Stock appreciation rights (SARs) refer to the right to obtain compensation equal to a rise in the common stock price of the company over the base price or an appreciation of the equity securities currently trading in the public sector. When the stock price of the company increases, SARs are lucrative for an employee, which makes them equivalent to employee stock options (ESOs). They contrast from alternatives in that the holder/worker doesn’t need to buy anything to get the returns. They are not needed to pay the (choices’) practice cost, yet get the measure of the expansion in real money or stock. The primary advantage of stock appreciation rights is that without having to purchase stock, workers will collect proceeds from stock price rises.

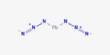

A SAR functions in the same way as a stock option because it gives the holder the right to earn over a fixed period of time an amount equal to the excess market value of the optioned shares. However, a SAR contrasts from an investment opportunity in that a representative gets a similar continues without the money expense related with an activity cost. Stock appreciation rights (SARs) and apparition stock are fundamentally the same as plans. Both are simply cash incentive schemes, although the incentives in the form of shares are paid out by some plans. SAR is said to be a mix of stock options which allows an employee the ability to gain an appreciation of the underlying stock’s value.

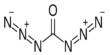

(Example of Stock Appreciation Rights)

SARs normally give the representative a money installment dependent on the expansion in the estimation of an expressed number of offers throughout a particular timeframe. Notwithstanding, the organization may pay the worker reward in offers. In most cases, after vesting, employees can exercise SARs. This basically implies that when SARs vest, they become available for exercise. For each employee, the SAR software arranges the vesting plan after which it can be exercised. The agreement connects SARs to the performance targets set by the organization.

Employers generally issue SARs along with stock options; these stock thankfulness rights are called couple SARs. Phantom stock gives money or stock reward dependent on the estimation of an expressed number of offers, to be paid out toward the finish of a predefined timeframe. SARs do not have a fixed settlement date; the workers may have flexibility on when to choose to exercise the SAR, such as options. As such, it is said that the SARs are in tandem with a stock option and entitle an employee to earn a sum proportionate to any stock price rise above the exercise price of the option.

Like a few different types of stock pay, SARs are adaptable and are regularly dependent upon clawback arrangements. Clawback arrangements indicate conditions under which the organization may reclaim a few or the entirety of the pay got by representatives under the arrangement. On the off chance that representatives anticipate that their own endeavors should impact the future course of the securities exchange’s worth, SARs will serve to rouse such endeavors. As such, SARs serve as a form of compensation for incentives. Under stock option programs, they are often approved because as tandem SARs, they are a necessary addition for workers to use stock options and pay off taxes due at the time of exercise.

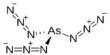

Some phantom proposals require the receiving of the award to achieve those goals, such as revenue, revenues, or other targets. These plans also refer to “performance units” as their phantom stock. Phantom stock and SARs can be given to anybody, however, in the event that they are given out extensively to workers, there is a likelihood that they will be viewed as retirement designs and will be dependent upon government retirement plan rules. Cautious arrangement organizing can maintain a strategic distance from this issue. As with non-qualified stock options, SARs are taxed the same way (NSOs). On either the grant date or when they are vested, there are no tax implications of any sort.

Most businesses will likewise retain supplemental government personal assessment. Besides, they will keep down assets to pay state and neighborhood charges where appropriate. Since SARs and apparition plans are basically money rewards or are conveyed as a stock that holders will need to trade out, organizations need to sort out some way to pay for them. In the form of shares, many employers would also defer taxes on SARs. An employer can for example give only a certain number of shares and withhold the remainder to cover the tax. As with NSOs, when holders sell the securities, the amount of revenue recognized upon exercise becomes the cost base for taxes.

SAR plans offer different focal points over different types of stock pay. One of the advantages is money benefits without financial installments. Another bit of leeway is the adaptability that permits SARs to be organized such that suits the recipients. Companies that give SARs must determine the workers earn them, the importance of these incentives, the liquidity of the SARs, and the rules to be followed for vesting. A SAR course of action is likewise utilized as a representative inspiration procedure by giving extra motivators past the standard pay, which decreases worker turnover rates.

SARs, however, require less shares to be issued and dilute the share price less than conventional stock plans. SARs can also help to inspire and attract workers, much like all other forms of equity compensation. SARs are additionally viewed as appealing pay for representatives, because of the disposal of the special tax assessment from the certified investment opportunities. On the disadvantage, SARs may apply a negative effect on the estimation of an organization’s offers by weakening the per-share profit because of investors.

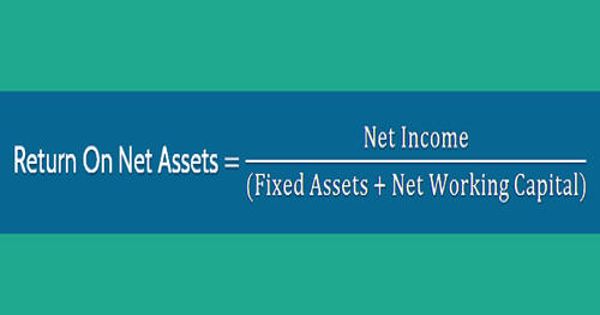

Accounting for phantom stocks and SAR is easy. These arrangements are viewed as deferred cash payments in the same way. Phantom stock is an arrangement entitling an employee to a cash bonus equal to the value of a rise in the stock price at a given time. However, this can drastically underestimate the genuine estimation of an organization, particularly one dependent on scholarly capital. Representatives conceded apparition investment opportunities acknowledge pay available as at the customary pay rate. Stock options are subject to tax status close to that of ordinary revenue and are subject to taxes.

Information Sources: