Financial Performance Analysis

Financial Performance is a subjective measure of how well a firm can use its assets from business and generate revenues. Financial Performance term is also used as a general measure of a firm’s overall financial situation over a given period of time, and can be used to compare with similar firms across the same industry or to compare industries or sectors in aggregation.

Financial performance analysis refers to an assessment of the viability, stability and profitability of a business, sub-business or project. It is performed by professionals who prepare reports using ratios that make use of information taken from financial statements and other reports. These reports are usually presented to top level management as one of their bases in making business decisions. Based on these reports, management may take decision. Financial performance analysis is a vital to get a financial overview about a company. Generally it is consists of the interpretation of balance sheet and income statement. Ratio analysis and trend analysis can be done by using these two statements. These analyses are the major tools for analyzing the company’s financial performance.

Balance sheet

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a “snapshot of a company’s financial condition”. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business’ calendar year. A standard company balance sheet has three parts: assets, liabilities and ownership equity.

Income Statement

Income statement also referred as profit and loss statement, earnings statement, operating statement or statement of operations is a company’s financial statement that indicates how the revenue is transformed into the net income. It displays the revenues recognized for a specific period, and the cost and expenses charged against these revenues, including write-offs (e.g., depreciation and amortization of various assets) and taxes. The purpose of the income statement is to show managers and investors whether the company made or lost money during the period being reported.

Ratio Analysis

A tool used by individuals to conduct a quantitative analysis of information in a company’s financial statements.Ratios are calculated from current year numbers and are then compared to previous years, other companies,the Industry, or even the economy to judge the performance of the company.The basic inputs to ratio analysis are the firm’s income statement and balance sheet for the periods to be examined. Ratio analysis is predominately used by proponents of fundamental analysis.

In finance, a financial ratio or accounting ratio is a ratio of two selected numerical values taken from an enterprise’s financial statements. There are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. Financial ratios may be used by managers within a firm, by current and potential shareholders (owners) of a firm, and by a firm’s creditors. Security analysts use financial ratios to compare the strengths and weaknesses in various companies. If shares in a company are traded in a financial market, the market price of the shares is used in certain financial ratios. In short, ratio analysis is essentially concerened with the calculation of relationships which, after proper identification and interpretation may provide information about the operations and state of affairs of a business enterprise.The analysis is used to provide indicators of past performance in terms of critical success factors of a business.This assistance in decision-making reduces reliance on guesswork and intution and establishes a basis for sound judgement.

Significance of using ratios

The significance of a ratio can only truly be appreciated when:

- It is compared with other ratios in the same set of financial statements.

- It is compared with the same ratio in previous financial statements (trend analysis).

- It is compared with a standard of performance (industry average).Such a standard may be either the ratio which represents the typical performance of the trade or industry, or the ratio which represents the target set by management as desirable for the business.

Types of Ratio Comparisons

Ratio analysis is not merely the application of a formula to financial data to calculate a given ratio. More important is the interpretation of the ratio value. To answer such questions as is it too high or too low? Is it good or bad? Two types of ratio comparisons can be made: Cross-sectional and Time-series analysis.

- Time-series Analysis:

Time-series analysis evaluates performance over time. Comparison of current to past performance, using ratios, allows the firm to determine whether it is progressing as planned. Additionally, time-series analysis is often helpful in checking the reasonableness of a firm’s projected financial statements.

- Cross-Sectional Analysis:

Cross-Sectional analysis evaluates performance of different firms` financial ratios at the same point in time.

- Combined Analysis:

The most informative approach to ratio analysis is one combines cross-sectional and time-series analysis. A combined view permits assessment of the trend in the behavior of ratio in relation to the trend for the industry.

Cautions about Ratio Analysis

Before discussing specific ratios, we should consider the following cautions:

- A single ratio does not generally provide sufficient information from which to judge the overall performance of the firm.

- Be sure that the dates of the financial statements being compared are the same.

- It is preferable to use audited financial statements for ratio analysis.

Be certain that the data being compared have all been developed in the same way

Groups of Financial Ratios

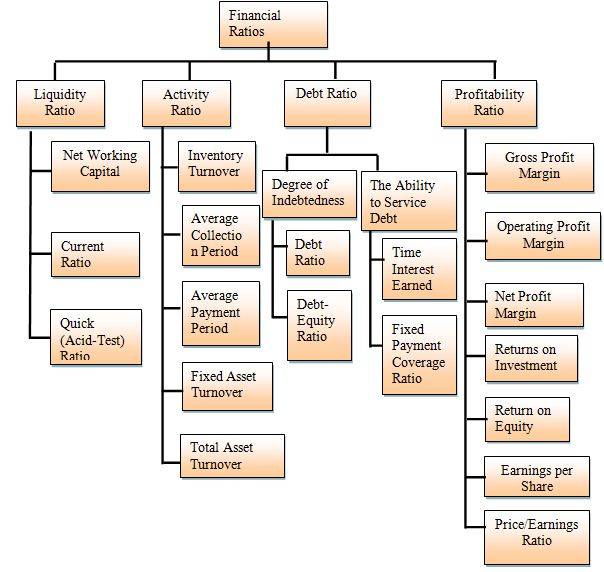

Financial ratios can be divided into four basic groups or categories:

- Liquidity ratios

- Activity ratios

- Debt ratios and

- Profitability ratios -run operation of the firm. Debt ratios are useful primarily when the analyst is sure that the firm will success

- Liquidity, activity, and debt ratios primarily measure risk, profitability ratios measure return. In the near term, the important categories are liquidity, activity, and profitability, because these provide the information that is critical to the short fully weather the short run.

Figure : Groups of Financial Ratios

Analyzing liquidity

The liquidity of a business firm is measured by its ability to satisfy its short term obligations as they come due. Liquidity refers to the solvency of the firm’s overall financial position. The three basic measures of liquidity are:

- Net working capital = Current Assets – Current Liability

- Current ratio = Current Assets / Current Liability

- Quick Ratio = Cash + Government Securities + Receivable / Total Current Liabilities

Net Working Capital:

Net Working Capital, although not actually a ratio is a common measure of a firm’s overall liquidity. A measure of liquidity is calculated by subtracting total current liabilities from total current assets.

Net Working Capital =Total Current Assets –Total Current Liabilities.

Current Ratio:

One of the most general and frequently used of these liquidity ratios is the current ratio. Organizations use current ratio to measure the firm’s ability to meet short-term obligations. It shows the banks ability to cover its current liabilities with its current assets.

Current Ratio = Current Asset/Current Liabilities

Standard ratio: 2:1

Quick Ratio:

The quick ratio is a much more exacting measure than current ratio. This ratio shows a firm’s ability to meet current liabilities with its most liquid assets.

Quick Ratio=Cash + Government Securities + Receivable / Total Current Liabilities.

Standard ratio: 1:1

Operating Cost to Income Ratio:

It measures a particular Bank’s operating efficiency by measuring the percent of the total operating income that the Bank spends to operate its daily activities. It is calculated as follows:

Cost Income Ratio = Total Operating Expenses / Total Operating Income

Analyzing Activity

Activity ratios measure the speed with which accounts are converted into sale or cash. With regard to current accounts measures of liquidity are generally inadequate because differences in the composition of a firm’s current accounts can significantly affects its true liquidity.

A number of ratios are available for measuring the activity of the important current accounts, which includes inventory, accounts receivable, and account payable. The activity (efficiency of utilization) of total assets can also be assessed

Total Asset Turnover:

The total asset turnover indicates the efficiency with which the firm is able to use all its assets to generate sales.

Total Asset Turnover = Sales/ Total Asset

Investment to Deposit Ratio:

Investment to Deposit Ratio shows the operating efficiency of a particular Bank in promoting its investment product by measuring the percentage of the total deposit disbursed by the Bank as long and advance or as investment. The ratio is calculated as follows:

Investment to Deposit Ratio = Total Investments / Total Deposits

Inventory turnover:

A ratio showing how many times a company’s inventory is sold and replaced over a period.

Inventory Turnover= Cost of goods sold/ Average Inventory

The days in the period can then be divided by the inventory turnover formula to calculate the days it takes to sell the inventory on hand or “inventory turnover days”. This ratio should be compared against industry averages. A low turnover implies poor sales and, therefore, excess inventory. A high ratio implies either strong sales or ineffective buying. High inventory levels are unhealthy because they represent an investment with a rate of return of zero. It also opens the company up to trouble should prices begin to fall.

