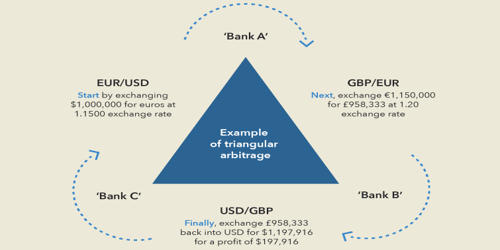

A triangular arbitrage opportunity is a trading strategy that exploits the arbitrage opportunities that exist among three currencies in foreign currency exchange. The aim is to make a profit when there’s a mismatch in the currency exchange rates. It is the act of exploiting an arbitrage opportunity resulting from a pricing discrepancy among three different currencies in the foreign exchange market. It occurs when the exchange rate of a currency does not match the cross-exchange rate. It is the result of a discrepancy between three foreign currencies that occurs when the currency’s exchange rates do not exactly match up. A triangular arbitrage strategy involves three trades, exchanging the initial currency for a second, the second currency for a third, and the third currency for the initial. The trader would exchange an amount at one rate (EUR/USD), convert it again (EUR/GBP) and then convert it finally back to the original (USD/GBP), and assuming low transaction costs, net a profit. The price discrepancies generally arise from situations when one market is overvalued while another is undervalued.

The nature of foreign currency exchange markets limits the price discrepancies between different currencies to a few cents or even to a fraction of a cent. During the second trade, the arbitrageur locks in a zero-risk profit from the discrepancy that exists when the market cross exchange rate is not aligned with the implicit cross exchange rate. This type of arbitrage is a riskless profit that occurs when a quoted exchange rate does not equal the market’s cross-exchange rate. Therefore, the transactions in a triangular arbitrage opportunity involve trading large amounts of money. The competition in the markets constantly corrects the market inefficiencies and arbitrage opportunities do not last long.

Triangular arbitrage opportunities rarely exist in the real world. A profitable trade is only possible if there exist market imperfections. This can be explained by the nature of foreign currency exchange markets. Profitable triangular arbitrage is very rarely possible because when such opportunities arise, traders execute trades that take advantage of the imperfections, and prices to adjust up or down until the opportunity disappears. Opportunities for this method of forex trading are very rare, and traders who manage to capitalize on it usually have sophisticated computer programs to automate the process. However, the strong presence of high-frequency traders makes the markets even more efficient. Price differences between exchange rates are tiny, so you must have a large amount of capital for this form of arbitrage to be worthwhile. Thus, the number of available arbitrage opportunities diminish.