Introduction

The internship report titled “Compensation practice and Employee satisfaction in Banking Industry” is submitted an partial prerequisite of the Bachelor of Business Administration program of. University of development alternative The purpose of this internship report is to learn how to conduct a professional research by exploring practically in banking sector. The topic was assigned by my internship supervisor Ishita Roy, Asst Professor, Department of Business Administration; University of development alternative In essence it comprises the relationship analyst that lies on private sector banks of Bangladesh in the compensation & employee satisfaction.

To complete this study, I have used structured questionnaire & each of the respondents has been interviewed through it. I have used tables & graphs while analysis. My work proceedings- from data collection to report writing was carried out on the basis of my preliminary work Schedule.

Although this research paper was carried out within short spell of time, but I have tried my best to impart the accurate & huge information concerning the comparative study on Compensation practice and Employee satisfaction in Banking Industry. I hope tills paper will facilitates Exim Bank LTD with the concept of Compensation & employee satisfaction (HR practice in organization).

In conclusion & Recommendation the overall picture of this research is compressed in brief & in recommendation part I highlight all the suggestions that I have made as a researcher, to improve the performance of HR department of Exim Bank, Gulshan Branch & I have also presented my work report of my internee program.

Background of the Study

Internship program is a pre-requisite for acquiring Bachelor Of Business Administration degree in . The University of development alternative entire Bachelor program is divided into twelve semesters. The internship program is generally executed in the last semester & it has got the same weight as other courses in the evaluation process. As the classroom discussion alone cannot give proper picture of real business situation, therefore it is as opportunity for the students to know about real life situation through this program. The program consists of at least three phases:

- Orientation with the organization: To acquaint the internee with the structure functions & performance of the organization.

- Completing the project work

- Writing the report

My Internship supervisor Ishita Roy, Asst Professor, Department of Business Administration, has selected the topic for my internship report ““Compensation practice and Employee satisfaction in Banking Industry”

Objective of the Study

General Objective:

To know about the HR management system of “Exim Bank” as a private sector commercial bank, its formation, its functional, operational & managerial aspects.

Project Objective:

Objectives regarding this study are as follows:

- To fulfill academic requirement.

- To gain practical knowledge in the banking sector.

- To collect an overview of the private banking in our country.

- To understand the ways of performance of the HR department of “Exim Bank”.

- To analyze and evaluate the performance of HRD & its Employees of Exim Bank in the field of Compensation & employee satisfaction (Human Resource Management).

- To assess and evaluate the relationship between the compensation paid & the growth of satisfaction of employees in their own job.

- To compare the performance with the standard set by the global market.

Limitations

I have obtained enthusiastic co-operation of the employees of Exim Bank Limited. Several limitations have taken in my project. Among them the following worth mentioning:

The time frame for the preparation of the report was spare. It proved to be very much scanty to engage in detailed research.

During the internship, in many part of my inquiry, my performance was stuck by some lacking in experience.

The survey on Compensation & employee satisfaction was conducted in Exim Bank. But the response was not inspiring, on the pretext of confidentially. For having inadequate data, extensive statistical analysis e.g. hypothesis testing, inferences, time series analysis etc. was not possible.

Banking Industry in Bangladesh

The banking system at independence consisted of two branch offices of the former State Bank of Pakistan and seventeen large commercial banks, two of which were controlled by Bangladeshi interests and three by foreigners other than West Pakistanis. There were fourteen smaller commercial banks. Virtually all banking services were concentrated in urban areas. The newly independent government immediately designated the Dhaka branch of the State Bank of Pakistan as the central bank and renamed it the Bangladesh Bank. The bank was responsible for regulating currency, controlling credit and monetary policy, and administering exchange control and the official foreign exchange reserves.

The Bangladesh government initially nationalized the entire domestic banking system and proceeded to reorganize and rename the various banks. Foreign-owned banks were permitted to continue doing business in Bangladesh. The insurance business was also nationalized and became a source of potential investment funds. Cooperative credit systems and postal savings offices handled service to small individual and rural accounts. The new banking system succeeded in establishing reasonably efficient procedures for managing credit and foreign exchange. The primary function of the credit system throughout the 1970s was to finance trade and the public sector, which together absorbed 75 percent of total advances.

The government’s encouragement during the late 1970s and early 1980s of agricultural development and private industry brought changes in lending strategies. Managed by the Bangladesh Krishi Bank, a specialized agricultural banking institution, lending to farmers and fishermen dramatically expanded. The number of rural bank branches doubled between 1977 and 1985, to more than 3,330. Denationalization and private industrial growth led the Bangladesh Bank and the World Bank to focus their lending on the emerging private manufacturing sector. Scheduled bank advances to private agriculture, as a percentage of sectoral GDP, rose from 2 percent in FY 1979 to 11 percent in FY 1987, while advances to private manufacturing rose from 13 percent to 53 percent.

The transformation of finance priorities has brought with it problems in administration. No sound project-appraisal system was in place to identify viable borrowers and projects. Lending institutions did not have adequate autonomy to choose borrowers and projects and were often instructed by the political authorities. In addition, the incentive system for the banks stressed disbursements rather than recoveries, and the accounting and debt collection systems were inadequate to deal with the problems of loan recovery.

It became more common for borrowers to default on loans than to repay them; the lending system was simply disbursing grant assistance to private individuals who qualified for loans more for political than for economic reasons. The rate of recovery on agricultural loans was only 27 percent in FY 1986, and the rate on industrial loans was even worse. As a result of this poor showing, major donors applied pressure to induce the government and banks to take firmer action to strengthen internal bank management and credit discipline.

As a consequence, recovery rates began to improve in 1987. The National Commission on Money, Credit, and Banking recommended broad structural changes in Bangladesh’s system of financial intermediation early in 1987, many of which were built into a three-year compensatory financing facility signed by Bangladesh with the IMF in February 1987.

One major exception to the management problems of Bangladeshi banks was the Grameen Bank, begun as a government project in 1976 and established in 1983 as an independent bank. In the late 1980s, the bank continued to provide financial resources to the poor on reasonable terms and to generate productive self-employment without external assistance. Its customers were landless persons who took small loans for all types of economic activities, including housing. About 70 percent of the borrowers were women, who were otherwise not much represented in institutional finance.

COMPANY PROFILE

EXIM Bank Limited

was established in 1999 under the leadership of Late Mr. Shahjahan Kabir , founder chairman who had a long dream of floating a commercial bank which would contribute to the socio-economic development of our country. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined their hands with the founder chairman to materialize his dream. Indeed, all of them proved themselves in their respective business as most successful star with their endeavor, intelligence, hard working and talent entrepreneurship. Among them, Mr. Nazrul Islam Mazumder became the honorable chairman after the demise of the honorable founder Chairman.

This bank starts functioning from 3rd August, 1999 with Mr. Alamgir Kabir, FCA as the advisor and Mr. Mohammad Lakiotullah as the Managing Director. Both of them have long experience in the financial sector of our country. By their pragmatic decision and management directives in the operational activities, this bank has earned a secured and distinctive position in the banking industry in terms of performance, growth, and excellent management. The authorized capital and paid up capital of the bank are Tk. 1000.00 million & Tk. 313.87 million respectively. The bank has migrated all of its conventional banking operation into Shariah based Islami banking since July 2004.Their authorized capital is tk.1000.00 crore. The number branches are almost 60 & proposed branches are ten. Their numbers of employee are around1440.

VISION & MISSION

Their vision and mission are stated in the following bullets:

- To be the finest bank in the banking arena of Bangladesh under the Shariah guidelines.

- To maintain Corporate and business ethics.

- To become a trusted repository of customers’ money and their financial advisor.

- To make our stock superior and rewarding to the customers/share holders.

- To display team spirit and professionalism.

- To have a Sound Capital Base.

- To provide high quality financial services in export and import trade.

- To provide excellent quality Customer service.

OBJECTIVE

To receive, borrow or raise money through deposits, loan or otherwise and to give guarantees and indemnities in respect of al debts and contracts.

- To establish welfare oriented banking systems.

- To play a vital role in human development and employment generation to invest money in such manner as may vary from time to time.

- To carry on business of buying and selling currency, gold and other valuable assets.

- To extend counseling and advisory services to the borrowers/ entrepreneurs etc. in utilizing credit facilities of the bank.

- To earn a normal profit for meeting the operational expenses, building of reserve and expansion of activities to cover wider geographical area.

Corporate Culture

This bank is one of the most disciplined Banks with a distinctive corporate culture. Here we believe in shared meaning, shared understanding and shared sense making. Our people can see and understand events, activities, objects and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the Bank and the needs of the customers who are of paramount importance to us. The people in the Bank see themselves as a tight knit team/family that believes in working together for growth. The corporate culture we belong has not been imposed; it has rather been achieved through our corporate conduct.

Management of EXIM Bank

Management is the process of planning, organizing, leading and controlling the work of organization members and of using all available organizational resources to reach stated organizational goals. The strength of a bank depends of the strength of its management team. EXIM Bank is proud to have a team of highly motivated, well-educated and experienced executives who have been contributing substantially to the continued progress of the bank.

Managerial effectiveness has been measured in EXIM Bank in terms of come selected criteria such deposit mobilization, loans and advances made, loan recovery, profitability and productivity. It has been found that EXIM bank is effective in respect of branch expansion, loan disbursement, loan recovery etc.

With a short span of time, EXIM Bank has become one of the leading and most successful bank not only among the third generation banks but also it superseded many other banks and financial institutions belonging to second and even first generation banks fro the point of view of its excellent business performance, extraordinary corporate culture and strong team work under the dynamic leadership of its management. Management is trying to support and assist well-motivated and experienced affairs to run the day to day affairs of the bank smoothly. For maintains quality management, it is required to train-up more official at head office and branch level in respect of sanctioning, disbursement and recovery of credit, project appraisals, customer services etc.

Board of Directors of EXIM Bank Limited :- Chairman –Mr.Md. Nazrul Islam Majumder

Directors

- Mr. Mohammad Abdullah

- Mrs. Nasreen Isalm

- Mrs. Nasima Akhter

- Mr. A.K.M. Nurul Fazal Bulbul

- AlhajMd. Nurul Amin

- Mr. Zubayer Kabir

- Mr.Md. Habibullah

- Md. Abdul Mannan

- Mr. Abdullah Al-Zahir Shapan

- Mr. Mohammed Shahidullah

Human resource management of EXIM Bank

Human resource is the fundamental asset of the organization. Human resource approach is concerned with the growth and development of people toward higher level of competency, creativity and fulfillment. Therefore, human resources development has been given its due importance in an environment that values performance, teamwork, fairness and integrity, it has both qualitative and quantitative dimension. EXIM Bank recognizes that intellectual capital is the most important asset for a financial institution.

Without proper and efficient human resources, no organization can run its operations. The bank believes that the professional competence bank personnel and its commitment for accomplishing assigned responsibilities are a first line of defense to prevent irregularities.

The objectives of Human Resource management of EXIM Bank are as follows:

- Conducting job analysis

- Planning employee needs and recruiting job candidates

- Selecting of candidates

- Orienting and training new employees

- Managing wages and salaries (Compensating Employees) and benefits

- Appraising performance

- Communicating (interview, counseling, disciplining)

- Training and developing managers

- Building employee commitment

Compensation :

Compensation is a systematic approach to providing monetary value to employees in exchange for work performed. Compensation may achieve several purposes assisting in recruitment, job performance, and job satisfaction.

Compensation the methods and practices of maintaining balance between interests of operating the company within the fiscal budget and attracting, developing, retaining, and rewarding high quality staff through wages and salaries which are competitive with the prevailing rates for similar employment in the labor markets.

Today’s compensation systems have come from a long way. With the changing organizational structures workers’ need and compensation systems have also been changing. From the bureaucratic organizations to the participative organizations, employees have started asking for their rights and appropriate compensations. The higher education standards and higher skills required for the jobs have made the organizations provide competitive compensations to their employees.

Compensation strategy is derived from the business strategy. The business goals and objectives are aligned with the HR strategies. Then the compensation committee or the concerned authority formulates the Compensation strategy. It depends on both internal and external factors as well as the life cycle of an organization.

Traditional Compensation Systems

In the traditional organizational structures, employees were expected to work hard and obey the bosses’ orders. In return they were provided with job security, salary increments and promotions annually. The salary was determined on the basis of the job work and the years of experience the employee is holding. Some of the organizations provided for retirement benefits such as, pension plans, for the employees. It was assumed that humans work for money, there was no space for other psychological and social needs of workers.

Change in Compensation Systems

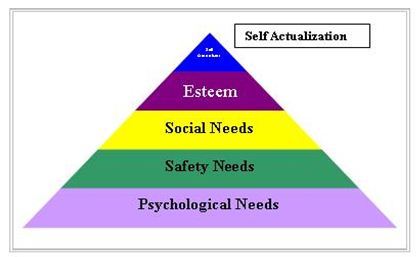

With the behavioral science theories and evolution of labor and trade unions, employees started asking for their rights. Maslow brought in the need hierarchy for the rights of the employees. He stated that employees do not work only for money but there are other needs too which they want to satisfy from their job, i.e. social needs, psychological needs, safety needs, self-actualization, etc. Now the employees were being treated as human resource.

Their performance was being measured and appraised based on the organizational and individual performance. Competition among employees existed. Employees were expected to work hard to have the job security. The compensation system was designed on the basis of job work and related proficiency of the employee.

Today’s Modern Compensation Systems

Today the compensation systems are designed aligned to the business goals and strategies. The employees are expected to work and take their own decisions. Authority is being delegated. Employees feel secured and valued in the organization. Organizations offer monetary and non-monetary benefits to attract and retain the best talents in the competitive environment. Some of the benefits are special allowances like mobile, company’s vehicle; House rent allowances; statutory leaves, etc.

Compensation and Reward system plays vital role in a business organization. Since, among four Ms, i.e. Men, Material, Machine and Money, Men has been most important factor, it is impossible to imagine a business process without Men. Every factor contributes to the process of production/business. It expects return from the business process such as rent is the return expected by the landlord, capitalist expects interest and organizer i.e. entrepreneur expects profits. Similarly the labor expects wages from the process.

Labor plays vital role in bringing about the process of production/business in motion. The other factors being human, has expectations, emotions, ambitions and egos.

Labor therefore expects to have fair share in the business/production process. Therefore a fair compensation system is a must for every business organization. The fair compensation system will help in the following:

- An ideal compensation system will have positive impact on the efficiency and results produced by employees. It will encourage the employees to perform better and achieve the standards fixed.

- It will enhance the process of job evaluation. It will also help in setting up an ideal job evaluation and the set standards would be more realistic and achievable.

- Such a system should be well defined and uniform. It will be apply to all the levels of the organization as a general system.

- The system should be simple and flexible so that every employee would be able to compute his own compensation receivable.

- It should be easy to implement, should not result in exploitation of workers.

- It will raise the morale, efficiency and cooperation among the workers. It, being just and fair would provide satisfaction to the workers.

- Such system would help management in complying with the various labor acts.

- Such system should also solve disputes between the employee union and management.

- The system should follow the management principle of equal pay.

- It should motivate and encouragement those who perform better and should provide Opportunities for those who wish to excel.

- Sound Compensation/Reward System brings peace in the relationship of employer and employees.

- It aims at creating a healthy competition among them and encourages employees to work hard and efficiently.

- The system provides growth and advancement opportunities to the deserving employees.

- The perfect compensation system provides platform for happy and satisfied workforce. This minimizes the labor turnover. The organization enjoys the stability.

- The organization is able to retain the best talent by providing them adequate compensation thereby stopping them from switching over to another job.

- The business organization can think of expansion and growth if it has the support of skillful, talented and happy workforce.

The sound compensation system is hallmark of organization’s success and prosperity. The success and stability of organization is measured with pay-package it provides to its employees.

Purpose or use of compensation:

Compensation is a tool used by management for a variety of purposes to further the existence of the company. Compensation may be adjusted according the business needs, goals, and available resources.

Compensation may be used to:

- Recruit and retain qualified employees.

- Increase or maintain morale/satisfaction.

- Reward and encourage peak performance.

- Achieve internal and external equity.

- Reduce turnover and encourage company loyalty.

- Modify (through negotiations) practices of unions.

Recruitment and retention of qualified employees is a common goal shared by many employers. To some extent, the availability and cost of qualified applicants for open positions is determined by market factors beyond the control of the employer. While an employer may set compensation levels for new hires and advertize those salary ranges, it does so in the context of other employers seeking to hire from the same applicant pool.

Morale and job satisfaction are affected by compensation. Often there is a balance (equity) that must be reached between the monetary value the employer is willing to pay and the sentiments of worth felt be the employee. In an attempt to save money, employers may opt to freeze salaries or salary levels at the expense of satisfaction and morale. Conversely, an employer wishing to reduce employee turnover may seek to increase salaries and salary levels.

Compensation may also be used as a reward for exceptional job performance. Examples of such plans include: bonuses, commissions, stock, and profit sharing, gain sharing.

Components of a compensation system:

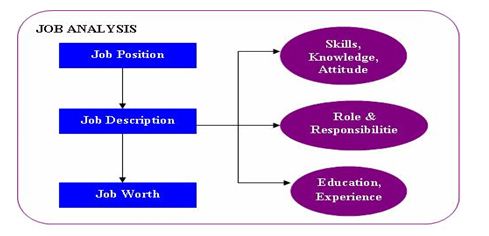

Compensation will be perceived by employees as fair if based on systematic components. Various compensation systems have developed to determine the value of positions. These systems utilize many similar components including job descriptions, salary ranges/structures, and written procedures. Job analysis is a systematic approach to defining the job role, description, requirements, responsibilities, evaluation, etc. It helps in finding out required level of education, skills, knowledge, training, etc for the job position. It also depicts the job worth i.e. measurable effectiveness of the job and contribution of job to the organization. Thus, it effectively contributes to setting up the compensation package for the job position.

The components of a compensation system include:

A critical component of both compensation and selection systems, job descriptions define in writing the responsibilities, requirements, functions, duties, location, environment, conditions, and other aspects of jobs. Descriptions may be developed for jobs individually or for entire job families. The process of analyzing jobs from which job descriptions are developed. Job analysis techniques include the use of interviews, questionnaires, and observation.

Importance of Job Analysis

Job analysis helps in analyzing the resources and establishing the strategies to accomplish the business goals and strategic objectives. It forms the basis for demand-supply analysis, recruitments, compensation management, and training need assessment and performance appraisal.

Components of Job Analysis

It is a systematic procedure to analyze the requirements for the job role and job profile. Job analysis can be further categorized into following sub components.

Job Position

Job position refers to the designation of the job and employee in the organization. Job position forms an important part of the compensation strategy as it determines the level of the job in the organization. For example management level employees receive greater pay scale than non-managerial employees. The non-monetary benefits offered to two different levels in the organization also vary.

Job Description

Job description refers the requirements an organization looks for a particular job position. It states the key skill requirements, the level of experience needed, level of education required, etc. It also describes the roles and responsibilities attached with the job position. The roles and responsibilities are key determinant factor in estimating the level of experience, education, skill, etc required for the job. It also helps in benchmarking the performance standards.

