | 0.36× to 0.50 x | 13 |

| |||

0.51× to 0.75 x | 12 |

| ||||

All calculations should be based on | 0.76× to 1.25 x | 11 |

| |||

annula financial statements of the | 1.26× to 2.00 x | 10 |

| |||

borrower (audited preferred) | 2.01× to 2.50 x | 8 |

| |||

2.51× to 2.75 x | 7 |

| ||||

More than 2.75× | 0 |

| ||||

2. Liquidity: (15%) | Greater than 2.74× | 15 | 54.00 |

| ||

Current Ratio (×) -Times | 2.50× to 2.74 x | 14 |

| |||

Current Assets to Current Liabilities | 2.00× to 2.49 x | 13 |

| |||

1.50× to 1.99 x | 12 |

| ||||

1.10× to 1.49 x | 11 |

| ||||

0.90× to 1.09 x | 10 |

| ||||

0.80× to 0.89 x | 8 |

| ||||

0.70× to 0.79 x | 7 |

| ||||

Less than 0.70× | 0 |

| ||||

3. Profitability: (15%) | Greater than 25% | 15 | 78.00% |

| ||

Operating Profit Margin (%) | 20% to 24% | 14 |

| |||

(Operating Profit/Sales) X 100 | 15% to 19% | 13 |

| |||

Criteria Weight | Parameter | Score | Actual Parameter | Score Obtained |

A. Financial Risk 50% | ||||

10% to 14% | 12 |

| ||

7% to 9% | 10 |

| ||

4% to 6% | 9 |

| ||

1% to 3% | 7 |

| ||

Less than 1% | 0 |

| ||

4. Coverage: (5%) |

| |||

Interest Coverage Ratio (×) – Times |

| |||

Earning before interest & tax (EBIT) | More than 2.00× | 5 | 10.00 |

|

Interest on debt | More than 1.51× Less than 2.00× | 4 |

| |

More than 1.25× Less than 1.50× | 3 |

| ||

More than 1.00× Less than 1.24× | 2 |

| ||

Less than 1.00× | 0 |

| ||

Total Score- Financial Risk |

| 50 |

|

|

B. Business/ Industry Risk 18% |

| |||

1. Size of Business (in BDT crore) | > 60.00 | 5 | 75.00 |

|

30.00 – 59.99 | 4 |

| ||

The size of the borrower’s business | 10.00 – 29.99 | 3 |

| |

measured by the most recent year’s | 5.00 – 9.99 | 2 |

| |

total sales. Preferably audited numbers. | 2.50 – 4.99 | 1 |

| |

< 2.50 | 0 |

| ||

2. Age of Business | > 10 Years | 3 | 10 |

|

> 5 – 10 Years | 2 |

| ||

The number of years the borrower | 2 – 5 Years | 1 |

| |

engaged in the primary line of business | < 2 Years | 0 |

| |

3. Business Outlook | Favorable | 3 | Favorable |

|

Critical assessment of medium term | Stable | 2 |

| |

prospects of industry, market share | Slightly Uncertain | 1 |

| |

and economic factors. | Cause for Concern | 0 |

| |

4. Industry Growth | Strong (10%+) | 3 | No Growth (<1%) |

|

Good (>5% – 10%) | 2 |

| ||

Moderate (1%-5%) | 1 |

| ||

No Growth (<1%) | 0 |

| ||

| 5. Market Competition | Dominant Player | 2 | Dominant Player |

|

Moderately Competitive | 1 |

| ||

Highly Competitive | 0 |

| ||

6. Entry/Exit Barriers | Difficult | 2 | Difficult |

|

Average | 1 |

| ||

Easy | 0 |

| ||

Total Score- Business/Industry Risk |

| 18 |

|

|

C. Management Risk 12% |

| |||

1. Experience | More than 10 years in the related line of business | 5 | More than 10 years in the related line of business |

|

Quality of management based on total | 5–10 years in the related line of business | 3 |

| |

# of years of experience of the senior | 1–5 years in the related line of business | 2 |

| |

management in the Industry. | No experience | 0 |

| |

2. Second Line/ Succession | Ready Succession | 4 | Succession within 2-3 years |

|

Succession within 1-2 years | 3 |

| ||

Succession within 2-3 years | 2 |

| ||

Succession in question | 0 |

| ||

3. Team Work | Very Good | 3 | Very Good |

|

Moderate | 2 |

| ||

Poor | 1 |

| ||

Regular Conflict | 0 |

| ||

Total Score- Management Risk |

| 12 |

|

|

D. Security Risk 10% |

| |||

1. Security Coverage (Primary) | Fully Pledged facilities/substantially cash covered / Reg. Mortg. for HBL | 4 | Registered Hypothecation (1st Charge/1st Pari passu Charge) |

|

Registered Hypothecation (1st Charge/1st Pari passu Charge) | 3 |

| ||

2nd charge/Inferior charge | 2 |

| ||

Simple hypothecation/Negative lien on assets | 1 |

| ||

No security | 0 |

| ||

2. Collateral Coverage (Property Location) | Registered Mortgage on Municipal corporation/Prime Area property | 4 | Registered Mortgage on Pourashava/Semi-Urban area property |

|

Registered Mortgage on Pourashava/Semi-Urban area property | 3 |

| ||

Equitable Mortgage or No property but Plant and Machinery as collateral | 2 |

| ||

Negative lien on collateral | 1 |

| ||

No collateral | 0 |

| ||

3. Support (Guarantee) | Personal Guarantee with high net worth or Strong Corporate Guarantee | 2 | Personal Guarantee with high net worth or Strong Corporate Guarantee |

|

Personal Guarantees or Corporate Guarantee with average financial strength | 1 |

| ||

No support/guarantee | 0 |

| ||

Total Score- Security Risk |

| 10 |

|

|

E. Relationship Risk 10% |

| |||

1. Account Conduct | More than 3 years Accounts with faultless record | 5 | More than 3 years Accounts with faultless record |

|

Less than 3 years Accounts with faultless record | 4 |

| ||

Accounts having satisfactory dealings with some late payments. | 2 |

| ||

Frequent Past dues & Irregular dealings in account | 0 |

| ||

2. Utilization of Limit | More than 60% | 2 | 65.00% |

|

(actual/projection) | 40% – 60% | 1 |

| |

Less than 40% | 0 |

| ||

3. Compliance of Covenants / | Full Compliance | 2 | Full Compliance |

|

Conditions | Some Non-Compliance | 1 |

| |

No Compliance | 0 |

| ||

4. Personal Deposits | Personal accounts of the key business Sponsors/ Principals are maintained in the bank, with significant deposits | 1 | Personal accounts of the key business Sponsors/ Principals are maintained in the bank, with significant deposits |

|

No depository relationship | 0 |

| ||

Total Score- Relationship Risk |

| 10 |

|

|

Grand Total – All Risk |

| 100 |

|

|

Number and Short Name of Grades Used in the CRG

- The proposed CRG scale consists of 8 categories with Short names and Numbers are provided as follows:

| GRADING | SHORT NAME | NUMBER |

| Superior | SUP | 1 |

| Good | GD | 2 |

| Acceptable | ACCPT | 3 |

| Marginal/Watch List | MG/WL | 4 |

| Special Mention | SM | 5 |

| Sub standard | SS | 6 |

| Doubtful | DF | 7 |

| Bad & Loss | BL | 8 |

Credit Risk Grading Definitions

A clear definition of the different categories of Credit Risk Grading is given as follows:

• Superior – (SUP) – 1

Credit facilities, which are fully secured i.e. fully cash covered.

Credit facilities fully covered by government guarantee.

Credit facilities fully covered by the guarantee of a top tier international Bank.

• Good – (GD) – 2

Strong repayment capacity of the borrower

The borrower has excellent liquidity and low leverage.

The company demonstrates consistently strong earnings and cash flow.

Borrower has well established, strong market share.

Very good management skill & expertise.

All security documentation should be in place.

Credit facilities fully covered by the guarantee of a top tier local Bank.

Aggregate Score of 85 or greater based on the Risk Grade Score Sheet

• Acceptable – (ACCPT) – 3

These borrowers are not as strong as GOOD Grade borrowers, but still demonstrate consistent earnings, cash flow and have a good track record.

Borrowers have adequate liquidity, cash flow and earnings.

Credit in this grade would normally be secured by acceptable collateral (1st charge over inventory / receivables / equipment / property).

Acceptable management

Acceptable parent/sister company guarantee

Aggregate Score of 75-84 based on the Risk Grade Score Sheet

• Marginal/Watch List – (MG/WL) – 4

This grade warrants greater attention due to conditions affecting the borrower, the industry or the economic environment.

These borrowers have an above average risk due to strained liquidity, higher than normal leverage, thin cash flow and/or inconsistent earnings.

Weaker business credit & early warning signals of emerging business credit detected.

The borrower incurs a loss

Loan repayments routinely fall past due

Account conduct is poor, or other untoward factors are present.

Credit requires attention

Aggregate Score of 65-74 based on the Risk Grade Score Sheet

• Special Mention – (SM) – 5

This grade has potential weaknesses that deserve management’s close attention. If left uncorrected, these weaknesses may result in a deterioration of the repayment prospects of the borrower.

Severe management problems exist.

Facilities should be downgraded to this grade if sustained deterioration in financial condition is noted (consecutive losses, negative net worth, excessive leverage),

An Aggregate Score of 55-64 based on the Risk Grade Score Sheet.

• Substandard – (SS) – 6

Financial condition is weak and capacity or inclination to repay is in doubt.

These weaknesses jeopardize the full settlement of loans.

Bangladesh Bank criteria for sub-standard credit shall apply.

An Aggregate Score of 45-54 based on the Risk Grade Score Sheet.

• Doubtful – (DF) – 7

Full repayment of principal and interest is unlikely and the possibility of loss is extremely high.

However, due to specifically identifiable pending factors, such as litigation, liquidation procedures or capital injection, the asset is not yet classified as Bad & Loss.

Bangladesh Bank criteria for doubtful credit shall apply.

An Aggregate Score of 35-44 based on the Risk Grade Score Sheet.

• Bad & Loss – (BL) – 8

Credit of this grade has long outstanding with no progress in obtaining repayment or on the verge of wind up/liquidation.

Prospect of recovery is poor and legal options have been pursued.

Proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is not warranted, and the anticipated loss should have been provided for.

This classification reflects that it is not practical or desirable to defer writing off this basically valueless asset even though partial recovery may be affected in the future. Bangladesh Bank guidelines for timely write off of bad loans must be adhered to. Legal procedures/suit initiated.

Bangladesh Bank criteria for bad & loss credit shall apply.

An Aggregate Score of less than 35 based on the Risk Grade Score Sheet.

Security and Documentation:

The security and documentation of Loans and Advances provided by Agrani Bank Limited is done at Branch office. The security for loan is shown in the following:

i) Fixed deposit receipts issued by any branch of the Bank.

ii) Balance in other deposits account with the approval of Head Office.

iii) Govt. Promissory Notes.

iv) Pratyrakhya Sanchay Patra, Bangladesh Sanchay Patra.

v) ICB Unit Certificates.

vi) Life Insurance Policies.

vii) Shares of various companies approved by Head Office from time to time and quoted on the Stock Exchange.

viii) Stocks and goods in trade, pledged or hypothecated.

ix) Hypothecation of power driven vehicles or water crafts.

x) Immovable property.

xi) Imported merchandise pledged or hypothecated.

xii) Trust receipts.

xiii) Govt./Corporation Salary and Pension Bills.

xiv) Import bills (PADs)

xv) Bills purchased.

xvi) Schedule Bank/Insurance guarantees.

xvii Export bills.

Credit Proposal & Sanction

Application for Advance/limit :

1. The party seeking a secured advance against any acceptable security must make an application to the branch where he maintains his operative account.

2. Advance may be allowed only after getting a limit sanctioned by the authorized officials.

Conducting preliminary study :

1. Conduct a preliminary study of the affairs of the intending borrower by consulting the following :

i) Borrower’s application

ii) Reports in confidence regarding the state of business of the intending borrower through available means.

iii) Borrower’s own mode of dealings.

iv) Statement of accounts of the borrower with own and other banks.

v) Statement of assets and liabilities ( in detail)

vi) Balance sheet/profit & loss accounts (in case of limited company) for 3 years.

vii) Memorandum & Articles of Association

viii) Income Tax certificates.

ix) Trade and other reports.

Interview of the proposed borrower:

1. Interview the intending borrower covering the following points :

a) Present & future prospect of the party’s business.

b) Total investment in this business.

c) Borrower’s stake in the business.

d) Amount of advance required.

e) Experience in the line.

f) Purpose.

g) Period of advance required for.

h) Source of repayment.

i) Party’s previous banker, if any.

j) Present liabilities with any other branch of the same bank or other banks and conducts of the advances.

k) Securities offered against advances from other branch of the same bank or other bank.

l) Proposed margin against the advance.

m) Security offered against the proposed advance.

n) Type of charge to be created against the proposed security.

o) Terms of repayment.

Filling of credit proposal form:

1. a) The applicant has submitted credit proposal together with owner’s declaration in the specified format detailing appropriate particulars/information.

b) The information furnished in the credit proposal form verified by the manager/branch in charge and the officer in charge, Advance Department. The branch officials shall be fully satisfied about correctness of the information/particulars and genuineness of the papers/documents, while processing the loan proposal before sending the same to the sanctioning authority.

Approval of limit:

1. The sanctioning authority on receipt of the proposal shall scrutinize the same and ensure that :

i) The proposal bears all pertinent information relating to the advance and the borrower.

ii) The borrower has signed the proposal form for credit.

iii) All necessary papers/documents have been enclosed with the proposal duly checked and verified by the branch.

iv) The officer in charge, Advance Department & the branch manager has signed the proposal jointly.

v) The proposal has been duly recommended.

vi) The proposal does not fall within the existing credit restrictions.

vii) Minimum margin requirement against the advance is proposed.

viii) The primary security has got easy marketability, durability and storability.

ix) Valuation of the property offered as collateral security is judiciously assessed by the engineer and branch manager as per proforma circulated by Head Office.

x) The intending borrower is not a defaulter of the Bank/other banks including DFIs.

xi) There is no letter of request from other banks for not allowing and or stoppage of facility to the proposed borrower.

xii) Working capital may be considered on project financed by any other bank including DFIs subject to favorable status report and obtaining “No Objection Certificate” from the financing institution.

xiii) Where 2nd charge on the fixed and floating assets (in case of a limited company) or 2nd mortgage on real estate is offered, clearance shall be obtained from the 1st mortgagee in respect of creation of 2nd charge on the property together with the confirmation that the documents will be held by them on behalf of the Bank and that they shall not part with the same without consent of the Bank.

Post sanction formalities:

1. After receiving the limit sanction advice, the branch shall.

i) Convey the terms and conditions stipulated in the sanction advice to the proposed borrower in writing.

ii) Obtain acceptance of the terms and conditions on duplicate copy of the letter.

iii) Complete documentation in all respect.

iv) Loan sanction advice issued by the Head Office containing some clause meant for the branch only should be excluded while sending the loan sanctioning advice to the borrower.

Disbursement of advance:

1. After being fully satisfied about the execution of all documents and observance of all formalities, disburse the advance to the party in accordance with the procedure hereinafter prescribed in the manual keeping in view the nature of security provided by the party.

Credit Monitoring:

To minimize credit losses, monitoring procedures and systems should be in place that provide and early indication of the deteriorating financial health of a borrower. At a minimum, systems should be in place to report the following exceptions to relevant executives in CRM and RM (Relationship Manager) team.

Past due principal or interest payments, past due trade bills, excesses, and breach of loan covenants.

Loan terms and conditions are monitored, financial statements are received on a regular basis and any covenant breaches or exceptions are referred to CRM and the RM team for timely follow-up.

Timely corrective action is taken to address findings of any internal, external or regulator inspection/audit.

All borrower relationship/loan facilities are reviewed and approved through the submission of a Credit application at least annually.

Computer system must be able to produce the above information for central/head office as well as local review. Where automated systems are not available, a manual process should have the capability to produce accurate exception reports. Exceptions should be followed up on and corrective action taken in a timely manner before the account deteriorates further.

Credit Monitoring Process

1. Monitoring and Supervision of Loans & Advances

a) Check the diary showing terminal dates of receipt of all statements of advances and statements of accounts. Reminders by telex/call/fax will be issued if any statement remain un-received at Head Office 3/5 days after due date.

b) Total of outstanding amounts shown in various statements of advances of a branch must agree with the balances shown/reported in the statement of affairs of the branch. Officer concerned in Advances Department must report difference if any to Managing Director. Similarly total outstanding loans and advances reported by individual branches as per statements must agree with total loans and advances of the Bank as per consolidated statement of affairs prepared in Head Office.

c) Concerned Officers in Advance Department will then check/verify every loan accounts reported whether it is within limit and security shown is clear and value of security is correct and enough to secure the outstanding loan amount.

d) i) If the loan officer at Head Office finds any discrepancy such as the loan exceeds approved limit or exceeds security value or not covered by approved limit or the limit expired or there is no change in the outstanding compared to previous months viz. static or contrary to any other terms of limit, he should immediately take up with branch manager for clarification/ adjustment etc. and put up notes to the In-charge or the Managing Director.

ii) Borrowers enjoying credit limit of Tk.1.00 (one) crore and above would be required to submit every quarter –

Projected operating statements (Trading/Profit and Loss Account) for next year; and Projected fund flow statement for next year and the credit officer at Head Office shall verify Whether on verification of date as per statements actual operational results (production, sales, profit) conformed to the projected figures or whether there was any divergence without plausible explanations. Whether end use of bank credit is according to the purpose for which it was approved.

iii) In cases of all cash credit to industrial borrower for Tk.10.00 (ten) lac and above, monthly progress report should be obtained to show comparative production and sales, working capital need on the basis of current asset and current liability in the proforma prescribed for the purpose.

e) If the officer finds that a loan against Trust Receipt (LTR) is remaining unpaid beyond due date and PADs are unpaid for more than 30 days from the date of receipt of same in case of shipment from Europe/America/ South America he should pursue the concerned branch and bring it to the notice of In-charge of credit division at Head Office. Special attention must be paid in case of PADs with shipment from Hong Kong, Singapore, Malaysia or India remain unpaid for 15 days. In case of shipment by land route by truck from neighbouring countries not more than 7 days should be allowed and Head Office must keep a watch over timely retirement of the documents.

f) i) All fresh facility statement must be checked thoroughly within 2/3 days of their receipt and comments if any must be sent to the branches quickly. Head Office must see that branches regularly send Fresh Facility Statement as per policy directives already issued. The branch manager shall give no unauthorised facility.

ii) If on examination of statement of advances any irregularity is detected in loan accounts as stated in para (b) and realisability or repayment is unlikely, then the branch must be asked to explain the situation. Head Office should establish contact with borrowers if necessary and officers from Head Office shall go to the branch for expediting recovery of the loans. Help from specialized account department may also be sought in extreme cases.

ii) Stern measures shall be initiated against the branch manager and credit officers if the default is attributed to their negligence or indulgence given to the borrowers.

g) i) In-charge of Head Office Credit Department shall prepare rosters every 3 months for on-site inspection of advances at branches by officers from Head Office. Such roaster shall remain only with the In-charge of Department and not known to any one. Inspecting Officers from credit department shall use spot inspection guidelines on advance during regular on-site inspection.

ii) Individual advance account with irregular transactions showing outstanding over Tk.25.00 lac in C.C. (Hypo)/LTR, Tk.50.00 lac in C.C. (Pledge) must be inspected by Head Office once in 2 months and in case of Tk.50.00 lac in C.C. (Hypo)/LTR and Tk.1.00 Crore and above in C.C. (Pledge)/LIM must be inspected once a month; (report will be made to the In-charge/Managing Director).

h) i) In case of term loans to industries in amount of Tk.20.00 lac and above upto Tk.50.00 lac, officers from Head Office Industrial Credit Department (ICD) must make on-site inspection every 2 months and in case of loans exceeding Tk.50.00 lac once a month.

ii) In case of Acceptance Bills liability in garment industries under Back to Back L/Cs for Tk.50.00 lac and above inspection must be made weekly.

i) Head Office shall prepare monthly statement of overdue loans and advances on the basis of principles conveyed to the branches in dealing with the advances and statement of classified loans half-yearly on the principles of classification of Bangladesh Bank. Head Office Credit Committee must discuss overdue and classified accounts every month and suggest measures to the Managing Director for improvement in recovery of overdue and classified loans.

j) Court cases filed by the branches must also be reviewed once a month by Head Office Credit Department for further actions.

k) Head Office shall prepare every month a consolidated statement of loans and advances to indicate Bank’s exposure in each type of loans and advances on the basis of risks involved and sectoral distribution for purposes of controlling excessive exposure in unwanted portfolios. Officer-in-Charge of Credit Department, Head Office shall try to keep loan portfolios within the limits approved in policy and place to the Managing Director.

Credit Recovery Process

Actions in case of non-recovery and the penal rate:

Suit is the final steps to be taken in respect of recovery of an advance, when all endeavors of the Bank i. e. personal contact, moral suasion, request, notice for repayment of the advance turned fruitless.

Legal Notice:

1. As preparatory to filling suit, the branch shall serve legal notice upon the borrower(s), guarantor(s). Directors of the company (in case of advance against Ltd. Co.) through the legal adviser/panel lawyer under registered post demanding adjustment of the liabilities within a specific time.

Checking documentation and collecting property particulars:

1. Documentation of the advance shall be checked to ensure that these are not barred by limitation for taking legal action. Full particulars of the assets of the borrower and co-obligants of the advance shall be ascertained.

Preparing review form:

1. Review form in respect of each party detailing therein full particulars about the borrower, his assets and the advance shall be filled in as per the proforma circulated by Head Office. While filing in the review form, chance of recovery shall be clearly mentioned. The review form shall be sent to the competent authority with due recommendation stating the reason for filing suit.

Filing of suit and special points of attention:

1. On receipt of approval immediate steps shall be taken to file suit through the Bank’s legal adviser/panel lawyer. While filing suit it shall be ensured that all the necessary parties, partners, directors (in case of Ltd. Co.) guarantor, as the case may be are made defendants in the suit and steps are taken to attach the assets before judgement. In case of mortgage of immovable property either by way of equitable mortgage/or by registered mortgage, mortgage/title suit and not money suit shall be filed.

Deference between IBBL and ABL Investment System:

Islamic Banking Vs Conventional Banking

Islamic Banking Conventional Banking

THEORETICAL ASPECTS

Philosophy:

Islamic Banking is an integral part of Islamic Economics and thereby an Islamic way of life.

The traditional banking brought up on the environment of capitalistic economics.

Definition:

Islamic Bank is a financial institution whose statutes, rules and procedures expressly state its commitment to the principles of Islamic Shariah and to the banning of the receipt and payment of interest on any of its operations. (OIC)

A Conventional Bank is a bank that deals with money and interest is considered as reward of mobility of money from the surplus unit to deficit unit of economy. Thus interest is the basis of existence of a conventional banking system.

Objective:

The objectives of Islamic Banking is to do good and bring welfare to the people.

Profit making motive is the main influential factor of Conventional banking.

Scope:

Banning of interest is not the only scope of Islami banking rather deployment of fund should also be restricted to the sharia permissible (Halal) businesses.

Permissibility of business in terms of Sharia is immaterial in Conventional Banking system.

Legality:

Five components make a financial transactions illegal in Islam: Riba (Interest),Rishwah (Corruption), Gharar (uncertainty), Mysir (Gambling) and Jahl (Ignorance)

Contemporary conventional banking directly and indirectly involved with the all of the elements.

Ethics

What is just/right and what is unjust/wrong is the integral part of Islamic banking..

In conventional banking such ideology is not exercised.

Islamic Banking Conventional Banking

OPERATIONAL ASPECTS

Deposit mobilization:

Islamic banks collect deposits on the basis of Mudaraba principle and Al Wadia principle.

Mudaraba Principle (Savings)

A contract between Mudarib (Bank) and Sahib al Mal (Depositor). Sahib al Mal provides the fund while Mudarib provide the management. If earned profit is distributed as per agreed ratio and financial loss is borne by Sahib al Mal. Bank also bears loss its skill / time / efficiency / goodwill.

Al

wadeeah Principle

There two parties in case of current depositors, i.e, Al Muadah (Bank) and Al Muadee (Depositors). Bank takes permission from the cleint to utilize that fund. Use of public fund with their consent. Under traditional banking, it is implied. Islam doesn’t allow to utilize others resources without their permission.

Savings Deposit

In traditional banking there is no existence of such contract as it collects deposit on fixed interest basis.

Currents Deposit

T There are also two parties, i, e Depositors and Bank. In this case conventional bank does not take the permission to utilize their funds.

01. Under Shirkat/Share modes :

Shirkat modes are Mudaraba and Musharaka. Mudaraba principle is the same as mentioned in case of deposit mobilization.

1) Musharaka is the equity participation of both the parties involved. Under Musharaka profit is shared as per agreement and loss is shared as per equity.

2) Mudaraba: Business can be formed with participation in management.

– 100% capital supplied by Bank

– 100% Management by the borrower.

Conventional banks do not practice these types of mechanism

However, there is an apparent similarity at operational level of the trading mechanism with the

– Project Loan with margin

–

02. Under Hire purchase mode :

(i) Hire purchase /Ijarah

The term Ijarah has been derived from the Arabic words Ajr and Ujrat which means consideration, return, wages or rent.

(ii) Hire Purchase Under shirkatul Melk

Hire purchase under shirkatul Melk is a special type of contract which has been developed through practice. Actually, it is a synthesis of three contracts: Shirkat, Izara and sale. Shirkat means partnership. Sharikatul Melk means share an ownership. contract.

In conventional banks, HP is practiced. Two contracts (Purchase and sale) are preformed Interest is accounted for at development period.

1) Short Term Hire Purchase for

wages or rent.

2) Long Term Hire Purchase for using any Land, Building, Truck, Bus, and Machineries of industry.

03.Overdrafts,Packing Credits, Cash Credit, LIM, PAD

Demand Loans, Purchase of Demand Drafts:

In Islamic banking there is no provision to practice the mentioned modes due to the involvement of interest. However working capital needs can be met through the mechanism mentioned earlier under Islamic banking.

These are well practiced by Buy mode

– Buy Murabaha

-Buy Muazzal

-By Salam

Overdrafts, Packing Credits, LIM, PAD

Cash Credit ,Demand Loans, Purchase of Demand Drafts

These are well practiced by conventional banks based on interest.

Islamic Banking Conventional Banking

ANALYTICAL ASPECTS

The Project efficacy test

The project efficacy test is applied in Islamic banking to verify the progress of projects at different phases initiated from the feasibility study and than the subsequent activities such as firm written contract, continuous follow up and supervision of the projects etc. financed by the respective bank.

Conventional bank works to confIrm the working flow of projects, as their prime concern is to secure the collateral rather to ensure the profitability of the project. Thus the Project efficacy test does not satisfy in conventional banks.

The Loan recovery test

The Loan recovery test is applied to measure the ability of a banking system to get back the loans financed by the system. If is the case of Islamic banking, it is more responsive to recover loan and less complacent about its recovery efforts.

Evidence suggests that conventional banking system depends closely on the collateral as the ultimate source of repayment.

Findings:

• The no of branches of ABL have been decreasing, the bank have a policy to close/ merge the losing branches

• The over all business of IBBL in different sector has been increasing day by day. So, the have to open new branches in business concentrated areas of the country.

Findings:

• The per branch man power of ABL have been decreasing, the bank have a policy to close/ merge the losing branches. The rate of retirement is higher than the recruitment.

• The per branch men power of IBBL have been increasing, the bank have a policy to open new branches. The rate of recruitment is higher than the retirement.

Findings:

• The ABL has 59% officer and 41% staff, where as IBBL has 79% officer and 21% staff

• The service quality of IBBL is better than ABL due to man power quality.

Findings:

• The investment of ABL has increased in 2005, but fallen in 2006 and again have risen in 2007. The management of ABL has taken a decision to decrease the cost of fund as well as investment rate.

• The investment of IBBL has been increasing rapidly due to increase of investor’s confidence on interest free investment policy of the bank.

Findings:

• The profit of IBBL has been increasing rapidly as compared to ABL due to the interest free policy of IBBL. The reliability & dependent of the customer on IBBL as compared to ABL is soaring day by day.

• The IBBL is now at the top position as a profit earning bank and ABL is in 3rd position.

Findings:

• The recovery position of IBBL is better as compared that of ABL.

• Due to political and other reasons the recovery rate of ABL is lower than that of ABL

• The monitoring and supervision of IBBL is better that of ABL due to Islamic invest policy.

Findings:

• The classification rate of ABL is very much higher compared that of IBBL.

• Due to political and other reasons the CL rate of ABL is higher than that of IBBL

• The monitoring and supervision of IBBL is better that of ABL due to Islamic invest policy.

Findings for sector wise investment:

• The IBBL and ABL have the major portion of investment in Trade finance and working capita (46% -55%).

• 21% to 16% priority in industrial sectors.

• 6% to 2% priority in agro based sectors, should be increased to promote agricultural production.

Conclusion

I have tried to find the investment policy, procedure, documentation and others features of IBBL & ABL described below:

- Investment features, functions and systems of IBBL and ABL,

- Investment performance of IBBL and ABL.

- Different investment schemes, modes, mechanism of IBBL and ABL,

- Investment proposal, appraisal procedures, documentation and the role of shariah council in operations of IBBL

- The no of branches of IBBL have been increasing, at the same time ABL is merging/closing the losing branches.

- IBBL have 186 branches and ABL have 886 branches

- Per branch man power of IBBL is 45and that of ABL is 12.

- Among total manpower of IBBL 79% is officer and 21 is staff. In ABL 59% is officer and 41 is staff.

- The fact that IBBL has continuous growth in investment, deposit, import, export, remittance and profit volume as compared to ABL

- The study is based on the trend analysis with particular reference to the investment, recovery, profitability. The analysis has revels that investment of IBBL is sound and it can improve day by day as compared to ABL.

- IBBL’s branches as well as skilled personnel has been increasing day by day as compared to ABL

- So, we can say that over all confidence and reliability is significantly rising on shariah based Islamic Banking