Executive summary

The overarching aim of this evaluation study was to assess the impact of the Companies Act

2006 on UK businesses, and to determine whether it is meeting its key policy objectives,

which include:

To enhance stakeholder engagement and a long term investment culture (promoting

wider participation, and ensuring decisions are based on a long-term view rather than

immediate return);

To ensure better regulation and a ‘Think Small First’ approach;

To make it easier to set up and run a company.

Many of the changes introduced through the Act appear to have been perceived as a piece

of good house-keeping, enabling somewhat archaic provisions to be removed, bringing

Company Law into the twenty first century, rather than radical change. It must be borne in

mind when reviewing these findings that the Companies Act 2006 is primarily an enabling

Act, so it is for a company to decide whether it wishes to take advantage of the measures

provided and when it wishes to do so. Thus further time must elapse to allow companies to

decide how they wish to proceed. It appears that some companies have made changes in

tranches rather than all in one go, and also that advisors have been hugely influential in

which changes have been made. That aside, awareness levels, particularly those relating to

small private companies, were higher than some stakeholders expected and so too were

levels of compliance / adoption with certain measures such as auditor limited liability

agreements.

1.1 Introduction and methodology

ORC International was commissioned by the Department for Business, Innovation and Skills

(BIS) in November 2009 to conduct an evaluation of the Companies Act 2006, to assess

awareness of and compliance with or the adoption of key measures implemented through

the Companies Act 2006; thus in turn allowing the impact of the Act to be evaluated. This

study was the first large scale evaluation of the Companies Act 2006, an enabling Act that

covers 1300 provisions affecting all sizes of companies in the UK. The research programme

was challenging given the scope of the Act, the need to cover all types of businesses, the

technicality of the subject matter and sampling complexities to ensure a robust approach.

Three primary means of data collection were undertaken:

One thousand computer aided telephone interviews (CATI) with UK businesses

(interviews were spread across a range of company sizes as detailed in the

methodology but excluded newly incorporated companies 1. Interviews were

conducted amongst those responsible for corporate governance and a stratified

random probability sampling approach was deployed in order to ensure a robust

baseline to measure the impact of the Companies Act).

Fifteen face to face depth interviews with key company law stakeholders from a

range of backgrounds (see Section 1.6 of Volume Two);

Fifteen face to face/ telephone case studies with businesses of interest identified

from the quantitative study 2.

Thirteen measures were selected by BIS to be assessed in the research study. Given that

the Act has 1300 sections, it would not have been feasible to evaluate the entire Act in one

research project. The measures were chosen based on the following criteria:

they were deemed to bring about the biggest savings or impose the highest costs of

companies;

if they had contentious issues at the time of Parliamentary Bill passage;

if they were highlighted by business and company law professionals as being of

particular interest and/ or importance.

Throughout the report levels of awareness of these measures are calculated on the basis of

those companies to which the measure was asked i.e. awareness of the codification of

directors’ duties has been calculated on a base of all companies but awareness of changes

to capital maintenance are calculated on a base of large private companies only (full

breakdown of which measures were asked to which company sizes can be viewed in

Section 1.4 of Volume Two). Similarly levels of adoption / compliance are based on all those

companies to which the specific measure applies. Figures in the report, other than the

information on the profile of businesses in Section Four, have been weighted largely on

basis of economic impact so results presented throughout the report tend to reflect the views

of larger companies in the sample (as detailed in Section Three of the report).

1.2Overall awareness and compliance with / adoption of measures

Overall, the large majority of companies interviewed (85%) were aware of recent changes

regarding Company Law, in particular the Companies Act 2006. As anticipated by

stakeholders, small private companies had the lowest awareness levels, with two fifths

(40%) being aware of recent changes regarding Company Law, compared with over nine in

ten quoted companies (94%).

Awareness of any changes to Company Law was highest amongst companies incorporated

by Companies House over ten years ago; from respondents who were company secretaries;

from companies within the SIC codes of transport, storage and communication and financial

intermediation; from companies who used advisors; and companies who used Companies

House and their solicitor as sources of guidance.

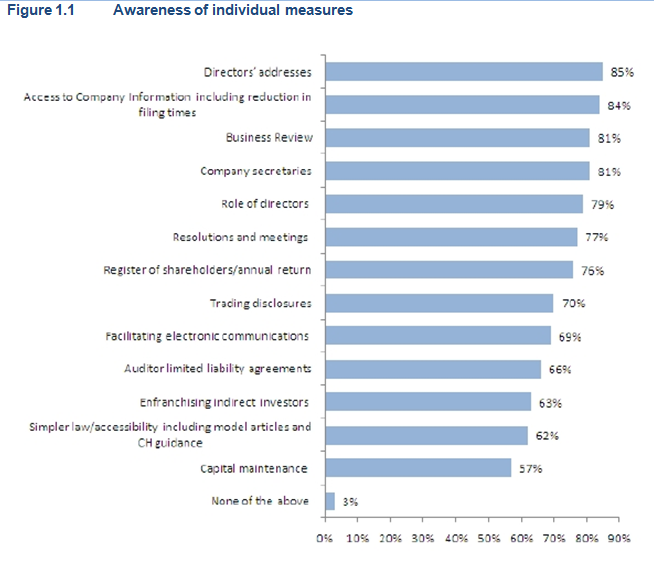

In terms of awareness of individual measures (see Figure 1.1), awareness was highest

regarding the change to directors’ addresses (85%; asked to all), access to company

information and filing times (84%; asked to public and quoted companies only), and the

business review (81% awareness from large private, public and quoted companies only).

Companies were least aware of the broad changes to capital maintenance (57% from large

private only), and simpler law/ accessibility (62%; asked to small, medium and large private

and public companies).

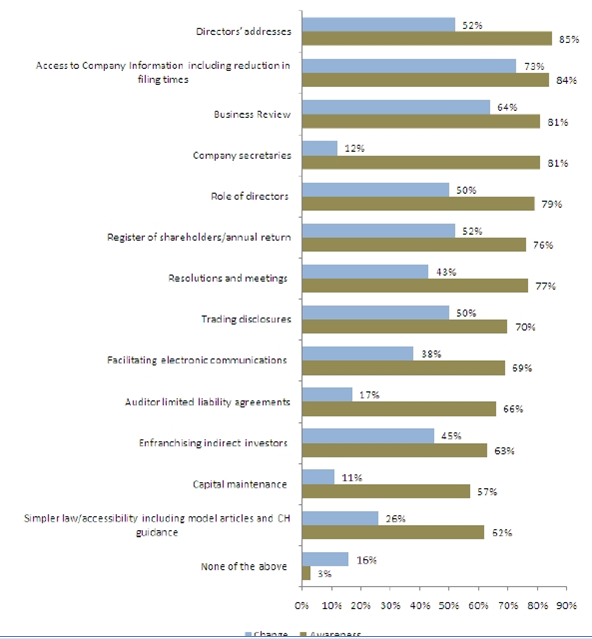

Levels of adoption, as shown in Figure 1.2, were found to be highest with regard to access

to company information including filing times (73%), and the business review (64%). In

contrast, the changes least used included those within the broad measure of capital

maintenance (11%), company secretaries (12%), and auditor limited liability agreements

(17%). Significantly more small private companies had made no changes (54%) to any

measure, than any other company size.

Figure 1.2

Awareness and adoption by individual measu resAdoption levels were also found to be highest amongst companies who had used BIS

resAdoption levels were also found to be highest amongst companies who had used BIS

publications or alerts, networking groups, or their own institute as their source of original

awareness of changes to Company Law.

Almost half of companies who had made a change found the changes in the law ‘easy’ to

understand (49%) whilst sixteen per cent found it ‘difficult’3. Quoted companies found

understanding the changes in the law most difficult 19% 4. Understanding of the changes

was furthermore highest among financial intermediation businesses and lowest in wholesale

and retail trade companies.

Company directors, owner/family members, and chief executive/ managing directors were

less likely to understand the changes well compared with company secretaries and finance

directors. Surprisingly, around half of accountants interviewed did not understand the

changes well.

Time-wise, one third of companies (33%) spent ten hours or less on all changes they had

made, with just over a fifth of companies (21%) estimating that they had spent over forty

hours; quoted companies were most likely to have spent over forty hours responding to the

changes in company law.

Compliance and adoption costs incurred were noted in terms of hours spent split by job roles

involved, and costs of external professional services were asked. Almost two-fifths (38%) of

companies had purchased external professional services (significantly so in quoted

companies, 53% of whom had purchased external professional services).

However, companies were asked to look back over a long time period given the first phase

of the Act’s implementation was in 2006, and the possible inaccuracy of their recall should

be borne in mind when reviewing this section.

1.3 Perceptions of individual measures

Although awareness of the codification of directors’ duties was high (79%), the proportion of

those perceived to have responded was lower at 50%, given the codification did not

represent a change in the current law, (all must comply with these provisions) but for just

under half of companies interviewed, the codification had not prompted a change in how

they carry out their duties). Overall, one-fifth of those who had responded agreed the

statutory statement had had an impact on the way directors discharged their duties, and

almost three fifths were aware of the changes to the procedure for bringing about a

derivative action for breach of duty (59%). Of those companies not initially aware of the

changes relating to directors’ duties, over one-third indicated that they would now take

advice from the company’s accountant on the nature of their requirements.

Quoted companies who had made a change to the business review were asked how difficult

they found providing the additional material and whether they found it easy to comply with

new regulations. In spite of some concerns prior to the change about the burden of reporting,

the majority felt neutral about this with 56% finding the extra material ‘neither difficult nor

easy’ to provide. Similar proportions (54%) found the process the same in terms of

compliance. Relatively low proportions of companies had indications on the usefulness of

the information from shareholders or felt that shareholders would find it useful.

Of those companies who had made a change to improving shareholder access to

information, awareness of the new filing dates was extremely high (95% of respondents).

Companies who had made related changes to eCommunications were asked if they had

sought and received shareholder approval to use website communications and whether they

had used the website default procedure. Over three-fifths of companies indicated that they

had in response to both questions.

All companies which had made at least one change following the simplification measures

were asked which had been adopted. Actions in response to two measures were most

common: the removal of the requirement to hold an AGM (51%) and the ability to execute

documents by a sole director (43%).

Of those companies who had made changes in relation to meetings and resolutions, 32%

agreed that they no longer hold AGMs 5 . Of these, 11% cited cost savings as the key driver

for the change 6. Almost three-fifths of those who had made a change indicated that they had

used the written resolution procedure (57%).

All small, medium and large private companies who had not made a change and who had a

company secretary were asked if they would consider abolishing the role. Just over one fifth

indicated that they would do so, of which one in ten would expect associated cost savings.

Of companies who had made a related change to directors’ addresses, 60% had provided a

new service address to Companies House 7. Of those who had not made a change, just

under one third indicated that they were likely to do so. Furthermore, of those who had taken

steps to making a change relating to trading disclosures, 98% were aware of their

obligations in terms of the display of their company’s name.

Just under one fifth (18%) of companies agreed that there had been benefits from the

provision to remove shareholders’ addresses from the annual return, and the vast majority

(97%) were unaware of concerns arising from their removal.

Almost a fifth of companies (17%) had entered, or taken steps towards entering an auditor

limited liability agreement. This level of adoption was higher than anticipated by

stakeholders, although interestingly several companies were unable to cite advantages (to

their company) of entering such an agreement.

1.4 Advice, guidance and third parties

1.4.1 Stakeholder views

Stakeholders interviewed collectively imagined that professional advisors would play a key

role in instigating awareness of the changes in Company Law, and in initiating change; the

consensus was that advisors were an appropriate and sensible means of knowledge

transfer.

Reinforced through case studies, stakeholders believed that communications were

disseminated largely based on mandatory changes; that advisors will have sent out briefings

but only where companies needed to make a change. As suggested by one case study

respondent, the push from third parties may have made companies who needed to know

about changes a bit sceptical about their necessity and relevance.

The extent to which BIS helped raise awareness was applauded by stakeholders but it was

larger companies who were anticipated to be the key beneficiaries of such activity.

1.4.2 Business views

One in five companies in the survey became aware of changes to Company Law through

BIS publications or alerts (20%), almost three quarters became aware through their advisor

(71%), and over half through their own institute (56% 8).

Companies aware of the Act but who had made no changes predominantly had become

aware of the Act through other means, such as training courses, personal investigation, and

other publications.

1.4.3 Companies House

Stakeholders made positive reference to Companies House as a source of guidance for

companies and as an awareness channel, and positive ratings were also received in terms

of Companies House being an instrumental source of bringing about initial awareness

(59%9).

Over three fifths of companies had used the Companies House website as a source of

information on company law (64%). Of those, almost three fifths of companies were satisfied

with the usefulness of the website (59% 10), and almost half agreed it was helpful (45% 11).

1.4.4 Third parties

Eighty three per cent of companies overall used an advisor; significantly more large private,

public and quoted companies were found to do so than small private companies (81%, 82%,

90% vs. 73%).

Solicitors were the over-riding source of advice for companies (68%), followed next by

accountants (39%); auditors were also heavily cited as another source of advice.

Companies would rather receive news of changes to Company Law via email, although

significantly more small private companies would prefer to have received direct mail than

other company sizes.

Measure specific, highest usage of advisors was found with capital maintenance,

enfranchising indirect investors and access to company information; lowest use was found

with regards company secretaries.

1.5 Evaluating policy objectives

Given the final implementation phase of measures introduced in the Companies Act 2006

was October 2009, it is still early to be assessing the Act’s impact and evaluating whether

policy objectives have been met, a consensus echoed by businesses and stakeholders alike.

Furthermore the challenge of identifying levels of awareness of the Companies Act 2006

among small private companies was known from the outset, given their high use of advisors

whereas larger private, public and quoted companies tend to employ in house accountants/

finance directors and company secretaries who keep abreast of changes in corporate

governance. Recently incorporated companies 12 were also excluded from the study

deliberately. Policy objectives, and specific goals included within the White Paper of 2005,

were assessed within this context.

1.5.1 Enhancing shareholder engagement and a long term investment culture

Measures introduced to enhance stakeholder engagement have been partially successful:

the additional information required in the business review has not been arduous to provide

and could be beneficial to shareholders, and changes to directors’ duties have the potential

to bring about a cultural shift in how decisions are made for the benefit of shareholders.

The ‘Enhancing indirect investors’ measure has had a greater uptake than expected and

increased shareholder democracy could still become a reality (companies have altered their

articles to allow for this, but the consequences of this change on investors are yet to be

known and will depend on actions by brokers and other intermediaries).

Auditor limited liability agreements are being utilised too, but the benefits of companies

entering into such agreements was questioned (although some companies referenced using

agreements to ensure auditor fees did not increase in future).

The Act has therefore paved the way for shareholder engagement to be enhanced, but this

has not yet been fully realised and, as agreed by stakeholders, is possibly not something

that legislation alone can accomplish.

1.5.2 Ensuring better regulation and a ‘think small first’ approach

Again this has been partially successful to date. Stakeholders, given their higher awareness

and understanding of both the policy objectives and the specific measures, were more

enthused than companies by simplified changes which allow for greater flexibility.

Companies are often still thinking of adopting the model articles- but they are not top priority,

thus in spite of a disappointing take up currently, this could well undergo an increase over

time. Newly incorporated companies, despite their exclusion from this study, will however

automatically adopt these measures from here on in and this will therefore change the stock

of companies over time.

The removal of the requirement to hold an AGM and procedures allowing written resolutions

have been positively received (although the extent to which formal AGMs were being carried

out prior to this is questionable, particularly for small companies as illustrated in Section

6.7.3); informal shareholder assent however was found to be the predominate means of

making decisions for companies with ten or fewer shareholders.

Few companies had abolished their company secretary role but the likelihood of small and

medium-sized private companies considering doing so in future was fairly high. However,

this modest reduction is in line with the Regulatory Impact Assessment (RIA) 13 estimation of

5%.

The reduction of capital by way of a solvency statement (included with the capital

maintenance measure) aimed at large private companies also appears to have been better

received than stakeholders anticipated; cost savings were referenced as the key driver here.

Changes have therefore simplified the law for small and medium-sized private companies,

but given their reliance on advisers for all legal matters, they do not appear to have been

that directly affected.

1.5.3 Making it easier to set up and run a company

It is still early days to assess performance with this objective (as with all objectives). On the

whole, the areas covered within this objective received more neutral responses, with

changes being acknowledged to be of less significance than the other changes introduced.

Advantages for new companies were noted in that directors do not need to submit a

personal address (and their previous residential address will not remain on the register as

with existing companies), and awareness levels of trading disclosure requirements were high

which can be seen in a positive light. Companies were however fairly neutral on the

provision allowing shareholder addresses to be removed from the annual return.

Deregulation was found to be an area of dispute: the changes brought in are being utilised,

but regulation remains and so too do references to red tape and administration obligations.

In principle the changes do appear to have facilitated the process of setting up and running a

company, and positives were noted, but on the whole companies and stakeholders were

more neutral about the implemented changes.

1.5.4 Overall evaluation (including cost savings/ flexibility benefits of measures

assessed)

The Companies Act 2006 has impacted companies to varying degrees dependent upon the

extent to which optional changes have been adopted and/or complied with. This therefore

added to the difficulty of measuring benefits at an overall level and should be borne in mind.

Despite high awareness, and in some instances high compliance or adoption, neutral

perceptions of added value in terms of flexibility and cost savings were captured from

companies. Stakeholders too were fairly neutral with one noting marginal cost savings from

changes to eCommunications.

In terms of flexibility, changes for private companies on resolutions and meetings were most

beneficial for companies with just under a third stating this change had been most beneficial

in terms of flexibility (31%); least beneficial were the register of shareholders and the

business review (15%), both mandatory changes.

Regarding cost savings, changes to eCommunications (30%), and resolutions and meetings

(20%) were most beneficial to companies; least beneficial was again the business review

(23%) additional requirements.

Overall, over a third of companies disagreed that Company Law had been simplified (34%

NET 14), whilst one fifth of companies agreed 15, indicating that time is needed for the

changes to further embed themselves and for benefits to be realised. It must be stressed

however that the Companies Act 2006 is primarily an enabling Act, so it is for a company to

decide whether it wishes to

1.6 Potential areas for change

In terms of areas for improvement, the following feedback was received:

Directors’ duties: added clarity and guidance to boost awareness and understand

of Section 172, in order to increase behavioural change.

Business review: added clarity on the process is still required to improve the quality

of information provided, to ensure the review is not seen as ‘boiler plate’. Should the

Operating and Financial Review (OFR) be reintroduced, clarity of requirements must

be stressed to optimise value provided to shareholders.

do so.

Directors’ addresses: previous addresses are not blocked out, credit agencies can

still access directors’ details, and one is no longer able to differentiate directors with

the same name on the register are all criticisms to be taken on board.

Register of shareholders: this change did not include the removal of all shareholder

addresses, another point for consideration moving forwards.

Simpler law/ accessibility: greater promotion of the benefits that could be derived

from adopting and/or amending the new template could increase up-take of new

model articles.

Enfranchising indirect investors: the owner of the shares is not then on the share

register, therefore no one else can write to them bar the stock broker- again to be

taken on board for consideration.

Auditor limited liability agreements: Companies appear to be entering agreements

whilst openly acknowledging they do not know of any benefits to their company- so

added clarity of Section 172 is required. US dual listed companies are also not able

to enter these agreements.

Guidance: available guidance materials should be promoted (particularly with the

small private company in mind, targeted by company size). Email (and direct mail for

small private companies) was cited as the preferred communications channel for

updates in Company Law, but for small private companies, other avenues such as

local business forums and town partnerships were also suggested.