The financial ratio that gauges the amount of cash dividends paid out to shareholders in relation to the market value per share is known as a dividend yield. It is the calculation of cash flow generated by an exchange-traded fund (ETF), a real estate investment trust (REIT), or any sort of income-generating entity. It is registered by partitioning the profit per share by the market cost per share and duplicating the outcome by 100. It is utilized as a proportion of pay comparative with the size of a venture.

Rather of computing the yield based on a total of distributions, the most recent payment is annualized and divided by the security’s net asset value (NAV) at the time of payment. Dividends are comparable to distributions. Individuals and investors who own exchange-traded funds (ETFs) and/or real estate investment trusts (REITs) are likely to get them. A corporation with a high dividend yield distributes a large portion of its income as dividends.

The dividend yield of an organization is constantly contrasted and the normal of the business to which the organization has a place. An appropriation can be characterized as a part of the benefits produced by a trust or an asset, which is disseminated to unitholders or financial backers, and a payment installment. It is one way to profit from investment classes (ETFs and REITs). Although distribution yields may be used to compare cash flows for annuity and fixed income assets, calculating them on a single payment might misrepresent the real returns given over longer periods.

Dividend yield is a metric that indicates the amount of money investors get from total dividends when they invest in a firm.

Understand that a stock’s dividend yield can change after some time either in light of market vacillations or because of profit increments or diminishes by the responsible organization. The capital increases and conveyances produced using the ventures preferably make up a financial backer’s absolute return. Companies pay out a portion of their profits to shareholders as dividends, while keeping the rest to reinvest in the firm.

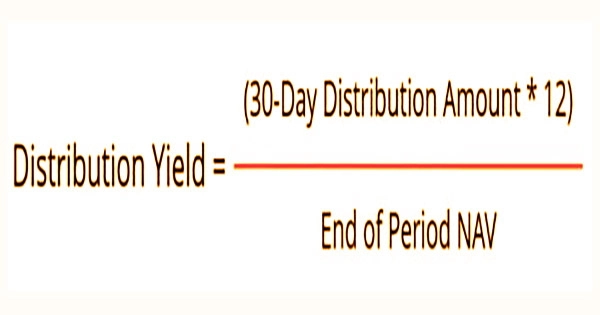

It’s crucial to remember that a distribution yield is calculated based on a fund’s historical performance and does not contain or make any assumptions for future performance. The computation for appropriation yields utilizes the latest conveyance, which might be interest, a unique profit, or a capital addition, and increases the installment by 12 to get an annualized complete. The distribution yield is calculated by dividing the yearly total by the net asset value (NAV).

Dividend yield is a metric that indicates the amount of money investors get from total dividends when they invest in a firm; it is usually stated as a percentage. While this measurement is frequently used to think about fixed pay ventures, the single-installment estimation strategy might possibly extrapolate bigger or more modest than-typical installments into conveyance yields that don’t mirror the genuine installments made over the following year or one more agent timeframe.

The formula below shows how the distribution yield can be calculated:

The majority of equities pay quarterly dividends, although a select minority pays monthly, semiannually, or annually. To calculate the average yearly return, the distribution yield equation uses the most recent distribution and multiplies it by 12. The annualized aggregate is then isolated by the net asset value (NAV) toward the finish of the period to gauge the yield of the dissemination. The finish of the period can be the month’s end and the dispersion can incorporate a capital increase, gains as interest got, or the revelation and receipt of a unique profit.

Annuity and fixed income portfolio distribution yields can be used as a proxy for cash flow comparisons and analysis. When a firm in a fund’s portfolio pays a non-recurring dividend, the payment is included in the recurring dividends for that month. A yield determined on an installment including an uncommon profit might mirror a bigger circulation yield than is really being paid by the asset.

Normally, companies with a high dividend yield do not maintain a large amount of their income as retained earnings. Their securities are referred to as income securities. Yield calculations based on periodic dividends and interest are often more accurate than yield calculations based on one-time or rare payments. The prohibition of non-repeating installments, in any case, can bring about a dissemination yield lower than the genuine payouts during the previous year.

The distribution yield, along these lines, doesn’t give substantial data on what a security asset will create from the time it is bought or put resources into, to the time that it is auctions off. It by and large gives a preview of pay installments for financial backers, however, the factors presented by capital increases dispersions, and exceptional profits can slant returns. It is possible that excluding irregular distributions or payments would result in lower distribution yields, but including payments might also skew the estimated yield.

Dividends are tax-free in the hands of investors, therefore investing in high dividend yield equities produces a tax-saving asset. Dividend stripping is often used by investors to save money on taxes. Moreover, despite the fact that distribution yields furnish financial backers with features for money installments, the factors related with extraordinary profit installments and capital increase circulation might give slanted returns.

Information Sources: