A Study of Import Process of Nestlé Bangladesh

Nestlé is World‟s largest health, nutrition and wellness company founded by the Henri Nestlé. Nestlé Bangladesh Limited started its commercial operation in 1994. Nestlé Bangladesh established its factory in Sreepur 55 km north of Dhaka. The factory produces the instant noodles and cereals and repacks milks, soups, beverages and infant nutrition products. This company is continuously growing through the policy of constant innovation, concentrating on its core competencies and its commitment to high quality food to the people of Bangladesh. To ensure high quality product Nestlé Bangladesh import most of their raw materials , the also use local raw materials as well but compare to imported raw materials it is low. The whole import procedure of raw material is done by Supply chain and Treasury Department. Supply chain place their requirement of raw material to respective suppliers through purchase order. Once the order is confirmed they request treasury department to open up a Letter of Credit or CAD (Cash against Documents), L/C is the most popular international trade payment method in Bangladesh as well as in Nestlé Bangladesh, which covers the issues like potential risk that the parties in international trade namely the importers and exporters wish to face or share between them. There are different parties involved in opening a Letter of credit and it also requires authorized papers to submit to their Authorized LC opening bank and they will facilitate NBL and give guarantee to the respective suppliers about the payment procedure. Once NBL opened the LC supplier get to know through their bank and they shipped the goods to the destined location. In this paper the whole procedure of LC opening to retirement is briefly explained.

Specific Objective

- To know about Nestlé Global and Nestlé Bangladesh Ltd.

- To know about the company‟s current mission, vision,objectives,and goals

- To have a very practical idea about the Import process of Nestlé Bangladesh

Methodology

The study is conducted on systematic procudure starting from the selection of the topic to final presentation. I presented this report on the basis of my experince as an intern in Nestlé Bangladesh Ltd. During these four months I have conducted descriptive research and used my practical experience .

Sources of Data

Primary Data: Sevaral disucussion with the different deparment of Nestlé Bangladesh. Moreover at the time of doing my task, gathered the required information.

Secondary data: Along with primary sources, several information collected from the Internet and from the website of Nestlé Bangladesh.

Corporate Portfolio of Nestlé

The brand portfolio delivers the message once again how big Nestlé in the food industry. It is the trust and effort of the Nestlé professionals which created the scenario. Today Nestlé covers almost every food and beverage category – giving consumers tastier and healthier products.

- Baby food:Cerelac, Gerber, Gerber Graduates, NaturNes, Nestum

- Bottled Water: Nestlé Pure Life, Perrier, Poland Spring, S.Pellegrino

- Cereal:Chocopic, Chini Minis, Cookie Crisp, Estrelitas, Fitness, Nesquik Cereal

- Chocolate & confectionary:Areo, Butterfinger, Cailler, Crunch, kit kat, Orion, Smarties, Wonka

- Coffee: Nescafé, Nescafé 3 in 1, Nescafé Cappuccino, Nescafé Classic, NescaféDecaff, Nescafé Dolce Gusto, Nescafé Gold, Nespresso.

- Culinary Chilled and Frozen food:Buitoni, Herta, Hot Pockets, Lean Cusine, Maggi

- Dairy: Carnation, Coffee-Mate, La Laitére, Nido

- Drinks:Juciy juice, Milo, Nesquick, Nestesa

- Food Service: Chef, Chef-Mate,Maggi, Milo, Minor‟s, Nescafé, Nestea, Sojra

- Healthcare nutrition: Boost, Nutren Junior, Peptamen, Resource

- Ice Cream: Dreyer‟s, Extreme, Haagen-Dazs, Movenpick

- Petcare: Alpo, Bakers Complete, Benful, Cat Chow, Chef Michael‟s Canine Creation, Dog Chow

History of Nestlé

1866-1905

In the 1860s Henri Nestlé, a pharmacist, developed a food for babies who were unable to breastfeed. His first success was a premature infant who could not tolerate his mother’s milk or any of the usual substitutes. People quickly recognized the value of the new product, after Nestlé’s new formula saved the child’s life, and soon, FarineLactée Henri Nestlé was being sold in much of Europe.

1905-1918

In 1905 Nestlé merged with the Anglo-Swiss Condensed Milk Company. By the early 1900s, the company was operating factories in the United States, Britain, Germany and Spain. World War I created new demand for dairy products in the form of government contracts. By the end of the war, Nestlé’s production had more than doubled.

1918-1938

After the war Government contracts dried up and consumers switched back to fresh milk. However, Nestlé’s management responded quickly, streamlining operations and reducing debt. The 1920s saw Nestlé’s first expansion into new products, with chocolate the Company’s second most important activity.

1938-1944

Nestlé felt the effects of World War II immediately. Profits dropped from $20 million in 1938 to $6 million in 1939. Factories were established in developing countries, particularly Latin America. Ironically, the war helped with the introduction of the Company’s newest product, Nescafe, which was a staple drink of the US military. Nestlé’s production and sales rose in the wartime economy.

1944-1975

The end of World War II was the beginning of a dynamic phase for Nestlé. Growth accelerated and companies were acquired. In 1947 came the merger with Maggi seasonings and soups. Crosse & Blackwell followed in 1960, as did Findus (1963), Libby’s (1971) and Stouffer’s (1973). Diversification came with a shareholding in L’Oréal in 1974.

1975-1981

Nestlé’s growth in the developing world partially offset a slowdown in the Company’s traditional markets. Nestlé made its second venture outside the food industry by acquiring Alcon Laboratories Inc.

1981-1995

Nestlé divested a number of businesses1980 / 1984. In 1984, Nestlé’s improved bottom line allowed the Company to launch a new round of acquisitions, the most important being American food giant Carnation.

1996-2002

The first half of the 1990s proved to be favorable for Nestlé: trade barriers crumbled and world markets developed into more or less integrated trading areas. Since 1996, there have been acquisitions including San Pellegrino (1997), Spillers Pet foods (1998) and Ralston Purina (2002). There were two major acquisitions in North America, both in 2002: in July, Nestlé merged its U.S. ice cream business into Dreyer’s, and in August, a USD 2.6bn acquisition was announced of Chef America, Inc.

2003 +

The year 2003 started well with the acquisition of Mövenpick Ice Cream, enhancing Nestlé’s position as one of the world market leaders in this product category. In 2006, Jenny Craig and Uncle Toby’s were added to the Nestlé portfolio and 2007 saw Novartis Medical Nutrition, Gerber and Henniez join the Company.

Corporate Mission:

At Nestlé, they believe that research can help them make better food so that people can live a better life. As consumers continue to make choices regarding foods and beverages they consume, Nestlé provide selections for all individual taste and lifestyle preferences.

Research is a key part of their heritage at Nestlé and an essential element of their future. They know there is still much to discover about health, wellness and the role of food in our lives, and they continue to search for answers to bring consumers Good Food for Good Life.

Corporate Vision:

Nestlé has an aim to meet the various needs of the consumer every day by marketing and selling food of a consistently high quality.

Good Food is the primary source of Good Health throughout life. Nestlé strive to bring consumers foods that are safe, of high quality and provide optimal nutrition to meet physiological needs. In addition to Nutrition, Health and Wellness, Nestlé products bring consumers the vital ingredients of taste and pleasure.

Confidence that consumers have in Nestlé respected brands, is a result of their company‟s many years of knowledge in marketing, research and development, as well as continuity – consumers relate to this and feel they can trust Nestlé‟s products.

The objectives are to deliver the very best quality in everything, from primary produce, choice of suppliers and transport, to recipes and packaging materials.

Nestlé in Bangladesh

Popular Nestlé brands started entering this part of the sub-continent during the British rule and the trend continued during the pre-independence days of Bangladesh. Nestlé Bangladesh limited started its commercial operation in Bangladesh in 1994. In 1998 Nestlé S.A. took over shares from local partner when Nestlé Bangladesh became a fully owned subsidiary of Nestlé S.A. The only factory produces the instant noodles and cereals and repacks milk soups beverages and infant products.

In Bangladesh Nestlé‟s vision is to be recognized as the most successful food and drink Company in Bangladesh, generating sustainable, profitable growth and continuously improving results to the benefit of shareholders and employees.

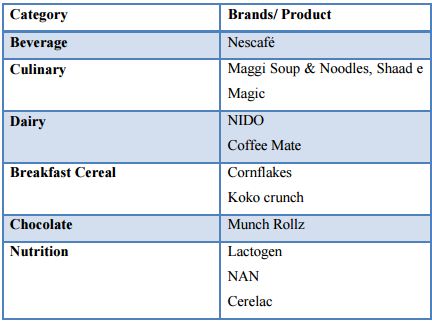

Products in Nestlé Bangladesh

Globally the product line of Nestlé is very large but in Bangladesh currently there are only 11 products. Nestlé believes all foods and beverages can be enjoyable and play an important role in a balanced and healthy diet and lifestyle; as a result how short the product line may be but it ensures the same quality in compare to the other countries.

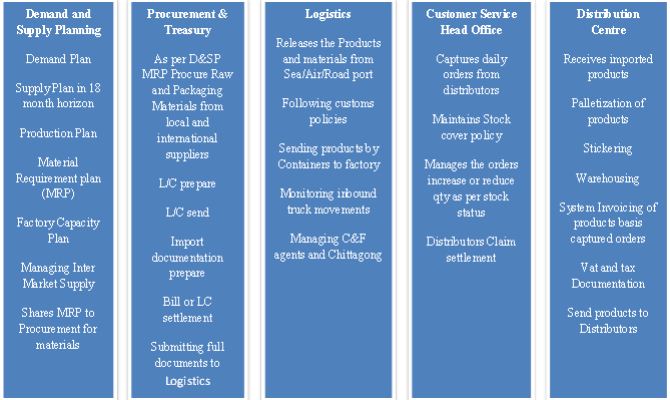

Functions of Nestlé Bangladesh

Day by day the demand and trust on the Nestlé products are growing. Focusing on the substantial growth and the other business perspective, the company developed its own functional areas.

Every function‟s main aim is to gain the ultimate excellence. Every function contributes from their end to meet the corporate goal. General Management takes cares of the overall operation and makes the key decision. Finance and control deals with the financial transaction and most importantly they also apply the control mechanism to remain the company complaint financially. Human resource focuses the management of employees and organizational Culture and also recruit best employee for NBL. Supply chain ensures the stable supply of the products according to the demand of the consumers; they are responsible to communicate with the supplier and import raw materials accordingly with the help of Finance and Control. Marketing looks after the existing brands, market share and product development. As Nestlé is the world‟s largest Nutrition Company so they have separate department Nutrition to look after the Nutritional products like CERELAC. Finally Sales and Nestlé Professionals are responsible for earning revenue for the company, but sales look after the retail distributer and Nestlé professionals look after institutional sales.

Flow of Import System

As Nestlé‟s tag line is “Good Food Good Life” they produce the product using high quality raw material. NBL imports most the raw materials and also locally procures some of raw materials. NBL imports

- RAW Material

- CAPX items

- Finish Goods

- Packaging Material

Importation of Goods looks after by jointly Supply chain Department and Treasury Department, but behind import every department has their assigned jobs, Import is the final part of a Trade Cycle.

L/C opening Request

When NBL decides the volume for monthly then Demand Planner sent it to Procurement department and procurement department contact with the supplier for purchasing the raw materials and place Purchase Order (PO). As soon as they confirmed the deal with supplier, they asks for-

- Pro-forma Invoice–Description of the product

- Country of origin

- Quantity

- Payment terms

- tolerance level (if required)

- Product price.

Logistic Department contacts with the Shipping Agent In case of FOB term and asked for-

Freight Certificate: The rate of freight has been set depending on the country and the container size. When they got the PI, procurement Department sent the L/C request to open a L/C to treasury department mentioning the following information

- Purchase Order (PO)

- Pro-forma Invoice with detail description

- Inco Term [FOB (Freight on Board), CFR (Cost and Freight), CPT (Cost Paid To)]

- Port details

- Terms & condition

- PSI(Pre shipment inspection) Mandatory/ Exempted

- S Code (Harmonized Commodity Description and coding system)

- Product Description

- Bank Name

- Port of Delivery

- Port of Shipment

Letter of Credit or CAD (Cash against Documents)

Trade transaction is gradually increasing in the international arena and for this international trade payment is particularly very crucial. There are so many factors that may affect the matter of securing payment for an international transaction. Most important among them are the potential risk and cost that the exporters and the importers are willing to face or share between them. There are some methods among them Nestlé Bangladesh follow 2 methods

- Letter of Credit or Documentary Credit

- Cash Against Documents

Letter of Credit or Documentary Credit

The most important of the payment methods used universally is a Letter of Credit which is also called Documentary Credit. Letter of credit is an instrument issued by a bank on behalf of the importer to make payment of agreed sums in foreign currency as stipulated to the exporter when the conditions specified in the document are met.

Letter of Credit (L/C) is the most popular international trade payment method in Bangladesh as well as in Nestlé Bangladesh, which covers the issues like potential risk that the parties in international trade namely the importers and exporters wish to face or share between them. This process is governed by a widely recognized and popular guiding framework of ICC (International Chamber Of Commerce) known as „Uniform Customs and Practices for Documentary Credit‟ publication number 600.

Forms of Letter of Credit

There are many types of Letter of Credits that are used in different countries of the world.

But International Chamber of Commerce (ICC), UCPDC- 600, which denotes only two types of LETTER of Credit are as follows-

- Revocable letter of credit:

If any letter of credit can be amendment or charge of any clause or cancelled without the consent of the exporter and importer is known as revocable letter of credit. It can be amended or cancelled by the issuing bank at any time without prior notice to the beneficiary. It does not constitute a legally binding undertaking by the bank to make payment.

- Irrevocable letter of credit:

If any letter of credit cannot be changed or amendment without the consent of the importer and exporter is known as irrevocable letter of credit. It constitutes a firm undertaking by the issuing bank to make payment. It therefore, gives the beneficiary a high degree of assurance that he will be paid to his goods or services provide he complies with terms of the credit.

**Nestlé Bangladesh Follows Irrevocable Letter of Credit process.

Advantages & Disadvantages of L/C

Advantages

- The importer is assured that the documents required by the letter of credit (if issued subject to the UCP) must be presented in compliance with the terms and conditions of the documentary credit and UCP rules.

- The buyer is assured that the documents presented will be examined by banking personnel knowledgeable in letter of credit operations.

- The importer is confident that the payment will only be made to the exporter after the fulfilment of the terms and conditions of documentary credit.

Disadvantage

- High bank charges.

Cash against Documents

Greater involvement of costs in letter of credit operations is one of the main reasons of switching to other modes of payment like Cash against Documents which is another payment process followed by Nestlé Bangladesh. In this process importer directly deals with the supplier fixed their terms and conditions and place the requirements. Banks have no role in this process. Nestlé Bangladesh open LCA in case of their most trustworthy suppliers on whom they can rely because the requirement we need, quality of the raw materials provided by the suppliers is totally based on trust we have on the supplier because we cannot bind them legally as there is no bank involvement. If they don‟t provide the raw material as per our requirement unless accepting those we don‟t have anything to do. The process is given below

- Importer Contacts with the Supplier and fixes deal

- Supplier Exports the Goods

- Supplier Provide Shipping Documents to their Bank

- Bank sends the documents to Importer‟s Bank

- Importer pays their bank for the Goods

- Importer‟s Bank gives the shipping Documents to Importer

- Importer‟s Bank transfer the payment to Exporter‟s bank

- Exporter‟s Bank pays off to the Exporter

Here Bank does not take any responsibilities for verifying the shipping documents. They just charge fees for facilitating Cash against Documents Transaction. Importer and Exporter both have to pay the charge advised by their own bank.

Advantage&Disadvantagesof LCA (Cash against documents)

Advantage

Less bank charges involved as importers directly deals with the supplier

Disadvantage

- Importer cannot bind the supplier legally if they don‟t provide the raw materials as per our requirements as bank don‟t verify the documents that are provided by the supplier. So if any complications arrive regarding the documents and raw material unless accepting the risks associated with this we don‟t have any option.

- In case of Finish goods as per the import policy (2013-2015) under Chapter 2 section 8 and sub section 4 it says that permissible goods (IRC commercial) goods can‟t be imported more than USD 1 lac in per fiscal year.

- Demand projection is difficult to be accurate. Nestlé Bangladesh requires frequent amendment depending on market condition so in case of LCA we can‟t amend, for this reason L/C is more preferable.

- In case of Importing Raw materials we can open LCA but for FONTERRA products (Growing up Milk Powder, Whole milk Powder Instant Fortified) amendment is frequently required so we can‟t import these two products through LCA.

- As CAPX item import very infrequent so Nestlé Bangladesh opens it through L/C but there is no objection to import it through LCA.

After getting the L/C request we contact with the insurance company for the risk coverage. We provide them the Pro-forma invoice and they assess the Premium that has to be paid before opening the L/C. We communicate with our bank to pay the premium, when insurance company gets the bill they provide the cover note. According to Imported Import policy

(2012-2015) chapter 2 sections 5 sub section (e) says that before opening L/C, necessary insurance cover note shall be purchased from the respective Insurance Company by paying the Premium against the Goods.

Insurance process for opening a LC

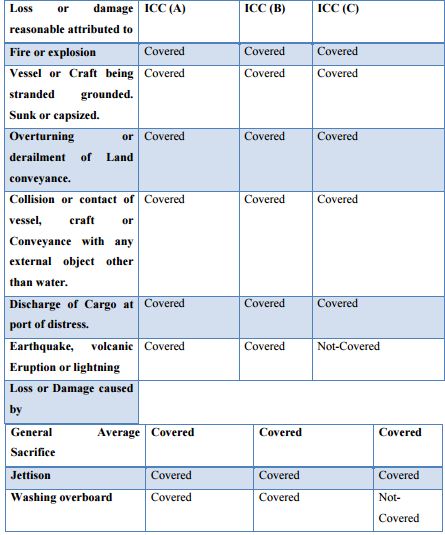

In Bangladesh Marine Cargo Insurance policies are prepared and issued in line with the recommendation of the United Nations Conference on Trade And Development(UNCTD) making the revised wording of the Institute Cargo Clause (ICC) mandatory from 31-3-1983. With the introduction of new policy form the new century old policy form and perils have been withdrawn and replaced by ICC (A) ICC (B) ICC (C) clauses respectively

The Mode of transportation:

Using which transport the product will be imported is one of the main factors for determining premium. The charges are different for different mode of transport. The Modes of transports are:

- A) Marine B) Air C) Road & Railway

And each of the modes has different Categories. Based on these two factors premium has been charged on the import.

Marine:

This marine cargo insurance covers the damaged or detriment by perils of the seas whilst in course of transit and therefore, the owner of the imported goods can always insure against the possible losses.

The Company also grants wider cover like Theft, pilferage and non-delivery (TPND) with ICC(C) on payment of additional premium as per tariff.

All the perils mentioned below may be obtained with ICC (B) on payment of additional premium.

- Scratching/Splitting, Breakage, hooks, holing, bursting, tearing,

- Leakage, rain water damage, theft pilferage & non-delivery.

The following additional perils are automatically covered under the Marine Policy:-

(1) 60 days cover at sea port from the date of discharge from the ship under “A” “B” & “C”

(2) WAR & SRCC covers are available on payment of additional premium.

Goods Carried By Rail/Lorry/Truck

Goods or cargo covered by above transports may be covered as under

1) By Rail/Lorry/Truck Risk only

2) By Rail/Lorry/Truck All Risks.

Goods Carried By Air

Goods or cargoes conveyed by above transport may be covered as under:

Air Risk Only

Air All Risks

Premium Rates

- All insurance company has to follow the Tariff book in order to set the Premium amount for import & export which is regulated by IDRA (Insurance Development Regulatory Authority).

- Use Air all and Lorry all risk for importing through Air and Lorry.

- Also take WAR & SRCC covers on payment of additional premium

- Stamp Duty/ Vat and other taxes:

- Marine policy shall carry stamp duty as per the stamp Act 1889 (and subsequent amendments thereto). The stamp duty shall be recoverable from the Assured

- VAT and other taxes shall be charged to the insured as per law.

L/C Opening Process

Documents that needed to open a L/C

Fund Transfer Letter: letter that confirms we have transferred the premium for the coverage of the imported Goods.

LC form: In this form we mentioned in details of our requirements ( Address of supplier, L/C value , Shipment date ,Expiry date ,Product description , H.S code, VAT reg no. , Inco term, Payment procedure )

L/C terms and condition: If we have any additional terms and conditions like In case of import of milk, milk food, milk products, edible oil and other food items produced in any country according to import policy (2012-2015) chapter 4 (Miscellaneous Provision) section 16 (Applicable conditions for import of food for human consumption) requires Health certificate, Melamine test Certificate, Hormone Certificate, Radioactivity levels certificate to submit. It also requires a certificate of county of origin. Under this term and condition all the additional requirements that needed by Govt. we have to mention.

LCA (Letter of Credit Authorization form): There are 5 copies of form and in each of the copies we have to mention the H.S code, Product description, L/C value clearly. According to Import Policy 2012-2015 Chapter 2 General provision for import Section 8 Import Procedure Sub section 16 (c) In case of import by opening L/C or without L/C, the authorized dealer bank shall get the LCA form registered and submit copies to Bangladesh Bank‟s import Department Chief controller of Imports and Exports Importer Customs Authority Bank Office (For NBL)

Pro-forma Invoice

IMP / Foreign Exchange form: In this form we have mention the H.S code L/C value. Up to all this documents need to be signed by finance authority. Then we sent documents to bank. Then bank send the swift copy which is a confirmation copy, they also send one copy to beneficiary bank to let them know that the L/C is open.

By getting the L\C, the exporter prepares the goods and ships the same as per instruction of the L\C and obtains a Bill of Lading from the shipping Authority.

Supplier set the Shipment Plan according to our requirement and delivers the product according to the Inco term. If they are sending it through Ship then they send Bill of lading which confirmed that the product is shipped to importer destination, if by truck then they provide truck receipt and for Air they provide master airway bill to importer‟s bank. Then Bank informed NBL and NBL pay the L/C amount to the bank in order to release the documents.

Inco term

The Inco terms (International Commercial Terms), also known as terms of delivery, are standard trade definitions most commonly used in international sales contracts. Developed and administered by the International Chamber of Commerce in Paris (ICC), Inco terms are universally recognised and followed to by the major trading nations of the world.

According to Import Policy (2012-2015) Chapter 2 section 5 general condition of import of goods “Goods can be imported on CFR,CPT,FOB,CIF,CIP,DAT,DAP, provided that in case of import on FOB basis the concerned importer shall have to comply with foreign exchange regulation.”

Nestlé Bangladesh Mostly imports their raw materials in order to uphold the quality. The Inco terms they used for importing are given below.

FOB (Freight on Board): FOB is one of the most common terms used in international trade. Under this term exporter takes the responsibility to carry the cost up to their named port. Exporter is responsible for export customs clearance and loading them onto the vessel. Form exporter‟s port to Importer‟s Warehouse all transportation cost has to be taken by Importer.

In Incoterms the point of transfer of responsibilities under FOB is described as the point “when the goods pass the ship‟s rail” Literally, that means that if during the loading onto the ship, the goods would fall on the jetty or into the water, Exporter is responsible for losses, but if the goods fall on the deck of the ship, the losses are the Importer‟s responsibility.

Under FOB Importer is responsible for handling, loading, stowage and other port charges.

CFR (Cost and Freight): CFR is formerly known as C&F and/or CAF (Incoterms 1990). Under this term exporter takes the transportation responsibility up to Importer‟s Port. But they added their cost with the invoice value.

CPT (Carriage Paid To): Under this term all transpiration (Road & Air) responsibility to the place mentioned by the buyer is carried by the importer.

As exporter is responsible for inland freight in importer‟s country the importer is responsible for the import customs clearance and all duties, taxes and other costs but Importer take a charge for their responsibility.

Retirement

The importer receives the intimation and gives necessary instruction to the bank for retirement of the import bills or for the disposal of the shipping document to clear the imported goods from the customs authority. The importer may instruct the bank to retire the documents by debiting his account with the bank.

When NBL has a payment for L/C they communicate with L/C opening Bank to check and negotiate the exchange rate of the currency that has to be paid. If the negotiated rate is satisfying then NBL informed the bank to debit their account with dollar equivalent BDT.

Then the bank releases the documents. Normally the bill of lading arrives before the product, but in case if the product arrives before, then the NBL bank takes the payment according to that day‟s exchange rate and protects the supplier and release the product. When the Bill of lading comes then NBL again negotiate with the bank regarding the exchange rate of that particular day and according to settled rate NBL will get back the access amount or will give the remaining amount and clear the bill of lading.

Amendment of L/C

In case of revocable L\C, amendment can be brought without prior notice of the beneficiary or issuing bank. But in case of irrevocable L\C, prior notice of the beneficiary is essential. Issuing bank will accept amendment of the L\C after consent of both the importer and exporter. The following clauses of L\C are generally amended:

- Increase/ Decrease value of L\C and Increase / Decrease of quantity of goods.

- Extension of shipment/negotiation period.

- Terms of delivery i.e, FOB, CFR, CIF etc.

- Mode of shipment

- Inspection clause

- Name and address of suppliers

- Name of the reimbursing bank

- Name of the shipping line etc.

Process of releasing product from Port

After reaching the Product at Port HOMEBOUND (Clearing and Forwarding agent of NBL) takes all the responsibility to deliver the product at specified destination for Raw Material and Packaging Material the destination is Factory and for Finish Good the destination point is Distribution Center.

When the product arrives at port Customs issue bill of entry Homebound takes the paper on behalf of us and places the product on port and submits the papers to customs and asked to verify the product and give certificate of Noting.

HOMEBOUND clears charges on behalf of NBL are given below-

- Association Fee

- Port charge

- Shipping agent charges

- Labor Charges

- Transportation Charges

- Agency Commission

- BSTI fee

- Transportation fee for sample

- Service charges

- After delivering the product Homebound submit their bills to NBL after verifying NBL makes the payment to HOMEBOUND

Recommendation

Local Supplier Development: Nestle Bangladesh need to develop local suppliers of our country to gain benefit in longer period of time. For this they should teach the local raw materials suppliers about the cultivation methods. Now-a-days in terms of quality products and materials our local companies are also doing well. Especially for Milk Powder, Spices or Oil items they can develop local supplier. This will save huge amount of money and time for Nestle and also will be beneficial for our country too.

Import Lead time reduction: At present most of the raw materials are imported and for most of them the lead time (Order to Factory arrival time) is very high. Average lead time is 2 months to 4 months. Here Nestlé Bangladesh needs to reduce lead time by negotiation with international suppliers or Nestle inters market subsidiaries.

Convince the supplier to accept CAD: If Nestlé can import goods through CAD (cash against document) then the huge bank charge for open up a L/C will be reduced. As in CAD bank has no role to play. Importer and exporter take all risk and responsibilities for importing and exporting goods.