A horizontal spread (more commonly referred to as a calendar spread) is a form of spread of options involving the purchasing of the same underlying stocks at the same price, but with different expiry dates. The objective is typically to benefit from changes in unpredictability over the long haul or adventure vacillation in estimating from momentary occasions. The spread can likewise be utilized as a technique for making huge influence with restricted danger. At the point when an Options dealer takes numerous situations in different choices in order to make a spread, yet the alternatives taken are with the end goal that they have distinctive expiry dates, at that point, the choice spread shaped is known as “Horizontal Spread”. Contracts underlying both options and futures build a de-facto leveraged position. It is done in the long run by purchasing options and selling them in the short term.

The horizontal spread refers to the old days when option trading was newly implemented and little (or much less) electronic trading and more floor trading used to occur. The exchange makes a charge in the broker’s record, and it implies that the cash paid for the exchange is the most extreme misfortune. The broker can’t bring about extra misfortunes regardless of whether the cost of the fundamental stock expands twofold crease or diminishes to zero. A trader first specifies an option or futures contract to buy to produce the horizontal spread and then sells a similar contract that has a shorter expiration date (all other features are the same). The two indistinguishable agreements, isolated simply by their termination date, make a distinction in value, a distinction which the market represents as time esteem explicitly the measure of time that varies between the two agreements.

(Example of Horizontal Spread)

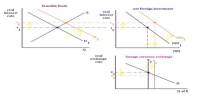

With horizontal spreads, from the beginning, the trader is aware of the risk level involved in the trade. A vertical spread, unlike a horizontal spread, involves purchasing the same underlying asset at different rates at the same market. In choices showcases, this differentiation is significant in light of the fact that the time estimation of every alternative agreement is a critical segment to its valuing. This spread kills the cost of that time an incentive however much as could reasonably be expected. On wide screens, the option prices (basically option chains) were shown in such a way that the months were displayed horizontally and the strike prices were displayed vertically. So any broker taking a gander at the alternative costs for different months would need to scroll evenly to check the option prices.

When building a horizontal spread, first make sure multi-leg orders are allowed by the trading platform. In futures markets, where time value is not a particular factor in trading, the price differential reflects the assumptions that market participants assume that the shift in pricing is likely to occur between the two separate expiry dates. The two choices contracts share comparative qualities, and they are just isolated by their termination date. The agreements make a distinction as expected, which is represented as time esteem, which is the time contrast between the two agreements. Horizontal spread requires the simultaneous purchase (or selling) of an option close the month and the sale (or purchase) of an option far away from the month.

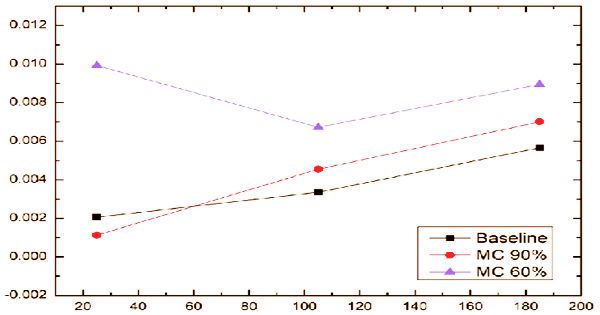

Since volatility and time esteem are exceptionally associated in choices valuing, the even spreads limit the impact of time, and it gives an occasion to pick up from the expanded instability over time. Since volatility and time value are closely related in the pricing of options, this form of spread minimizes the impact of time and provides a greater probability of benefiting from volatility rises over the time of the trade. Short spreads can be made by switching the setup (purchase the agreement with closer lapse and sell the agreement with a more far off termination). This variety tries to benefit from diminishes in instability.

Volatility is the basis of returns from a horizontal spread; volatility tests the shift in the stock price over time. The caveat is that the two choices can and likely will exchange at various suggested instability measures, however it is uncommon that the development of unpredictability and the impact on the cost of the level alternative spread act unique in relation to what might be normal. If a trader opens a short horizontal spread, they can gain a return with reduced volatility. The trader is then said to be buying in the short term and selling the stock in the far future. The trader would gain a return on the long horizontal spread with increased volatility in the stock price.

Horizontal spreads are the product of the disparity between short-term options and long-term options over time. This is why often horizontal spreads are referred to as calendar spreads.

The main types of horizontal spreads include:

- Call Horizontal Spreads: Call horizontal spreads are a neutral technique in which the investor profits when the price of the underlying asset stagnates. With the time decay between the near-term and the distant-term options, the trader profits. The method utilizes options for calling; it is often referred to as a calendar call spread.

- Put Horizontal Spreads: Put horizontal spreads is also a technique of neutral options that wins if the price of the underlying asset stagnates or decreases by a small margin. Put options are used in the technique and it is also known as calendar put spread.

Time rot favors the broker when selling an alternative. Transient choices accompany a higher time rot contrasted with long haul alternatives, and it brings about a positive return for the exchange. A flat spread includes purchasing alternatives in the long haul and selling them for the time being. It generates a deduction, and the maximum loss is the money paid. The trader can not suffer any further losses even though the price of the underlying stock doubles or goes down to zero. The loss of a trader is therefore reduced.

Information Sources: