Introduction:

This internship report is generated under the supervision of A.N. M. Asaduzzaman Fakir, Department of Accounting & Information Systems, Jagannath University, Bangladesh. This internship report is required to fulfill award of BBA Degree. The topic of this report was “Financial Performance Analysis of Square Pharmaceuticals Ltd.” The main objective of doing this report is to have a practical experience of the real life aspects of the Financial Management that we have study in the classroom.

To prepare this report I have selected and got opportunity to work as an internee in the reputed and well-known leading “Square Pharmaceuticals Ltd. ” a firm of Square Group.

History of Square Pharma

This company was founded in 1958 by Samson H. Chowdhury along with three of his friends as a private firm. It went public in 1991 and is currently listed on the Dhaka stack exchange Square Pharma Ltd, the flagship company, is holding the strong leadership position in the pharmaceutical industry of Bangladesh since 1985 and it has been continuously in the 1st position among all national and multinational companies since 1985. Square pharmaceuticals Ltd. Is now on its way to becoming a high performance global player.

Objective of the Study

The main objective of this report is to introduce with the information contained in the financial reports of company and to give the opportunity to use this information in preparing a report on a target company.

The objective of the study may be viewed as:

- General Objective

- Specific Objective

General Objective:

The general objective of the study is to evaluate the information of general objective “financial performance of Square Pharmaceuticals Ltd.”

Detailed Objective:

The Detailed objectives may be spelled out as follows:

- To collect information from financial statements of the company

- To find out the Management problems and solve the problems

- To highlight the financial ratios in credit analysis and competitive analysis as well as financial capability of the company.

- To satisfy the shareholders by informing about the company.

- To give some idea about its management and organization structure.

Methodology

The theoretical part of the report is based solely on secondary information. And the major source of data for preparing the report is based on secondary information like annual reports.

Data Source :

- Primary Data

- Secondary Data

Primary Data:

- From the organization’s Annual Reports.

- Related literature of Dhaka Stock Exchange and Securities and Exchange Commissions has also been consulted.

- By interviewing the organization’s officials time to time.

Secondary Data:

- The powerful Spreadsheet analyzer MS Excel.

- Word processor: MS Word.

Scope of the Study

The scope of the study may be stated as under:

- The study would help financial planning and decision making.

- The study would help of ratio Analysis.

- The study would aware the Annual report of the company corrective and appropriate measure timely to improve the company performance.

- The study would also help the price and share market to the company’s present and future position.

Limitations of the study

Some of the limitations faced while preparing this report are mentioned here:

- The main limitation faced was that SPL used a completely different accounting system from that I have learned for our academic purposes. So it was difficult to find out the necessary figures for ratio calculations.

- Another limitation of this study is that no industry average for any ratios

- SPL was available. So, most of the ratios did not reflect the BPL position in the industry.

Square Pharmaceuticals Limited operates business in various divisions. But they do not show the accounts of every division in their annual report. As a result, I could not compare exactly pharmaceutical division’s financial position

with other pharmaceutical companies.

- The proposed report will cover the tools and techniques of financial management in the selected pharmaceutical companies.

- Information of this organization is publicly available and my appearance as an apprentice it may not possible for me to collect certain information which is confidential to the organization.

As the organization has a large existence around the country and of course a very old one, I could not explain the whole, due to operating complexities and time constraints. The time that was given to prepare the report has not been adequate.

Company History

Square Pharmaceuticals Ltd. or (SPL), a member of SQUARE Group, came into existence as a public limited company in 1976. It commenced commercial operation in 1980 and went for public issue of shares in 1985. The shares of company are listed with the Dhaka and Chittagong Stock Exchanges of Bangladesh. The total numbers of shareholders are 47,811 and the total numbers of employees are 1,328.

The company operates in a single industry segment. It has its own manufacturing facilities. The principal activities of the company are

-manufacturing of formulation and sales drugs and sales of the produced items

home and aboard. The overseas offices and associates of SPL are UK, USA, Pakistan, Myanmar, Singapore, Kenya, Yemen and the exports outlets are Bhutan, Georgia, Germany, Hong Kong, Iran, Iraq, Kenya, Malaysia, Myanmar, Nepal, Pakistan, Russia, Singapore, South Korea, Taiwan, Thailand, Ukraine, Vietnam and Yemen.

SPL is the leading pharmaceutical manufacturer in the country. It all began in 1580 when SPL’s first product made under license of Bayer AG, Germany rolled out of a small manufacturing plant in Tongi, Dhaka. Products made under license of Upjohn Incorporated, USA followed. After its initial years of struggle it broke ground with the launching of its own products in 1983. The journey continued and barrier after barrier were crossed, challenges were faced and overcome to transform SPL into what it is at present.

Today, SPL holds a 15% share in the domestic market after competing with such IfcAinational Giants as Welcome, Novartis, Hoecsht, Rhone Poulenc Rorer, Glaxo, ftsonsetc.

COMPANY MISSION

Our Mission is to produce and provide quality & innovative healthcare relief for people, maintain stringently ethical standard in business operation also ensuring benefit to the shareholders, stakeholders and the society at large.

COMPANY VISION

We view business as a means to the material and social wellbeing of the investors, employees and the society at large, leading to accretion of wealth through financial and moral gains as a part of the process of the human civilization.

“If there is one characteristic that has typified the SQUARE approach it is Vision to be the best of our nature and human resources. A vision to establish our group and country as a respected and valued regional presence.”

Company Profile

BOARD OF DIRECTORS

Mr. Samson H. Chowdhury Chairman

Mr. Samuel S. Chowdhury Vice Chairman

Mr. Tapan Chowdhury Managing Director

Dr. Kazi Harunar Rashid Director

Mr. M. Sekander Ali Independent Director

Ms. Ratna Patra Director

Mr. Anjan Chowdhury Director

Mr. Kazi Iqbal Harun Director

Mr. K. M Saiful Islam Director

AUDIT COMMITTEE

Mr. M. Sekander Ali Chairman

Mr. Samuel S. Chowdhury Member

Mr. Kazi Iqbal Harun Member

MANAGEMENT COMMITTEE

Mr. Tapan Chowdhury Chairman

Mr. K M Saiful Islam Member

Mr. Parvez Hashim Member

Mr. M. Ashiqul Hoque Chawdhury Member

Mr. Muhammadul Haque Member

Mr.Md. Kabir Reza, FCMA Member

Profile of Square Pharmaceuticals:

| Corporate Headquarter | 117 Dhanmondi R/A , Road No.2 Dhaka-1205, Bangladesh. |

| Operational Headquarter | 19 Dhanmondi R/A , Road No.7Dhaka 1205, Bangladesh |

| Factory | . 126 Kathaldia, Tongi ,Gazipur. |

| Year of Establishment Commercial Production Status | 1976

|

| Commercial Production | 1980 |

| Status | Public Limited Company |

| Business Line | Manufacturing and marketing of pharmaceutical finished products and Active Pharmaceutical Ingredients (APIs) |

| Overseas Offices &Associates | UK, USA, Pakistan, Myanmar, Singapore, Kenya, Yemen, Nepal ,CezchRepublic |

| Export Markets Authorized Capital (TK) Paid-up Capital(TK) Net Turnover 2003 (TK) Number of Shareholders Stock Exchange Listings Number of Employees 1,000 million 508.9 million 2,183.8 million 47,811 Dhaka, Chittagong 1,328

| Bhutan, Cambodia, Germany, Hong Kong, Iran, Iraq, Malaysia, Russia, South Korea , Srilanka, Thailand, Ukraine, Vietnam

|

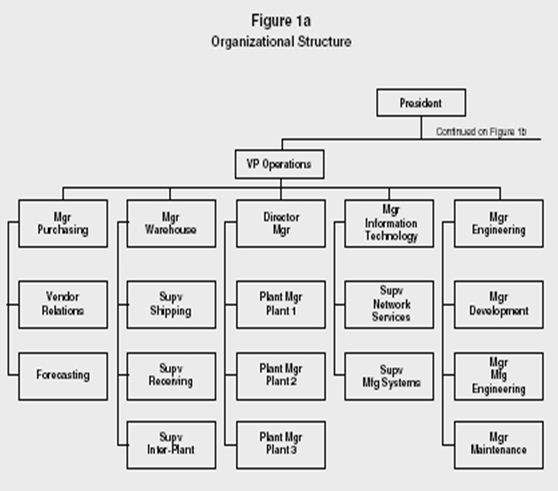

Departments of SPL

SPL has highly qualified professional staffs for handling all the condition of the company. Introduction of various divisions are as follows:

- Central Product Management (CPM) Department

- Purchase Department

- Financial System Development (FSD) Department

- Safes Department

- Human Resource Department

- Finance and Accounts Department

- SPL Factory (Works Department).

- Management Information System (MIS) Department

- Multimedia

- Medical Services Department (MSD)

Major Achievement of the Company:

- 1982: Licensing Agreement signed with F. Hoffmann-La Roche Ltd., Switzerland

- 1985: Achieved first position in the Pharmaceutical Market of Bangladesh among all national and multinational companies

- 1987: Pioneer in pharmaceutical export from Bangladesh.

- 1991: Converted in to a Public Limited Company.

- 1994: Initial Public Offering of Square Pharmaceutical Shares.

- 1995: Chemical Division of Square Pharmaceuticals Ltd. starts production of pharmaceutical bulk products (API).

- 1997: Won the National Export trophy for exporting pharmaceuticals.

- 1998: Agro-chemicals & Veterinary Products Division of Square Pharma starts its operation.

- 2001: US FDA/UK MCA standard new Pharmaceutical factory goes into operation built under the supervision of Bovis Lend Lease, UK.

- 2004: Signing of agreement with ROVIPHARM, Vietnam to manufacture and market Square products under license in Vietnam.

- 2004: Secured the top position for the best published accounts and report for 2003 in the manufacturing category for transparency and excellence in corporate reporting

- 2005: New State-of- the-Art Square Cephlosporins Ltd. goes into operation; built under the supervision of TELSTAR S.A. of Spain as per US FDA/ UK MHRA requirements.

- 2007: Square Pharmaceuticals Ltd., Dhaka Unit gets the UK MHRA approval.

- 2008: New SVPO (Small Volume Parenteralandi:Ophthalmics) plant starts operation in Dhaka Unit.

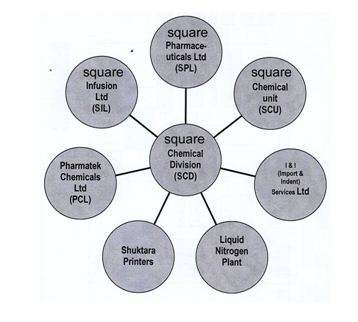

Square Chemical Division

Square chemical division one of the part of Square group, where SPL is committed to cater to the healthcare needs of the nation. Maintaining the ecological balance is of paramount to SPL, BIL and PCL. The company is committed to preventing all forms of pollution to preventing all forms of pollution by reducing environmental damage due to the manufacturing activities to an attainable minimum level. The bulk of the profit of SQUARE group comes from ne Chemical Division. Its quality products, services and high standard of 3rofessionalism helped to earn public recognition both home and aboard its success is evidence of what a strict focus on quality can achieve, Square Pharmaceutical’s product range continues to expand every year and each new product adds to the many lives already improved. The whole chemical division can be divided by the following ways.

Diagram of Square Chemical Division

Different units under Chemical Divisions are:

- Square Pharmaceuticals Ltd (SPL)

- Square Infusion Ltd (SIL)

- Basic Chemical unit (BCU)

- Pharmatek Chemicals Ltd (PCL)

- I&I Services Ltd

- Shuktara Printers

- Liquid Nitrogen Plant

Review of the Annual Reports

This part of the report is based on the key figures contained in the financial statement of Square Pharmaceuticals Limited. Although the figures were included in their published Annual Reports, those were not summarized in the form I followed.

Sales:

We calculated the trend analysis of sales. In this case, year 2005 was selected as base year. The trend percentages of sales were computed by dividing the sales amount of each following year by 2,310,362,227.

| Year 1 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Sales | 2,398,984,575 | 2,452,524,212 | 2,401,241,111 | 2,508,788,068 | 2,183,829,795 |

| Trend | 103.84% | 106.15% | 103.93% | 108.59% | 94.52% |

From the table we can see the fluctuating condition of sales during the last five years. But in the year 2010 it decreased from 108% to 94%. However, the year 2009 increase was substantial.

Cost of Goods Sold:

Keeping up with the decreasing amount of sales, cost of goods sold also Decreased. In this case again we considered year 2005 as a base year and the amount was 1,580,430,638. The trend percentage was calculated by dividing each year sale by the base year.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| COGS | 1,597,118,077 | 1,556,741,208 | 1,459,108,308 | 1,620,493,149 | 1,355,748,848 |

| Trend | 101.06% | 98.50% | 92.32% | 102.53% | 85.78% |

In the year 2010 it COGS shows decreased value than its previous year, -cwever, the year 2009 increase was substantial.

on Financial Performance of SPL (2011) —

Earning Profit before Interest and Tax (EBIT):

We calculated the trend analysis of EBIT. In this case, year 2005 was selected as base year. The trend percentages of EBIT were computed by dividing the amount of each following year by 500,614,133.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| EBIT | 532,271,952 | 582,587,493 | 609,940,536 | 533,226,958 | 420,220,039 |

| Trend | 106.32% | 116.37% | 121.84% | 106.51% | 83.94% |

The EBIT (Earning Profit before Interest and Tax) was increased in the year 2007 and decreased in the year 2010. This is happened because of their decreasing sales over the years.

Gross Profit:

For calculating the trend analysis of Gross Profit, year 2005 was selected as base year. The trend percentages of Gross Profit were computed by dividing the amount of each following year by 729,931,589.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Gross Profit | 801,866,498 | 895,783,004 | 942,132,803 | 888,294,919 | 828,080,947 |

| Trend | 109.86% 122.72% 129.07% | 121.69% | 113.45% | ||

According to the above calculation we can see that the Gross Profit increased in the year 20078and 2006 and decreased onwards.

Operating Expenses:

For calculating the trend analysis of operating expenses, year 2005 was selected as base year. The trend percentages of Gross Profit were computed by dividing the amount of each following year by 333,099,067.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 | |

| COGS | 365,738,983 | 303,176,313 | 322,483,320 | 343,185,534 | 397,998,572 | |

| Trend | 109.80% | 91.02% | 96.81% | 103.03% | 119.48% | |

Operating expenses of SPL was lower in the year 2010 and 2006 but it increased in the next following years. Here the year 2010 was more substantial

Operating expenses of SPL was lower in the year 2000 and 2001 but it increased in the next following years. Here the year 2001 was more substantial.

Five years’ Statistics

[Amounts in thousand Taka]

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 | ||||||

| Authorized capital | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | ||||||

| Paid Capital | 508,875 | 442,500 | 442,500 | 442,500 | 442,500 | ||||||

| total Turnover | 2,183,830 | 2,508,788 | 2,401,241 | 2,452,524 | 2,398,985 | ||||||

| Export Turnover | 59,594 | 50,284 | 47,325 | 44,268 | 35,846 | ||||||

| Gross Margin | 828,081 | 888,295 | 942,133 | 895,783 | 816,089 | ||||||

| profit Before Tax | 263,619 | 362,232 | 430,420 | 422,644 | 413,312 | ||||||

| Net Profit | 224,643 | 341,680 | 401,780 | 398,295 | 386,576 | ||||||

| fixed Assets at cost | 6,669,824 | 5,512,974 | 5,141,780 | 4,062,660 | 3,759,880 | ||||||

| Shareholders Equity | 4,643,615 | 4,441,096 | 4,165,791 | 3,764,011 | 3,454,217 | ||||||

| Dividend | 20% | 20% | 15% | 20% | 20% | ||||||

| Return on Paid up I Capital | 52% | 82% | 97% | 96% | 93% | ||||||

| Equity Per Share | 91 | 100 | 94 | 85 | 78 | ||||||

| Earnings Per Share

| 4.41 | 6.71 | 9.08 | 9.00 | 8.74 | ||||||

| Market Price Per Share | 39.72 | 41.83 | 49.50 | 66.90 | 32.31 | ||||||

| price Earnings |R2tio(Time) | 9.00 | 6.23 | 5.45 | 7.43 | 3.70 | ||||||

| number of Shareholders | 47,811 | 49,960 | 50,367 | 50,618 | 50,733 | ||||||

| General Public & 1 Sponsors | 35,568 | 37,317 | 37,568 | 38,447 | 38,426 | ||||||

| foreign Investors | 42 | 43 | 43 | 43 | 43 | ||||||

| ICB & Investors Account | 12,201 | 12,600 | 12,756 | 12,128 | 12,264 | ||||||

| Number of Employees | 1,328 | 1,218 | 1,151 | 1,047 | 1,010 | ||||||

| Officials | 862 | 747 | 695 | 581 | 544 | ||||||

| Staff | 466 | 471 | 456 | 466 | 466 | ||||||

This graph is showing that the Total Turnover outstanding is increasing for SPL over the year. And in the last year it is near about 2,400,000 million. All most double the last year.

Cost of Goods Sold:

Keeping up with the decreasing amount of sales, cost of goods sold also Decreased. In this case again we considered year 2005 as a base year and the amount was 1,580,430,638. The trend percentage was calculated by dividing each year sale by the base year.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| COGS | 1,597,118,077 | 1,556,741,208 | 1,459,108,308 | 1,620,493,149 | 1,355,748,848 |

| Trend | 101.06% | 98.50% | 92.32% | 102.53% | 85.78% |

In the year 2010 it COGS shows decreased value than its previous year, -cwever, the year 2009 increase was substantial.

on Financial Performance of SPL (2011) —

Ratio Analysis

Introduction: Ratio analysis provides only a single snapshot, the analysis being for one given point or period in time.

Financial ratios, calculated from the information of financial statement that are used to analyze a past financial performance.

Financial ratios seldom provide answers rather they provide the basis for asking the right questions about a firm’s financial performance.

Financial ratios can be classified according to the information they provide. The following types of ratios frequently are used:

1. Liquidity ratios

2. Leverage ratios

3. Activity ratios

4. Profitability ratios

5. Market Measure ratios.

Improtant of ratios:

- Liquidity Ratio: Liquidity ratios are the first ones to come in the picture. These ratios actually show the relationship of a firms cash and other current assets to its current liquidities. Two ratios are discussed under liquidity ratios. They are:

- The current ratio is a widely used measure for evaluating a company “liquidity” and short term debt paying ability. This ratio indicates the extent to which current liabilities are covered by those assets expected to be converted to cash in the near future. Current assets normally include cash, marketable securities, accounts receivables, and inventories. Current liabilities consist of accounts payable, short-term notes payable, current maturities of long-term debt, accrued taxes, and other accrued expenses.

- Quick test ratio: This ratio indicates the firm’s liquidity position as well. It actually refers to the extent to which current liabilities are covered by those assets except inventories.

2. Leverage ratio: Financial leverage ratios are used to judge a firms ability to meet long-term obligations. two ratios are discussed under Leverage ratios. They are

A. Debt to total assets: The debt to assets ratio reveals the extent to which a company is financed with debt. This ratio indicates how much of the firms assets have been financed by borrowing.

B. Time Interest earned: This ratio provides an indication of the margin of safety between financial obligations and the net income.

C. Activity ratios: Activity ratios are used to measure how efficient the firm uses its resources to generate sales. Two ratios are discussed under activity ratios. They are

A. Average collection period: The approximate amount of time it takes for a business to receive payments owed, in terms of receivables, from its customers and clients.

B. Receivable turnover: Receivable turnover ratio indicates the rate of receivable to turn into cash. This also is events of the helpfulness of the company’s credit.

4.Profitability ratio: Profitability ratio shows profitability in relation to sales or to investment. It indicates the efficiency of firms operation. Two ratios are discussed under profitability ratios. They are

A. Gross Profit margin: This ratio gives an idea about the success relation to sales on after the cost of goods sold is removing. This ratio indicates the efficiency of operations and how products are priced.

B.Net profit Margin: The profit tells you how much profit a company makes for every $1 it generates in revenue. Several financial books, sites, and resources tell an investor to take the after-tax net profit divided by sales.

Liquidity Ratios:

Current Ratio:

Formula : Current Assets/Current Liabilities

| Year | Calculation | Ratio |

| 2006 | 1609350687 / 1471680549 | 1.09 times |

| 2007 | 1837871677 / 1606425627 | 1.14 times |

| 2008 | 1784174322 / 1490321573 | 1.2 times |

| 2009 | 1982226375/1509003009 | 1.31 times |

| 2010 | 2088113545 / 1328229729 | 1.57 times |

Analysis: Initially Pharmaceuticals Limited had a very low current ratio. But over the next four years it shows an increasing trend. In 2006 the current ratio was 1.09, which gradually increased to 1.57 in 2010

Interpretation: Current ratio shows the firm’s short-term debt paying ability. In case of Pharmaceuticals Limited, it’s current ratio of year 2010 shows 1.57 which is greater than 1. This implies that the firm is capable of meeting its current liabilities by its current assets. The firm has the capacity of paying Taka 1.57 to pay off Taka 1 of its current liability. This current ratio makes the firm more attractive to the bankers and trade creditors, and as well as shareholders.

Quick Ratio:

Formula : Current Assets-Inventories/Current Liabilities

| Year | Calculation Ratio | |

| 2006 | (1609350687-1046613844) / 1471680549 | 0.38 |

| 2007 | (1837871677-1173573503) / 1606425627 | 0.41 |

| 2008 | (1784174322-1144320036) / 1490321573 | 0.43 |

| 2009 | (1982226375-1113539289) / 1509003009 | 0.58 |

| 2010 | (2088113545-1143710812) / 1328229729 | 0.71 |

Analysis: For Pharmaceuticals Limited, quick ratio also shows a increasing trend. In 2006, the quick ratio of Pharmaceuticals Limited was 0.38. In 2007, the ratio was 0.41. In 2008, it was 0.43. In 2009, it was 0.58 and in 2010, it was 0.71.

Interpretation: Quick ratio measures the immediate ability to meet its current debts. For Pharmaceuticals limited, the quick ratio of year 2010 was 0.71. The firm has only Taka 0.71 to meet its Taka 1 of current debts. This implies the firm does not have enough cash to pay off its current debt. This lack of cash has taken place because the firm has more inventory than other liquid assets. This makes the company dubious concern for the short-term liability holders. Since over the five years quick ratio shows an increasing trend, so it is good sign for the company.

Super Quick/Acid Test Ratio:

Formula : Cash + Marketable Securities/Current Liabilities

| Year | Calculation | Ratio |

| 2006 | 28861341/1471680549 | 0.02 |

| 2007 | 31765405/1606425627 | 0.02 |

| 2008 | 43021401/ 1490321573 | 0.029 |

| 2009 | 5352819/ 1509003009 | 0.0035 |

| 2010 | 4911867/1328229729 | 0.0037 |

Analysis: In 2006, the quick ratio of Pharmaceuticals Limited was 0.02. In 2007, the ratio was 0.020. In 2008, it was 0.029. In 2009, it was 0.0035 and in 2010, it was 0.0037, which shows that ‘s cash inflow decreased sharply over the years.

Interpretation: It is the most stringent measure in this perspective. It deals with extremely liquid assets like cash and bank balance against current liabilities. Due to its extreme cautions attitude the ratio is not widely used. The company had relatively good cash position in the year 2008 and declined afterwards. However it shows they need an intensive care on cash management

Liquidity Ratios:

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Current Ratio | 1.09 | 1.14 | 1.2 | 1.31 | 1.57 |

| Quick Ratio/Acid Test ratio | 0.38 | 0.41 | 0.43 | 0.58 | 0.71 |

| Super Quick /cash Ratio | 0.02 | 0.02 | 0.029 | 0.0035 | 0.0037 |

Leverage Ratios

Debt to Equity Ratios:

Total Liabilities

Formula:

Total Shareholder’s Equity

| Year | Calculation | Ratio |

| 2006 | 1506044630 / 3454216663 | 0.436 |

| 2007 | 1646734105/3764011336 | 0.437 |

| 2008 | 2194476724/4165791144 | 0.527 |

| 2009 | 2321595008/4441096192 | 0.523 |

| 2010 | 3384592022 / 4643614519 | 0.729 |

Analysis: Debt to equity ratio for the company was 0.436 in 2006. The ratio almost same 0.438 in2007. In 2008, it was 0.527. In 2009 it decreased slightly to 0.523. However in 2010 it increased to 0.729.

Interpretation: Debt to Equity ratio shows the relationship between debt financing and equity financing. A high ratio shows a large share of financing by the creditors and Vis”-a’-vis. By using debt capital or trading on equity, company can magnify the shareholders profit. In 2006, the company’s liabilities were Taka 0.436 compare to the Shareholder’s equity of Taka 1. Although, it was increased to Taka 0.527 in 2008 and 0.729 in 2010, it is still below the standard rate.

Debt of Total Asset:

Total Liabilities/

Formula:

Total Assets

| Year | Calculation | Ratio |

| 2006 | 1506044630 / 4960261293 | 30.36% |

| 2007 | 1646734105 / 5410745440 | 30.43% |

| 2008 | 2194476724/6360267868 | 34.50% |

| 2009 | 2321595008/6762691200 | 34.33% |

| 2010 | 3384592022 / 8028206541 | 42.16% |

Analysis: The debt to total Assets shows an increasing trend for the average companies. In case of Pharmaceuticals Limited, in 2006 it was 30.36%. However, it was slightly increased in 2007 is 30.43% and in 2008 it was 34.50%. In 2009 it slightly decreased to 34.33% and in 2010 it was 42.16%.

Interpretation: Debt to total assets shows the proportion of total assets financed by debt. The debt ratio year of 2006 is 30.36% that means lenders has financed 30.36% of the capital employed. So the owner has financed 1-.3036 = 0.6964 i.e., 69.64% of net assets.

This ratio indicates that the Pharmaceuticals Limited is using less debt capital than the owners capital and it is also indicates that SPL is low riskier company.

Equity Ratio

Total Shareholder’s Equity

Formula:

Total Assets

| Year | Calculation | Ratio |

| 2006 | 3454216663 / 4960261293 | 69.64% |

| 2007 | 3764011336 / 5410745440 | 69.57% |

| 2008 | 4165791144/6360267868 | 65.50% |

| 2009 | 4441096192 / 6762691200 | 65.67% |

| 2010 | 4643614519 / 8028206541 | 57.84% |

Analysis: In 2006, the equity ratio for SPL was 69.64%. However, it decreased to 69.57% in 2007, 65.50% in 2008 and 57.84% in 2010. in 2009 it was 65.67%.

Interpretation: Equity ratio shows the protection of total assets financed by equity. In case of SPL, 69.64% of the total assets was financed by the shareholders equity.

Time-Interest Earned (TIE) Ratio:

EBIT

Formula:

Interest Expenses

| Year | Calculation | Ratio |

| 2006 | 532271952/118960393 | 4.47 |

| 2007 | 582587493 / 159943284 | 3.64 |

| 2008 | 609940536 / 179520085 | 3.40 |

| 2009 | 533226958 / 170994495 | 3.12 |

| 2010 | 420220039/156601506 | 2.68 |

Analysis: In 2006, the EBIT ratio of SPL was 4.47. It decreased to 3.64 in 2007, 3.40 in 2008, 3.12 in 2009 and again decreased to 2.68 in 2010.

Interpretation: The TIE ratio measures the extent to which earnings before interest and taxes (EBIT), also called operating income, can decline before the firm is unable to meet its annual interest payments.

Interpretation: The ratio shows the decreasing trend of SPL since 2006 due to covering its interest charges by low margin of safety. This decreasing trend of TIE does not show a good sign for a company like SPL and in this case bank and other stakeholders may not be interested for further investment in this company.

Leverage Ratios:

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Debt to Equity Ratio | 43.6 | 43.7 | 52.7 | 52.3 | 72.9 |

| Debt total Asset Ratio | 30.36 | 30.43 | 34.5 | 34.33 | 42.16 |

| Equity Ratio | 69.64 | 69.57 | 65.5 | 65.67 | 57.84 |

| Times-interest Earned Ratio | 4.47 | 3.64 | 3.4 | 3.12 | 2.68 |

Activity Ratios:

Inventory turnover:

Cost of Good Sold

Formula:

Average Inventories

| Year | Calculation | Ratio |

| 2006 | 1582895575/1048031327 | 1.51 |

| 2007 | 1556741208/1110802415 | 1.40 |

| 2008 | 1459108308/1127561226 | 1.29 |

| 2009 | 1620493149/1120550257 | 1.45 |

| 2010 | 1355748848/1128625051 | 1.20 |

Analysis: The inventory turnover ratio for SPL showed a gradually falling trend over the last five years. In 2006, the ratio was 1.51. But within the next three years the ratio declined to 1.40,1-29 and 1.20 respectively. Though in 2009 the ratio was 1.45.

Interpretation: Inventory turnover shows the effectiveness of investments in inventories. Decrease the inventory turnover is a bad sign for SPL. It indicates the decrease of net income of the firm.

Inventory Turnover in days:

Days in a Year

Formula:

Inventory Turnover

| Year | Calculation | Ratio |

| 2006 | 360/1.51 | 238 |

| 2007 | 360 / 1.40 | 257 |

| 2008 | 360/1.29 | 286 |

| 2009 | 360/1.45 | 250 |

| 2010 | 360 / 1.2 | 300 |

Analysis: In 2006, the firm’s inventory turnover was 238 days, which increases over the period

of time. In 2007, it increased to 257 days, which ultimately reached 300 days in 2010.

Interpretation: Average inventory shows the number of days to convert inventory into sales. For SPL, which indicates inventory management system is not in a good shape and needs immediate management action.

Average Collection Period:

Receivables

Formula:

Average sales per day

| Year | Calculation | Ratio |

| 2006 | 251851605 / 6663846 | 37.79 |

| 2007 | 308800577/6812567 | 45.33 |

| 2008 | 333884395/6670114 | 50.06 |

| 2009 | 447307967 / 6968856 | 64.19 |

| 2010 | 499677576/6066194 | 82.37 |

Analysis: The average collection period for SPL showed gradually increased over the last five years. In 2006, the firm’s average collection period was 38 days, which increases over the period of time. In 2007, it increased to 45 days, in 2008 is 50 days, in 2009 it was 64 days, which ultimately reached 82 days in 2010

Interpretation: Average Collection Period is used to evaluate the company’s ability to collect its credit sales in a timely manner. The trend shows high increase in collection which blocks the cash hence cash management problem occurred. They had constant collection period during the years 2006-2010 it was increased, ranging from 38 days to 82 days . This indicates that customers are not paying their bills on time. Though SPL tried to reduce the collection period but the trend in DSO over the past few years has been risking.

Fixed Asset turnover:

Sales

Formula:

Net Asset

| Year | Calculation | Ratio |

| 2006 | 2398984575 / 3350910606 | 0.72 |

| 2007 | 2452524212 / 3572873764 | 0.69 |

| 2008 | 2401241111/4576093546 | 0.52 |

| 2009 | 2508788068 / 4780464825 | 0.52 |

| 2010 | 2183829795 / 5940092996 | 0.37 |

Analysis: The Fixed Asset turnover ratio for SPL showed a gradually falling trend’s over the last five years. In 2006, the ratio was 0.72. But within the next four years the ratio declined to 0.69,0.52,0.52 and 0.37 respectively.

Interpretation: The fixed assets turnover ratio measures how effectively the firm uses its plant and equipment to help generate sales. The ratio of SPL shows the lower trend from the year 2006 to 2010. This indicating that the company is not used its fixed assets as intensively (efficiently).

Total Asset Turnover:

Sales

Formula:

Average Total Assets

| Year | Calculation | Ratio |

| 2006 | 2398984575 / 5042855730 | 48% |

| 2007 | 2452524212 / 5226800585 | 47% |

| 2008 | 2401241111/5793534226 | 41% |

| 2009 | 2508788068/6278112713 | 40% |

| 2010 | 2183829795/7153159627 | 31% |

Analysis: The firm’s asset turnover ratio has decreased over the last five years. In 2010, it was 0.31 compare to 0.40 in 2009, 0.41 in 2008, 0.47 in 2007 and 0.48 in 2006

Interpretation: Asset turnover ratio shows how efficiently assets are used to generate sales. In case of SPL, the total asset turnover of is 0.48, 0.47, 0.41, 0.40 and 0.31 times implies that SPL generates a sale of Taka 0.48, 0.47, 0.41, 0.40 and 0.31 for one Taka investment in fixed and current assets together. Decreasing trend is bad sign for the company. To become more efficient, company sales should be increased.

Average Payment Period:

Accounts

Formula ´ 360

Payable turnover

| Year | Calculation | Ratio |

| 2006 | 360 / 8.626 | 41.73 |

| 2007 | 360 / 5.30 | 67.92 |

| 2008 | 360 / 6.55 | 54.93 |

| 2009 | 360 / 8.78 | 40.98 |

| 2010 | 360/7.18 | 50.15 |

Analysis: In 2006, the, Avg. Payment period was 42 days. It increased to 68 days in 2007. 55 days in 2008, 41 days in 2009 and again increased to 50 in 2010.

Interpretation: The average payment period is the average amount of time needed to pay accounts payable. Prospective lenders and suppliers of trade credit are especially interested in the average payment period, because it provides them with a sense of the bill-paying patterns of the company. The ratio of the average payment period trend shows that the company’s payment period was high in the year 2007.

Accounts Receivable

Turnover Ratio:

Sales

Formula:

Accounts Receivables

| Year | Calculation | Ratio |

| 2006 | 2398984575 / 251851605 | 9.53 |

| 2007 | 2452524212 / 308800577 | 7.94 |

| 2008 | 2401241111/333884395 | 7.19 |

| 2009 | 2508788068 / 447307967 | 5.61 |

| 2010 | 2183829795 / 499677576 | 4.37 |

Analysis: The firm’s Accounts Receivable turnover ratio has gradually decreased over the last five years. In 2006, it was 9.53 compare to 7.94 in 2007, 7.19 in 2008, 5.61 in 2009 and 4.37 in 2010.These show an decreasing trend in debtor’s turnover.

Interpretation: Debtor’s turnover shows the effectiveness of the collection of debtor’s account. In case of SPL the collection from debtors have decreased. And it is indicates that the credit management policy of SPL is not satisfactory

Activity Ratios:

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Inventory Turnover Ratio | 151 | 1.4 | 1.29 | 1.45 | 1.2 |

| Inventory Turnover in Days | 238 | 257 | 286 | 250 | 300 |

| Average Collection Period | 37.79 | 45.33 | 50.06 | 64.19 | 82.37 |

| Fixed Asset Turnover Ratio | 0.72 | 0.69 | 0.52 | 0.52 | 0.37 |

| Total Asset Turnover Ratio(%) | 48 | 47 | 41 | 40 | 31 |

| Average Payment Period | 41.73 | 67.92 | 54.93 | 40.98 | 50.15 |

| Accounts Receivable Turnover Ratio | 9.53 | 7.94 | 7.19 | 5.61 | 4.37 |

Net Profit Margin:

Profit after Taxes

Formula: ´100

Sales

| Year | Calculation | Ratio |

| 2006 | 386575927 / 2398984575 | 16.11% |

| 2007 | 398294673/2452524212 | 16.24% |

| 2008 | 401779808/2401241111 | 16.73% |

| 2009 | , 341680048/2508788068 | 13.62% |

| 2010 | 224643327/2183829795 | 10.29% |

Analysis: The net profit margin ratio for Pharmaceuticals Limited was 16.11% in 2006. And it sharply increased over the next two years. In 2007 it was 16.24%, in 2008, it was 16.73%. But next two years in 2009 and 2010, there was gradually decrease of 13.62% and 10.29% respectively.

Interpretation: The net profit margin ratio indicates the efficiency of management in turning over the company’s goods at a profit. A high profit margin ratio is a high sign of a good management and a relatively low profit margin is definitely a danger signal warranting a careful and detailed analysis of the factors responsible for it.

From the above figure it can be observed that the net profit margin was comparably stable in the year 2006-2008, but due to increase of the cost of goods sold, net profit margin were low in the next two years.

Gross Profit Margin:

Gross Profit

Formula —————–100

Sales

| Year | Calculation | Ratio |

| 2006 | 816089000 / 2398984575 | 34.00% |

| 2007 | 895783004/2452524212 | 36.50% |

| 2008 | 942132803/2401241111 | 39.20% |

| 2009 | 888294919 / 2508788068 | 35.40% |

| 2010 | 828080947/2183829795 | 37.90% |

Analysis: The firm’s gross profit margin has increased rapidly over the three years. In 2006, the firm’s gross profit margin was 34%. In 2007 it was 36.5% and in 2008 it was 39.2% but in 2009 it decreased to 35.4%. Again it increased to 37.9% in 2010.

Interpretation: Gross profit margin indicates the efficiency of management in turning over the company’s goods at a profit The gross profit margin measures the percentage of each sales remaining after the company has paid for its goods. The higher the gross profit margin indicates that the company is in good position/ which can be viewed in the year 2008. In 2008 the company converted its gross profit to Taka 39 of per 100 Taka sales. But afterwards it’s declined in the year 2009 and then increased in the year 2010. So the gross profit margin of SPL is in ups and downs or fluctuating position from 2006-2010.

Operating Expenses Ratio:

Operating Expense

Formula: ——————————– 100

Sales

| Year | Calculation | Ratio |

| 2006 | 261001092 / 2398984575 | 10.88% |

| 2007 | 303176313/2452524212 | 12.36% |

| 2008 | 322483320/2401241111 | 13.43% |

| 2009 | 343185534/2508788068 | 13.68% |

| 2010 | 397998572 / 2183829795 | 18.22% |

Analysis: The Operating Expense ratio for SPL was lowest of 10.88% in

2006. But it gradually increased over the next four years. In

2007, it was 12.36%, in 2008 it was 13.43%, in 2009 it was 13.68% and in 2010 it was 18.22%.

Interpretation: This ratio indicates that 10.88%, 12.36%, 13.43%, 13.68% and 18.22% of sales have been consumed by the operating and financial expenses. And this implies that the remaining percentage of sales i.e., 89.12%, 87.64%, 86.57%, 86.32% and 81.78% were left to interest, taxes, and earnings to owner of the last five years of 2006, 2007, 2008, 2009 & 2010 respectively.

Turn on Total Assets:

Net Income

Formula ———————- 100

Total Assets

| Year | Calculation | Ratio |

| 2006 | 386575927/4960261293 | 7.79% |

| 2007 | 398294673 / 5410745440 | 7.36% |

| 2008 | 401779808 / 6360267868 | 6.32% |

| 2009 | 341680048 / 6762691200 | 5.05% |

| 2010 | 224643327 / 8028206541 | 2.80% |

Analysis: The firm’s return on assets has sharply declined over the five years period. In 2006 it had the highest return on assets of 7.79%. In 2007 it was 7.36% of total assets, in 2008 it was 6.32% , in 2009 it was 5.05% and in 2010 it was only 2.80% of total assets.

Interpretations: Return on assets shows the overall earning power of total assets irrespective of capital structure. The higher the return on total assets is better. But the trend of SPL’s return on assets shows downward trend and declined since 2006 at a lower rate can be observed. The reason of the decline was due to the more investment in total assets.

Earning Per Share:

Net Profit after taxes

Formula:—————————————-

No. of common Share outstanding

| Year | Calculation | Ratio |

| 2006 | 386575927 / 44250000 | 8.74 |

| 2007 | 398294673 / 44250000 | 9.00 |

| 2008 | 401779808/44250000 | 9.08 |

| 2009 | 341680048 / 50887500 | 6.71 |

| 2010 | 224643327 / 50887500 | 4.41 |

Analysis: Earning per share shows an increasing trend for SPL in 2006-2008. In 2006 it was Taka 8.74 per share. It increased to Taka 9.00 in year 2007 and Taka 9.08 in year 2008. But it rapidly decreased to Taka 6.71 in year 2009 and Taka 4.41 in year 2010.

Interpretation: Earning per share facilitates comparisons of earnings between companies. In case of Pharmaceuticals Limited, earning per share is quite good. Earning per share was high in the year 2008 and it was sharply decreasing since 2009 mainly due to increase in number of shareholders in the year 2010 hence EPS declined.

Basic Earning per Ratio:

Net Profit before Tax

Formula:——————————- 100

Total Assets

| Year | Calculation | Ratio |

| 2006 | 413311559/4960261293 [ | 8.33% |

| 2007 | 422644/5410745 | 7.81% |

| 2008 | 430420 / 6360267 | 6.77% |

| 2009 | 362232463 / 6762691200 | 5.36% |

| 2010 | 263618533/8028206541 | 3.28% |

Analysis: The firm’s Bas[c Earning power has sharply declined over the five years period. In 2006 it had the highest Earning power of 8.33%. In 2007, it was 7.81% of total assets, in 2008 it was 6.77%, in 2009 it was 5.36% and in 2010 it was only 3.28% of total assets.

Interpretations: Basic earning power registered a declining trend since 2008 onwards which is also replica of ROA trend and trend of capital turnovers

Profitability Ratios

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Net Profit Margin(%) | 16.11 | 16.24 | 16.73 | 13.62 | 10.92 |

| Gross Profit Margin(%) | 34 | 36.5 | 39.2 | 35.4 | 37.9 |

| Operating Expenses Ratio(%) | 10.88 | 12.36 | 13.43 | 13.68 | 18.22 |

| Return on Total Asset(%) | 7.79 | 7.36 | 6.32 | 5.05 | 2.8 |

| Return on Equity(%) | 11.19 | 10.58 | 9.64 | 7.69 | 4.84 |

| Earning Per Share | 8.74 | 9 | 9.08 | 6.71 | 4.41 |

| Basic Earning Power Ratio(%) | 8.33 | 7.81 | 6.77 | 5.36 | 3.28 |

Market Measure Ratios

Price Earning Ratio:

Market price per share

Formula:————————————–

Earning per share

| Year | Calculation | Ratio |

| 2006 | 32.31 / 8.74 | 3.70 |

| 2007 | 66.90 / 9.00 | 7.43 |

| 2008 | 49.50 / 9.08 | 5.45 |

| 2009 | 41.83/6.71 | 6.23 |

| 2010 | 39.72 / 4.41 | 9.01 |

Analysis: The Price Earning ratio of the Pharma is 3.70 times, 7.43 times, 5.45 times, 6.23 times and 9.01 times of the last five years of 2006, 2007, 2008, 2009 and 2010 respectively.

Interpretations: The overall P/E ratio shows upward and downward trend during the year 2006 to 2010. P/E ratios are higher for firms with high growth prospects, but SPL is lower for riskier firms. Because SPL’s P/E ratio is very low & it has above average risk associated with leverage.

Earning Yield Ratio:

Earning per share

Formula:——————————–

Market price per ordinary share

| Year | Calculation | Ratio |

| 2006 | 8.74/32.31 | 27.05% |

| 2007 | 9.00/66.90 | 13.45% |

| 2008 | 9.08/49.50 | 18.34% |

| 2009 | 6.71/41.83 | 16.04% |

| 2010 | 4.41/39.72 | 11.10% |

Analysis: The Earning yield ratio of the Pharma is 27.05%, 13.45%, 18.34%, 16.04% and 11.10% of the last five years of 2006, 2007, 2008, 2009 and 2010 respectively.

Interpretations: The Earning yield evaluates the shareholders return in relation to the market value of the share. In the year of 2006 & 2008 the investors of the SPL has been earned more than the other years.

Dividend Yield Ratio:

Dividend per share

Formula: ———————————100

Market price per ordinary shares

| Year | Calculation | Ratio |

| 2006 | 2.00 / 32.31 | 6.19% |

| 2007 | 2.00 / 66.90 | 2.99% |

| 2008 | 1.50/49.5 | 3.03% |

| 2009 | 2.00 / 41.83 | 4.78% |

| 2010 | 2.00 / 39.72 | 5.04% |

Analysis: The dividend yield ratio of the Pharma is 6.19%, 2.99%, 3.03%, 4.78% and 5.04% of the last five years of 2006, 2007, 2008, 2009 and 2010 respectively.

Interpretations: The dividend yield is the income component of a stock’s return stated on a percentage basis. The highest Dividend Yield ratio can be observed in 2006 is 6.19% and the lowest is 2.99% in 2007. The trend shows fluctuating condition year by year (2006-2010). The company should increase the dividend per share to maintain a balance between market price and dividend declaration.

Dividend Payout Ratio:

Dividend per share

Formula: ———————————100

Earning per share

| Year | Calculation | Ratio |

| 2006 | 2.00 / 8.74 | 22.88% |

| 2007 | 2.00 / 9.00 | 22.22% |

| 2008 | 1.50 / 9.08 | 16.52% |

| 2009 | 2.00/6.71 | 29.81% |

| 2010 | 2.00 / 4.41 | 45.35% |

Analysis: The dividend payout ratio of the Pharma is 22.88%, 22.22%, 16.52%, 29.81% and 45.35% of the last five years of 2006, 2007, 2008, 2009 and 2010 respectively.

Interpretations: Dividend payout ratio indicates the percentage of companies earnings paid out in cash to its stockholders. And also indicates the percentage of current earnings retained by it for reinvestment purposes.

Dividend payout ratio was low in the year of 2008 due to imbalance increase in dividend per share and earning per share. In the recent years the payout ratio was excellent, due to low retained earnings.

Market Measure Rations

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Price Earning Ratio | 3.7 | 7.43 | 5.45 | 6.23 | 9.01 |

| Earning Yield (%) | 27.05 | 13.45 | 18.34 | 16.04 | 11.1 |

| Dividend Yield%) | 6.19 | 2.99 | 3.03 | 4.78 | 5.04 |

| Dividend ay-out Ratio (%) | 22.88 | 22.22 | 16.52 | 29.81 | 45.35 |

FINDINGS

Findings regarding various aspects of financial performance of Pharmaceuticals Ltd. is presented below:

- The liquidity position of the company is satisfactory, because the company’s current ratio and quick ratio is in an increasing trend. The liquidity ratios show that they have very alarming condition for meeting the outside liabilities from their current assets.

- Leverage is the ability of a company to increase the Earning Per share (EPS) by using debt capital. Pharmaceuticals Ltd. is using more equity capital than the long-term debt capital but it is good sign that the debt is increasing from year to year, in terms of leverage ratio.

- Activity ratios are not much impressive in case of Pharmaceuticals Ltd. Particularly close attention should be increase in such areas as inventory turnover, average collection period and fixed asset turnover.

- The total profitability of SPL was quite good from 2006 to 2008, but the last two years profitability has suffered a bit, although the gross profit margin has increased in 2010.

- Profitability is the indicator of success or failure of a company operating policy. But other indicators are declining profitability trend is alarming and speaks of very uncomfortable position for the company in the year 2009 & 2010.

- The possible causes of fall of return on asset, return on equity, basic earning ratio may be rise in cost of production, administrative cost, financial cost etc.

- The Price Earning Ratio of the industry indicates that how much the invested is ready to offer against EPS. The market measure position of SPL is satisfactory due to increasing price earning and high rate of dividend pay-out ratio.

Here this ratio indicated that the SPL is a good growing company & if they maintain the cost of production and relative cost in operating then SPL will be a good position in the near future.

CONCLUSION

Thus we can say that there are lots of applications of financial analysis in the modern days of business. To assess any business condition financial analyses give a clear financial picture of any business organization. Which helps to evaluate the trend and condition of that organization.

From small to big business organization financial analysis helps a great deal in decision-making process. As it helps to give idea about the financial condition, thus it helps in future financial projection and decision-making process of any business house.

Eventually one can assess- how important is financial analysis in the modern days of business. It gives the exact picture of the financial condition and helps future projection of any organization.

Square Pharmaceuticals Ltd. is one of the market leaders and in some cases market leader in the Pharmaceuticals Industry of Bangladesh. It is gradually expanding its asset base and able to proper utilize its assets well. The overall financial position of the company may be said to be satisfactory over the years. Since SPL is a good concern of Square Group so, the position may

again be improved if management becomes more careful of/income and expenditure, use of working capital.

RECOMMENDATIONS

The overall performance of Pharmaceuticals Ltd shows a satisfactory position although they are suffering a bit last few years. The liquidity ratios show that they have very impressive ability to meet the outside liabilities from current assets. On the other hand the profitability as well as total assets are in increasing trend. Although they have very low return on asset at the end of the study but it can be said that there is every possibility to get better financial condition and improvements by taking appropriate and accurate actions to protect decreasing tendency.

Whereas due to fall in earning yield, Return on Asset, return on equity, Basic earning power ratio, there is every possibility of further fall in market price of share. Appropriate measures should be taken to improve the above ratios.

The problem of Pharmaceuticals Ltd. can be solved to certain extend. The following suggestion can be made in order to solve the problem:

- They should increase dividend per share that will serve as a promotional tool.

- Improvement of productivity through work-study and training of front line supervisors.

- Contribution analysis for each of the product lines to optimize profit in light of demand factors.

- Effects to bring selling prices in line with costs having regard to competition and other market factors.

- They have to be more careful about utilization of working capital.

- Close attention should be given to inventories and debtors.

- Rationality and planning in materials purchases to avoid unnecessary inventory build up or shortage of materials.