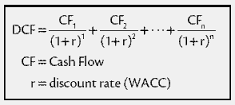

In finance, discounted cash flow analysis is one way of valuing a project, company or asset using the concepts of the time value of funds. All future dollars flows are believed and discounted through the use of cost of capital to supply their present prices. The sum of future cash passes, both incoming and outgoing, is the internet present value, which is taken as the significance or price from the cash flows in question. Discounted cash flow analysis is widely used in investment fund, real estate growth, corporate financial administration and patent value. This valuation method employed to estimate the attractiveness associated with an investment opportunity.

Discounted Cash Flow