Abstract

IFIC Bank started functioning as a finance company in 1976. It was formed as a joint venture between the Government of Bangladesh and several farsighted sponsors from private sector. As GOB relaxed rules and allowed private sector to establish banks in 1983, IFIC was transformed into a commercial bank. At present GOB owns 32.75% of total shares of the bank and private entrepreneurs own 8.62% of that. And the rest is in the hands of general people.

The bank set its mission to present quality service to the clients through its skilled work force having dedication and innovative talents.

As a servicing industry, the banks are customers oriented. Customers are the driven power of a bank and it earns profit by providing service to customers. As the banking area is very hard and competitive, in order to survive and successfully compete with other banks, a bank not only has to serve but has to nicely and effectively serve its customers. Now, in Bangladesh more than 50 scheduled banks are operating their activities to serve customers.

Online banking is the demand of time. It is now no longer a “nice to have” but an “impossible to survive without” for all banks. IFIC Bank Ltd performs many of its operation in on line and trying to include rest of the operations.

Online banking comes with huge benefits. Many customers warmly adopt the habit of online banking. Some eagerly wait for new online services. But some still prefer traditional banking. They find traditional banking easy, hassle free and more trustworthy than online banking.

IFIC Bank Ltd is continuing to begin new online services one by one. During my project period I got the opportunity to observe customer closely. I found that many customer want more online services to save their time and cost. Many customers are happy with traditional banking. Some customers have no faith on online banking.

The fact is that the perception of online banking differs from person to person. Here I have tried to identify customers’ (IFIC Bank Ltd) perception of online banking.

INTRODUCTION

This chapter takes into consideration the background of the study, sources of information, objective of the study, research question, scope of the project, and limitation of the study and research methodology.

BACKGROUND OF THE STUDY

Modern banks play an important role in promoting economic development of a country. Banks provide necessary funds for executing various programs underway in the process of economic development. They collect savings of large masses of people scattered throughout the country, which in the absence of banks would have remained ideal and unproductive. These scattered amounts are collected, pooled together and made available to commerce and industry for meeting the requirements.

As a servicing industry, the Banks are customers oriented. Customers are the driven power of a Bank and it earns profit by providing services to customers. Customers are the person or institutions which deal with the Bank. In general, he, who has an account in a Bank, may be treated as a customer. In broad sense, customers may be seen from the two wings – Depositors and Borrowers. Beside these, other short-term served customers may exist in a Bank. As the Banking area is very hard and competitive, in order to survive and successfully compete with other Banks, a Bank has to serve its customers very carefully. Now, in Bangladesh more than 50 scheduled Banks are operating their activities to serve customers.

To fulfill the demand of time and impress the customer most of the banks are now trying to make their whole banking operation through online.

Online banking is the demand of time. It is now no longer a “nice to have” but an “impossible to survive without” for all banks. IFIC Bank Ltd performs many of its operation in on line and trying to include rest of the operations.

Online banking comes with huge benefits. Many customers warmly adopt the habit of online banking. Some eagerly wait for new online services. But some still prefer traditional banking. They find traditional banking easy, hassle free and more trustworthy than online banking.

IFIC Bank Ltd is continuing to begin new online services one by one. During my project period I got the opportunity to observe customer closely. I found that many customer want more online services to save their time and cost. Many customers are happy with traditional banking. Some customers have no faith on online banking.

Online banking makes life easier, there is no doubt. But introducing a new system is not easy because it brings some difficulties with it. In case of starting full online banking; the bank has to introduce some new system/products. In that situation both employees and customers face some problem to adopt that new system/product.

Sources of the Information

Information collected to furnish this report is both from primary and secondary sources. Secondary data was derived from various sources including banks papers, different circular sent by Head Office of IFIC Bank and Bangladesh Bank, other related researcher reports, website, previous seminar papers etc. Primary information was obtained from the specific person dealing certain products, interview with customers, interview with banking staffs, own observation, working experiences with banking staffs. For the industry related, legal, infrastructure related information internet was a good source.

OBJECTIVE of the Study

A Bank operates its activities not only to earn profit, but also to serve its clients in accordance with their needs and demands. Online banking is the demand of time as well as the demand of customer. IFIC Bank is popular for its better customer services. The main objectives of the study are to evaluate the customer expectations in term of online banking, their problems with online banking, etc. However, besides this, the study is an attempt to fulfill the following objectives:

- To identify customers perception of online banking

- To find out the facilities of online banking available in IFIC Bank Ltd.

- To find out the level of customer satisfaction with the available online banking facilities.

- To analyze the customers’ opinions towards different online services of IFIC Bank Ltd.

- To identify the customers’ reactions when suddenly they asked for some extra rules to make the system online.

- To analyze the employees opinions towards different online system of IFIC Bank Ltd.

- To identify employees problem to operate the system that newly installed.

Scope of the project

Banking sector is a large and difficult area. A Bank has different products, different services and different customers. Different departments of a Bank perform different activities.

This study says only about the customers of IFIC Bank Ltd. Different Bank has different types/classes of customers. Their reaction will differ on same matter. The major parts of the customer’s opinions are taken from that branch.

Limitations of the Study

The major difficulties are as follows:

- A study that encloses interviews of very few clients can not conclude anything accurately.

- A Bank has some restriction to present all the real data of the bank to the general people, so all relevant data and document collection is difficult.

- It was very much hard to collect information. Customers are very much busy. So they are not so interested to give genuine information.

- Some of the customers are afraid to provide answer/information.

- The authority was very busy, so they could not give me enough time for discussion about various problems.

- Personal barriers like inability to understand some official terms, office decorum etc. creates a few problems to me.

- Finally, Due to time limitation large-scale research is not possible.

Research Methodology

Firstly I made a plan about what to do. Then check out some banking activities of the bank staffs. Gather some practical banking knowledge from some banker of IFIC Bank Ltd.Then working few days with them and acquire some experiences. After learning some work I gave some customer services. When I became easy with customers I collect some primary data from them. I also talk with few bank staffs personally to collect more primary data. I collect my secondary data from different sources like bank website, brochures, commercials etc. After collecting necessary data I made the project.

The whole project was prepared through the following seven steps:

- Step 1 → Planning for the study

- Step 2 → Acquire knowledge about several banking activities

- Step 3 → Work few bays like a banker and gather some experience

- Step 4 → dealing with customers

- Step 5 → Data collection from different sources of bank (primary and secondary)

- Step 6 → Analysis of collected data

- Step 7 → Draw summary and recommendations.

Literature Review

Introduction

This chapter seeks to analyze relevant research documentation and findings essential to improve this research and its capacity to analyze the concerns it seeks to accomplish. Several researches have been carried out on online banking and it is important to examine them in relation to this research topic. This will enhance effectiveness and stimulate an all inclusive analysis and discussions of critical issue in relation to the topic under consideration. The content of this chapter comprise the theoretical framework. El-Sherbini et al. (2007) investigated the customers’ perspectives of online banking, their perceived importance for it, usage patterns and problems rising on its utilization. The paper discussed the strategic implications of the research findings. Empirical data were gathered from bank customers in Bangladesh to achieve the research objectives. All bank customers in Bangladesh were considered as population of research interest. The results showed the perceived importance of online banking services by customers, current and potential use of IB services in Bangladesh and problems perceived by bank customers in using IB. The researchers’ main hypothesis tested that top five services considered relative important in IFIC Banks were “Review account balance”, “Obtain detailed transactions histories, “Open accounts”, Pay bills” and Transfer funds between own accounts”. Akinici et al. (2004) developed an understanding of consumers’ attitudes and adoption of Internet banking among sophisticated consumers. Based on a random sample of academicians, demographic, attitudinal, and behavioral characteristics of Internet banking (IB) users and non-users were examined. The analyses revealed significant differences between the demographic profiles and attitudes of users and non-users. IB users were further investigated, and three sub-segments were defined according to a set of bank selection criteria. Finally, based on the similarities between various Web-based bank services, four homogeneous categories of services were defined.

Online banking

Online banking is the practice of making bank transactions via the Internet. Online banking allows us to make deposits, withdrawals, pay bills etc all with the click of a mouse. Online Banking is one of the few web applications where benefits to customers and banks are already widely proven. It is now no longer a “nice to have” but an “impossible to survive without” for all banks. Online banking means a kind of self-help financial services provided by the bank for its clients by the medium of Internet, including account information inquiry, account transfer & payment, online payment, agency services, etc.

The benefits are many.

For the online banking customer, the convenience factor rates high. No longer does a person have to wait for the bank statement to arrive in the mail to check account balances. One can check the balance every day just by logging onto one’s account. In addition to checking balances and transactions, one can catch discrepancies in the account right away and deal with them swiftly. The best part is that this can be done anywhere! As long as one has Internet access, one can practice online banking. All the online banking facilities are not till available in Bangladesh.

Since bills are paid online, the necessity of writing checks, affixing postage and posting the payment in the mail is eliminated. Once the amount is entered and the payee is checked off, the funds are automatically deducted from the payer’s choice of account.

Since the cost to the bank is minimal, the cost to the consumer, in many cases, is also minimal. While there is usually a fee for online banking, it can be extremely low. Those who partake in online banking all agree it’s worth every penny.

Online banking also eliminates paper waste, which is a plus not only for those who have to handle all the paper work, but also for the environment.

Of course, there are also cons.

Banking sites can be difficult to navigate at first. Plan to invest some time and/or read the tutorials in order to become comfortable in your virtual lobby.

Security is always an issue with Internet transactions. Although information is encrypted, and the chances of your account being hacked are slim, it happens. Banks pay big bucks to install high tech firewalls.

You’re also missing the personal service. No smiling teller or representative hands you a receipt. Instead, except for what’s printed into your account, all the paperwork is up to you. Always print copies of important transactions.

If you have to deposit cash or checks, you’ll still have to spend time at the ATM. unless a payment to you is directly deposited; this is one thing you’ll always have to handle manually.

Sound management of banking products and services, especially those provided over the internet, is fundamental to maintaining a high level of public confidence not only in the individual bank and its brand name but also in the banking system as a whole. Key components that will help maintain a high level of public confidence in an open network environment include:

- Security: Banks must have a sound system of internal controls to protect against security violate for all forms of electronic access.

- Authentication: In cyberspace, as in the physical world, customers, banks, and merchants need assurances that they will receive the service as ordered or the merchandise as requested, and that they know the identity of the person they are dealing with.

- Trust: Public and Private Key cryptographic systems can be used to secure information and authenticate parties in transactions in cyberspace. A trusted third party is a necessary part of the process. That third party is the certification authority.

- Non-repudiation: Non-repudiation is the undeniable proof of participation by both the sender and receiver in a transaction. It is the reason public key encryption was developed, i.e. to authenticate electronic messages and prevent denial or repudiation by the sender or receiver.

- Privacy: For the case of online banking personal information is very confidential. So the information should be very much private. The banks should ensure the privacy of all these information.

- Availability: The bank should maintain their service at every moment. The customers of online banking are time conscious and time is much more important to them. So the service should be available all the time.

online Banking products and services

Online Banking products and services can include wholesale products for corporate customers as well as retail products for individual customers. Ultimately, the products and services obtained through online banking may mirror products and services offered through other bank delivery channels. Some examples of online products and services include:

- Cash management

- Automated clearinghouse transactions

- Bill presentment and payment

- Balance inquiry

- Funds transfer

- Downloading transaction information

- Bill presentment and payment

- Loan applications

- Investment activity

- Other value-added services

Other internet banking services may include providing internet access as an Internet Service provider (ISP). Historically, banks have used information systems technology to process checks (item processing), drive ATM machines (transaction processing), and produce reports (management information systems). In the past, the computer systems that made the information systems operate were rarely noticed by customers. Today, websites, electronic bill presentment and payment systems are an important way for banks to reach their customers.

What is a Customer?

In general terms, a customer is a person or organization that a marketer believes will benefit from the goods and services offered by the marketer’s organization. As this definition suggests, a customer is not necessarily someone who is currently purchasing from the marketer. In fact, customers may fall into one of three customer groups:

- Existing Customers – Consists of customers who have purchased or otherwise used an organization’s goods or services, typically within a designated period of time. For some organizations the time frame may be short, for instance, a coffee shop may only consider someone to be an Existing Customer if they have purchased within the last three months. Other organizations may view someone as an Existing Customer even though they have not purchased in the last few years (e.g., television manufacturer). Existing Customers are by far the most important of the three customer groups since they have a current relationship with a company and, consequently, they give a company a reason to remain in contact with them. Additionally, Existing Customers also represent the best market for future sales, especially if they are satisfied with the relationship they presently have with the marketer. Getting these Existing Customers to purchase more is significantly less expensive and time consuming than finding new customers mainly because they know and hopefully trust the marketer and, if managed correctly, are easy to reach with promotional appeals (i.e., emailing a special discount for new product).

- Former Customers – This group consists of those who have formerly had relations with the marketing organization typically through a previous purchase. However, the marketer no longer feels the customer is an Existing Customer either because they have not purchased from the marketer within a certain time frame or through other indications (e.g., a Former Customer just purchased a similar product from the marketer’s competitor). The value of this group to a marketer will depend on whether the customer’s previous relationship was considered satisfactory to the customer or the marketer. For instance, a Former Customer who felt they were not treated well by the marketer will be more difficult to persuade to buy again compared to a Former Customer who liked the marketer but decided to buy from someone else who had a similar product that was priced lower.

- Potential Customers – The third category of customers includes those who have yet to purchase but possess what the marketer believes are the requirements to eventually become Existing Customers. Locating Potential Customers is an ongoing process for two reasons. First, Existing Customers may become Former Customers (e.g., decide to buy from a competitor) and, thus, must be replaced by new customers. Second, while we noted above that Existing Customers are the best source for future sales, it is new customers that are needed in order for a business to significantly expand. For example, a company that sells only in its own country may see less room for sales growth if a high percentage of people in the country are already Existing Customers. In order to realize stronger growth the company may seek to sell their products in other countries where Potential Customers may be quite high.

CUSTOMER PERCEIVED VALUE

According to BusinessDictionary.com(2007-2008) defines the value offered by a firm as: Extent to which a goods or service is perceived by its customer to meet his or her needs or wants, measured by customers willingness to pay for it. It commonly depends more on the customers’ perception of the worth of the product than on its intrinsic value

Expand of online banking

Numerous factors are motivating banks towards online banking. The challenge is to make sure the savings from online banking technology more than offset the costs and risks associated with conducting business in cyberspace.

There are many market factors that drive a bank’s strategy towards on line banking. Some are discussing below:

Cost efficiencies: Banks can deliver banking services on the internet at transaction costs far lower than traditional ways. The actual costs to execute a transaction will vary depending on the delivery channel used. These costs are expected to continue to decline.

Revenue Enhancement: By reducing cost and attracting new customer bank can increase its revenue.

Competition: The competitive pressure is the chief driving force behind increasing use of online banking technology, ranking ahead of cost reduction and revenue enhancement. Banks see online banking as a way to keep existing customers and attract new ones to the bank.

Geographical Reach: Online Banking allows expanded customer contact through increased geographical reach and lower cost of delivery channels. In fact some banks are doing business exclusively via the internet – they do not have traditional banking offices and only reach their customers online.

Branding: Relationship building is a strategic priority for most banks. Online banking technology and products can provide a means for banks to develop and maintain an ongoing relationship with their customers by offering easy access to a broad array of products and services. By capitalizing on brand identification and by providing a broad array of financial services, banks hope to build customer loyalty, and enhance repeat businesses.

Customer Demographics: Online banking allows banks to offer a wide array of options to their banking customers. Some customers will rely on traditional branches to conduct their banking business. Other customers are early adopters of new technologies that arrive in the marketplace. The challenge to banks is to understand their customer base and find the right mix of delivery channels to deliver products and services profitably to their various market segments.

As use of the internet continues to expand, more banks are using the web to offer products and services or otherwise enhance communications with consumers. The internet offers the potential for safe, fast, and convenient new ways to shop for financial services and conduct banking business, any day, any time.

Global scenario of online banking

Online banking has grown gradually in the UK over the past decade and is now used by 39% of adults, or 17 million people. But growth has slowed in the past couple of years. That’s odd because only46% of UK Net users access their bank accounts online, yet 74% regularly shop online. By 2012, it is expected that 44% of adults to use online banking in the UK, or nearly 22 million people. It is hoped that between 2009 and 2014, the total number of US online bill payment households will increase from 48 million to 63 million. Online banking has grown steadily in France over the past decade, boosted by the growth in Net use overall, and is now used by 31% of adults, or 15 million people. Growth to continue at a similar rate for the next five years because French Net users are becoming increasingly confident with the channel and because banks can still do more to persuade customers to bank online, starting with reducing or eliminating the charges that many still impose on customers who bank online. By 2013, it is expected that 42% of adults to use online banking, or more than 22 million people. With only 12% of Swedish banking customers using branches, Sweden has the lowest branch use in Europe. Swedish banks have successfully migrated the majority of their customers to ATMs and online banking 83% and 71%, respectively. It is projected that, by 2012-2013, 81% of Dutch and 47% of German consumers will use Internet banking.

THE SUPPORTING IT INFRASTRUCTURE

Though the first main frame computer came to Bangladesh in 1964, but the usage of PC became popularize very late to the common people. Several large banks and private entrepreneurs in industrial sectors are the path makers of achieving benefits from computer and computerized applications. Bureau of Statistics and a few nationalized banks are the leaders in using computer in government sector by processing data and information, while industrial concerns in private sectors are the leaders in applying computer for their accounting, payroll and inventory related applications.

Today the people are getting more technology conscious. They are well aware of the benefits of the technology. This made many people a user of the internet facilities. The number of users increased fast over the years.

Internet Usage and Population Statistics:

YEAR | No. of Users | Population | % |

| 2000 | 100,000 | 134,824,000 | 0.1 |

| 2007 | 450,000 | 137,493,990 | 0.3 |

| 2009 | 556,000 | 156,050,883 | 0.4 |

| 2010 | 617,300 | 158,065,841 | 0.4 |

| 2011 | 5,501,609 | 158,570,535 | 3.5 |

Figure: Internet Usage and Population Statistics

Though we have seen some sharp rise in the growth of internet and internet users, there are some impediments on the way to the growth of internet in Bangladesh. Some of the reasons are listed below:

- Underdeveloped IT industry

- Lack of efficient use of IT network

- No direct access to the information super highway

- Limited skilled human resources

- Poor telecommunication infrastructure

- Low-level of computer literacy

- Widespread poverty

- Low telephone penetration

- Lack of software in the Bengali language

Opportunities for a better Internet support

- Bangladesh has a nationwide fiber-optic network established by Bangladesh Railway. This facility can provide excellent backbone for nationwide voice and data communication.

- As we have no direct access to the information super highway the only option is to communicate through satellite. Satellite communication is costlier than fiber optic.

- To avoid satellite communication and its high cost, we can establish the missing link to the information super highway if the nation-wide fiber-optic network is allowed to link up with the high speed fiber-optic backbone in India.

- Availability of telephone lines and reduction in service fee will attract many professionals into internet arena.

- Young generation should play a vital role in developing IT industry in Bangladesh.

ONLINE BANKING OF BANGLADESH

At present the banks in Bangladesh are using the limited electronic banking services. It is expected that bank can attain more profit and offer better services to its customers by, introducing on line banking facilities. The foreign commercial banks operating in Bangladesh like Standard Chartered Bank, Citi Corp. N.A. and the HSBC are the pioneers to introduce the electronic banking facilities. They provide ATM, Debit Card, Credit Card, Home Banking, Internet Banking, Phone Banking, on line banking etc. services.

Among the indigenous banks, the Private Banks are ahead of the public banks. Prime bank ltd, Dhaka bank ltd., BRAC bank ltd., Dutch-Bangla bank ltd, Eastern Bank Ltd., Mercantile bank Ltd., and IFIC Bank Ltd. is already stepped on towards electronic banking facilities. Apart from these banks, Mutual Trust Bank ltd. also introduced ATM service. Among the four Nationalized Commercial Banks (NCBs), Agrani and Janata bank has some access to the electronic banking facilities. Bangladesh Bank, the Central Bank of Bangladesh, is also trying to formulate the structure of electronic banking facilities. All of these private banks offering limited on line banking services. Most of these banks only offer services by providing ATM card. Most of them do not offer wide range of internet banking facilities which is the main advantages of e-banking. Can deposit money in any branch and withdraw money from ATM machine- is treated the best e-banking facility available in Bangladesh While electronic money transfer starts in a limited edition. Sonali and Agrani Bank Ltd., is also providing on line banking services in a limited scale. Rupali Bank Ltd. is also developing on line banking. BASIC bank which is 100 percent public owned but served as private sector banking has a technological advancement.

A broad spectrum of Internet banking services, a subset of electronic finance, is available in Bangladesh with different degree of penetration. The credit card is available from VISA, MasterCard and VANIK. Some foreign banks provide electronic fund transfer (EFT) services. It is at an early stage and used on a very limited scale. Microchips embedded Smart Card is also becoming popular in the country, particularly for utility bill payment. Automated teller machine (ATM) is expanding rapidly in major cities. A group of domestic and foreign banks operate shared ATM network, which drastically increase access to this type of electronic banking service. The network will gradually be extended to other parts of the country.

The e-banking services provided by the banks in Bangladesh could be divided in three groups: ATM Services, Internet Banking (i-Banking), and SMS Banking. The scopes of these services are vast, but the banks in Bangladesh do not provide all of these services. Some of the banks provide these or other services and charges fees for ATM transaction, SMS and i-Banking while the western banks inspire clients to do ATM banking without fee or a minimum fee to reduce banking expense.

Last couple of years shows dramatic improvement in the awareness situation in the banking sector regarding the comprehensive application of ICT. Local software companies have been starting competition to supply useful complete banking software with all the basic features of banking module. However, many forms of electronic banking services are not possible to offer in Bangladesh at this moment due to the technology backwardness, infrastructural underdevelopment and legal infrastructure. Those products would be very useful for export-oriented industry to reduce lead-time in export and keep comparative advantage in the international market.

PROBLEM OF ONLINE BANKING SYSTEM IN BANGLADESH

Numerous problems have been identified in the field of on line banking system in Bangladesh. Some of them are in the followings:

- Inefficiency and inadequate knowledge of the bank management about the on line banking.

- Lack of proper Strategic plan to gain and retain market share of the indigenous banks.

- Lack of international standard communication channel.

- High cost of establishing on line banking system.

- Inadequate back and front office management.

- Lack of integrated plan among the banks and the Central Bank authority.

- Inefficient Clearing House Facilities.

- Inappropriate software and less trust by the Bank authorities on local software.

- Biased-ness of the management of bank towards foreign software.

- Legal barriers and appropriate policy framework.

SWOT ANALYSIS

To find out the viability of a particular product we must perform a SWOT Analysis of the product. This will analyze the Strengths, Weaknesses, Opportunities, and Threats of the particular product. For analyzing the performance of Online Banking in Bangladesh we the following SWOT Analysis is considered.

STRENGTH

- Online Banking is new in our market. Only a few banks are now offering online services in solving banking problems. Most of the banks are offering only accounting information online. Actual fund transfer and fund disbursement is not possible in all the banks that are offering online services. So this product will enjoy the benefit of a first mover.

- It is cheap both for the banks and the customers. The bank will be able to lower down the overhead costs and make more profit out of it. Online banking will require less manual workers. Again the customers will be able to save time as well as money for their transaction needs.

- Internet banking is convenient as the service is available all the time at just a click away.

WEAKNESSES

- Security breakdown: The system will have a problem with the identification of the individual who is initiating the transaction. In Bangladesh, the identification of an individual is not yet supported digitally. So there will be a problem in moving to the Internet era for banking purposes just now. First we will have to develop a digital database of the users of the internet banking services.

- The transaction can be cancelled only via internet. The internet infrastructure of our country is not that much supportive to provide all time access to the web. So there will be a problem in executing the service with its full functionality.

OPPORTUNITIES

- Non-branch banking is becoming popular in our country. Many banks are now offering non-branch banking facilities. A person can withdraw or deposit money in any branch of the bank he has account with. So moving to online banking will allow the banks to offer non-branch banking facilities.

- The internet services are becoming very common to us. So a service offered through the internet will be widely accepted in the near future.

THREATS

- People have concern about security and privacy. They like to feel their money with their hand. They actually don’t believe in virtual money transfer.

- In the field of IT new technology is coming every day. The one which is very popular today might get obsolete tomorrow. So to have a competitive edge over the competitors the banks must always update their services.

- The movement towards online banking might marginalized the customers who do not have internet access or who are not technologically sound.

ONLINE SERVICES OFFERED BY SOME BANK OF BANGLADESH

In Bangladesh more than 50 scheduled banks are operating their activities to serve customers. Many of those banks offer exciting online product and services. Some are described below:

Dutch Bangla Bank:

Internet Banking Features

- Account Summary: The Customer will be able to view the list of Current, Saving, Term Deposit and Loan accounts with the current balance.

- Account Details: The Customer can choose a particular account and see the account details including unclear fund, limit, interest accrued etc.

- Account Activity: The customer can see or print his transaction activity in a given account for a particular period.

- Transfer Funds: The customer can transfer funds from one of his accounts to another of his accounts within the bank.

- Standing Instructions: The customer can setup, modify or delete standing instructions for transferring fund from one of his account to another account (his account or 3rd party).

- Open/Modify Term Deposit: The customer can open a term deposit by transferring funds from one of his current or savings accounts with the bank. He can also modify the TD and redeem / part-redeem it.

- Loan Repayments: The customer can make payment of the loan installment from his CASA account.

- Statement Request: The customer can make a request for account statement for a required period. The bank will manually service this request.

- Cheque Book Request: The customer can make a request for a Cheque book.

- Cheque Status Inquiry: The customer can choose an account and enter the Cheque number for which the status should be viewed.

- Stop Payment Cheque: The customer can mark his Cheque leaf as stop payment.

- Interest Rate Inquiry: The customer can query on the interest rates on CASA & Term Deposit Products.

- Foreign Exchange Rate Inquiry: The customer can query on the Foreign Exchange (FX) Rates using this function.

- Refill Pre-Paid Card: The customer can buy a refill number for his pre-paid mobile phone or ISP link.

- Change Password: The customer can change his Internet Banking Password using this function.

Additional Internet Banking Features for Corporate Banking

- Letter of Credit: The customer can initiate the LC application through Internet Banking.

- Bank Guarantee: The customer can initiate the Bank Guarantee through Internet Banking.

- Limits Query: The customer can view his Loan Limits and Limits Utilization through Internet Banking.

Eastern Bank Limited

EBL Internet banking application addresses the needs of small, individual and corporate account holders of the bank. This application provides a comprehensive range of banking services that enable the customer to meet most of their banking requirements over the Net. The transactions that are supported by the internet banking provided by Eastern Bank Limited are as follows:

- Round the clock access

- Real-time transaction history

- Loan account inquiry

- Pay bills

- Transfer to own accounts

- Issue Pay Order

- Open new fixed deposits

HSBC

Internet Banking service manage customers finances. They can take control of their account whether at home or abroad. They can access their accounts anytime, from anywhere in the world! Other services include:

- Access your account 24/7 (subject to planned maintenance periods).

- View your balances and transactions

- Make transfers between eligible HSBC accounts.

- Online Bill Payments – Make life easier. Pay your bills online

- Create, view, amend and cancel standing orders

- Apply online for different products.

- Update your email address, contact telephone numbers and other personal information

- Foreign Exchange – Perform foreign exchange enquiries

- Statements – View, print and download your Statements to track your transactions.

- Total Banking Portfolio, Net worth & Account Summary – Check/update your personal information/account.

- Time Deposits – Placement of new time deposit, check or update your personal information and accounts.

Mercantile Bank

Clients can access their personal and business accounts and manage their money 24/7 hours a day. The highest level of encryption protection safeguards each and every one’s account information. Through electric banking one can easily avail following services:

- Check account balances and deposits

- See which checks have cleared

- Transfer funds between accounts

- Schedule future transfers

- View recent transactions

- Make bill payments

- View images of cleared checks daily

- Statement viewing and canceled check retrieval

How to work CitiDirect

To gain more control over ones cash positions, one needs easy access to accounts and information in real time. One needs an application that is easily customized by individual users and streamlines day-to-day operations. One will need the convenience of local banking and the global solutions of an industry leader. The solution is CitiDirect Online Banking. The motto of CitiDirect is “Money isn’t everything but it can be everywhere”. The facilities available are:

- Online Direct Debit Transaction Process

- Information Reporting

- Real-time information reporting for more effective cash management

- Delivered with the highest level of security

- Easy-to-use application

- World Link through CitiDirect

- comprehensive payment transaction solution

- Flexible, streamlined functionality

- Reliability, speed and information

- Payments through CitiDirect

- A comprehensive payments solution globally and locally

- Simplified, secure transaction management

- Timely, accurate information

- E-mail and Wireless Banking Alerts by CitiDirect

SCB

Standard Chartered offers the client a comprehensive range of Cash Management services. Whether it is a financial institution, a multi-national corporation or a domestic company, Electronic Banking application has the capability to support full range of Cash Management reporting and transaction initiation needs. It provides the secure, reliable and effective link between the client and client’s accounts anywhere across the Standard Chartered network. Electronic Banking provides various types of support through a wide range of operating systems, sweeping transaction accessories with the provision of reporting features or other special functions. There are 10 offices and 50 employees under this division, which operates in 26 countries.

COMPANY OVERVIEW

INTRODUCTION

This study is based on customer perception of online banking. And the customers who participate in this study as respondent are from IFIC Bank Ltd. So, it is necessary to know the bank. This chapter discuss about the bank from different angle.

HISTORICAL BACKGROUND OF IFIC BANK LTD.

International Finance Investment and Commerce Bank Limited (IFIC Bank) is banking company incorporated in the People’s Republic of Bangladesh with limited liability. It was set up at the instance of the Government in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial institutions aboard. In 1983 when the Government allowed banks in the private sector, IFIC was converted into a fully fledged commercial bank. The Government of the People’s Republic of Bangladesh now holds 32.75% of the share capital of the Bank. Directors and Sponsors having vast experience in the field of trade and commerce own 8.62% of the share capital and the rest is held by the general public. Initially, the bank’s authorized capital was Tk 100 million divided into 1 million ordinary shares of Tk 100 each. IFIC conducts all types of commercial and investment banking functions.

VISIONS OF IFIC BANK LIMITED

To cope with the challenge of the new millennium, it hired experienced and well-reputed banker of the country from the inception. The bank has efficient and dedicated professional and equipped with modern technology to provide the best service in the need of the people and thus realize its vision. So its vision: “to be the most efficient bank in terms of customer service, profitability and technology application”.

MISSION OF IFIC BANK LIMITED

To provide service to their clients with the help of a skilled and dedicated workforce whose creative talents, innovative actions and competitive edge make their position unique in giving quality service to all institutions and individuals that bank care for.

The bank is committed to the welfare and economic prosperity of the people and the community. Bank wants to be the leader among banks in Bangladesh and make our indelible mark as an active partner in regional banking operating beyond the national boundary.

In an intensely competitive and complex financial and business environment, bank particularly focuses on growth and profitability of all concerned.

GOALS & OBJECTIVES OF IFIC BANK LIMITED:

A Bank operates its activities not only to earn profit, but also to serve its clients in accordance with their needs and demands. In this sense, customer service is one of the important jobs of the Banks. The main objectives of the study are to evaluate the efficiency and effectiveness of the IFIC Bank Ltd. officials in servicing their customers.

Maximization of profit through customer satisfaction is the main objective of the Bank .in addition .the others relevant objectives are:

- To develop saving attitude and making acquaintance with banking facilities.

- To be market leader in high quality banking products and services.

- To contribute in economic growth.

- To help in poverty alleviation and employment generations.

- To ensure an adequate rate of return on investment.

- To ensure optimum utilization of all available resources.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- Achieve excellences in customer service.

- To play a significant role in the economic development of the country.

- To protect money laundering

TECHNOLOGY

Since the beginning of its journey as a commercial bank in 1983, IFIC Bank has been giving great emphasis on the adoption of modern technology. It became the pioneer in the field of automation by introducing computerized branch banking right in the same year. Subsequently, all the branches were brought under similar automated platforms with upgraded software applications to offer all the critical banking features. At present all 100 domestic branches are fully computerized under networked environment.

The Bank has taken up a new project with Misys International Banking System Inc. (UK) to further upgrade its banking operation to state-of-art world class on-line banking solutions to provide faster and even more convenient centralized services to the clients.

Besides, the Bank is also operating fully on-line Automated Teller Machine (ATM) services under the banner Q-Cash at a number of locations in Dhaka and Chittagong. The ATM facilities are available to the customers at Q-Cash booth.

Since the importance of Web presence in the Internet is absolutely critical, IFIC Web Site www.ificbankbd.com has long been launched for the convenience of the customers, where all the activities and information are constantly being posted and updated. A Central Mailing System is operational at the Head Office to let the customers have direct electronic access to the selected staff.

SOFTWARE USE BY IFIC BANK

| Service | Software Use | Vendor’s Name |

| Core Banking | Equation Branch Server | Misys International Banking System Ltd. UK |

| Equation Branch Automation | DO | |

| Trade Innovation | DO | |

| SMS Banking | Mobile Banking Management | SSL Wireless Limited |

| Internet Banking | iBanking | In-house |

| Various Cards | Q-cash | IT Consultants Limited (ITC) |

| VISA | ||

| ATM Shared (VISA/MASTER) | Tranzware,Compass Plus | IT Consultants Limited (ITC) |

| POS Terminal | Tranzware Online Switching | IT Consultant, BD, Russia |

| EFT | Money Gram | |

| X-press | UAE Exchange, UAE | |

| Placid Express | Plasic N.K corporation USA | |

| Coinstar Money Transfer | Coinstar Money Transfer, India | |

| SWIFT | SWIFT | Belgium |

| SWIFT Alliance | ||

| PC CONNECT | NBPKaraci, Pakistan | |

| Offline Branch Computerization | BexiBank4000 | Beximco Computers |

LIST OF PRODUCTS/SERVICES OF IFIC BANK LTD

Deposit Product: Savings Account, Smart Savings Account, Super Saving Plus – More Money, Current Account, Special Notice Deposit – SND Account, Fixed Deposit Receipt (FDR), Pension Savings Scheme (PSS), School Savings Plan – A Plus, Monthly Income Scheme – Protimash, Three Years Deposit Plus (3YDP), Double Return Deposit Scheme (DRDS), Millionaire Dream Plan (MDP)

NRB Account: Foreign Currency A/C, NFCD, Wage Earners Development Bond, USD Premium Bond, USD Investment Bond, Inward Foreign Remittance

Loan Products:

IFIC Easy Loan, Consumer Durable Loan, Parua (Education Loan), Thikana (Home Loan), Any Purpose Loan, IFIC Marriage Loan, CNG Conversion Loan, IFIC Home Renovation Loan, IFIC Medical Loan, IFIC Holiday Loan, IFIC Peshajeebi Loan, IFIC Auto Loan

Other Products / Services: Q-cash, VISA Debit Card, Credit Card, SMS banking, Internet banking

LIST OF ONLINE PRODUCTS/SERVICES OF IFIC BANK LTD

Deposit Product: Savings Account, Smart Savings Account, Super Saving Plus – More Money, Current Account, Special Notice Deposit – SND Account, Pension Savings Scheme (PSS), Double Return Deposit Scheme (DRDS), Millionaire Dream Plan (MDP)

SMS Banking: This service allow customer to do some banking activities through SMS from their mobile. The services are as follows

- Check account balance

- Short Statement of last 5 transaction, etc.

POS: Point of Sales Service for the customer who wants to withdraw money from any branch using their card.

Card Transaction: This product allow customer to withdraw money anytime from ATM booth. Here, customer can do account transaction, balance enquiry etc. They don’t need to carry much cash with them.

Cash and Cheque Deposit and Withdraw: Customer can deposit cash and cheque in any branch of the bank. A customer can also withdraw money from any branch whether he has an account in that branch or not.

Internet Banking: This service allow customer to do some banking activities through internet from his home or office or anywhere of the world. The services are as follows

- Check account balance

- View and verify transactions on account

- View Statement

- Print Account Summary

- Print Account Statement

- View Check-Book usage status

- View & update short profile

Results

INTRODUCTION

Here I present the data collected from the two samples, i.e, and the interviews with the online banking staff of IFIC Bank Ltd and the collective response to the questionnaires by the customers. The presentation will be in two parts, data collected from the bank staff and that collected from the customers.

BACKGROUND OF THE BANK

Before I sort out and analyzed the data collected, I present a background of the bank with regards to what the online products and services they offer. This information was gathered from their websites and brochures and compared with what was gathered from the interview with bank staffs and what customers confirmed they received from online banking.

BACKGROUND OF THE RESPONDENTS

Staff members of bank represent the bank. They were made up of three female and two male respondents. All the five respondents have worked in their banks for over three years and were quite familiar with the operations of online banking. All of the respondent customers has at least an account in Progoti Sarani Branch of IFIC Bank and also familiar with all the online product and services offered by the bank.

MAJOR ONLINE BASE PRODUCTS AND SERVICES PROVIDED BY THE BANK

Deposit Product: Savings Account, Smart Savings Account, Super Saving Plus – More Money, Current Account, Special Notice Deposit – SND Account, Pension Savings Scheme (PSS), Double Return Deposit Scheme (DRDS), Millionaire Dream Plan (MDP)

SMS Banking: This service allow customer to do some banking activities through SMS from their mobile. The services are as follows

- Check account balance

- Short Statement of last 5 transaction, etc.

POS: Point of Sales Service for the customer who wants to withdraw money from any branch using their card.

Card Transaction: This product allow customer to withdraw money anytime from ATM booth. Here, customer can do account transaction, balance enquiry etc. They don’t need to carry much cash with them.

Cash and Cheque Deposit and Withdraw: Customer can deposit cash and cheque in any branch of the bank. A customer can also withdraw money from any branch whether he has an account in that branch or not.

Internet Banking: This service allow customer to do some banking activities through internet from his home or office or anywhere of the world. The services are as follows

- Check account balance

- View and verify transactions on account

- View Statement

- Print Account Summary

- Print Account Statement

- View Check-Book usage status

- View & update short profile

In contrast to traditional banking products/services, all the product and services of online banking can be obtained from the traditional channel. The difference here therefore rests solely on the difference in channel delivery.

INTERVIEW QUESTIONS FOR BANKING STAFF

1. What are the major online base products / services your bank provides to its customers?

Answer: According to respondents, major online products/services are as follows: Internet Banking, SMS Banking, Card Transaction, Cash and Cheque Deposit and Withdraw. Others are the same as cataloged and explained in the preceding heading and this corroborated what I found on their websites, brochures, commercials and customers’ identification of the online products and services that they access from the bank. The feedback from the customers was especially important because some services could only be assessed with a customer password and cannot be confirmed by merely visiting the websites.

2. How has online banking improved your bank’s productivity?

Answer: Live Branch position, Customer’s flexibility to enjoy banking facilities from any branch of the bank all over Bangladesh by opening accounts in one branch. Customers are very happy with that. The respondents indicate that online banking has increased the productivity of their bank as well as that of their customers. Both the bank and its customer save more time and cost, and in addition, they save more man-hour for the bank. As customers are spared long queues in the bank and the trouble they have to take in going through heavy traffic and long distances to reach their bank, corresponding, and the pressure on traditional banking outlets are reduced thereby improving services for a fewer number of customers.

3. What kind of feedback do you receive from your customers on online banking services?

Answer: According to respondents, customers have a mixed reaction about online banking services. Some are satisfied with existing online services and some are not. They want more services. Some complain about slow uploading of banking website and links. A recent event depicts a clear picture of the mixed reaction of customers. According to respondents, their PSS (Pension Savings Scheme) account was not online. But recently they transform the account into online product. A new customer will get this facility from the first day of account opening. He or she can deposit his or her money into a savings account in any branch of the bank. Every month a certain amount of money (written in A\C opening form) will be deducted from their saving account to PSS account. They don’t need to come to bank every month to deposit money, they don’t need to remember the date of depositing money, they don’t need to go to a branch where they opened the account, need not to worry about late fees etc. This online product (PSS) surely comes with solution of many problems. Whenever any customer come to open a PSS account and know that he has to open a saving account also, many of them become happy to know that they can enjoy the benefits described above. But some are not interested to this new online product. They are alright with the problems that can be solved by this online PSS. In case of old customer, the respondents face more problems. Whenever they asked their old PSS holder that they have to open a new account to transfer their PSS into online product, some are happily ready to do that to enjoy the facilities of online banking. But most of the customers become very angry and not ready to do that. Some argued that the bank should tell the customer about all the rules before starting a new account not after opening an account. If any new system emerges, that should not apply on old customers – a customer said that.

4. What products/services do you plan to introduce into the online banking in the future?

Answer: The bank is going to introduce more online products and services to their customers. These include:

- Mobile banking

- Card Cheque

- Deposit in ATM

- Fund transfer from one account to other accounts

- Paid utilities bill

- Adding some extra features in internet banking

5. What are the challenges that your bank is facing in providing online banking services?

Answer: The responses to this question are itemized as follows:

- The respondents said that high cost of establishing on line banking system is one of the main challenges for the bank in providing online banking services. Because the bank has to be sure that the savings from online banking technology is more than the cost of conducting business in cyberspace.

- Poor telecommunication systems and technological infrastructures etc.

- The interviewees reveal that there is a clear sense of misgiving about online banking among some customers who were offered online services. Some of them use internet only in office and some of them never do.

DATA COLLECTED FROM ONLINE BANKING CUSTOMERS FROM THE QUESTION POSED IN THE QUESTIONNAIRES

[I asked about 100 people. Many of them don’t use internet, so they can’t enjoy the full benefit of online banking. They use cards which is also an online product. But they are unfamiliar with many other online products/services. Here the entire 50 respondents who participate in this study use internet banking (a part of online banking) that means use internet either in office or home or both place.]

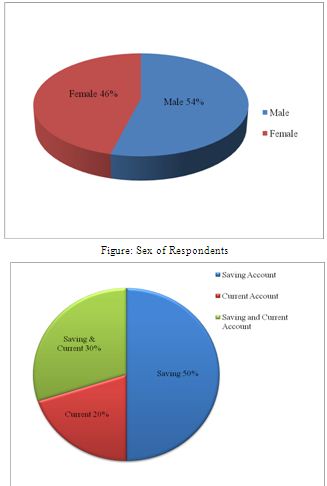

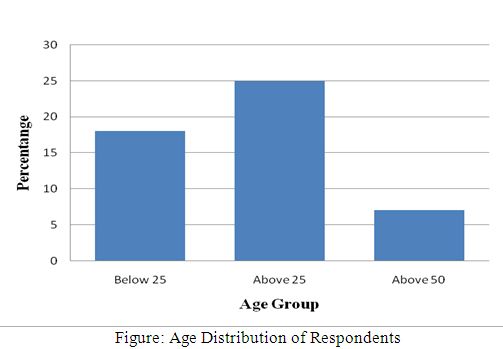

I first present the distribution of online banking customers based on sex, account type and age distribution. 50 customers participate in it and among them 27 were male respondent and 23 were female respondent. 25 respondents run a saving account, 10 current account and 15 respondents run both current and saving account. 18 were below 25 years, 25 were above 25 years and 7 were above 50 years.

1. Why did you subscribe online banking? And what are the products/services that you access online from your bank?

Answer: Respondents indicated that they subscribed online services because they use the internet at home or office, or because they perceived it as modern. Some customers use it because their bank introduces it.

Regarding the question on the kinds of products and services that the respondents access from online banking, they enumerated all the products and services that the banks offer online confirming what I gathered from the interviews, websites, brochures and advertisements.

2. How do the online products and services differ from traditional banking products and services that you know?

Answer: The respondents did not perceive much difference between online products and services and those of traditional banking except in the self service dimension of online banking and the vast information that were readily available online. They also focused on the time and cost saving advantage of online services. But some customer added that in spite of using online banking they like traditional banking more than online banking. Because in traditional banking they can inquiry a matter from bank staffs until it becomes clear to them. In online banking everything depends on customer to understand a matter by himself. They also prefer to feel their money with their hand not virtually.

3. How reliable or good is your internet connectivity and how does online banking save you in terms of monetary and time costs?

Answer: Many of the respondents have problems with internet connectivity. Nonetheless all respondents felt that they were saving costs from using the internet in terms of time and money. They explain that for many banking activities they don’t need to go bank, it saves both money and time.

4. What benefits do you get or problems do you encounter with online banking?

Answer: Respondents reiterated the benefits of saving time and cost. Some mentioned about self service advantages. In case of problem they mentioned about slow connectivity, downloading of web pages.

5. Do you suffer any security and privacy threat in accessing online banking?

Answer: On the whole, respondents had had no security threats or privacy violation. But some expressed that in near future privacy can be violated as technology is enhancing day by day and practice of online banking is also increasing.

6. What kind of additional online products/services would you wish were provided by your bank?

Answer: Respondents wish they could carry out full transactions with their online banking with adequate security and also cross transaction with other financial institution. They felt that the present services provided by their bank is limited compared to what pertained in other parts of the world.

7. Do you have any message to your bank regarding online banking?

By this question I tried to understand customers’ satisfaction or dissatisfaction on their bank regarding online banking.

Answer: Most of the customers run account in more than one bank. They complained that they get more online services facility in another bank than IFIC Bank.

In case of ATM, some customers complain about unavailability and some customers about network.

After any kind of transaction, customers want sms notification. But their banks sms notification alert is irregular. Some feel insecurity for that.

Some customers mentioned that in case of balance transfer to some branches of the bank out of Dhaka city, the bank takes a online charge, it should be free.

Introducing new rule after opening an account is also disliked by most of the customers. They think in case of introducing any new rule the bank should consider about old customers. Some customers’ requirement is small and they are quite happy with their bank.

INTRODUCTION

In this chapter, I discuss the result of the data I collected in relation to the frame of references, concept and theories that underpin the study. The discussion is presented in three parts according to the research questions.

RESEARCH QUESTION

What are online banking products and services that IFIC Bank Ltd offers to their customers?

Online banking becomes a way of attracting new customer and also impresses the existing customer. Many researchers view customer value as a key element in achieving company success. This study tries to identify the kind of product and services IFIC Bank Ltd is offering to deliver customer value and also the upcoming product and services that are coming to increase customer value and finally the customers’ perception who access such product and services.

The study revealed that online banking is a complementary service to traditional banking in Bangladesh. In indentifying the products and services, we took a number of approaches. I examined the website of the bank, read through their brochures and other advertising devices, interviewed bank staffs and matched the information gathered with customers’ responses regarding the product and services. Short list of online products and services is listed below:

- Several Deposit Product

- SMS Banking

- POS: Point of Sales

- Card Transaction

- Cash and Cheque Deposit and Withdraw

- Internet Banking:

- Check account balance

- View and verify transactions on account

- View Statement

- Print Account Summary

- Print Account Statement

- View Check-Book usage status

- View & update short profile

The services that are not offered by the bank include full transactions such as Fund transfer from one account to other accounts, bill payments etc. Cross-selling is one of the key models of the internet platform. The present product and services provided by the bank is limited compared to what pertained in other parts of the world even in some other banks of Bangladesh. Thus, the bank has a wide range of offering they can offer as they consolidate existing product and services.

RESEARCH QUESTION

What are the upcoming online banking products and services that IFIC Bank Ltd is going to offer their customers?

The bank staffs said that in case of providing online banking services their bank faces the challenge of high cost. We also saw in case of online banking the main challenge is to make sure the savings from online banking technology more than the costs and risks associated with conducting business in cyberspace. So, the bank could not offer full rang online banking products and services till now. But the existing online products and services is also attracting new customers and in recent time the customer increase rate is 300%, according to respondents. The bank has about 4, 60,000 accounts, among those accounts 1, 75,000 are active account. The bank staffs think that online banking is one of the reasons behind this increase in account number. As the customers are the driver of a bank asset, the bank is now ready to introduce some more online products and services to its customers very soon. Including:

- Mobile banking

- Card Cheque

- Deposit in ATM

- Fund transfer from one account to other accounts

- Paid utilities bill

- Adding some extra features in internet banking

RESEARCH QUESTION

What is the perception of customers of online banking?

It indicated already that the essence of online banking increase customer value. Although the full range of online banking facilities is not yet available but it is available to some extent. But all the customers are not using it. One of the main problems is lack of awareness. People still think that their money is safer in their hand than online. When I described the benefit of online PSS A/c to some client, I found different point of view of them. Online PSS A/C has many advantages including: a customer need not to come to bank every month. One customer who was a housewife said that she loved to come to bank every month. She also felt secure to deposit her money physically. This is not her point of view only; many customers shared the same statement. It is very hard to change such mentality.

Some customers said that traditional banking is easy to carry out. Some internet banking users also support that traditional banking is easy to carry out than online banking because they are not much familiar with these services.

A huge number of customers taking banking services does not capable to bear the cost of additional equipments like computer, computer accessories , Internet etc. from their own organization or at home. Using Internet facility still very costly and people has little knowledge in operating computers. A few numbers of cyber café is available but for banking purpose customers do not feel safe to use these facilities. As a result total numbers of customers who are habituated in on line banking systems are limited.

Some customers come and asked the bank staff to write the deposit slip for them because they can’t write properly. It is very difficult to take those customers under the umbrella of online banking.

A different picture is also available. Some customers said that they need to inquiry their account statement frequently and it is difficult to visit the bank so frequently. Now they can get their necessary information from their home or office through internet. They enjoy all the available services provided by their bank. Moreover, they want the additional services available in other banks and not yet available in their bank.

At one point, all the customers are agreed that in case of introducing any new rule (whether it for online banking or traditional banking) the bank should be careful. It should take right decision so that the old customers do not suffer for that new rule.

As the customers have a mixed reaction of online banking, the bank’s latest product online PSS A/C also gets a mixed reaction. Some customers adopt it happily. And some customers close their account because they don’t want to grant the new rule. They don’t want to open another saving account to make their PSS A/C online. It is clear that for them the benefits of online banking is less worthy than other factors.

SUMMARY

The study revealed that online banking is a complementary service to traditional banking in Bangladesh. Because customers till depend on traditional banking more than online banking. For many reasons they prefer traditional banking. They like to feel their money with hand. They think it is more secure form than virtual form. The sense of security is of great importance. In Bangladesh most of the people are illiterate and obviously they are technology ignorant. Again, among the literate portion many of them have computer phobia. So these people can’t trust on the online banking services. To gain the confidence on online banking the overall computer literacy must be developed. With that goal government has taken initiative even in the root level to develop it literacy in the country. This would be a perfect ground for the development of online banking.

Bank must also create the environment that will encourage customers to hook up. Many potential customers who cannot purchase personal computer can be encouraged to acquire them through special bank loans payable through small monthly deduction from the customer’s account.

Nonetheless, some customers enjoyed the advantages of the online services and expressed the desire for more services online.

RECOMMENDATION

Online banking became “an impossible to survive without” for all banks. In mission statement the bank states that it wants to provide better service to their clients with the help of a skilled and dedicated workforce. To do so, the bank must give more concentration on online services. Here, I have come up with some recommendation which IFIC Bank Ltd can use for their advancement. These are:

- If it is feasible for bank than online charge (i.e. for balance transfer) should be removed.

- Make sure that sms notification system is working properly.

- Some important online services (like mobile banking) that are already introduced by other banks should be started as early as possible. Otherwise valuable customers can be switched to another bank.

- As the number of customers is increasing, the number of ATM booths should increase.

- Before introducing any new product or service, train your staffs about that product or service. It will make staffs performance better and quick. Therefore, the customer service will improve.

CONCLUSION

It is reasonable to predict that online services will improve; many more banks will go fully online and competition will increase in this area. Wu et al (2006) strongly suggest from their findings that online banking will prove disruptive to traditional banking and therefore core competencies and new ways of serving the customer must be developed. Hope that this work will set the stage for a rigorous approach to online banking.