Average Collection Period:

Average collection period is useful in evaluating credit and collection policies. This ratio also measures the quality of debtors. It is arrived at by diving the average daily sales into the accounts receivable balance:

Average Collection Period=Accounts receivable/ (Credit sales/365)

A short collection period implies prompt payment by debtors. It reduces the chances of bad debts. Similarly, a longer collection period implies too liberal and inefficient credit collection performance. It is difficult to provide a standard collection period of debtors.

Average Payment Period:

Average payment period ratio gives the average credit period enjoyed from the creditors that means it represents the number of days by the firm to pay its creditors. A high creditor’s turnover ratio or a lower credit period ratio signifies that the creditors are being paid promptly. This situation enhances the credit worthiness of the company. However a very favorable ratio to this effect also shows that the business is not taking the full advantage of credit facilities allowed by the creditors. It can be calculated using the following formula:

Average Payment Period=Accounts payable/ Average purchase per day

Fixed Asset Turnover:

A financial ratio of net sales to fixed assets. The fixed-asset turnover ratio measures a company’s ability to generate net sales from fixed-asset investments – specifically property, plant and equipment (PPandE) – net of depreciation. A higher fixed-asset turnover ratio shows that the company has been more effective in using the investment in fixed assets to generate revenues. The fixed-asset turnover ratio is calculated as:

Fixed Asset Turnover=Gross Turnover/ Net fixed assets

Analyzing Debt:

The debt position of that indicates the amount of other people’s money being used in attempting to generate profits. In general, the more debt a firm uses in relation to its total assets, the greater its financial leverage, a term use to describe the magnification of risk and return introduced through the use of fixed-cost financing such as debt and preferred stock.

Debt Ratio:

The debt ratio measures the proportion of total assets provided by the firm’s creditors.

Debt Ratio = Total Liabilities / Total Assets

Equity Capital Ratio:

The ratio shows the position of the Bank’s owner’s equity by measuring the portion of total asset financed by the shareholders invested funds and it is calculated as follows:

Equity Capital Ratio = Total Shareholder’s Equity / Total Assets

The ability to service debt:

It refers the ability of a firm to meet the contractual payments required on a scheduled basis over the life of a debt. The firm’s ability to meet certain fixed charges is measured using coverage ratios.

Time Interest Earned Ratio:

This ratio measures the ability to meet contractual interest payment that means how much the company able to pay interest from their income.

Time Interest Earned Ratio=EBIT/ Interest

Analyzing Profitability:

These measures evaluate the bank’s earnings with respect to a given level of sales, a certain level of assets, the owner’s investment, or share value. Without profits, a firm could not attract outside capital. Moreover, present owners and creditors would become concerned about the company’s future and attempt to recover their funds. Owners, creditors, and management pay close attention to boosting profits due to the great importance placed on earnings in the marketplace.

Operating Profit Margin:

The Operating Profit Margin represents what are often called the pure profits earned on each sales dollar. A high operating profit margin is preferred. The operating profit margin is calculated as follows:

Operating Profit Margin = Operating Profit / Sales

Net profit Margin:

The net profit margin measures the percentage of each sales dollar remaining after all expenses, including taxes, have deducted. The higher the net profit margin is better. The net profit margin is calculated as follows:

Net profit Margin = Net profit after Taxes / Sales

Return on Asset (ROA):

Return on asset (ROA), which is often called the firms return on total assets, measures the overall effectiveness of management in generating profits with its available assets. The higher ratio is better.

Return on Asset (ROA) = Net profit after Taxes / Total Assets

Return on Equity (ROE):

The Return on Equity (ROE) measures the return earned on the owners (both preferred and common stockholders) investment. Generally, the higher this return, the better off the owners.

Return on Equity (ROE) = Net profit after Taxes / Stockholders Equity

Price/ Earnings ratio (PE ratio):

The Price/ Earnings ratio (price-to-earnings ratio) of a stock is a measure of the price paid for a share relative to the income or profit earned by the firm per share.

P/E ratio – Price per share / earnings per share

Earnings per share (EPS):

Earnings per share (EPS) are the earnings returned on the initial investment amount.

EPS= Net income/no. of share outstanding