The internship program is an opportunity for the students and it bears a great significant for us. It familiarizes the students with the practical business operations. The students of internship program get the chance to understand the real business world closely and familiarize themselves with internal and external expects of business. It gives them an opportunity to develop the analytical skill and scholastic aptitude.

All over the world the dimension of banking has been changing rapidly due to Deregulation, Technological innovation and Globalization. Commercial banks in Bangladesh have to keep pace with the change in global business. Now banks have to compete in market place both with the local institutions as well as with the foreign institutions. To survive and thrive in such a competitive banking world, two important requirements are development of appropriate financial infrastructure by the central bank and development of “professionalism” in the sense of developing an appropriate manpower structure and its expertise and experience. To introduce skilled banker, only theoretical knowledge in the field of banking studies is not sufficient. An academic course of the study has a great value when it has practical application in real life situation. So, I need proper application of my knowledge to gate some benefit from my theoretical knowledge make it more tactful. When I engage myself in such fields to make proper use of my theoretical knowledge in my practical life situation. Such theoretical knowledge is obtained from a course of study at only the half way of the subject matter. Internship implies on other the full application of the method and procedures through rich acquire of subject matter can be forcefully applied in my day-to-day life situation. Such a procedure of practical application is known as internship.

BACKGROUND OF THE STUDY

Knowledge and learning becomes perfect when it is associated with theory and practice. Theoretical knowledge gets its perfection with practical application. After the completion of the 10 semester courses I was placed in Uttara Bank Limited, Moghbazer Branch in order to complete a short internship program for getting practical knowledge. This is an orientation to the entire banking department and finally a study on a particular arena of Loan Department on Uttara Bank Limited”. While working with both of my supervisors in which I can make a detail research and present my understanding about that Loan area in this report.

This internship program brings me closer to the practices in banking and helps to develop a little understanding about the detailed mechanism of the Overall Banking System And Loan of Uttara Bank Limited.

This practical orientation is also a positive development in professional arena. Recognizing the importance of practical experience, Department of has introduced a twelve-week practical exposure as a part of the curriculum of Bachelor in Business Administration in Marketing. In this state I have worked to reflect my entire efforts at analyzing the experience of practical orientation related to overall banking activities of the UBL.

RATIONALE OF THE STUDY

Historically Bangladeshi bank has been burdened with huge number of classified loans. As a result the burden of bad dept has a negative impact of their new investment. Many financial institutions are trying to avoid giving long term loans to the industries, especially to new industries. In this situation the concept of syndicate financing is a new concept in Bangladesh. When I am successfully complete this study, it can be used to identify the performance of Uttara Bank Ltd. and also invent new technique, which can be used to prevent a good loan to become a classified loan and these technique can also be used in other banks to get the same benefit.

OBJECTIVE OF THE STUDY

There are several types of objectives involve here for this study. The objectives of studies are

To get a clear picture of Loan procedure of General banking and loans .

To find out the bank’s efficiency in managing loans.

To find out the bank’s efficiency in providing customer services.

To acquire the knowledge of practical operations and the function of the Bank.

To gain an overall idea and know about the financial position of the bank.

To find out the exiting problems of the bank (Branch) and provide some suggestions.

To analyze the bank’s overall performance

To show the trend of the key financial indicates faced by the bank branch.

SCOPE OF THE STUDY

In the period of my involvement at Moghbazer branch of Uttara bank limited where I joined as an internee, I hope to understand the General Banking, Loan Procedure is my selected topics.

It is said that my working area for internship program was just the Moghbazar branch of the bank. I tried with all my best to observe the overall general banking operations and day-to-day transactions & functions of the branch. And also loan & advance section. For the purpose of the relevant information of other branch and also head Office, I am communicate with the branch manager of Moghbazar branch with the help of my branch advisor and also tiring to visit Head Office and other branches for collecting information an overall banking operation.

METHODS OF DATA COLLECTION

In conducting the study the data have been used were collected by using two methods. The methods are as follows:

Observation Method

Observation method may be defined as the systematic watching of facts and events occurring in the field of study. The researcher has observed all the activities of Loan banking services. Through this method, he has collected some data about Loan banking services.

Interview Method

Interview is a face to face situation where one person (the interviewer), asks a person being interviewed (the respondent), questions to obtain answer pertinent to research problems. To get the real information and data about Loan banking services, researcher asked some respondents and clients directly.

SOURCES OF DATA

In preparing this report, both primary and secondary sources of information have been used.

Primary Sources of Data

When data are collected through direct searching in the field then it is called primary source of data. Primary Sources are:

- Personal observation.

- Desk work in different section.

- Discussion with the bank’s officers.

- Discussion with my bank’s advisor/ supervisor.

Secondary Sources of Data

The secondary data are collected from Internet, different article published in the journals and magazines. Secondary sources are:

- Annual report of the bank.

- Publication’s of Bangladesh Bank.

- Different types of book related with banking.

- Newspaper.

- Website information.

LIMITATION OF THE STUDY

To prepare this report, I have faced some limitations, which are mentioned in the follows:

Time Limitation

The main and the first constraints is time that hinder to cover all aspect of the study. In three month it’s not possible to cover learning about any bank properly and also going to write a report on this. So limitation of time is the main problem.

Lack of Data

If anyone can wise than he can gather primary data to the banks employees. But this data is not proper for writing a report. Secondary data is also very rears. It is just only the annual report and the web site. But in the web site the information is updated and is properly given.

Limitation of Scope

While collecting data, the authority did not disclose much information due to the confidentially of the Bank.

CORPORATE VISION

To become a leading banking institution which play a pivotal role in the development of the country. The gist of our vision is “Together Towards Tomorrow”. UTTARA Bank Ltd of Bangladesh believes in togetherness with its customer, in its march on the road to growth and progress with service. To achieve the desire goal, there will pursuit of excellence at all stages with a climate of continuous improvement, because, in UTTARA Bank, we believe, the line of excellence is never ending. Bank’s strategic plans and networking will strengthen its competitive edge over others in rapidly changing competitive environments. Its personalized quality service to the customers with the trend of constant improvement will be cornerstone to achieve our operational success.

CORPORATE MISSION

i) Continuous improvement in our business policies.

ii) Cost reduction integration of the technology at all level.

iii) To be the most caring and customer friendly and service oriented bank.

iv) To ensure ethics and transparency in all levels.

v) Above all, to add effective contribution to the national economy.

BANK OPERATIONAL AREA

Uttara bank limited is one of the front ranking first generation private sector commercial bank in Bangladesh. Uttara bank operation area mainly is Deposited, Loans. Remittance, Capital market.

Deposited

The bank principal source of fund was deposit. The banks deposit stood at Tk.59387.3 million as on 31 December 2011 compared to Tk.50817 million, thus recording 16.87 percent growth in last year. When customer open more deposit in bank that’s why there banking earn very much high.

Loans.

The bank implemented the system of credit risk assessment and lending procedures by strict separation of responsibilities among risk assessment, lending decision and monitoring function to improve the quality and soundness of loan portfolio. In 2011 Uttara bank limited registered a steady growth in the credit portfolio posting a growth of 6.22 percent. Total loans and advances of the bank stood at Tk.39451.4 million during the year 2009 as compared to Tk.37141.3 million of the previous year. Average loan per Branch stood at Tk.187.0 million. Sector wise allocation

of advance revealed a well-diversified portfolio of the bank with balance exposure in different sectors.

Foreign Remittance

Extension use of the technology along with large delivery has significantly fostered the growth of UBL remittance business. Uttara bank limited has seen a successful year 2011 in terms of expansion of its remittance business through its foreign correspondent and exchange houses. The bank has been continuing to extend special importance on foreign remittance from the last couple years. The volume of foreign remittance in the year 2011stood at Tk.44635.3 million in the preceding year registering as increasing of 23.74 percent. In order to keep pace with the time a scheme namely “Express Payment Scheme” has been introduced for inward remittance by using modern technology. Under this scheme a payee having his account with any branch of Uttara bank limited gets the proceeds of remittance sent from any part of the world with in 2 hours.

Share Capital

The authorized capital of the bank increased from Tk.1600.0 million to Tk.3200.0 million during the year 2011. The paid up capital of the bank has been increased to Tk.1597.4 million from Tk.798.7 million due to declaration of 100 percent bonus share in 2009. The total number of share was 15,973,184. The government of the peoples republic of Bangladesh, eighteen banks and fifty two financial institution held total 676397 shares worth Tk.67,639,700.00 and remaining 42,499 private shareholders held total 15,296,787 shares worth Tk.1,529,678,700.00. The total equity of shareholders of the bank at the end of year 2009 stood Tk.6,206.9 million and in 2008 stood Tk.3,688.8 million.

That is most operation area in Uttara Bank Limited in Bangladesh.

ACHIVEMENT

Uttara bank limited has been a nationalized bank in the name of uttara bank under the Bangladesh bank nationlization order 1972 formally known as Eastern banking corporation limited. Uttara bank converted into uttara bank limited as a public limited company in the 1983. Uttara bank achievement in 27 years many things. In last year Uttara bank position is number nine. There banking profit was Tk.302 crores. Uttara bank total asst is Tk.10,000 milion. And total cash was Tk.1585 milion. Day by day Uttara bank rise very first.

Year | Total Asset | Total Cash | Total Profit2009 |

2009 | Tk.10,000 million | Tk.1585 million. | Tk.302 crore. |

NUMBER OF BRANCH

CAPITAL AND RESERVE OF UTTARA BANK LIMITED

The Authorized capital of the Bank increased from Tk. 1,000.00 million to Tk. 1,600.00 million during the year 2011. But the bank has already got approval from Bangladesh Bank to raise its Authorized Capital from Tk. 1,600.00 million to Tk 3,200.00 million. The paid up capital of the Bank has been increased to Tk.1597.4 million from Tk. 798.7 million due to declaration of 100% bonus share in 2009. The total number of share was 15,973.184. The Government of the People’s Republic of Bangladesh, five Banks and fifty two financial institutions held total 676,397 shares worth Tk. 67,639,700.00 and remaining 42,499 private Shareholders held total 15,296,787 shares worth Tk 1,529,678,700.00. The total equity of shareholders of the Bank at the end of the year 2009 stood Tk 6,206.9 million and in 2008 stood Tk 3,688.8 million .

The Reserve Fund increased to Tk. 4,609.6 million during the years by increasing 59.49 percent increase over last years Tk. 2,890.2

INTRODUCTION OF GENERAL BANKING AND LOANS

There are several types of departments perform in a bank. General banking is one of the most important departments for banking sector. General banking department is that department which is mostly exposed to the minimum number of bank customers. It is the introductory department of the bank to its customers. There are no businesses in the world who doses not think about profit. All business concern about profit through selling product or provide services. A bank provides various type of financial service to its customers for profit. Dilkusha branch of Uttara bank ltd. has all required of general banking and all these section are run by manpower with their high quality banking knowledge.

Under General Banking department the following sector are included:

Account opening department

Cash department

Clearing department

Collection department

Local remittance department

Loans.

In the following they are shortly describe

ACCOUNT OPENING DEPARTMENT

The relationship started with the customer and the bank by opening the account. Initially all the accounts are opened with a deposit of money by the customer. But in this day there are several types of rules and regulation provided by the government for opening the account. This is only for the terrorist (JMB) arise of our country that damages the total nation. Now if any one wanted to open his/ her account then they must sign in the money laundering, they have to tell about there money sources and face various types of question.

Function of the Department

The function of the department is to perform the following main function:

Accepting Deposit

Opening of account

Cheque book issue

Transfer of account

Closing of account

Accepting Deposit

Deposits are life blood of a commercial bank. Without deposit there are no accounts can be opened? In Shantinagar branch there are various types of account are offered for the various customer. They are different group. They are like

Demand deposit account

Time deposit account

Fixed deposit account

Demand Deposit Account

The amount in account are payable in demand so it is called demand deposit account. The following accounts are under Demand deposit accounts:-

Current account

Saving account

STD (Short notice term deposit)

CC (Cash Collection)

Current Account

These types of account can be opened by both individual and business concern. A current account holder can draw Cheque on his account for any amount for any number of times in a day as the balance in his account permits. When the amount is large than the account holder may be

remind it a few days ago. This account provides no interest. The minimum balance to be maintained is Tk. 2000/-. No new account can be opened with a Cheque.

Savings Account

Individuals for savings purposes open this type of Account. Current interest rate of these accounts is 5.50% per annum. A minimum balance of Tk.1000 is required to be maintained in a SB account interest on CB account is calculated and accrued monthly and credited to the account half yearly. Interest calculation is made for each month on the basis of the lowest balance at credit of an account in that month. A depositor can withdraw form his SB account not more than twice a week up to an amount not exceeding 25% of the balance in the account.

Any Bangladeshi National residing home or abroad may open savings account with UBL

This account may be opened in single/joint name.

The account holder may nominate his nominee in this account.

The nominee can get the balance amount without submitting succession certificate after the death of account holder.

Requirement for Opening of the A/C

Account opening form as per format below. The account opening form and signature card to be filled in and duly signed.

Two copies passport size photographs of the account holder.

Photograph of nominee (if any) duly attested by the account holder.

Photocopy of the 1st 7 pages of the passport for non-resident Bangladeshi national.

Signature in the account opening form/card must be same with the signature of the passport.

Special Notice Term Deposit (STD)

The deposit in this account is withdrawal on prior notice varying from 7 to 29 days and 30 days or more. The interest is paid on the balance of the account. Current interest rate is 6.50% per annum.

Govt., Semi-Govt., Autonomous organization and an individual may open STD Account with UBL.

UBL offers attractive/competitive rate of interest in STD Account. 7 days notice required to withdraw big amount.

Opening Procedure

For opening such A/C, application in the prescribed from along with a set of specimen signature duly verified by Bangladesh mission abroad or by a reputable bank of any other person known to the bank, should be obtained by the brandies. In case of persons, already maintain any F.C A/C or N.F.C.D. A/C with them, reference to that F.C A/C will serve, the purpose of introduction, the branch may verify the signature from the specimen signature and already available with them. Only one such F.C A/C can be maintained and the balance in the A/C should not exceed $ 30.000/- or equivalent pound sterling at any one time. The A/C holder is also required to submit photocopies of passport, visa, and work permit/contract. As this is a current account no Interest is paid to the A/C holder.

Time Deposit Account:

The amount in this A/C is payable only after stipulated time. The following a/cs are under time deposit a/c: Fixed Deposits which are repayable after the expiry of fixed period and negotiable.

Bearer certificate of deposits (BCD), which are repayable after the expiry of fixed period but are negotiable. These are not renewable. Non –resident foreign currency deposits are them deposits

maturing after 1 month, 3 months, 6 months and 1 year. This a/c’s can be opened either in U.S dollar or pound sterling. No interest is paid in case of premature encashment.

Fixed Deposit Account

These are deposit, which are made with the bank for a fixed period specified in advance. The band need not maintain each reserve against these deposits and therefore, bank gives high rate of interest on such deposits. A FDR is issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest and the date on which the deposit will fall due for payment.

INTEREST ON DEPOSITS

Particulars | Rate Of Interest |

| Interest Rate on Deposits: Savings Deposits Special Notice Deposits (STD) | 5.50% 6.50% |

| Fixed Deposits (Time Deposits) 3 months 6 months 1 year 2 years and above 3 years and above

| 8.25% 8.50% 9.00% 9.25% 9.50% |

OPENING OF ACCOUNT

It includes two steps. They are

- Account opening procedure.

- Classification of customer.

Account Opening Procedure

Documents needed for each accounts separately:

(Current/ Saving accounts)

Current Account

1. Limited Company

Certificate of Incorporation.

Certificate of Commencement of business.

Memorandum of association.

Article of association.

Power of attorney.

Resolution of the Board of Directors authorizing opening of an account.

Societies/ Club/ Association.

Other than above mentioned common documents resolution of who will operates the account

Must be noted.

Proprietorship Firm

Name of the authorized persons, designation, specimen, signature card, trade license, and passport / chairman certificate.

Partnership Firm

The form should describe the names and address of the entire partner.

Trade license from City Corporation is needed.

Partnership deed.

Letter of authority is achieving.ISSUE OF CHEQUE BOOK

According to Section 60f Negotiable Instruments Act, 1881, a Cheque is “A Bill of Exchange drawn on a specified banker and not expressed to be payable otherwise than on demand.” To facilitate withdrawals and payments to third parties by the customer, UBL provides a Cheque book to the customer Cheque book contains 10 leaves for savings account while for current account is 25 or 50 or even100 leaves. A Cheque book issuing register is maintained in this regard. This register contains the Cheque book number, leaf number, issuing date. After giving this entries to this register, information are send to the Computer Department for taking necessary steps to pass the cheques during withdrawal. The Cheque book also contains requisition slip-which is used by the customer to obtain new Cheque book. When all the leaves are used, the customer submits this slip to the bank. A senior official then issues a new Cheque book and subsequent entries are given in the register and in computer.

If the Cheque book is lost, the customer has to furnish a guarantee indemnifying by an application to the bank. After fulfilling this, a new cheque book is issued. Seldom customers are allowed to use loose cheques if the customer wants to draw money without presenting previously issued cheque. A separate register is maintained in this regard. But this is highly discouraged in UBL. In a few days ago when the account holder will busy than he send a representative, the banker issued cheque and provide a acknowledgement with the cheque book. When the acknowledgement are return by the account holder by the signature than he can draw the cheque. But now the rules and regulation by the government is so heard, so the account holders have to come for issuing a new cheque book. A fresh cheque can be issue by following ways.

Issuance of fresh cheque book

LOCAL REMITTANCE DEPARTMENT

UBL has its branches spread throughout the country and therefore, it serves as best mediums for remittance of funds from one place to another. This serves is available to both customers of the bank. The department, which provides the facility, is known as local remittance department.

Function of the Local Remittance Department

The following are the main function performed by the credit department:

Issuing & payment of demand draft.

All related correspondence with other branch & Banks

Compliance of Audit & Inspection

Balance of D.D. payable & D.D. paid with advice

Attached to sanchaya patra and wage Earners development Bonds.

Payment of Incoming TT.

Issuing, encashment of pay order and maintenance of record and proof sheet.

Issuing and encashment of all kind of sanchaya patras and wage earners development bond.

All related statement & correspondences with Bangladesh Bank & other Bank.

Issuance of Local Drafts

Issuing and encashment of BCD

All related correspondences

Issuing of outgoing TT

Issuance of Local Drafts

Issuance of T.T. ICA. IBCA & IBDA

Transaction Types

Collection of Cheque

Up to Tk. 25,000 @ .15%, Minimum Tk. 10.

Above Tk. 25,000- 1, 00, 000, @ .15%, Minimum Tk. 50.

Above 1, 00,000-5, 00,000 @ .10%, Minimum Tk. 150.

Above 5, 00,000 @ .50% Minimum Tk. 600- Maximum 1,200.

Demand Draft ( D.D )

Local Draft is an instrument containing an order of the Issuing branch upon another branch known as drawee branch, for payment of a certain sum of money to the payee or to his order on demand by the beneficiary presenting the draft itself.

CASH DEPARTMENT

Case department of different instruments is made in the cash section. Procedure of cash payment against Cheque is discussed under elaborately. Cash payment of Cheque includes few steps:

First of all the clients comes to the counter with the check and give it to the officer in charge there. The officer checks whether there are two signatures on the back of the Cheque and checks

his balance in the computer. After that the officer will give it to the cash in charge. Than the cash in charge verifies the signature from the signature card and permits the officer in computer to debit the client’s account by giving posting. A posted seal with teller number is giving. Then the Cheque is giving to the teller person and he after checking everything asks the drawer to give another signature on the back of the cheque. If the signature matches with the one giving previously then the teller will make payment keeping the paying Cheque with him while writing the denomination on the back of the Cheque. Cash paid seal is given on the claque and make entry in the payment register. Cash department maintain 2 types of entry book. One is A book and another one is M book. A Book’s limit is 1-2500000 taka. And M Book’s limit is 2500000-5000000 taka. This system is followed both cheque receipt and payment.

There are few things that shell be scrutinized and checked before making payments.

Name or the drawer

Account number

Specimen signature

The validity of the Cheque and make it sure that is it not post dated or undated.

The amount in words and figures are same.

Cash balance calculation.

The calculation is done by the officer in charge of cash section and then manager or authorized officer will check the balance and sign in the cash balance book. The balance is maintained in the balance book. Opening balance of current day in the closing balance of the previous day. Total receiving of the current day is added with the opening balance and total payment is deducted for calculating the closing balance or each balance

CLEARING DEPARTMENT

According to the article 37(2) of Bangladesh Bank Order, 1972, the banks, which are the number of the clearinghouse, are called as scheduled Bank. The scheduled banks clear the chouse draw upon one another through the clearing house. This is an arrangement by the central bank where every day representative of the member banks gather in the clear the chouse. Banks for credit of the procedure to the customer’s account accept Cheque and other similar instruments. The bank receives such instrument during the day from account holder. Many of these instruments are draw payable at other bank. If these were to be present at the drawee banks to collect the procedure, it would be necessary to employee many massagers for the purpose. Similarly, there would be many chouse draw on this the messengers of other bank would present bank and them at the counter. The whole process of collection and payment would involve considerable labor, delay, risk and expenditure. All the labor, delay, risk and expenditure are substantially reduce, by representative of all the banks meeting at a specific time, for exchanging the instruments and arriving at the net position regarding receipt or payment. The place where the banks meet and settle their dues is called the clearing house.

Function of the Department

The following are the main functions performed by the department:

- Pass outward instruments to the clearing house.

- Pass inward instruments to representative department.

- Return instruments in case of dishonor.

- Prepare IBCA or IBDA for the representative branch and HO.

- Accounting entries of clearing department.

COLLECTION DEPARTMENT

Cheque, drafts etc. are drawn on bank located outside clearing house are sent for collection. Principal branch collects its clients above mentioned instruments from other branch of UBL and branches of other than UBL. In case of out ward bills of collection customers account is credited after finishing the collection processor and in case of inward bills customers account is debited for this purpose.

CUSTOMER SATISFACTION OF LOAN .

We know, Customer is the main Source of the Bank and Others Commercial Department. Banking business consists of borrowing and lending. Banks act as intermediaries between surplus and deficit economic units. Thus a banker is a dealer in money and credit. Banks accept deposit from large number of customers and then lend a major portion of the accumulated money to those who wish to borrow. In this process banks secure reasonable return to the savers, make funds available to the borrowers at a cost and earn a profit after covering the cost of funds. Banks, besides their role of intermediation between savers and borrowers and providing an effective payment mechanism, has been allowed to diversify into many new areas of better paying business activities.

Loans and advances comprise the most important asset as well as the primary source of earning for the bank. On the other hand, loan is also the major source of risk for the bank management. A prudent bank management should always try to make an appropriate balance between its return and risk involved with the loan portfolio and unregulated bank might be fraught with unregulated risk for maximizing its potential return. In such a situation a bank might find itself in serious financial distress instead of improving its financial health. Consequently not only the depositors but also the general shareholders will be deprived of getting back their money from the bank

Commercial banks collects money from one group of people as deposits and distribute them within the other group of customers as loans and advances and it is the most important function of commercial bank. By this way the bank earns profit.

As a private commercial Bank UBL has some inherent commitment to the society. It provides loans and advances to the customer, which can gear up the economy actively. Commercial and Industrial loans to business concerns to finance their day-to-day activities, to finance their longer term needs and for other business purposes. The maturity of these range from 1 (One) year to 10 (Ten) years or longer. UBL has been extending credit facilities to the potential, productive and sector as per Bangladesh Bank instructions. Good loans are profit-earning asset to the Bank. A big portion of opening income is generated from sound lending.

The Bank implemented the system of credit risk assessment and lending procedures by strict separation of responsibilities among risk assessments, lending decisions and monitoring function to improve the quality and soundness of loan portfolio. In 2009 Uttara Bank Limited registered a steady growth in the credit portfolio posting a growth of 6.22 percent. Total loans and advances of the Bank stood at TK 39,451.4 million during the year 2009 as compared to TK 37,141.3 million of the previous year. Average loan per Branch stood at TK 187.0 million. Sector wise allocation of advances revealed a well-diversified portfolio of the Bank with Balanced exposure in different sector.

So in this point of view , Customer is the method used for making reference to the metter Field.

CATEGORIES OF LOANS

Categories of loans offered by the bank UBL:

Agriculture

Large and medium scale industries

Export

Other commercial lending (Jute and fertilizer)

Small and cottage industries

Personal loan

Consumer loan

Others

Some other loans are:

Housing loans

Residential

Commercials

Transport

Cold storage

Brick field

Gold loans

Against work order

Against work (FDR) loan against sanchaypatar

Loan against WEBD, ICB, unit certificate

Loans against life insurance policy

Other special program.

Sector wise position of loans and Advance as on 31.12.2009 (Taka in millions)

Sectors of Loans & Advances | Public/ Nationalized | Private | Total |

| Agriculture : a)Crops b)Fisheries c)others | – – – | 92.4 30.2 191.7 | 92.4 30.2 191.7 |

| 2. Industrial leading(Term): a) Large & Medium b) Small & Cottage | – – | 5167.3 11.3 | 5167.3 11.3 |

| Industrial leading (Working Capital): a) Large & Medium b) Small & Cottage | – – | 545.6 25.7 | 545.6 25.7 |

| Commercial Lending: a)Export b)Import c)Internal Trade | – – 10.5 | 858.4 3628.8 14439.3 | 858.4 3628.8 14449.8 |

| Special Programmed: a)Consumer Credit Scheme (Uttaran) b) Personal loan Scheme c) Small Business loan Scheme d) Uttaran House Repairing and Renovation Scheme | – – – – | 87.4 02.6 246.3 4263.6 | 87.4 02.6 246.3 4263.6 |

| Housing: a)GeneralHousingBuilding loan b)Staff HousingBuilding loan | – – |

32.7 402.6 |

32.7 402.6 |

| 7. Leasing Financing | – | 391.6 | 391.6 |

| 8. Others | – | 5861.3 | 5861.3 |

| 9. Bills disconnected and purchased a) In Bangladesh b) Outside of Bangladesh | – – | 3027.0 135.1 | 3027.0 135.1 |

| Total: Loan & Advance | 10.5 | 39440.9 | 39451.4 |

Agriculture | Industrial Lending | special Program | Housing | Lease Financing | Others | Commercial Lending | Bills Purchased & Discounted |

1% | 15% | 11% | 1% | 1% | 15% | 48% | 8% |

Personal Loan Scheme for Salaried Officers

UBL started personal loan scheme for salaried officials of reputed organizations from 1999 to meet:-

Emergency expenses for own marriage of a service- holder or his dependents.

Emergency expenses of urgent surgical operation/ medical treatment.

Emergency educational expenses of the children for admission/purchase of books, examination fees etc.

Special Features

Any permanent salaried employee aged between 20 to 55 years is eligible to get loan.

No collateral security is required.

Maximum Amount of loan Tk. 1, 00,000.

Maximum period of loan up to 3 years.

Required Document

Document related to applicants job to prove himself

Two copies passport size photographs.

Photograph of nominee (if any) dully attested by the account holder.

CONSUMER-CREDIT SCHEME:

UBL started uttaran consumer’s credit scheme from 1996. UBL offers opportunity of financial assistance for-

Motor cycle/car-New or re-conditioned.

Refrigerator/deep freeze.

Television /VCR/VCP/VCD.

Radio/Two in one.

Air condition/Waters cooler/Water pump.

Washing Machine.

House hold furniture.

Cellular Telephone.

Electric Fan.

Bi-cycle.

Dish antenna.

Baby Taxi, Tempo/Microbus(For self employed person)

Kitchen articles such as Oven, Micro oven, Toaster etc.

Special Feature

No collateral security is required.

Simple rate of interest.

Quick sanction.

Maximum loan amount Tk. 300000.

% incentive on total interest charge.

Required Document

Documents related to applicants jobs to prove him.

Two copies passport size photocopies.

Photograph of nominee (if any) duly attested by the account holder.

Figure in Million

Particulars | 2005 | 2006 | 2007 | 2008 | 2009 |

Deposit | 36891.9 | 39360.2 | 43586.4 | 50,817.0 | 59,387.3 |

Advance | 21851.5 | 25163.9 | 28477.4 | 37,141.3 | 39,451.4 |

CREDIT RATING OF THE BANK

The Credit Rating (Surveillance Rating) of uttara Bank Limited was rated by the Credit Rating Agency of Bangladesh Limited (CRAB) on the basis of audited Financial Statement as on 31.12.2008. The Summary of the rating is presented below:

Credit Rating Report (Surveillance Rating) on Uttara Bank

Particular | Long Term | Short Term |

| Current Rating (Based on 31.12.2008) | A2 (Strong capacity & High Quality) | ST-2 (Good grade) |

| Date of Rating | 25.06.2009 | 25.06.2009 |

| Validity of Rating | 01(one) year | 01(one) year |

CRAB has awarded “A2” (Pronounced as single A Two) to Uttara Bank Limited in the Long Term and ST-2 in the Short Term.

DOUBLE BENEFIT DEPOSIT SCHEME

Any adult Bangladeshi National will be eligible to open this account.

Minimum Tk. 100000 (Taka one lac only) and multiples thereof will be accepted as deposit under this scheme.

The period shall be of 6 (six) years term.

Deposit may be encased before its maturity and no interest will paid if encased before 1 (one) year of deposit.

Interest will be paid at savings rate if encased after 1 (one) year.

Advance will be allowed up to 80% of the deposit after completion of one year.

Full amount including interest will pay on maturity.

Govt. Tax, surcharge, source-Tax, Levy, Govt. excise duty will be recovered from the depositors account.

Account holder can appoint a nominee against the account.

Bank reserves the right to close the account at any time and make amendment/ alteration of the terms & conditions of the scheme without assigning any reason.

Bank efficiency ratios

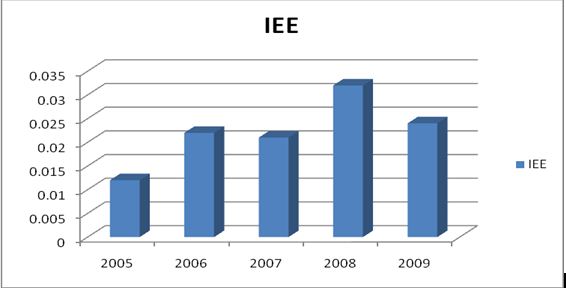

7. IEE = interest income to expenses = (IN−IE) / ATLA = (interest income − interest expenses) / average total Loans and advances

Calculation:

Year | Interest income – interest expense | Average total loan & advance | Ratios % |

2005 | 254.2 | 209.1 | 0.012 |

2006 | 274.2 | 251.6 | 0.022 |

2007 | 299.7 | 284.7 | 0.021 |

2008 | 408.4 | 371.4 | 0.032 |

2009 | 449.2 | 394.5 | 0.024 |

Figure-: IEE from 2005 to 2009

Interpretation:

The value of Interest income to expenses of Uttara Bank Limited was increased from 2005 to 2006 and in 2007 the value was decreased slidely and the value was increased dramatically in 2008 but it was fall in 2009. So we can see that the value is going up and down.

8. OEA = operating expense to assets = OE / ATA = operating expenses / average total assets

Calculation:

Table

Year | Operating expense | Average total assets | Ratios % |

2005 | 122.4 | 420.6 | 0.028 |

2006 | 139.6 | 452.1 | 0.031 |

2007 | 167.7 | 528.6 | 0.032 |

2008 | 180.7 | 584.4 | 0.031 |

2009 | 209.2 | 719.4 | 0.029 |

Interpretation:

From the graph we can see that the operating expense to assets of Uttara Bank Limited was continuously increased from 2005 to 2006 to 2007. But it was decreased in 2008 to 2009 from 2007.

OIA = operating income to assets = OI / ATA = operating income / average total assets

Calculation:

Table

Year | Operating income | Average total assets | Ratios % |

2005 | 237.8 | 420.6 | 0.066 |

2006 | 267.8 | 452.1 | 0.059 |

2007 | 314.3 | 528.6 | 0.059 |

2008 | 411.2 | 584.4 | 0.07 |

2009 | 460.6 | 719.4 | 0.064 |

Figure-: OIA from 2005 to 2009

Interpretation:

The value operating income to assets of Uttara Bank Limited was 0.066 in 2005. It was decreased in 2006 and remains constant in 2007. OIA was increased in 2008 and in 2009 it was decreased.

OER = operating expenses to revenue = OE / OI = operating expenses / operating income (revenue)

Calculation:

Table

Year | Operating expense | Operating income | Ratios % |

2005 | 122.4 | 237.8 | 0.421 |

2006 | 139.6 | 267.8 | 0.521 |

2007 | 167.7 | 314.3 | 0.534 |

2008 | 180.7 | 411.2 | 0.439 |

2009 | 209.2 | 460.6 | 0.454 |

Interpretation:

From the graph we can see that the value of operating expense to revenue of Uttara Bank Limited was increased in 2005 to 2006 to 2007 and the value of operating expense to revenue was decreased in 2008 and the value of operating expense to revenue was increased in 2009.

The value of asset turnover of Uttara Bank Limited was increased in 2005 to in 2006. But in 2007 it was decreased and in 2008 ATO again increased and it was decreased in 2009 from previous one year. So we can see that the value of asset turnover is going up and down.

Interpretation:

From the graph we can see that the value of net non-interest margin of Uttara Bank Limited was highly increased in 2005. After that the value was dramatically decreased in 2006 to 2007 and the value was slowly increased from 2007 to 2008 to 2009.

Asset-quality indicators

PEA = provision to earning assets = PLL / ATLA = provision for loan losses / average total loans and advances

Calculation:

Table

Year | Provision for loan losses | Average total loans & advance | Ratios % |

2005 | 300.0 | 234.6 | 0.01 |

2006 | 400.0 | 251.6 | 0.016 |

2007 | 255.8 | 284.7 | 0.009 |

2008 | 925.5 | 371.4 | 0.002 |

2009 | 320.0 | 394.5 | 0.008 |

Figure: PEA from 2005 to 2009

Interpretation:

The value of provision to earning assets of Uttara Bank Limited was increased from 2005 to 2006. But the value was dramatically decreased in 2007 from previous two years. After that the value was increased in 2009 from previous year.

LR = loan ratio = ATLA / ATA = average total loans and advances / average total assets

Calculation:

Table

Year | Average total loans & advance | Average total assets | Ratios % |

2005 | 234.6 | 420.6 | 0.5195 |

2006 | 251.6 | 452.1 | 0.557 |

2007 | 284.7 | 528.6 | 0.539 |

2008 | 371.4 | 584.4 | 0.635 |

2009 | 394.5 | 719.4 | 0.548 |

Interpretation:

From the graph we can see that the value of loan ratio of Uttara Bank Limited was increased in 2005 to 2006 and the value was decreased in 2007 from previous year. The value of Loan Ratio was increase in 2008 and in 2009 it was decrease from previous year.

LTD = loans to deposits = ATLA / ATD = average total loans and advances / average total customer deposits

Calculation:

Table

Year | Average total loans & advance | Average total customer deposits | Ratios % |

2005 | 234.6 | 368.9 | 0.614 |

2006 | 251.6 | 393.6 | 0.657 |

2007 | 284.7 | 435.8 | 0.679 |

2008 | 371.4 | 508.1 | 0.755 |

2009 | 394.5 | 593.8 | 0.685 |

Interpretation:

From the graph we can see that the value of loans to deposits of Uttara Bank Limited was continuously increased from 2005 to 2006 to 2007 to 2008. After that in 2009 the value was decrease from 2008.

Liquidity ratios

17. CTA = cash to assets = C / ATA = cash / average total assets

Calculation:

Table

Year | Cash | Average total assets | Ratios % |

2005 | 4016.8 | 420.6 | 0.093 |

2006 | 4198.2 | 452.1 | 0.093 |

2007 | 5002.5 | 528.6 | 0.095 |

2008 | 5860.1 | 584.4 | 0.1 |

2009 | 5348.1 | 719.4 | 0.074 |

FINDINGS IMPROVEMENT OF SECURITY

Now a day’s Uttara bank ltd. is one of the top performer bank in our country. But the security system is very weak. Because they have no security camera in the bank and of course the branch also which is very weak sector of Uttara bank limited.

Improvement of their services

They have to improve their services. Now the entire bank of our country provides such outstanding services like ATM/ On-line banking/ Credit Card/ Debit Card and many others types of services. BRAC bank provides some extra services like ‘Campus account’ Uttara bank have to provide these types of services to the customers.

Disguised Employment

In course of my brief Bank’s career in UBL I found that a good number of employees are not working hour. This work force should be brought under utilization. The skill and experience of this section of employers should be utilized properly in the development of the Bank.

BETTER RECRUITMENT

Uttara Bank Ltd. must pursue a strong and an effective recruitment system so that the right persons are recruited in the right position (job). Though the bank is expanding, it must focus on attracting, getting and retaining qualified personnel’s for filling the vacant positions.

Disguised Employment

In current situation it would be the major problem of Uttara bank limited. The situation of too many heads but few heads must be eliminated for the future of the bank. In order to enhance the productivity of the work force at Uttara bank limited, the management must have to consider the appropriate amount of work force required and must assess the productivity of each employee. The employees who do not have many things to be done should be relocated or provision should be given to them for voluntarily retirement.

ENHANCEMENT OF REMUNERATION

The most important lacking of UBL that have to be improving immediately is Enhancement of remuneration. The current remuneration of Uttara bank limited in very poor, unimpressive and not capable to attract quality personnel to fill up its position. It have to be said that the foreign banks pay double that of Uttara bank limited and other private banks also pay a higher scale of remuneration than Uttara bank limited. It is the time the management should consider revising the remuneration package in order to attract the high quality human resource and of course to retain them in Uttara bank limited.

In course of my brief Bank’s career in UBL I found that a good number of employees are not working hour. This work force should be brought under utilization. The skill and experience of this section of employers should be utilized properly in the development of the Bank.

RECOMMENDATION

Before drawing the end I would like to offer the following suggestions for bringing improvements of UBL.

In general banking department they follow traditional system. The entire general banking system is not fully computerized so an implementation of fully automated system is required.

They are not using data base networking in information technology (IT) department. So they have to transfer data from branch to branch and branch to head office by using transferable disk. Such as –floppy which are risky?

The Accounts opening procedure is not easier to the customers, so every branch have to need a separate desk for account opening.

CONCLUSION

Banking sector is the chief financial intermediaries in a country. It’s also true for Bangladesh. Uttara bank limited is a very challenging institution. In the age of globalization and free trade, the process and the system of running a bank is changing. UBL (Uttara Bank Ltd.) is continuously managing itself with this changing environment. The company strategies are clean and concise. The return is pretty good. If the company performs this way, we can expect that in near future Uttara bank limited may become one of the top performer in banking sector of our country. They are also able to contribute to our economy in better way. The working environment of the bank is impressive. It was also found that the bank (Branch) is doing better in most of the sectors and their performance is better than average. However during the year 20012 their investment is not sufficient. The investment during 2012 went down in comparison to that of the previous years. Finally it can be said that the bank is doing very good in the competitive market and if it can continue to perform this way it can become a leading banking institution which can play a pivotal role in the development of the country.