The concept of Time Value of Money

The concept of tome value of money suggests that the money received at a different point of time has a different value. It is the concept that money available at the present time is worth more than the identical sum in the future due to its potential earning capacity. The financial manager must appreciate this fact and understand why they are different and how they are made comparable.

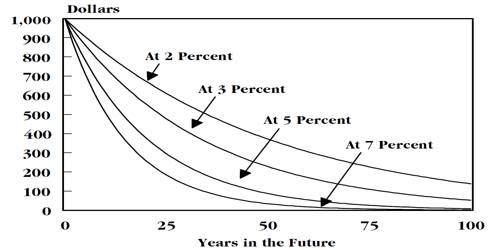

The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future. Time value of money is a concept to understand the value of cash flows occurred at a different point of time. If we are given the alternatives whether to accept $ 100 today or one year from now, then we certainly accept $ 100 today. It is because there is a time value to money. Every sum of money received earlier has a reinvestment opportunity.

For example, if we deposited $ 100 in the savings account at a 5% annual rate of interest, it will increase to $ 105 at the end of one year. Money received at present is preferred even if we do not have reinvestment opportunity. The reason is that the money that we receive in the future has less purchasing power than the money that we have at present due to the inflation. What happens if there is no inflation? Still, money received at present is preferred, it is because most of us have a fundamental behavior to prefer current consumption to future consumption. Thus,

- the reinvestment opportunity or the earning power of the money,

- the risk of inflation, and

- an individual’s preference for current consumption to future consumption are the reasons for the time value of money.

The concept of time value of money is useful in addressing our real-life problems relating to planning for future family expenditure. The fundamental code of finance maintains that given money can generate interest, the value of a certain sum is more if you receive it sooner. Many financial decisions of the firm require a consideration regarding the time value of money. The corporate manager must always concentrate on maximizing shareholders wealth. Maximizing shareholders wealth, to a larger extent, depends on the timing of cash flows from investment alternatives. In this regard, the time value of money concept deserves serious considerations on all financial decisions.

Information Source: