Cash flow from operating activities (CFO) is that the cash inflows and outflows of a company’s core business operations. It’s a vital line on the income statement. Income from operating activities doesn’t include long-term capital expenditures or investment revenue and expense. CFO focuses only on the core business and is additionally called operating cash flow (OCF) or net cash from operating activities.

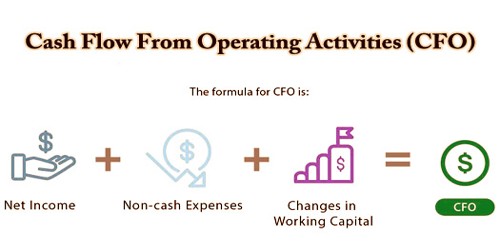

Operating activities include generating revenue, paying expenses, and funding working capital. It is calculated by taking a company’s (1) net income, (2) adjusting for non-cash items, and (3) accounting for changes in working capital. There are two methods for depicting cash from operating activities on a cash flow statement: the indirect method and the direct method.

The indirect method begins with net income from the income statement then adds back noncash items to arrive at a cash basis figure. The direct method tracks all transactions in a period on a cash basis and uses actual cash inflows and outflows on the cash flow statement.

Cash Flow From Operations provides a measurement of money inflows and outflows for a selected period of our time, usually quarterly or annually. CFO excludes cash flows from investing and financing so as to concentrate on the cash flows for the continuing operations which is able to determine the future success of the company.

There is a generic cash flow from operations formula that can be used:

Cash Flow from Operations = Net Income + Non-Cash Items + Changes in Working Capital

In the long run cash flow from operations must be positive for the company to remain solvent. Investing and financing activities are usually cash flow negative, making positive cash flow from operations essential within the long term. It is cash flow from operations which will be wont to make capital expenditures, design new products, make acquisitions (investing activities), pay dividends, repurchase stock, and/or reduce debt (financing activities).

The purpose of defining ‘Cash Flow From Operation Activities’ is to isolate and focus on the well-being of the day-to-day operations or core business of the company. It is the lifeblood of the organization, making it one of the most important metrics an analyst can examine.

Cash availability allows a business the choice to expand, build and launch new products, repurchase shares to affirm their strong financial position, pay out dividends to reward and bolster shareholder confidence or reduce debt to save on interest payments. Investors attempt to look for companies whose share prices are lower and cash flow from operations is showing an upward trend over recent quarters. The disparity indicates that the company has increasing levels of cash flow which, if better utilized, can cause higher share prices in the near future.

Operating cash flow is calculated by starting with net income, which comes from the bottom of the income statement. Since the income statement uses accrual-based accounting, it includes expenses that may not have actually been paid for yet. Thus, net income has to be adjusted by adding back all non-cash expenses like depreciation, stock-based compensation, and others.

Positive (and increasing) cash flow from operating activities indicates that the core business activities of the company are thriving. It provides an additional measure/indicator of profitability potential of a company, in addition to the traditional ones like net income or EBITDA (Earnings Before Interest Taxes Depreciation and Amortization).

The cash flow statement is divided into three sections cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. Collectively, all three sections provide an image of where the company’s cash comes from, how it is spent, and also the net change in cash resulting from the firm’s activities during a given accounting period.

Investors examine a company’s cash flow from operating activities (CFO), within the cash flow statement, to determine where a company is getting its money from. In contrast to investing and financing activities which can be one-time or sporadic revenue, the operating activities are core to the business and are recurring in nature.

Information Sources: