The major purpose of this report is to analyze the present marketing strategies and then formulate suitable marketing strategies for Q cash in Private Commercial Banking Sector and its Impact on United Commercial Bank Limited. Other objectives are find out annual effective charges, fees for using of debit cards and find out suitable promotional activities are followed by card providers. Finally analyze how customers will be satisfied and find out the present marketing strategies, objectives of other bank.

OBJECTIVES OF THE STUDY

BROAD OBJECTIVE

- To find out the demographic profiles of debit card holders.

- To analyze the present marketing strategies and then formulate suitable marketing strategies for Q cash.

SPECIFIC OBJECTIVE

- To find out the demand for debit card.

- To find out the perception of the users about debit card.

- To find out annual effective charges, fees for using of debit cards.

- To find out the demographic characteristics (customers income, age, occupation etc).

- To find out suitable promotional activities are followed by card providers.

- To analyze how customers will be satisfied.

- To find out suitable places for the ATM and outlets for point of sell.

- To find out the present marketing strategies, objectives of other bank.

RESEARCH QUESTION AND HYPOTHESIS

RESEARCH QUESTION

Question-1: How many people use debit card?

Justification: From this question I can come to know presently how many customers are using card. This will help me to how to increase card users.

Question-2: Who are the users of debit card?

Justification: From this question I can come to know who the users of debit card are and we can also know about their income, age and occupation etc. This will help me to focus or identify the targeted customers.

Question-3: What are the present marketing strategies, objectives or practices in different banks for Q-Cash?

Justification: From this question I can know that there are different types of banks offering Q-cash facilities, what are their marketing strategies, objectives are practicing. This will help me to compare strategies and objectives with each other and UCBL can formulate suitable marketing strategies.

Question-4: What is the demand for debit card?

Justification: From this question I can come to know the current demand for debit card and can identify the potential card holders.

Question-5: What will be the charges or fees for using card?

Justification: This answer will help me know about customer perception about annual charge, cost of initial purchase, charges for different uses etc.

Question-6: Why people use debit card?

Justification: From this question I can get what are the reasons (fear of theft, easily available, 24 hours cash withdrawal) that people use debit card.

Question-7: What types of advertisement or promotional activities should be carried out?

Justification: From this question I can come to know what types of advertisement will be more effective such as print media, live media and campaign.

Question-8: What will be the facilities those increase customer’s satisfaction?

Justification: From this question I can come to know how to increase customers’ satisfaction. The facilities may be available ATM booth, lower annual charge, and lower cost of initial purchase.

HYPOTHESIS

We will test hypothesis at 95% confidence level because most of the researches are conducted at 95% confidence level, to minimize error and to get accurate result. And the test will be one tail test because here hypothesis are mentioned in the form of greater or lesser value.

Hypothesis-1:

At 95% confidence level

Null Hypothesis Ho: More than 45% people would not like to use debit card.

Alternative Hypothesis H1: More than 45% people would like to use debit card.

Hypothesis-2:

At 95% confidence level

Null Hypothesis (Ho): Ho: ∏ ≤ 0.45 Lower annual charge will not increase card users.

Alternative Hypothesis H1: ∏> 0.45 Lower annual charge will increase card users.

Hypothesis-3:

At 95% confidence level

Null Hypothesis (Ho): Ho:∏≤0.75 reduced charges will not increase customer satisfaction.

Alternative Hypothesis (H1): Ho:∏>0.75 reduced charges will increase customer satisfaction.

Hypothesis-4:

At 95% confidence level

Null Hypothesis (Ho): Ho:∏ ≤ 0.60 flexible terms and conditions will not increase card users.

Alternative Hypothesis (H1): H1:∏>0.60 flexible terms and conditions will increase customers.

Hypothesis-5:

At 95% confidence level

Null Hypothesis (Ho): Ho:∏≤0.80 customer’s income less than 20,000 tk does not use debit card.

Alternative Hypothesis (H1): H1:∏>0.80 customer’s income more than 20,000 tk uses debit card.

RESEARCH METHODOLOGY

TYPE OF RESEARCH

The research is an applied one because it provides solution. It aims to find out the specific information needed by UCBL regarding their debit card operation. The study in this paper is not a causal one because it is not aimed at finding out the cause and effect relationship amongst the relate variables. The data collection and findings will be mainly basing on quantitative method and for interpretations and recommendations qualitative approach will be followed.

BASIC RESEARCH METHOD

The basic research method in this study will be survey method initially depth interview will be carried out to get the information on debit card investment of different banks which are existing in the market.

SAMPLING PLAN

TARGET POPULATION

For this research Simple Random Sampling procedure has been used. Because simple random sampling ensures that each respondent will have an equal chance of being selected. For conducting this research, the target population is the service holder, students and business persons.

SAMPLING FRAME

A sampling frame is a representation of the elements of the target population. It constitutes of a list or set of directions for identifying the target population. Simple Random sampling has been used to collect the information required to analyze the formulating suitable marketing strategies for Q cash. Respondents were selected from bank, department store and shopping center purchasing using the ATM card, in various cash withdrawal booth.

SAMPLING PROCEDURE

To reduce the sampling error we will follow the probability sampling procedure because every respondent of the population will have a known and non zero probability of selection.

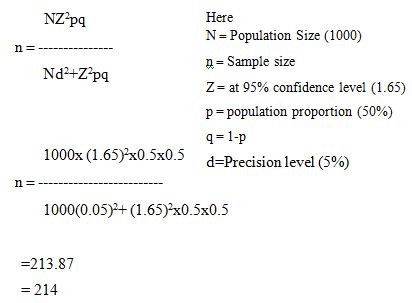

SAMPLE SIZE DETERMINATION

Simple Random Sampling procedure has been used to draw samples from population. The sample size has been calculated by using the following formula

The actual sample size is = 214 persons

SOURCES AND METHOD OF DATA COLLECTION

SECONDARY DATA

Secondary data may be available from library, website journal etc.

PRIMARY DATA

The procedures that have applied during the research process are-

- Face to face Interview.

- Observational studies

- Questionnaire Survey

ANALYSIS PLAN

RELIABILITY TEST

Data will be tested for reliability by equivalent form reliability test.

VALIDITY TEST

Validity will be tested to confirm the validity of the data obtained. For this research we use face and content validity.

STATISTICAL ANALYSIS

- Will be used to test hypothesis between sample means, sample proportions and difference in sample means.

ASSUMPTION OF THE STUDY

No research work is free from assumption. The assumptions are with the respect to the organizations, market, conditions, position. The assumption can be pointed out as below:

- Data collected through questionnaire and personal interview from the respondents are correct.

- The research methodology is appropriate.

- 54 Sample size used in the study is representing the population.

REPORT REVIEW

The report is divided into two different parts. First part of the report is the organization part, which will give a general picture of the organization United Commercial Bank Limited as a whole, including the businesses it does. The other part is the project part, is assigned by the organization to fulfill the requirement of the internship as well as the need of the company. The topic is “formulating a suitable marketing strategy for q-cash for private commercial banking sector and its impact in UCBL.”

INTRODUCTION OF UCBL

UCBL was incorporated in Bangladesh as Banking Company under the Companies Act.1913. And commended operation on June 26, 1983 when the Govt. allowed some commercial bank to operate in the private sector. As a scheduled bank of the country the bank’s activities are subject to the effective control, supervision and guidance of the Bangladesh Bank. The bank in primarily oriented towards extending financial assistance in the trade and commercial sector besides lending in the industrial sector.

Sponsored by some dynamic and reputed entrepreneurs and eminent industrialists of the country and also participated by the Government, UCBL started its operation in mid 1983 and has since been able to establish the largest network of 131 branches among the first generation banks in the private sector.

With its firm commitment to the economic development of the country, the Bank has already made a distinct mark in the realm of Private Sector Banking through personalized services, innovative practices, dynamic approach and efficient management. The Bank, aiming to play a leading role in the economic activities of the country, is firmly engaged in the development of trade, commerce and industry through a creative credit policy.

OBJECTIVES AND STRATEGIES

The bank has its objective to built itself into highly progressive and growing institution in view of this it has built its strategies to form a management with a combination of highly skilled, well educated young, energetic dedicated officers and eminent bankers of the country with varied experience and expertise working with missionary zeal for the growth and progress of the institution.

Along with that bank has an objective which include

- To provide quick and superior service by applying modern information technology.

- In all aspects the UCB has launched development growth of the bank to be sustained and this technique is to be maintained.

- The bank wants to come closer to their customers to play a vital role in national development by improving congenial relationship with their customers.

- The bank wants to invest in their valued shareholders income generating projects and giving them maximum dividend.

- In the competitive market, the bank is to provide new innovative banking services to its valued customers and build up its own image.

- To ensure the improvement of professionals quality of manpower by increasing the work efficiency and technological knowledge.

- To improve own by creating creative banking services in competitive market.

MAJOR FUNCTIONS OF UCBL

FINANCIAL AND ACCOUNTS DIVISION

Finance and accounts division is a very important division for UCB, because it

- Maintain daily liquidity positions, treasury bills, call money, debentures, placement of funds etc.

- Monthly accrued interest calculation of all interests being accounts, inter branch calculation for head office, amortization of all fixed and other assets.

- Preparation of statement of accounts and profit and loss account for the bank.

- Weekly deposit and advance analysis of the bank.

- Cost of fund analysis.

- Maintenance of accounts, preparation of annual report of the bank, maintenance of provident fund accounts, maintenance of income and expenditure posting, maintenance of salaries and wages of the employees etc.

- Fulfilling reporting requirements of Bangladesh Bank.

CREDIT RISK MANAGEMENT AND ADMINISTRATION

The primary objective of this division is to evaluate the credit worthiness and debt payment capability of present loan customers and loan applicants. The respective branches send all loans and advances proposals from the prospective borrowers to the principal branch credit risk management for an approval. If this department finds the loan proposal attractive, it either approves it or sends it for broad approval. It is also responsible for keeping track of the credit portfolio by obtaining regular information from the branches. It sets prices for credits and ensures affecting it at the branches. This department also monitors the various loan accounts of the branched and prepares various statements for Bangladesh Bank.

CUSTOMER BANKING DIVISION

The mission of consumer banking is to serve individual customer throughout every stage of their life stage. The consumer banking activities includes processing credit issue, conducting trade services, consumer service and delivering service to individual and corporate customers. UCB has decided to give more focus on consumer banking since it has lacking in this sector and is in a process are planning to develop modern delivery channels like ATMs, tele banking, internet banking, credit cards etc and many other new consumers products and services to meet specific financial demands of the customers as well to make life easy and convenient.

GENERAL BANKING DIVISION

General banking is the starting point of all banking operation in the bank. It is the department, which provides day to day services to the customers. Daily transaction occurs where it receives deposits from the customers and meets their demand for cash by honoring cheques. It opens new accounts, remit funds, issue bank drafts and pay orders.

General banking division has four major sections in this branch. These sections are as follows

- Account opening section: In this section the customers can enter in to legal contract with the bank by creating an account under certain rules and regulation which may vary from customer to customer depending on the type of account the want to create.

- Clearing: The main function of clearing section is to operate with safety security of financial transaction of financial instruments like DD, PO, checks etc on behalf of customers through Bangladesh bank clearing house, outside bank clearing, inter branch clearing.

- Remittance: In this section money is being transferred through post and telegraph by means of Demand Draft, Pay Order, and Telegraphic Transfer.

- Cash: This section receives cash from depositors and pays cash against cheques, drafts and pay orders and slip over the counters.

Along with those other functions of this division includes:

- Cheques book issue

- Maintenance of safe deposit lockers

- Saving all transaction in computer

- Payment of daily cash expenses

- Keeping good relations with valued customers

FOREIGN EXCHANGE DIVISION

The main function of foreign exchange division is to remit foreign exchange from foreign countries to local countries. Foreign exchange transactions are functioned in three ways and they are import, export and remittance.

Following are the main functions taking place in foreign exchange division

| Name | Description | Purpose |

| PAD | Payment Against Document | 1. Advance against sight L/C 2. Forced loan |

| LTR | Loan Against Trust Receipt | 1. To finance import L/Cs |

| CC(HYPO) | Loan Against Hypothecatian of Inventory and Book Debts | 1.To finance inventory 2. Other business operations 3. General purpose |

| CC(PLEDGE) | Cash Credit Against Pledge of Inventory and Hypothecation Of Book Debts | To finance pledge inventory |

| Acceptance | Acceptance Against ULC | To finance assets through Bankers Acceptance |

| LBPD | Local Bill Purchased Documentary | 1. To purchase/discount against local usance L/C 2. Upfront interest to be realized |

| ULC | Usance Letter of Credit | For importation |

| SOD | Secured Overdraft | General Purpose |

| OD | Overdraft against other collateral | General purpose |

| Import Loan(HYPO) | Import Loan Against hypothecation of inventory and book debts | To finance import L/C against contract |

THE FUNCTIONS PERFORMED BY THIS DIVISION ARE AS FOLLOWS

- Correspondent banking relationship

- Supervision of foreign exchange transaction of other units

- Monitoring on compliance of Bangladesh Bank regulation

- Supervise sale/ purchase of foreign currencies

- Reconciliation of Nostro Account

COMPETITIVE ANALYSIS

United Commercial Bank has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMEL rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operation.

INDUSTRY ANALYSIS

To conduct an industry analysis on the bank UCB we have taken Porters five Forces Model and SWOT analysis into consideration.

Porter’s Five Forces

Through Porter Five Forces analysis it is determined the forces which drive competition for UCB, contending that the competitive environment is created by the interaction of five different forces acting on the Banking sector. In addition to rivalry among existing firms and the threat of new entrants into the market, there are also the forces of supplier power, the power of buyer and the threat of substitute products or services.

The Degree of Rivalry

Due to the entrance and emergence of many private local banks in Bangladesh the intensity of rivalry for UCB is very high. This is causing value created by UCB dissipated through head competition. There is a threat for UCB of offering by other similar banks with substitute products, and existing power of customers in the market is high.

The Threat of Entry

Banking industry is the most flourishing business sector these days in Bangladesh thus causing more and more people involve in this sector of business. So, there is large number of potential and existing competitors for UCB in the market influencing average banking profitability.

The Threat of Substitute

UCB provides superior customer satisfaction through their dedicated employees which differentiate them from other banks services thus the banks threat of substitute is competitively low. But since the switching cost for customers of UCB is low there is an existence of threat of substitution in this sector.

Buyer’s power

This force is relatively high for UCB because the switching cost for the customers is comparatively low at the same time there are large number of customers with huge amount of transactions on daily basis. At the same time the bank is shortly opening quite a few branches at various locations at Dhaka city.

Supplier Power

This force is also comparatively high for UCB because the bank is oblige by the rules and regulations of Finance of Ministry and Bangladesh Bank. At the same time UCB faces fragmentation of customers because it is bound to follow mandatory monetary policy set by Bangladesh Bank.

UCBL’S PRODUCTS & SERVICES

- UCB Multi Millionaire

- UCB Money Maximizer

- UCB Earning Plus

- UCB DPS Plus

- Western Union Money Transfer

- SMS Banking Service

- Online Service

- Credit Card

- One Stop Service

- Time Deposit Scheme

- Monthly Savings Scheme

- Deposit Insurance Scheme

- Inward & Outward Remittances

- Travelers Cheques

- Import Finance

- Export Finance

- Working Capital Finance

- Loan Syndication

- Underwriting and Bridge Financing

- Trade Finance

- Industrial Finance

- Foreign Currency Deposit A/C

- NFCD ( Non Resident Foreign Currency Deposit Account )

- RFCD ( Resident Foreign Currency Deposit Account )

- Consumer Credit Scheme

- Locker Service

ONLINE BANKING

The Bank has set up a wide area network (WAN) using leased data circuit and leased public Switch Date Network (PSDN) across the country to provide on-line facility to its valued clients. Broadband data transmission service is another area that is being examined for a centralized customer information base. VSAT is used as an ideal solution for both high availability and reliability.

DEPOSIT SCHEME

Bearing this view in mind United Commercial Bank Limited has a number of deposit schemes. These are,

- Time Deposit Scheme

- Monthly Saving Scheme

- Deposit Insurance Scheme

- Foreign Currency Deposit Account

- NFCD (Non-resident Foreign Currency Deposit Account)

- RFCD (Resident Foreign Currency Deposit Account)

LOAN SCHEME

Like all other banks United Commercial Bank Limited also has a host of loan schemes for the customer’s satisfaction. By applying these loan schemes they perform the essential role of channeling funds from surplus savers to deficit spenders. These loan schemes include,

- Import Finance

- Export Finance

- Working Capital Finance

- Loan Syndication

- Underwriting & Bridge Financing

- Trade Finance

- Industrial Finance

- Consumer Credit Scheme

ONE STOP SERVICE

Like any other country of the world, the people living in the urban areas of our country lead a very busy life. Time is very valuable to them. Despite this, they are to waste their valuable time at the counter of different Banks and other Institutions for payment of their monthly bills of different utility services like Electricity, Telephone, Water, and Gas etc. They, as such, face enormous difficulties for payment of their monthly bills in time. Such inconveniences of the urban people can be removed by making an arrangement to collect all the bills of various utility services at One Point.

With this end in view, United Commercial Bank Limited has introduced a Scheme entitled “ONE STOP SERVICES SCHEME”. The scheme is designed to provide all the required services to the customer in making payment of their following bills on their behalf from the counter of the Bank:

- To pay Electricity Bills

- Cash deposit in his/her account at any branch of the Bank irrespective of location.

- Cash deposit in other’s account at any branch of the Bank irrespective of location.

- Transfer of money from his/her account with any branch of the Bank.

CREDIT CARD

United Commercial Bank Limited has begun the credit card business in 2006. This credit card is truly global – Locally & internationally translatable with the same card. This is a dual product higher coverage of acceptance globally in POS terminals & ATMs is the Special feature of the United Commercial Bank’s credit card.

SMS BANKING

The most recent service introduce by United Commercial bank is “SMS” banking. By SMS banking one can make transactions with the bank by using his/her mobile phone. Customer can transfer money from one account to another or can withdraw money through SMS banking.

NETWORK

UCBL always considers client service the most vital factor to face ever-increasing competition and challenge in the Banking sector and as such places on it utmost importance. With that end in view the Bank continued its personalized approach with speed, precision and accuracy. Presently the number of the branches stood at 131 covering almost all the important places of the country. Moreover worldwide international correspondent’s network of the Bank has been continuously expanding covering the important countries in all the countries of the world.

Besides the Bank has arrangement with a number of Exchange Houses at Singapore, U.A.E., Oman, Qatar, and Kuwait to facilitate remittances from expatriate Bangladeshis.

To cope with modern banking requirement all the branches are being computerized. To develop expertise on computer operation, regular training program of computer for the officers are continuing. The bank is examining the possibility of introducing new computer programs (ON-LINE BANKING) for improving customer service and has finalized arrangements with other private commercial banks to introduce ATM. SWIFT has already been introduced to speed up international transactions and passing of L/Cs at HEAD OFFICE. SWIFT will soon be introduced at all the A.D branches of the Bank.

ITS INFRASTRUCTURE STRATEGY

United Commercial Bank Limited is effectively pursuing its IT policy with the aim of achieving efficiency in operation and meeting customer and market expectations. Conscious efforts have been taken for induction and up gradation of information technology in use at various levels to gain competitive edge over the others. At present, all the branches of the Bank are computerized under UNIX environment, which is better secured. They are in a process of selection a robust retail banking software as a total solution in banking. This technology will greatly help them to serve the customers better and streamline the cost of operation effectively.

The Bank has already hosted its Web Site (www.ucbl.com) to facilitate dissemination of information about their banking services and facilities. The web site is constantly updated with new development and latest figures. The Web site has been very popular particularly with non-resident Bangladeshi and others to know about various services and products of this bank.

FINANCIAL STATEMENT

CAPITAL AND RESERVES

During the year 2012 authorized capital of the Bank remained unchanged at Tk. 1980 million. The paid-up capital stood at Tk. 498.02 million and reserve fund stood at Tk. 523.43 million on December 31, 2012.

DEPOSIT

Deposit of the Bank increased in the year 2012 than in the year 2011. On November 30, 2012 total deposit of the Bank stood at Tk. 20430.4 million as against Tk.19726.7 million in 2012.

CREDIT

On December 31, 2012 net credit of the Bank rose to Tk. 21226.4 as against Tk.1715.49 in 2002.

INVESTMENT

On December 31, 2012, total investment of the Bank stood at Tk. 5612.06 million as against Tk. 3332.34 in 2012.

FOREIGN TRADE

The Bank’s foreign trade policy is designed to assist development of trade, commerce and industry in the country in consonance with the guidelines of Bangladesh Bank. Total import business handled by the Bank during the year 2012 was Tk. 23134.07 million while export business was Tk. 11428.26 million.

Theoretical Review

INTRODUCTION

The debit card as a payment mechanism has experienced double-digit growth for more than a decade and debit cards remain the fastest-growing consumer payment vehicle in comparison to cash, checks, and credit cards. Debit cards can also allow for instant withdrawal of cash, acting as the ATM card for withdrawing cash and as a cheques guarantee card. Merchants can also offer “cashback”/”cashout” facilities to customers, where a customer can withdraw cash along with their purchase.

A debit card (also known as a bank card or check card) is a plastic card that provides an alternative payment method to cash when making purchases. Functionally, it can be called an electronic cheques, as the funds are withdrawn directly from either the bank account, or from the remaining balance on the card. In some cases, the cards are designed exclusively for use on the Internet, and so there is no physical card.

USES OF DEBIT CARD

Most stores, gas stations, restaurants and other locations accept debit cards for payment. Ask the cashier or clerk if the store accepts debit card. If so, making a purchase or a payment (i.e. for car repair, meal at a restaurant, etc.) with a debit card is fairly simple:

- The clerk or cashier will swipe your card in the same way he or she would swipe a credit card for payment. If the cashier doesn’t ask, make sure to tell him or her that you are using a debit card.

- The cashier will then enter the amount of your purchase, which you should see on a PIN (personal identification number) pad or station. The PIN machine will ask you to enter your 4-digit identification number and to verify the amount that is being debited from your account for the purchase. Some retailers will give you the option of withdrawing additional money above the cost of the purchase – to have extra cash on hand–say $10 or $20. If you choose that option then you will be asked to verify the final total transaction amount (including the cash back that you requested) and then the request will be sent to your bank.

- The cashier will then get an approval code from your bank, which tells him or her that the transaction was approved, meaning that you have enough money in your account to pay for the purchase.

- Once your purchase is approved the bank “holds” that amount of money in your account to process and send funds to the retailer where you made your purchase. It’s important for you to know that the funds are held from your account, because if the transaction is incorrect and the cashier goes to “void” it out, those funds will still be held in your account until the transaction is verified with the store. So if there is an error with the transaction ask the cashier to do a “sale return” instead of voiding it out. That way the exact amount of the transaction will be credited back to your account and those funds will not be held by your bank. Then the cashier can process it as a new transaction with the final, correct amount to be deducted from your account.

- Your monthly bank statement will list each debit card transaction directly on your account statement in the same way that checks are listed (for checking accounts) or withdrawals.

ADVANTAGES OF DEBIT CARD

- Debit and check cards, as they have become widespread, have revealed numerous advantages and disadvantages to the consumer and retailer alike. Advantages are as follows (most of them applying only to a some countries, but the countries to which they apply are unspecified):

- A consumer who is not credit worthy and may find it difficult or impossible to obtain a credit card can more easily obtain a debit card, allowing him/her to make plastic transactions.

- Use of a debit card is limited to the existing funds in the account to which it is linked (except cases of offline payments), thereby preventing the consumer from racking up debt as a result of its use, or being charged interest, late fees, or fees exclusive to credit cards.

- For most transactions, a check card can be used to avoid check writing altogether. Check cards debit funds from the user’s account on the spot, thereby finalizing the transaction at the time of purchase, and bypassing the requirement to pay a credit card bill at a later date, or to write an insecure check containing the account holder’s personal information.

- Like credit cards, debit cards are accepted by merchants with less identification and scrutiny than personal checks, thereby making transactions quicker and less intrusive. Unlike personal checks, merchants generally do not believe that a payment via a debit card may be later dishonored.

- Unlike a credit card, which charges higher fees and interest rates when a cash advance is obtained, a debit card may be used to obtain cash from an ATM or a PIN-based transaction at no extra charge, other than a foreign ATM fee.

DISADVANTAGES OF DEBIT CARD

- Many banks are now charging over-limit fees or non-sufficient funds fees based upon pre-authorizations, and even attempted but refused transactions by the merchant (some of which may not even be known by the client).

- Many merchants mistakenly believe that amounts owed can be “taken” from a customer’s account after a debit card (or number) has been presented, without agreement as to date, payee name, amount and currency, thus causing penalty fees for overdrafts, over-the-limit, amounts not available causing further rejections or overdrafts, and rejected transactions by some banks.

- In many places, laws protect the consumer from fraud much less than with a credit card. While the holder of a credit card is legally responsible for only a minimal amount of a fraudulent transaction made with a credit card, which is often waived by the bank, the consumer may be held liable for hundreds of dollars, or even the entire value of fraudulent debit transactions. The consumer also has a shorter time (usually just two days) to report such fraud to the bank in order to be eligible for such a waiver with a debit card, whereas with a credit card, this time may be up to 60 days. A thief who obtains or clones a debit card along with its PIN may be able to clean out the consumer’s bank account, and the consumer will have no recourse.

MARKETING STRATEGY

Marketing strategy is a process that can allow an organization to concentrate its limited resources on the greatest opportunities to increase sales and achieve a sustainable competitive advantage. A marketing strategy should be centered on the key concept that customer satisfaction is the main goal. And is a method of focusing an organization’s energies and resources on a course of action which can lead to increased sales and dominance of a targeted market niche. A marketing strategy combines product development, promotion, distribution, pricing, relationship management and other elements; identifies the firm’s marketing goals, and explains how they will be achieved, ideally within a stated timeframe. Marketing strategy determines the choice of target market segments, positioning, marketing mix, and allocation of resources. It is most effective when it is an integral component of overall firm strategy, defining how the organization will successfully engage customers, prospects, and competitors in the market arena.

TYPES OF STRATEGIES

Marketing strategies may differ depending on the unique situation of the individual business. Typically there are four types of market dominance strategies:

- Leader

- Challenger

- Follower

- Nicher

STRATEGY FORMULATION

Strategic formulation is a combination of three main processes which are as follows:

- Performing a situation analysis, self-evaluation and competitor analysis: both internal and external; both micro-environmental and macro-environmental.

- Concurrent with this assessment, objectives are set. These objectives should be parallel to a time-line; some are in the short-term and others on the long-term. This involves crafting vision statements (long term view of a possible future), mission statements (the role that the organization gives itself in society), overall corporate objectives (both financial and strategic), strategic business unit objectives (both financial and strategic), and tactical objectives.

- These objectives should, in the light of the situation analysis, suggest a strategic plan. The plan provides the details of how to achieve these objectives.

MARKETING ACTION PLAN

- Placement and execution of required resources are financial, manpower, operational support, time, technology support

- Operating with a change in methods or with alteration in structure

- Distributing the specific tasks with responsibility or molding specific jobs to individuals or teams.

- The process should be managed by a responsible team. This is to keep direct watch on result, comparison for betterment and best practices, cultivating the effectiveness of processes, calibrating and reducing the variations and setting the process as required.

- Introducing certain programs involves acquiring the requisition of resources: a necessity for developing the process, training documentation, process testing, and imalgation with (and/or conversion from) difficult processes.

MARKETING STRATEGY IN BANKING

Marketing approach in banking sector had taken significance after 1950 in western countries and then after 1980 in Turkey. New banking perceptiveness oriented toward market had influenced banks to create new market. Banks had started to perform marketing and planning techniques in banking in order to be able to offer their new services efficiently.

Marketing scope in banking sector should be considered under the service marketing framework. Performed marketing strategy is the case which is determination of the place of financial institutions on customers’ mind. Bank marketing does not only include service selling of the bank but also is the function which gets personality and image for bank on its customers’ mind. On the other hand, financial marketing is the function which relates uncongenially, differences and non similar applications between financial institutions and judgment standards of their customers.

The marketing comprehensions that are performed by banks since 1950 can be shown as in following five stages:

- Promotion oriented marketing comprehension

- Marketing comprehension based on having close relations for customers

- Reformist marketing comprehension

- Marketing comprehension that focused on specializing in certain areas

- Research, planning and control oriented marketing comprehension

THE MARKETING MIX IN BANKING SECTOR SERVICE

Recently, banks are in a period that they earn money in servicing beyond selling money. The prestige is get as they offer their services to the masses. Like other services, banking services are also intangible. Banking services are about the money in different types and attributes like lending, depositing and transferring procedures. These intangible services are shaped in contracts. The structure of banking services affects the success of institution in long term. Besides the basic attributes like speed, security and ease in banking services, the rights like consultancy for services to be compounded are also preferred.

PRICE

The price which is an important component of marketing mix is named differently in the base of transaction exchange that it takes place. Banks have to estimate the prices of their services offered. By performing this, they keep their relations with extant customers and take new ones. The prices in banking have names like interest, commission and expenses. Price is the sole element of marketing variables that create earnings, while others cause expenditure. While marketing mix elements other than price affect sales volume, price affect both profit and sales volume directly.

Banks should be very careful in determining their prices and price policies. Because mistakes in pricing cause customers’ shift toward the rivals offering likewise services.

Traditionally, banks use three methods called “cost-plus”, “transaction volume base” and “challenging leader” in pricing of their services.

DISTRIBUTION

The complexity of banking services are resulted from different kinds of them. The most important feature of banking is the persuasion of customers benefiting from services.

Most banks’ services are complex in attribute and when this feature joins the intangibility characteristics, offerings take also mental intangibility in addition to physical intangibility. On the other hand, value of service and benefits taken from it mostly depend on knowledge, capability and participation of customers besides features of offerings. This is resulted from the fact that production and consumption have non separable characteristics in those services.

PROMOTION

One of the most important element of marketing mix of services is promotion which is consist of personal selling, advertising, public relations, and selling promotional tools.

PERSONAL SELLING: Due to the characteristics of banking services, personal selling is the way that most banks prefer in expanding selling and use of them. Personal selling occurs in two ways. First occurs in a way that customer and banker perform interaction face to face at branch office. In this case, whole personnel, bank employees, chief and office manager, takes part in selling. Second occurs in a way that customer representatives go to customers’ place. Customer representatives are specialist in banks’ services to be offered and they shape the relationship between bank and customer.

ADVERTISING: Banks have too many goals which they want to achieve. Those goals are for accomplishing the objectives as follows in a way that banks develop advertising campaigns and use media.

- Conceive customers to examine all kinds of services that banks offer

- Increase use of services

- Create well fit image about banks and services

- Change customers’ attitudes

- Introduce services of banks

- Support personal selling

- Emphasize well service

Advertising media and channels that banks prefer are newspaper, magazine, radio, direct posting and outdoor ads and TV commercials. In the selection of media, target market should be determined and the media that reach this target easily and cheaply must be preferred.

Banks should care about following criteria for selection of media.

- Which media the target market prefer

- Characteristics of service

- Content of message

- Cost

- Situation of rivals

Ads should be mostly educative, image making and provide the information as follows:

- Activities of banks, results, programs, new services

- Situation of market, government decisions, future developments

- The opportunities offered for industry branches whose development meets national benefits.

Project Part

QUESTIONNAIRE AND ANALYSIS

Question No-1: Who are the users of debit card?

Objective Of the question: To find out the demographic profile of debit card users.

Age Distribution:

The objective of this section is to identify the age distribution of the user of Debit card.

Table-01: Age distributions of debit card users

| Age Class | No of Respondents | Percentage (%) |

| 21-25 | 11 | 5 |

| 26-30 | 27 | 12.5 |

| 31-35 | 70 | 32.5 |

| 36-40 | 64 | 30 |

| Above 40 | 42 | 20 |

Source: Primary Data

Findings: From the survey it is found that out of 214 respondents 5% are in the 21-25 age groups, 12.50% are in the 26-30 age groups, 32.50% are in the 31-35 age groups and 30% are in the 36-40 age groups, 20% are in the 40 above groups. So it can be said that majority of respondents are in-group 31-35 age.

Gender Identification:

The objective of this section is to identify the gender distribution of the user of Debit card

Table: Gender distribution of debit card users

| Gender | No of Respondents | Percentage (%) |

| Male | 171 | 80 |

| Female | 43 | 20 |

Educational Level:

Here it is tried to identify the education level of the respondents.

Table: Education Level of debit card users

| Education Level | No of Respondents | Percentage (%) |

| SSC | 6 | 3 |

| HSC | 32 | 15 |

| Graduate | 91 | 42.5 |

| Post Graduate | 64 | 30 |

| Others | 21 | 10 |

Finding: From the survey it is found that out of 214 respondents 2.5% have passed S.S.C level, 15% have passed H.S.C level, 42.5% are Graduates, 30% are post graduates, 10% have others qualification. So from above information, it can be said that majority of respondents are graduate.

Occupation of Customers

In this section, occupational state description is analyzed.

Table: Occupation classification of debit card users

| Types of Occupation | No of Respondents | Percentage (%) |

| Service | 53 | 25 |

| Business | 86 | 40 |

| Students | 32 | 15 |

| Professionals | 43 | 20 |

Finding: From the survey it is found that out of 214 respondents 40% are business man, 25% service holders, 20% are professionals, and 15% are students. So, it can be said that majority of respondents are Businessman.

Income Level:

In this section income level of respondents is analyzed.

Table: Income distributions of debit card users

| Income level | No of Respondents | Percentage (%) |

| 15000-25000 | 4 | 3 |

| 25000-35000 | 21 | 10 |

| 35000-45000 | 49 | 23 |

| 45000-55000 | 58 | 27 |

| Above 55000 | 79 | 37 |

Finding: From the survey it is found that out of 214 respondents 2.50% are in 15000-25000 income level, 100% are in 25000-35000 income level, 22.50% are in 35000-45000 income level, 27.50% are in 45000-55000 income level, and 37.50% are in above 55000 income level. We found that respondents whose income level above 55000 use debit card more.

Question-: What will be the bases for using preferred bank?

Objective of the Question: To find out Reasons for choosing preferred Bank in case of charge, product facility, easy process etc.

Table: Factors of choosing preferred bank.

| Choosing categories | No of Respondents | Percentage (%) |

| Product Facility | 68 | 32 |

| Brand image | 47 | 22 |

| Lower charges | 38 | 18 |

| Available ATM booth | 21 | 10 |

| Easy process | 21 | 10 |

| Others | 17 | 8 |

Finding: Here I have tried to show the reasons for choosing preferred bank.

From above figure it is found that out of 214 respondents, 32% respondents have chosen their preferred bank because of product facilities, 22% have chosen because of brand image, 18% respondents have chosen because of lower charges, 10% have chosen because of available ATM booth, 10% respondents have chosen their preferred Bank because of Easy process, and 8% have chosen Banks because of other reasons. It is clear that the majority of respondents have chosen their preferred Banks for attractive product facilities.

Question: What are the numbers of present card holders among different banks?

Objective of the question: To find out the percentage of card holders among banks.

Table: Overall Debit card holders of Different banks among Respondents

| Name of Bank | No of Respondents | Percentage (%) |

| DBBL | 118 | 55 |

| Standard Chartered Bank | 32 | 15 |

| Brac Bank | 32 | 15 |

| Dhaka Bank | 26 | 12 |

| UCBL | 6 | 3 |

Finding: From this graph, it is found that out of 214 respondents, 55% have debit card of DBBL, 15% have Debit card of Standard Chartered Bank Ltd, 15% have debit card of Brac Bank Ltd, 12% have Debit card of Dhaka Bank Ltd, and 3% have debit card of UCBL. It is clear that the majority respondents are using Debit Card of DBBL.

Question: Which bank is better based on availability of ATM booth?

Objective of this question: To find out which bank has the highest ATM booth.

Table: Bases on ATM booth which bank is the best

| Name of Bank | No of Respondents | Percentage (%) |

| DBBL | 150 | 70 |

| Standard Chartered Bank | 21 | 10 |

| Brac Bank | 21 | 10 |

| Dhaka Bank | 15 | 7 |

| UCBL | 6 | 3 |

Finding: In this figure, I have shown the responses of the respondents about the availability of ATM Booth for Debit card. From the survey, it is found that out of 214 users, 70% respondents said that DBBL has highest ATM Booth, 10% respondents believe that Standard Chartered Bank has highest ATM Booth, 10% respondents believe that Brac Bank provides highest ATM Booth for Debit card, 7% believe that Dhaka Bank has highest ATM Booth, and 3% respondent believe that UCBL Bank has highest ATM Booth, and 3% respondent It is found that DBBL has the highest ATM booth.

Question: Which bank is better based on availability of cash?

Objective of the question: To find out which bank giver better cash availability in ATM booth.

Table: Ranking of bank bases on cash availability

| Name of Bank | No of Respondents | Percentage (%) |

| Standard Chartered Bank | 53 | 25 |

| UCBL | 43 | 20 |

| Dhaka Bank | 43 | 20 |

| DBBL | 32 | 15 |

| Brac Bank | 21 | 10 |

| Others | 21 | 10

|

Finding: From above figure it is found that out of 214 debits card users, 25% are fully agreed or fully satisfied for the cash availability on ATM Booth of Standard Chartered Bank 20%, are agreed in general that UCBL is the best for cash availability on ATM Booth. 20%, are fully agreed on Dhaka Bank, 15 respondents are fully agreed on for cash availability on ATM Booth of DBBL, 10% respondents are agreed for cash availability on ATM Booth of Brac and 10% respondents are for cash availability on ATM Booth of others bank. It is found that standard Chartered bank gives better cash facilities in ATM booth.

Question-: Based on the processing system to issue a Debit card which bank is the best to respondents?

Objective of this Question: To find out which bank follows easier system to issue debit card.

Table: Bases on processing system which bank is preferred

| Name of Bank | No of Respondent | Percentage (%) |

| DBBL | 64 | 30 |

| UCBL | 53 | 25 |

| Dhaka Bank | 43 | 20 |

| Brac Bank | 32 | 15 |

| Standard Chartered Bank | 21 | 10 |

Finding: From that figure we found that 30% respondents think that DBBL give flexible process to issue a debit card, 25% respondent think that UCBL give flexible process to issue a debit card, 20% respondent think that Dhaka Bank give flexible process to issue a debit card, 15% respondent think that Brac Bank give flexible process to issue a debit card and 10% respondent think that Standard Chartered Bank give flexible process to issue a debit card. It is found that DBBL follows more flexible system to issue debit card.

Question: Based on Promotional Activities which bank is best to the Respondents?

Objective of this Question: To find out the promotional activities regarding debit card of different banks.

Table: Promotional activities of different bank

| Name of Bank | No of Respondents | Percentage (%) |

| Standard Chartered Bank | 75 | 35 |

| DBBL | 53 | 25 |

| Brac Bank | 43 | 20 |

| Dhaka Bank | 32 | 15 |

| UCBL | 11 | 5 |

MARKETING STRATEGY of “Q-CASH”

PRODUCT STRATEGY

UCBL should go immediately for launching the different types debit card package, because the market is very competitive. In debit card market the main competitor is DBBL. Today DBBL is doing aggressive marketing but in the very near future days some of the consortium banks will take the lead in Q-Cash for their card strategy. UCBL can launch the following types of debit card

- Classic

- Visa Card

- Master Card

- VISA Classic Blue International

- VISA Gold Local

PRICE STRATEGY

Initial Price:

As per the agreement UCBL will get the first years debit card free cost, so UCBL should aim to sale maximum number of cards in the very first year, which will at the same time cover up the gap between the other consortium banks who are running the card division. UCBL can follow the following price strategy.

Yearly Charge:

| Type of services | Classic | Visa Card | Master Card |

| Issuance fee(1st year only) | Free | 500 | 1500 |

| Annual Fee(2nd year onward) | 200 | 800 | 1200 |

| Replacement Fee | 200 | 300 | 500 |

| PIN Change Fee | 200 | 200 | 200 |

PROMOTION STRATEGY

Advertising platforms

- Television

- Radio

- Billboards

- Newspaper etc.

Most of the respondents said that newspaper is more effective for advertising because they can know details information. So, UCBL must follow newspaper for advertising.

Publicity & Public Relation:

- Press kits

- Seminars( college, universities etc)

- Annual reports

- Charitable donations

- Company magazine

- Publication

4.4 PLACEMENT STRATEGY

The place is where you can expect to find your customer and consequently, where the sale is realized. Knowing this place, you have to look for a distribution channel in order to reach your customer. Distribution is about getting the products to the customer. Some examples of distribution decisions regarding the bank for Q cash include: wide market coverage of ATM booth. UCBL has 131 branches all over the Bangladesh but they have only 77 ATM booth. To increase customer service and satisfaction UCBL should set up sufficient number of ATM booth.

The customer of ATM card can withdraw in total 60,000 taka from any ATM booth as many times as he or she needs within 24 hours.

In ATM booth there must have

- Cash availability

- Instruction how to withdraw cash

- High security

- Customer solution department

ATM booth Location

| Division | |

| Dhaka Division | 40 |

| Chittagong Division | 17 |

| Rajshahi Division | 05 |

| Khulna Division | 06 |

| Sylhet Division | 07 |

| Borishal Division | 01 |

| Rongpur Division | 01 |

| Total | 77 |

OPPORTUNITIES FOR Q-CASH

OPPORTUNITIES FOR Q-CASH

The demand for debit is gradually increasing. The debit card as a payment mechanism has experienced double-digit growth for more than a decade and debit cards remain the fastest-growing consumer payment vehicle in comparison to cash, checks, and credit cards. The following data shows growth trend of debit card in Bangladesh

From this figure it is said that in 2005 debit card holders was 3.2 million, in 2006 3.4 million, in 2011 3.8 million, in 2012 4.1 million and in 2009 4.5 million in 2010 5.1 million in 2011 5.5 million & 2012 was 6.2 million.

The Banks need to ensure the payment cards provided as part of a current account have debit card functionality. Banks need to recognize that a customer who takes cash from a cash machine to make a purchase is a cost to the Bank, that same purchase using a debit card is revenue to the Bank.

The debit card needs active marketing, some of the ideas can be taken from the credit card initiatives, points awarded, cash back, competitions, usage rewards etc. Significantly Banks need to market the card not necessarily the account. The debit card needs to become the fashionable manner of payment and needs to be discriminated from the credit card. We are already seeing this approach with pre-paid cards and I expect to see this developing as a model for all debit cards.

The demands on the technology to aid this transformation will be to provide behavioral low latency information to the business and marketing functions and, importantly, to ensure that the credit and fraud risk associated with debit card transactions are minimized, to provide the confidence to making the debit card a universal part of the bank account based products.

The information provision will need to be enhanced to allow authorization systems to provide current and historic information on card user behavior to facilitate contemporaneous, targeted marketing. This can be achieved by ensuring transactional data gets posted in near real time to a comprehensive business information database.

PROBLEM AND SOLUTION OF DEBIT CARD

PROBLEMS

Problem-01: No UPS or generators are installed on machine.

Justification: In my survey the sample size 214. Out of 214, 80% i.e.171 respondents said that all of the ATM booths have no generator and UPS facility during the load shedding. So, customers faces problem in withdrawal cash from ATM booth during load shedding

Problem-02: There was no customer care number to call and get any help.

Justification: Out of 214 respondents, 85% i.e. 182 respondents said that there is no customer care center or number for problem solving.

Problem-03: No branch was there to get any help.

Justification: Out of 54 respondents, 40% i.e. 21 respondents said that there is no branch besides the ATM booth.

Problem-04: There was no guard to get any help.

Justification: Out of 54 respondents, 55% i.e. 30 respondents said those security guards who are engaged for ATM booth are not well trained and educated. All of the cases they cannot help the customers.

Problem-05: No of ATM booth is very poor.

Justification: Out of 54 respondents, 90% i.e. 47 respondents said that the UCBL has small number of ATM booth. They have only 77 ATM booths.

Problem-06: In many times customers face cash shortage.

Justification: Out of 54 respondents, 35% i.e. 20 respondents said that in some occasion such as EID they face cash shortage.

Problem-07: Lack of security.

Justification: Out of 54 respondents, 70% i.e. 38 respondents said that most of the ATM booths have lack of security. The location of ATM is very important for security.

Problem-08: There is no instruction how to withdraw cash from booth.

Justification: Out of 54 respondents 78% i.e 42 respondents said that there is user manual or instruction how to withdraw cash from ATM booths. This problem is especially for new users.

PROBABLE SOLUTION

- In ATM booth there should have UPS or generator facility to withdraw cash during load shedding.

- It should establish customer care center for problem solving that the customer can be satisfied.

- It should recruit educated and well trained guard for ATM booth.

- Number of ATM booths should be increased.

- Ensure cash availability on ATM booth, because it effects on the customers satisfaction.

- Location ATM booths will be suitable so that the customer cannot face lack of security.

- Bank should provide user manual to customer and instruction in ATM booth how to withdraw cash.

Debit Card & Customer Care Call Center: 01730066334

Hotline : 01713039595

Collection : 01811481293

Credit Card Customer Care : 01978222273

SUMMARY OF THE FINDINGS

- From the survey it is found that out of 214 respondents 5% are in the 21-25 age groups, 12.50% are in the 26-30 age groups, 32.50% are in the 31-35 age groups and 30% are in the 36-40 age groups, 20% are in the 40 above groups. So it can be said that majority of respondents are in-group 31-35 age.

- The majority respondents are male. Although now a day female are involving more on the service or business, but it is also true that in our country male are the chief wage earner.

- The majority of respondents are Graduate. So the debit card users are well educated.

- It is found that out of 214 respondents 40% are business man, 25% service holders, 20% are professionals, and 15% are students. So, it can be said that majority of respondents are Businessman.

- The income level of the majority respondents is above 55000. And it can be easily said that higher income group people are mainly interested on Debit Card. And it also true that amount of deposit depends on income of the customers.

- The majority respondents are using debit Card of Dutch Bangla Bank Limited. Dutch Bangla Bank Limited is the market leader of debit Card.

- It is found that out of 214 users, 70% respondents said that DBBL has highest ATM Booth, 10% respondents believe that Standard Chartered Bank has highest ATM Booth, 10% respondents believe that Brac Bank provides highest ATM Booth for Debit card, 7% believe that Dhaka Bank has highest ATM Booth, and 3% respondent believe that UCBL Bank has highest ATM Booth, and 3% respondent It is found that DBBL has the highest ATM booth.

- Standard Chartered Bank and Dutch Bangla Bank Ltd made a contract for the ATM Booth so that the Customers can get available ATM Booth

- The majority respondents are dissatisfied for the ATM Booth. It is the biggest weakness for the UCBL, and if the Bank does not increase more booths, then it will be biggest threat for UCBL Bank LTD.

- The majority respondents think that Dutch Bangla Bank Ltd provides best product features to the debit card holders. That’s why the customers are fully satisfied for the product features on debit card of Dutch Bangla Bank Ltd.

- The majority of respondents have chosen debit card for attractive product facilities.

- Based on Promotional activities Standard Chartered Bank is the best.

- The majority respondents think that Standard Chartered Bank is the best for debit card based on cash availability on ATM Booth.

- The majority respondents think that Dutch Bangla Bank is the best for debit card based on processing system to get the debit card.

- UCBL provides better customer services.

- The majority respondents prefer Newspaper for the advertising of debit card because customers get details information from newspaper.

Conclusion

To survive in the challenge of economic crisis a modern bank is offering a wide array of financial services and the bank’s service menu is growing rapidly. And Debit Card is one of the most important and demandable Products of the Bank sector. The UCBL bank limited has been trying to operate its business successfully in Bangladesh from the beginning of the banking uprising in our country. UCBL has much more potential to explore the existing situation. From this report it came to know that there are many factors to which customers are dissatisfied especially for debit card. In order to confiscate this dissatisfaction it would be better, if this Bank gets more spirited in every aspect in their service. It should be considered that the customers have very few choices of banks with which they can actually compare the good service. However, the local banks have recently focused their attention to customer service, satisfaction and debit card service. Moreover, there are a good number of private banks that are in the competition. Therefore, it is better for UCBL Bank Ltd not to let the situation be worse, and from now, this Bank should emphasize on serving customers more effectively and efficiently for debit card.

Recommendations

In order to get competitive advantage and to deliver quality service, top management should try to formulate suitable marketing strategies I have some suggestions for The UCBL derived from my observations out of my survey on 214 customers. Those are given below:

- UCBL Bank Ltd should special focus on female customers, because the majority of respondents are male. So the bank should give extra facility to female customers for acquiring huge customers.

- UCBL Bank Ltd should not focus not only on the higher income level customers but also the bank should give more importance on medium income level customers, so that the bank can acquire huge customers.

- UCBL Bank Ltd should introduce Master Card for the customers.

- Now days the students are being more interested on Debit card. So this bank should give more importance to acquire these customers. I think UCBL should make contract with some organizations to give debit cards with extra facility.

- UCBL provides lower annual charges to the customers, but most of the people or customers of other banks do not know about the lower annual charges of this Bank. So I think this Bank should promote the debit card for knowing the people about lower annual charges of the Bank.

- One of the main problems of UCBL Bank Ltd is the ATM Booth. Because this bank has only 77 ATM Booth. So, I think this bank should increase more ATM booth for the debit card users.

- I think UCBL Bank Ltd should give importance on the attractive environment of the ATM Booth.

- I think the Bank should make exceptional procedures for the cash withdrawal system of the Bank to attract more customers.

- UCBL Bank Ltd should give more importance on the cash availability on ATM booth, because it effects on the customers satisfaction.

- To compete in the debit card market, I think UCBL Bank Ltd should offer many special product features to attract the customers.

- The main problem of UCBL Bank Ltd is the promotional activities. Because the lack of promotional activities, the most of the customers do not know about the facilities of this bank. So I think UCBL should advertise more on it’s Products specially about debit card.

- I think this bank should give some attractive extra facilities to the customers, because many of the banks are giving extra facilities to the customers for their satisfaction.

- And at the same time UCBL bank ltd should make a lot of promotional partners.

- I think this bank should also advertise more about the cash advance facility of the UCBL. Because the customers are fully satisfied about it.

- This bank should give advertise more on Newspaper, because it is the most preferred media of the respondents. But the bank also should give advertise on Billboard.

- UCBL should launch customer service department for debit card. This will be a pioneer for debit card marketing because there is no customer service department for debit card in another bank.

- UCBL bank should always monitor the performance of it’s competitors in the field of debit card activities

- Use of effective management information systems.