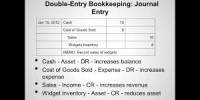

The accounting process starts when transactions are posted to the accounting records called journals. The recording process may be manual or automated.

The manual process means that a bookkeeper records transactions into paper journals as they occur or at the end of a day, week, or month, depending on frequency. The manual process is not used widely any more.

The automated process involves use of the accounting software, where a bookkeeper can enter all transactions, again daily, weekly, and monthly or as needed. Due to the efficiency increase with the automated process, it is the most used nowadays.

The process of entering the transactions into journals (whether on paper or in accounting software) represents bookkeeping.

The next step in the process is summarization and presentation of the financial information. Again, this may be completed manually or automatically with help of accounting applications. This process is known as accounting.

Note that there is no definite separating line between bookkeeping and accounting. Bookkeeping mostly relates to entering and recording transactions, while accounting means preparing the information for presentation of financial statements or other reports.

Once all transactions for a period have been posted, the financial statements are prepared. There are four basic financial statements in financial accounting (in the order of preparation):

- Income Statement (Profit and Loss Statement)

- Equity Statement (Statement of Owners’ Equity)

- Balance Sheet (Statement of Financial Position)

- Cash Flow Statement (Statement of Cash Flows)

The Income Statement shows the profit or loss for the period. It includes revenues and expenses, which provide the net result for the period. This statement is prepared for the period, meaning it includes all transactions that took place during the period.

The Equity Statement shows the capital and other equity accounts of the company and how such accounts changed during the period.

The Balance Sheet shows the company’s assets, liabilities and equity as of the end of the period. This statement is prepared as of a date, and not for the period, like the Income Statement.

The Cash Flow Statement shows the cash movements during the period. Such cash movements include all cash receipts and expenditures.