Executive Summary

An economy of a country depends on banking sector greatly to be like wheels of vehicle. How much wheel is regulated relies on how much banks are established in the country. And the banks keep active the wheels of economy through banking operation by transaction within the customers. It is very important role what they are playing collecting money from the one group to landing another group where the money is regulated all the time. And industry, firm, corporation is growing successfully by well operating banking section to effective and quick service to the customer to help them. National Bank Limited knows it very well how to survive well in the banking sector within the competitive market launching different attractive product to increase deposit to create self different. And also it analyzes which sectors are more profitable to return back more quickly what is invested. My aim was to find it what our services are and how we collect deposit through different packages. I worked in general banking (accounts opening, deposit, clearance in accounts department and remittance) that improved my professional learning. Therefore, I tried to describe what I gained the information, knowledge from my own experience. This report will be a combination of different aspects of the banking deals and operations under general banking activities.

Origin of the Report:

As the mandatory course of MBA program it is very necessary to prepare final report on “General Banking of National Bank Limited” based on practical knowledge and experience.

Financial institutions are investment mediators what link the service providers and clients of fund. The key to successful banking relies on ability of balance numerous financial activities simultaneously. So, ensuring efficient and effective banking operation, there is no alternative way without to be stronger banking of National Bank Limited.

I have been servicing in National Bank Limited since 2nd March 2006. Now I am working at Chowgacha Branch, Chowgacha, Jessore as Senior Executive Officer & 2nd Officer. Since long period of banking service I worked at different desks. As a result I have to do every things everyday. More over if there any confusion arises we can solve this by discussion with other colleagues and Branch in Charge. Thus it helps me efficiently to prepare the report.

Objectives:

There are some purposes of preparing the report which helps me to fulfill my thirsty. These are given:

To acquire knowledge about relationship between theoretical knowledge and practical activities.

To know how the different departments are interrelated with them.

To know about Branch level General Banking Activities.

Limitations:

v Inexperience on practical work to do so.

v Three months time is not proper to perfectly represents on this task.

v I have the official job due to not managing proper time.

v Sometimes data is not available.

Methodology:

The information which is represented in the report is collected internally and externally. Internal section can be the combination of primary data and external represents secondary data. Within 3 months a lots of events have been occurred from where it helps to prepare the report. Sometime orally I have collected information which is not available. And these can be gathered only personal experience

Background of National Bank Limited:

National Bank Limited established as the first private sector bank fully owned by Bangladeshi entrepreneurs on March 28, 1983. From the very inception, it was the firm determination of National Bank Limited to play a vital role in the national economy. They are determined to bring back the long forgotten taste of banking services and flavors. It wants to serve each one promptly and with a sense of dedication and dignity. The emergence of National Bank Limited in the private sector was an important event in the Banking arena of Bangladesh. When the nation was in the grip of severe recession, the government took the farsighted decision to allow the private sector to revive the economy of the country. Several dynamic entrepreneurs came forward for establishing a bank with a motto to revitalize the economy of the country. National Bank Limited has its prosperous past, glorious present, prospective future and under processing projects and activities. NBL has been flourishing as one of the largest private sector Bank with the passage of time after facing many stress and strain. The members of the board of directors are creative businessmen and leading industrialists of the country. To keep pace with time and in harmony with national and international economic activities and for rendering all modern services, NBL, as a financial institution, automated all its branches with computer networks in accordance with the competitive commercial demand of time. Moreover, considering its forth-coming future, the infrastructure of the Bank has been rearranging. The expectation of all class businessmen, entrepreneurs and general public is much more to NBL.

National Bank Limited is one of the leading private commercial bank having a spread network of 130 branches and 15 SME/Agri Branches (total 145 service locations) across Bangladesh and plans to open few more branches to cover the important commercial areas in Dhaka, Chittagong, Sylhet and other areas in 2010.

National Bank Limited has been licensed by the Government of Bangladesh as a Scheduled commercial bank in the private sector in pursuance of the policy of liberalisation of banking and financial services and facilities in Bangladesh. In view of the above, the Bank within a period of 25 years of its operation achieved a remarkable success and met up capital adequacy requirement of Bangladesh Bank.

National Bank Limited is a customer oriented financial institution. It remains dedicated to meet up with the ever growing expectations of the customer because at National Bank, customer is always at the center.

Since its inception, the bank was aware of complying with Corporate Social Responsibility. In this direction, we have remained associated with the development of education, healthcare and have sponsored sporting and cultural activities. During times of natural disasters like floods, cyclones, landslides, we have extended our hand to mitigate the sufferings of victims. It established the National Bank Foundation in 1989 to remain involved with social welfare activities. The foundation runs the NBL Public School & College at Moghbazar where present enrolment is 1140. Besides awarding scholarship to the meritorious children of the employees, the bank has also extended financial support for their education. It also provided financial assistance to the Asiatic Society of Bangladesh at the time of their publication of Banglapedia and observance of 400 years of DhakaCity.

The Transparency and accountability of a financial institution are reflected in its Annual Report containing its Balance Sheet and Profit & Loss Account. In recognition of this, NBL was awarded Crest in 1999 and 2000, and Certificate of Appreciation in 2001 by the Institute of Chartered Accountants of Bangladesh.

Mission and Vision Statement of National Bank Limited:

Mission:

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

Vision:

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision.

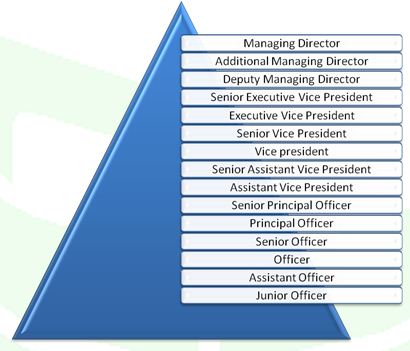

Management Hierarchy of National Bank Limited (NBL):

General Banking:

General banking is all about the combination of different departments and the activities performing in banking operation. Basically it shows how department helps to collect money from the one client and lend to the other client and to do so it has distinctive goal as well as objective. Always they try to fulfill their target what actually given by top management to accomplish touch overall goal of the bank through their branches. Each and every section of the branch is interrelated with other one not having to be any wrong. So it’s not headache only that section which has something wrong, it has to be carried every section. As well, all sections are ready to help each other to perform their activities. The department tries to create interest in customers’ mind through why they would come in the bank and what would be the advantage behind this. People are getting interested to deposits in the bank to match time value of the money and have security as well as withdraw their money based on demands and needs by paying cheques. To be principal instruments interest security and different services play as vital role to attract the customers. In fact, there is no relation between banker and customers except transaction related activities. And that’s why banker always tries to provide best and unique opportunity to the customer through superior services rather to other banks to hold them. Therefore different activities like cheque, pay order issue, local, foreign remittance, funds, account opening etc are carry out by the departments.

General Banking consists of the different sections in the branch. These are:

Customer Service, Account Opening/Closing, Remittance, Deposit Department, Locker Service, Account Department, CashDepartmentetc.

Customer Services:

In the branch different sections are ready to give the services which are the ultimate solution of the customers. Any information, if customer wants to know, he or she can get it either phone or coming in the bank. But by phone all information is not provided due to maintain security. Normally what amount of money in their (customer) account, to open an account what should be followed, when can be taken cheque book and deposit book, what the condition of interest rate, how money can be transferred to other bank etc. This type of services bank provided to the customer. People always want to get the customer service as early as possible. NBL wants as fast as possible they will offer the services to the customer rather than other banks holding own position and go forward more by superior services through smiling face as well as well behaving what they need. Sometime which facilities (products) have been come in new way for the customers and helpful are informed. To develop customer service more, sometimes they are asked what their expectation to the bank about it is. If it is possible manager tries to add with customer service Therefore info provider has to be always spirited and active to provide just in time. These services and account opening to provide Junior officer basically is active in the Chowgacha Branch.

Services and Product:

At competitive market, to survive strongly is much more challenging and difficult. To hold own exultancy, NBL beside traditional services has launched new products and services through customization. Account opening to closing and different services of NBL what they provide is given below:

Account opening:

To start the transaction permanently in a National Bank registration should be maintained which is account opening. Md. Safikul Islam (Junior officer) is always ready to provide this type of service By account opening one considered as own and loyal client to the bank. Therefore it wants to retain this customer for a long time providing superior services. To open an account some criterion client has to follow which helps to keep information about them to it. To open account in the National Bank they have different account form to registry in different name. Generally to open any account first of all collecting the form filling account holder’s name, father’ name, mother’s name, date of birth, citizenship, religion, present and permanent address and signature. Introducer’s approved should be mandatory and filling nominee’s information like A/C holder in the form. After this task he or she will be given a photocopy of voter ID card/valid passport/Nationality Certificate and three copies photographs (two for A/C holder and another one for nominee). Then officer will check it and give an A/C no. as well deposit book to deposit money in the A/C no. Then the respective officer inputs data into A2Z Software. Then he prints thanks letter for introducer and A/C holder and sends these letters in respective address to verifying addresses of introducer & A/C holder. After verifying A/C holder’s address the officer issue cheque books to withdraw money.

NBL (National Bank) focuses different importance to the different A/C. according to that the requirement varies.

Deposit Products:

Current Deposit Account: Current Deposit account is the most important for the bank. This A/C is opened by business people who are used to daily transaction for business purposes. People mostly maintain this A/C to have daily transaction in any time and for security. No interest is paid in Current Deposit Account due to any time withdraw from the bank and deposit to the bank. To open this account, there some rules and regulation which is controlled by Bangladesh Bank (Central Bank) have been maintained by National Bank (NBL). Below some criterions are give to open this A/C:

Current Deposit Account (Personnel):

ü Collect an Account opening form from the Bank.

ü Fill all the requirements of the form.

ü Nominee is must be specified.

ü Photograph is most important for any account two for holder and one for nominee (Except institutional A/C).

ü To open this account the most important things is a photocopy of voter ID card/valid passport/Nationality Certificate issued by local govt. must have to add with the account opening form and also enclose the form 12 with the account opening form.

Current Deposit Account (Sole Proprietorship):

ü Signature Card.

ü Photograph 3 or 4 for holder attested by introducer and 2 for nominee of signatories attested by A/C holder.

ü Copy of valid Trade License.

ü TIN Certificate.

ü 18-A permission from Bangladesh Bank (for GSA & Agents only).

Current Deposit Account (Partnership):

ü Signature Card.

ü Photography of signatories attested by introducer.

ü Partnership Deed.

ü Partners letter of authority to open account and authorization for operation.

ü Copy of valid Trade License.

ü 18-A permission from Bangladesh Bank (for GSA & Agents only).

Current Deposit Account (Limited Liability Company):

ü Signature Card.

ü Photograph of signatories attested by introducer.

ü Copy of Memorandum and Articles of Association.

ü Copy of Certificate of Incorporation and commencement of business.

ü Copy of Board Resolution to open the account and authorization for operation.

ü List of Directors and signatories along with addresses.

ü Latest copy of From XII.

Current Deposit Account (Association/Trust/Society):

ü Signature Card.

ü Photograph of signatories attested by introducer.

ü Copy of Resolution of governing body to open the account and authorization for operation.

ü Copy of consolation / bylaws/ rules.

ü Certificate of registration.

ü List of authorized signatories and members of the governing bodies along with address.

ü Trust Deed (for Trust account only)

Saving Account: Saving account is quite different from Current A/C. Bank provide interest 4.5% at present to the client to maintain deposit in. Here, client can not withdraw his money any time as his wish. Some restrictions have to follow to withdraw money per week. People are more interested to open A/C for sending and receiving money from different source abroad and local as well getting interest and security. To open it here some rules what should be maintained:

Account Opening Procedure:

ü Collect an Account opening form from the Bank.

ü Fill all the requirements of the form.

ü Nominee is must be specified.

ü Photograph is most important for any account.

ü The account holder sign of his/her own self in front or the specific bank principle Officer in the account opening form.

ü To open this account the most important things is that Passport Photocopy or the Word Commissioner Certificate must have to add with the account opening form.

Fixed deposit Receive (FDR):

This product is totally different from the other products current and saving account. Because in this case rules, regulation and other formalities are much lower. To have a fixed big amount of money in the bank and it is an agreement for non-withdraw before maturity period, risk is low. People are more inspired to get huge amount of money after time period to have high interest. At present, NBL is offering up to 10.50~ 12.00% interest rate for various time period prefixed by NBL.

Account Opening Procedure:

ü Collecting a form and fill up all the requirements of A/C holder.

ü Nominee must be mentioned and related information also.

ü Two copies passport size photograph one for holder one for nominee.

ü Needed passport or national ID card or commissioner certificate.

Monthly Saving Scheme: Monthly saving scheme product brought to the welfare for the customers who call it as a NMS(National Bank Monthly Savings Scheme). Who doesn’t have the big amount of money to deposit at a time in the bank but want to get accumulated money with profit after a certain period of time, for them this opportunity is opened to deposit monthly in the bank. One can open this account more than one as well as jointly. Minority can open account with guardian. This product has a variation with different figure starting from 500 to 50,000 for 3, 5 and 8 years like this:

Monthly Installment | 3 years | 5 years | 8 years |

500/- | 20,627/- | 37,896/- | 70,849/- |

1,000/- | 41,255/- | 75,791/- | 1,41,691/- |

2,000/- | 82,510/- | 1,51,583/- | 2,83,394/- |

3,000/- | 1,23,765/- | 2,27,374/- | 4,25,091/- |

4,000/- | 1,65,020/- | 3,03,166/- | 5,66,788/- |

5,000/- | 2,06,274/- | 3,78,957/- | 7,08,485/- |

10,000/- | 4,12,549/- | 7,57,914/- | 14,16,970/- |

Monthly Income Scheme (MIS): some people want to get a fixed amount of money in every month as a income source. Based on this demand and expectation, NBL has brought Monthly Income Scheme. Monthly income depends on how much the figure of money is deposited to get proportionally at the customers’ hand. For three years or five years minimum Tk.100,000/= or proportionally highest Tk.50,00,000/= by depositing, there is excellent and attractive opportunity to income Tk.1,000/= to Tk.50,000/= . Individually/Jointly can open this account. Minor can open this a/c with help of matured guardian. The pattern of the monthly income scheme is like this:

Onetime Deposit | Monthly Income |

1,00,000 | 1,000 |

2,00,000 | 2,000 |

3,00,000 | 3,000 |

4,00,000 | 4,000 |

5,00,000 | 5,000 |

10,00,000 | 10,000 |

20,00,000 | 20,000 |

30,00,000 | 30,000 |

40,00,000 | 40,000 |

50,00,000 | 50,000 |

Millionaire Deposit Scheme: This product offers to be a millionaire anybody in different years and with different figures of money. To get certain and bright future, National Bank has brought this product. It has 5, 7 and 10 years period wise saving facility benefit. Whatever the years, one will get 1 million money from the bank. To do so one can apply for more than one A/C. Jointly and with guardian below 18 can also open this account. It’s pattern like this:

Saving Amount | Years | Given Money |

12,450 | 5 | 10,00,000 |

7,870 | 7 | 10,00,000 |

4,550 | 10 | 10,00,000 |

Double Benefit Scheme: Double benefit is the customized product of National Bank Limited. It’s not a dream where single money is getting double. NBL is now giving double after 6 years from the date deposited money. Deposited range of money is 50,000 to 50,00,000. One can opens more than one account.

Foreign currency deposit:

Maintaining foreign currency account through its Authorized Dealer Branches National Bank Limited gives an opportunity. Bangladesh nationals residing abroad or foreign nationals residing abroad or Bangladesh and foreign firms operating in Bangladesh or abroad or Foreign missions and their expatriate employees can use this deposit service. For account opening two copies of recent photograph, nominee’s photograph, passport copy, ID of residence in abroad is required.

Benefits: No initial deposit is required to open the account; interest will be offered 1.75% for US Dollar account, 3.00% for Euro account and 3.25% of GBP account; interest provided on daily product basis on the credit balance (minimum balance of US Dollar 1000/- or GBP 500/- at least for 30 days) maintaining in the account.

Account Closing:

For two reasons, one can be closed. One is by banker and other is by the customer.

By banker: If any customer doesn’t maintain any transaction within six years and the A/C balance becomes lower than the minimum balance, banker has the right to close an A/C.

By customer: If the customer wants to close his A/C, he writes an application to the manager urging him to close his A/C.

But in practice, normally the customers don’t close A/C willingly. At times, customers don’t maintain any transaction for long time. Is this situation at first, the A/C becomes dormant and ultimately it is closed by the bank.

Loans & Advances products:

Overdraft:

NBL offers overdraft facility for corporate customers for day to day business operations.

Benefits (Condition Apply)

ü Low charges in overdraft account maintenance.

ü Facility is available against deposit receipt or mortgage property.

ü Low interest rate 13-16.50%.

Account Opening

ü Introductory current account.

ü Others necessary documents as per loan requirement.

Lease Finance:

National Bank Limited offers leasing facility for clients with easy installment facility.

Financing Area

ü Capital machinery.

ü Different equipments.

ü Gas, Diesel generator and Power plant.

ü Medical equipments.

ü Lift or elevator.

ü Information Technology equipments.

ü Construction equipments.

Benefits (Condition Apply)

ü Competitive monthly rental.

ü Tax benefit.

ü Fast processing.

ü Easy handover after leasing period.

Home Loan:

NBL offers home loan facility for purchasing flats or construction of house.

Benefits (Condition Apply)

ü Financing amount extends up to 70% or Tk. 75,00,000 which is highest of total construction cost.

ü Grace period available up to 9 months in flat purchase or 12 months in construction.

ü Competitive interest rate.

ü No application or processing fee.

Eligibility:

Any Bangladeshi citizen or NRB, who is capable of repayment, can apply for this loan.

NBL offers financial support to small businessmen/enterprise with new products named “Festival Small Business Loan” and “NBL Small Business Loan” has been introduced in the Bank.

Benefits (Condition Apply)

ü Maximum Tk.3.00 lac (Festival Scheme) and Maximum Tk.5.00 lac (Small Business Scheme).

ü 3 Months (Festival Scheme) and 5 years (including 1 month grace period (Small Business Scheme))

ü Collateral Free Advance.

Eligibility

Any genuine and small businessmen/ entrepreneurs/enterprise having honesty, sincerity, and integrity.

Cards:

NBL provides two types of card facilities one is Credit Card (Visa Card & Master Card) & another is Debit Card (Power Card)

Credit Card:

NBL Credit Card is accepted in many merchant outlets around the world. Our wide range of merchants include hotels, restaurants, airlines, & travel agents, shopping malls and departmental stores, hospitals & diagnostic centers, jewelers, electronics & computer shops and many more.

Benefits (Condition Apply)

ü Dual Currency Card Facility.

ü Lowest Rate of Interest.

ü Lowest Card Fees. Special Discount of Card Fee *** condition applicable.

ü You can transfer 80% amount of your Local Card Limit to any NBL A/c or have Pay Order Facility.

ü No Excess Limit Charge.

ü No Hidden Charges.

Power Card:

NBL Power Card is the first debit card for which you don’t have to maintain any account with our any branch. Two types of NBL Power cards local currency card & Duel Currency card.

Benefits (Condition Apply)

ü It is a Pre-paid Card.

ü Annual / Renewal Fee Tk. 200/- only.

ü May be issued and refilled from RFCD/FC Account.

ü Accepted at all VISA POS merchants.

ü Cash withdrawal at all ATM booths bearing VISA and Q-cash logo (Except HSBC in Bangladesh).

ü Drawing of Cash: (i) from NBL ATMs – Free of charges (ii) From ATMs under Q-cash network- Tk.10.00 per transaction (iii) From other ATM – Tk. 100.00 per transaction.

ü Cash Withdrawal Fee (aboard)-2.00% on the cash drawn amount or US$2.00, whichever is higher.

ü Only 1% loading fee against both International and Local Power Card at the time of Refilling.

ü Yearly Tk.100.00 for enrollment of SMS service.

Account Opening

ü 2 copies of your recent photograph.

ü Nominee’s Photograph.

Departments:

Remittance:

Remittance of funds is a very crucial service of NBL. It aids to remit fund from one place to another place on behalf of its customers as well as non- customers of bank. NBL has its branches in the major cities of the country and therefore, it serves as one of the best mediums for remittance of funds from one place to another.

The main instruments used by NBL, Dilkusha Branch for remittance of funds.

ü Payment Order Issue/Collection

ü Demand Draft Issue/Collection

ü T.T. Issue/Collection

ü IBC/OBC/LBC Collection.

Payment Order Issue/Collection:

The pay order is an instrument issued by bank, instructing itself a certain amount of money mentioned in the instrument taking amount of money and commission when it is presented in bank. Only the branch of the bank that has issued it will make the payment of pay order.

Issuing of Pay Order:

The procedures for issuing a Pay Order are as follows:

ü Deposit money by the customer along with application form.

ü Give necessary entry in the bills payable (Pay Order) register where payee’s name, date, PO no, etc is mentioned.

ü Prepared the instrument.

ü After scrutinizing and approval of the instrument by the authority, it is delivered to customer. Signature of customer is taken on the counterpart.

Online Banking Services:

Now all branches of NBL are connected by ABBS connectivity. As a result customer of one branch can deposit or withdrawal his/her money through any other branches of NBL at cheapest cost or service charges. Here it is mentioned that online facilities are available for Current Deposit A/Cs, Savings Deposit A/Cs & Special Notice A/Cs only.

IBC/OBC:

By OBC, we mean that those cheques drawn on other banks which are not within the same clearing house. Officer gives OBC seal on this type of cheques and later sends a letter to the manager of the branch of the some bank located in the branch on which cheque has been drawn. After collection of that bill branch advises the concerned branch in which cheques has been presented to credit the customer account through Inter Branch Credit Advice (IBCA).

Locker Service:

Locker service is not available in Chowgacha Branch of National Bank (NBL). But other branches of NBL are providing facility of locker service for the purpose of safeguarding the valuable property of customers. The person or organization that has any account in bank branch can enjoy this service. They keep their valuable assets in banker’s custody. Customers have right to look after with a key of their individual locker provided by bank. NBL maintains the following types of lockers:

Large locker.

Medium locker.

Small locker.

For enjoying this service, clients have to give charge yearly Tk.2500/-, Tk.2000/- and Tk.1500/- for large, medium and small locker respectively.

Accounts:

Account Department plays most vital role in Banking. Accounts Department is a department with which each and every department is related. It records the profit & loss A/C and statement of assets and liabilities by applying of book-keeping. The functions of it are theoretical & computerized based. NBL Chowgacha Branch records its accounts daily, weekly, and monthly every record.

Basically Accounts Department is not alone. Accounts department is a mix of as follows:

1. Cash

2. Transfer

3. Clearing

Cash:

Sk. Maruful Islam (Junior officer) is active as a cash in charge. In fact, he maintains cash related all activities and Md. Joynal Abedin (Junior officer) & SM Kamran Hossain (HR Contract Cash) assist him to accomplish it accurately. This section of any branch plays very significant role in Accounts Department. Because, it deals with most liquid assets of the NBL. This section receives cash from depositors and pay cash against cheque, draft, PO, and pay in slip over the counter. Every bank must have a cash counter where customer withdrawn and deposit their money. When the valued client’s deposit their money at the cash counter they must have to full fill the deposit slip his/her own, then they sing as the depositor option’s then they deposit their money through cash officer at the cash counter. There are several types of deposit slip as follows:

Current Deposit A/C Slip,

Saving’s Deposit A/C Slip

Pay order Slip

Demand Draft Slip

T.T. Slip.

Online Deposit Slip

After paying this kind’s of slip, the valued client waits for the deposit slip book outside of the cash counter. The Deposit officer Zulfikar Ali Haider (Junior officer) deposit the money in their account through computer software, while the depositors account credited, then he puts a seal in the deposit slip.

Receiving Cash:

Any people who want to deposit money will fill up the deposit slip and give the form along with the money to the cash officer over the counter. The cash officer counts the cash and compares with the figure written in the deposit slip. Then he puts his signature on the slip along with the ‘cash received’ seal and records in the cash receive register book against A/C number.

At the end of the procedure, the cash officer passes the deposit slip to the counter section for posting purpose and delivers duplicate slip to the clients.

Credit Department:

Credit in charge: responsible of all kinds of analytical and financial analysis of borrower in every steps of lending that ie; selection of borrower, proposal preparation, documentation, disbursement, recovery

Credit officer: proposal preparation, documentation, disbursement, repayment monitoring, prepare all kinds of monthly, quarterly, half yearly and yearly advance related statement.

Selection of borrower: Borrower is selected on what the credit products they want to take based on the terms and conditions. Each term if they fulfill in order to requirement then supervisor from the bank goes to visit to justify. Sometimes the clients come to borrow with the reference of manager or the head office.

Proposal of preparation: To prepare the proposal needed information is:

Photograph of the client

Trade license to be needed

Tin certificate required

Income statement

Balance sheet

Address. Etc.

Head office sanction: If head office gets the all requirements what should be needed from the branch about the client, they give advice to approve for the loan.

Documentation:

- i. Demand Promissory note: client do promise through formal way for the loan.

ii. Letter of Arrangement: Client in a formal way by written document requests the loan.

iii. Letter of Disbursement: Bank give the loan to the client having all documents where there signature, confirmation can be seen to sue any kind of fraud.

iv Letter of guarantee: It is the document of guarantee paper that client is liable to the bank.

V Security Document: Some sorts of instrument are kept from the client like as,

All kinds of original deed.

Mortgage (registered)

Power of attorney (registered) etc.

Disbursement: Monitoring the activity through disbursement scheduling. For instance, if anybody takes a loan from NBL 50crore for a building, each step is supervised and according to that money is given the portion of 50crore one by one.

Recovery: After the time period bank collect the money according to the contract from the client.

SWOT Analysis of NBL:

Strength:

- NBL has the strong good will in the banking sector.

- To be old Private bank, it has a strong experience in this sector.

- One of the largest no. of branches bank in the country.

- They are stronger based on capital and asset.

- Highest no. of clients.

Weakness:

- IT section is weak comparatively to others as they are using old and backdated software.

- Sometimes they have to pay extra time due to not having it expert in different branches.

- ATM card and booth is the great week point of them.

- Refreshment facility is poor where customer is the key to bring deposit.

- All are not skilled highly.

Opportunity:

- Due to have a strong brand image they may establish different industry or firm. For instance housing, consumer products etc.

- They may launch e-banking, mobile banking and strong online banking.

- Branches as well as booth they may set up in different areas.

- Expanding the business in abroad.

Threats:

- Rivals are increasing day by day.

- Fast service is more challenging compare to others.

- Political unexpected activities.

- Share marker instability.

- Rules and regulations are changed any time ordering from central bank.

- Utilization of modern software.

Findings:

- It can be said that they are the lower position in order to ATM booth.

- On line banking is not strong.

- They don’t have ATM debit card which is very popular now a days.

- Most of the cases employee only concerns about only his or her job.

- Marketing policy is not so strong in banking sector like others.

- Comparatively less facility is given to the employees rather than other banks.

Recommendation:

- Number of booth should be increased to fulfill the demand of the customers.

- They are using A to Z software in banking activities which is old. They may use modern software to provide service faster to the clients.

- Online banking should be improved. They say online but it is not actually where people faces lots of problem for that.

- They can start mobile banking what already launched in other banks.

- In the branch there is no proper space to transaction at Chowgacha branch of NBL. So head office should supervise this condition and enlarge the space.

- Islamic banking is the popular term what they may run to increase profitability.

Conclusion:

NBL always try to increase their profitability through different service reaching to the customer hand. To be more near to the customer they are increasing their branches as well as services. And that’s why their no. of branches is more than 145. More services providing more easily how can be done always they analyze about that. To be more than 27 years experience, they have the great advantage to journey a long path. They believe that customers’ satisfaction is the indicator of wealth maximization. Within three months I got lots of opportunity to achieve experience how to deal with the clients what the behavior should be an official which is not possible gain from the book or in the class. It was great job in the banking environment. I got a real communication skill in the office to expand my confidence level. Sometimes people become so crazy and angry but we have to tolerate and make them understand though they are wrong. So this way of behave may help in future on job career.