The opportunity that I am interested in traveling regularly again in the future is zero. It is very inefficient.

And while workers and employers are somewhat divided over where they stand on the question of long-distance labor, the Covid-19 epidemic has shaken the permanently operating country; we are not going back to pre-COVID normal. Firstbase is developing a software and hardware solution to help remote workers quickly get the tools and support they need, rather than return to offices to support workers who are exposed to distance labor.

And today the company announced that it has closed on a $ 13 million series led by Andreessen Horowitz. B Capital Group and Alpaca VCO have rounded up the capital; in the mid-2020s, an accelerator took part in the cohort. Significantly, Firstbase did not start with its current product focus. As common as the beginning it is born as something completely different. With a core fintech curve, the company is back in 2018 remote.

However, the experience was not significant, Firstbase co-founder and CEO Chris Hard told TechCrunch. It was difficult for workers to acquire the technology they needed and it was difficult to get it back if they left the company, he explained. Later, with less effort in capital and time, the company realized that some of the internal technologies it created to help remote employees meet their hardware and software requirements could be widely applied. There are 600 companies. That number has multiplied since then.

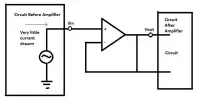

The company’s products are doubled. It is a software service that helps companies track and manage the hardware resources that their remote workers use. And it’s a hardware service that can pre-install the software on the hardware and provide shipping to employees and remote IT support.

Notably, customers can either use Firstbase’s software alone, which they provide on a SAS basis, or offer both its software and hardware. Firstbase has two sources of gross margin. Its software business will earn explicit software revenue and the company could make a total profit from its hardware business, hard explained. The hardware part of the startup model appears to be more equipped than the software component.