Executive Summary

National Bank Limited is a customer oriented financial institution. It remains dedicated to meet up with the ever growing expectations of the customer because at National Bank, customer is always at the center. Customer satisfaction is a measure of how products and services supplied by a company meet or surpass customer expectation. It is seen as a key performance indicator within a business. So, assessing the level of customer satisfaction actually helps to measure an organization‘s position in business. I am doing my internship in National Bank limited with rotation on different desks which includes Accounts Opening, General Banking, Retail Banking, Clearing, Remittance, Loans and Advances etc. In this report “The Customer Satisfaction on different services of National Bank Limited”. I will focus on various aspects of this Bank. Since they are standing at good position among the private banks, their financial position, market shares, marketing mechanisms, overall strengths and weakness, objectives, goals will be cross examined for analyzing the fact that how they were and how they will be in future. Various types of analysis will help us to understand the comparative position and a transparent picture of this Bank that will help us to draw any comment at a glance.

As I am directly in touch with customers, the report will deal with the service quality and customer satisfaction of National Bank Limited. A survey will be conducted on the customers of National Bank Limited. The objective of this report will be to determine how well National Bank Limited is satisfying the customers on different service grounds. Various important issues of customer satisfaction will be presented in light of the findings of the survey.

Lastly, the findings will be examined to prescribe a set of specific recommendations to improve the overall service quality according to customers expectations and also to solve the existing problems in the whole organizational level.

INTRODUCTION

During the last decade, banking became the most competitive industries of Bangladesh with a huge amount of growth. A large number of new banks have their places in industry and yet there are more to register in the list. In this modern era of business, banking activities have spread out in many areas like merchant banking, share trading, giving lease and so on. In such a highly competitive service industry, the importance of customer satisfaction cannot be de-emphasized.

National Bank Limited is one of the most renowned private commercial bank in Bangladesh. During a short span of time the Bank has been able to establish a good image in the Banking sector and has become a house hold name in the country due to several customers – friendly deposit and loans scheme. I am doing my internship in National Bank limited with rotation on different desks which includes Accounts opening, General Banking, Retail Banking, Clearing, Remittance, Loans and Advances etc. In this report “The Customer Satisfaction on different services of National Bank limited Bank Ltd.”, I will focus on various aspects of this Bank. Since they are standing at good position among the private banks, their financial position, market shares, marketing mechanisms, overall strengths and weakness, objectives, goals will be cross examined for analyzing the fact that how they were and how they will be in future. Various types of analysis will help us to understand the comparative position and a transparent picture of this Bank that will help us to draw any comment at a glance.

As I am directly in touch with customers, the report will deal with the service quality and customer satisfaction of National Bank limited. A survey will be conducted on the customers of National Bank limited. The objective of this report will be to determine how well National Bank limited is satisfying the customers on different service grounds. Various important issues of customer satisfaction will be presented in light of the findings of the survey.

Lastly, the findings will be examined to prescribe a set of specific recommendations to improve the overall service quality according to customers expectations and also to solve the existing problems in the whole organizational level.

BANKING SECTORS OF BANGLADESH

Bangladesh Bank (BB) has been working as the central bank since the country’s independence. Its prime jobs include issuing of currency, maintaining foreign exchange reserve and providing transaction facilities of all public monetary matters. Bangladesh Bank is also responsible for planning the government’s monetary policy and implementing it thereby.

The number of banks in all now stands at 49 in Bangladesh. Out of the 49 banks, four are Nationalized Commercial Banks (NCB’s), 28 local private commercial banks, 12 foreign banks and the rest five are Development Financial Institutions (DFI’s).

Sonali Bank is the largest among the NCBs while Pubali is leading in the private ones. Among the 12 foreign banks, Standard Chartered has become the largest in the country. Besides the scheduled banks, Samabai (Co-operative) Bank, Ansar-VDP Bank, Karmasansthan (Employment) Bank and Grameen Bank are functioning in the financial sector.

Bangladesh Bank (BB) regulates and supervises the activities of all banks. The BB is now carrying out a reform program to ensure quality services by the banks. The list of banks doing their operation in Bangladesh are-

Nationalized Commercial Banks (NCBs)

Name | Telephone |

| 1. Sonali Bank | 9550426-34, 8614588 |

| 2. Janata Bank | 9560072-80, 9560042-43 |

| 3. Agrani Bank | 9566153-54, 9566160-69, |

| 4. Rupali Bank | 9551624, 9554122, 9552183-4 |

Private Commercial Banks (PCBs)

| 1. Pubali Bank | 9569050-2, 9551614-7 |

| 2. Uttara Bank | 9566067-9, 9551162, 9565732 |

| 3. National Bank Ltd. | 9563081-5, 9561201 |

| 4. The City Bank Ltd. | 9565925-34 |

| 5. United Commercial Bank Ltd. | 9560585 |

| 6. Arab Bangladesh Bank Ltd. | 95608878, 9560312-6 |

| 7. IFIC Bank Ltd. | 9562062, 9563020-29 |

| 8. Islami bank Bangladesh Ltd. | 9552897-8, 9563040, 9563046-9 |

| 9. Al Baraka Bank Bangladesh Ltd. | 9563768-9, 9565031-2 |

| 10. Eastern Bank Ltd. | 9556371,9556361-2 |

| 11. National Credit & Commerce Bank Ltd. | 9561902-4 |

| 12. Prime Bank Ltd. | 9567265-70, 9564677 |

| 13. South East Bank Ltd. | 9550081-5, 9551575, 9557714 |

| 14. Dhaka Bank Ltd. | 9556587-10, 9556583 |

| 15. Al-Arafah Islami Bank Ltd. | 7123255-7, 9568007, 9569353 |

| 16. Social Investment Bank Ltd. | 9559014, 9554855 |

| 17. Dutch-Bangla Bank Ltd. | 9568537-39 |

| 18. Mercantile Bank Ltd. | 9559333 |

| 19. Standard Bank Ltd. | 9667224, 9667802 |

| 20. One Bank Ltd. | 9564249, 7551799, 9564255-6 |

| 21. EXIM Bank | 9553925, 9553872, 9566418 |

| 22. Bangladesh Commerce Bank Ltd. | 9559831-32, 9668170 |

| 23. Mutual Trust Bank Ltd. | 9569318, 7113239 |

| 24. First Security Bank Ltd. | 9560229, 9564733 |

| 25. The Premier Bank Ltd. | 8819916, 9890547, 9890012 |

| 26. Bank Asia Ltd. | 8117055, 8117066 |

| 27. The Trust Bank Ltd. | 9870011 Ext.-4191 |

| 28. Shah Jalal Bank Limited (Based on Islamic Shariah) | 9556011 |

Foreign banks

| 1. American Express Bank | 9561751-52, 9561496-97 |

| 2. Standard Chartered Bank | 9561465, 9550181-90 |

| 3. Habib Bank Ltd. | 9551228, 9555091-2,9563043-5 |

| 4. State Bank of India | 9554251, 9553371 |

| 5. Credit Agricole Indosuez (The Bank) | 8111959 |

| 6. National Bank of Pakistan | 9560248-9 |

| 7. Muslim Commercial Bank Ltd. | 9563649, 9563650 |

| 8. City Bank NA | 9550063-64 |

| 9. Hanvit Bank Ltd. | 8813270-73 |

| 10. HSBC Ltd. | 9660536-43 |

| 11. Shamil Islami Bank Of Bahrain EC | 9666701-5 |

| 12. Standard Chartered Bank | 9561465, 881718-9 |

Development Banks

| 1. Bangladesh Krishi Bank | 9560021-5, 9560031-35 |

| 2. Rajshahi Krishi Unnayan Bank | 775008-9, 9569408 |

| 3. Bangladesh Shilpa Bank | 9555150-9, 9566114 |

| 4. Bangladesh Shilpa Rin Sangstha | 9565818,9565046 |

| 5. Bank of Small Industries & Commerce Bangladesh Ltd. | 9564830, 9658190 |

Others

| 1. Ansar VDP Unnayan Bank | 8313198, 8322181 |

| 2. Bangladesh Samabai Bank Ltd. (BSBL) | |

| 3. Grameen Bank | 8015755-8 |

| 4. Karmasansthan Bank | 9563311 |

A.1 AN OVERVIEW OF NATIONAL BANK LIMITED

National Bank Limited was established as the first hundred percent Bangladeshi owned Bank in the private sector. NBL started its never-ending journey from 23 March 1983. The Board of Directors of the Bank consists of the finest intellects of the country’s business, commerce and banking areas. NBL brought a change in services in the banking sector besides the traditional Govt. banks with its excellent difference. The success of NBL is for its cooperative, helpful approach, understanding the real banking needs of each and every client and concern for their benefits and welfare. From the beginning NBL had the great objectives about the Share holders- to maximize their facilities as well as dividend. Now NBL is bigger concern compare to others in the same industry holding 91 branches in the inland area. In 1995 NBL acquired equity and management of Nepal Arab Bank Limited and in 1996 NBL opened a representative office at Myanmar. In different countries NBL has some exchange booths to facilitate the foreigners. With a string sense in all business area of commercial banking NBL could foresee tremendous growth in home bound remittance from Bangladeshi expatriates in USA, UK, Middle East and in different countries of the work. Consequently, NBL established a unique money remittance system with Western Union of USA for inbound and outbound remittance. Still now, NBL has this sort of novelty service facilities. NBL always is committed to fulfill its ethical responsibility to the society, country and to the whole world.

NBL has participated in the Brained Multi Purpose Project, a major enterprise undertaken for improving the ecological balance and the socio- economic conditions of the farmers the northern region of the country. Establishment of NBL Foundation, which operates National Bank Public School & College and sponsorship of various sports tournaments are few of the mentionable projects that display NBL’s commitment to the society. Besides the different types of Accounts, NBL has some special schemes that really represent bank’s concern about the clients, some of them are – MSS, SDS, SIS Credit Card, ATM services.

A.2 BOARD OF DIRECTORS

| Moazzam Hossain | : | Chairperson |

| Zainul Haque Sikder | : | Director |

| Parveen Haque Sikder | : | Director |

| Alhaj Khalilur Rahman | : | Director |

| Prof. Mahbub Ahmed | : | Director |

| Zakaria Taher | : | Director |

| Ron Haque Sikder | : | Director |

| Rick Haque Sikder | : | Director |

| Lt. Col. (Rtd) Md. Azizul Ashraf, psc | : | Director |

| Mabroor Hossain | : | Director |

| A K M Enamul Hoque | : | Director |

| Capt. Abu Sayeed Monir | : | Director |

| Salim Rahman | : | Director |

| Md Abdur Rahman Sarker | : | Managing Director |

A.2.1 SOURCES OF FUND :

Table: Source of Fund of National Bank Limited:

| Paid up capital | 3.09 |

| Reserve & Surplus | 6.59 |

| Deposits & other account | 83.44 |

| Borrowings | 1.68 |

| Other liabilities | 5.20 |

A.2.2 PROPERTY & ASSETS :

Table: Total Property & Assets of National Bank Limited:

| Cash & Bank Balance | 9338.57 |

| Call Money | 1359.80 |

| Investment | 12315.20 |

| Loans & Advance | 65129.28 |

| Fixed Assets | 2200.85 |

| Other Assets | 1741.06 |

A.2.3 LIABILITIES & CAPITAL :

Table: Total Liabilities & Capital of National Bank Limited:

| Borrowing | 1539.56 |

| Deposits | 76838.64 |

| Other Liabilities | 4789.82 |

| Paid up Capital | 2846.54 |

| Reserve & Surplus | 6070.23 |

A.3 MISSION & VISION

Mission

Our mission is to continue our support for expansion of activities at home and abroad by adding new dimensions to our banking services which have been ongoing in an unabated manner. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service, as well as our commitment to serve the society through which we want to get closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up-gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

Vision

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country have been our cherished vision.

A.4 COMMITMENTS

In carrying ourselves at work

Discipline Honesty & integrity

Sincerity

Caring

Creativity

In serving the Bank

Loyalty

Total commitment & dedication

Excellence through teamwork

In serving customers

Customer- first

Quality-focus

Credibility & secrecy

A.5 OBJECTIVES OF NBL

Offering quick and improved clientele services through application of modern information technology.

Playing an important role in the national progress by including improved banker customer relationship.

Ensuring highest possible dividend to the respected shareholders by making best use of their equity.

Pursuing the policy of nurturing balanced growth of the Bank in all sectors.

Consolidating our position in the competitive market by introducing innovative banking products.

Ensuring highest professional excellence for our workforce through enhancement of their work efficiency, discipline and technological knowledge.

Expanding the Bank’s area of investment by taking part in syndicated large loan financing.

Increases finances to Small and Medium Enterprises (SME) sector including agriculture and agro-based industries, thus making due contribution to the national economy.

Upholding the image of the bank at home and abroad by pursuing dynamic and time benefiting activities.

Ensuring maintenance of capital adequacy, comfortable liquidity, asset quality and highest profit through successful implementation of the Management Core Risk Program.

A.6 STRATEGY & STRENGTHS

National Bank’s goal is to become a leading provider of integrated financial services for small and medium-sized enterprises (SME’s), institutional investors and high net-worth individuals in Bangladesh. The Bank intends to achieve this central goal by taking the following measures:

Strategic Direction and the Challenges of the Bank

Although the immediate outlook for the local operating environment is expected to be turbulent, the Bank intends to continue its growth momentum through the initiatives and strategic priorities set out in the Corporate Plan. The Bank is well positioned to mitigate the risks posed by the potential volatility covering a period of five years on a rolling basis. This year the Bank prepared the plan for the period covering the years 2010. The strategic direction of the Bank in critically reviewed by the Management as well as by the Board at the time preparing and approving the Corporate Plan and the Budget. In keeping with the Vision and Mission statement of the Bank, the strategic direction has been clearly identified and laid down in the Corporate Plan. It detailed out SWOT analysis of the Corporate Banking, Personal Banking, Treasury, Information Technology, Human Resources Management and Bangladesh Operations of the Bank. Besides, it spells out Goals and Objectives of these main segments along with detailed action plans with specific time frames to achieve them. The Corporate Plan and the Budget incorporates highly ambitious targets for the plan period. Undoubtedly, the Corporate Plan and the Budget has immensely contributed in guiding the organization to its present level. Further, it has contributed to building up the target driven culture across the organization and leading to record superlative performance and to maintain the pre eminent position in the banking industry.

A.7 MOTO

The Bank will be a confluence of the following three interests:

Of the Bank : Profit Maximization and Sustained Growth.

Of the Customer : Maximum Benefit and Satisfaction.

Of the Society : Maximization of Welfare.

A.8 CORPORATE SOCIAL RESPONSIBILITY

Earning the highest level of trust requires the balanced provision of value to four constituents: customers, shareholders, market environment & society and employees. Through this process, the Bank aims to contribute to the sustainable development of society as a whole, and to fulfill corporate social responsibly (CSR). The bank has taken string initiative in various areas for attaining greater social goals. To reinforce CSR activities, the bank has focused in the areas of employment, education, sports & cultural activities, and disaster relief.

A.9 CORE VALUES

NBL’s core values consist of 6 key elements. These values bind our people together with an emphasis that our people are essential to everything being done in the Bank.

Integrity

NBL protects and safeguards all customer information.

NBL treats everyone in an equitable and consistent manner.

NBL creates an environment, which earns and maintains customer trust.

Open communication

NBL builds customer relationship based on integrity and respect.

NBL offers a full line of products and excellent service.

NBL is committed to the prosperity of the customers and shareholders.

Performance Driven

In NBL, customers and employees are judged in terms of their performance.

Continuous self improvement

Continuous learning, self-challenge and strive make ways for self improvement of workforce at NBL.

Quality

NBL offers hassle free better service timely.

NBL builds-up quality assets in portfolio

Teamwork

Interaction, open communication, and maintaining a positive attitude reflect NBL’s commitment to a supportive environment based on teamwork.

A.10 CORE INDICATOR

Deposits & Loans and Advances (Taka in million)

A.11 Segmental Information:

A.12 WORKFORCE

National Bank Limited (NBL) recognizes that a productive and motivated Work Force is a prerequisite to leadership with its Customers, its Shareholders and in the Market it serves. NBL treats every Employee with dignity and respect in a supportive environment of trust and openness where people of different backgrounds can reach their full potential.

The Bank’s Human Resources Policy emphasize on providing Job Satisfaction, Growth Opportunities, and due recognition of superior performance. A good working environment reflects and promotes a high level of loyalty and commitment from the employees. Realizing this National Bank limited (NBL) has placed the utmost importance on continuous development of its Human Resources, identify the strength and weakness of the employee to assess the individual training needs, they are sent for training for self-development. To orient, enhance the Banking knowledge of the employees National Bank Training Institute (DBTI) organizes both in-house and external training.

A.13 MANAGEMENT SYSTEM

Since its journey as Commercial Bank in 1995 National Bank Limited (DBL) has been laying great emphasis on the use of improved Technology. It has gone to Online Operation System since 2003. And the new Banking Software FLEXCUBE is newly installed. As a result the Bank will able to give the services of international standards.

A.14 CORRESPONDENT RELATIONSHIP

The Bank established correspondent relationships with a number of Foreign Banks, namely American Express Bank, Bank of Tokyo, Standard Chartered Bank, Mashreq Bank, Hong KongShanghai Banking Corporation, CITI Bank NA-New York and AB Bank Ltd. The Bank is maintaining Foreign Exchange Accounts in New York, Tokyo, Calcutta, and London. The Bank has set up Letter of Credit on behalf of its valued Customers using its Correspondents as advising and reimbursing Banks. The Bank maintains a need based Correspondent Relationship Policy, which is gradually expanding. The number of Foreign Correspondents is now 350.

A.15 DEPARTMENTS OF NATIONAL BANK LIMITED

If the Jobs are not organized considering their interrelationship and are not allocated in a Particular Department it would be very difficult to control the system effectively. If the any Departments are not fitted for the Particular Works there would be Haphazard Situation and the Performance of a Particular Department would not be measured. National Bank Limited (NBL) has does this work very well. Different Departments of National Bank Limited (NBL) are as follows:

Human Resources Division

Personal Banking Division

Treasury Division

Operations Division

Computer and Information Technology Division

Credit Division

Finance & Accounts Division

Financial Institution Division

Audit & Risk Management Division

A.16 EXISTING BRANCHES

On 23 March 1983 NBL was first started at Dilkusha Branch. At the age of 19 years it has established a total of 75 branches over the country and made a smooth network in side the country as well as throughout the world. The number of branches as territory-wise is mentioned in the following table:

Name of the Area | Number of branches |

| National | 46 |

| Chittagong | 30 |

| Rajshahi | 18 |

| Khulna | 20 |

| Sylhet | 16 |

| Total | 130 |

Time line of the National Bank Limited

A.17 ORGANIZATION STRUCTURE

Chain of Command:

Chairman | |||

Board of Directors | |||

Managing Director | |||

Deputy Managing Director | |||

Executive Managing Director | |||

| |||

Executive Vice-President | |||

Senior Vice President | |||

Vice President | |||

Asst. Vice President | |||

Senior Principal Officer Grade-I | |||

| |||

Principal Officer Grade-II | |||

Senior Officer Grade-III | |||

Senior Officer Grade-IIIA | |||

Senior Officer Grade-IIIB | |||

Probationary Officer | |||

Junior Officer | |||

Typist Office Assistance Security Staff Driver |

A.18 GROWTH OF THE BANK

The National Bank Limited (NBL) is one of the most successful Private Sector Commercial Bank in our country, though it started its operation only nine years back. It has achieved the trust of the general people and made reasonable contribution to the Economy of the country by helping the people investing allowing Credit Facility.

A.18.1 CAPITAL & RESERVES

Year | Authorized Capital | Paid up Capital | Reserve fund & surplus |

2009 | 7450 | 2846.54 | 6070.22 |

2008 | 2450 | 1872.72 | 4253.55 |

2007 | 2450 | 1208.20 | 3360.19 |

2006 | 2450 | 805.47 | 2468.78 |

2005 | 1000 | 619.59 | 2115.02 |

Capital Management of the Bank is to maintain an adequate capital base to support the projected business and regulatory requirement. NBL always maintain a prudent balance between Tier- 1 and Tier-2 capital. The Bank has maintained overall capital adequacy at 13.56 percent in 2009 of which 10.89 percent and 2.67 percent as Tier-1 and Tier-2 capital respectively against Bangladesh Bank’s requirement of 10 percent. The deposit base of the bank registered a growth of 27.66 percent in the reporting year over the last year and stood at Tk.76,838.64 million. Expansion of branch network, competitive interest rate and deposit products contributed to the growth. The customers of the bank were individuals, corporations, financial institutions, government and autonomous bodies etc.

NBL. has a consistent dividend policy. In line with that Stock Dividend of 52 percent was declared for the year 2008 which strengthened paid-up capital base and it stood at Tk. 2,846.54 million 2009 against authorized capital of 7,450.00 million. The statutory reserve enhanced by 35.95 percent to Tk.6070.22 million in 2009 after transferring 20 percent on pre-tax profit while it was Tk.3, 397.70 million in 2008. At the end of 2009 shareholders’ equity increased by 45.55 percent to Tk.8,916.76 million from Tk.6,126.27 million of 2008. The Bank opened a total number of 24,385 LCs amounting USD 1,117.61 million in import trade in 2009. The main commodities were scrap vessels,rice, wheat, edible oil, capital machinery, petroleum products, fabrics & accessories and other consumer items.

The Bank has been nursing the export finance with special emphasis since its inception. In 2009 it handled 18,761 export 2009 it handled 18,761 export documents valuing USD 559.78 million with a growth of 5.41 percent over the last year. Export finances were made mainly to readymade garments, knitwear, frozen food and fish, tanned leather, handicraft, tea etc. The daily average investment of the treasury in local currency was Tk 10,629.10 million in the from of Call Lending, Term Lending, Reverse Repo, Debentures and Govt. Securities. The yield was 1.17 percent higher than previous year. Like previous year, inflow of foreign currency of the current year was higher than the previous year. Treasury was actively participated in interbank market, both in local and foreign currencNational Bank Limited generated profit before provision of Tk.3,397.70 million in 2009 which was Tk.3,123.82 million in 2008 registering a growth of 8.77 percent. Net Profit after tax grew by 36.45 percent to Tk.2,070.47 million in 2009 after making provision for loan loss and income tax for Tk.200.00 million and Tk.1,150.00 million respectively.

Interest income increased by 17.88 percent to Tk.6,821.39 million in 2009 from Tk.5,786.71 million in 2008 due to growth of advances. It accounted 61.98 percent of the total operating income.The income from investment increased sharply by 89.51 per cent to Tk.1,779.32 million in 2009 from Tk.938.92 million in 2008. Commission and exchange earning decreased by 3.20 percent to Tk.1,463.70 million in 2009 from Tk.1,512.13 million of 2008.

Overall increase of deposits pushed up the interest expenses by 24.91 percent from Tk.3,594.84 million in 2008 to Tk.4,490.34 million in 2009. Salary & allowances increased by 26.89 percent, Rent & taxes, insurance premium, utility charges etc increased by 23.36 percent. Total operating expenses was Tk.3,118.11 million in 2009 in comparison to Tk. 2,174.40 million in 2008.

In spite of taking all out efforts to reduce the non-performing assets of the bank giving top most priority, the classified loans raised by 42.17 percent to Tk.3,880.31 millions as on 31 December, 2009 from Tk. 2,729.33 millions of previous year. Global recession and internal political uncertainty of 2007 & 2008 in the country many industries and business enterprises could not run properly & had to incur huge loss and turned non-performing which is a major cause of increase in classified loan.

Besides all other activities recovery of classified loans & advance gets top most priority. Though appropriate action plans taken and relentless efforts exerted to reduce the non-performing assets, during the year under review, the bank recovered Tk.345.40 million and Tk.97.37 million against classified loans & advances and written-off respectively. Even then non-performing assets increased a little bit to 5.96 percent of total loans & advances, which is within a tolerable level.

Moreover, during 2009, bank obtained court verdict of 9 suits valuing the property of Tk.36.23 million under section 33(7) & 33(5) of the Artha Rin Adalat Ain-2003. Necessary formalities are being done to sell the properties to realize the debts. Bank filed 33 new suits in the year 2009 to recover Tk.862.47 million and is relentlessly pursuing the suits for early disposal.

As a contributor of national economy, NBL is relentlessly working to ease the flow of inward foreign remittance. The bank introduced different products and technology including SWIFT, (Tk. 620.69 crore ) higher than that of 2006 acheving a growth rate of 29.07 percent. Intorduction of products like Home Delivery Scheme , Electronic Fund Transfer(EFT) and different instant payment system and mordern technologies like SWIFT and online services have strengthed the position of the bank. devices for more speedy payments. Further, NBL entered into a deal with ASA, a leading NGO having 3,000 outlets and also with Social Islamic Bank to expand bank’s domestic network.

With the passage of time, NBL earned the confidence and trust of the wage earners and successfully handling a sizeable volume of remittances, which is depicting a gradual increasing trend. In 2009, foreign remittance brought through NBL was USD 645.97 million showing an increase of USD 63.50 million over the previous year, which registered an

| Particulars | 2006 | 2007 | 2008 | 2009 |

| Authorized Capital | 2450.00 | 2450.00 | 2450.00 | 7450.00 |

| Paid up Capital | 805.47 | 1208.20 | 1872.72 | 2846.54 |

| Reserve Fund | 2468.78 | 3360.19 | 4253.32 | 6070.22 |

| Deposits | 27762.12 | 28973.39 | 32984.05 | 40350.87 |

| Total Advance | 22257.15 | 23129.65 | 27020.21 | 32709,68 |

| Investments | 4044.20 | 4374.17 | 3564.82 | 5730,38 |

| Import Business | 19264.50 | 22028.30 | 31648.20 | 42458.50 |

| Export Business | 16341.80 | 17105.30 | 21344.10 | 28019.20 |

| Remittance Business | 7637.50 | 9035.50 | 13618.20 | 21311.10 |

| Total Income | 3622.31 | 3715.21 | 4202.52 | 5728,82 |

| Total Expenses | 2677.22 | 2980.06 | 3351.19 | 4582.04 |

| Profit (before provision & Tax) | 336.09 | 484,21 | 581.13 | 1058.73 |

| Profit (after provision & Tax) | 88.12 | 170.02 | 271.67 | 507.49 |

| Fixed Asset | 889.61 | 895.35 | 1431.23 | 1627.29 |

| Total Asset | 47929.57 | 48024.96 | 55046.13 | 66533.80 |

| Book Value of Share | 395.31 | 360.68 | 441.36 | 406.50 |

| Market Value of Share | 226.61 | 475.25 | 746.50 | 760.50 |

| Income per Share | 17.07 | 27.44 | 43.85 | 63.01 |

| Dividend Paid | 20% (Bonus Share) | 20% (Bonus Share) | 30% (Bonus Share) | 60% Cash dividend |

| No. of foreign correspondents | 358.00 | 410.00 | 391.00 | 400 |

| No. of employees | 2185.00 | 2133.00 | 2183.00 | 2270 |

| No. of Shareholders | 9276.00 | 9491.00 | 9564.00 | 1040 |

| No. of Branches | 95 | 102 | 115 | 130 |

A.18.2 PROFIT

National Bank Limited (NBL) registered an Operating Profit of Tk.704 Million as on December 31, 2007. Tk 839 Million on 2008. The growth ratio is 19%.

Profit of NBL Taka in Million

Year | Profit |

2009 | 3397.70 |

2008 | 3123.83 |

2007 | 2215.10 |

2006 | 1146.78 |

2005 | 851.32 |

A.18.3 DEPOSITS & LOAN AND ADVANCES

The deposit base of the bank registered a growth of 27.66 percent in the reporting year over the last year and stood at Tk.76, 838.64 million. Expansion of branch network, competitive interest rate and deposit products contributed to the growth. The customers of the bank were individuals, corporations, financial institutions, government and autonomous bodies etc.

Deposits & Loans and Advances

Year | Deposits | Loans and Advances |

2009 | 76838.64 | 65129.29 |

2008 | 60187.89 | 50665.07 |

2007 | 47961.22 | 36475.74 |

2006 | 40350.87 | 32709.68 |

2005 | 32984.05 | 27020.21 |

A.18.4 INTERNATIONAL TRADE

The Bank opened a total number of 24,385 LC’s amounting USD 1,117.61 million in import trade in 2009. The main commodities were scrap vessels, rice, wheat, edible oil, capital machinery, petroleum products, fabrics & accessories and other consumer items.

The Bank has been nursing the export finance with special emphasis since its inception. In 2009 it handled 18,761 exports 2009 it handled 18,761 export documents valuing USD 559.78 million with a growth of 5.41 percent over the last year. Export finances were made mainly to readymade garments, knitwear, frozen food and fish, tanned leather, handicraft, tea etc.

Import of NBL (Taka in Million)

Year | Import |

2005 | 31648.20 |

2006 | 42458.50 |

2007 | 62759.00 |

2008 | 78226.32 |

2009 | 77539.77 |

Export of NBL (Taka in Million)

Year | Export |

2005 | 21344.10 |

2006 | 28019.20 |

2007 | 31824.00 |

2008 | 36284.44 |

2009 | 38398.85 |

A.18.5 INVESTMENT BANKING

The daily average investment of the treasury in local currency was Tk 10,629.10 million in the form of Call Lending, Term Lending, Reverse Repo, Debentures and Govt. Securities. The yield was 1.17 percent higher than previous year. Like previous year, inflow of foreign currency of the current year was higher than the previous year. Treasury was actively participated in inter bank market, both in local and foreign currency.

Investment Banking of NBL (Taka in Million)

Year | Investment Banking |

2005 | 3564.82 |

2006 | 6239.83 |

2007 | 7760.38 |

2008 | 9156.61 |

2009 | 12315.20 |

B.1 CUSTOMER SERVICE

Customer Service is the Service provided in support of a Company’s Core Product. Customer Service most often includes answering question, taking orders, dealing with billing issue, handling complaints, and perhaps scheduling maintenance. Customer service can occur on site, or it can occur over the phone or via the Internet. Many companies operate Customer Service call centers, often staffed around the clock. Typically there is no charge for Customer Service. Quality Customer Service is essential to building Customer Relationships. It should not, however, be confused with the Services provided for sale by a Company.

The success of Customer Services is the Customer Satisfaction. It depends on the Product’s actual performance relative to a Buyer’s Expectations. A Customer might experience various degree of satisfaction. If the Product’s performance falls short of expectations, the Customer is dissatisfied. If performance matches expectations, the Customer is satisfied. If performance exceeds expectations, the Customer is highly satisfied or delighted.

Customer Service of a Company has to have the Responsiveness, which means the willingness to help Customers and to provide prompt Service. This dimension emphasizes attentiveness and promptness in dealing with Customer request, question, complaints, and problems.

Responsiveness is communicated ton Customer by the length of time they have to wait for assistance, answer to questions, or attention to problems. Responsiveness also captures the notion of flexibility and customizes the Service to Customer needs.

B.2 CUSTOMER SERVICES IN BANKING BUSINESS

Customer Services in Banks may be grossly categorized into Deposit Services, and Credit Services. Customers’ Services generally mean taking Deposit of Money from Customers, giving Loans & Advances to the Customers and various Ancillary Services (Off Balance Sheet Services). These activities require an arrangement of service process: Branch Expansion, Survey of Economic Environment, Location of Deposit Potential, Identification of Credit Needs, and Collect Information about Target Markets. Accordingly, Banks make arrangement to deliver their Services to the Potential Customers in terms of Acceptance, Sanction, Advances, Commitment, Transfers, Remittance, Opening of Letter of Credit (L/C), Export Documents Handling, Bills Collections and many other Services.

B.3 CUSTOMER SERVICES IN NATIONAL BANK

Like some other Banks National Bank Limited (NBL) has also some Services that it provides its Potential Customers. National Bank Limited usually provides two types of services:

B.3.1 Corporate Financial Services of National Bank Limited (NBL)

It is very true that major contribution to the bank’s equity has come from business banking sector. It provides several types of services under business banking. NBL offers corporate banking facilities; it also provides commercial, Institutional, Quasi Government or Correspondence facilities.

B.3.1.1 Corporate Banking Service:

NBL is recognized as the good financial institution in corporate finance services sector in our country. Its professional management team caters to the needs of its clients and provides them with a wide range of financial services some of which are project financing and investment consultancy, syndicated debt and equity, bond and guaranties, local and international treasury products.

B.3.1.2 Institutional Banking:

The institutional service provided by NBL is designed for different fund based organizations like donor agencies, NGOs, voluntary organizations, foreign missions, airlines, shipping lines and their personnel with the facilities, which are freely convertible to major international currencies, local and foreign currency remittances through a large network of branches and correspondence.

B.3.1.3 Commercial Banking:

NBL offers different commercial banking facilities to all commercial concerns specially those with particular involvement with import and export finance. It provides the finance facilities like- trade finance facilities including counseling, confirming export L/Cs, and issue of import L/Cs backed by its correspondent network. It also provides bonds and guarantees, investment advice, leasing facilities, project finance opportunities.

B.3.1.4 Quasi-Government Banking:

The Quasi Government service of NBL helps the government by providing different financial service like efficient and knowledgeable management of trade business (import and export), skills in barter, swaps and counter trade deals. In addition, the opportunity of debenture finance for new projects, possibilities of hard currency loans and lease deals, the opportunity of syndicated hard currency, financing of loans and import L/C, highly efficient account management and remittance handling within the country.

B.3.2.1 Personal Banking Service

Deposit Accounts:

Current Account (CD)

Short Term Deposit A/C (STD)–rate of interest 5.5%- 6%

Saving A/C (SD)- rate of interest 6%

Fixed Deposit Receipt (FDR).

Foreign Exchange Transactions

Consumer Credit Scheme

E-Cash 24 Hour Branch Banking

NBL Bank Credit Card

Secured Overdraft

Personal Loan

Car Loan

Safe Deposit Lockers

Private Foreign Currency Accounts

Utility Bill Payments

How to open an account:

First interact with the client and understand his/ her interest to open an A/C, address, profession, social status and also his referee.

Must have logical explanation to open the A/C

Current Photograph

Asked for some papers:

Tax Identification Note (TIN)

Photocopy of passport

Trade license

Introduce mark on the form, from any employee of NBL

Employment certificate

If joint A/C:

Declaration – who will withdraw money?

Notice from client – if client want to withdraw more then ¼ of their deposits or more then 50 thousand, notice must give before 1 week of withdrawal

If it is a company’s A/C then MA is must after fulfillment of all requirements a client is permitted to open an Account.

Different types of Current Accounts:

Individual

Proprietorship

Partnership

Company

Club, society etc.

Who can open an FDR?

Any legal, mentally fit persons can open FDR. In time of opening FDR no photo and introducer is needed. FDR is made for any amount.

Duration & Interest rate:

Fixed Deposit Recite is made for different maturity containing different interest rate:

Sl. | Category Of Deposit | Revised rate of interest (p.a.) | |

1 | FDR for 1 months and above but less than 3 months | Below 50.00 lac | 5.00% |

| 50.00 lac & above | 5.50% | ||

2 | FDR for 3 months & above but less than 6 months | Below 50.00 lac | 8.00% |

| 50.00 lac & above | 8.50% | ||

| Agreegate Balance 1 crore & above | Upto – 9.50% | ||

3 | FDR for 6 months & above but less than 1 year | Below 50.00 lac | 8.00% |

| 50.00 lac & above | 8.50% | ||

| 1.00 Crore & above Agreegate Balance 1 crore & above | 8.75% Upto – 9.50% | ||

| 4 | FDR for 1 year and above | Below 1.00 crore | 8.50% |

| 1.00 crore & above | 8.75% | ||

| 1.00 crore & above Above | Upto – 9.50% | ||

Rules for FDR:

Normally after maturity and following necessary rules holder of FDR can withdraw total money with interest rate.

But if the holder want to withdraw his money before maturity then he does not get any interest, but withdraw deposited money

In case of premature FDR no penalty, no IR in 3 or 6 months FDR.

But in case of 12 or 24 months bank cut up 6 months. After that if any slab then according to this he gets IR.

Upon interest rate 10 % income tax must cut up.

There are some rules incase of Excise duty (yearly charged)

Amount Excise Duty

Up to 10000/- Nil

10000 – 100000 120/-

100000 – 1000000 250/-

1000000 – 10000000 500/-

10000000 – 50000000 2500/-

50000000 & above 5000/-

Some Special packages:

NBL monthly saving scheme (NMS):

It is an attractable savings project for limited income group. National bank Ltd. got quick response in this project. A depositor can deposit 500-10000 Taka monthly for 5-8 years. The return is as follows:

Monthly Installment | Return after 3 years 9.00% | Return after 5 years 9.25% | Return after 8 years 9.50% |

500 | 20,627 | 3 7,896 | 70,849 |

1000 | 41,255 | 75,791 | 1,41,697 |

2000 | 82,510 | 1,51,583 | 2,83,394 |

3000 | 1,23,765 | 2,27,374 | 4,25,091 |

4000 | 1,65,020 | 3,03,166 | 5,66,788 |

5000 | 2,06,274 | 3,78,957 | 7,57,914 |

10000 | 4,12,549 | 7,08,485 | 14,16,970 |

NBL deposit scheme (NDS)

The scheme will be titled as NDS. The period of deposits will be 3 years. Credit facilities up to 80% are allowed against lien on balance of NDS A/C, at 15% rate of interest of quarterly rest.

NDS Amount (in Taka) | Monthly Benefit Payable (in Taka) |

50000 | 450 |

100000 | 900 |

200000 | 1800 |

300000 | 2700 |

400000 | 3600 |

500000 | 4500 |

1000000 | 9000 |

2000000 | 18000 |

5000000 | 45000 |

| Number of Register | 7 |

| Name of registers

|

|

The activities of Cash Department:

This cash Department deals with cash, maintain the registers of Incoming and outgoing of cash flows. Cash department has to properly maintain cash management policy. Within this policy cash department performs activities through some steps and follows some policy, especially insurance policy.

Three types of Insurance Policies maintain in this department for getting insurance coverage:

Cash in safe insurance: up to Tk. 50,00,000 coverage

Cash on counter insurance: up to Tk.10,00,000 coverage

Cash in transit insurance: up to Tk. 1,00,00,000 coverage

In cash department above mentioned registers are maintained. For example, in receive register there are two heads. One is receive from branch and other banks, other are receive from customers. Hence in payment register there are also two heads. One is payment to branch and other banks and another is payment to the customer.

Generally cash balance register are two types:

Cash balance book – incase of large branch this book is maintained one after one day, but in case of small branch this book is maintained on current date.

Evening cash balance book – in case of emergency receive from customers, bank has to maintain this special kind of book for party services.

Calculation of Closing cash balance:

Opening balance ……….……

+ Cash received ……………..

Grand total ………………….

– total Payment ……………….

Closing cash balance .……..

SWIFT Services:

NBL is one of the first few Bangladesh Banks to obtain membership of SWIFT (Society for World Inter-bank Telecommunication). SWIFT is a members’ owned cooperative which a first and accurate communication network for financial transaction such as Letter of credit, Fund Transfer etc. By being a member of SWIFT, the bank has opened up possibilities for uninterrupted connectivity with over 5700 user institutions in 150 countries all over the world.

B.3.2.2 BILLS AND CLEARING DEPARTMENT

The bills and clearing department performs their duties for collection purpose. This purpose happens through two ways:

Through clearing house:

Clearing House is a combined place where all listed banks represent themselves and distribute all cheques drawn on the banks and collect cheques drawn on their own bank. Clearing house’s works are monitored by Bangladesh Bank. Every listed bank has account with Bangladesh Bank. Through clearing house every bank clear their liability. Mechanism of operation of the Clearing House is by now an well developed one. Generally the mechanism is as under:

Every member bank of the Clearing House prepares a bank-wise list of cheques and drafts received from its customers and drawn on different banks.

Representative of each bank visits the Clearing House with the cheques and their list in the morning and delivers the cheques and drafts to the representatives of the respective banks. Similarly, he/she also receives the cheques drawn on his/her bank from the representatives of the other banks.

The representatives return to their respective banks to meet again in the afternoon to return the dishonored instruments, if any, to the representatives of the respective banks.

The representative of each bank computes the final balance payable or receivable by his bank or other bank from other banks after taking into account the various amounts of receipts and payment.

The final settlement is effected by the supervisor of the Clearing House by debiting or crediting, as the case may be, the accounts of the respective banks as maintained with the Clearing House.

Registers:

For collection purpose maintains some register such as –

Local bills for collection (LBC)

Outward bills for collection (OBC)

Inward bills for collection (IBC)

B.3.2.3 BRANCH BANKING

Convenience is the key feature of the Personal Banking Program of National Bank Limited (NBL). The aim of NBL is to provide every Customer easy access to his/her Account from any Branch and ultimately from any where.

Recognizing the need of the Customers, NBL has recently networked all of the Branches in National, Narayanganj, Chittagong and Sylhet to permit its valued Customers to carry out Transactions from any Branch. Cash Withdrawal or Deposit or any type of Personal Banking Transactions can be performed using the Any Branch Banking Service. All Transactions under Any Branch Banking are absolutely free of charge.

The following Services are available under Any Branch Banking:

Cash Withdrawal from one’s Account from any branch of the Bank.

Cash and Check Deposit into one’s Account from any Branch of the Bank.

Cash and Check Deposit in other’s Account from any Branch of the Bank.

Transfer of Money from one’s Account with any Branch of the Bank.

B.3.2.4 NATIONAL BANK CREDIT CARD

NBL provide both Credit card & Debit Card Basically this department deals with credit cards, and now days only the ‘Master Card’. But NBL recently is starting the operation of VISA Power Card as a Debit Card. Master Card is using as an alternative of cash. In the real world cash carrying is not safe always that’s why credit card is very popular in the modern world and also in Bangladesh. People can draw cash from the ATM with out any involvement of human, by credit card one can buy anything from the shop.

– NBL has 2 types of Master cards:

Silver & Gold, both has local & International range.

– Interest rate is 2% for both Local and International.

Application and proposal prepare to open a card:

Application receive from a party

Verify the securities (FDR, Saving Certificate, CD or SD A/C)

For exporter lien will be his F.C A/C and payment of card will be through USD.

Send the certificate to the top management

If approved by the management the card will punch and deliver after 1 day to the Clint.

Charging procedure of Master Card:

Gold | Silver | ||

International | Local | International | Local |

$50 + 15% (vat) | Tk. 2000 + 15% (vat) | $ 25 + 15% (vat) | Tk. 1200 + 15% (vat) |

Debit Card (Visa Power Card):

NBL Power Card Issued to a cardholder to avail of services and to purchase or to draw cash by properly presenting the same at the notified Member Establishment / Bank/ATM. Three types of Power Card is available –

Local Card

International Card.

Dual Card

The card holder may avail any of the above Cards subject to fulfillment of necessary requirements.

Salient Features of the NBL Power card:

NBL Power Card can be used for purchases at merchants where VISA Cards are accepted through electronic point of sales terminals.

NBL Power Card can be used for withdrawing cash from Automated Teller Machines (ATM) s.

Personal Identification Number (PIN) necessary for withdrawal of cash will be provided by the bank

For Local Card there is no issuance fee for the 1st year and from the 2nd year only Tk. 200 will be charged.

For the International Card highest charge will be $ 40 & lowest will be $ 15.

To get a NBL Power Card customer has to submit only two copy of his/her recent photograph and the TIN (Tax Identification Number).

B.3.2.5 SECURED OVERDRAFT

| Rescheduling Rules: | After receiving rescheduling application bank has to query why loan account becomes defaulted. Considering rescheduling bank has to observe borrowers liability with other bank. Bank must have to observe borrower’s cash flow statement, Income statement, Balance sheet. Sometime bank can inspect borrower’s industry/firm physically to ensure borrower’s repayment capacity of rescheduling liability. Bank must preserve this report .if bank satisfied with above conditions, and then loan can be rescheduled. Otherwise legal action must be taken, keeping sufficient provision and write off the loan. Rescheduling must be for minimum time period. |

| Rescheduling of Term loan: | v Between maximum 15% of overdue installment or 10% of outstanding – which is lower pain in cash then 1st rescheduling considered. Between maximum 30% of overdue installment or 20% of outstanding – which is lower pain in cash then 2nd rescheduling considered. v Between maximum 50% of overdue installment or 30% of outstanding – which is lower pain in cash then 3rd rescheduling considered. |

| Rescheduling of demand and continuous loan: | In case of demand and continuous loan’s rescheduling rate of down payment vary in order to loan amount.

Overdue loan amount Rate of down payment One crore taka 15% One – five crore taka 10% Five crore and above 5% |

B.3.2.6 LOANS AND ADVANCED

Loans & Advance is a major earning source of a Bank. NBL is also very careful to provide loan, normally NBL sanction loan to individuals, small/medium or large industries. Actually loans give out of the Bank’s deposits, against valuable security.

NBL follows some general rules/principle to provide loan to its client.

The bank shall provide suitable credit services and products for the markets in which it operates.

Loans and advances shall normally the financed from customers’ deposits and not out of the share, temporary funds or borrowings from other banks.

Credit will be allowed in manners which will in no way compromise the Bank’s standards of excellence and to customers who will complement such standards.

All credit extension must comply with the requirement of banking companies Act 1991 and Bangladesh Bank’s instructions as amended from time to time.

The aggregate of all cash facilities shall not exceed 80% of customer deposits. It is further governed by the statutory and liquidity reserve requirement of Bangladesh Bank.

| Classification of Loans & Advances |

|

Cash Credit (CC) Section

| What is CC : | Actually cash credit is one kind of credit facilities to the customer. CC is a fully continuous loan. Generally this loan issued for providing working capital of a business. |

| Types of CC : | Two types of cash credit are used : Hypothecation (Hypo) Pledge |

| Some discussion about CC : | Generally hypothecation is used in a large scale. In hypo stock acts as a primary security and keeps under borrower’s full responsibility. In case of pledge stock possession is kept under bank and bank guard it own cost. After submitting bills by party bank pay bill amount to the supplier and party collect money from supplier. Party has to maintain certain % of margin to the bank. |

| Papers required to give the CC: |

|

| Documentation for giving the CC: | For registered mortgage : v A proposal v Original sale deed v Original Title deed v Original Via/transferred deed v CS, RS, SA, Porcha v Mutation v Up to-date Math Porcha v Non encampment certificate v Rent receipt v Duplicate carbon copy (DCR) v Rajuk approval |

| CC Recovery: | When borrowers are unable (unwillingly) to repay the loan then bank liquidate the mortgaged property. Before this bank make a personal interaction with borrower and in some case facilitate him/ her some time to improve his condition. But those party do not repay the loan willingly bank issue letter in favor of them for quick repayment of loan. Or facilitate them renewal of loan amount or make some arrangement to adjust their loan. There are 3 kinds of arrangement : v In case of first arrangement borrower has to pay 15% of loan amount to the bank, then he /she can goes to arrangement. v In case of second arrangement borrower has to maintain 30% of loan amount to the bank v In case of third arrangement this percentage is 45%. If borrower does not pay his/her liability although taking this reminder action then bank goes to legal action (file case). |

Secured Overdraft (SOD) Department

| The securities Can be: | Secured Overdraft works on : v Fixed Deposit Recite (FDR) v Savings Certificate v Wage Earners Development Bond (WEDB) |

| Different interest rate of different securities: | FDR: Loan against FDR between 80% – 90% interest rate is 2% – 3%. If loan issued above 90% Interest Rate is 3.5% – 4.5%. Savings Certificate : Interest Rate is 16% WEDB : Interest Rate is 16% |

| The steps of providing the SOD: | Generally SOD guarantee is issued for tender purpose Having SOD guarantee party has to submit work order Along with other required papers. If party needs advance payment to finish work, he needs APG, PG etc. party never paid total work value at a time, paid on a step by step after submitting bills. If bank wants every cheque drawn on bank then employer and party notarize it. On total bills employer cut up followings: Retention money : 10 % * Advance income tax : 4 % VAT : 4.5 %18.5 % * After service period this is refundable So party’s net bill receivable (NBR) is determined after cutting 18.5% charge on work value & this value is distributed step by step. |

| Terms & Conditions for SOD: | Necessary conditions of SOD advances :: v Nature of limit v Amount of limit v Purpose v Validity v Rate of interest v Mode of repayment v Security |

| Before sanctioning a Loan: | Before sanctioning guarantee lending risk analysis (LRA) and proposal preparation is must. Branch send the LRA report with the proposal to the board meeting (if loan is above 20 lacs) to finalize the decision of providing Loan. |

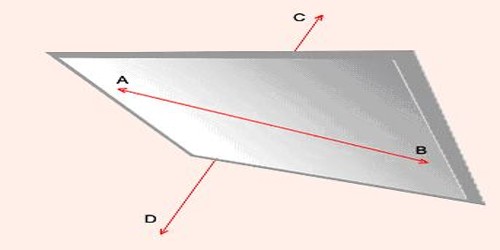

Lending Risk Analysis (LRA) to take the decision of lending following risks are covered, showed in diagram

Bank Guarantee (BG) Department

| Different types of Bank Guarantee: | 1) Bid Bond: Actually in the time of tender bid bond is used. It’s one kind of instrument. 2) Performance Guarantee (PG): Generally bank gives PG upon party’s work ability for a certain time period. PG gives on total work value. 3) Advanced payment guarantee (APG): APG gives for the initial amount. 4) Security Bond : Sometimes a security bond is issued to secured “ Bid Bond , PG , APG ,” 5) Counter Guarantee: A Guarantee against a Bank guarantee. |

| Party involvement:

| There are three parties related with bank guarantee : v Beneficiary / Employer v Party / Applicant v Bank / Financial Institution |

| Conditions for BG: | Assurance for completion capacity of work Within the validity period , work must be done Bank must be responsible for any lapses, disorders. Inability of party & treated as failure. |

| Validity of BG: | Work order must have a valid period and within this valid period party has to finish his work. But if employer wants he can extend this valid period. |

| Extension of validity period : | Extension of validity may be made on : v Beneficiary’s request v Party’s request v Both party and beneficiary’s request |

Loan general section

| Types of Loan General: | There are 3 types of general loan are seen :

|

| Theme of ADB loan: | Asian Development Bank distributes a handsome fund to different developing countries. Generally in case of ADB loan charges 12% interest rate for 6 years repaid on monthly installment basis. Loan repayment starts after 1 year. |

| Theme of EHBL: | In case of EHBL purpose, loan provides employees having 8 years permanent/confirms services. Loan provides on the basis of 100 months basic salary (Basic salary*100). Installment pays Tk. 750 per lac. Within 18 years repayment must be made. Interest rate is 9% (simple) |

| Value delightment factors: | After retirement repayment can continue Safety Scheme : If any employee died on servicing then installment cut down from this scheme. If not died then after loan adjustment this deposit (70%) return with interest. For this regulation following rules must be followed : If loan is 2 lacs Safety money is Tk. 100 per month. If loan is (2 – 4 ) lacs Safety money is Tk. 300 per month. If loan is (4 – 6) lacs Safety money is Tk. 400 per month. If loan is (6 – 9) lacs Safety money is Tk. 500 per month. If loan is (9 –12) lacs Safety money is Tk. 600 per month. If loan is (12-15) lacs Safety money is Tk. 700 per month If loan is above 15 lacs Safety money is Tk. 800 per month. |

| v In case of Flat loan, loan repayment starts after 6 months v In case of land /house loan, loan repayment starts after 18 months |

Loan General (House Building Loan) Section

| Theme of HBL: | Generally HBL is issued for customers. Interest rate of house building loan is 17% |

| Required papers of HBL: | To build house on existing land /extension of the existing house: 1) Whether the land is under direct possession of owner. Possession certificate from recommending authority after spot verification. 2) Whether the land is fit for immediate construction or requires earth filling. 3) cost of earth filling /development of plot if necessary 4) Copy of approved plan from RAJUK/CDA/ KDA/Purchaser /an engineer. 5) Estimate cost of the proposed construction signed by a PWD engineer not below the rank of Asst. engineer. 6) Clearance certificate form the Bank’s approved lawyer regarding the genuineness of the right, title etc. of the owner of the land. |

Different Securities for Different Types of Advances:

Types of Advances | Securities | Interest Rate |

| Inland Bills Purchased (IBP) | Bill itself | 16% |

| Payment Against Document (PAD) | Shipping documents for import | 16% |

| Loan Against Imported Merchandise (LIM) | Pledge of imported merchandise | 16% |

| Trust Receipt (TR) | Trust receipt obtained in lien of import documents. | 16% |

| Export Cash Credit (ECC) | Pledge or Hypothecation | 7% |

| Foreign Bills Purchased (FBP) | Shipping documents for export | 7% |

B.3.2.7 SAFE DEPOSIT LOCKERS

The Customers could use the Locker Facility of National Bank Limited (NBL) and thus have the option of covering their Valuables against any unfortunate incident. NBL offers Security to their Locker Service as afforded to their own Property at a very Competitive Price. The Bank is usually at this Service for the Customers from Saturday through Thursday from 9:00 am to 4:00 pm.

B.3.2.8 PRIVATE FOREIGN CURRENCY ACCOUNTS

Most Branches of National Bank Limited (NBL) has Authorized Dealers License to deal in Transactions in Foreign Currency and open Private Foreign Currency Accounts. Current or Fixed Term Accounts in US Dollar ($) or Pound Sterling (£) Accounts may be opened in the name of:

Bangladeshi Nationals residing abroad

Bangladeshi Nationals ordinarily resident in Bangladesh

Foreign Nationals residing abroad or in Bangladesh

Foreign Firms registered abroad and operating in Bangladesh or abroad

Foreign Missions and their expatriate Employees

Non-resident Foreign Currency Deposit (NFCD) Accounts are Interest bearing Time Deposit Accounts. Accounts may be opened for 1, 3, 6 months and 1 year term. Interest Rates on NFCD Accounts are determined after a careful assessment of Interest Rates on Deposit Accounts in the International Market. The Rates that NBL offers are usually higher than the International Market. Any amount brought in with declaration to Customs Authorities in form FMJ and up to US Dollar 5,000.00 brought in without any declaration can be deposited into such Accounts.

Foreign Exchange through Inward Remittance from abroad and Outward Remittances may be freely carried out into and from these Accounts. Foreign Exchange earned through Business done or Services rendered in Bangladesh, however, cannot be deposited into these Accounts.

B.3.2.9 UTILITY BILL PAYMENTS

National Bank Limited (NBL) offers a Multi-mode Utility Bill Payment Facility for its Customers whether it is Cellular Phone Bill, Telephone Bill, Electricity Bill or Water Bills of them. It is also possible for the NBL Customers to make Utility Bill Payment by using E-Cash ATM Service.

B.3.2.10 INTERNATIONAL TRADE & FOREIGN EXCHANGE

National Bank Limited (NBL) provides Foreign Exchange Transaction facilities to its Customers. NBL gives the Foreign Exchange facilities for Travel, Medical Treatment, Education in Abroad, etc.

When one travels abroad for Business, Holidays or any other purposes, he/she can obtain his/her Foreign Currency and Traveler’s Check permissible under Government Regulations without any hassle from any Branch of National Bank Limited (NBL).

The Key Branches of the Bank in National, Narayanganj, Chittagong and Sylhet are staffed by personnel experienced in International Trade Finance. These offices are the focal point for processing Import and Export Transactions for both small and large Corporate Customers.

The Bank is offering its Customers, Professional Advice on all aspects of International Trade Requirements, namely:

Issue, Advising and Confirmation of Documentary Credits

Arranging Forward Exchange Cover

Pre-shipment and Post-shipment Finance

Negotiation and Purchase of Export Bills

Discounting of Bills of Exchange

Collection of Bills

Assist Customers to insure all Risks

In the International Trade & Foreign Exchange Activities, National Bank Limited do the following operations:

1. Documentary Credit

Having a worldwide network of correspondents and a team of experienced trade professionals, National Bank Ltd. is uniquely poised to establish Documentary Credits in most currencies and can provide for drawings at sight or at a term to suit your financing requirements. The Bank can also arrange confirmation of Documentary Credit – an additional undertaking given by our correspondent banks providing for payment to the exporter ‘without recourse’ for documents presented in strict compliance with the terms and conditions of the Documentary Credit.

The Bank also deals in all types of Export letters of credits. Each day, the Bank advises a large number of export credits, and arranges opening of back to back letters of credit.

2. Forward Exchange Cover

The Bank can arrange Forward Exchange Cover to provide protection against fluctuation in Exchange Rates. Supported by REUTERS Dealing System, the Bank’s Foreign Exchange Dealers are able to provide its Customers the most competitive solution for their Foreign Exchange Requirements.

3. Pre-shipment and Post-shipment Finance

The Terms of Payment desired by the Importers or Exporters may differ at times, e.g. Sight Payment required by the Exporters, but 180 day terms required by Importers. National Bank Limited (NBL) can tailor Provision of Finance to suit the Importers needs. Pre-shipment Finance can be made for the Export of Goods for the period between receipt of orders and the time of shipment. Post-shipment Finance is available from the time between the shipment date and receipt of payment. These forms of Finance preserve the Importers and the Exporters Working Capital.

4. Negotiation or Purchase or Discounting of Bills

National Bank Limited (NBL) offers Negotiation, Purchasing or Advancing Funds against Shipping Documents drawn on the Overseas Buyer and crediting the Exporters immediately with the Proceeds, Less Bank Charges and Interests.

The Exporters have the option of receiving the proceeds in Local Currency or in the Currency of the bill of exchange. The Bank offers facility to open Exporters’ Retention Quota Account to retain Exports Proceeds in a Foreign Currency Account as permissible under regulations.

If Shipment is being effected under a Documentary Credit calling for a term or sight bill of exchange with Charges for Account of the Beneficiary. National Bank Limited (NBL), upon request, will discount the bill of exchange and credit the Exporters immediately, provided Documents presented are in strict, Compliance with all stipulated terms and conditions of the Documentary Credit.

Full recourse is preserved against the drawer of a bill of exchange and in the event of non-payment the Bank will look to the exporter to reimburse the full amount of the transaction.

5. Local Documentary Bills for Collection (LDBC)

National Bank Limited (NBL) arranges the Forwarding of Documents on the behalf of its Customers and Collection of Proceeds being received following payment by the Overseas Parties.

6. Insurance Cover

National Bank Limited (NBL)’s Trade Professionals assist the Customers to satisfy that the Goods have been insured to cover all the Risks involved. This is a Complimentary Service provided by the Trade Team of the Bank.

National Bank Limited (NBL) makes every effort to ensure that its Trade Flows are efficiently transacted, well managed and securely financed. The Bank’s Trade Solutions are customized to meet its Trade Demands with full satisfaction.

B.3.3 FOREIGN REMITTANCE SERVICE

Fund transfer from one country to another country goes through a process which is known as remitting process. Suppose a local bank has 200 domestic branches and has the corresponding relationship with a foreign bank say “X”, maintaining “Nostro Account” is US$ with the bank the bank, Bangladeshi expatriates are sending foreign remittance to their local beneficiary, through that account.

Now, when the Bangladeshi expatriates through other banks of different countries remit the fund to their “Nostro Account” with “X”, then the local International Division of Bank’s Head office will receive Telex message and the remittance section will record the advice and generate the advice letter to the respective branch of the bank. The branch will first decode the letter, verify signature and cheek the account number and name of the beneficiary. After full satisfaction, the branch transfers the amount to the account of the beneficiary and intimates the beneficiary accordingly. But sometimes complexity arises, if the respective local bank has no branch where the beneficiary maintains his account. Then the local bank has to take help of a third bank who has branch there.

National Bank Limited is the Authorized Dealer (AD) to deal in foreign exchange business. As an authorized dealer, the bank must provide some services to the clients regarding foreign exchange and this department provides the services of remitting foreign currencies from one country to another country. In the process of providing this remittance service it sells and buys foreign currency. The conversion of one currency into another takes place at an agreed rate of which the Banker quotes one for buying and another for selling.

| NBL was the first domestic bank to establish agency arrangements with the world famous Western Union in order to facilitate quick and safe remittance of the valuable foreign exchanges earned by the expatriate | |

| Bangladeshi nationals. This has meant that the expatriates can remit their hard-earned money to the country with much ease, confidence, safety and speed. | |

B.3.4 LEASE FINANCE

National Bank Limited (NBL) offers Lease Financing for acquiring of Capital Machineries, Equipments and other items. The Scheme is Flexible and can provide full funding for a Business Venture.

The Lease Financing scheme of the Bank is simple, convenient and is backed by prompt Service from a team of dedicated personnel. On the other hand, Rental Payable under Lease Financing is treated as Revenue Expenditure which, as such, is deductible for Tax purposes.

Items eligible for Lease Financing Scheme of the National Bank Limited (NBL) are:

Capital Machinery (Imported or Local) required for setting up New or BMRE of Existing Import Substitute or Export Oriented or Indigenous Technology based Industrial Units.

Medical Equipments required for the Doctors’ Chambers or Clinics, viz. etc.

Personal Computers with Dot or Laser Jet Printers, UPS, Stabilizer and other required Accessories.

Air Conditioner (Split or Window), Lift, Standby Generator, etc.

Photo Copier, Overhead Projector, Spiral Binding Machine and Laminating Machine, etc.

Video Equipments for Production of Package Program, Add Film etc.

Vehicles like Luxury Coach, Bus, Mini-bus, Truck, Closed Body Van (Covered Van) and Three-wheeler Delivery Van, Car, Microbus and Jeep (not for commercial use.)

Lease Term

Lease Terms may vary to suit the Customers’ Needs but not exceeding the Period as detailed below:

Capital Machinery or Equipments: Maximum 5 years (For Computers or Medical Equipments – generally 3 years.)

Automobiles: Maximum 4 years (For the New One) and 3 years (For the Reconditioned One)

Fees and Charges

Risk Fund, Supervision and Monitoring Charges are applicable on each item under Lease. Additionally, Project Examination or Inspection Fees are levied in related cases. The Rates however vary according to items. For this the Customers have to contact with the Branches or Investment Division of National Bank Limited (NBL) for the Current Rates.

Insurance for Leased Items

Leased Items are duly insured under the Bank’s Clauses throughout the Lease Term. In case of Automobiles, Comprehensive Insurance with RSD Clause is required covering the entire Lease Term and the Vehicle is registered in the sole name of the Bank. In all cases, Insurance Premium is borne by the Lessee.

In the Procurement and Installation of the Leased Items, the Bank accepts the choice of equipments and installation of the Customers covered under the Lease Agreement.

Availability of Fund for Procurement and Installation of Leased Items

Fund is made available after execution of Lease Agreement and Firm Purchase Order is placed with the Manufacturer or the Supplier in conformity with the Terms of the Agreement. In case of Imported Item, the Bank will open Irrevocable Letter of Credit (L/C) in its own name.

Responsibility for Repair and Maintenance of Leased Items

The Lessee is responsible for the Maintenance and Repair of the Leased Items. The Lessee is obliged to operate the Leased Item with optimum care and prudence.

Security required for the Lease Finance

Security Requirements vary according to the Nature of the Asset and Legal Status of the Lessee. The Requisites for a particular Lease Item or a Project can be ascertained by contacting the Branches or the Investment Division of the National Bank Limited (NBL).

Advance Deposit required for the Lease

An amount equal to 1 to 3 months Lease Rentals is required to be deposited before execution of the Lease Agreement. The amount of the Advance Rental is refundable without Interest on Successful Termination of the Lease Agreement, subject to necessary appropriation of Salvage Value and other Charges (if any).

B.3.5 CAPITAL MARKET SERVICES

As a diversified activity, NBL capital market services (NBL-CMS) started its operation in January 2008 with modern infrastructure facilitess. National Bank Limited (NBL) is a member of the National Stock Exchange (DSE) and Chittagong Stock Exchange (CSE).The services include opening of BO account, depository sevices of CDS. Trading in share maket,financing the clients under margin rule and counseling the investors. TK.368.60 million was earned from the activities in 2009 while it was TK 101.20 in 2008.

Trading in the Stock Exchanges

Besides the operational activated of brokerage house at NBL CMS, head office, it opened three branches at Imamgonj, Banani in National and Andeerkilla in Chittagong. We planned to open 10 to 12 branches in potential areas. To boost up its activities further CSE membership has been acquired at TK. 145.00 million. The Bank actively participates in the screen-based On-Line Trading of both the Stock Exchanges to purchase and sell Shares and Debentures on behalf of its Clients.

Investment Division offers Clients the latest updates on the Stock Prices and Trading of Stocks. The Facility may be availed by maintaining an Account with the Investment Division. A Minimum Balance is required to be maintained in the Account whilst a Commission is charged for undertaking the Trade Deals.

B.3.6 COMPANY’S COMPETETIVE CONDITIONS

National Bank Limited was born as the first hundred percent Bangladeshi owned Bank in the private sector. At present NBL has been carrying on business through its 124 branches and 11 SME / Krishi centers (total 135 service locations) spread all over the country. Since the very beginning, the bank has exerted much emphasis on overseas operations and handled a sizable quantum of home bound foreign remittance. It has drawing arrangements with 415 correspondents in 75 countries of the world, as well as with 37 overseas Exchange Companies located in 13 countries. NBL was the first domestic bank to establish agency arrangements with the world famous Western Union in order to facilitate quick and safe remittance of the valuable foreign exchanges earned by the expatriate Bangladeshi nationals. This has meant that the expatriates can remit their hard-earned money to the country with much ease, confidence, safety and speed. As it have so many branches in different areas. So people easily take their services to NBL. It has one of the most competitive advantages for NBL in the banking market.

The acronym for SWOT stands for

- STRENGTH

- WEAKNESS

- OPPURTUNITY

- THREAT

The SWOT analysis comprises of the organization’s internal strength and weaknesses and external opportunities and threats. SWOT analysis gives an organization an insight of what they can do in future and how they can compete with their existing competitors. This tool is very important to identify the current position of the organization relative to others, who are playing in the same field and also used in the strategic analysis of the organization.

C.1 Strengths of National Bank Limited (NBL):

Accountable Corporate Governance

Experienced Top Management

Good Asset Quality

In Bangladesh NBL has wide range of customer base and is operating efficiently in this country.

NBL has a bulk of qualified, experienced and dedicated human resources.

NBL has the reputation of being the provider of good quality services to its potential customers

NBL recently providing ATM facility to the customers. This is will make a great strength of NBL.

Satisfactory Business Growth

Diversified Product Lines

Good Profitability

Good Operating Efficiency

Social Welfare

C.2 Weaknesses of National Bank Limited (NBL):

Dependent on fixed deposits

Moderate risk management system

Limited delegation of power

MIS at primary stage

Limited Branch Network

Limited Market Share

Lake of advertisement

Lake of budget in case of branding

C.3 Opportunities of National Bank Limited (NBL):

Draft Drawing arrangement with major banks.

ATM, POS and other forms of Alternate delivery channels.

Product based on needs of NRB’s.

Increasing service quality and awareness among NBL Staff through training.

SME and agro based business.

Real time online banking.

Credit card in dual currency.

Basel-II compliances to tap advantages from RM system.

Opportunity to become market leader

Opportunity to brand expansion

C.4 Threats of National Bank Limited (NBL):

- Different services of FCB’S (Phone Banking/Home Ban king)

- Existing card services of Standard Chartered Grind lays Bank

- Daily basis interest on deposit offered by HSBC

- Entrance of new PCB’s Increased competition in the market

- Market pressure for increasing the SLR

- Market pressure for dollar crisis

- More banks are entering into the remittance business

- More numbers of branches of other banks have commenced business as outlets for Western Union

- Privatization of Government Banks resulting in discontinuation of TT arrangement due to conflict of business

- Rate war with Sonali, IFIC, Uttara, and Bank Asia resulting in lower Exchange gain.

- Threat of loan collection

§ Political Interference and Government Regulations

§ Unstable political environment of the country