Equity share is a main source of finance for any company giving investors rights to vote, share profits, and claim on assets. It gives partial ownership of a public company to a buyer, also known as a shareholder, who undertakes the entrepreneurial risk associated with a business venture. The amount of funding provided by a company’s owners and shareholders plus the company’s retained earnings are referred to as stockholders’ equity and shareholders’ equity when the balance sheet for the company is prepared. Holders of this type of shares are entitled to a portion of the company’s profits and get the right to vote on corporate matters, such as setting corporate policy, accepting takeover bids, and electing the members of a board of directors.

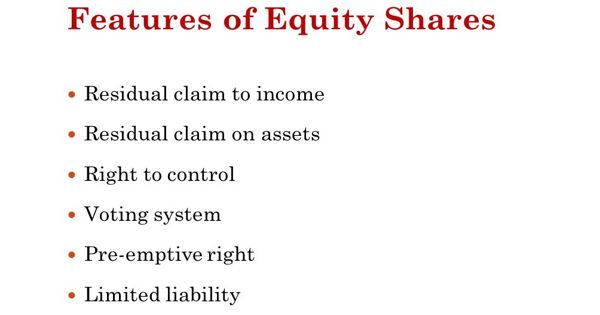

Features of Equity Shares

Equity shares have the following characteristics, which make it one of the most popular investment tools in a stock market –

(a) These shares are permanent in nature. In other words, these shares are the permanent assets of a company and are returned only when it winds up business.

(b) Most types of equity shares include voting rights to an investor, allowing him/her to choose individuals responsible to run the business. Electing efficient managers allows a company to increase its annual turnover, thereby increasing investors’ average dividend income.

(c) Equity share capital remains with the company. It is given back only when the company is closed.

(d) Equity shares are transferable, i.e. ownership of equity shares can be transferred with or without consideration to other person.

(e) Equity shareholders are eligible to realise additional profits generated by a company in a fiscal year. This increases the total wealth of individual investors having a considerable investment in equity shares of a company.

(f) Equity Shareholders possess voting rights and select the company’s management.

(g) Even though equity shares are not repaid until a business closes down, equity shares already issued can be traded in the secondary capital market. Thus, investors can withdraw funds from a company upon their discretion. This ensures massive wealth creation through capital appreciation of such shares.

(h) The dividend rate on the equity capital relies upon the obtainability of the surfeit capital. However, there is no fixed rate of dividend on the equity capital.

(i) You can transfer the ownership of these shares to any other person. Also, note that the dividend pay-out depends on the availability of surplus funds with the company. So, in cases, when a company fails to make enough profits, it may not have the surplus capital to pay out dividends to the shareholders.

(j) Equity shareholders have the right to control the affairs of the company. The liability of equity shareholders is limited to the extent of their investment.

Since equity shares are riskier, they have the potential to offer higher returns on investment. Hence, if you have a high risk-appetite, then you can opt for these shares to earn greater returns. When you buy a share of a firm, generally it’s the equity share. As an equity shareholder, not only you give yourself the chance to earn high returns but also residual income.

Information Source: