Documentary Credit

Documentary credit means the same thing as “letter of credit”. This is one of the varieties of letter of credit which requires the attachment of documents of title to goods to any bill drawn thereunder. IT is the most used payment technique in international trade. It is used when the transaction amounts are very high or when one party has doubts about the morality or solvency of the other. It helps your company to hedge against the risks related to export trading.

Documentary Credit is a payment technique whereby a bank commits itself, on behalf of its client, to pay to a beneficiary within a fixed period, the price of goods/services against the delivery by the exporter of previously agreed and compliant documents proving the value and shipment of the goods/services. It is particularly useful where the buyer and seller may not know each other personally and are separated by distance, differing laws in each country, and different trading customs. It provides security for both the exporter and the importer.

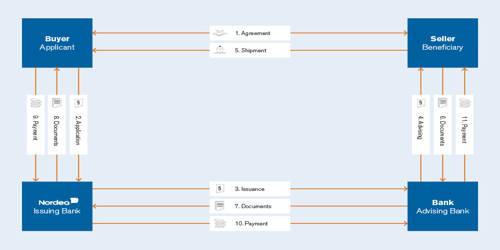

Main actors involved in the documentary credit –

- The importer – It is the buyer who gives the instructions for opening the Documentary Credit. He is the originator of the documentary credit.

- The importer’s bank – It receives instructions from the importer, the client, and opens or issues the documentary credit. That is why it is called the issuing bank.

- The exporter’s bank – Located in his country, it is the bank that notifies the exporter, the beneficiary, upon receipt of the documentary credit.

- The exporter – It is the beneficiary of the documentary credit. He is the seller in favor of whom the documentary credit is open.

A typical procedure of a documentary credit is as follows:

- The contract is made between the importer and the exporter. The process begins when the exporter and importer agree on a sales contract.

- The importer asks its bank to issue a documentary credit to the exporter. The importer then initiates the documentary credit mechanism by going to its bank and requesting it to open the credit.

- The importer’s bank sends the documentary credit to the exporter’s bank (advising bank).

- The exporter’s bank advises the exporter of the issue of the documentary credit.

- Confirmation (optional). Exporters may insist on confirmed credits when they want to have a trusted local payment.

- The exporter (beneficiary) is notified of the availability of the credit.

- The exporter’s bank sends the documents to the importer’s bank and receives payment either at sight or term.

- Shipment and presentation of the documents. If the exporter agrees with the terms of the credit, it then proceeds to ship the goods.

- Examination of documents/discrepancy/waiver. The bank examines the documents carefully to ensure that they comply with the terms of the credit.