The debt service reserve account (DSRA) is a separate account set aside to make debt payments in the event that cash flows are disrupted to the point where debt cannot be serviced. When the cash flow available for debt services (CFADS) is less than the required amount to make payments, the DSRA is critical. It’s anything but a critical part of a task finance model and is normally ordered in a bank term sheet. On account of a credit understanding, the moneylender will without a doubt force a statement that requires a DSRA, with an equilibrium that should be occasionally reestablished to a base sum.

Depending on the needs of the lender to the agreement, the DSRA can store up to 12 months’ worth of debt service (including interest and principal). The minimal amount is frequently determined by the amount of interest and principal owed. DSRA’s can likewise change after some time, for instance, a loan specialist may require a year of DSRA for the initial not many long stretches of an undertaking, and once incomes have balanced out for the DSRA focus to diminish. The DSRA will be included in the project cost, and leverage will be calculated using total debt / total project cost, both of which include the DSRA.

The debt service reserve account serves as a safety net to ensure that payments to lenders are made on time. However, in project finance transactions, the loan level is often determined by operating cash flows (CFADS), and DSRA is typically financed by equity. It’s anything but a significant piece of undertaking financing and is ordinarily used to guarantee the borrower gets the adaptability to determine issues or rebuild their obligation during times where the obligation administration inclusion ratio is under 1.

Lenders who are concerned about borrowers failing on payments may find the DSRA to be quite useful. On the surface, the DSRA appears to be straightforward: anticipate debt payments for the following 6-12 months and set money aside in a separate account. On the off chance that the obligation installments increment or diminishing, basically increment subsidizing to the DSRA or delivery cash from the DSRA. It’s anything but a wellbeing measure that gives the borrower time to manage an absence of income accessible to support obligation and keeps them from defaulting.

The DSRA is often funded near the end of the construction process, before the loan begins to amortize. This is especially true in the case of non-recourse project finance, in which the lender is only entitled to profits from the project. The DSRA would then need to be funded via a combination of loan and equity, with the gearing ratio being the most common method. It is normal made once the credit gets repayable, for example, after the development of a venture. On the off chance that the undertaking’s incomes accessible for obligation adjusting isn’t sufficient to meet the obligation commitments, the obligation administration save account is credited.

Remember that the DSRA needs to budget for the following 6 to 12 months of debt payments. If the debt grows larger, the interest and principal payments will grow as well, necessitating a larger DSRA. The debt service account is frequently demanded by the borrower in the credit agreement for the benefit of the agent. As a rule, the DSRA should meet a necessary least equilibrium and will be reestablished by terms in the credit understanding. Banks will require a DSRA if all else fails to pay obligation in case of issues with the venture say a startling blackout or upkeep needs to happen.

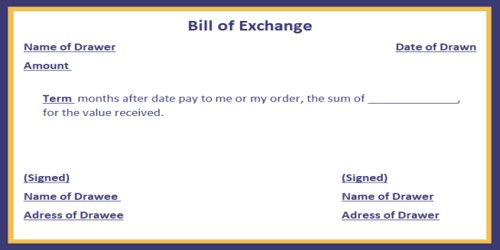

Examples of different clauses within a credit agreement pertaining to the DSRA follows:

- “Following the conversion date, the borrower must deposit one-fifth of the principal and interest due into the debt service reserve account before the end of the first fiscal quarter. Additional or smaller sums will be deposited from time to time to account for changes in the amount payable.”

- “The borrower must deposit a five-million-dollar sum into the debt service reserve account on the closing day.”

- “The various subaccounts within the debt service reserve account must be restored to at least the required amount within six months after the end of each fiscal year.”

- “The debt service payment account and the debt service reserve account will be maintained in the debt service fund. Money in the debt service reserve account may be transferred to the debt service payment account in the case of a default, to be used to pay debt service costs on the debt obligations.”

- “If a debt service charge is due and the debt service payment account’s subaccount is inadequate to cover the debt service charge, the trustee will transfer an amount to cover the shortfall. It will come from the debt service reserve account’s appropriate subaccount.”

In such cases, the undertaking can in any case cover obligation installments with positively no income being produced for the DSRA time frame. This gives everybody included some solace and the undertaking sufficient opportunity to figure out issues. When constructing a financial model for a project, the DSRA and funding method are vital to consider. Cash inflows and outflows will be affected by the funding of the DSRA as well as the utilization of this reserve account.

Information Sources: