Customer Perception about the Trade Service of HSBC

Banks are the key financial institutions that play a vital role in the country’s economy. Globalization in the banking sector has thrown up opportunities as well as challenges. Competition is getting an edge day by day. It paces with the continuous development occurring in the tremendous competitive environment.

It is a financial intermediary accepting deposits and granting loans offers the widest menu of services of any financial institution. They are the principal source of credit for million of individuals and firms and for many units of government. Moreover, for small local business ranging from grocery shops to automobile dealers, banks are often the major source of credit to stock the shelves with merchandise or to fill a dealer’s showroom with new cars. When business and consumers must make payments for purchase of goods and services, more often not they use bank provided checks, credit or debit cards, or electronic accounts connected to a computer network. And when they need financial information and financial planning, it is the bankers to whom they turn most frequently for advice and counsel.

As global economic growth occurs, understanding trade is increasingly important. And, my purpose in conducting my Internship in a multinational bank such as HSBC Bank (Trade Services Department) stems from my interest in international trade- not just the operational aspects of the Bank, but what are necessary to become successful in real or practical work life. To bolster our imagination, we need to keep up on the changing situations i.e. we need an interest in foreign affairs. And, my Internship in the Trade Services Department of HSBC Bank has given me the opportunity in viewing what is happening in actual trade businesses.

In HSBC Bank, the international trade is handled by Trade Services Department or briefly called as a pet name HTV (HSBC Trade Services) throughout the bank all over the world.

Objective of the Report

Broad Objective:

- The research was conducted for a two-fold purpose. First to analyze various aspects of HSBC trade services and second to have a practical knowledge of the professional life and to relate the four year theoretical learning to profession.

Specific Objectives:

- To find out the whether the trade service of HSBC meets the requirement of its customer

- To get the concept whether trade service needs an improvement or not.

- To identify strengths and weaknesses along with threats and opportunities of HTV (HSBC trade service).

Methodology of the Report

This report contains both primary and secondary data. The data sources I have used to complete this report are given below:

Sources of Information:

Primary Sources:

- informal discussions with employees, respective Unit Heads and officers of HSBC trade services

- Through observing various organizational procedures and structures

- Through surveys on customers of the organization

After collection of primary data statistical tools have been applied to interpret the collected data.

Secondary Sources:

I have elaborated different types of secondary data in my research. Sources of secondary information can be defined as follows:

- Bank’s Annual Report

- Brochures of the HSBC

- Websites of HSBC

HSBC at a Glance

Headquartered in London, HSBC Holdings plc is one of the largest banking and financial services organizations in the world. It began operations in Hong Kong more than 130 years ago. The HSBC Group’s international network comprises some 7,000 offices in 80 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. With listings on the London, Hong Kong, New York and Paris stock exchanges, around 190,000 shareholders in some 100 countries and territories hold shares in HSBC Holdings plc. The shares are traded on the New York Stock Exchange in the form of American Depositary Receipts.

Through a global network linked by advanced technology, including a rapidly growing ecommerce capability, HSBC provides a comprehensive range of financial services: personal, commercial, corporate, investment and private banking; trade services; cash management; treasury and capital markets services; insurance; consumer and business finance; pension and investment fund management; trustee services; and securities and custody services.

Asset: US $ 2,509,409 million in 2012.

Profit (After Tax): US $ 21,868 million in 2002

Staff: 170,000 employees in 81 countries and territories.

Growth of the Bank

The HSBC Group is named after its founding member, The Hong Kong and Shanghai Banking Corporation Limited (HSBC), was established in 1865 to finance the growing trade between China and Europe. The inspiration behind the founding of the bank was Thomas Sutherland, a Scot who was then working for the Peninsular and Oriental Steam Navigation Company. He realized that there was considerable demand for local banking facilities in Hong Kong and China and he helped to establish the bank which opened in Hong Kong in March 1865. Then as now, the banks headquarters were at 1 queen’s road central in Hong Kong and a branch was opened one month later in Shanghai.

Throughout the late nineteenth and the early twentieth centuries, the bank established a network of agencies and branches based mainly in China and South East Asia but also with representation in the Indian sub-continent, Japan, Europe and North America. In Many of its branches the bank was the pioneer of modern banking practices. From the outset, trade finance was a strong feature of the bank’s business with bullion, exchange and merchant banking also playing an important part. Additionally, the bank issued notes in many countries throughout the Far East.

During the Second World War the bank was forced to close many branches and its head office was temporarily moved to London. However, after the war the bank played a key role in the reconstruction of the Hong Kong economy and began to further diversify the geographical spread of the bank. The group expanded primarily through offices established in the banks name until the mid 1950s when it began to create or acquire subsidiaries. This strategy culminated in 1992 with one of the largest bank acquisitions in history when HSBC holdings acquired Midland Bank plc, which was founded in UK in 1836.

Global operating area of HSBC

HSBC, which is established in 1865 to finance the growing trade between China and Europe headquarter is in the Hong Kong SAR, where it is the leading commercial bank, operating into a network of 220 branches that serves three-quarters of the territory’s adult population.

HSBC has been both a pioneer and pillar of banking in many communities around the world and is very proud of its history. In Asia-Pacific, Hong Kong Bank and its subsidiaries provide a wide range of personal and commercial banking and related financial services through some 170 offices in 20 countries and territories.

HSBC Holdings acquired Midland Bank, one of the principal UK clearing banks, in 1992. Headquartered in London, the bank has a personal customer base of five and a half million, business customers of over half a million, and a network of almost 1,700 branches in the United Kingdom. Midland has offices in 28 countries and territories, principally in continental Europe, with a number of offices in Latin America.

Hong Kong Bank, in which Hong Kong Bank has a 62.1% equity interest, maintains a network of 146 branches in the Hong Kong SAR, where it is the second largest locally incorporated bank after Hong Kong Bank. Hang Send Bank also has a branch in Singapore and two branches and two representative offices in China.

Marine Midland Bank, headquartered in Buffalo, New York, has 380 banking locations statewide. The bank serves over two million personal customers and 120,000 commercial and institutional customers in New York State and, in selected businesses, throughout the United States.

Hong Kong Bank of Canada is the largest foreign-owned bank in Canada and the country’s seventh-largest bank. With headquarters in Vancouver, it has 116 branches across Canada and two branches in the western United States.

Banco HSBC Bamerindus was established in Brazil in 1997. The bank has its head office in Curitibank and a network of some 1,900 branches and sub-branches, the second largest in Brazil.

Hong Kong Bank Malaysia is the largest foreign-owned bank in Malaysia and the country’s fifth-largest bank, with 36 branches.

The British Bank of the Middle East (British Bank) is the largest and most widely represented international bank in the Middle East, with 31 branches throughout the United Arab Emirates, Oman, Bahrain, Qatar, Jordan, Lebanon and the Palestinian Autonomous Area, including an offshore banking unit in Bahrain. The bank also has branches in Mumbai and Trivandrum, India, and Baku, Azerbaijan, as well as private banking operations in London and Geneva.

HSBC Banco Roberts was acquired in 1997. Based in Buenos, Aires, it is one of Argentina’s largest privately owned banks with 60 branches throughout the country. Hong Kong Bank of Australia has 16 branches across Australia. It is the flagship of the HSBC Group’s businesses there, operating under the name HSBC Australia, and providing a complete range of financial services.

The Saudi British Bank, a 40%-owned member of the HSBC Group, has 63 branches throughout Saudi Arabia and a branch in London.

Other associated Group banks are British Arab Commercial Bank, The Cyprus Popular Bank and Egyptian British Bank. Wells Fargo HSBC Trade Bank is a San Franciscobased joint venture between HSBC and Wells Fargo Bank, providing trade finance and international banking services in the United States through its offices in five western states and in conjunction with Wells Fargo’s 32 regional commercial banking offices in 10 western states. In addition, the Group has a non-equity strategic alliance with Wells Fargo Bank, which provides access to a wide range of banking services, through those bank’s more than 1,900-staffed outlets. The Group also has a non-equity alliance with Wachovia Corporation, one of the leading corporate banks in the United States, with business relationships in 50 states.

HSBC Business Principles

- Outstanding customer service;

- Effective and efficient operations;

- Strong capital liquidity;

- Conservative lending policy;

- Strict expense discipline.

HSBC Bangladesh at a Glance

The Hongkong and Shanghai Banking Corporation (HSBC) Ltd is a member of the HSBC Group – one of the world’s largest financial services organizations Headquartered in London, HSBC is present in 87 countries and territories with around 7500 offices. In Bangladesh, HSBC started its operations in 1996 and today, it serves customers in Dhaka, Chittagong and Sylhet through a network of 13 offices, 39 ATMs and 9 Customer Service Centers (CSC). HSBC is the only bank to be present in 7 Export Processing Zones (EPZs) of Bangladesh.

Operations started: 3 December 1996

Profit before Tax (as of 31 December 2011):

BDT: 7,245,221,938

USD: 88,738,916

Number of offices: 13

Number of ATMs: 39

Number of CSCs: 9

Number of EPZ offices: 7

Recent recognition and awards

- Best International Islamic Bank 2011 by Euro money

- Best Employer Award 2010 by Bdjobs.com

- Best Domestic Cash Management Bank in Bangladesh 2010 by Euro money

- Best Emerging Markets Bank of the Year 2012 by Euro money

- Best Emerging Markets Debt House by Euro money

- The World’s Most Valuable Banking Brand by The Banker Magazine

- Top Banking Brand in Asia by Media Magazine and TNS

HSBC’s Operation in Bangladesh

- Retail Banking and Wealth Management: With a network of 13 offices, 38 ATMs, 9 Customer Service Centers, an offshore banking unit, and offices in 7 EPZs, HSBC offers a full range of personal banking and related financial services including current and savings accounts, personal loans, time deposits, travelers cheques and inward and outward remittances.

- Commercial banking: Commercial banking is a traditional strength of the HSBC Group. In Bangladesh, HSBC is a popular choice for customers because of the Group’s international reach and a wide range of financial services and products. HSBC has an offshore banking unit (OBU) license and can therefore also provide foreign currency financing to qualifying customers. In addition, there are 7 business development centers in the country’s major 7 EPZ areas including Dhaka, Chittagong, Adamjee, Mongla, Comilla, Karnaphuli and Ishwardi.

- Corporate and institutional banking: Corporate and institutional banking provides dedicated relationship management services to HSBC’s clients in major corporate and financial institutions. The Bank’s focus is on fostering long-term relationship based on its international connections and extensive knowledge of Asia and Asian business.

- HSBC net: HSBC net, a proprietary computer-based software package, provides customer with an instant link into the HSBC Group’s international computer network, allowing them to perform transactions and obtain a diverse range of up-to-date information 24 hours a day, 365 days a year.

- Trade & Supply Chains: Trade finance and related services are a long-standing core business of HSBC based on the depth and spread of its corporate customer base, highly automated trade processing systems and extensive geographic reach.

- Payments and cash management: HSBC is one of the leading providers of payments and related services to financial institutions, corporate and personal customers in Bangladesh. Underpinned by the Group’s extensive network of offices and capabilities, payments and cash management assists companies in efficient cash management through the provision of payments, collections, and liquidity and account services.

Custody and clearing: HSBC is a leader in custody and clearing in the Asia Pacific region and the Middle East. The network uses advanced securities clearing system, which was developed in-house and provides round-the-clock online real-time access to clients’ securities portfolios.

- Investment banking and markets: This division brings together the advisory, financing, asset management, equity securities, private banking, trustee, private equity, and treasury and capital market activities of the HSBC Groups.

- Treasury and capital markets: HSBC’s treasury and capital markets business ranks among the largest in the world and serves the requirements of supranational, central banks, international and local corporations, institutional investors, and financial institutions as well as other market participants

Foreign Exchange and trade

Meaning of Foreign Exchange

Foreign Exchange means exchange of foreign currency between two countries through export and import. Foreign exchange is the process of conversion of one currency into another. The term ‘Foreign Exchange’ has three principal meanings:

– It is a term used referring to the currencies of other countries in terms of any single one currency. To a Bangladeshi Taka, Dollar, Pound-Sterling etc. are foreign currencies and as such foreign exchange.

– The term also commonly refers to some instruments used in international trade, such as bill of exchange, drafts, travelers’ cheque and other means of international remittance.

– The term foreign exchange is also quite often referred to the balance in foreign currencies held by a country.

People those are involved in Foreign Exchange trade

- The buyer, who places orders and imports goods (meaning to bring into the country)

- The seller, who manufactures and exports goods (meaning to ship out of the country) and issues invoices

- The manufacturer if the seller does not make his own goods Shipping companies, who transport the goods to overseas and issue bills of leading as receipt of goods.

- Government and embassies who give permission to importer and exporter by issuing import and export licenses and consular invoices respectively.

- The insurance company, to insure the goods against risk. An insurance policy or certificate is issued to this effect.

- The customs and excise, who levy import duty and issue custom’s invoice.

- Various professional bodies, which issue inspection certificates certifying that the goods have been inspected and meet certain quality standards.

- Lawyers who draw up contract of sale.

- Agents, who represent either the buyer or seller overseas.

- Shipping registers, ensure that whether the carrying ship is sea worthy

- Chamber of commerce, which issues certificate of origin.

- Banks, those participate in most trade transactions to some extent, from full finance to the processing of simple remittances.

SWOT Analysis regarding HTV

In order to develop a conceptual theory SWOT analysis is very vital. In the process of making a SWOT an observer identifies the strength and weakness of the company and also the opportunities and threat to the company. The SWOT analysis of HSBC has given below.

Strengths of HTV

- HSBC is the leading provider of financial services Identity worldwide. With its strong corporate image and identity it can better position in the minds of customers. This image has helped HSBC grab the personal banking sector of Bangladesh very rapidly.

- HSBC is known worldwide for its distinct operating procedures. The company’s managing for value strategy to satisfy customers needs better and also keeps the firm profitable.

- Everyone in HSBC from the appraiser to the top management has to work to the same schedule towards a different aspect of the same goal, interfacing simultaneously at all level over quite a long period of time.

- HSBC employees are one of the major assets of the company. The employees of HSBC have a strong sense of commitment towards organization and also feel proud and a sense of belonging towards HSBC. The strong organizational culture of HSBC is the main reason behind this strength.

- HSBC Trade Service provides hassle free customer service to its client base comparing to the other financial institutions of Bangladesh. Personalized approach to the needs of customers is its motto.

- At HSBC HTV workshops are conducted periodically. On the workshops, all people participate as equals, with new members free to openly challenge top managers.

- HSBC HTV also has Management by Objectives (MBO) everywhere. Each person has multiple objectives. All the employees must have to get the approval of their bosses on what they are going to do. Later they review as how well they have performed their job with their management as well as the peer group.

- The MBO makes the review a communication device among various groups. The key to the system is a “one-to-one” meeting between a supervisor & a subordinate. In the meeting, the problems in dealing with customers are put forward first & everyone dug it to solve them.

- HSBC HTV owns the best banking and information technology in Bangladesh. It ultra modern banking systems starting from terminal pc’s to HUB’s are based on the international HSBC group standards and are the latest. The Hexagon product is one of the best examples in this context.

Weaknesses of HTV

- HSBC HTV has a very narrow operating span in Bangladesh. It has only 2 full service branches in Bangladesh situated only at Dhaka and Chittagong. Various geographic segments are currently not availing the services of HSBC due to inconvenient branch location or absence of neighborhood branches.

- HSBC HTV currently don’t have any strong marketing activities through mass media e.g. Television. TV ads playa vital role in awareness building. HSBC has no such TV ad campaign. HSBC HTV can peruse a diversification strategy in expanding its current line of business.

- The account maintenance cost for HSBC is comparatively high. This is very often highlighted by other banks. In the long run this might turn out to be a negative issue for HSBC.

- Recently HTV came up with various rules and regulations which customers sometimes find annoying and difficult.

Opportunities of HTV

- HSBC is one of the experts in acquiring various firms and organizations. In Bangladesh it can also diversify quickly by acquiring various local established banks and increase its total operation within Bangladesh rapidly.

- Repayment capacity as assessed by HSBC of individual client helps to decide how much one can borrow. As the whole lending process is based on a client’s repayment capacity, the recovery rate of HSBC is close to 100%. This provides HSBC financial stability & gears up HSBC to be remaining in the business for the long run.

- The ultimate goal of HSBC HTV is to .expand its operations to whole Bangladesh. Nurturing this type of vision & mission & to act as required, will not only increase HSBC’s profitability but also will secure its existence in the log run.

- One of the key opportunities for HSBC HTV is its efficient managers. HSBC has employed experienced managers to facilitate its operation. These managers have already triggered the business for HSBC as being new in the market.

- Bangladesh is a developing country, to satisfy the needs of the huge population, a large amount of investment is required. On the other hand building EPZ areas and some Govt. policies easing foreign investment in our country made it attractive to the foreigners to invest in our country. So, HSBC has a large opportunity here.

- The basic assumption of trade business is that customer will come to the bank and ask for service that is why local & foreign banks are not that much enthusiastic about letting know their service features. This an opportunity for HSBC to develop massages regarding their services.

Threats of HTV

- The upcoming private local & multinational banks posses a serious threat to the existing banking network of HSBC: it is expected that in the next few years more commercial banks will emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against and win the battle of banks.

- Now day’s different foreign and private banks are also offering similar type of trade service with an almost similar or lower profit margin. So, if all competitors fight with the same weapon, the natural result is declining profit.

- This is a major problem in Bangladesh. As HSBC is a very new organization the problem of non-performing loans or default loans is very minimum or insignificant. However, as the bank becomes older this problem will arise enormously and the bank may find itself in a more threatening environment. Thus HSBC has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem.

- Bangladesh is economically unstable country. Flood, draught, cyclone, and newly added terrorism have become an identity of our country. Along with inflation, unemployment also creates industry wide recession. These caused downward pressure on the capital demand for investment.

Major Findings

To get a clear idea about the customer perception about the trade service I did a small survey asking the 20 customers of HSBC Trade Services. This questionnaire was made with the concern of HSBC Chittagong Head of trade MR. Anisul Karim and Senior Relationship Manager MR. Omar Sharif. These questions were also prepared by consulting with the customers about some common factors about foreign exchange trade with a bank. Trough these questions I tried to find out whether the HTV requires changes or not. While talking with customers I got some issues those pursue customers to do transaction with a bank. These are:

- L/C Opening cost

- Branch in KEPZ (Karnaphuli Export Processing Zone) and CEPZ (Chittagong Export Processing Zone)

- Document Process Time.

- Funding.

- Business Relation.

- Any extra facilities.

- Placement of the bank.

- Level of satisfaction.

- Business Risk.

- Overall Satisfaction.

So from these above terms I will have a clear and concise prediction about the quality of HTV.

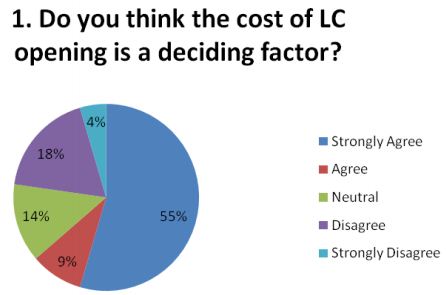

L/C Opening Cost

At HSBC L/C opening cost is determined by the Relationship Managers which creates a great effect on customers. However L/C opening cost is also dependent on the volume of the transaction.

From the graph it can be seen that majority of th ecustomers think that the cost cost of L/C opening is a deciding factor to do transanctuon with HSBC trade service. From the L/C opening cost customers take decission wheteher to transanct with HSBC or not. HSBC Trade Service has marginal L/C opening cost which attracts customer to do transaction with them and time to time HSBC makes research to get an exact idea about how much L/C opening cost it should be to atrract and reatin customer.

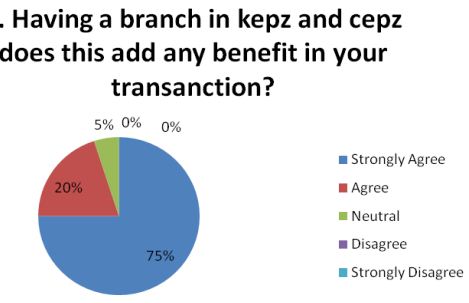

Branches in KEPZ and CEPZ

Customers related with foreign trade have connectivity with Export Processing Zone at some level. So it becomes very helpful for customers specially whose business in EPZ if they get a bank branch in EPZ.

Avobe graph shows that 75% of the customers are being benefitted beacause HSBC has a branch in KEPZ (Kharnaphuli EPZ) and CEPZ (Chittagong EPZ). It helps to faster the transanction of their business. Because it becaomes more faster and easier while the customers get a bank just nearby themselves. It saves both the business time and money. So HSBC Trade Service or HTV is surely advanced in this criteria.

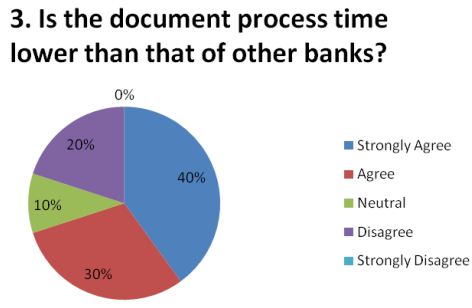

Document Process Time

In foreign trade and exchange document process timing plays a vital role. More the document processing time is faster more the business is efficient.

At HSBC the whole trade department is full of expericnced anda trained employees. Employees get the training in gl0bal standard which make them able to process the documnent very fast. Not only that HSBC has a universeal banking network throughout the world also. So no matter the document is from anywhwre or anytype it does not take that much time to process for HSBC and its result is reflecting on the avobe figure. The avobe figure shows that almoast 70% of customers belive that the document process timing in HSBC is lower than that of other bank.

Recommendations

After three months of my internship and based on my consumer research I would like to draw some conclusion about the HTV. They are:

- The approach of HSBC Bangladesh is upbeat in finding good customers but HSBC has a very narrow operating span in Bangladesh their total of number branches in comparison to their huge customers are very small in numbers. Moreover in Chittagong they have only one trade service system to support imports and exports customers which is sometimes become difficult to manage.

- HSBC should increase the number of satisfied customer which will result in great business value in future.

- Recently HSBC came up with a huge number of rules and regulations regarding foreign trade and exchange. Which sometimes customers find difficult to deal with. HSBC should set off these regulations sometime.

- HSBC can organize more workshops regarding their foreign trade systems which will be helpful for the customers to deal with

- HSBC has different ratings for different countries. Often exporters and importers find some difficulties due to this. In this globalization this types of ratings shouldn’t be there.

- Recent political instability creating a mass destruction in foreign trade through this bank is also suffering a pressure. So HSBC should come up with new branches to handle the pressure.

Conclusion

Nowadays challenge is increasing in an increasing rate. In that case to bit the challenge, HSBC should take these issues under serious consideration so that they will be called outstanding as a world’s local bank. This is because the competitors might identify these gaps and there is always the possibility that they could use them at their advantage. On the other hand, although HSBC is preferred highly by most customers, there are some who are dissatisfied with it. It is important to retain these customers. The retention of these customers is vital because bad or negative word of mouth influence have a tendency of spreading more than good word of mouth influence. However, once the dissatisfied customers are satisfied, it will not only help the bank to retain existing customers, but it will also enable the bank to attract new customers through positive word of mouth influence. To do so, HSBC has to provide better service as promised and the same time, adapt the new strategy according to customer expectation which would lead to a greater number of satisfied customers, thus enabling the bank to have competitive edge over its competitors.