Job worth

Job Worth refers to estimating the job worthiness i.e. how much the job contributes to the organization. It is also known as job evaluation. Job description is used to analyze the job worthiness. It is also known as job evaluation. Roles and responsibilities helps in determining the outcome from the job profile. Once it is determined that how much the job is worth, it becomes easy to define the compensation strategy for the position.

Therefore, job analysis forms an integral part in the formulation of compensation strategy of an organization. Organizations should conduct the job analysis in a systematic at regular intervals. Job analysis can be used for setting up the compensation packages, for reviewing employees’ performance with the standard level of performance, determining the training needs for employees who are lacking certain skills.

Salary Surveys

Collections of salary and market data. May include average salaries, inflation indicators, cost of living indicators, salary budget averages. Companies may purchase results of surveys conducted by survey vendors or may conduct their own salary surveys. When purchasing the results of salary surveys conducted by other vendors, note that surveys may be conducted within a specific industry or across industries as well as within one geographical region or across different geographical regions. Know which industry or geographic location the salary results pertain to before comparing the results to your company.

Types of compensation:

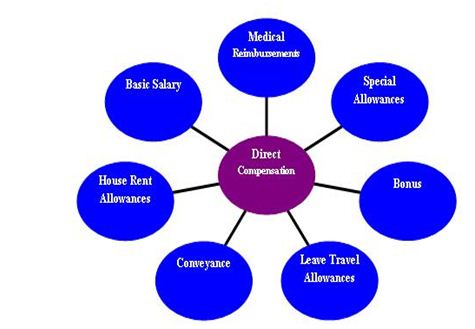

Direct Compensation

Direct compensation refers to monetary benefits offered and provided to employees in return of the services they provide to the organization. The monetary benefits include basic salary, house rent allowance, conveyance, leave travel allowance, medical reimbursements, special allowances, bonus, Pf/Gratuity, etc. They are given at a regular interval at a definite time.

Basic Salary

Salary is the amount received by the employee in lieu of the work done by him/her for a certain period say a day, a week, a month, etc. It is the money an employee receives from his/her employer by rendering his/her services

House Rent Allowance

Organizations either provide accommodations to its employees who are from different state or country or they provide house rent allowances to its employees. This is done to provide them social security and motivate them to work.

Conveyance

Organizations provide for cab facilities to their employees. Few organizations also provide vehicles and petrol allowances to their employees to motivate them.

Leave Travel Allowance

These allowances are provided to retain the best talent in the organization. The employees are given allowances to visit any place they wish with their families. The allowances are scaled as per the position of employee in the organization.

Medical Reimbursement

Organizations also look after the health conditions of their employees. The employees are provided with medi-claims for them and their family members. These medi-claims include health-insurances and treatment bills reimbursements.

Bonus

Bonus is paid to the employees during festive seasons to motivate them and provide them the social security. The bonus amount usually amounts to one month’s salary of the employee.

Special Allowance

Special allowance such as overtime, mobile allowances, meals, commissions, travel expenses, reduced interest loans; insurance, club memberships, etc are provided to employees to provide them social security and motivate them which improve the organizational productivity.

INDIRECT COMPENSATION

INDIRECT COMPENSATION

Indirect compensation refers to non-monetary benefits offered and provided to employees in lieu of the services provided by them to the organization. They include Leave Policy, Overtime Policy, Car policy, Hospitalization, Insurance, Leave travel Assistance Limits, Retirement Benefits, Holiday Homes.

Leave Policy

It is the right of employee to get adequate number of leave while working with the organization. The organizations provide for paid leaves such as, casual leaves, medical leaves (sick leave), and maternity leaves, statutory pay, etc.

Overtime Policy

Employees should be provided with the adequate allowances and facilities during their overtime, if they happened to do so, such as transport facilities, overtime pay, etc.

Hospitalization

The employees should be provided allowances to get their regular check-ups, say at an interval of one year. Even their dependents should be eligible for the midi-claims that provide them emotional and social security.

Insurance

Organizations also provide for accidental insurance and life insurance for employees. This gives them the emotional security and they feel themselves valued in the organization.

Leave Travel

The employees are provided with leaves and travel allowances to go for holiday with their families. Some organizations arrange for a tour for the employees of the organization. This is usually done to make the employees stress free.

Retirement Benefits

Organizations provide for pension plans and other benefits for their employees which benefits them after they retire from the organization at the prescribed age.

Holiday Homes

Organizations provide for holiday homes and guest house for their employees at different locations. These holiday homes are usually located in hill station and other most wanted holiday spots. The organizations make sure that the employees do not face any kind of difficulties during their stay in the guest house.

Flexible Timings

Organizations provide for flexible timings to the employees who cannot come to work during normal shifts due to their personal problems and valid reasons.

Compensation Plans Develop a program outline.

- Set an objective for the program.

- Establish target dates for implementation and completion.

- Determine a budget.

Designate an individual to oversee designing the compensation program.

- Determine whether this position will be permanent or temporary.

- Determine who will oversee the program once it is established.

- Determine the cost of going outside versus looking inside.

- Determine the cost of a consultant’s review.

Develop a compensation philosophy.

- Form a compensation committee (presumably consisting of officers or at least including one officer of the company).

- Decide what, if any, differences should exist in pay structures for executives, professional employees, sales employees, and so on (e.g., hourly versus salaried rates, incentive-based versus no contingent pay).

- Determine whether the company should set salaries at, above, or below market.

- Decide the extent to which employee benefits should replace or supplement cash compensation.

Conduct a job analysis of all positions.

- Conduct a general task analysis by major departments. What tasks must be accomplished by whom?

- Get input from senior vice presidents of marketing, finance, sales, administration, production, and other appropriate departments to determine the organizational structure and primary functions of each.

- Interview department managers and key employees, as necessary, to determine their specific job functions.

- Decide which job classifications should be exempt and which should be nonexempt.

- Develop model job descriptions for exempt and nonexempt positions and distribute the models to incumbents for review and comment; adjust job descriptions if necessary.

- Develop a final draft of job descriptions.

- Meet with department managers, as necessary, to review job descriptions.

- Finalize and document all job descriptions.

Evaluate jobs.

- Rank the jobs within each senior vice presidents and manager’s department, and then rank jobs between and among departments.

- Verify ranking by comparing it to industry market data concerning the ranking, and adjust if necessary.

- Prepare a matrix organizational review.

- On the basis of required tasks and forecasted business plans, develop a matrix of jobs crossing lines and departments.

- Compare the matrix with data from both the company structure and the industry wide market.

- Prepare flow charts of all ranks for each department for ease of interpretation and assessment.

- Present data and charts to the compensation committee for review and adjustment.

Determine grades.

- Establish the num

- ber of levels – senior, junior, intermediate, and beginner – for each job family and assign a grade to each level.

- Determine the number of pay grades, or monetary range of a position at a particular level, within each department.

Establish grade pricing and salary range.

- Establish benchmark (key) jobs.

- Review the market price of benchmark jobs within the industry.

- Establish a trend line in accordance with company philosophy (i.e., where the company wants to be in relation to salary ranges in the industry).

Determine an appropriate salary structure.

- Determine the difference between each salary step.

- Determine a minimum and a maximum percent spread.

- Slot the remaining jobs.

- Review job descriptions.

- Verify the purpose, necessity, or other reasons for maintaining a position.

- Meet with the compensation committee for review, adjustments, and approval.

Develop a salary administration policy.

- Develop and document the general company policy.

- Develop and document specific policies for selected groups.

- Develop and document a strategy for merit raises and other pay increases, such as cost-of-living adjustments, bonuses, annual reviews, and promotions.

- Develop and document procedures to justify the policy (e.g., performance appraisal forms, a merit raise schedule).

- Meet with the compensation committee for review, adjustments, and approval.

Obtain top executives’ approval of the basic salary program.

- Develop and present cost impact studies that project the expense of bringing the present staff up to the proposed levels.

- Present data to the compensation committee for review, adjustment, and approval.

- Present data to the executive operating committee (senior managers and officers) for review and approval.

Communicate the final program to employees and managers.

Present the plan to the compensation committee for feedback, adjustments, review, and approval.

- Make a presentation to executive staff managers for approval or change, and incorporate necessary changes.

- Develop a plan for communicating the new program to employees, using slide shows or movies, literature, handouts, etc.

- Make presentations to managers and employees. Implement the program.

- Design and develop detailed systems, procedures, and forms.

- Work with HR information systems staff to establish effective implementation procedures, to develop appropriate data input forms, and to create effective monitoring reports for senior managers.

- Have the necessary forms printed.

- Develop and determine format specifications for all reports.

- Execute test runs on the human resources information system.

- Execute the program.

BASIC COMPONENTS OF COMPENSATION PROGRAMS

A pay program may include the following four components: base pay, wage and salary add-ons, incentive payments, and benefits and services. Base pay refers to the cash that an employer pays for the work performed. This base pay can be further delineated as either a wage or a salary. Wages are hourly rates of pay regulated by the Fair Labor Standards Act of 1938. This federal legislation formed the foundation of minimum wage, overtime pay, child labor, gender equality, and record keeping requirements for U.S. businesses. Employees who are subject to the Fair Labor Standards Act are known in compensation management parlance as “nonexempt.” Salaries, which are usually paid to managers and professionals, are annual or monthly calculations of pay that usually have less relation to hours worked. Most (but not all) salaried workers are “exempt” from the Fair Labor Standards Act of 1938.

Wage and salary add-ons include cost-of-living adjustments (or COLAs), overtime, holiday and other premium wages, travel and apparel expenses, and a host of related forms of premiums and reimbursements. Wage and salary add-ons are used to compensate employees for work above and beyond their normal work schedules or to reimburse them for expenses related to their jobs. COLAs are usually across-the-board contractual increases tied to an economic indicator, such as the consumer price index, that reports an increase in the cost of living.

Incentive payments refer to funds employees receive for meeting performance or output goals as well as to seniority and merit pay. Companies provide these forms of compensation to influence employee behavior, improve productivity, and reward employees for their years of service or their strong job performance.

Finally, benefits and services include paid time off, health insurance, deferred income such as pension and profit sharing programs, company cars, fitness club memberships, child care services, and tuition reimbursement. Social Security, workers’ compensation, and unemployment compensation are three legally required benefits. Since its initial passage in 1935, the Social Security Act has been amended and expanded to protect workers and their families from losses due to retirement, disability, and/or death.

COMPENSATION ADMINISTRATION MODEL

A general model of compensation administration encompasses the creation and management of a pay system based on four basic, interrelated policy decisions: internal consistency, external competitiveness, employee contributions, and administration of the compensation program. Compensation professionals work with these policy decisions according to individual corporations’ needs, keeping in mind the ultimate objectives of compensation administration—efficiency, equity, and compliance. Companies develop their individual compensation strategies by placing varying degrees of emphasis on these four policy decisions. This model of compensation administration shows how companies consider most of the 13 factors previously presented that influence pay rates.

INTERNAL CONSISTENCY:

Compensation managers seek to achieve internal equity and consistency—rationalizing pay within a single organization from the chief executive officer on down—through the analysis, description, evaluation, and structure of jobs. This policy requires compensation managers to compare jobs or skill levels to determine the contributions employees with different job titles or skill levels make toward accomplishing company goals. Compensation managers, therefore, should consider internal consistency when determining pay rates for employees who do the same work and employees who do different work. The objective of internal consistency is for compensation managers to determine equitable rates of pay by considering the similarities and differences in work content or job skills as well as the different contributions employees with different jobs and skill levels make to a company’s goals. The different values companies have for employees with different jobs reflect the perceived importance of the various jobs or skill levels to achieving company goals.

Internal consistency depends on how a company is structured—i.e., its hierarchy. Companies traditionally maintained larger hierarchies with several levels, but the corporate restructuring and reorganizing trend of the 1990s has resulted in flatter corporate structures with just a few levels. The pay structure of a company is its range of pay rates for different jobs and skill levels within the organization. In other words, pay structures reflect corporate structures. For example, a company may have three organizational levels: executive, managerial, and professional. Each of these levels may correspond to different pay rates. Hence, employees may have salaries of $60,000 in the executive level, $45,000 in the management level, and $30,000 in the professional level. The differences in pay among the various levels are called pay differentials, so the differential between executives and managers is $15,000 and the differential between executives and professionals is $30,000.

An emphasis on internal consistency forces employers to allocate pay fairly across a company’s levels. Consequently, a company with the pay and corporate structure outlined above would have deemed it fair that executives earn twice as much as professionals, which seems reasonable in that some companies pay their highest-paid employees 10 to 200 times as much as their lowest-paid employees.

The number of levels and the degree of pay differentials are based on three general criteria: the value of a job and a job’s responsibilities, the skills and knowledge needed, and job performance and productivity. Employers can use these criteria to modify employee behavior by indicating what kinds of responsibilities, performance, productivity, skills, and knowledge employees need to move into a different level and receive a higher pay rate.

More specifically, six primary but interrelated factors can shape a company’s pay structure:

- Social Customs: Beginning in the thirteenth century, employees began demanding a “just” wage. This idea evolved into the current notion of a federally mandated minimum wage. Hence, economic forces do not determine wages alone.

- Economic Conditions: Demand for labor influences employee wages. Employers pay wages based on the relative contributions employees make to production goals. In addition, supply and demand for knowledge and skills helps determine wages.

- Company Factors: Pay structures depend on the kind of technology a company has and on whether a company uses pay as an incentive to motivate employees to improve job performance and to accept more responsibilities.

- Job Requirements: Some jobs may require greater skills, knowledge, or experience than others and hence fetch a higher pay rate.

- Employee Knowledge and Skills: Likewise, employees bring different levels of skills and knowledge to companies and hence they are qualified to work at different levels of a company hierarchy and receive different rates of pay as a result.

- Employee Acceptance: Employees expect fair pay rates and determine if they receive fair wages by comparing their wages with their coworkers’ and supervisors’ rates of pay. If employees consider their pay rates unfair, they may seek employment elsewhere, put forth little effort in their jobs, or file lawsuits.

EXTERNAL COMPETITIVENESS:

Achieving external competitiveness in the area of compensation means balancing the need to keep operating costs (including labor costs) low with the need to attract and retain quality workers. External competitiveness is how a company’s rates of pay compare to those of its competitors.

Compensation managers achieve external competitiveness by comparing wage levels within their industry, examining their companies’ resources and goals, and establishing their own pay levels accordingly. In general, companies can set their pay levels to lead, match, or follow competitors’ pay practices. Contemporary compensation policies include “variable pay,” where pay levels reflect the fluctuation of the firms’ success or decline, and positioning as “employer of choice.” “Employer of choice” emphasizes the total compensation package, and may include employment security, educational opportunities, and the promise of intellectual challenges or latitude. In practice, some employers use different policies for different units and/or job groups.

Job surveys have also been developed by professional human resource groups over the decades. The New York-based American Management Association’s “Executive Compensation Service” has compiled and published information on compensation and related subjects since 1950. This publication provides a means for measuring a company’s compensation packages against those of other companies.

Establishing the pay level balances a company’s profit requirements with competition for competent employees. Factors determining pay level include:

- Competition in the labor market: the supply and demand for employees with various qualifications.

- Product market conditions: the degree of demand for specific products and the level of industry competition.

- Organizational characteristics: industry, management philosophy, size, and technology.

Weighing all these considerations, firms can choose to pay more than the industry average, and therefore favor attracting and retaining quality employees, or pay less than their competitors’ average hoping to attract and retain employees through no compensation means such as recognition events, achievement celebrations, and working in a pleasant environment. A competitive pay level—one that balances all considerations—can help contain labor costs, enlarge the pool of qualified applicants, increase quality and experience, reduce voluntary turnover, discourage unionization, and abate pay-related work stoppages. Once a company has determined its pay level relative to its competitors, compensation managers must determine the best compensation package for each occupation.

EMPLOYEE CONTRIBUTIONS:

This policy area involves the weight companies choose to place on employee performance in determining a compensation program. Some companies may choose to pay all employees the same wage, while others decide to reward employees for seniority and productivity. Companies that choose the latter route tend to emphasize incentive and merit aspects of compensation programs. This approach enables companies to give their employees a measure of control over their compensation and ideally thereby influence their performance. This policy assumes that employees are significantly motivated by pay, which studies fail to confirm or refute conclusively. Nevertheless, pay studies suggest that pay is one of several important employee motivators, just not the consummate one. Compensation based on employee contributions generally is distributed on the basis of employee evaluations.

In order to carry out evaluations perceived as being fair by employees, companies must establish performance standards. To do so, companies should maintain a list of updated job descriptions that indicate what aspects of employee performance will be measured for each job. The aspects of employee performance to be measured should be reasonably attainable. Furthermore, employees should participate in establishing standards and they should know the standards at the beginning of the review period.

A performance evaluation may include objective and/or subjective measurements. Objective assessments (such as number of pieces produced per hour, number of words typed per minute) are clearly reliable and fair, although they may be more difficult to establish for some jobs. Subjective measurement are problematic because of the potential for bias and because inaccurate measurement can lead to employee frustration and apathy. Some objective methods of compensation for performance have become very popular incentives in the late 20th century.

Perhaps the most common examples are sales commissions and piecework, but creative additions to these staples have been added recently. Gain-sharing programs tie incentives to increased productivity, quality improvements, and or cost savings. Profit sharing links pay to increases in company profits, and employee stock option plans base increased compensation on a company’s stock performance. These programs are geared toward making each employee’s vested interest in the company clearer and more immediate through his or her paycheck. These concepts also help control labor costs, because employees do not receive the rewards unless the company performs well.

ADMINISTRATION:

The administrative policy refers to the tasks of compensation managers in designing and implementing a pay program. Taking into consideration the previous three policies, compensation managers must choose the components that they will include in a company’s compensation program—that is, which kinds of base pay, wage and salary add-ons, incentives, and benefits they will offer employees with different jobs and skill levels. Administration also involves determining whether the pay program will attract and retain needed employees successfully, whether employees consider the pay program fair, how competitors pay their employees and if competitors are more or less productive.

Compensation also must reinforce the organization’s strategic conditions. Intensifying competition in many industries has brought about shifts in overall corporate strategies and changes in compensation. For example, Ford Motor Co. decided to emphasize customer service in the 1990s as part of its marketing strategy. In order to encourage dealerships to shift their focus as well, Ford had to change its incentive program. Whereas incentives had previously been based strictly on sales, they began to relate to more customer-service-oriented goals.

Employee satisfaction

Employee satisfaction is a measure of how happy workers are with their job and working environment. Keeping morale high among workers can be of tremendous benefit to any company, as happy workers will be more likely to produce more, take fewer days off, and stay loyal to the company. There are many factors in improving or maintaining high employee satisfaction, which wise employers would do well to implement. Employee satisfaction is the terminology used to describe whether employees are happy and contented and fulfilling their desires and needs at work. Many measures purport that employee satisfaction is a factor in employee motivation, employee goal achievement, and positive employee morale in the workplace. Satisfied employees can satisfy customers & can get the organizations goal easily.

Employee satisfaction, while generally a positive in your organization, can also be a downer if mediocre employees stay because they are satisfied with your work environment.

Factors contributing to employee satisfaction include treating employees with respect, providing regular employee recognition, empowering employees, offering above industry-average benefits and compensation, providing employee perks and company activities, and positive management within a success framework of goals, measurements, and expectations.

Employee satisfaction is often measured by anonymous employee satisfaction surveys administered periodically that gauge employee satisfaction in areas such as:

- management,

- understanding of mission and vision,

- empowerment,

- teamwork,

- communication, and

- Coworker interaction.

The facets of employee satisfaction measured vary from company to company.

A second method used to measure employee satisfaction is meeting with small groups of employees and asking the same questions verbally. Depending on the culture of the company, either method can contribute knowledge about employee satisfaction to managers and employees.

Measure employee satisfaction:

To measure employee satisfaction, many companies will have mandatory surveys or face-to-face meetings with employees to gain information. Both of these tactics have pros and cons, and should be chosen carefully. Surveys are often anonymous, allowing workers more freedom to be honest without fear of repercussion. Interviews with company management can feel intimidating, but if done correctly can let the worker know that their voice has been heard and their concerns addressed by those in charge. Surveys and meetings can truly get to the center of the data surrounding employee satisfaction, and can be great tools to identify specific problems leading to lowered morale.

Measuring employee satisfaction and productivity levels require the use of employee surveys and measurements of the performance indicators. Companies may use questionnaires and surveys to measure employee satisfaction. Some examples of the performance indicators are

Timeliness, quality, quantity and yearly performance appraisals. Regardless of how these things are measured, employee satisfaction and productivity can be the main ingredients for a successful organization.

Instruction:

- Design an employee satisfaction survey using a range of degrees of satisfaction. For example, the answers may be very satisfied at the highest range and not satisfied at all at the lowest range. Some questions can be about the work itself, supervisor, hours, environment, pay, benefits, co-workers, etc. Prepare at least 25 questions to gather a significant amount of data.

- Develop the tools to measure productivity levels by analyzing the job descriptions and required output. If it is a job that requires so many widgets to be produced in one hour, counting the number of widgets on an hourly basis is easy. If the job requires no more than three errors in a day’s productivity, it is simple to check for errors at the end of the day. Timeliness is measure by number of widgets produced per hour.

- Schedule meetings with supervisors and managers to review employee satisfaction and performance. Have a discussion about previous performance appraisals that revealed attitude.

Factors of Employee satisfaction:

Six factors that influence job satisfaction. When these six factors were high, job satisfaction was high. When the six factors were low, job satisfaction was low. These factors are similar to what we have found in other organizations.

Opportunity

Employee survey studies show that employees are more satisfied when they have challenging opportunities at work. This includes chances to participate in interesting projects, jobs with a satisfying degree of challenge, and opportunities for increased responsibility. Important: this is not simply “promotional opportunity.” As organizations have become flatter, promotions can be rare. People have found challenge through projects, team leadership, special assignments – as well as promotions.

Actions:

- Promote from within when possible.

- Reward promising employees with roles on interesting projects.

- Divide jobs into levels of increasing leadership and responsibility.

It may be possible to create job titles that demonstrate increasing levels of expertise which are not limited by availability of positions. They simply demonstrate achievement.

Stress

When negative stress is continuously high, job satisfaction is low. Jobs are more stressful if they interfere with employees’ personal lives or are a continuing source of worry or concern.

Actions:

- Promote a balance of work and personal lives. Make sure that senior managers model this behavior.

- Distribute work evenly (fairly) within work teams.

- Review work procedures to remove unnecessary “red tape” or bureaucracy.

- Manage the number of interruptions employees have to endure while trying to do their jobs.

- Some organizations utilize exercise or “fun” breaks at work.

Leadership

Data from employee satisfaction surveys has shown employees are more satisfied when their managers are good leaders. This includes motivating employees to do a good job, striving for excellence, or just taking action.

Actions:

- Make sure your managers are well trained. Leadership combines attitudes and behavior. It can be learned.

- People respond to managers that they can trust and who inspire them to achieve meaningful goals.

Work Standards

Employee survey data points out those employees are more satisfied when their entire workgroup takes pride in the quality of its work.

Actions:

- Encourage communication between employees and customers. Quality gains importance when employees see its impact on customers.

- Develop meaningful measures of quality. Celebrate achievements in quality.

Trap: Be cautious of slick, “packaged” campaigns that are perceived as superficial and patronizing.

Fair Rewards

Employees are more satisfied when they feel they are rewarded fairly for the work they do. Consider employee responsibilities, the effort they have put forth, the work they have done well, and the demands of their jobs.

Actions:

- Make sure rewards are for genuine contributions to the organization.

- Be consistent in your reward policies.

- If your wages are competitive, make sure employees know this.

- Rewards can include a variety of benefits and perks other than money.

As an added benefit, employees who are rewarded fairly, experience less stress.

Adequate Authority

Employees are more satisfied when they have adequate freedom and authority to do their jobs.

Actions:

When reasonable:

- Let employees make decisions.

- Allow employees to have input on decisions that will affect them.

- Establish work goals, but let employees determine how they will achieve those goals. Later reviews may identify innovative “best practices.”

- Ask, “If there were just one or two decisions that you could make, which ones would make the biggest difference in your job?”

Other factors influences / effects to employee satisfaction: It can include factors as following:

Organization development factors

• Brand of organization in business field and comparison with leading competitor.

• Missions and Vision of organization.

• Potential development of organization.

Policies of compensation and benefits factors

• Wage and salary

• Benefits

• Rewards and penalties

Promotions and career development factors

• Opportunities for promotion.

• Training program participated or will do.

• Capacity of career development

Work task factors

• Quantity of task

• Difficult level of task

Relationship with supervisor factors

• Level of coaching

• Level of assignment for employee

• Treatment to employee etc

Working conditions and environment factors

• Tools and equipment

• working methods

• Working environment

Corporate culture factors

• Relationship with coworkers

• Level of sharing etc

Competencies, Personalities and Expectations of employee factors:

• Competencies and personalities of employee are suitable for job?

• Expectations of employee are suitable for policies of organization?

Many experts believe that one of the best ways to maintain employee satisfaction is to make workers feel like part of a family or team. Holding office events, such as parties or group outings, can help build close bonds among workers. Many companies also participate in team-building retreats that are designed to strengthen the working relationship of the employees in a non-work related setting. Camping trips, paintball wars and guided backpacking trips are versions of this type of team-building strategy, with which many employers have found success.

Of course, few workers will not experience a boost in morale after receiving more money. Raises and bonuses can seriously affect employee satisfaction, and should be given when possible. Yet money cannot solve all morale issues, and if a company with widespread problems for workers cannot improve their overall environment, a bonus may be quickly forgotten as the daily stress of an unpleasant job continues to mount.

If possible, provide amenities to your workers to improve morale. Make certain they have a comfortable, clean break room with basic necessities such as running water. Keep facilities such as bathrooms clean and stocked with supplies. While an air of professionalism is necessary for most businesses, allowing workers to keep family photos or small trinkets on their desk can make them feel more comfortable and nested at their workstation. Basic considerations like these can improve employee satisfaction, as workers will feel well cared for by their employers.

The backbone of employee satisfaction is respect for workers and the job they perform. In every interaction with management, employees should be treated with courtesy and interest. An easy avenue for employees to discuss problems with upper management should be maintained and carefully monitored. Even if management cannot meet all the demands of employees, showing workers that they are being heard and putting honest dedication into compromising will often help to improve morale.

Findings of the study

By comparing theoretical background and compensation & employee satisfaction of Exim Bank Ltd, the following points may summarize:

Factors influencing compensation management & employee satisfaction in this organization:

The factors influencing compensation management & employee satisfaction are broken into two categories: Internal and External Compensation basically consists of two types which are, direct and indirect. Exim Bank Limited very much concern about this both types of compensation. And around 75% employees are happy about it. Job Evaluation is done for appraisal and to measure the performance. We know compensation should do in equity. Although some employees do not really think that the bonus that is given to then is not always finely tuned. Pay structures of compensation with each grade containing a minimum salary/wage and either step increments or grade range. Exim Bank Limited is maintaining this through providing increment time to time which approved by the board. Generally they increase the salary 30% on an average. Bonus is another right of the employee which they must get after a certain time. In Exim Bank Limited all regular employees of the Bank who have completed at least six months continuous service with the Bank on the date of declaration of bonus, will be entitled to the incentive bonus. Last time they provide total amount of BD taka 17 crore to their employees. If we compare the benefits and services of Exim Bank with the compensation we can see that they are providing many benefits and services for their employee, like

- Gratuity,

- arranging staff loans,

- provident fund as per provident fund rules,

- Group insurance/ death-cum-survival benefit under Exim Bank superannuation fund.

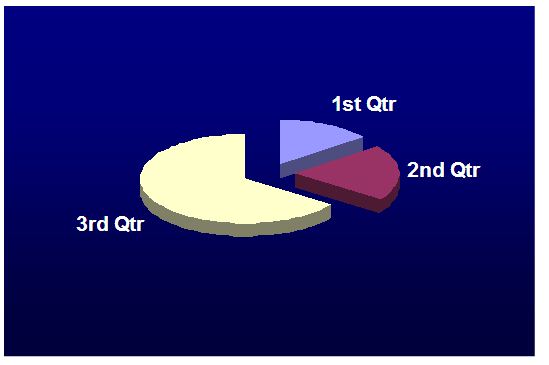

- Last of all It is clearly observed that Exim Bank serving a quite good performance not only in compensation but also in overall activities of HR management and their 75 % employees are happy. Although they have a small portion of dissatisfied employees but overall it is quite good.

Here, 1st qtr represent the percentages of dissatisfied employees

Here, 1st qtr represent the percentages of dissatisfied employees

2nd qtr represent the percentage of moderate employees

3rd qtr represent the percentage of satisfied employees

So, from the overall scenario we can say that, Exim Bank’s employee satisfaction dependent on their compensation system. Compensation system majorly influences the satisfaction level of employees.

Recommendation

Basically, an organization always efforts to increase the employees productivity to face the uncertain environment and always gets its change quickly. The environment change that occurs in any kids of position level, either in basic position, middle, and also top position. The development and innovation in technology and education that quickly happen, has been changing the job characteristics in which needs the special skill, make the employees should increase their skill and ability in completing their work well in order that they can give their high productivity to company. And the same things happened to Exim bank.

The employee productivity is the important discourse for Exim Bank, because it is related to the achievement and performance that can be achieved by employee. In which, it will influence the company performance too. Therefore, company should be able to increase the employee productivity. This can be completed by creating and maintain the work situation and condition that can encourage employee to increase their performance, either when do their job individually or together in a teamwork.

Employee productivity depends on the amount of time an individual is physically present at a job and also the degree to which he or she is “mentally present” or efficiently functioning while present at a job. Exim Bank need to address both of these issues in order to maintain high worker productivity, and this may occur through a variety of strategies that focus on employee satisfaction, health, and morale If an employee believes that their job is interesting and fun, they are more likely to work hard and attend work consistently.

On the other hand, if the employee of Exim bank believes that their job is boring or demanding a negative attitude will develop, leading to a decrease in productivity. Generally, the more productive people are, the more satisfied they tend to be productive employees. When employees feel satisfied they will be less likely to leave their work.Job satisfaction itself depends on the level of intrinsic and extrinsic outcomes and how the jobholder views those outcomes. These outcomes have different values for different people. For some people, responsible and challenging work may have neutral or even negative value depending on their education and prior experience with work providing intrinsic outcomes. For other people, such work outcomes may have high positive values. People differ in the importance they attach to the job outcomes. Those differences would account for different levels of job satisfaction for essentially the same job tasks.

Conclusion

From the aforesaid topic & my point of origin to work in Exim Bank Limited, I can say that I really enjoyed my internship period at Exim Bank Limited form the very first day. I am confident that this 3 (three) months internship program at Exim Bank of Bangladesh will definitely help me to realize my further career in the job market. I also understand:

“People don’t leave their jobs, they leave their managers.”

Although committed and loyal employees are the most influential factor to becoming an employer of choice, it’s no surprise that companies and organizations face significant challenges in developing energized and engaged workforces. However, there is plenty of research to show that increased employee commitment and trust in leadership can positively impact the company’s bottom line. In fact, the true potential of an organization can only be realized when the productivity level of all individuals and teams are fully aligned, committed and energized to successfully accomplish the goals of the organization.

As a result, the goal of every company should be to improve the desire of employees to stay in the relationship they have with the company. When companies understand and manage employee loyalty -rather than retention specifically – they can reap benefits on both sides of the balance sheet i.e., revenues and costs.

Today, employee loyalty needs to be earned, rather than assumed, and must be specific, rather than general – employees are looking at their employment as a means of achieving personal goals rather than simply being the “good corporate soldier” of the past. This means that companies need to express and act on a commitment to develop employees’ career objectives by introducing initiatives that make employees believe that their current job is the best path to achieving their career goals.

However, this is not to claim that pay and benefits are unimportant. There are strong correlations between compensation, benefits plans and employee commitment. It should not be surprising, though, that the compensation plans with the strongest link to employee commitment are those that give employees a stake in the future success of the organization.