Monetary policy is a financial tools used by economists to explain ways of managing the supply of money in an economy. By monetary policy Government control supply of money over the country. It is the relationship between interest rate and supply of money. This report focus on a theoretical overview of monetary policy in general and to know about Monetary Policy of Bangladesh. Also explain the monetary policy tools those are used in Bangladesh.

Background of the Study

Monetary policy is the term used by economists to describe ways of managing the supply of money in an economy. It is the process by which the monetary authority of a country controls the supply of money often targeting a rate of interest for the purpose of promoting economic growth and stability.

Monetary policy rests on the relationship between the rates of interest in an economy, that is, the price at which money can be borrowed, and the total supply of money

Within almost all modern nations, special institutions (such as the Federal Reserve System in the United States, the Bank of England, the European Central Bank, the People’s Bank of China, and the Bank of Japan) exist which have the task of executing the monetary policy and often independently of the executive. In general, these institutions are called central banks and often have other responsibilities such as supervising the smooth operation of the financial system.

With the creation of the Bank of England in 1694, which acquired the responsibility to print notes and back them with gold, the idea of monetary policy as independent of executive action began to be established. The goal of monetary policy was to maintain the value of the coinage, print notes which would trade at par to specie, and prevent coins from leaving circulation. The establishment of central banks by industrializing nations was associated then with the desire to maintain the nation’s peg to the gold standard, and to trade in a narrow band with other gold-backed currencies. (www.bangladesh-bank.org)

Objectives of the study

The important objectives of the study include:

i) To give a theoretical overview of monetary policy in general.

ii) To know about Monetary Policy of Bangladesh.

iii) To explore the monetary policy tools those are used in Bangladesh.

iv) To investigate the challenges that create varies to the path of implementation of monetary policy in Bangladesh.

Methodology of the Study

This study has been prepared on the basis of experience gathered from theoretical knowledge. Only secondary data have been collected to prepare this study. I have presented my experience and findings by using different figures and tables in the various part of this study.

The data are collected from the given sources.

- Prospectus of Bangladesh Bank

- Website of Bangladesh Bank

- Book, magazine etc.

For preparing this study, I have collected the information from various website.

A Theoretical Picture Of Monetary Policy

Definition of Monetary Policy

Monetary policy is the term used by economists to describe ways of managing the supply of money in an economy.

The actions of a central bank, currency board or other regulatory committee that determine the size and rate of growth of the money supply, which in turn affects interest rates. Monetary policy is maintained through actions such as increasing the interest rate, or changing the amount of money banks need to keep in the vault. (By Geoffrey St. Marie,2011)

Monetary policy includes all monetary decisions and measures irrespective of whether their aims are monetary and non-monetary, all non-monetary decision and measures that aim it affecting the monetary system.( Paul Einzig, 2008)

Monetary policy employing the central bank’s control of supply of money as an instrument for achieving the objectives of general economic policy. (Harry G. Johnson,2008)

Significance of Monetary Policy

The Monetary Policy has a great significance on economy. Some of there are as follows. (www.bangladesh-bank.org)

- To control supply of money

- To Setup rate of interest.

- To promote economic growth & stability.

- To stabilize price & low unemployment.

- To control inflation & deflation.

Tools of Monetary Policy Generally Used

Monetary policy tools are as follows

a) Monetary base

Monetary policy can be implemented by changing the size of the monetary base. Central banks use open market operations to change the monetary base. The central bank buys or sells reserve assets (usually financial instruments such as bonds) in exchange for money on deposit at the central bank. Those deposits are convertible to currency.

b) Reserve requirements

The monetary authority exerts regulatory control over banks. Monetary policy can be implemented by changing the proportion of total assets that banks must hold in reserve with the central bank. Banks only maintain a small portion of their assets as cash available for immediate withdrawal; the rest is invested in illiquid assets like mortgages and loans. By changing the proportion of total assets to be held as liquid cash, the Federal Reserve changes the availability of loan able funds. This acts as a change in the money supply

c) Discount window lending

Discount window lending is where the commercial banks, and other depository institutions, are able to borrow reserves from the Central Bank at a discount rate. This rate is usually set below short term market rates (T-bills).It is of note that the Discount Window is the only instrument which the Central Banks do not have total control over.

d) Interest rates

The contraction of the monetary supply can be achieved indirectly by increasing the nominal interest rates. Monetary authorities in different nations have differing levels of control of economy-wide interest rates. . By raising the interest rate under its control, a monetary authority can contract the money supply, because higher interest rates encourage savings and discourage borrowing. Both of these effects reduce the size of the money supply.

e) Currency board

A currency board is a monetary arrangement that pegs the monetary base of one country to another, the anchor nation. As such, it essentially operates as a hard fixed exchange rate, whereby local currency in circulation is backed by foreign currency from the anchor nation at a fixed rate. Thus, to grow the local monetary base an equivalent amount of foreign currency must be held in reserves with the currency board. This limits the possibility for the local monetary authority to inflate or pursue other objectives.

f) Unconventional monetary policy at the zero bound

Other forms of monetary policy, particularly used when interest rates are at or near 0% and there are concerns about deflation or deflation is occurring, are referred to as unconventional monetary policy. These include credit easing, quantitative easing, and signaling. (Monetary Policy”. Federal Reserve Board. January 3, 2006.)

Bodies of Monetary Policy

With the recommendation of World Bank/IMF, government in 2003 provided the degree of autonomy to the bank to carry out its responsibilities without undue interference of the government and a new body, called co-ordination Council.

Monetary Policy Decision- Making Process

The MPC sets monetary policy that is consistent with domestic economic conditions to ensure price stability and sustainable economic growth. In addition, the MPC plays an important role in determining guidelines for exchange rate policy that is consistent with the monetary policy stance. Approximately every six weeks ( 8 times a year), the MPC needs to assess the economic and financial condition as well as the risk factors that may affect future inflation and economic growth in its consideration of monetary policy direction. In each meeting the MPC secretariat presents the latest economic data on financial market conditions, fiscal position, international financial environment, and production, as well as other factors that may affect the price level, including world commodity prices and US interest rates. The plausible trends of these variables are widely discussed and subsequently incorporated into the inflation and GDP forecasts.

The Bangladesh Bank undertakes open market operations to ensure that the policy rate is held- as close as possible- to the level determined by the MPC. Each quarter, the Bangladesh Bank publishes a quarterly inflationary report to present the latest economic and inflation forecasts to the MPC in a clear and forward looking manner, as well as communicates to the general public views of the MPC to in reaching their various policy decisions. (Bangladesh Economic Review 1999, Ministry of Finance, Government of Bangladesh.)

Monetary Policy: Bangladesh Experience

Background of monetary policy in Bangladesh

The policy adopted by the central bank for control of the supply of money as an instrument for achieving the objectives of general economic policy. As stated in the Bangladesh Bank order 1972, the principal objectives of the countries monetary policy are to regulate currency and reserves. To manage the monetary and credit system; to preserve the par value of domestic currency ; to promote and maintain a high level of production, employment and real income ; and to foster growth and development of the country’s productive resources in the best national interest. Although the long term focus of monetary policy in Bangladesh is on growth with stability, the short term objectives are determined after a careful and realistic appraisal of the current economic situation of the country.

With the shift of the policy stance of the government in various phases, necessary adjustments were made in the country’s monetary policy in the first year after liberation, the primary target of monetary policy was to regulate not the quantity of money, but the direction of the flow of money and in support of the government financial programmed. In 1975, Bangladeh entered in to a standby-arrangement with IMF and the country’s monetary policy got a changed shape, which fixed an explicit target to save limit of monetary expansion on annual basis, with this change, Bangladesh Bank started setting short-term objectives of monetary policy in close collaboration of the government and tried to achieve the target by using the direct instrument of control. The principal target of monetary control was broad money (M2) i.e. , the sum of the currency in circulation and the total deposits of money in banks. The targeted growth of M2 depended on a realistic forecast of the growth rate of real GDP, an acceptable rate of inflation and an attainable level of international reserve.

Bangladesh Bank took majors to monitor credit and monetary expansion keeping in view the price situation and international reserve position. Efforts were made to achieve the targeted growth of domestic credit and thereby, the money supply, through imposing ceiling on credit to the government, public and private sector. The major policy instrument available to Bangladesh Bank and provide liberal refinance facility at confessional rate for priority lending. According to the national economic policy, the Banks were to provide the desired volume of credit t and administered and low rate of interest. In that situation, Bangladesh Bank practically did not have any effective instrument for making adjustment in the growth of money supply or for transmitting market signals into changes in money supply. The monetary policy therefore, could not function in true sense as a result the banking system could not play its role as an effective financial intermediary. (Central Banking in the New Millenium.” Ahluwalia,)

Strategy of Monetary Policy in Bangladesh

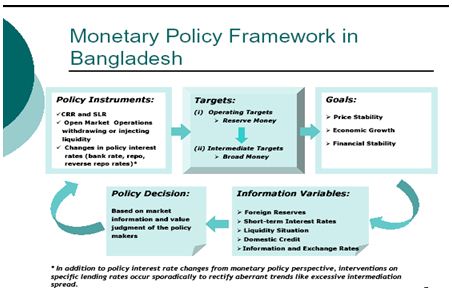

The MPS (Monetary Policy Statement) starts with expression of the monetary policy frameworks in terms of the goals, instruments, and the channels of transmission. Maintaining price stability while supporting the highest sustainable output growth is the stated objective of monetary policies pursued by the Bangladesh Bank.

Frameworks of Bangladesh’s Monetary Policy

The framework of monetary policy in Bangladesh set out below

a) The Policy Target

In this backdrop it is necessary that the monetary policy framework (in terms of the goals, the instruments, and the analytic channels of transmission) be articulated for greater clarity and transparency benefiting both the policy makers as well as the stakeholders. A policy system, where the goals are transparent and their achievement verifiable, directly adds to the credibility of the central bank, a major objective of this document is to define such a framework. Most industrial economy monetary policy is run with the task of keeping watch on both the output gap (i.e., the deviation of actual output from its long-run equilibrium level) and the inflation gap, which is similarly defined. In contrast, however, the challenge in the developing world is how to augment the capacity output through both productivity growths as well as via the installation of additional capacity.

Faster growth in most developing contexts is necessary to reduce (and eventually eliminate) common poverty. Hence the appropriate monetary policy strategy in the Bangladesh context would be to achieve the goal of price stability with the highest sustainable output growth. Any monetary stimulus to promote growth must keep in perspective the broader goal of macroeconomic stability, which is a prerequisite for future growth. Price stability would also include the stability of the currency regime.

While fiscal policy too is relevant in addressing these goals and thus there is a need

for policy coordination, monetary policy must play its due role. While leading central banks in the industrial world have increasingly adopted the unitary goal of fighting inflation, interestingly directive by enumerating-

- The promotion of price stability.

- Ensuring full employment.

- Supporting global economic and financial stability (so long as the latter maybe targeted without prejudicing the first two goals) as the chief monetary policy goals.

In broad terms therefore the latter view is consistent with the BB vision as enunciated above, although anchored along different perspectives.

b) Inflation Target

It is the general wisdom that monetary policy tools are of immediate influence in controlling inflation. However contemporary evidence amply illustrates that monetary policy cannot deal well with the inflationary impact of external shocks such as the recent international price of oil and related energy products. Many central banks as a consequence focus on the core inflation, which is typically constructed by subtracting the most volatile components (e.g., food and energy prices, indirect taxes etc) from the consumer price index (CPI). The Bank of Canada argues

that it is the core concept that better predicts the underlying price stability in the economy. Hence as a policy goal, core inflation may be a more credible target than CPI inflation. While there is no standard measure of core inflation in the Bangladesh context at this time, the construction methodology is made complex by two facts. First is that food items constitute nearly 60 percent of the CPI index, and while the appropriate commodity group weights may require a re-think, to ignore food entirely in defining the core inflation may render the construction a bit like throwing the baby away with the bath water. Secondly, in the Bangladesh context, the volatility of the international energy prices appear not to filter down to the CPI since the relevant domestic prices are subsidized by the state. Periodic adjustments in administered energy prices have always lagged the world market changes in both the time line as well as in magnitude often most dramatically. While it may be useful to focus on the non-food component of the index (which occupies only 41.6 percent of the full CPI) in order to gauge at the build-up of underlying inflationary forces in the economy, it would be unwise to treat this alone as a valid measure of core inflation.

c) Growth target

GDP growth projections of the Medium Term Macroeconomic Framework (MTMF) in the government’s National Strategy for Accelerated Poverty Reduction (NSAPR), modified appropriately in the light of unfolding actual developments, are used as output growth targets for the purpose of monetary policies.

(National Policy Forum Dhaka: 20-22 August, 2009 Organized by: Centre for Policy Dialogue, Prothom Alo, The Daily Star,)

Instruments of Monetary Policy in Bangladesh

In 1989, the government adopted a comprehensive Financial Sector Reform Programmed (FSRP), following which the country’s monetary policy assumed a new orientation towards promotion of market economy in a competitive environment. Bangladesh Bank started moving away from direct quantitative monetary control to indirect methods of Monetary management since the beginning of 1990. Although, the fixation of target continued to remain as the central piece of exercise, the way to achieve it had been changed. Credit ceilings on individual banks and direct controls of interest rates were withdrawn. At present, the money supply is regulated through indirect manipulation of reserve money instead of credit ceiling. Major instruments of monetary control available with Bangladesh Bank are the bank rate, open market operations, rediscount policy, and statutory reserve requirement.

The methods of credit Control

The methods of credit control can be classified as follows

Quantitative Methods

i) Bank rate policy

ii) Open market policy

iii) Variation of reserve ratio

Qualitative Methods

- Rationing of credit

- Direct action

- Regulation of consumers’ credit

- Moral persuasion

- Publicity

The methods of credit control are described below

Quantitative Methods

The methods by which Central Bank controls the total amount of credit in the economy are termed as quantitative methods of credit control.

Bank rate policy

The rate which central bank lends money to the commercial banks and discounts bill of exchange is called bank rate. If central bank increases the bank rate then the commercial banks will increase their marker of interest rates. As a result the borrowers borrow less form commercial banks and amount of credit reduces in the economy. In an opposite way amount of credit will be increased in the country.

Effects

Effects on price level: If bank rate increases, cost of credit will increase and the businessmen will reduce their borrowing s form commercial banks. This will reduce production and increase unemployment in the economy. As a result, income and price level will go down and depression in business and trade will be the outcome. If there is a decrease in the bank rate the opposite e results of above will be experienced in the economy.

Effects on foreign trades: An increase in bank rate wills increases other interest rates in the country. So, investment will be profitable. It will ensure the insertion of foreign capital into the economy and leakage of domestic capital will be stopped. Moreover, increased bank rate will decrease the piece level because amount of credit will be reduced into country. This decreased price level will again encourage expert and discourage import, which will make balance of payment favorable. Opposite effects of above will be experienced if the central bank decreases the bank rate in the economy.

Limitations of Bank rate policy

- Bank rate policy would not be effective if there lacks strong linkage between bank rate and market/ interest rate especially for a developing country like Bangladesh.

- If commercial banks have excessive money; then bank rate may not be effective because they will lend in lower interest rates though bank rate increases.

- Bank may successes during the time of prosperity. Because businessmen become highly ambitious of their profits in this situation and will borrow money though the interest rate increases.

- Reduction in bank rate may not be successful to increase the amount of credit during the time of depression. So, bank rate policy has several limitations in its After that it is the best weapon of central bank to control the amount of credit in the economy.

Open market policy

The method by which the central bank controls the amount of credit by selling and buying government credit instrument is termed as open market operation. When the central bank intends to contract credit, it sales the credit instruments in the market. These instruments are purchased by commercial banks and people also buy them issuing cheque to the commercial banks. Thus money goes to the central bank and amount of money for credit creation reduces which in turn contracts the amount of credit in the economy.

Limitations of open market policy

- Selling- it reduces amount of cash of commercial banks .but if commercial banks take loan form central bank it would not be effective to reduce credit.

- Buying- it increases the amount of cash in commercial banks. But it may not be able to expand credit if commercial banks repay loan to the central bank with this increased cash.

- Depreciation- During depreciation credit expansion through purchasing credit instruments is not possible. Because in this period businessmen will not want tomorrow from commercial bank.

Variation of reserve ratio

Each commercial bank has to keep legally a certain portion of its total deposits as reserve with central bank. This is called reserve ratio. If central bank increases this reserve ratio, excess reserve in commercial banks will reduce and

thus credit creation will be contracted in the economy. In an opposite way central bank can increase the amount of credit by decreasing the reserve ratio.

Limitations

- Increase in reserve ration can be effective for that commercial bank having small amount of cash. Because bank having large volume of cash will have sufficient excess reserve to create credit though reserve ration increases. In this case it will not be effective.

- Decrease in reserve ration may not be effective to expand credit during depression businessmen are discouraged to borrow in this situation.

- Non-scheduled commercial banks are out of this control.

Qualitative Methods

The methods used to control credit in special sectors for special purposes are called qualitative\selective methods of credit control. These methods do not deal with the amount of credit rather change the flow or direction of credit used in different sectors of economy.

a) Rationing of credit

Rationing of credit means fixing the amount of credit among different sectors of the economy. By this method central bank can decrease the amount of credit in one sector and can increase it in other sector. For example, if central bank thinks that there is excessive investment in garments industry and jute industry suffers form required investment, then it can order the commercial banks not to disburse credit beyond required amount in garments industry and divert the excess amount to jute industry.

Limitations

- Borrowers may use the credit money in other purposes.

- It is difficult for central bank to supervise whether the credit money is being used purposively or not.

- Sometimes commercial banks think this type of work as an unwanted intervention by central bank.

b) Direct action

If it is proved by central bank that credit creation policy of any commercial bank is not transparent then central bank can take punitive measures against that bank and thus affects its credit creation. These punitive measures may be of not rediscounting bills of exchange, discounting bills of exchange at a rate higher than the prevailing rare, etc. As a result, the commercial bank will compelled to follow sound central bank policy.

c) Regulation of consumers’ credit

It is a method to control credit in consumable goods, which are purchased in installment basis. If central bank circulates to increase the amount of down payment or reduce the number of installment then consumer’ credit will be contracted in the economy. In an opposite way consumers’ credit can be increased. It was followed in USA during Korean War.

d) Moral persuasion

To make the banking system sound and efficient, central bank sometimes requests the commercial banks to increase or decrease credit. As a guardian’s request, commercial banks follow it and thus amount of credit is controlled in the economy.

e) Publicity

Sometimes central bank applies publicity as a weapon of credit control. Central bank publishes weekly, fortnightly or monthly bulletins and annual reports where balance sheets and other business and economic condition of different commercial banks are presented well. As a result the commercial banks become more careful in the line of their credit creation. Thus central bank applies various types of measures to control credit in the economy. But central bank should apply different types of method simultaneously rather to use single method to make credit control effective. ( Bangladesh Bank Working Paper Series: WP 0708, 2007)

Challenges, Recommendation &Conclusion

Key Challenge for Monetary Policy of Bangladesh

The challenges of monetary policy in Bangladesh are as follows

- There Exist a Non-Monetized Sector

In Bangladesh there is a existence of non monetized economy in large extent people areas where many of the transaction are of the barter type and not monetary type .similarly ,due to non monetized sector the progress of commercial banks is not up to mark ,this creates a major bottleneck in the implementation of the monetary policy in Bangladesh.

- Excess Non Banking Financial Institutions (NBFI)

As the economy launch itself into a orbit of economic growth and development,the financial sector comes up with great speed as a result many non banking financial institutions (NBFI) come up ,these NBFIs also provide create in the economy ,however the NBFIs is do not come under the purview of a monetary policy and thus nullify the effect of a monetary policy.

- Existence of Unorganized Financial Markets

The financial markets help in implementing the monetary policy ,in many developing countries the financial markets especially the money markets are of an unorganized nature and in backward conditions ,in many places people like money lenders ,traders ,and business actively take part in money lending ,but unfortunately they don’t not under the purview of a monetary policy and creates hurdle in the success of a monetary policy

- Higher Liquidity Hinders Monetary Policy

In rapidly growing economy the deposit base of money commercial bank is expanded, this creates excess liquidity in the system .under this circumstance even if the monetary policy increase the CRR or SLR, it does not deter commercial banks from credit creation ,so the existence of excess liquidity due to high deposit base is a hindrance in the way of successful monetary policy.

- Money Not Appearing In an Economy

Large percentage of money never comes in the mainstream economy, rich people, traders ,business and other people prefer to spend rather than to deposit money in the bank ,this shadow money is used for buying precious metals like gold silver ,ornaments ,and land and in speculation ,this type of lavish spending give rise to inflation trend in mainstream economy and the monetary policy fails to control it.

- Time Lag Affects Success of Monetary Policy

The success of the monetary policy depends on timely implementation of it ,however ,in many cases unnecessary delay is found in implementation of the monetary policy ,or many times timely directives are not issued by the central bank , then the impact of the monetary policy is wiped out.

- Monetary and Fiscal Policy Lacks Coordination

In order to attain a maximum of the above objectives ,it is unnecessary that both the fiscal and monetary policies should go hand ,as both these policies are prepared and implementation by two different authorities ,there is a possibility of non coordination between these two policies ,this can harm the interest of the overall economic policy

Recommendation

- In Bangladesh, capital markets should be expanded and organized enough to succeed the monetary policy.

- The credit control mechanisms like open market operation, bank rate, etc. should be effective.

- A narrow bill market should make the discount rate effective.

- Banking habits are also underdeveloped which hampers the effectiveness of monetary policy seriously. So banking habits should be developed.

- Steps should be taken to abolish the existence of liquidity trap.

- To run the monetary policy smoothly and effectively, it is essential to pay sufficient attentions to increase the GDP.

Conclusion

In view of formulating credible monetary policy to attain the achievement of economic objective, the difficult part for the central banks is to distinguish, within ongoing inflation evolutions, between short term volatility and the underlying pressure of inflation,. While it has now become standard practice for most central banks around the world to monitor core inflation, no progress has so far been made in the Bangladesh context. The paper takes a pioneering look in measuring core inflation in Bangladesh focusing on the popular exclusion and trimmed mean approaches. The performance criteria adopted in this analysis so that the measure of core inflation developed in the paper has strong money-induce characteristics and therefore, can credibly be used as a short or medium term guide of monetary policy in Bangladesh.