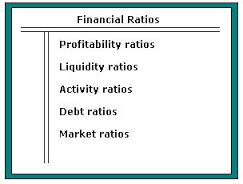

Primary purpose of this article is to Discuss on Financial Ratio Analysis. Financial Ratios Analysis is commonly used by current and also potential investors, creditors and banking institutions to evaluate a company’s past performance to spot trends in a business also to compare its performance with all the average industry performance. It also enables them to identify strengths and weaknesses of business and to justify further investments in the business. Internally, managers use these rates to monitor performance also to set specific goals and policy initiatives. Rates are classified as productivity ratios, liquidity ratios, tool utilization ratios, leverage ratios and valuation ratios while using indications they provide.

Discuss on Financial Ratio Analysis