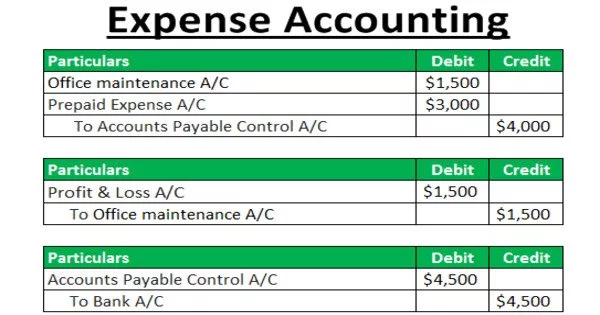

An expense account is a right to reimburse employees for money spent on work-related expenses. It allows you to track and organize the various expenses that your company incurs over time. Cost of sales, utility expense, discount allowed, cleaning expense, depreciation expense, delivery expense, income tax expense, insurance expense, interest expense, advertising expense, promotion expense, repairs expense, maintenance expense, rent expense, salaries, and wages expense, transportation expense, supplies expense, and refreshment expense are some examples of common expense accounts.

Expenses are increased by debits and decreased by credits in an expense account. When you spend money, your expense account grows. Expense accounts are temporary accounts, which means they are reset when a new period begins.

- Normal Balance

An expense account must be debited to be increased. An expense account must be credited before it can be decreased. The standard expense account balance is a negative number. It is important to remember the accounting equation, Assets = Liabilities + Equity, in order to understand why expenses are debited. Expenses appear in the equity portion of the equation because equity is defined as common stock plus retained earnings, and retained earnings are defined as revenues minus expenses minus dividends.

- Closing Expense Accounts

Expense accounts must be closed or zeroed out at the end of the year. Expense accounts must be closed because they are temporary, meaning they only apply to one accounting period and will not carry over to the next. When expense accounts are closed, they are linked to another temporary account called Income Summary.

- Contra Expense Accounts

Contra accounts are accounts that are related but distinct from the primary account. A contra expense account will behave in the opposite manner as a normal expense account; instead of debiting to increase, a contra account must credit to increase. Instead of crediting to decrease, it will be credited to increase.

Usages of Expense account

The expense account concept has two different symbolism. One involves take a trip and entertainment bills, and the other is really a more general concept identifying a kind of account. Both explanations are noted beneath.

There are a number of reasons why you need to track your expenses in an account in business. Separating your expenses can help you stay legal. Separating your expense amounts into different categories can help you avoid mixing deductible and non-deductible expenses. If you deduct non-deductible expenses from your taxable income, the IRS may get suspicious.

An expense account is also critical for staying organized and helping you budget. When you separate your business’s expenses, you get a better idea of which expenses are constant and which are intermittent. That way, you can predict future expenses when creating your budget.