The yield to maturity (YTM), book yield, or redemption yield of a bond or other fixed-income asset, such as a bond, is based on the assumption or understanding that an investor buys the security at the current market price and keeps it until the security has matured (reaches its maximum value), and that all interest and coupon payments are made on time. All in all, it is the internal rate of return (IRR) of an interest in a security if the financial backer holds the security until development, with all installments made as planned and reinvested at a similar rate. The YTM is often expressed in terms of Annual Percentage Rate (A.P.R.), but industry convention is more commonly followed. Annualized yields with semi-annual compounding are quoted in a variety of major markets (such as gilts).

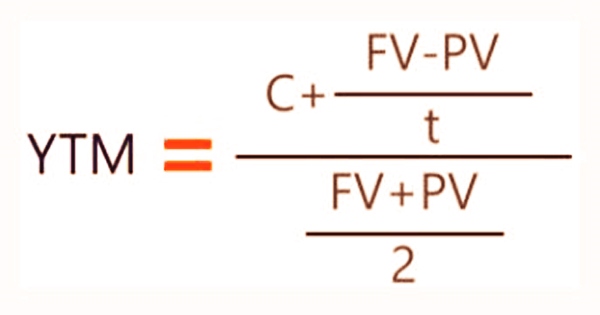

The YTM is similar to the current yield in that it calculates the return that can be expected if security is held for a year. YTM, on the other hand, is slightly ahead of the curve and accounts for the time value of capital. However, in contrast to the current yield, YTM represents the current estimation of a security’s future coupon installments. As such, it factors in the time estimation of cash, though a straightforward current yield figuring doesn’t. As a result, it is often regarded as a more rigorous method of measuring a bond’s return. In most cases, YTM is expressed as an annual percentage rate (APR). The following formula can be used to calculate it:

Where:

C – Interest/coupon payment

FV – Face value of the security

PV – Present value/price of the security

t – How many years it takes the security to reach maturity

The overall expected return for an investor if the bond is held to maturity is known as yield to maturity (YTM). The present values of potential cash flows from an investment that matches the current market price are factored into YTM. The formula’s aim is to calculate a bond’s (or other fixed-asset security’s) yield based on its most recent market price. The YTM estimation is organized to show dependent on intensifying the compelling yield a security ought to have once it arrives at development. It is unique in relation to straightforward yield, which decides the yield a security ought to have upon development, yet depends on profits and not accumulated interest.

The yield to maturity is a single interest rate that equates the present value of a bond’s cash flows to the price of the bond. The coupons must be re-invested in an investment that yields at least as much as the yield on maturity. Reinvestment risk is the risk that the yield to maturity will not be reached because the coupons cannot be reinvested at the YTM rate. It’s imperative to comprehend that the recipe above is just helpful for an approximated YTM. To ascertain the genuine YTM, an investigator or financial backer should utilize the experimentation technique. This is accomplished by substituting various rates into the current value slot of the formula. Once the price matches the current market price of the security, the true YTM is calculated.

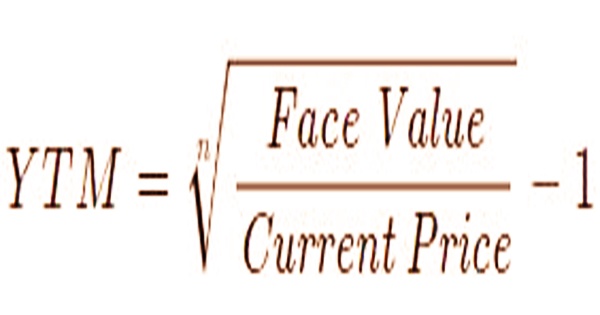

This, however, is based on the premise that the entire profit is reinvested at a constant rate and the investment is kept until maturity. An investor is aware of the bond’s price, coupon payments, and maturity value. However, the discount rate must be calculated; the yield to maturity is the discount rate. The following is the formula for calculating the YTM of a discount bond:

where:

n = number of years to maturity

Face value = bond’s maturity value or par value

Current price = the bond’s price today

Some writing in any case, for example, the paper Yield-to-Maturity and the Reinvestment of Coupon Payments asserts that making the reinvestment supposition that is a typical mix-up in monetary writing and coupon reinvestment isn’t needed for YTM recipe to hold. The present value of all potential cash flows equals the bond’s market price because yield to maturity is the interest rate an investor will receive by reinvesting any coupon payment from the bond at a constant interest rate until the bond’s maturity date.

The essential significance of yield to maturity is the way that it empowers financial backers to draw correlations between various protections and the profits they can anticipate from each. It is basic for figuring out which protections to add to their portfolios. YTM may be used to determine whether or not a bond is a safe investment. It aids in determining whether or not a bond is worth investing in. For a like-to-like comparison, YTM may also be used to compare bonds of different maturities.

At the point when the YTM is not exactly the (normal) yield of another speculation, one may be enticed to trade the ventures. Care ought to be taken to take away any exchange costs, or charges. It is also beneficial in that it helps investors to gain a better understanding of how changes in market conditions can affect their portfolio because when the price of securities falls, the yield rises, and vice versa. The key thing to note is that YTM provides estimated returns to investors. Despite the fact that bonds are definitely less unpredictable than stocks, nothing in the realm of speculations can be taken by the stone. Settle on an educated choice and view at different factors too.

Information Sources: