Introduction

A Bank is a very much indispensable organization in modern economy. It plays a very significant role in the economic development of a country and forms the core of money market in an advanced economy. Globally the banking process and its area of operation are increasing day by day. It is also changing due to technological innovation, deregulation, globalization etc. All these are happening because of its demand. Basically bank take deposits from customers against interest and lend it to the borrowers against interest for certain period of time. For getting loan, both individuals and organizations depend on banks. After detailed analysis banks grant loan to borrowers and disburse it among them. Besides loan banks give various types of services to their customers. Uttara Bank limited is one of the largest and oldest private sector commercial bank in Bangladesh, with years of experience. Uttara Bank plays a vital role in economic development of our country.

My study topic is on Credit management of Uttara Bank Limited; A study on Savar Branch. The main aim of my study is to acquainted knowledge about credit management of Uttara Bank Limited.

Bank’s Credit means the credit granted by a banker to his customers. Bank temporarily transfers purchasing power to its borrowers; this provided purchasing power can be termed as loan, credit or advance. It is a lender’s trust in a person’s/ firm’s/ or company’s ability or potential ability and intention to repay. In other words, credit is the ability to command goods or services of another in return for promise to pay such goods or services at some specified time in the future. Bank lends not only its cash, but also its goodwill and belief to customers, such as L/C, traveler’s cheques and traveler’s notes. For a bank, it is the main source of profit and on the other hand, the wrong use of credit would bring disaster not only for the bank but also for the economy as a whole.

Organization

Uttara Bank one of the largest and oldest private sector commercial bank in Bangladesh, with years of experience. Adaptation of modern technology both in terms of equipment and banking practice ensures efficient service to clients. 213 branches at home and 600 affiliates worldwide create efficient networking and reach capability. Uttara is a bank that serves both clients and country.

Historical Background of the Organization:

Name of the Company:

UTTARA BANK LTD

Legal form:

Uttara Bank Limited (The Bank) had been a nationalized bank in the name of Uttara Bank under the Bangladesh Bank (Nationalization) order 1972, formerly known as the Eastern Banking Corporation Limited. The Bank started functioning on and from 28.01.1965. Consequent upon the amendment of Bangladesh Bank (Nationalization) order 1972,

The Uttara Bank was converted into Uttara bank Limited as a public limited company in the year 1983. The Uttara Bank Limited was incorporated as a banking company on June 29, 1983 and obtained business commencement certificate on August 21, 1983.

The Bank floated its shares in the year 1984. The registered office of the bank is located at 90, Motijheel commercial area, Dhaka-1000. It has 213 branches all over Bangladesh through which it carries out all its banking activities. The Bank is listed in the Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited as a publicly quoted company for trading of its shares.

Uttara Bank Limited is one of the well established and almost half century old private sector commercial bank in Bangladesh. The bank has been carrying out business through its 213 branches spreading all over the country. It has maintained a strong market position by providing quality services to its customers.

The bank has made significant progress in all areas of business in 2008. The bank has achieved significant success in loans and advances, deposit and remittances in year 2008. As a result the bank has been able to earn remarkable profit in business.

Uttara Bank at a glance:

- UBL is one of the largest private banks in Bangladesh.

- It operates through 213 fully computerized branches ensuring best possible and fastest services to its valued clients.

- The bank has more than 600 foreign correspondents worldwide.

- Total number of employees nearly 3,780. (As on 31.12.2011)

- The Board of Directors consists of 13 members.

- The bank is headed by the Managing Director who is the Chief Executive Officer.

- The Head Office is located at Bank’s own 18-storied building at Motijheel, the commercial center of the capital, Dhaka.

UBL Networks

| Corporate Offices ( Corporate Branch & Local Office ) | 2 |

| Regional Office | 12 |

| Worldwide Affiliates | 600 |

| Total Branches ( Including Corporate Branch & Local Office ) | 213 |

| Authorized Dealer Branches | 38 |

| Treasury & Dealing Room | 1 |

| Training Institute | 1 |

| Man Power | 3780 |

Products and Services of UBL

UBL has different products and services under its three departments: General Banking, Foreign Exchange and Credit Department. Alongside traditional products and services, the Bank has some tailor made products in liability and asset sides. Of those mentionable are nine types of Savings Schemes for deposit mobilization in one hand and Consumer Credit Scheme, Lease Finance, Personal Loan, Uttaran House Repairing and SME financing in other hand. Besides, the Bank has also some electro-banking products based on information technology of which Q-cash UBL ATM Debit cards are to be mentioned for providing 24 hours services to customers.

Vision

“Building a profitable and socially responsible financial institution focused on Market and Business with growth potential, thereby assisting and stakeholders build a just enlightened, well democratic and poverty free Bangladesh”. Thus Uttara Bank will be one of the largest private-sector commercial bank in Bangladesh.

Mission

To build Uttara bank limited into an efficient, market driven, customer focused institution with corporate governance structure. Continuous improvement in the business policies, procedures integration of technology at all levels by ensuring:

►To extend services for people to attain their satisfaction.

►To maintain a steady growth of market share.

►To maximize bank’s profit by ensuring its growth.

►To maintain a high moral and ethical standard.

Organizational Goals

Uttara Bank will be the absolute market leader in the number of loans given to small and medium sized enterprises throughout Bangladesh. It will be a world-class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank in this part of the world by developing:

- Realistic deposit mobilization plan

- Appropriate lending risk assessment system

- System to make good advances.

- Recruitment, compensation training and orientation plan.

- Plan for offering better customers service.

- Appropriate management structure, systems, procedures and approaches

Background of the Study:

No knowledge is fully complete unless it is fully supported events on ground. Whatever may be the quality of theoretical knowledge, it is not complete without practical implication on ground. This realization is more pronounced in the study of Business Administration where experience on ground plays a dominant role.

Bachelor of Business Administration (BBA) is designed with an excellent combination of practical and theoretical aspects. After completing the BBA to fulfill the requirement of this Degree, I was assigned to pursue Internship in Uttara Bank Limited, Savar Branch, Dhaka.

I have tried my best to use this opportunity to enrich my knowledge on banking system. After observing thoroughly, I have prepared this report on the basis of my findings and observation relating to the topic.

Scope of the Study:

The study covers credit management activities of UBL. This report gives a narrative overview of credit department of Savar branch, Dhaka of UBL. It consists of my observation and on the job experience during the internship period. This report incorporates the different aspects of credit management tools and techniques and its effect on the performance of the bank.

Objectives of the study:

►To identify the credit schemes of Uttara Bank Ltd, Savar Branch;

►To describe the lending procedure and approval process of UBL, Savar Branch;

►To explain credit risk management process of UBL;

►To describe recovery process of UBL, Savar Branch;

►To identify the problems related to credit management of UBL, Savar Branch;

►To make some recommendations to solve those problems.

Methodology of the study:

Sources of Data:

Primary Sources

▪ Officers of the branch

▪ Clients of the branch

Secondary Sources

▪ Annual reports of Uttara Bank Limited (2009, 2010, 2011)

▪ A book on ‘Credit Policy and Lending Guidelines’ (Revised edition-2009), Published by UBL.

▪ Manuals of Credit Management of UBL

▪ Published materials and office circulars of UBL

▪ Website of the UBL.

Target Population:

All officers and clients of Uttara Bank Limited, Savar Branch.

Sample Size:

▪ Officers: 05

▪ Clients: 07

Method of data Collection:

Face to face conversation and depth interview with the respective officers and clients of the branch. Observation the credit management activities.

Limitations of the Study:

From the beginning to end, the study has been conducted with the intention to making it as a complete and truthful one. However, many problems appeared in the way of conducting the study. During the study it was not possible to visit the whole area covered by the bank although the financial statements and the other information regarding the study have been considered.

The study considers following limitations:

Lack of proper time:

Time period of this study is really short. I only have 55 working days (almost 8 weeks) to spend in branch and to complete this report. So I am unable to go deep of the study. Most of the time the officers were busy and were not able to give me much time.

Insufficient data:

Some desired information could not be collected due to privacy of the business. As a newcomer I have little experience in this regard. And many practical matters have been written from my own observation that may vary from person to person. The study has been completed based on information of Savar branch only, so it may not reflect the whole picture of UBL. Lack of in depth knowledge and analytical ability for writing such report.

Types of Credit Facilities of UBL:

Depending on various nature of financing, all the credit facilities have been brought under two major groups: (a) Funded Credit and (b) Non-funded credit. Under non-funded credit, there are basically two major products namely Letter of Credit and Letter of Guarantee.

Funded Facilities:

Bank Overdraft

Overdraft facility is the result of an agreement with the bank by which a current account holder is allowed to withdraw a specified amount over and above the credit balance in his/her account. It is a short term facility, for 1 year and it is granted for general or business purpose. This facility is made available to current account holders who operate their account through cheque. The customer is permitted to withdraw the amount as their necessary. Interest is charged on actual amount withdrawn by the customer. The interest rate on overdraft is higher than that of the rate on loan. Customers can repay it in lump sum, monthly or quarterly basis.

This credit facility is sanctioned against Hypothecation of inventory or stock of goods of customers. The purpose of this credit is to finance Inventory. Customers repay the credit in lump sum from the cash flow. The tenor or validity is 1 year for this credit.

Pledge of goods is maintained by the Bank to sanction this credit to customers. To finance Inventory is the purpose of this credit. Repayment is made from cash flow in lump sum.

Loans allowed to UBL bank employees for purchase of apartment/construction of house shall be known as staff house building loan (SHBL).

Uttaran House Repairing Loan

This loan is sanctioned for repairing purpose of customer’s house. The rate of interest for Uttaran House Repairing Loan is 18%, which is higher than that of other types of loan. It is provided for the high level income holders.

Consumer Loan

Consumer credit is one kind of credit facility allowed by the Bank to buy home appliances, cars and others necessaries that is repayable within a certain period through monthly installments. But the Bank provides this loan facility to customers very rarely.

Personal Loan Scheme for Salaried Officers

- Emergency expenses for own marriage of a service- holder or his dependents.

- Emergency expenses of urgent surgical operation/ medical treatment.

- Emergency educational expenses of the children for admission/purchase of books, examination fees etc.

Special Features:

- Any permanent salaried employee age between 20 to 55 years is eligible to get loan.

- No collateral security is required.

- Maximum Amount of loan is Tk. 1, 00,000.

- Maximum period of loan is 3 years.

Required Documents:

- Documents related to applicant’s job for proof.

- Two copies of passport size photograph.

- Photograph of nominee if any duly attested by the account holder.

This bank provides consumer credit to government service holder, own employees and service holder of non-governmental organization. A guarantee is taken from the person who is known with the bank or the employees in the office.

Demand Loan against

UBL provides demand loan to the customers against Fixed Deposit Receipt on demand. The purpose of this loan is to meet the obligation under forced circumstances. The Bank is eagerly interested to provide this Demand Loan against Fixed Deposit Receipt because of liquidity of FDR. If necessity arises, the Bank can do encash the FDR quickly to meet needs. Repayment is made under special arrangement of the Bank.

Financing:

Uttara Bank Limited has been putting its stress on small Enterprise Financing and Medium Enterprise Financing. The Bank’s strategy is to provide working capital and term loan to different small and medium scale manufacturers, traders and service providers that fall into SME universe. The Bank defines a business with fixed asset value of below TK.50lac and 25 employees as Small Enterprise. Also, a business with fixed asset value of TK.50lac to TK.1.5crore and employees more than 25 is defined as medium enterprise.

Term Loans:

Term loan is the loan against fixed assets of borrowers. The purpose of this type of loan is to finance fixed assets, machinery and equipment. The loan is repaid through monthly or quarterly installments. Tenor or validity of term loan is maximum 8 years. There are 3 different types of Term Loans:

- Tenor or validity is up to 1year.

- Tenor or validity is more than 1 year & up to 3 years.

- Tenor or validity is more than 3 years.

Lease Financing:

Lease financing is one of the most convenient sources of acquiring capital machinery and equipment whereby a customer is given the opportunity to have an exclusive right to use an asset usually for an agreed period of time against payment of rental. It is a term financing repayable by lease rental. UBL deals in Finance lease only.

Lease financing categories:

►Capital machinery preferably for its client base in the garments sector;

►Heavy construction equipment;

►Elevators/Lift;

►Air conditioner;

►Vehicles like luxury bus, mini bus, taxi cab, car, pick-up etc;

►Medical equipment;

►Generators, computers and any other items as may be deemed fit by the bank.

Syndicate Financing:

Syndication means joint financing by more than one bank to the same clients against a common security. This is done basically, to spread the risk. It also provides a scope for an independent evaluation of risk. Participation in consortium or syndicate financing through term financing is an important sector of investment of this bank.

Non-funded facilities:

Letter of Credit

Letter of Credit is an agreement by a Bank to make payments on behalf of a party under specified conditions. Bank ensures the exporter to make the payment on behalf of the importer. The tenor or validity is maximum 12 months. In UBL the Letter of Credit can be only issued by Authorized Dealer (AD) Branches; but Savar Branch, Dhaka is not an AD branch. So it can not able to issue L/C directly.

Guarantee:

UTTARA BANK LTD. offers guarantee for its reliable and valuable customer as per requirements. This is also a facility in contingent liabilities from extended for participation in development work like supply of goods and services. Through is the Bank ensures its party to make payments for credit. If the party fails to pay the due, then the Bank will pay for it.

Interest Rate of the Schemes:

Types of Loans | Interest Rate % |

| Cash Credit (Hypo) | 17 |

| Cash Credit (Pledge) | 18 |

| Over draft | Above 3 |

| House Building loan (General) | 18 |

| House Building loan (Staff) | 6.5 |

| Consumer Loan | 18 |

| Loan against FDR, MDS | 15.5 |

| SME | 17 |

| Lease Financing | 18 |

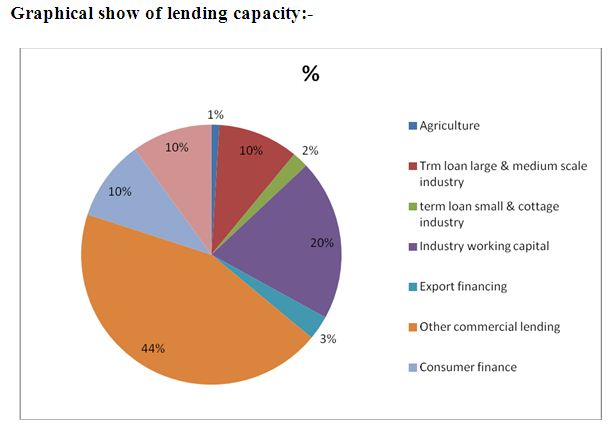

Lending Cap:

Credit portfolio is guided by the following Sect oral Caps in UBL. The Caps will be reviewed from time to time depending on the market conditions, shift in Government Policy and UBL’s credit policy:

| SL No. | Sector Caps | Sectoral Allocation (%) |

| 1 | Agriculture | 1% |

| 2 | Term loan large & medium scale industry | 10% |

| 3 | Term loan small & cottage industry | 2% |

| 4 | Industry working capital | 20% |

| 5 | Export financing | 3% |

| 6 | Other commercial lending | 44% |

| 7 | Consumer finance | 10% |

| 8 | Others | 10% |

| Total | 100% |

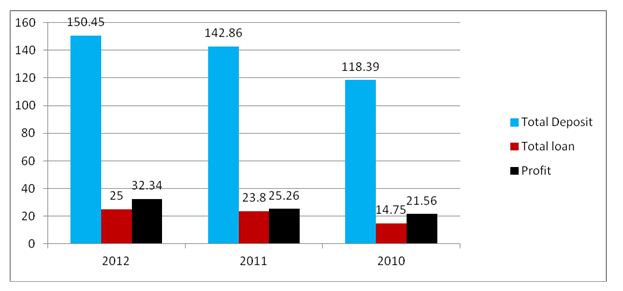

Branch Total Deposit, Loans and Profit

| Particulars | 2010 | 2011 | 2012 |

| Total Deposit | 118.39 | 142.86 | 150.45 |

| Total loan | 14.75 | 23.8 | 25 |

| Classified Advance | 2.69 | 1.39 | 1.138 |

| Profit | 21.56 | 25.6 | 32.34 |

Graphical show of total deposit, loans and profit (last three years) of Savar branch

The graph shows that the deposit of Savar branch is increasing, but investment is not increased significantly.

Branch Loans under different heads

| Particulars | 2010 | 2011 | 2012 |

| Small Enterprise Financing | 4.80 | 6.35 | 7.20 |

| Medium Enterprise Financing | 2.75 | 4.95 | 5.05 |

| Corporate (large)Enterprise Financing | 0.00 | 0.00 | 0.00 |

| Consumer Loan | 4.50 | 6.40 | 6.30 |

| Agri Loan | 0.00 | 0.00 | 1.25 |

| Other Loan | 2.70 | 6.1 | 5.20 |

Branch Loans under different heads

From the above table we see that small enterprise financing amount is the highest and corporate financing amount is zero. On the other hand agricultural loan amount is the lowest.

Discouraged Business Types:

In context of present economic situation vis-à-vis Government Policy as well as market scenario, the following industries and lending activities are considered as discouraged.

Military Equipment/Weapon Finance Highly leveraged transactions Finance of speculative business Logging, Mineral Extraction/Mining or other activity that is ethically or environmentally sensitive. Lending to companies listed on CIB black list or known defaulters Share lending Lending to holding companies Bridge Loans relying on equity/debt issuance as a source of repayment.

Credit Policy of UBL

Bank credit policy is the compilation of some wise decisions, which help the loan officer in every steps of the loan process to execute his/her duty efficiently and properly. Credit policy gives to loan management specific guidelines for making loan decisions, shaping and managing the Bank’s overall loan portfolio. UBL has some policies for managing credit, those are following:

- Maintaining Know Your Customer (KYC) Policy

- Discouraging low net worth or highly levered borrowers

- Preference to trade and commerce sector

- To ensure liquidity of customers

- Diversification of credit portfolio

- To ensure safety and security of credits

- Preference to short-term credit

- Preference to sanction loan of small amount

- To give importance on making profit

- To grow consumer loans (personal, house repairing)

- To maintain sanctioning loan in readymade garments sector.

Strategy of Credit Management of UBL

The Bank undertakes to establish a credit risk management culture for practicing minimum credit standards, assessing and managing risks, segregation of risk taking and risk managing activities through:

- Risk taking willingness &

- Risk managing skills & wisdom

The Bank has some specific strategies for credit management, those are as follows:

- To cover risk through security against loan sanctioning

- To increase coverage of loan services for wide range of geographical area

- To enhance existing limits of good borrower clients

- Extension of consumer loans

- Extension of loans in textile (yearn/fabrics manufacturing) sector

- Encouraging loans for export oriented industries Maintaining good collateral security against loans.

Customer’s Credit Worthiness:

To select good borrowers UBL examines some specific criteria of those borrowers. The Bank analyses customer’s character, capacity, capital, collateral, and condition (5 C’s) to justify credit worthiness and eligibility for a bank investment, those are described below:

Character:

The bank analyses past track record of loan transactions of borrowers in UBL and in other banks. Also, the accuracy of the information provided in the loan application is examined. Moreover, the customer’s quality of integrity, responsibility, trustworthiness, and industry goodwill and credit character is scrutinized.

Capacity:

The customer’s credit repayment capacity and ability is justified before sanctioning loan. The Bank examines cash inflows, outflows, net profit, and liquidity from customer’s financial statements. Also, the Bank forecasts about customers earning and stability of the financial condition.

Capital:

The bank analyses current financial position of the potential customer’s organization. The total amount of net asset, debt-equity ratio and capital are examined by the Bank. If capital structure shows that the firm is highly levered, then the Bank marks it negatively.

Collateral:

Marketability of collateral is important to bank; if customers become defaulter the bank can sell quickly that collateral which is easily marketable. The Bank justifies whether the collateral is safe, secured and sufficient or not.

Condition:

Respective officer forecasts the economic and business conditions during the loan period. And also analyzes the stability of the forecasted source of income of the loan applicant.

Lending Procedure of UBL:

Loan sanctioning is extremely important for a Bank, because of risk associated with it. Any Bank wants to minimize risks, secure its assets and maximize wealth. To sanction loan properly, UBL follows a specific sanctioning process. The loan sanctioning steps are as follows:

Application for Loan

The borrower has to apply to UBL for loan by filling up of a specific application form. In the application form customer mention what type of investment facility he/she wants from the bank including his/her personal information and business information. Branch manager or relationship manager conducts the initial interview with the customer. The following documents, reports, and papers are necessary with the application form:

- Trade License photocopy

- Historical Company Accounts for at least 3 years (Audited/Un-audited)

- Bank Statement/Loan Account Statement(last 12 months)

- Projected Company Accounts

- Business Plan or Project Feasibility Report

- Declaration of Stock/Inventory Book Debt for at least 12 months

- Attested copy of Partnership Deed (for partnership firm)

- Attested copy of Certificate of Incorporation, Memorandum & Articles of Association for Joint Stock Company

- Tax Identification Number(TIN)

- CS, SA, RS, BS khatians & up-to-date rent receipt for Equitable or Registered Mortgage.

Collection of Information

Receiving the loan application form, UBL sends a letter to Bangladesh Bank for obtaining a report. This report is called CIB (Credit Information Bureau) report. The purpose of this report is to be informed that whether the customer has taken loan from any other bank or not, if ‘yes’ then whether these loans are classified or regular.

If Bangladesh Bank sends positive CIB report on that particular borrower and if the bank thinks that the prospective borrower will be a good one, the bank will be scrutinize the documents.

Scrutinizing of Information

First of all, Relationship Manager inspects project or firm for the loan is applied. On the other hand, Branch Manager also inspects personally. They are investigated projects existence ownership, legality, distance from the bank office, viability, monitoring cost & possibilities are examined. The Relationship Manager prepares Risk Grading Score Sheet to measure the risk.

Branch Manager Collets all documents from the customer and those documents sends to Zonal Office. After, Zonal Office investigates his/her prospective investment sector or firm.

Then, they collect information about this investment and send this report to the head office with documents.

Loan Appraisal

Then the head office analyses the documents. If they seem to be a good one then next will come processing stage. In this stage, the bank prepares a proposal. A proposal contains all relevant information (e.g. name of the client, type of the loan, amount of the loan, rate of interest, period of giving loan, repayment, security etc).

Head Office scrutinizes the investment proposal and afterwards puts up a memorandum to executive committee of Board of Director. The Investment Committee reviews the investment proposal and accepts or rejects the proposal.

Sanction of Loan

After approval by the Investment Committee a sanction advice is prepared in favor of the client. The Bank sends sanction letter to its clients, which contains the following elements:

- Loan Limit

- Type & Amount of Loan

- Purpose of Loan

- Rate of Interest

- Securities

Loan Documentation

The Bank’s Credit Administration Division ensures that all approvals and documents are in order. Also, the Bank prepares security documents in accordance with the approved terms and ensures those are legally enforceable. Charge documents vary on the basis of types of facility, types of collateral. The Bank checks the following documents:

- Valuation Certificate

- Tax Clearance Certificates

- Inventory Report

- VAT certificate

- Liability Statements from different parties

- Receivables from different parties

- Last 2 years net income business transactions

- CIB report

- Performance report with the Bank

Loan Disbursement

After receiving all the documents and ensuring preconditions the bank disburses the loan to the customer and monitoring of loan starts as well. The Bank prepares a loan disbursement authorization form.

For withdrawing the loan amount in case of Personal Loan customer creates a current account and the loan amount is transferred to the C/A. In case of Business Loan, Bank transferred loan amount to the client’s account.

Credit Approval Process

The loan approval process of Uttara Bank Limited contain some specific order, those are the following:

- The Relationship Manager will assess the particulars of the application and will sanction loans/advances if within the delegated power of RM.

- But if it is not within the delegated power, RM will recommend the limit to Zonal Head, who will sanction loan /advance as per delegation. If it beyond his discretionary power he send to CRM Marketing at Head Office for scrutiny.

- After examining the proposals they will forward the same to CRM approval wing mentioning that the proposal may be taken up for decision.

- If there is any deviation, they will mention the same and also send the proposals to CRM approval wing for decision by HOC.

- The recommending or approving executives take responsibility for and are held for their recommendations or approval .Delegation for approval of limits should be in accordance with revised business delegation powers circulated by Head Office from time to time.

Disbursement Process

- Disbursements under loan facilities are only made when all standard charge documents and security documentation are in order and preconditions for disbursement are met fully.

- RM and Credit Administration officer to jointly prepare documentation check list.

- Credit Administration Division is to authorize disbursement.

- Evidence of disbursement is to be documented in the Disburse Authorization Form.

- Disbursement authority to check that pricing of the facility are within the Bank’s declared band.

- All disbursement/ drawings are to be covered by approved credit lines.

- A clean updated CIB report must be obtained before any disbursement.

- All formalities related to large loans and loans to Directors should be guided by Bangladesh Bank circulars and related section of Bank Company Act.

CREDIT RATING REPORT (SURVEILLANCE) ON UTTARA BANK LIMITED RATED BY CRAB BASED ON

Credit Rating Agency of Bangladesh Limited (CRAB) has upgraded the long term rating of Uttara Bank Limited to “AA3” (pronounced as Double A three) from A1 and retained the Short Term rating at “ST-2” for the year 2011.

A comparative position of the credit Rating of Uttara Bank Ltd. for the year 2011 and 2010 is furnished below.

| Year of Rating | Rating Results | |

Long Term | Short Term | |

2011 | AA3 | ST-2 |

2010 | A1 | ST-2 |

| Date of Rating | 14.06.2012 | |

| Validity | 30 June-2013 | |

| Outlook | Stable | |

Commercial Banks rated “AA3” have very strong capacity to meet their financial commitments. AA3 is judged to be of very high quality and is subject to very low credit risk. Commercial Banks rated ST-2 are considered to have strong capacity for timely repayment. Commercial Banks rated in this category are characterized with commendable position in terms of liquidity, internal fund generation, and access to alternative sources of funds. The rating reflects the Bank’s strength in risk weighted capital adequacy, satisfactory profitability, improving trend in asset quality and surplus provision.

Credit Assessment Procedure

Clients have to submit a formal application for desired loan amount to RM by mentioning financial value of primary securities and collateral securities. They have to attach trade license, documents of collateral securities, financial statements and other required papers mentioned by UBL.

- The RM will primarily verify the applications of clients, visit clients business organizations and also visit clients house/land properties that have mentioned as collateral securities by the clients. The RM will follow UBL`s established Know Your Customer (KYC), Money Laundering guidelines, and Bangladesh Bank’s regulations at all times.

- Based on the findings of such visits, RM will go for preparing a full fledged Credit Application after undertaking a through credit check, and critical credit and risk assessment of the client according to Credit Policy & Guidelines of UBL. The Proposal is to be sent to the Head of Marketing (HOM) along with the recommendation of the Relationship Manager/Credit Manager& Zonal Head- to initiate the proposal to CRM (approval) for credit approval process.

- The Credit Application is to be fully documented along with all legal, business, financial information with full disclosures so that approving authority can take decision.

assesses the following risk areas:

The majority shareholders, management team and group of affiliate companies of the borrowers will be assessed by UBL. Any issue regarding lack of management depth, succession, complicated ownership structures or inter- group transactions will be addressed and related risk mitigated by UBL.

The key risk factors of the borrower’s industry will be assessed by the bank. Any issues regarding the borrower’s position in the industry, overall industry concern or competitive forces will be addressed. Also, the strengths and weaknesses of the borrower will be compared to its competitors and identified.

The bank evaluates financial value of collateral securities being proposed by borrower. The valuation activities are performed by the enlisted surveyor (a third party company who evaluates collateral’s value) of the bank. The surveyor company provides a Valuation Certificate by mentioning both the Market Value (MV) and the Force Sale Value (FSV) of collateral security. All charges regarding valuation are provided by the clients. The quality and priority of security being proposed will also be assessed by Relationship Manager and Zonal Head. The area map, location of the land showing in a sketch with particulars of the property etc. are submitted inevitably along with the valuation certificate.

Any customer or supplier concentration will be indicated the bank, as these will have a significant impact on the future viability of the borrower. UBL analyze a minimum of 3 years historical financial statements of the borrower. Also guarantor’s financial statements will also be analyzed by the bank. The analysis will address the quality and sustainability of earnings, cash flow and the strength of borrower’s balance sheet. The bank gives more importance on the analysis of cash flows, leverage and profitability. Required financial ratio analyses are calculated by UBL to justify the financial strength of the company from their financial statements.

In case of term loan facilities (tenor more than 1 year) borrower’s future/ projected financial performance should be provided, indicating an analysis of the sufficiency of cash flow to service debt repayments. Loans will not be granted if projected cash flow is insufficient to repay debt.

For existing borrowers, the historical performance in meeting repayment obligations is assessed by UBL.

Mitigating factors are specified against risks identified in the credit assessment. Possible risks include, but are not limited to margin sustainability and/ or volatility, high debt load(leverage/gearing), overtrading, overstocking, or debtor issues; rapid growth; acquisition or expansion; new business line/ product expansion; management changes or succession issues; customer or supplier concentrations and lack of tran sparency or industry issues.

The amounts and tenors of financing proposed are justified based on the projected repayment ability and loan purpose. Excessive tenor or amount compared to business needs lead to increase in risk of fund diversion and may adversely impact the borrower’s repayment ability.

Credit proposals and granting of loans depend on sound fundamentals, supported by a through financial and risk analysis. Credit Risk Grading is performed by using Risk Grading Techniques, to know the intensity of risks associated with the loan proposal.

Credit Risk Management Process Credit Risk Grading:

CRG is a collective definition based on the pre-specified scale and reflects the underlying credit risk for a given exposure. A credit risk grading deploys a number or alphabet or symbol as a summary indicator of risk associated with a credit exposure. CRG is the basic module for developing a credit Risk Management System.

Functions of

Well managed credit risk grading system promotes safety and soundness of banks by facilitating informed decision making. Grading system measures credit risk and differentiates individual credit or groups of credits by the risk they pose. This allows management to monitor changes and trends in risk levels. The process also helps the management to optimize returns.

Use of CRG

UBL adopt the Risk Grading System prepared by Bangladesh Bank as a mandatory requirement for all exposures irrespective of amount for all lending except Small Enterprises financing and special credit of UBL. The aggregation of such grading across the borrowers, activities and lines of business provide a better assessment of the quality of the credit portfolio of the branches and the bank as a whole.

The Risk Grading System is vital for decision making at pre and post sanction stages. At pre-sanction stage, it helps in approval of decisions in terms of extent of exposure, appropriateness of credit facilities, credit structure, loan pricing, mitigating tools, etc. to put a cap on the risk level. At post sanction stage, it helps in deciding the depth and frequency of review, periodicity of grading and other precautions to be taken.

Risk grading is a key measurement of UBL `s asset quality and as such, it is essential that grading is a robust process.

Risk Grading Matrix:

The purpose of Credit Risk Grading Matrix is to apply uniform standards to ensure a common standardized approach to assess the quality of individual obligor, credit portfolio of a unit, line business, the branch or the bank as a whole. These will largely constitute obligor risk level analysis and portfolio risk level analysis.

The following Risk Grading Matrix is provided as a guideline for UBL officials. But there is a chance to assign a more conservative risk grade if conflict arises between risk score and personal judgment

Risk Grading Matrix

| Risk Grading | Short Name | Number | Score |

| Superior | SUP | 1 | Fully Secured-100 |

| Good | GD | 2 | 85+ |

| Acceptable | ACCPT | 3 | 75-84 |

| Marginal/Watch List | MG/WL | 4 | 65-74 |

| Special Mention | SM | 5 | 55-64 |

| Substandard | SS | 6 | 45-54 |

| Doubtful | DF | 7 | 35-44 |

| Bad/Loss | BL | 8 | < 35 |

Risk Grading Process

- For ascertaining Risk Grade of an account, UBL prepares a Financial Spread Sheet (FSS) on the basis of historical financial statements of the party while analyzing the Credit Risk elements of a credit proposal from financial point of view.

- The FSS is well designed and programmed software having two parts- input and output sheets. The financial data of the borrower need to input in the input sheet first, output of FSS is automatically generated.

- Credit Risk Grading is a regulatory requirement for all exposures irrespective of amount for corporate and commercial lending. It is used for all credit facilities-new or renewal for specific transactions or regular limits.

- All risk grades are prepared by the RM and completed in consultation with the Branch Manager.

Credit Risk Grading Review

Credit Risk Grading for each borrower is assigned at the inception of lending and periodically updated. Frequencies of the review of the credit risk grading are mentioned below:

Number | Risk Grading | Review frequency (at least) |

1 | Superior | Annually |

2 | Good | Annually |

3 | Acceptable | Annually |

4 | Marginal/Watch list | Half yearly |

5 | Special Mention | Quarterly |

6 | Sub-standard | Quarterly |

7 | Doubtful | Quarterly |

8 | Bad & Loss | Quarterly |

Credit Monitoring

Credit monitoring helps a bank to get maximum profit by minimizing credit risks. Credit monitoring means to observe whether the repayments of credits (principal amount and interest) from clients are occurring regularly or not, under the terms and conditions of sanctioned credits.

To minimize credit loss, UBL follows a robust monitoring procedure and system that provides an early indication about the deteriorating financial health of a borrower. The system shall be in place to produce and report the following status reports to MD, Head of Credit, Head of Marketing, Branch Managers and RMs.

- Past due principles or interest payments, past due trade bills.

- Breach of covenants.

- Loan terms and conditions that are not complied with, financial statements those are not on a regular basis.

- Documentation deficiencies.

- Any covenant breach or exception to be referred to HOC and RMs for timely follow up.

- Expired Credit Lines.

Branch Monitoring of Credit

- Monitor transactions in accounts to ensure turnover and utilization of limits.

- Thoroughly reviewing all past dues, collateral short fall, covenant breach and other irregularities, if any.

- Rectify all audit objections and follow their suggestions.

- Periodic client calls and reviewed by branch head.

- Factory visit/stock inspection/and progress of work against work/ implementation of projects are to be recorded and reviewed.

- Borrower to be communicated about past dues, overdue installments, expiry of insurance, guarantee, limits etc.

- Early alert reports are prepared within 7days of identification weakness in the business and financial weakness of the client and sent o HO Credit Administration Department.

Non-Performing Loan (NPL) Accounts Management

Management of all NPLs is assigned to the In-charge of Recovery Unit who will be responsible for coordinating and administering the action plan or recovery strategy of the loans. The In-charge will serve as the primary contact person of the loanee after loans are downgraded or classified as sub-standard. To ensure implementation of appropriate action plans or recovery strategies the autonomy of RU be maintained.

Classification of Loans:

Loan classification is required to get a real picture of the advances provided by the Bank. Purpose of loan classification is to be aware about uncertainty and risk. It helps to monitor and take appropriate decision regarding each investment account, all types of investments fall into following four scales:

- Repayment is regular

- Repayment is stopped or irregular but has reasonable prospect of improvement. Interest is booked into Interest Suspense Account and loan loss provision is made.

- Unlikely to be repaid but special collection efforts may result in partial recovery. Loan loss provisions are raised and interest is booked into Interest Suspense Account.

- Very little chance of recovery and legal options is pursued.

CL Statement

| Loan’s Type | Unclassified (Period)

| Substandard (Period) | Doubtful (Period) | Bad (Period)

|

| Continuous and Demand Loans | Expiry up to 5 months | 6 to 8 months | 9 to 11 months | 12 months+ |

| Term Loans up to 5 years | 0 to 5 months | 6 to 11 months | 12 to 17 months | 18 months+ |

| Term Loans more than 5 years | 0 to 11 months | 12 to 17 months | 18 to 23 months | 24 months+ |

| Agricultural Loans | 0 to 11 months | 12 to 13 months | 36 to 59 months | 60 months+ |

Publication of UTTARA BANK LTD.

Credit Recovery Process

The UBL has a rule to create Credit Recovery Unit at the branch to manage the deteriorating Loans and Advances classified as Sub-standard, Doubtful, and Bad & Loss.

Steps of Recovery Process

The Recovery Unit will take normal steps like physical contact with the borrowers and through letters for adjustment of all classified loans. If any borrower fails to do within a specified period final notice followed by a legal notice is served. Even if no tangible result is achieved legal action is to be initiated through the Bank’s Panel lawyers (taking permission from Head office) under provisions of the existing laws (Artha Rin Adalat Ain, 2003) of the country. Recovery Unit at the branch level may also send proposals for amicable settlement or rescheduling of the classified Loans and Advances, through the Zonal Office for approval of Head Office. Recommendation of both the Branch Manager and Zonal Head is required before or after filling of the recovery suit against deposit of down payment.

The Recovery Unit’s primary functions will be to:-

- Determine account action plan or recovery strategy.

- Pursue all options to maximize recovery.

- Ensure making adequate and timely loan loss provision as per Bangladesh Bank’s norms.

- Regular review of all classified loan accounts.

Problems:

I have identified some problems and limitations in credit department of Uttara Bank Limited. Because of these problems UBL cannot provide better services to its clients, which may hamper to reach the ultimate success of the bank. The problems identified are given below:

- The loan processing period is very often lengthy due to make credit proposals, proper documentations and negligence of the employees. Most of this time is spent for the correspondence between the branch and Head Office.

- The terms and conditions of credit division are sometimes difficult to understand and maintain to the ordinary clients.

- In agriculture sector its lending is not satisfactory, which is only 1%.

- Consumer loan facilities like car loan, marriage loan, education loan etc. are almost zero. For this reason this bank lags behind other modern commercial banks.

- The bank avoids corporate (large) enterprise financing to avoid risks associated with it, while trade and commerce financing get highest priority.

- Credit card facility, which is a popular form of money today, is not provided by this bank.

- Lack of manpower slows down to provide better services to its borrower-clients.

- Credit monitoring and supervision activities are very poor and not effective. When a borrower fails to repay 4 or 5 installments then the bank officials go to the bower to persuade him/her.

- The bank has no specific credit recovery unit to realize the credit from borrowers in time. Generally the branch Manager and the Relationship Manager perform these activities.

- This bank has no credit sales and marketing wing to attract and increase valued borrower-clients.

- Due to lack of online banking facilities, the bank is not able to attract new deposits and thus lending ability of the branch is in threat now.

Recommendations:

UBL has been achieving success for twenty nine years, but competition is being increased simultaneously in banking sector of our economy. Lots of banks have been established and they being expanded with the passage of time. To survive as a top banking organization UBL has to do lots of things, some of these are given below:

- The bank should speed up its loan processing time, to ensure better services for its clients. The branch manager should be given more authority to sanction loan for reducing loan processing time.

- The terms and conditions regarding credit should be moderate for the clients. Also, the bank should arrange seminars to clarify the terms and conditions of credit department to its clients.

- To maintain a good portfolio of credit the bank should diversify its loan services. Lending for agriculture and medium enterprise purpose should be increased.

- For increasing the market share the bank should increase its consumer loan facilities.

- The level of lending in corporate (large) enterprise financing should be increased by the bank to increase potentiality of more revenue.

- A large part of business transactions will be done through credit card in near future. So, the bank should introduce credit card facility immediately.

- Skilled manpower should be employed to ensure professionalism for performing financial activities more efficiently.

- For reducing loan loss and maximizing revenue the supervision and monitoring activities should be performed effectively and efficiently.

- The introduction of credit recovery unit can be a unique tool to realize credit from the borrowers.

- Credit sales and marketing wing should be introduced to attract and retain a large number of clients.

- The bank should introduce online banking facility to attract clients and increase deposits, which may increase the fund available for lending.

Conclusion

Uttara Bank Limited is a leading commercial bank in our country for its goodwill, large number of branch, interactive corporate culture and team work among employees. The Savar Branch of UBL offers various types of loans and advances to customers according to banking rules and regulations of our country. The main source of income of the Bank is its credit sanctioned to various parties. The focus of the bank lies on its large clientele base and their expectation from the bank.

The performance of the Branch is satisfactory but not enough to be a top banking company. From the Branch position as on recent year ended, it can say that more emphasize is given to finance for the trade and commerce sector but consumer loan, corporate (large) enterprise financing is not prioritized by the Bank. Skilled manpower and professionalism of employees are necessary for the Bank to provide better services, increase customers and retain them. Introduction of credit card facility, online banking, credit sales and marketing may bring positive result and increase profit of the Bank, which may help the Bank to hold a top position in banking sector. Moreover, proper monitoring, supervision and recovery activities can reduce loan loss and increase credit realization for the bank.

UBL has opportunity to proliferate product line to enhance its sustainable competitive advantage and ensure earning more profit. Business innovation and improvement and removal of present problems may strong the Bank’s position in banking sector and thus the Bank will be able to reach its ultimate goal.