Shahjalal Islamic banks to reveal their customers’ list along with the customers contact details. However, such a list could not be availed from the banks due to reasonable competitive reasons of the banks. Hence, the study adopted a non-probability sampling method, instead of a probability sampling.

Executive Summary

Islamic banking, the more general term is expected not only to avoid interest-based transactions, prohibited in the Islamic Shariah, but also to avoid unethical practices and participate actively in achieving the goals and objectives of an Islamic economy.

Shahjalal Islami bank limited is a commercial bank and its play a very important role in our economy. Shahjalal Islami Bank Limited (SJIBL), a Shariah based commercial bank in Bangladesh, was incorporated as a public limited company on 1st April, 2001 under Companies Act 1994.The bank commenced commercial operation on 10th May, 2001 by opening it’s first branch.

The primary objective of this report is to analyze the “Islamic Marketing Process35. To know about the General Banking activities of the banks. To know about the Foreign Exchange system. To know the Investment policy of the Banks. To know about the remittance of funds. To acquire an in depth understanding of the functions of each department. Coordinating the functions of various departments. To know the marketing strategy of Shahjalal Islami Bank Limited.

Data was collected from students, housewife, job women and garments worker primarily by survey method. It is also used observation method for primary data collection.

The vision is to be the unique modern Islamic Bank in Bangladesh.

This type of deposit schemes of SJIBL are, Mudaraba Monthly Income Scheme, Mudaraba Double/Triple Benefit Scheme, Mudaraba Monthly Deposit Scheme, Mudaraba Millionaire Scheme, Mudaraba Hajj Scheme, Mudaraba Housing Deposit Scheme , Mudaraba Cash Waqf Scheme. The special feature of the Investment policy of Shahjalal Islami Bank Limited is to invest on the basis of profit loss sharing system in accordance with the tenets and principles of Islamic Shariah.

Generally investment clients do not come to the Islamic Banks only for Shariah purpose rather for low transaction cost. Shahjalal Islami Bank Limited will be turned into a dynamic Islamic Bank in the country and will expand its Banking Business all over the Country to provide the Banking services to the groups including the deserving economic groups of the society who have no easy access to the banking channel

This Bank also provides online banking, SWIFT services, SMS Services, SJIBL VISA Card, etc to the customers. Shahjalal Islami Bank is computerized and provides different computer based services such as- Online services Automated Accounting, Integrated System, Signature Verification, Any Branch Banking, ATM Services.

So, overall performance of IBBL is increasing day by day. Because most of the people in our country are religious minded and they want to invest their money according to Islamic Shariah. Moreover people of all walks of life can easily transact with SJIBL comparing to other commercial private banks in the country.

The target market of this bank is Muslim people. Most of the respondents do not satisfied for the interest rate on deposit. The majority respondents think SJIBL should advertise more on its product. Because most of the respondents do not know the product feature of the bank, they mainly open account in this bank for personal relationship and Islamic Bank. The majority respondents prefer TV for advertising. Because most of the respondents think people watch TV in the leisure time, so if the SJIBL give advertise on TV, then the people can easily watch advertisement. And also should give advertise on Newspaper, Billboard, and Radio.

SJIBL should give more importance on branch location. And also should establish more branches. SJIBL should make good strategy for online banking efficiency. SJIBL should give lowest interest rate on loan. This bank needs more ATM Booth for customer satisfaction.

Introduction

Origin of the report

Bachelor of Business Administration (BBA) program consists of integrated theoretical and practical method of teaching. In fact practical orientation with day-to-day activities of an organization is one of the most important requirements of BBA program. To fulfill this purpose I was sent to Shahjalal Islami Bank limited (SJIBL), Foreign Exchange Branch as an intern in this regard under the supervision of two supervisors one is internal form the institute and another is from the organization for three months. The paper will deal with the “Customer Satisfaction on Investment of Shahjalal Islami Bank limited (SJIBL)”. On the basis of working experience for this period I have prepared this report and I have tried my best to relate the theoretical knowledge with the practical work situation.

Background

In the late seventies and early eighties, Muslim countries were awoken by the emergence of Islami Bank which provided interest free banking facilities. There are currently more than 300 interest free institutions all over the world. Islami Bank now a days not only operate in almost all Muslim countries but have extended their wings to the western world to serve both Muslim and non Muslim customers. In case of Islami Banking, the establishment of Mitghamar Local Savings Bank in 1963 is said to be a milestone for modern Islami Banking. The history of Islami Banking can nevertheless be traced back to the birth of Islam.

Objective of the report:

The primary objective of this report is to observe the investment related activities for the Investment Department of Shahjalal Islami Bank Ltd.

The other objectives include:

To measure the level of customer satisfaction with different products/services

Offered by the Shahjalal Islamic bank Limited.

- To study the awareness and usage of SJBL products/services to the customers.

Scope of the research:

The focus of the report will be on various functional areas of Shahjalal Islami Bank Limited.

I was assigned to Shahjalal Islami Bank Limited by the authority and found the following boundary of my study there:

- Account opening department

- Clearing department

- Cash department

- Export and import department

- Investment department

Data collection procedure:

I have collected data for this report in two ways. First I collected primary data through survey and for doing the survey I have prepared a questionnaire on Visa Debit Card of Mercantile Bank Limited. I observed the behavior of both customers and employees. In order to collect secondary data I used official website, Mercantile Bank’s annual report and different document of the bank

Questionnaire:

I collected 20 customers’ opinion of SJIBL through questionnaire to gather information about customer satisfaction related to marketing process of SJIBL.The survey instrument for collecting the data were a questionnaire including open and closed-end questions.

Organization Part

Vision of SJIBL

To be the unique modern Islami Bank in Bangladesh and to make significant contribution to the national economy and enhance customer’s trust & wealth, quality investment, employees’ value and rapid growth in shareholders’ equity.

Mission of SJIBL

- To provide quality services to customers.

- To set high standard of integrity.

- To make quality investment.

- To ensure sustainable growth in business.

- To ensure maximization of shareholders’ equity.

- To extend our customers innovative services acquiring state-of-the-art technology blended Islamic principles.

- To ensure human resource development to meet the challenges of time.

Goal:

- To strive for customers best satisfaction & earn their confidence.

- To manage and operate the bank in the most effective manner.

- To identify customers’ needs and monitor their perception towards meeting those needs.

- To review and update policies, procedures and practices to enhance the ability to extend better services to the customer.

- To train and develop all employees and provide them adequate resource so that the customer needs are reasonably addressed.

- To promote organizational efficiency by communicating company plan, policies and procedures openly to the employees in a time fashion

- To cultivate a congenial working environment.

- To diversify portfolio both the retail and wholesale market.

Strategies of SJIBL

- To strive for customers best satisfaction & earn their confidence.

- To manage and operate the bank in the most effective manner.

- To identify customers’ needs and monitor their perception towards meeting those needs.

- To review and update policies, procedures and practices to enhance the ability to extend better services to the customer.

- To train and develop all employees and provide them adequate resource so that the customer needs are reasonably addressed.

- To promote organizational efficiency by communicating company plan, policies and procedures openly to the employees in a time fashion

- To cultivate a congenial working environment.

Products & Services:

Products:

Bank means mobilizing fund from surplus unit and deployment of fund for deficit unit. SJIBL mobilize its fund from surplus unit through different types of deposit schemes and deployment this fund for deficit unit through various investment schemes. So the main products of SJIBL are different kinds of deposits and investment schemes.

Deposit scheme

Deposit is the “life-blood” of a bank. Bank has given utmost importance in mobilization of deposits introducing a few popular and innovative schemes. The mobilized deposits were ploughed back in economic activities through profitable and safe investment.

This type of deposit schemes of SJIBL are:

- Mudaraba Monthly Income Scheme

- Mudaraba Double/Triple Benefit Scheme

- Mudaraba Monthly Deposit Scheme

- Mudaraba Millionaire Scheme

- Mudaraba Hajj Scheme

- Mudaraba Housing Deposit Scheme

- Mudaraba Cash Waqf Scheme

- Al-Wadia Current Deposit

- Mudaraba Saving Deposit

- Mudaraba Short Notice Deposit

- Mudaraba Term Deposit

- Mudaraba Scheme Deposit

- Mudaraba Special Deposit

- Mudaraba Foreign Currency Deposit

- Mudaraba Lakhpoti Deposit Scheme

- Mudaraba Mohor Deposit Scheme

- Mudaraba Education Deposit Scheme

- Mudaraba Marriage Deposit Scheme

Investment

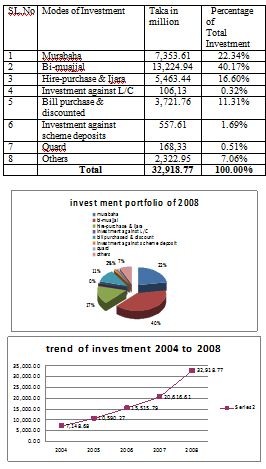

Total investment of the bank stood at TK. 32,918.77 million as on 31.12.2008 as against Tk. 20,616.61 million of 31.12.2007 registering an increase of Tk. 12,302.12 million, i.e. 59.67% growth. The Bank is careful in development of the fund. Mode wise investments portfolio as on 31.12.2008 are given below:

The Bank entertains good investment-clients having credit-worthiness and good track record. The Bank has got a few Investment Schemes to provide financial assistance to comparatively less advantaged group of people which are:-

- Households Durable Scheme

- Small Business Investment Program

- Small entrepreneur Investment Program

- Medium Entrepreneur Program

- Housing Investment Scheme

- Rural Investment Program

- Car Investment Scheme

- Woman Entrepreneur Investment Scheme

Besides this, some new scheme introduced in the year 2008, which are given below:

- Investment for Self-employment

- Investment Scheme for Executives

- Investment Scheme for Doctors

- Investment Scheme for Marriage

- Investment Scheme for CNG Convocation

- Investment Scheme for Overseas employment

- Investment Scheme for education

Automation in Banking Operation

For automation and up gradation of the services in the Bank, Local Area Network (LAN)

And Wide Area Network (WAN) system have already been developed, In the year 2008, IT & Computer Division of the Bank has arranged trainings on different issues for the employees. Following arraignments have been for improved customer services:

On line Banking Services:

To provide better services to the valued customers using the latest technology and electronic media competing with other private banks to set the establish full automated, on-line, centralize banking systems interfacing with all delivery channels link, like ATM (Automated Teller Machine), POS (Point of Sale-Fund Transfer Machine for purchasing at any shop/service center.), any branch banking, home banking, tele banking, internet banking etc. Online banking or any branch banking is a system where transactions, queries and statements of any client of a certain branch may be carried out from another branch of the bank.

SJIBL VISA CARD:

Card is considered as a new dimension of product resulting from technological development in the banking arena. In line with our affiliation with VISA International for VISA ATMs and POS, the following two products are launched broadening service product of the bank to the clients:

- VISA Electron (SJIBL VISA Debit Card – Local)

- VISA Prepaid (SJIBL VISA Prepaid Card – Local and International)

The important features of SJIBL VISA Card are given below:

- Sense of satisfaction of having an international brand.

- Any where any time banking.

- 24 hours and 7 days a week banking.

- Directly linked with cardholders account.

- Convenient cash withdrawal at ATMs.

- Acceptability at huge number of Q-cash ATMs around Bangladesh.

- Accepted at all VISA terminals locally and globally.

- Local and international transaction with the same card (for duel card).

- Balance Inquiry.

- Mini statement.

- PIN change.

- Shopping at a large number of Q-cash POS terminals around Bangladesh.

- Payment of utility bill.

- Avoid pressure of at counter of bank.

- Minimizing risk of carrying cash.

SMS/ Push Pull Service

This is a service provided by the bank through mobile phone. This new technology based service will helps the bank to attract new customer base. Through SMS or Pull Push service client will be facilitated with cell phone based banking service. This SMS service will help the bank to enhance and extend customer service levels on a collaborative basis and reduce teller queues.

Services:

- Balance inquiry

- Cheque Book Request

- Cheque Leaf status

- FC Rate Information

- Cheque Stop Payment Instruction

- Statement request by Courior/Post

- Statement request by E-mail.

- Last Three Transaction Statements

- Help inquiry

- PIN Change

Personal Management Information System

In Head Office PMIS system is going to be implemented in full phase with the following features: Employees recruitment, posting, personal, leave, increment, promotion, training, retirement, attendance, payroll, Provide fund, Tax etc should be controlled by PMIS. This system should be run in LAN and WAN environment and centrally controlled data of all employees. Employees ID, Biometric Image with Signature will remain be enrolled in the software.

SWIFT

The Bank has already become a member of Society of Worldwide Inter Bank Financial Tele communication (SWIFT) to provide Secured and accurate communication network for financial transactions, i.e. L/C, Remittance, etc.

RETURNS

The Bank has also established liaison with the facility of RETURNS, through which the bank received, latest information about the exchange rate, et and other price sensitive information to take prompt and correct decision.

Computer services:

Shahjalal Islami Bank is computerized and provides the following services some of these services will be introduced soon. Shahjalal Islami Bank Limited introduced a few schemes, which are very popular:

- Online services

- Automated Accounting

- Integrated System

- Signature Verification

- Any Branch Banking

- ATM Services

- POS Services

- SMS Push Pull Services

Gp Bill:

Grameen Phone subscribers availing the service to pay their bills, advances, security deposit and other related charges through all branches of Shahjalal Islami Bank Limited.

Capital Market Services

The capital market showed notable progress during 2008. The monthly average price index at the Dhaka Stock exchange (DSE) showed an upward trend along with substantial improvement of turnover value. The monthly average of all share price index (DSI) DSEG, and DSE20 increased by 55.1 percent, 49.6 percent, and 39.6 percent respectively in June 2008 over June 2007. The daily average turnover stood at Tk. 0.7 billion in the year 2007 showing a healthy growth of 223.4 percent. The increased market turnover in

2008 was largely contributed by trading of shares of banks, insurance companies, mutual funds, and power sector companies. At the end of 2008, market capitalization at DSE as 17. percent in June 2007. However, volatility in the stock market seems to have magnified and monitoring by the stock market regulators.

Shahjalal Islami bank commenced its Brokerage House operation in the year 2008 through a separate division named ‘Capital Market Service Division’ (CMSD). CMSD provides BO Account facility and margin facility to its customers to invest in the secondary markets. Diversified products with different category of investment ceiling and other value added services are also available for customers. The customers were also provided with assisted services facilities on the basis of published information and accounts the division managed portfolio value of more than 833 million under margin accounts. As a result at 1st year, i.e. in 2008, CMSD made a significant profit. The Bank has established a well decorated and highly technology based trading facilities for the connivance of the customers. CMSD is planed to open more 8 branches in 2009.

Data collection and Interpretations

A summary of findings on customer profile along three variables: age, level of income (average monthly income of the respondent).It has been found that the majority of the customers (58%) range between 25 to 35 years of age. About half of the respondents have an average monthly income ranging between BDT10,000 to BDT20,000 (Bangladesh currency = BDT). There are 27% respondents who fall below this range and 18% respondent who fall above this income range. It is to note that such age category in Bangladesh generally include entry and mid-level executives and professionals both in the private and public sector.

Findings

Customer Satisfaction with SJIBL Products/Services

On the satisfaction of SJIBL bank customers with Islamic bank products/services. It has been observed that except for Local Documentary Bill Purchased, Foreign Documentary Bill Purchased, Bai-Salam, and ATM services, all the Islamic bank products/services have a mean score above the average score.

Now, to find out whether any particular product/service has above average satisfaction, the following hypothesis has been tested for each product/service.

Null hypothesis: SJIBL customers have an average satisfaction with each Islamic bank product/service (i.e. H0=3).

Alternative hypothesis: SJIBL customers have an above average satisfaction with each Islamic bank product/service (i.e. HA>3).

The results as derived after testing the above hypothesis for each product/service . Foreign Documentary Bill Purchased, Bai-Salam, Letter of credit, and SWIFT require immediate attention as none of these products/services have customer satisfaction significantly above average level. It is to note that all investment products/services for customers have above average satisfaction.

They also found a very low customer satisfaction with various financing facilities and an above average mean on satisfaction with ‘current account’ and ‘savings account’. However, they reported an above average mean on ATM services while in this current study the ATM services enjoyed below average mean of satisfaction.

Customers’ Awareness of the Products/Services: Does Length of Relationship With SJIBL Play Any Role?

There may be two explanations. First, customers may be generally aware of various common products such as current and savings account. Retail customers usually start relationship with banks by adopting current and/or savings account. Second, in case of the other products/services, customers’ length of relationship may not have mattered because the products/services are not usually meant for retail customers. In case of the following products/services, customer awareness depends on the length of customers’ relationship with Savings Bond (at 1% significance level), Bai- Muajjal (at 5% significance level), Bai- Murabaha (at 5% significance level), Letter of Credit (at 1%

Significance level), and ATM Services (at 1% significance level). The findings for Savings Bond, Bai-Muajjal, Bai-Murabaha. The latter three are borrowing instruments for customers and such borrowing does not occur frequently. Customers become aware over time depending upon their need for investment in large amounts.

Recommendations

Most of the customers of SJIBL fall in the age category of 25-35 years. The reason might be the short history of Islamic banks in Bangladesh. About half of the customers under study fall in the income category of BDT10, 000-20,000. Customers’ high concentration in this income category is consistent with the findings of age category since entry and mid-level executives and professionals both in the private and public sector of the age category tend to have a similar level of basic monthly income. About three fourth of the customers surveyed were either college/bachelor or master/PhD. Such a finding indicates that SJIBL customers have high formal education.

High customer awareness and usage exist for current account and saving account, two very basic types of customers’ investment vehicles. Respondents are also aware to a large extent of and are using the other two investment products- term deposit and savings bond.

There is relationship between customers’ awareness of SJIBL products/services and customers’ length of relationship with SJIBL in case of the following products/services only: Savings Bond, Bai- Muajjal, Bai- Murabaha, Letter of Credit, and ATM Services. Hence, it can be deduced that a customer’s awareness of borrowing instruments tend to depend on how long customer’s relationship with the bank is.

Signification relationship exists between customers’ usage of the following products and customers’ age: current account, savings deposit, term deposit, savings bond, and Bai-Salam. Current account, savings deposit, term deposit, and savings bond is most popular in the age category products/services: Customers with higher levels of education tended to use more of the following products: savings deposit, savings bond, Bai-Muajjal.A number of products/services of Islamic banks have an above-average customer satisfaction. However, customers did not report an above-average satisfaction with the following products/services, most of which are borrowing products for customers: Hire purchase under Local Documentary Bill Purchased, Foreign Documentary Bill Purchased, Bai-Salam, Letter of credit, and SWIFT.

Customers have above average satisfaction with various service delivery elements of Islamic banks except for employees. Such a poor level of customer satisfaction with employees draws serious concern for a service industry like banking. The importance of bank selection criteria are as follows in the order of descending importance: religious principles, convenient location, family and friends, and rate of return. However, only ‘religious principles’ demonstrated an above average mean, suggesting that Islamic bank customers still prefer Islamic mode of banking mostly because the banks follow Islamic principles.

Customers with age categories beyond 25 years do not care for rate of return as a bank selection criteria. Customers with lower levels of income tend to rely on the recommendations of friends and family in choosing a bank whereas customers in the higher income category selected Islamic banks mainly for religious reasons. Customers in the higher income categories tend to rely on convenient location of the bank in making bank selection decisions. Customers’ level of education does not play any significant role in customers’ employment of bank selection criteria.

From the conclusions of the study, the following recommendations can be reasonably forwarded for Islamic banks in Bangladesh. First, among the age categories, 25-35 years deserve particular attention. Since this is the age category which has the most usage and more representation in the sample. Such a technique will ensure attraction of job-market entering people towards SJIBL products/service and also retention of the people who are likely to remain long-term loyal customers. Second, Islamic banks should try to find out some ways to better familiarize its customers with the Banking Behavior of SJIBL in borrowing products for customers. Arabic terms for most of these products in a non-Arabic speaking country like Bangladesh may pose a special predicament in customers’ familiarity and recall of products, which may again hinder word-of-mouth of the customers.

Third, besides religious principles, customers in the lower income category tended to rely on the experience of their family members and friends in choosing Islamic banks. Hence, SJIBL should pay an urgent attention to improve satisfaction of their existing customers. One step towards this would be to find out ways for improving customer satisfaction with employees and for improving satisfaction with the products/services that did not receive above average satisfaction from employees.

Finally, religious principles remain at the heart of people’s preference for Islamic banks. This indicates that the banks should remain highly dedicated to Islamic principles.

Any attempts to introduce any products/service (particularly the ones that have a fixed amount of profit upfront instead of a ratio of profit sharing) that may have substantial similarity with the traditional banking products/services should be thoroughly explained on the basis on Islamic principles and should be checked for customers’ acceptance.

Conclusion

Shahjalal Islami Bank Limited is one of the most renowned banks in the country.

SJIBL has introduced a new dimension in the field of innovative and benevolent banking in our country. The bank has successfully made a positive contribution to the economy of Bangladesh with in very short period of time. Its profit is gradually increasing. Therefore, Shahjalal Islami Bank Limited (SJIBL) is trying to establish the maximum welfare of the society by maintaining the principles of Islamic Shariah which is based on “Quran” and “Sunnah”. Profit earning is not the only motive and objective of the bank’s overall policy rather emphasis is given in attaining social good and in creation employment opportunities. Shahjalal Islami Bank Limited (SJIBL) has been established with a view to conduct interest free banking to establish participatory banking instead of debtor-creditor relationship and finally to establish welfare oriented banking through its overall banking operations that would lead to a just society.

I hope SJIBL do more work for socio-economic development besides their banking business. To keep pace with ever-changing uncertain domestic business environment and face the challenges of revised global economic scenario, the bank should be more pro-active and responsive to introduce new marketing strategy to hold the strong position in home and abroad. For the future planning and the successful operation in its prime goal in this current competitive environment I hope this report can provide a good guideline. I wish continuous success and healthy business portfolio of Shahjalal Islami Bank Limited (SJIBL).

Finally, Shahjalal Islami Bank Limited (SJIBL).has been established with a view to conduct interest free banking to establish participatory banking instead of debtor-creditor relationship and finally to establish welfare oriented banking through its investment operations that would lead to a just society.