Comparative Analysis of bKash Limited

bKash Limited is a joint venture between BRAC BANK Limited, Bangladesh, and Money in Motion LLC, USA. The ultimate objective of bKash is to ensure access to a broader range of financial services for the people of Bangladesh. It has a special focus to serve the low income masses of the country to achieve broader financial inclusion by providing services that are convenient, affordable and reliable. (bKash, 2013)

The report is containing a comparison between bkash and DBBL Mobile Banking in terms of their branding. There the comparison based on visibility level, area covered by the company and other branding issue.

The report also portrays the industry through Porters’ Five forces model. The state of the industry is best portrayed through the model. The threat of new entrants is low due to the shortage in spectrum and bargaining power of suppliers is also low.

If one studies the comparative analysis of the market, it can be seen that bkash has already built brand equity among its customer. Thus far, it has been able to hold on to its leadership without doing much.

Objectives

In Recent days mobile financing industry become very much comprehensive. It deals with different areas to capture the market & it requires huge promotional activities to survive. Beside this it takes huge effort to known this system with general people. Moreover, they have to come up with different innovative ideas to have a position in the market. Thus, the study covers a broad spectrum such as Service, price, promotion, government, regulation etc. Based on the above facts the specific objectives of the study follows:

- To give an overview of Mobile financing industry in Bangladesh

- To find out about the future prospects in the industry.

- To evaluate the performance of bKash.

- To evaluate the competitiveness of bKash in the market.

- To get an insight of the products of bKash.

Background:

bKash Limited is a subsidiary of BRAC Bank. It is a joint venture organization between Money in Motion, LLC, USA and Brac Bank Limited Bangladesh (bKash, 2013). Its mission is to provide affordable, convenient and reliable financial service towards the customers. Its technology platform is Fundamo (visa) (Bangladesh Bank, 2013). It also has the Full Mobile Financial Service permission. bKash’s mobile network partners are Robi, Grammen Phone, Banglalink and airtel. It is the only the mobile financial service provider which has one service menu for all the operators. It has in total 30,000 agents all over the country. Still now it has the highest numbers of agents in Bangladesh. bKash Limited is giving the service of cash in, cash out, send money (P2P) and payment (payment through organization or in shop). It is offering free registration and also free balance, statement check and changing PIN offer. Rather than the authorized agents it is also available in all Robi WICs, BRAC channel and Continental Courier channel. It’s highest amount of daily transaction limit is 1,25,000 Taka and highest amount of monthly transaction limit is 2,50,000 Taka. Also its monthly highest P2P transaction limit is 25,000 taka (Bank, July 2012). Still now, bKash is the most visible mobile bank in Bangladesh. It is running heavy advertising from the beginning. It is running its marketing through TV advertisement, Radio advertisement, billboard, Poster, festoon, leaflet, shop pointer etc.

bKash provides six type of services. They are:

- Cash- In

- Cash-Out

- Send Money

- Payment

Cash- In

This is a process of deposit money to bKash account. This service is provide in the agent point. The total process is given bellow:

- Go to any bKash Agent

- Let the agent know the amount want to Cash In

- Write down the bKash Account Number and the Cash In amount in the Agent Register

- Pay the amount of money want to Cash in

- In exchange, the agent will send balance to bKash Account.

Cash-Out

If bkash users have sufficient balance in their bKash Account, users can withdraw cash anytime. There is two way of withdraw money from bkash account, one option is from agents and another is from BRAC Bank ATM Booth.

Send Money

Send Money allows you to transfer money from one bKash Account to another bKash Account. To send money the process is given bellow:

- Go to any bKash Mobile Menu by dialing *247#

- Choose “Send Money”

- Enter the bKash Account Number who want to send money to

- Enter the amount who wants to send

- Enter a reference about the transaction.

- Now enter the bKash Mobile Menu PIN to confirm the transaction

Payment

Anyone can make payments from bKash Account to any “Merchant” who accepts “bKash Payment”. For example, if anyonewant to pay after shopping the process will be:

- Go to your bKash Mobile Menu by dialing *247#

- Choose “Payment”

- Enter the Merchant bKash Account Number for pay

- Enter the amount want to pay

- Enter the Counter Number* (the salesperson at the counter will tell you the number

- Now enter bKash Mobile Menu PIN to confirm (bKash, 2013)

Mobile Banking

The massive improvement of technologies around the world brings an opportunity to improve the technological platform of banking sector. The goal of the extending service of banks with improve technology is to satisfy the desire of customers. One of the extending services with modern technological advancement is Mobile Banking. In this process of banking customer are allowed to access into the banking system in anytime from anywhere.

The requirements for this process are to have a mobile device and mobile network connection. The core benefit of this mobile banking is to reach to the people who do not have the access in internet banking or in normal banking procedure. It is mostly helpful for the people of remote areas (GSMA Mobile and Development Intelligence, 2012). According to Raseda Sultana, millions of people across the developing nations are relying on informal economic activities for their living and most of these people are from the bottom stage of the pyramid. These mass populations do not have the access into the basic financial services or the regular banking system. This mobile banking brings the opportunity for these people to get the banking facility. Now the reason why “mobile banking” is getting greater emphasize because more there are than 4 billion mobile subscribers who represent 61% population of world. So it is the best way to reach among the biggest portion of world population. Also, mobile banking needs less processing than general banking process. It helps the banks to reduce cost, requires less storage facility. Mobile Banking is also better process among all the other e-banking process. In internet banking there has the higher risk then mobile banking due to hacking system. Also to use internet banking people needs extra skills to use computer. On the other hand, to use Mobile Bank, customers’ needs to have the basic idea about how to operate mobile in daily life. So to use this mobile banking a great level of awareness is not needed to create. It is said that mobile banking is one of the best thing ever happened in the personal finance management. Through this process customers will keep them attached with the banking system all the time. This mobile banking is still in growing business. In some countries mobile banking is become very much popular while in some countries it is just in the beginning stage. Though it is in an emerging stage but already mobile banking has created a good level of impact in world economy.

World View of Mobile Banking

According to Mas (2010) a financial revolution is happening in money transactional world and it is not only happening only in the skyscrapers of rich countries but also in the slums of developing countries. This revolution is happening through the branchless banking system of mobile banking. Mobile Banking first introduced in 2001. From 2001 to 2006 there were only 10 Mobile Banks were in world. In 2009 it increased up to 25, in 2010 it increased up to 38 and in the middle of 2011 this number of mobile bank increased up to 50. Surprising by the end of 2011 this number reached up to 140 m-commerce organizations. The major mcommerce boom has happened in African region following by Asian countries (Michael U. Klein, 2011) In African Nations, different mobile companies are coming with the mcommerce business. Orange mobile company is running an m-commerce business with brand name of Orange Money mobile banking. They are running this business in Mali, Senegal, Madagascar, Kenya, Ivory Coast and Niger. Since 2008 they have signed up 1 million people. Though there are multiple mobile banks are working in African nations but the real impact has been made by M-Pesa. M-Pesa is a mobile bank which is a subsidiary of Vodafone. Only in Kenya, M-Pesa register more than 13 million customer, while in Tanzania, M-Pesa has 6 Million customers and in 2010 in total 670 million transactions generated through this mobile banking service. In Latin America potion Telefonica is giving the service of mobile banking in four countries. Among those countries in Brazil, mobile banking is establishing its place in good speed. It is believed that after Africa, Latin America is the place where mobile bank will have greater success. In Latin America only 35 percent people have bank account while 90 percent people have mobile phones. In northern American side, in USA almost 20% people are using mobile banking service in regular purpose. In Asian side mobile banking is also on the way of success. In Pakistan, where are only 14% regular banking subscribers in there already 500,000 customers are already subscribed with mobile banking (http://www.thecitizen.co.tz). This mobile banking is also successful in South Korea, Japan, China and Malaysia. In Japan, there are already more than 1.5 million active mobile banking users and it is increasing. Maldives and Bangladesh are also joining in this race. In India till now 77 banks have received the approval for mobile banking. Though mobile banking have a greater success in world-wide it is not seen the success in the European region yet. It’s already failed in Spain, Austria and some Scandinavian countries. In Germany, in 2003 there were 22 banks were giving mobile banking service but in 2006 it reduced into 14. It is believed that after the establishment of 3G service in all over the Europe, then mobile banking may have success in Europe.

Infrastructure for Mobile Banking

Mobile Banking service can be provided in two different processes. One of these are Banks can directly give the mobile banking service towards the customer. In this process banks are having their own network system. On the other hand, in other process banks are using the 3rd party for giving this mobile banking service. In this process banks are having only the database system and the service providing duty is relying on the 3rd party. Now, based on these services providing process, service can be delivered in two different ways. These are application based (GPRS protocol) and the other one is SMS based. In most of the countries especially in the developing countries, SMS based mobile banking is using widely. It requires very low cost and low bandwidth and also it is easy to understand.

Mobile Banking in Bangladesh Banking

Bangladesh is 8th largest populated country in the world with around 161 million populations. In Bangladesh, almost 31.5% populations are living under poverty (The Central Intelligence Agency (CIA), 2013). From this huge population only 13% people have bank account. On the other hand, there are almost 90 million mobile phone subscribers in Bangladesh. From the point of view of Bangladesh, the expansion of e-banking is opposed by the problem of institutional, infrastructure and regulatory problems. Absence of central networking system, unskilled people and absence of proper policies are lacking behind the whole system. Bangladesh Bank is developing country’s payment system but by that time all the banks are not able to improve their ICT system. In this scenario, it’s hard to reach to mass people with current banking system. From this plot, the concept of mobile banking emerged to reach the banking facility to the unbanked people. People also take this system as good one as 69% people believe this “mobile banking” has prospect in Bangladesh (Bank, July 2012)Mobile banking is a new banking concept in Bangladesh. Bangladesh Bank is influencing banks to operate this mobile in a serious manner to reach to the unbanked people of Bangladesh. Bangladesh Bank believes that mobile is the easiest way to reach to the rural part of the country with the banking service.

Still now, Bangladesh Bank has given license to 23 banks to run this mobile banking operation. Among these, 14 banks have full Mobile Financial Service permission and other 9 banks have the permission for international remittance transaction only through mobile. (Bank, July 2012)

Comparative Analysis of bKash Limited

Market Analysis

Mobile Financial Services (MFS) is an approach to offering financial services that combines banking with mobile wireless networks which enables users to execute banking transactions. This means the ability to make deposits, withdraw, and to send or receive funds from a mobile account. Often these services are enabled by the use of bank agents that allow mobile account holders to transact at independent agent locations outside of bank branches. MFS is still new in Bangladesh and this report aims to capture its early development and learn lessons.

Access to formal financial services can help households to better plan and manage their lives. MFS offers the opportunity to build another channel beyond the bank branch and ATM network to enable millions to have easier access to the formal banking system. Bangladesh Bank aims to build a commercially viable, competitive and safe MFS market. Bangladesh has a big market for mobile telecom business and the industry is expanding quickly. This MFS services is given by the mobile operators. The estimated total population of Bangladesh was 152,518,015 on 16th July and the total numbers of active mobile phone subscribers are 92,120,000 at the end of May 2012, i.e. around 60.40% of total population use mobile phones. So MFS have the opportunity to reach around 60.40% of total population in Bangladesh. (Bank, July 2012)

The MFS market is at an early stage of development as the newest providers are seeking to stabilize their technology, build out agent networks and acquire new customers. This involves a complex, sequenced set of activities that includes: (1) finding and training agents, (2) marketing to bring attention to the service, (3) acquiring customers using know‐your‐customer (KYC) and account opening processes while at the same time helping new customers to begin to transact. The deployments that are most active today are seeking to expand their customer bases during 2012. (Bank, July 2012) For example, BRAC Bank/bKash and DBBL aim are aiming for multi‐fold growth during 2012 which could push their combined customer accounts to between 2 and 3 million within a year’s time, possibly more. It is hoped that other providers entering the market might also grow and provide more alternatives and competition. It is still early and much more will be learned about MFS in Bangladesh over the coming year.

Findings on the MFS Market Structure

The MFS guidelines and the ‘honest broker’ role taken on by Bangladesh Bank have been instrumental in the recent growth of this sector. After several years of uncertainty, the firm move by Bangladesh Bank to establish MFS guidelines provided a positive signal that is enabling market growth. Bangladesh Bank has also been proactive in bridging differences between commercial banks and MNOs, and this ‘honest broker’ role has been instrumental to the recent rapid growth of BRAC Bank and Dutch‐Bangla Bank in this sector.

Banks and MNOs share the view that the potential for MFS lies initially with P2P, small merchant payments and mobile top-ups. Interviews and surveys with banks and MNOs presents a consistent picture that the expectations are for small payments to be the early drivers of MFS. At the same time some also see the benefits of safekeeping of funds.

Importantly, banks and MNOs don’t expect large volumes of inward foreign remittances to be received over MFS. They recognize that mobile accounts will need to have more usability before clients will want to receive inward foreign remittances into a mobile account.

Deployments focusing on establishing mobile accounts and driving small domestic payments are the priority. BRAC Bank/bKash and Dutch Bangla Bank are the early leaders in the market. Both Dutch Bangla and BRAC Bank/bKash launched in 2011 and have moved to activate agent networks in nearly all districts. They have built these initial agent networks through NGO partners or other third party distribution companies. Both have opened several hundred thousand mobile accounts and their transaction volumes since launch are higher than others so far. DBBL and BRAC Bank/bKash rely primarily on making contracts with MNOs for the use of USSD channels.

The most significant efforts are currently on identifying, quantifying and negotiating mutually beneficial partnerships between banks and MNOs. MNOs have opened up their USSD channels to banks and more such agreements are being actively negotiated. These negotiations are complicated because of several factors. One is that banks appear to have a regulatory advantage given the clear decision for a bank‐led market. At the same time, banks tend to want MNOs to be a vendor of wireless connections rather than equal business partners in a joint venture. MNOs believe they have more to offer than wireless connectivity. They feel they bring distribution power, an understanding mass market client behaviors and skills in how to manage a business’s involving millions of users. On the other hand, MNOs may not fully appreciate the regulatory risks or business case for the banks. For instance, MNOs may over‐estimate the float revenue banks might gain. These differences of perception are common in other countries as well. Even with agreements in place the further negotiation of adjustments and additions to the partnerships will remain important for market development.

The challenge of forging partnerships is compounded by different expectation of the total size of the MFS market and the timeline to generate an attractive ROI. Some are targeting only several hundred thousand users, while others see the market opportunity to be tens of millions of users. Some market players want to see a positive return on investment in a matter of 1‐2 years. (Bank, July 2012)

Others feel that the micro‐payments business must be very large to succeed and therefore estimate that the market may take up to 5 years to develop. The different perceptions of market size and timelines make the process of partnership negotiation complicated.

Comparative Analysis of Performance

BRAC Bank was founded in 2001 by the large development organization BRAC. While BRAC Bank went public after its first three years in operation it remains affiliated with the broader BRAC group. A third generation bank, BRAC Bank has built its profile based on a core business of lending to the SME market, but added more retail and corporate work in recent years.

In 2011 BRAC Bank launched a 51% owned subsidiary called bKash combined with an investment from the USA based Money in Motion. Bangladesh Bank granted permission to BRAC Bank and bKash jointly to operate the MFS business. The MFS guidelines specifically allow banks and their subsidiaries to carry out the MFS business BRAC Bank/bKash launched its operations in July 2011 and its initial MNO partner was Robi. In January Grameen Phone (GP) opened a USSD channel to bKash opening the service to GP subscribers. BRAC Bank/bKash’s service is delivered over the Fandom platform initially developed in South Africa which has since been acquired by Visa. BRAC Bank/bKash has agents in all districts of Bangladesh and its aspiration is to be a large scale provider of MFS reaching tens of millions of Bangladeshis in a few years’ time. BRAC Bank/bKash are cautious that the service would not be profitable for another 4‐5 years. BRAC Bank/bKash has also received a $10 million grant from the Bill and Melinda Gates Foundation and technical assistance from Shore Bank International to support the launch of its MFS services. BRAC Bank/bKash also partners with BRAC to identify and train new agents in addition to receiving agents from Robi and also searching for agents directly. From BRAC Bank/bKash perspective, the main challenge is to establish sound commercial agreements with MNOs. The other challenge is to motivate agents and clients to begin to use the service more actively. BRAC Bank/bKash believes building the business will take more time, scale and awareness building.

DBBL has long been a strong advocate for the use of technology in banking. Along with its 113 branches, DBBL has been active building a wide payments infrastructure with 2,000 5.5 ATMS and 4,000 POS terminals, 2.3 million debit cards, and an Internet Payment Gateway. DBBL launched its MFS service branded “DBBL Mobile” in March 2011 using a technology platform from an international vendor called Sybase 365. Presently DBBL operates this as a separate platform from its core banking system, but the two systems can be linked in the future. This platform uses various technologies (SMS, IVR, and USSD) to open accounts and process payments. The main service is a menu driven service accessed through USSD channels provided under agreements with Airtel, Banglalink and GP. DBBL also offers an SMS/IVR based service for Citycell subscribers. DBBL makes its services available through a network of 3,181 agents provided by a combination of Banglalink, Citycell, Airtel, and UISC8.

But the largest number of agents DBBL acquires itself through third party distributors. In total DBBL reports agents in 61 districts serve a total of 172 thousand accounts. Dutch‐Bangla Bank sees the main challenges in establishing stable commercial relationships to use the wireless networks of MNOs. It also sees profitability and revenue in the early stages as a major challenge because the revenues are not sufficient to provide the income necessary to agents to build the business. An additional challenge is maintaining quality and covering the high cost of KYC with large numbers of new accounts being opened. (Bank, July 2012)

Subscribers Analysis

bkash Limited is at present leading the industry with around 3 million subscribers out of a total market size of approximately 4.75 million subscribers as of March 2013. DBBL mobile banking has 1 million subscribers in the network and the second position in the industry.

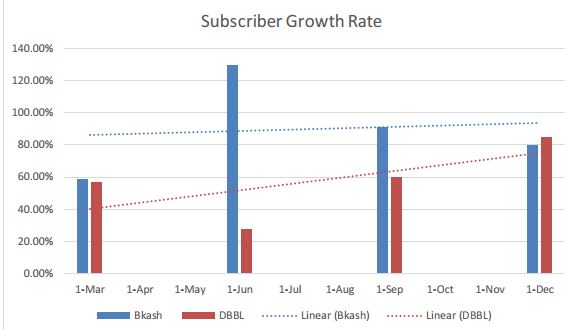

Trust Bank, M-Cash and other MFC is not that much strong to compete with bKash and DBBL. They in total have around .75 million subscribers as of March 2013. Growth rate of subscribers from March, 2012 to March, 2013 are given below:

The result of the analysis is interesting as it is a common perception bkash has the highest subscriber growth rate. We can see that DBBL is continuously growing faster than bkash but they reach 1 million subscribers whereas bkash reach 4 million subscribers with in same time frame. Here we can see growing rate of bkash slowly increasing then DBBL but the number of subscriber is very much high.

Market Share

Mobile financing industry is very new in Bangladeshi market. Now bkash is leading this market with around 71% of market share. Along with bkash DBBL mobile banking have the 24% of market share. Mainly bkash& DBBL mobile banking cover the most of the market. Others company such as Trust Bank, Merkentile Bank, Eastern Bank and others covers 5% of total market share.

Agents Analysis

The total number of agents is reflects the company’s condition in the market. In Mobile financing industry agents is mandatory to provide the service.So all company are try to motivate there agents by commotion. In the chart we can see bkash agents growth rate is slightly down the DBBL but the total number of bkash agents are 40000 where age DBBL have 25085 all over in Bangladesh. The number of bKash agents is high because of they give the agents 30tk on registration but DBBL gave 10tk. So over the last year bkash has more agents point in all over the country then DBBL.

Analysis on Branding

In mobile financing industry companies are not those much aware about the branding because the entire mobile financing service provider is under any BANK. Beside this it seems that bkash and DBBL mobile banking are far aware about branding then others. This two service provider shown uniqueness,Emotional Connections and Consistency in there branding. In bellow we are analysis about their branding in terms of some core branding characteristic.

Visibility

This is one of the core requirements for any branding, without proper visibility level the branding is not profitable. If we talk about bkash branding it is more visible then other brand. Such as bkash have 73 billboards all over the country and those are in well visible label. Beside this DBBL have 500 boards in every sub-District in Bangladesh, but those are not in good visibility level.

Uniqueness

One of the most important site of any product or service branding is its uniqueness. If we see the branding of bkash and DBBL, both the company try to be unique in their branding. Beside this if we compare this two then bkash branding is more unique then DBBL. bKash have boat branding, Car Sticker branding, Drama Branding, on the other site DBBL try to Branding in a traditional way newspaper advertisement and TVC. In bellow I show some picture of unique branding of bkash

Target Audience

In this industry the main target audiences are rural and low income people in our country. MFS try to provide banking service to the people who are usually not interesting in banking. So that the company are branding there product to the target market.If we see the all TVC of bkash and DBBL the made a scenario of rural people. Beside this bkash is more advance then DBBL they are targeting urban people also by providing payment service.

Performance Analysis by Porter’s Five Forces Model

From last year, the competitive environment in the mobile financing industry has become intensely competitive, with not only constant special offers and new value added services, but also with new and bigger entrants.

The following sections describe the competitive environment in the industry using Michael Porter’s five forces model.

Threat of Intense Segment Rivalry

This mobile financing industry is growing very fast. Now bkash and DBBL Mobile Banking dominated the market. This two are covering the market very fast beside this they are try to incise their market share before more computation. But in recent days Ialami Bank Bangladesh introduce M Cash. It could be one of main compotator for those two companies.

However, the monopoly soon came to an end in this industry.

In mobile financing industry there are some banks who are offering mobile banking those are Prime Bank, Bank Asia, Trust Bank, Dhaka Bank, Mercantile Bank, Premier Bank, Jamuna Bank. They all are very much potential compotators in this industry. Here this all companies are very much establishing to run mobile banking. But they are not concentrating in this site so it’s easy to bkash and DBBL for capturing the market.

Since BRAC Bank introduces bKash in this industry they are doing aggressive marketing. Now they are covering 71% of market share with huge number of agents. (Wadud, 2013)They also have TVC, Billboard, Newspaper add to promote their services. Beside this DBBL is doing this kind of branding to promote their mobile banking services.

Now in this mobile banking industry bkash is the market leader, (Wadud, 2013) but growth rate is very high in this industry. So any one can come to this industry and that will be threat for bkash. bKash is very much aware about this that’s why they are capturing the market rapidly. Beside this they introduce their services in every possible scope they have.

After coming in to the industry Islami Bank’s M cash is doing well. They are giving a hard computation to other companies. M cash is doing aggressive marketing in terms of other companies. The visibility of the company is quite good.

So, the rivalry among existing competitors is high.

Threat of New Entrants

Bangladesh Bank introduces a new rule that every Bank should have mobile banking service. So it is not that much hard to new entry in this industry. But beside this Bangladesh bank has some regulation for new entrees. Existing companies have created brand positioning and economies of scale in coverage- that also act as entry barrier. In addition the price battle between the competitors in service charge. So potential direct entry to the industry is relatively restricted at the moment, due to control over licenses. However, companies are finding other ways to enter the industry, i.e. through merging with existing operator’s mobile financing industry are moderate.

Threat of Substitute Products

Mobile Banking is a high-tech industry and the substitutes that would replace the services of today are strongly related to the factor of innovation. In case of Bangladesh mobile telecom banking industry, substitutes exist in the form of government post office and some

However, there is no strong competitive substitute for mobile telecom industry as the existing alternatives are either nearly obsolete or in embryonic stage and thus poses very carrier services little threat to the industry. bkash is only company in the country who provide services in height agents point and ATM booth. However, the substitute services are not much strong so the companies are not giving high concentrate in substitute

So, the threat from substitutes is weak in Bangladesh.

Threat of Buyers Growing Bargaining Power

There are mainly 3 mobile banking operators in Bangladesh and they offer almost homogenous services which have low switching costs between operators and thus has provided buyers with extremely high bargaining power. The bargaining power of buyers in this industry is moderate. With the exception of remote-area customers who have no alternative service available in their vicinity.

Bargaining Power of Suppliers

The bargaining power of suppliers in the mobile industry varies depending on the brand name and strategic importance of the network as well as the size of the Company, such as Grameen phone, Banglalink, Robi, Citycell, Teletalk in the mobile banking industry is that type of suppliers who enjoy strong power in the industry. On the other hand there are many potential suppliers and vendors in mobile banking industry e.g. various agents, merchants such as aarong, agora, bata and others beside this are major suppliers of telecom equipment in Bangladesh the industry is moderate to weak.

SWOT Analysis

To understand the business environment of a particular firm, we need to analyze both the general environment and the firm‘s industry and competitive environment. One of the most basic techniques for analyzing firm and industry conditions is SWOT analysis. It is a widely used technique through which managers create a quick overview of a company‘s strategic situation.

Strengths

bKash Limited: bKash has always been committed to providing quality services. Its strengths include- it‘s the market leader, it has got skilled & dedicated workforce, strong financial position wide range of product and product innovation skills, highest reach in the country, building brand image and reputation in the industry, strong company culture, customer care.

DBBL: The strength of DBBL lies in it’s in its controlling system. They have a mobile banking office in every sub-district all over the country. They have a good number of agent point and merchant account. There controlling system is main strengths along with brand name.

Weaknesses

bkash: The weaknesses of bkash are understand people about the service, facing challenges regarding branding , Sometimes system is down, conflict management skills for solving regulatory problems, poor leadership development from local talents for top level position, poor negotiation & conflict management skills for solving regulatory problems.

DBBL: The weakness of DBBL is their numbers of agent’s .They also have one of the lowest number of merchants account. There branding is very week, they don’t have any billboard whereas bkash have 72 billboard in all over the country. (Wadud, 2013) In agent point there pointer is less visible then bkash one.

Opportunities

bkash: Opportunities of bkash is huge in Bangladeshi market. Because the total number of active mobile phone subscribers are 92,120,000 at the end of May 2012 in Bangladesh. All of the mobile phone subscribers are the potential target market for bkash. Beside this bkash is leading the market so they have more opportunity then other.

DBBL: DBBL has 2nd place in this MFI and this industry has huge number of potential clients untouched. If DBBL want they can increase their customer very fast. Beside this they have huge opportunity for marketing. By this they can promote their product very well.

Threats

bkash: One of the main challenges stems from the perception of technology maintained by low income users. For example, many users mistakenly think that they require advanced skill to use the technology. A similar issue arises in that users often think that advanced English is required to use bKash. So it’s really hard to convince low income users about the invisible money concept.

DBBL: The main threat for DBBL is the rapid growth of bkash. From previous analysis bkash and DBBL started their journey from same time but now bkash has71% and DBBL has 24% market share. If it is continue at this rate sooner bkash capture almost all the market. Besides this mobile banking is a complex system for uneducated people. But their main targeted people are uneducated. So create awareness among the rural people about the mobile banking is another big threats for DBBL.

Findings

The findings of the report are given below:

- Mobile banking is a new technology in Bangladesh which started from 31st March 2011. Dutch Bangla Bank Limited pioneered in mobile banking services in Bangladesh. Most people heard about it but not have a clear idea.

- bkash provide the best quality service among the all company, and they are the market leader also.

- Although bkash and DBBL started their journey in a same year but bkash is now far way then DBBL in terms of service, coverage, branding and other side.

- The total market share of bkash is 71% which is very much high for any industry.

- In one case DBBL have the advantage that is in controlling, because in every subdistrict DBBL have their mobile banking office. On the other site bkash control by their agents

- bkash have strong customer service point, and 24/7 service in call center.

- DBBL have the higher growth rate then bkash but in terms of number of subscribers bkash is far ahead.

- In terms of branding bkash is more visible then DBBL

Recommendations

While working with the report, there were certain things that came in front of my eyes which bkash, I think, should consider. The recommendations are:

- Mobile financing services mainly depend on the technology so bkash need to improve their server as early as possible because some time the server down for one or two hour.

- bkash need to promote their service by doing one to one marketing because of the complexity of the service.

- The payment service of bkash is not satisfactory so that if they want to capture the urban people.

- bkash need to introduce mobile recharge service as early as possible because most of the youth use DBBL mobile banking only because of this service.

- International remittance service of bkash is not clear to everyone so that they need to promote that service with high priority.

- In resent time Islami Bank Bangladesh introduce mobile banking service called MCash. So bkash need to have close observation on M-Cash, because they became the threat for bkash.

Conclusion

It is my immense pleasure to conclude the report as a part of my internship program. The report is a reflection of my work, sincerity, credibility as well as coordination between me & bkash Limited. I tried my best to provide as much as information I could. As the industry is its early stage, companies tend to keep their information confidential. I consider myself lucky to be able to work in a company that provides such scope for learning. Certainly, this is very uncommon in Bangladesh. The work environment is also one of the best among the companies in Bangladesh.

The mobile financing industry is growing at excellent pace. While it took only two year for bkash to reach 3 million, DBBL have 1 million within two year. Beside this all the other companies have huge potential to increase their market share, because the industry is in very early stage. There is huge opportunity for the new interns in the industry.

At the wrapping up it can be said the bkash limited still working hard to grab the market although they are the market leader with 71% market share. But the competition of this industry developed rapidly. But yet bkash is in a comfortable place in this industry but mot in a secure place. To retain the market leader position bkash is introduce new services. If they can continue to cater to the needs of their customers like they are doing now, they have a bright future ahead of them.