Today’s fast growing companies need business banking services that fully meet their expectations for speed, convenience, efficiency and security. To ensure their optimum level of satisfaction, regarding their necessity for this type of affluent banking services different types of local as well as multinational banks are coming up with diverse and dynamic corporate banking services.

Banks are playing a vital role in the economic progress of our country. Now-a-days, the banks try to give priority in the perspective of our national interest. The Banking Industry in Bangladesh is one characterized by strict regulations and monitoring from the central governing body, the Bangladesh Bank. The chief concern is that currently there are far too many banks for the market to sustain. As a result, the market will only accommodate only those banks that can transpires the most competitive and profitable ones in the future.

Bank perform the in dispensable task of intermediating between the two groups and offering convenient financial service to surplus-spending individuals and institutions in order to attract fund and these loaning those funds to deficit- spending individuals and institutions. Another contribution of bank make their willingness to accept risky loan from borrower, while issuing low risk securities to their depositors. Bank also satisfies the strong needs of much customer’s liquidity. It is true thus clear that the underlying principle of a business of banking is that the resources mobilized through the acceptance of deposit must contribute the main stream of funds, which are to be utilized for lending or investment purpose.

STATEMENT OF THE RESEARCH PROBLEM

The prime reason of this study is to become familiar with a practical business world and to attain practical knowledge about the banking corporate world, which is so essential for each and every student to meet the extreme growing challenges in job market. It is also known to all of us that there is no alternative of practical knowledge & practical knowledge is much more durable & useful than the theoretical knowledge. This study will help us to get a true picture of practical business world particularly about the various aspects of Agrani Bank Ltd. So this is of paramount importance for each student, regardless of his/her study area of disciplines.

I have tried to prepare the in such a way that it reflects what I learn during this period. I tried to clarify my experience with practical knowledge on General Banking activities.

OBJECTIVE OF THE STUDY

The main objective of the study is to gain practical knowledge and to acquire knowledge about the practice banking business. In addition, the prime objective of the study is to know the existing banking business in Agrani Bank Ltd.. The other objectives are given below:

As a part of the MSS program.

- To have an exposure on the banking environment of Bangladesh.

- To define the strategies regarding the strength and weakness of the bank.

- To Identifying the difference between theory and practice overall Management

- To know the general banking function, it’s procedures, rules and regulation

- To know the activities of the foreign exchange department

- To provide information about the ABL to the future researcher and readers who want to know about this bank.

- To identify the major policies by which they are operating now.

- To identify the facilities offered by the Agrani Bank Ltd.

METHODOLOGY OF THE STUDY

Data collection

The data needed for conducting the study has been collected from the primary sources as well as secondary sources. In collecting the necessary data, care has been taken so that all the variables that in some way can’t affect the objectives of the study. The information that I used in this study is collected by the following way:

Primary Data Sources:

Primary information has been collected through:

** Different Manuals of ABL

** Different circulars of ABL

Secondary Data Sources:

Most of the information required for my study purpose was collected from secondary sources:

** Institution booklet & annual report

** Policy guide hand notes

** Circulars,

** Publish book

** Different Papers of ABL

** Prospectus of ABL

** Unpublished Data

** Different Text Books

** Official Documents

The major portion of data sources has been collected from secondary data sources. Information required formulating suggestions and recommendation have been availed from related text and research papers.

Data Analysis

I analyzed the data to find out the required information. I used necessary number of table, chart, and graph to present the report. Ms-Word, Excel or any required computer program used to process the data. . Necessary tables have been prepared on the basis of collected data and various statistical techniques have been applied to analyses on the basis of classified information

Limitations of the study

Objective of the practical orientation program is to have practical exposure for the students. Our tenure was for three months only, which was somehow not sufficient. After working whole day in the office it was very much difficult to study again the theoretical aspects of banking.

Other limitations are as follows:

- Most of the information has been taken from Secondary sources.

- Very few statistical tools have been used.

- For the lack of our practical knowledge, some shortcoming may be available in the paper.

- The bank has naturally shown us some indifference connecting its most confidential information.

- The executives of Agrani Bank Ltd were too busy to spare time for the terms paper.

- The duration of our internship program is only 3 months. The allocated time is not sufficient for us to gather knowledge and to make the study a complete and fruitful one.

- The study also suffered from inadequacy of data provided by Agrani Bank Ltd.

Banking Business in Bangladesh

Regulatory Authority of Banking Industry in Bangladesh:

Banking Business in Bangladesh

Bangladesh shares a common past with India and Pakistan in respect of development of the business of banking. Historians try to trace the origin of banking to the Vedic age. The writings of Manu bear testimony to what can be called a crude from a banking. The reference to the business of banking, albeit again of rudimentary form, could be found in the Katell’s “Arthoshastro”. These ‘banks’ were in fact family run enterprises. With the advent of Muslim rule in India the fortune hunting Afghan traders started money lending business in exchange of interest some time in 1312 A.D. They were know as “Kabuliawallas”.

History:

The banking system at independence consisted of two branch offices of the former State Bank of Pakistan and seventeen large commercial banks, two of which were controlled by Bangladeshi interests and three by foreigners, other than west Pakistan. There were fourteen smaller commercial banks. Virtually all banking services were concentrated in urban areas. The newly independent government immediately designated the Dhaka Branch of the State Bank of Pakistan as the Central Bank and renamed it the Bangladesh Bank. The bank was responsible for regarding currency, controlling credit and monetary policy, and administering exchange control and the official foreign exchange reserves. The Bangladesh Government initially nationalized the entire domestic banking system and proceeded to reorganize and renamed the various banks. Foreign owned banks were permitted to continue doing business in Bangladesh.

Banking System in Bangladesh:

At the moment financial sector reform programs are underway. Private banks and insurance companies with few exceptions are functioning creditably. Bangladesh pursues a liberal market economy. Bangladesh Bank is the apex bank of the country responsible for promoting healthy growth and development of the banking system. Banks and insurance companies, both in the private and public sectors, are operating freely and contributing to the economy. Foreign banks like HSBC, SCB, City Bank etc. function in Bangladesh through their branches.

Wider commercial role:

The commercial role of banks is not limited to banking and includes;

- Issue of banknotes (promissory notes issued by a banker and payable to bearer on demand.)

- Processing of payments by way of telegraphic transfer, EFTPOS, internet banking or other means.

- Issuing bank drafts and bank cheques

- Accepting money on term deposit

- Lending money by way of overdraft, installment, loan or otherwise.

- Safekeeping of documents and other items in safe deposit boxes.

- Currency exchange

Economic Function:

The economic function of banks include:

- Issue of money

- Netting and settlement of payments

- Credit intermediation

- Credit quality improvement

- Maturity transformation

Regulatory Authority of Banking Industry in Bangladesh

Bangladesh Bank is a typical central bank of a third world country with a medley of tasks on its agenda. These agenda include not merely issuing notes and controlling supply of money but also the responsibility to act as the holder of gold and currency reserves, banker to the government, lender of the last report, supervisor of the banking system, overseer of national credit policy, promoter of credits to agricultural and other important socio-economic sector and administrator of exchange control.

Bangladesh Bank:

Bangladesh Bank (BB) has been working as the central bank since the country’s independence. Its prime jobs include issuing of currency, maintaining foreign exchange reserve and providing transaction facilities of all public monetary matters. BB is also responsible for planning the government’s monetary policy and implementing it thereby.

Banking Legislations of Bangladesh:

The Banking Companies act, 1991, has been the most important piece of legislation enacted in Bangladesh to define all aspects of operation of banking institutions and regulation of their activities by regulatory authorities. This important landmark was preceded by a medley of laws passed by the parliament and presidential Ordinances and Orders enacted or promulgate during the British and later Pakistan eras.

Bangladesh Bank Order, 1972: 1991, Bangladesh Bank Order, 1972 also contains a few provisions about regulating some aspects of banking operation.

Conclusion

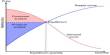

At last we can say that SWOT analysis is the detailed study on the organization’s exposure and potential in perspective of its strengths, weakness, opportunity and threat. This facilities the organization to make their existing line of performance and also foresee the future to improve their performance in comparison to their competitors. As though this tool, an organization can also study its current position, it can also be considered as an important tool for making changes in the strategic management of the organization.