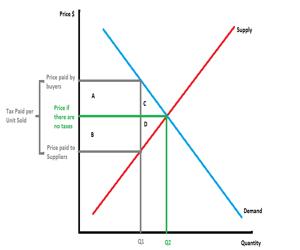

Inflation tax is not a real legal tax paid to a government; instead “inflation tax” refers to the consequence for hold cash at a time of high inflation. When the government prints extra money or reduces interest rates, it floods the market with money, which raises inflation in the future. If an investor is holding securities or other property, the outcome of inflation may be small. The amount of reduce in the price of cash is termed the inflation tax for the way it punishes people who grip assets in cash, which tend to be lower and middle-class income earners.

Inflation Tax