An Overview of Bangladesh Krishi Bank

Bangladesh Krishi Bank (BKB) is a 100% government owned specialized Bank in Bangladesh. KRISHI means Agriculture. Since its inception, BKB is financing in agricultural sector remarkably. BKB also performs commercial banking. People working abroad can easily send money home through our Taka Drawing Arrangement.

The major occupation of the people of Bangladesh is “Krishi”. Krishi is a Bengali word which means “Agriculture”. About 85% of the population depends directly or indirectly on agriculture which contributes a significant portion to GDP.

Bangladesh Krishi Bank (BKB) has been established under the Bangladesh Krishi Bank order 1973 (President’s Order No 27 of 1973). BKB is a Banking Company under the Banking Company Act-1991. Its Head Office is located at Krishi Bank Bhaban, 83-85 Motijheel Commercial Area, Dhaka-1000, Bangladesh.

International Banking

Bangladesh Krishi Bank (BKB) has been engaged in Foreign Exchange Business since 1980. It deals in all kinds of export, import, remittance and other sorts of foreign exchange business. BKB has got 200 major correspondent banks globally and maintain sufficient number of Nostro accounts in various foreign currencies with different leading banks in important business centers of the world. BKB has taken a massive foreign exchange programmes to increase business. Import of capital machinery and raw materials for agro-processing industries and export of agricultural products, foreign remittance & all sorts of foreign exchange transactions and services are being provided by BKB.

Introduction

International trade involves a flow of goods from seller to buyer in accordance with a contract sale .Different amount of natural resource, while other might have not. Therefore, countries need to exchange goods to satisfy mutual needs and wants.

International Trade

International trade involves a flow of goods from seller to buyer in accordance with a contract of scale. It is the exchange of goods and services between peoples of different countries.

Reason for international trade

Main reason for international trade is as follows

►Uneven resources distribution

Different countries have different amounts of natural resources, while other might have not. therefore counties need to exchange goods to satisfy mutual needs and wants.

►The lack of self-sufficiency

Each country can obtain those goods that each alone can not produce or obtain the resources to run them into finished products.

►specialization

The need for trade will arise because a country cannot survive with only one kind of goods (specialization goods

►Economic principal of comparative advantage

It is mutually beneficial if each country specializes on producing the goods which is has greater advantage and obtains those goods from other countries that it cannot produce cheaply at home.

►Difference in the demand of goods among countries

Some countries, which are producers of certain goods, still have to import the same goods from abroad. this may due to the insufficient supply locally to meet the strong demand for the goods.

Benefits of international trade

Some major benefits of international trade are-

►A gain in output for the participating countries

International trade enables a country to specialize in the production of goods and services in which it has comparative advantages.

►Better living Standard

Specialization in production makes goods cheaper, so the Standard of living is improved.

►Economics of scale

As countries specialize in the production of goods and services, they are able to operate on a large scale, and thus enjoy the benefits arising from the economics of scale.

►Transfer of technology

The transfer of technology automatically accompanies an exchange of goods because nation can learn from the products of other nations (computer software).

►Improving international relationship

With more trade activities and closer contact, there comes an exchange of culture and ideas resulting in better understanding among the nation.

►Marinating price stability

With international trade ,shortage of resources And goods can be solved by imports. demand and supply can be brought closer together. Price fluctuation can be minimized.

►International trade encourages competitions

Competition s may help to prevent the growth of domestics monopolies . efficiency in production can be achieved.

Problems in international trade

Risks of goods, credit risk of foreign exchange, differences in legal systems among countries, differences in political systems among countries, economic divergence. The political and economic condition in one country may deteriorate etc.

The role of banks in enhancing international trade

►Provision of advances

The provision of finance to importer (e.g. trust receipt facility, documentary credit facilities ) and exporters (e.g. negotiation of export bills, purchase of bills for collection) encourages enterprise to engage in trade and enhance their liquidity position.

►Provision of alternation payment methods

Importers may not accept the payment of cash in advance, which gives exporters the greatest protections. On the other hand, the exporters may not accept open account, which gives Importers the best payment methods. A letter of credit, through bank channels overcomes the disadvantages of these two settlement methods and satisfies to a great extent, both the importer and exporters. So with help of banks volumes can be enlarged.

►Medium of fund transfer

A bank system allows payment to be made safely and quickly by one part to another, e. g. telegraphic transfer.

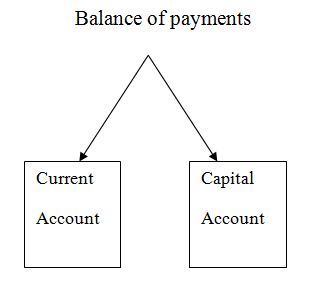

Balance of payments

The balance of payments is a bookkeeping system for recording all payments that have as direct bearing on the movement of funds between a nation (private and government) and foreign countries.

Current Account

The current account shows international transaction that involve currently produced goods and services. The difference between merchandise export (line 1) and import (line2) is called the trade balance. When merchandise imports are greater than exports, we have a trade deficit. if exports are greater than imports, we have trade surplus. The current account accounts are the net payments or receipts that arise from investment income, the purchase and sale of services and unilateral transfer.

Capital Account

The Capital account describes the flow of capital United States and other countries. Capital outflows are American purchase of foreign assets (a payment item) and capital inflows are foreign purchase s of American assets (a receipts item). The capital outflows are less than the capital inflows.

Balance of payments considerations

Balance of payments considerations were more important than they are the current management floating regime. When a no reserve currency country is running balance-of-payments deficits. To keep from running out of these reserves, it had to implement concretionary monetary policy to strengthen its currency.

Letter of Credit

Letter of credit can be defined as a credit contact where by the buyers bank is committed (on behalf of the buyer) to place an agreed amount of money at the sellers disposal some agreed conditions. Importer/ seller who applies for opening an l/c and Bank opens/ issues a l/c on behalf of the importer. Bank adds its confirmation to the credit and it is done at request of issuing bank may or may not be the advising bank . advising/notifying bank through which the l/c is advised to the exporters. This bank is actually situated in exports country. It may also assume the role of confirming and/or negotiating bank depending upon the condition of the credit.

Letter of credit

Letter of credit can be defined as a credit contact where by the buyers bank is committed (on behalf of the buyer ) to place an agreed amount of money at the sellers disposal under some agreed conditions. Since the agreed condition include among other things, the presentation of some specified documents, the letter of credit is called.

Different types of documentary credit (d/c)

Red clause credit

Red clause credit is a special type of credit with a clauses inserted authorized the advising or confirming bank to make advances to the beneficiary before presentation of the documents.

The clause is added in the documentary credit at the request of the applicant for the credit. In other words ,it is a reshipment finance in their form of a loan the advising/confirming bank provides to the beneficiary, with payment of principal and interest guaranteed by the issuing in case the beneficiary fails to ship goods and defaults in payment of the advances.

The credit specified the advances to be given to the beneficiary , which Can be in the form of percentage or a fixed sum .

Finance is given against undertaking from beneficiary certifying that he promise to ship goods and submit documents to advising bank , which has provided him with finance . possible risks in issuing a red clause credit –

- Exporter may use the advance for other purpose

- Documents presented from the exporter may have discrepancies unacceptable to the importer .

Revolving credit

A revolving credit is a credit, which provides for the amount of the credit to be renewed automatically after use without the need to renew the credit every time. It can be revolved with respect to either

- Time or

- Amount (i.e. total value of the credit)

A revolving credit “with respect to time” can be cumulative or non-cumulative. A cumulative revolving credit allows any unused credit amount of a previous month to be carried forward to the next month. A non-cumulative revolving credit, on the other hand, provides for a maximum amount of credit to be drawn each month. If the exporter fails to draw for the month , the amount in the Month (full amount or any utilized balance) will be forfeited automatically.

Transferable letter of credit

A transferable letter of credit, which can be transferred in whole or in part by the original beneficiary to one or more “second beneficiaries”. It is normally used when the first beneficiary does not supply the goods himself, but acts as a middleman between the supplier and the ultimate buyer.

Back-To-Back letter of credit

A Back-To-Back letter of credit is a new credit, it is different from the original credit based on which the bank undertakes the risk under the back-to-back letter of credit. In this case , the banks main surety/security is the original credit (master l/c). the original credit (selling credit ) and the back-to-back credit (buying credit) are separate instruments independent of each other and in no way legally connected, although they both from part of the same business operation. The suppliers (beneficiary of the back-to-back credit ) ships goods to the importer or suppliers goods to the exporter and present documents to the bank as is specified in the credit. It is intendment that the exporter would substitute his own documents for negotiation under the original credit, his liability under the back-to-back credit would be adjusted out of these proceeds. The exporter l/c is marked lien and no margin is taken. So we can say that back-to-back id term given to an ancillary credit which arises where the seller used the credit granted to him by the issuing bank to his suppliers.

Confirmed credit

If a letter of credit is confirmed by a bank (the advising bank ), this means , in addition to the definite undertaking to the issuing bank to honor beneficiary’s draft, the advising bank makes also its promise to pay the beneficiary . such confirmation by the advising bank not only confirms the undertaking if the issuing bank but also constitutes an additional promise on the advising bank (which becomes a confirming bank).

Documentary letter of credit

Documentary credit may be either

1. revocable credit

2. irrevocable credit,.

- Revocable credit: A revocable credit is a credit , which can be amended are cancelled by the issuing bank at any time without prior notice to the seller.

- Irrevocable credit : An irrevocable credit constitutes a definite undertaking of the issuing bank(since it cannot be amended or cancelled without the agreement of all parties there to), provided that the stipulated documents are resented and the seller satisfies the terms and conditions. This sort of credit always referred to irrevocable letter of credit .

Parties Related to a Letter of Credit

The parties are:-

- the issuing bank

- the confirming bank, if any

- the beneficiary .

Others parties, which facilitate the documentary credit, are:

- the applicant

- the advising bank

- the negotiating bank / applicant bank

- The transferring bank, if any.

The parties of letter of credit

Importer: purchaser/buyer who applies for opening l/c.

Issuing bank : it is the bank which opens/issues a l/c on behalf of the importer.

Confirming bank: it is the bank, which adds its confirmation to the credit and it is done at request of issuing bank. Confirming bank may not be the advising bank.

Advising/notifying bank: it is the bank through which the L/C is advised to the exporters. This bank is actually situated in exporters country. It may also assume the role of confirming and /or negotiating bank depending upon the condition of the credit.

Negotiating bank: it is the bank that negotiates the bills and pays the amount of the beneficiary. The advising bank and the negotiating bank may or may not be the same. Sometimes it can be confirming bank.

Paying /accepting bank: it is the bank on which the bill will be drawn (as per condition of the credit). Usually it is the issuing bank.

Reimbursing bank: it is the bank that would reimburse the negotiating bank after getting payment instruction from issuing bank.

Securitization of L/C application

The Bangladesh krishi bank official scrutinizes the application in the following manner—

- The terms and conditions of the l/c must be complied with UCPDC 600 and exchange control & import trade regulation.

- Eligibility of the goods to be imported.

- The l/c must not be opened in favor of the importer.

- Radioactivity report in case of food item.

- Survey report or certificate in case of old machinery.

- Carrying vessel is not of Israel or of Serbia-Montenegro.

- Certificate declaring that the item is in operation not more than 5 years in case of car.

Transmission of L/C to Beneficiary through advising Bank:

When the transmission of T/C is done through tested telex or fax to advise the l/c to the advising bank. The advising bank verifies the authenticity of the L/C.

BKB has corresponding relationship or arrangement throughout the world by which the L/C is advised. Actually the advising bank does not take any liability if otherwise not required.

Presentation of the document

- The seller being satisfied with the terms and the conditions of the credit makes shipment of the goods as per L/C terms.

- After making the shipment of the goods in favor of the importer, the exporter submits the documents to the negotiating bank.

- After receiving all the documents, the negotiating bank then checks the documents against the credit. If the documents are found in order to. The bank will pay, accept or negotiable to BKB.

- Branch & bank received seal to be affixed on the forwarding schedule.

- The bill of exchange & transport documents must immediately be crossed to protect loss or fraudulent.

BKB checks the documents. The usual documents are-

- Invoice.

- Bill of lading.

- Certificate of origin.

- Packing list/weight list.

- Shipping advice.

- Non-negotiable copy of bill of lading.

- Bill of exchange.

- Pre-shipment inspection report.

- Shipment certificate.

Examination of shipping documents

One of the principal of document credit is that all parties deal with document and not with goods (articles 6 of UCPDC-600). That is why, the documents should be scrutinized properly. If any discrepancy in the documents is found that is to be informed to the pity. A checklist may be followed for examining the documents.

Amendment of the letter of credit

When the parties involved in a L/C, especially the seller want to change the terms and conditions due to some obvious and genuine reasons the credit should be amended. BKB transmits the amendment by tested telex to the advising bank. If the L/C is amended, service charge and telex charge is debited from the account accordingly. According articles 6 of UCPDC 600. amendment must be complete and precise .

Import, Export & Remittance

- Introduction

- Import

- Procedure of import

- Payment procedure of the import documents

- Financing features

- Import business of BKB

- Export

- Export L/C process

- Export financing

- Position of export business of BKB

- Remittances

Import

Bills (import) deals with L/C and the issuance of L/Cs for import purposes. The letter of credit serves as a vehicle for the importer and exporter to ensure that their goods and money are coming. It is important to remember that the bank deals with documents and not goods. There are various steps towards the issuance of a L/C; these steps will also include BKB, as well as various serving as negotiating, confirming etc., banks.

This department deals with different types of L/Cs and with the payment of L/Cs.

There is a clear line as to the role of the bank as an advising bank and as a guarantor. L/Cs are used for the sale and purchased of goods.

A buyer, importer or applicant goes to their bank and applies for a letter of credit. This letter of credit is given and the bank then sends this L/C to another bank in another country. They may send this L/C to a sister bank or to an advising, negotiating or confirming bank. Either way these other bank is treated as an intermediary beneficiary and the seller or exporters. The L/C is given to certify that upon the receipt of goods, the importer will immediately send the money. Negotiating banks are also sometimes used, where there is a different bank, and they are given the L/Cs; and they will deal with the payments. Some advising banks are negotiating banks can be one and the same. In case the bank in the other country is not know to the importers bank, a sister bank known by both parties can be used as a guarantor of funds.

L/Cs is used mainly in trade. They usually include the mode of shipment of a specific good, and what the port of destination is. The expiry of the shipment, the documents all need to be submitted to the issuing bank. Certificates of origin , of where the goods ids produced , inspection certificates as to quantity and quality are general things importing countries will ask for pertaining to the shipment. Individual countries may have their own set of demands they want to ask.

There are two criteria for importing goods.

- commercial and

- industrial

There are also two types of L/C:

- sight L/Cs and

- usance L/Cs

Sight L/C has to be paid immediately though advanced payments can be allowed. Usance L/C has to be at a fixed maturity date. For example, payment upon the receipt of goods.

Beneficiaries that want to apply for a l/c need to have proper credit facilities. After calculating the outstanding and there is still room, then a l/c is issued. Calculations of margin and charges are also done. Upon the receipt of goods, proper documentation is certified and then payment is done. The reimbursement of funds can be made in through negotiating. They can be negotiated to the bank of choice in the relevant currency.

Essentially, an import letter of credit does not differ from an export letter of credit except from the point of view if the user. An importer has different considerations from those of the exporter, and a well-structured letter of credit will adequately serve the needs of both.

The application process

When a buyer determines that he will need a letter of credit in order to purchase or finance an order, an application must be completed. A letter of credit constitutes a contingent liabilities of the applicant(buyer) and , therefore , the bank , which issues it, hence each letter of credit issued, becomes an extension of commercial credit. For that reason, it is necessary to apply for an import letter of credit just as one would apply for a loan. Once the credit approval is in place , the actual process of requesting the issuance of the letter of credit can be a relatively simple one.

Requesting an amendment

If, after the letter of credit has been received , the seller finds that some of its terms or conditions are unacceptable , he may contract the buyer to arrange for an amendment. The buyer then requests the issuing bank to issue an amendment. If the terms of the amendment restrict, contract , or alter the value of the letter of credit in any way, the seller must grant his approval before the amendment can be considered.

Procedure of import

The procedure, which follows at the time of import , is as follows

- The buyer and the seller conclude a sale contract provided for payment by documentary credit.

- The buyer instructs his bank (the issuing bank) to issue a credit in favor of the seller/exporter/ beneficiary.

- The issuing bank then sends message to another bank (advising /confirming bank), usually situated in the country of seller then advise or confirms the credit issue.

- The advising / confirming bank then informs the seller through his bank that the credit has been issued.

- As soon as seller receives the credit, if the credit satisfy him or her then he or she can reply that , he or she can meet its terms and conditions, he or she is in the position to load the goods and dispatch them.

- The seller /exporter then sends the documents evidencing the shipment to the bank where the credit is available (the nominated bank). This can be the issuing bank of advising /confirming bank ;bank named in the credit as the paying ,accepting and negotiating bank.

- The bank then checks the documents against the credit. If the documents meet the requirements if the credit, the bank pay, accept or negotiate according to the terms of credit. In the case if credit available by negotiation, issuing bank will negotiate the resources.

- The bank if other than the issuing bank sends the documents to the bank.

- The issuing bank checks the documents and if they find that the documents has meet the credit requirements, than they realize to the buyer upon payment of the amount due or other terms agreed between him and the issuing bank.

- The buyer sends transports documents to the carrier will then proceed to deliver the goods.

Financing features

Besides serving as a vehicle for payment, a letter of credit can serve as a financing instruments if the seller and issuing bank agree to the arrangement. The most common methods are described below.

Deferred payment

With this arrangement, payment is not required until a specified number of days after shipment of the merchandise .they buyer will have access to the documents so that he can claim his goods from the carrier, but payment is deferred until the stipulated future date.

Time draft

As with a deferred payment letter of credit, the buyer will be able to obtain the merchandise without making immediate payment as long as the letter of credit stipulates that the draft be drawn at a specified number of days after sight or after shipment. The bank on which the draft is drawn accepts the draft, thereby creating a bankers acceptance, and undertakes to pay it at its maturity. The seller then has the option of holding the draft to its maturity and collecting its face value, or discounting the draft before it maturities. Discount rates are usually more receivables with this instruments is attractive, especially in a high interest rate environment.

Payment procedure of the import document

Date of payment

Usually is made within 7 day after the documents have been received if the payment is become differed, the negotiating bank claim interest for making delay.

Preparing sale memo

a sale memo is made at B.C. rate to the customer. As the T.T. &O.D. rate is paid to the ID(Remittance), the difference between these two rates is exchange trading. Finally, an inter branch exchange trading credit advice is sent to ID(Remittance).

Requesting for currency

For arranging necessary fund for payment, a requisition is sent to the international department.

Export

There is profit to be made in exports. The international market is much larger than the local market. Growth rates in many overseas markets far outpace domestic market growth. And meeting and beating innovative competitors abroad can help companies keep the edge they need at home.

There are also real costs and risks associated with exporting. It is up to each company to weight the necessary commitment against the potential benefit.

Ten important recommendations for successful exporting should be kept in mind:

- Obtain qualified export counseling and develop a master international marketing plan before starting an export business. The plan should clearly define goals, objectives, and problems encountered.

- Secure a commitment from top management to overcome the initial difficulties and financial requirements of exporting. Although the delays and costs involved in exporting may seem difficult to justify in comparison with established domestic sales, the exporter should take a long-range view of this process and carefully monitor international marketing efforts.

- Take sufficient care in selecting overseas distributors. The complications involved in overseas communications and transportation require international distributors to act more independently than their domestic counterparts.

- Establish a basis for profitable operations and orderly growth. Although no overseas inquiry should be ignored, the firm that acts mainly in response to unsolicited trade leads is trusting success to the element of chance.

- Devote continuing attention to export business when the local market booms. Too many companies turn to exporting when business falls off in the domestic market. When domestic business start to boom again, they neglect their export trade or relegate it to a secondary position.

- Treat international distributors on an equal basis with domestic counterparts. Companies often carry out institutional advertising campaigns, special discount offers, sales incentive programs, special credit term programs,warranty offers, and so on in the domestic market but fail to make similar offers to their international distributors.

- Do not assume that a given market technique and product will automatically be successful in all countries. What works in Japan may fall in Saudi Arabia. Each market has to be treated separately to ensure maximum success.

- Be willing to modify products to meet regulations or cultural preferences of other countries. Local safety and security codes as well as import restrictions cannot be ignored by foreign distributors .

- Provide readily available servicing for the product. A product without the necessary service support can acquire a bad reputation quickly.

Export L/C Process

The letter of credit is a highly Standardized instrument, which has evolved over many years into a reliable method of effecting payment for commercial transactions throughout the world. To ensure a seamless transaction when relying on an export letter of credit for payment, it is important to understand the responsibilities of the parties.

Elements of letter of credit

Every letter of credit should be scrutinized as soon as it is received special attention should be paid to the following key elements-

Key Dates

These include the latest date for shipment, the number of days for presentation of documents, payment(in the case of deferred payment or time letters of credit ), and the expiration date. These dates should be realistic and acceptable.

Amount

A letter of credit which says “about $x” means the exporter may draw 10% more or less. If the merchandise description calls for “about x” amount of product, then the exporter may ship 10%more or less.

Documentary requirements

Documents should be obtainable in time to meet the latest date for presentation. Special consideration must be given requirements for consularized invoices, inspection certificates and evidence of prior notification.

Negotiability

The letter of credit can be freely negotiable or restricted to the counters of a named bank.

Export Financing

Export financing can be two types

- pre-shipment credit

- post-shipment credit

1. Pre-shipment credit

Pre-shipment credit, as the name suggest, is given to finance the activities of an exporter prior to the actual shipment of goods. Pre shipment credit is essentially a short-term credit and liquidated by negotiation or purchase of export bills covering the merchandise generally. The bank grants pre-shipment credit against irrevocable, confirmed, unrestricted letter of credit received by an exporter from an overseas buyer. Before extending pre shipment credit, the bank takes into consideration the credit worthiness, export performance of the exporter and other documents and information which are otherwise required for sanction of loan as per the existing rules and regulation in force.

- export cash credit (hypothecation)

- export cash credit (pledge)

- export cash credit against trust receipt

- packing credit

- back to back letter of credit

- Credit against red-clause letter of credit.

Export cash credit (hypothecation)

Under this arrangement, a credit is sanction against hypothecation of the raw materials or finished goods for export. Such facility is allowed only to major exporters. As the bank has got no security in this case, except charge documents and lien of export L/C or contract, the bank normally insist in the exporter finishing collateral security. The letter of hypothecation creates a charge against the merchandise in favor of the bank but neither the ownership nor the possession is passes to it.

Export cash credit (pledge)

This credit facility is allowed against a pledge of exportable goods or materials .In this case ,cash credit facilities are extend ed against the pledge of goods to be stored in the godown under banks control by singing a letter of pledge and other pledge documents .the exporter surrenders the physical possession of the goods to the banks effective control as security for payment of bank dues .In the event of failure of the exporter to honor his commitment, the bank can sell the pledge merchandise for recovery of the advance.

Export Credit Against Trust Receipt

In this case, credit limit is sanctioned against trust receipt; (TR).here also, unlike the pledge, the exportable goods remain in the custody of the exporter. He is required to execute a stamped export trust receipt in favor of the bank, wherein a declaration is made that goods purchased with financial assistances of bank are held by him in trust for the bank .trust type of credit is granted when the exporter wants to utilize the credit for processing ,packing and rendering the goods in exportable condition and when it seems that exportable goods cannot be taken into banks custody. This facility is allowed only ton the major party and collateral security is generally obtained in this case.

Packing credit

In this case, credit facilities are extended against security of Railway /steamer Receipt /barge Receipt /Truck Receipt evidencing transportation of goods to the port for shipment of the goods in addition to the usual charge documents and line. Of export letter of credit .This type of credit is sanctioned for the transitional period from dispatch of the goods till negotiation of the export documents .the drawings under export cash credit (hypothecation/pledge)limit are generally adjusted by drawings in packing credit limit which is in turn liquidated by negotiation of export documents.

Back-To-Back letter of credit

A Back-To-Back letter of credit is a new credit, it is different from the original credit based on which the bank undertakes the risk under the back-to-back letter of credit. In this case , the banks main surety/security is the original credit (master l/c). the original credit (selling credit ) and the back-to-back credit (buying credit) are separate instruments independent of each other and in no way legally connected, although they both from part of the same business operation. The suppliers (beneficiary of the back-to-back credit ) ships goods to the importer or suppliers goods to the exporter and present documents to the bank as is specified in the credit. It is intendment that the exporter would substitute his own documents for negotiation under the original credit, his liability under the back-to-back credit would be adjusted out of these proceeds. The exporter l/c is marked lien and no margin is taken. So we can say that back-to-back id term given to an ancillary credit which arises where the seller used the credit granted to him by the issuing bank to his suppliers.

Credit against red-clause letter of credit.

Red clause credit is a special type of credit with a clauses inserted authorized the advising or confirming bank to make advances to the beneficiary before presentation of the documents.

The clause is added in the documentary credit at the request of the applicant for the credit. In other words ,it is a reshipment finance in their form of a loan the advising/confirming bank provides to the beneficiary, with payment of principal and interest guaranteed by the issuing in case the beneficiary fails to ship goods and defaults in payment of the advances.

The credit specified the advances to be given to the beneficiary , which Can be in the form of percentage or a fixed sum .

Finance is given against undertaking from beneficiary certifying that he promise to ship goods and submit documents to advising bank , which has provided him with finance possible risks in issuing a red clause credit –

- Exporter may use the advance for other purpose

- Documents presented from the exporter may have discrepancies unacceptable to the importer .

Remittance

There are two systems of remittances. They are as-

Inward remittance

Inward remittance refers to the extent where the bank makes payment to the client against foreign demand draft. Bank will make payment to the client by verifying test number and signature of the authorized officer.

Outward remittance

It refers to the extent where by the bank issues foreign demand draft. The bank charges tk.300 per demand draft.

Conclusion

Foreign exchange services department the largest department of the branch in terms of manpower and profit earned. In this year. It earned more than 60% of branch’s total profit. This department provides all the services related to international and disburse credit if the proposal is sound. As specialized financing, it provides term finance to medium and small-services, industries. The branch also provides house-building loan. Thus by providing this various services, Principal Branch, BKB, Is playing an important role in the banking system and in the payment system of Bangladesh.