EXECUTIVE SUMMERY

The internship report has been prepared on Foreign Exchange Activity of Islami Bank Bangladesh Ltd., Kawranbazar Branch” Bank has a significant role in the economic development process of a country. Today banking sectors are being proved the most important sector in the economy of Bangladesh. Banks are the custodians of the society economic resources and total economies development depends on the proper utilization of these resources. The successful banking business ensures the growth of the economy by the effective uses of the funds. In order to developing the national economy, banks keep in mind going for lending, maintaining safety, liquidity and profitability.

In August 1974, Bangladesh signed the Charter of Islamic Development Bank and committed itself to reorganize its economic and financial system as per Islamic Shari’ah. In January 1981, Late President Ziaur Rahman while addressing the 3rd Islamic Summit Conference held at Holy Makkah and Taif suggested, “The Islamic countries should develop a separate banking system of their own in order to facilitate their trade and commerce.”

This statement of Late President Ziaur Rahman indicated favorable attitude of the Government of the People’s Republic of Bangladesh towards establishing Islamic banks and financial institutions in the country.

In November 1982, a delegation of IDB visited Bangladesh and showed keen interest to participate in establishing a joint venture Islamic Bank in the private sector. They found a lot of work had already been done and Islamic banking was in a ready form for immediate introduction. Two professional bodies – Islamic Economics Research Bureau (IERB) and Bangladesh Islamic Bankers’ Association (BIBA) made significant contributions towards introduction of Islamic banking in the country.

I have tried to include all the necessary information related to the topic “Foreign Exchange Activity of Islami Bank Bangladesh Ltd. Kawranbazar Branch”. While preparing this report I have always tried my level best to make it authentic and at the same time easily understandable. For this, I came up with a number of reference books to get the theoretical backup. There may be some mistakes and unforeseen errors, which may arise due to my naïve or inexperience state.

This report is composed of ten chapters. In the First chapter Origin of the Report, Background of the Report , Purpose of the study , Report Objective, Scope of the Report, Report Methodology, Sources of Data, Limitation of the study have been highlighted brief description of Banking sector of Bangladesh is presented in chapter two. Chapter three has presented the profile of Islami Bank Bangladesh Limited., , Findings and Conclusions Performance Evaluation of IBBL Kawranbazar Branch of the Bank has been discussed in chapter five. Problem & prospects of Foreign Exchange of the Bank is discussed in Chapter six. .In chapter Eight the analysis and major findings of the report. In Chapter nine is discussed conclusion and recommendations are presented and finally in chapter Ten the Appendices and bibliography is presented.

Introduction:

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep city in their heart to fashion and design their economic lives in accordance with the precepts of Islam. The establishment of Islami bank Bangladesh limited on March 13, 1983, is the true reflection of this inner urge of its people, which started functioning with effect from march 30, 1983.This bank is the first of its kind in southeast Asia. It is committed to conduct all banking and investment activities on the basis of interest-free profit- loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new sliver lining of hope towards materializing a long cherished dream of people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic development bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent personalities of Middle East and the gulf counties, Islamic bank Bangladesh limited has by now earned the unique position of a leading private commercial bank in Bangladesh.

Origin of the Report

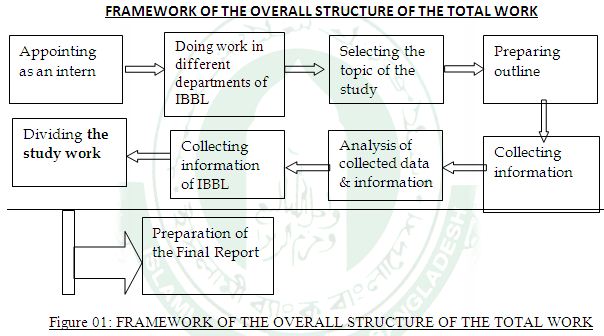

This report is an internship report prepared as a requirement for the completion of BBA program (Major in Human Resource Management) of Daffodil International University. The primary goal of internship is to provide the job exposure to the student and an opportunity to implement theoretical knowledge in real life situation. The program covers a period of 2 months of organizational attachment and 2 weeks of report finalization work.

I was sent to the Islami Bank Bangladesh Limited (IBBL). Kawranbazar Branch to take the real life exposure of the activities of banking from January 09, 2012 to March 08, 2012.

Background of the Report

As a requirement for the fulfillment of our BBA program, in the Faculty of Business Administration, Daffodil International University, we have to perform three months internship. As a student of BBA I have gathered enough theoretical knowledge, and now I want to put my potentiality in the practical field. Islami Bank Bangladesh Limited has given me the opportunity to commence my internship.

During the internship program, students are required to prepare a report on the organization where they have been attached. Islami Bank Bangladesh Limited. and all the officials always encourage and welcome the students for their internship program. I have tried my best to properly apply my potentiality and theoretical knowledge to make the report reliable and information worthy. My honest effort will be regarded as successful if this dissertation fulfills the objective of the program.

Scope of the Report

As I was sent to Islami Bank Bangladesh Limited, Kawranbazar Branch, the scope of the study is only limited to this Branch. The report covers details about Islami Bank Bangladesh Limited, Kawranbazar Branch, (especially Foreign Exchange operation).

Objectives of the study

The Study has been conducted with the following specific objectives:

- To know the foreign exchange activities of Islami Bank Bangladesh Limited, Kawranbazar Branch;

- To identify the formalities maintained by both the bank and client in processing and receiving Foreign Exchange products;

- To have an depth idea regarding the requirements and the limitations at the time of applying for Foreign Exchange procedures and other formalities;

- To identify the major problems the bank encounters in handling foreign exchange activities in Kawranbazar Branch of IBBL; and

- To recommend some suggestions based on findings

Methodology

The official and management body of IBBL primarily necessary provided necessary information in preparing this report. Therefore, other necessary information and data of the report are collected through various documents of IBBL, library work and web site of IBBL.

Sources of Data

The primary sources of Data:

Face to face conversation with the respective officer of the branch.

Face to face conversation with Department wise.

Liaison with Foreign Exchange Department.

Relevant file study as provided by the officers concerned.

Observation.

The Secondary Sources of Data:

Annual reports of the MBL.

Periodicals published by the Bangladesh Bank.

Different books, articles etc. regarding Financial Analysis.

Daily summary sheet.

Various type of statement.

Various resister books.

Various printed form.

Web page:

Limitation of the study

I have obtained wholehearted co-operation from employee of IBBL, Kawranbazar Branch in Dhaka. They were trying to give me enough information to complete this report properly. But they were not able to give me many documents; on the way of my study because of they were very busy in all day & for maintaining organizational privacy policy.

I have tried my best to provide the necessary information about Foreign Exchange Banking Activities.

Further more for going to prepare this report I have faced the following problems that may be termed as the limitation of the study:

Shortage of time period:

I had to complete this report writing within a shorter period of time since many days have passed during the training session. So the time constraint of the study hindering the course of vast area and time for preparing a report within the mentioned period is really difficult.

Accessibility:

Another limitation of the study is to access the internal records of the Bank.

Lack of discussion:

Although bankers were trying their best to give me time for discussion, but their nature of duty is that they give me little time to discuss.

Lack of records:

There are insufficient books, publications periodical statement; facts and figures narrowed the scope of accurate analysis. If this limitation were not been there, then the report would have been more useful and attractive.

Poor library facility:

Islami Bank Bangladesh Ltd. is not enriched with periodical Book and Journals. Lack of Books and Journals I had faced difficult in preparation of Foreign Exchange.

Background of the organization

2.1.1. Islami Bank Bangladesh Limited (IBBL) at a glance

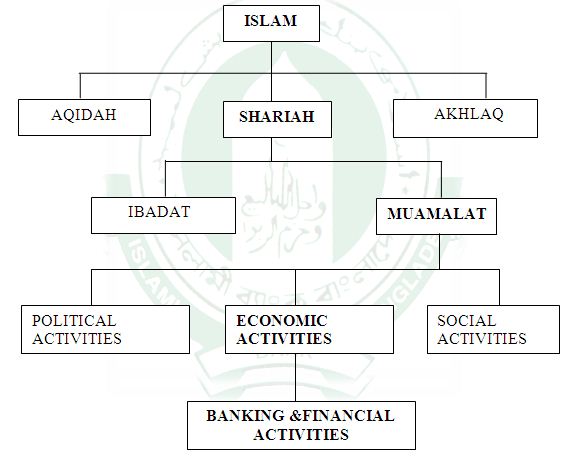

Islam is not only a religion but also a complete code of life and Islami Banking & finance is an integral part of life of a Muslim. Similarly Shari’ah Concept and principles are unavoidable code of business operations of the Bank. An Islami Bank is a financial institute whose status, rules and procedures expressly state its commitment to the principles of Islamic Shari’ah and to the banning of the receipt and payment of interest on any of its operation. Islamic bank is essentially a normative concept and could be defined as conduct of banking in consonance with the ethos of value system of Islam. The principle sources of Islamic Banking are “Quran” and “Hadith”. Islamic banking is systems of financial intermediation that avoids receipt and payment of interest in its transactions and conducts its operations in a way that it helps achieve the objectives of an Islamic economy. Alternatively, this is a banking system whose operation is based on Islamic principles of transactions of which profit and loss sharing (PLS) is a major feature, ensuring justice and equity in the economy. That is why Islamic banks are often known as PLS-banks.

Islami Bank Bangladesh Limited is a Joint Venture Public Limited Company engaged in commercial banking business based on Islamic Shari’ah with 58.03% foreign shareholding having largest branch network (236 Branches & 30 SME/Krishi Branches i.e. total 266 Branches) among the private sector Banks in Bangladesh. It was established on the 13th March 1983 as the first Islamic Bank in the South East Asia.

It is listed with Dhaka Stock Exchange Ltd. and Chittagong Stock Exchange Ltd. Authorized Capital of the Bank is Tk. 20,000.00 Million ($244.87 Million) and Paid-up Capital is Tk. 10,007.71 Million ($122.53 Million) having 63,001 (30.06.2011) shareholders as on 31st December 2011.

Historical Background of IBBL

In August 1974, Bangladesh signed the Charter of Islamic Development Bank and committed itself to reorganize its economic and financial system as per Islamic Shariah. In January 1981, the President of People’s Republic of Bangladesh While addressing the third Islamic conference held at Mecca and Taif suggested “The Islamic countries should develop a separate banking system of their own in order to facilitate their trade and commerce”. This statement of the president indicated favorable attitude of the government of the People’s Republic of Bangladesh towards establishing Islamic banks and financial institution in the country.

In early November 1980, Bangladesh bank, the country’s Central Bank, sent a representative to study the working of several Islamic Banks abroad.

In November 1982, a delegation of IDB visited Bangladesh and showed keen interest to participate in establishing a joint venture Islamic bank in the private sector. They found a lot of work had already been done and Islamic banking was in a ready from for immediate introduction. Two professional bodies of Islami Economics Research Bureau (IERB) and Bangladesh Islami Bankers’ Association (BIBA) made significant contribution towards introduction of Islami banking in the country.

They came forward to provide training of Islamic banking to top bankers and economists to fill up the vacuum of leadership for the future Islami bank in Bangladesh. They also had seminars, symposiums and workshops on Islami economic and banking throughout the country to mobilize public opinion in favor of Islami banking. Their professional activities were reinforced by a number of Muslim entrepreneurs working under the support of the then Muslim Businessmen society (now reorganized as Industrialist & Businessmen Association). The body concentrated mainly in mobilizing equity capital for the emerging Islami bank.

At last, the long drawn struggle to establish an Islami bank in Bangladesh become a reality and Islami bank Bangladesh limited was established in march 1983 in which 19 Bangladeshi national, 4 Bangladeshi institutions and 11 banks, financial institutions and government bodies of the middle East and Europe including IDB and two eminent personalities of the kingdom of Saudi Arabia joined hands to made the dream a reality.

Mission, Vision, Objectives and Strategies of IBBL

Mission

To establish Islami Banking Through the introduction of a welfare-oriented banking system.

To ensure equity and justice in the field of all economic activities.

To achieve balance growth and equitable development through diversified investment operations particularly in the priority sectors and less development areas of the country.

To encourage socio-economic upliftment and financial services to the low income community particularly in the rural areas.

Vision

IBBL’s vision is to always strive to achieve superior financial performance, be considered a leading Islamic Bank by reputation and performance.

To establish and maintain the modern banking techniques, to ensure soundness and development of the financial system based on Islamic principles and to become the strong and efficient organization with highly motivated professional, working for the benefit of people, based upon accountability, transparency and integrity in order to ensure stability of financial systems.

To encourage people savings in the form of direct investment.

To encourage investment particularly in projects those are more likely to lead to higher employment.

Strategic Objectives

To ensure customers’ satisfaction.

To ensure welfare oriented banking.

To establish a set of managerial succession and adopting technological changes to ensure successful development of an Islamic Bank as a stable financial institution.

To prioritize the clients welfare.

To emerge as a healthier & stronger bank at the top of the banking sector and continue stable positions in ratings, based on the volume of quality assets.

To ensure diversification by Sector, Size, Economic purpose & geographical location wise Investment and expansion need based Retail and SME/Women entrepreneur financing.

To invest in the thrust and priority sectors of the economy.

To strive hard to become an employer of choice and nurturing & developing talent in a performance-driven culture.

To pay more importance in human resources as well as financial capital.

To ensure lucrative career path, attractive facilities and excellent working environment.

To ensure zero tolerance on negligence in compliance issues both sharia’h and regulatory issues.

To train & develop human resources continuously & provide adequate logistics to satisfy customers’ need.

To be excellent in serving the cause of least developed community and area.

To motivate team members to take the ownership of every job.

To ensure development of devoted and satisfied human resources.

To encourage sound and pro-active future generation.

To achieve global standard.

To strengthen corporate culture.

To ensure Corporate Social Responsibilities (CSR) through all activities.

To promote using solar energy and green banking culture and ecological balancing

Organization structure of IBBL

Management of IBBL:

A Board of Directors consists of 13 directors those are elected from the foreigners and local shareholders. They provide policy guide lines to Islami Bank Bangladesh limited. The Board of Directors forms an Executive Committee for smooth and efficient operations of the Bank Executive Committee consists the members of the Board. Besides, a Management committee consisting of the senior executives headed by the chief executive looks after the actual operations of the Bank.

Shari’ah Supervisory Committee

The Shari’ah Supervisory Committee of the Bank plays a vital role in framing and exerting policy for strict adherence of Shari’ah principles in the Bank. As per Islamic Banking Guideline circulated by Bangladesh Bank, The Shari’ah Supervisory Committee is represented by 12 members consisting of prominent Ulama having adequate knowledge in Fiqhul Moamalat, renowned lawyers and eminent economists. The Shari’ah Supervisory Committee of IBBL gives opinions and guidelines to implement and comply of Shari’ah principles in all activities of the Bank particularly in the modes of investment. The Committee is governed by a bye-laws approved by the Board of Directors.

As part of major responsibilities of the Committee, Shari’ah inspections is also conducted in all the branches under its direct supervision to ensure Shari`ah compliance in all activities of the Bank.

Functions of IBBL

Islami Bank Bangladesh limited is performing the following functions:

To maintain all types of deposit accounts.

To make investment.

To handle foreign exchange business.

To extend other banking services.

To conduct social welfare activities through Islami Bank Foundation.

Features of IBBL

The bank is committed to run all its activities as per IslamiShariah. IBBL through its steady progress and continuous success has earned the reputation of being one of the leading private sector banks of the country. The distinguishing feature s of IBBL is as follow:

All its activities are conducted on interest-free banking system according to Islamic Shariah.

Establishment of participatory banking instead of banking on debtor-creditor relationship.

Investment is made through different modes permitted under IslamiShariah

Investment income of the Bank is shared with the Mudaraba depositors according to a ratio to ensure a reasonable fair rate of return on their depositors.

Its aims are to introduce a welfare-oriented banking system and also to establish equity and justice in the field of all economic activities.

It extends Socio-economic and financial services to the poor, helpless and low-income group of the people for their economic up liftmen particularly in the rural areas.

It plays a vital role in human resource development and employment generation particularly for the unemployed youths.

Its aim is to achieve balanced growth and equitable development of the country through diversified investment operations particularly in the priority sectors and in the less developed areas.

It extends co-operation to the poor, the helpless and the low-income group for their economic development.

Nature of Business

The Islami Bank Bangladesh Limited is pioneer in introducing Shari’ah based interest free utiliz banking in Bangladesh with a mission to establish welfare oriented banking system and to ensure equity and justice in the field of all economic activities. All of its activities are directed on principles of Islamic Shari’ah.There is Shari’ah council, which is entrusted with the responsibility for ensuring that the activities of the bank are being conducted on the precepts of Islam.IBBL is one of the leading first generation private sector banks in Bangladesh, which provides all kinds of commercial banking service.

Principle Products & Services

Islami Bank Bangladesh Ltd. offers all types of commercial banking services based on Islamic Shari’ah.Main products of the banks are as follows:

Deposit Products:

Al-Wadiah Current Account.

Mudaraba Hajj Savings Account.

MudarabaWaqf Cash Deposit Account.

Mudaraba Special Savings (Pension) Account.

MudarabaMohor Savings Account.

Mudaraba Savings Bond.

Mudaraba Monthly Profit Deposits Account.

Mudaraba Term Deposits Account.

Mudaraba Savings Deposits Account.

Mudaraba Special Notice Deposits Account.

Mudaraba Foreign Currency Deposits Account etc.

Investment Products

Bai-Murabaha

Bai Muazzal

Bai Salam

Hire Purchase

Hire Purchase under Shirkatul Melk

Musharaka

Mudaraba

Foreign Exchange

Export

Import

Remittance

Others

Issuance of T.T, D.D, P.O

Locker Service

Bankers to the Issue etc.

Strategic, operational, legal issues and problems

The implementation of an interest-free banking raises a number of questions and potential problems if seen from the macro and micro operational point of view. A partial list of the issues confronting Islamic banks includes:

Issues related to Macro Operation

Liquidity and Capital

Valuation of Bank Assets

Credit Creation and Monetary Policy

Financial Stability

The Ownership of Banks

Lack Capital Market and Financial Instruments

Insufficient Legal Protection

Issues Related to Micro Operation of Islamic Banks

Increased Cost of Information

Control over Cost of Funds

Mark-up Financing

Excessive Resort to the Murabaha Mode

Utilization of Interest Rate for Fixing the Profit Margin in Murabaha Sales

Financing Social Concerns

Lack of Positive Response to the Requirement of Government Financing

These are some of the immediate problems confronting policy makers and regulators. Of course, it has to be kept in mind that these issues are at their elementary level of discussion. Much work has to be undertaken in terms of procedures, infrastructure and allowing a new framework to develop and mature. The ensuing analysis should make some these issues clearer, but the progress so far has been less than substantial.

CONSTRAINTS FACED BY ISLAMIC BANKS IN BANGLADESH

Constraints faced by Islamic banks in Bangladesh are analyzed as below.

Problem with legal reserve requirement

Lack of opportunities for profitable use of surplus funds

Apprehension of liquidity crisis and possibility of liquidity surplus

Problems in capital market investment

Absence of inter-bank money market

Predominance of Murabaha financing

Depression of Profit

Absence of legal framework

Absence of Islamic insurance company

Stepping up for Distributional Efficiency

The task is more challenging for Islamic banks, as they have to promote their distributional efficiency from all dimensions together with profitability. Islamic banks, step by step, have to be converted into profit-sharing banks by increasing their percentage share of investment financing through PLS-modes. The Islamic banks, to do that, can be selective in choosing clients for financing under PLS-modes.

Islamic banks should establish a direct functional relationship between the income of the bank and that of the depositors and between the income of the bank and that of the entrepreneurs. The relationship improves with the share of bank financing under PLS-modes increases. Islamic banks should immediately take measures to revert the trends of resource transfer from both low-income groups to high-income groups and from rural to urban areas. This is extremely important from the viewpoint of their banking philosophy as well as for their tacit commitment for distributional equity. They should develop a monitoring mechanism by which distributional impact of their banking operation could be traced out and necessary policy can be formulated to continuously improve the equity situation. Banking inequality index developed in the present study might be useful for this purpose particularly in the case of inter group transfer of incomes.

The Islamic banks should actively consider utilization of rural potentials from both efficiency and equity grounds in the context of the present-day socio-economic conditions of Bangladesh. Strong commitments and stepping up through experiment and implementation of innovative ideas are the appropriate ways to do that.

Promotion of Allocative Efficiency

The Islamic banks can improve their a locative efficiency by satisfying social welfare conditions in the following manner. (a) They should allocate a reasonable portion of their investible funds to social priority sectors such as agriculture (including poultry and fishery), small and cottage industries and export-led industries such as garments, shrimp cultivation, etc. (b) When the percentage shares of allocation of investible funds are determined, profitability of the projects should be the criterion for allocating loan able funds. The criterion would be best satisfied if more and more projects were financed under PLS-modes.

Welfare Activities of IBBL

Welfare is a condition of having good health, comfortable living and pleasant working conditions (Hornby). Hence, it can be said that welfare services are those which ensure conditions of having good health, comfortable living and working conditions, which are generally one’s basic needs. Islam views work as the primary means of earning and acquiring income and wealth. But if real income is not sufficient to purchase necessities of life, then welfare services become essential in a society to maintain the minimum standard of living of the people. In fact, in every society, there are many people who lack the necessary income and, consequently, face inadequate lifestyles due to unemployment and under-employment. Their condition cannot improve if welfare services remain absent and concentration wealth remains in certain segments of society. The Quran states the principle that “wealth should not circulate only among the rich” [59:7]

The Quran also encourages people to contribute generously to social welfare and helping the needy in society. Thus the Quran establishes the general principle of generous welfare spending while encouraging sacrificial levels of spending perhaps for social crises and for conditions demanding high financial support. Thus Islam calls for the meeting of the basic needs of the poverty groups through welfare services, which might include –

Care for others:

Abdullah, A.1987mentioned that care for others, or helping behavior, is another cardinal principle of Islamic economic behavior. It tempers the self-interest that is ingrained in human nature to ensure survival. It is a natural concomitant of trusteeship, since one serves the Master by caring for His people. The Prophet, peace is upon him, said: “Mankind is God’s dependents, so the most beloved of people in the Sight of Allah are those who do good to His dependents. “Helping behavior is required because of the interdependent nature of manhood life. There is no fulfillment in life without interaction with others; individual facility requires socialization. The exclusive pursuit of self-interest in social relations is counter-productive; it defeats its own purpose. Men serve their individual and collective interest best when each individual cares for the welfare of others while striving to protect and promote his own interest. This is what religion teaches. Those who deny it, deny religion.

Zakat:

Zakat is one of the five pillars of Islam. In a broad sense, it is only for social welfare purposes as specified by the Quran: “The Zakat is (meant) only for the poor and the needy, those who collect the tax, those whose hearts are to be won over, for the freeing of human beings from bondage, for the relief of those overwhelmed by debts, for the cause of God (all priority social needs), and for the wayfarer: (this is) an ordinance from God and God is all-knowing, Wise”[9:60].

Qard Hasan(benevolent loan):

Since interest on all kinds of loan is prohibited in Islam, a loan, which is to be given in accordance with the Islamic principle, has to be, by definition, a benevolent loan (Qard Hasan), i.e. a loan without interest. It has to be granted on the grounds of compassion; to remove the financial distresses caused by the absence of sufficient money in the face of dire need. Since banks are profit-oriented organizations, it would seem that there is not much scope for the application of this technique. However, Islamic banks also play a socially useful role. Hence, they make provisions to provide Qard Hasan besides engaging in income generating activities. However practices differ in this respect. Some banks provide the privilege of interest free loans to the holders of investment accounts at the bank. Some other banks have the provision to provide interest free loans to needy students and other economically weaker sections of the society. Yet, some other banks provide interest free loans to small producers, farmers, entrepreneurs who are not qualified to get financing from other sources. The purpose of these interest free loans is to assist them in becoming financially independent or to assist in raising their incomes and standard of living.

Mobilization of Zakah:

A pioneering experiment putting the principles of Islamic banking into practice was conducted in Mit-Ghamr in Egypt from 1963 to 1967, in which three types of accounts were operated. A Zakah account was one of them. The Zakah account attracted the stipulated amount of Zakah for redistribution amongst the poor (Ahmad, K. (2000)). Since Islamic banks follow the rules of The Islamic Shari’ah, they have to pay Zakah on their own resources (capital assets etc.), which paved the way for mobilization of financial resources for the needy and poor. “An Islamic bank accumulates its Zakah in the Zakah fund and distributes amongst the poor as per Islamic Shari’ah”.

Rotating Savings and Credit Associations:

This credit program is intended to alleviate poverty. Under this program a small number of individuals, typically six to forty, form a group and select a leader who periodically collects a given amount (a share) from each member. The money collected (the fund) is then given in rotation to each member of the group. The leader receives no special consideration (other than possibly getting the first fund). He may also get commission, who in return may assume liability for defaults. Loans are interest-free. This program helps to generate economic activities among the poor in the non-corporate sector. It deals with informal finance and credit packages that improves the situation of poorer families and creates local income opportunities for the people. It also discourages internal migration. At a grass root village and local level it is directed towards landless laborers, marginal farmers, fishermen, small artisans, (e.g. blacksmith, carpenter, potter and handicraft producer), urban unemployed, small traders, rural industries and small to medium scale business enterprises.

Empowerment and Humanizing Family Credit Program:

Under this program, the bank is operating with a human face. For example, it offers financing of consumer durable assets for the newly married couple provided marriage is dowry free.

Environmental Friendly Business Program:

This credit program is directed towards small traders of Tokai (mainly street children of distressed parents) with a recovery rate of 100%

Social Fund:

Every IB has already established its social fund by mobilizing voluntary social saving, linked to its all Formal, Non-formal and Voluntary Sector Banking operations. IB has been able to mobilize a surplus Social Fund for social investment purposes in the family empowerment action program, social education fellowship program, and in the health and social services sector.

Cash Waqf Certificate:

IBBL has already introduced the Cash Waqf Certificate Scheme intended to empower the family heritage of the rich and to benefit society as a whole. It could, be the most effective and perpetual mode of deposit mobilization and use of its profit for perpetual social investment and benefits is virtually unlimited. A waquif can choose the purpose (s) to be served by his investment from the list of some purposes identified by IB; which are related with Family Rehabilitation, Education and Culture, Health and Sanitation, Social Utility Service, or any other purpose(s) approved by Islamic Shari’ah.

Welfare Oriented Special Investment Schemes

- Household Durables Scheme

- Housing Investment Scheme

- Real Estate Investment Scheme

- Transport Investment Scheme

- Car Investment Scheme

- Investment Scheme for Doctors

- Small Business Investment Scheme

- Agriculture Implements Investment Scheme

- Rural Development Scheme

- Micro Industries Investment Scheme

- Women Entrepreneurs Investment Scheme

- Mirpur Silk Weavers Investment Scheme

Equity and Entrepreneurship Fund of Bangladesh Bank

Definition and Concept of Islamic Bank

The definition of “Islamic Banking” and prove whether its activities are unequal to the conventional banking system & satisfy the principle of Islamic Shari’ah. Definition given by ‘OIC’ is- “An Islami bank is financial institution whose statutes, rules and regulations expressly state it’s commitment to the principle of Islamic shra’ah and to he banning of the receipt and payment of interest on any of its operation”. This definition indicates that IBBL is more convenient and acceptable to the Muslim mankind.

Islamic Bank is committed to conduct all kinds of banking activities on the basis of profit-loss sharing system. The objective of the Islamic Shari’ah is to promote the welfare of the people which lies in safeguarding their faith, their life, their intellect, their posterity and their wealth. The basis of this Shari’ah is wisdom and welfare of the people in this world as well as the hereafter, which lies in complete justice, mercy, well-being and wisdom.

Features of Islamic Bank

Prohibition of interest

The traditional capitalist banking system depends on interest. It receives interest for providing loans and pays interest for taking loans. The spread between these two interests is the source of its profit. But according to Islamic Shariah all types of interest is banned. So, Islamic bank does not carry on business of interest and it completely avoids the transaction of interest.

Investment Based on Profit

After departing from interest, the alternate ways of income for Islamic bank is investment and profit. Thus IBBL gives up any transaction of interest and makes investments based on profit. Bank distributes its profit to its depositors and shareholders.

Investment in Halal Business

Islamic Shariah has banned the business of haram goods. For example, Islam not only forbids the drinking of alcohol but also banned any business of alcohol. Therefore, Islamic bank does not get any haram business and only do halal business.

Halal Paths and Procedures

Islamic Shariah also rejects any haram path or process in case of a halal business. Therefore, Islamic bank system only allows the halal path procedures of halal business.

Difference between Conventional Bank and Islamic Bank

| Conventional Banking | Islamic Banking |

| 1. The functions and operating modes of conventional banks are based on manmade principles. | 1. The functions and operating modes of Islamic banks are based on the principles of Islamic Shariah. |

| 2. The investor is assured of a predetermined rate of interest. | 2. In contrast, it promotes risk sharing between provider of capital (investor) and the user of funds (entrepreneur). |

| 3. It aims at maximizing profit without any restriction. | 3. It also aims at maximizing profit but subject to Shariah restrictions. |

| 4. It does not deal with Zakat. | 4. In the modern Islamic banking system, it has become one of the service-oriented functions of the Islamic banks to collect and distribute Zakat. |

| 5. Leading money and getting it back with interest is the fundamental function of the conventional banks. | 5. Participation in partnership business is the fundamental function of the Islamic banks. |

| 6. Its scope of activities is narrower when compared with an Islamic bank. | 6. Its scope of activities is wider when compared with a conventional bank. It is, in effect, a multi-purpose institution. |

| 7. It can charge additional money (compound rate of interest) in case of defaulters. | 7. The Islamic banks have no provision to charge any extra money from the defaulters. |

| 8. In it very often, bank’s own interest becomes prominent. It makes no effort to ensure growth with equity. | 8. It gives due importance to the public interest. Its ultimate aim is to ensure growth with equity. |

| 9. For interest-based commercial banks, borrowing from the money market is relatively easier. | 9. For the Islamic banks, it is comparatively difficult to borrow money from the money market. |

| 10. Since income from the advances is fixed, it gives little importance to developing expertise in project appraisal and evaluations. | 10. Since it shares profit and loss, the Islamic banks pay greater attention to developing project appraisal and evaluations. |

| 11. The conventional banks give greater emphasis on credit-worthiness of the clients. | 11. The Islamic banks, on the other hand, give greater emphasis on the viability of the projects. |

| 12. The status of a conventional bank, in relation to its clients, is that of creditor and debtors. | 12. The status of Islamic bank in relation to its clients is that of partners, investors and trader. |

| 13. A conventional bank has to guarantee all its deposits. | 13. Strictly speaking, and Islamic bank cannot do that. |

Definition of Foreign Exchange

Foreign Exchange means exchange foreign currency between two countries. It we consider ‘Foreign Exchange’ as a subject, then it means all kind of transactions related to foreign currency. In other wards foreign exchange deals with foreign financial transaction.

H.E Evitt defined ‘Foreign Exchange’ as the means and methods by which rights to wealth expressed in terms of the currency of one country are converted into fights to wealth in terms of the currency of another country.

Description of the foreign exchange

Foreign Exchange Department is international department of the bank. It deals with globally and facilities international tread through its various modes of services. It bridges between importers and exporters. Bangladesh bank issues license to scheduled banks to deal with foreign exchange. These banks are known as Authorized Dealers. If the branch is authorized dealer in foreign exchange market, it can remit foreign exchange from local country to foreign country. This department mainly deals with foreign currency. This is why this department is called foreign exchange department.

Regulations of foreign exchange :

Foreign Exchange Regulation (FER) Act,1947 enacted on 30th march, 1983 in the then British India provides the legal basis for regulating certain payments, dealings in foreign exchange and securities and the import and export of currency and bullion. This Act was first adapted in Pakistan and then, in Bangladesh. The Act is reproduced at Appendix. Bangladesh bank is responsible for administration of regulations under the Act. Appendix provides a list of Bangladesh bank’s offices and their jurisdiction.

* Basic regulations under the FER Act are issued by the Government as well as by the Bangladesh Bank in the form of Notification which are published in the Bangladesh Gazette. Notification issued by the Bangladesh government and erstwhile Government of Pakistan and the Bangladesh bank and the erstwhile state bank of Pakistan are reproduced at Appendices and .directions having general application are issued by Bangladesh Bank in the form of notifications, foreign exchange circular letters.

* Authorized Dealer (Ads) in foreign exchange are required to bring the foreign exchange regulations to the notice of their customers in their day-to-day dealing and to ensure compliance with the regulations by such customers. The Ads should report to the Bangladesh bank any attempt, direct or indirect, of evasion of the provisions of the Act, or any rules, orders or directions issued there under.

* The Ads must maintain adequate and proper records of all foreign exchange transactions and furnish such particulars in the prescribed returns for submission to the Bangladesh bank. They should continue to preserve the records for a reasonable period for ready reference as also for inspection, if necessary, by Bangladesh bank’s officials.

Import:

Import of goods into Bangladesh is regulated by the ministry of commerce and industry in terms of the import and export (control) Act, 1950, with import policy orders issued by annually, and public Notices issued from time to time by the office of the chief Controller of import and export (CCI & E). Through the process of import some vital but which are inadequate in our country products are imported to meet the local needs of the people. Import business of islami Bank Bangladesh ltd is very significant for IBBL and National economy.

Import Mechanism:

To import, a person should be competent to be an ‘importer’. According to Import and Export (control) Act, 1950, the Chief Controller of Import and Export provides the registration (IRC) to the importer. After obtaining this, the person has to secure a letter of credit authorization (LCA) from Bangladesh Bank. And then a person becomes a qualified importer. He requests or instructs the opening bank to open an L/C.

Procedures of opening L/C to Import:

To open L/C , The requirements of an importer are:

- He must have an account in the bank like IBL.

- He must have Importers Registration Certificate (IRC)

- Report on part performance with other bank. IBBL collects this report from Bangladesh Bank.

- CIB (Credit Information Bureau) report Bangladesh Bank.

- A proposal approved by the meeting of executive committee of the bank. It is necessary only when the L/C amount is small or there is no limit.

- If the L/C amount is large or there is a limit, then an approval from Bangladesh Bank is needed. Usually this approval is needed for amount more than one corer.

Export:

Creation of wealth in any country depends on the expansion of production and increasing participation in international trade. By increasing production in the export sector we can improve the employment level of such a highly populated country like Bangladesh. Bangladesh exports a large quantity of goods and services to foreign households. Readymade textile garments (both knitted and woven), jute, jute-made products, frozen shrimps, tea are the main goods that Bangladeshi exporters export to foreign countries. Garments sector is the largest sector that exports the lion share of the country’s export. Bangladesh exports most of its readymade garments products to U.S.A and European Community (EC) countries. Bangladesh exports about 40% of its readymade garments products to U.S.A. Most of the exporters who export through IBBL are readymade garments exporters. They open export L/Ss here to export their goods, which they open against the import L/Cs opened by their foreign importers. Export L/C operation is just reverse of the import L/C operation. For exporting goods by the local exporter, bank may act as advising banks and collecting bank (negotiation bank) for the exporter.

Export Policy:

Export policies formulated by the Ministry of Commerce, Government provide the overall guideline and incentives for promotion of exports in Bangladesh. Export policies also sat out commodity-wise annual target. It has been decided to formulate these policies to cover a five year period to make them contemporaneous with the five-year plans and to provide the policy regime.

The export-oriented private sector, through their representative bodies and chambers are consulted in the formulation of export policies and are also represented in the various export promotion bodies set up by the government.

Foreign Remittance:

On March 24, 1994 Bangladesh Take was declared convertible for current account International Transaction. As a prelude to this wide-ranging reforms were made in the country’s foreign exchange regime to lay the ground for a market friendly environment to induce investment, growth and productivity. Following liberalization under convertibility, most remittances are now approved by the Authorized Dealers themselves on behalf of the central bank. Only a few remittances of special nature require Bangladesh Bank’s prior approval.

Foreign remittance means remittance of foreign currencies from one place/ persons to another place/ persons. In broad sense foreign remittance includes all sale and purchase of foreign currencies on account of Import, Export, Travel and other purposes. However , specifically Foreign remittance means sale and purchase of foreign currencies for the purposes other than export and import. As such, this chapter will not cover purchase and sale of foreign currencies on account of Import and Export of goods.

Outward Remittance:

The term “Outward Remittance” include not only remittance i.e. sale of foreign currency by TT. MT, Drafts, Traveler’s cheque but also includes payment against imports into Bangladesh and local currency credited to non-resident taka accounts of Foreign Banks or convertible taka account.

Private Remittance:

1. Family Remittance Facility:

a. Foreign National working in Bangladesh with approval of the Government may remit through an Authorized Dealers 50% of salary and 100% of leave salary as also actual savings and admissible person benefits. No prior approval of bank is necessary for such remittance.

b. Remittance of moderate amounts of foreign exchange for maintenance abroad of family members (spouse, children, parents)of Bangladesh Nationals are allowed by Bangladesh Bank on written request supported by certificate from the Bangladesh mission in the concerned country.

Remittance of Membership fees/registration fees etc:

Authorized Dealers may remit without prior approval of Bangladesh Bank, membership fees of foreign professional and scientific institutions and fees for application registration, admission, examination (TOEFL,SAT etc.) in connection with admission into foreign educational institutions on the basis of written application supported by demand notice/Letter of the concerned institution.

Education:

Prior permission of Bangladesh Bank is not required for releasing foreign exchange in favor/on behalf of Bangladesh students studying abroad or willing to proceeds abroad for studies.

4. Remittance of Consular Fees:

Consular fees collected by foreign embassies in Bangladesh Taka and deposited in a taka account maintained with an AD solely for this purpose may be remitted abroad without prior approval of Bangladesh Bank.

5. Remittance of evaluation fee:

Authorized Dealers without prior approval of Bangladesh Bank may remit evaluation fee on behalf of Bangladesh desiring immigration to foreign countries for getting educational certificates of the person concerned evaluated by a foreign institution. A demand note of the foreign immigration authority is required for this purpose.

6. Travel:

Private travel quota entitlement of Bangladesh Nationals is set at US doller 3000/- per year for visit to countries other than SAARC member countries any Myanmar is US doller 1000/- for travel by air and US doller 500/- for travel by overland route. Authorized Dealers may release this travel quota in the from of foreign currency notes up to US doller 500/- or equivalent and balance exchange in the from of TCs or total quota in the from of TCs the applicable quota will be half the amount allowable to adults.

Authorized Dealers may release above travel quota without prior approval of Bangladesh Bank subject to observation and satisfaction of following points-

i. The intending traveler is a customer of the AD bank or is sufficiently well known to the AD Bank or the intending traveler has paid relevant Travel Tax. The intending traveler has a valid passport.

ii. The AD should verify and satisfy itself that may foreign exchange released for an earlier travel was utilized with he journey being actually undertaken or was duly enchased unutilized.

iii. The intending traveler is in possession of confirmed air ticket for journey to be undertaken and that the intended journey to be undertaken not later than two weeks after date on which exchange is issued.

iv. The amount releases is endorsed on the passport and air ticket of the traveler with indelible ink, with the signature and the name of the AD branch embossed in the passport and ticket. However, while issuing foreign exchange to the Diplomats/privileged persons/ UN personnel, Govt. Officials travel ling on officials’ duties, such endorsement in the passports need not be made.

v. In each case of release of foreign exchange for travel aboard, photocopies of first six pages of the passport and the page recording endorsement of foreign exchange and photocopies of the pages of ticket showing name of the passenger , route and date of journey and endorsement of foreign exchange along with the relative T.M. form should be sent to Bangladesh Bank along with monthly returns.

7. Health and Medical:

Authorized Dealers without prior approval of Bangladesh Bank may release foreign exchange up to US dollar 10,000/- for medical treatment abroad on the basis of the recommendation of the medical Board set up the Head Directorate and the cost estimate of the foreign medical institution.

8. Seminars and Workshops:

Without prior approval of Bangladesh Bank AD may release US dollar 200/- per diem and dollar 250/- per diem to the private sector participants for attending seminars, conferences and workshops organized by recognized International bodies is SAARC member countries or Myanmar and in other countries respectively for the actual period of the seminar/workshop/conference to be held on this basis of invitation letters received in the names of the application or their employer institutional.

9. Foreign Nationals:

i .The Authorized Dealers may issue foreign currency TCs to foreign nationals without any limit foreign currency notes up to US dollar 300/- or equivalent per person against surrender of equivalents amounts in foreign currencies . The TCs and foreign currency notes should however ,be delivered only on production of ticket for a destination outside Bangladesh and the amount issued should be endorsed on the relative passports.

ii. Authorized Dealers may allow recon version of unspent Taka funds of foreign tourists into foreign exchange on production of the enchashement certificate of foreign currency Reconversion shall be allowed by the same AD with which the foreign currency was encashed earlier. AD should retain the original encashment certificate and relative FMJ forms where reconversion exceeds US dollar 5000/-.

10. Remittance for Hajj:

Authorized Dealers may release foreign exchange to the intending

pilgrims for performing Hajj as per instructions/circulars to be issued

by the Bangladesh Bank each year.

11. Other Private remittance

Application for remittances by private individuals for purposes other

Than those mentioned above should be forwarded to Bangladesh

Bank for consideration and approval after assessing the bonafides of

the purpose of remittance on the basis of documentary evidence submitted by the applicant.

12.Official and Business Travel:

- Official Visit.

- Business Travel Quota for New Exporters

- Business Travel Quota for Importers and Non-exporting Producers

- Exporter’s Retention Quota.

Commercial Remittance :

- Opening of branches or subsidiary companies abroad

- Remittance by shipping companies airline and courier service

- Remittance of royalty and technical fees

- Remittance on account of training and consultancy

- Remittance of profits of foreign firms/ branches

- Remittance of Dividend

- Subscriptions to foreign media services

- Costs/ for Reuter monitors

- Advertisement of Bangladeshi products in mass media abroad

- Bank Charges.

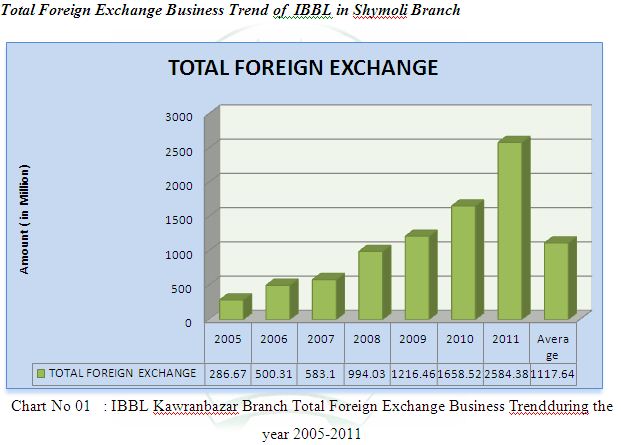

Foreign Exchange Performance Evaluation:

Islamic Bank Bangladesh Limited has glorious history in mobilizing foreign exchange Business. Over the year the bank’s Foreign Exchange Business was a record high amount among all banks in Bangladesh. The bank has a wide network of Authorized Dealers through out the year. Well- equipped and international network with skilled manpower, the bank is confident of running foreign exchange business efficiently to the satisfactory of importers, exporters and Bangladeshi expatriates working abroad.

IBBL has a good network of correspondent banks around the world for its foreign exchange business. The performance are given in the following page.

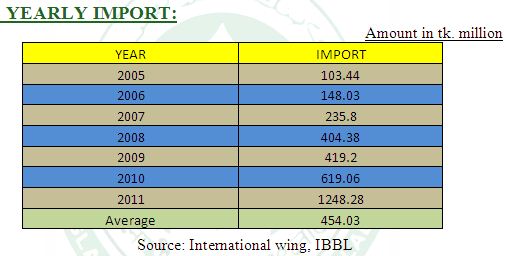

As above table show that . the Import amount in Tk. Million from 2005-2011. The import business witnessed a much better performance in 2011; the amount was Tk.1248.28 million. Before that year amount was Tk.619.06 and the year 2005 the amount was Tk.103.44. So through out the year 2005-2011, the Import business is increasing.

Import Items:

During the year 2011 bank opended 35,929 import Latter of Credit for Tk.1248.28 million as against 32,991 letter of Credit for Tk. 619.06 million in 2010 showing 22.79% growth in amount. Major items of Import consist of the following:

(Amount in Million Taka)

| SL. No | Items | 2011 | 2010 | ||

| Amount | % of total | Amount | % of total | ||

1 | Raw Cotton, Yarn, Fabrics & Accessories | 307.70 | 24.65% | 185.53 | 29.97% |

2 | Capital Machinery | 211.21 | 16.92% | 71.75 | 11.59% |

3 | Fertilizer | 68.16 | 5.46% | 19.81 | 3.20% |

4 | Agricultural Equipment | 0.00 | 0.00% | 0.00 | 0% |

5 | Wheat | 20.35 | 1.63% | 35.10 | 5.67% |

6 | Irons, Steel & Other Base Metals | 56.42 | 4.52% | 22.72 | 3.67% |

7 | Motor Vehicles | 0.00 | 0% | 0.00 | 0% |

8 | Chemicals | 36.20 | 2.90% | 26.56 | 4.29% |

9 | Edible Oil (Crude & Refined) | 27.96 | 2.24% | 23.71 | 3.83% |

10 | Rice | 7.24 | 0.58% | 29.41 | 4.75% |

11 | Scrap Vessel | 0.00 | 0% | 0.00 | 0% |

12 | Others | 513.04 | 41.10% | 204.48 | 33.03% |

| Total | 1248.28 | 100.00% | 619.06 | 100.00% |

Table 03: Import Items

Analysis and Major Findings :

The major findings and analysis of the study are as follows:

- Lack of manpower in Foreign Exchange Department especially in export division of Shymoli Branch is a big problem. The manpower of that section is not sufficient for prompt service.

- As IBBL is not a foreign bank, it cannot attract as much as clients for Foreign Trade. Because clients prefer Global bank for foreign transactions.

- Lack of promotional initiatives to expand the foreign exchange business was observed.

- From the previous years it has been observing that frequently the currency of taka is devaluating and dollar currency is going very high and devaluation of taka is hampering import business and other sectors too.

- Government new regulations like as L\C margin reduce the Foreign Exchange transaction.

- Strict controlling of central bank in foreign currency endorsement is a major problem.

- The employees of Foreign Exchange department of this branch are outfacing from insufficient computer facilities.

Recommendations:

In light of the findings, the recommendations are as follows:

- The bank should arrange more training programs for their officials. Quality training will help the officials to enrich them with more recent knowledge of foreign currency activities.

- Margin and commission on L/Cs varies from customer to customer. A few customers are allowed to open L/C even with nil margin and fees commission. I think the bank should review the customer transaction behaviors for a period of time and should develop a certain policy in this regard.

- In case of L/Cs, sometimes customers insist on giving their payments though their documents are found discrepant. In some cases bank has to give payment to these customers for different reasons. But it lessens the creditability of the bank. I think the bank should be strict as possible about giving payment against discrepant documents without hurting the customers.

- In case of export L/Cs, the government encourages the exporters by giving different facilities like tax-cuts. I think the bank should also think about such type of facilities to be given to the exporter because Bangladeshi Exporters like readymade garments exporters are going to face a tough situation in coming years from the exporters of the others countries.

- In cases, the foreign banks want confirmations from other foreign banks with which this bank has correspondence. This proves the poor financial condition of the country. Bank should try to improve this situation.

- Over burden of work and ill defined assignment unable the employee to discharge their duties in cool manner. It also creates a hazardous situation in the work process. So, all the employees should be assigned with proper and specific assignment.

- The manager may also provide sufficient sophisticated computers to the employees in the foreign exchange department of this branch.

- The manager should take some promotional activities so that the businessmen will feel interest to open their L/C in the foreign exchange department, Shymoli Branch of IBBL. As a result, the manager can successfully expand the activities of foreign exchange department of this Branch.

Conclusion:

As an increase of IBBL. I have truly enjoyed my internship form the learning and experience viewpoint. I am confident that this two months internship program at IBBL will definitely help me to realized my further carrier in the job market.

Islamic Bank Bangladesh Limited is a new generation bank. It is committed to provide high quality financial services/ product to contribute to the growth of GDP of the country through stimulating trade commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, poverty alleviation, raising standard of living of limited income group and overall sustainable social-economic development of the country. Though it is a new bank, IBBL makes a strong position through it’s varies activities. Its number of clients, amount of deposit and investment money increases day by day. This bank already has shown impressive performance in investment. The bank now should think to start new services and take different types of marketing strategy to get more customers in this competition market of banking