The degree of uncertainty in investment returns is risk tolerance; it is the capacity of an investor to mentally tolerate the prospect of losing money on an investment. The amount of risk an investor can afford to take is calculated by many factors. A significant factor of investing is risk tolerance. Knowing the risk tolerance level assists financial specialists with arranging their whole portfolio and will drive how they contribute. For instance, if a person’s risk tolerance is low, speculations will be made conservatively and will incorporate all the more okay ventures and less high-hazard ventures. The risk tolerance of an individual will change over his or her life and decide what kind of investments he or she is likely to make. Before selecting their investments, every investor must gauge their risk tolerance.

Those with aggressive risk tolerance will want to concentrate more on stocks, while bonds and other fixed-income assets are likely to be the focus of cautious investors. Age is often associated with risk tolerance, but it is not the only deciding factor. Nonetheless, from an overall perspective, individuals who are more youthful and make some more extended memories skyline are frequently ready to and are urged to face more noteworthy challenges than individuals more established with a more limited term skyline. Not everyone can stomach the thought of a major investment losing money. The higher risk associated with such investments, such as bonds, is also worth the higher reward these investments can offer for certain individuals.

(Risk Tolerance)

More serious risk tolerance is frequently inseparable from values and value assets and ETFs, while lower hazard resilience is regularly connected with securities, security assets, and ETFs. Risk tolerance isn’t static; it can change over the long run, in view of an individual’s monetary standing. Factors that influence Risk Tolerance:

- Timeline: Based on their investment plans, every investor will follow a different time horizon. Generally, if there is more time, more changes may be taken. A person who needs a specific amount of cash toward the finish of fifteen years can face more challenges than a person who needs a similar sum before five years’ over. This is due to the fact that demand over the years has shown an upward trend. In the short term, though, there are constant highs.

- Goals: Financial goals vary from person to person. It is not the main aim of financial planning for many to accumulate the largest sum of money possible. The sum needed to accomplish certain goals is determined, and a speculation technique to convey such returns is typically sought after. Subsequently, every individual will face an alternate challenge resistance dependent on goals.

- Age: Young individuals should usually be able to take more chances than older people. Young people have the potential to make more money and have more time on their hands to deal with market volatility.

- Portfolio size: The bigger the portfolio, the more lenient to chance. A financial specialist with a $50 million portfolio will have the option to face more challenges than a speculator with a $5 million portfolio. If the value decreases, as opposed to a smaller portfolio, the percentage loss is much less in a larger portfolio.

- Investor comfort level: Each investor deals differently with risk. Naturally, some investors are more comfortable with risk-taking than others. Conversely, for some investors, market uncertainty can be particularly frustrating. Therefore, risk tolerance is specifically connected to how relaxed an investor is when taking risks.

Risk tolerance appraisals for speculators flourish, including hazard related reviews or polls. More seasoned speculators and individuals who are near retirement are probably going to have lower risk tolerance. Such investors want to prefer more secure investment instruments over riskier ones, such as certificates of deposit (CDs) or savings accounts. Detailed knowledge of securities and their tendencies makes it possible for certain individuals and institutional investors to buy extremely risky instruments, such as small-company stocks that may plunge to zero or options contracts that may expire worthlessly. While keeping a base of riskless protections, forceful speculators go after the most extreme gets back with the greatest danger.

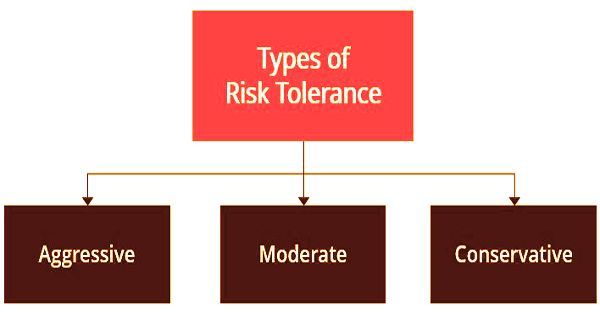

Bonds and savings accounts also don’t have a high return rate, but relative to stocks, they are much less likely to lose money. Some investors are worried about their money’s ability to lose value, even though the investment will bounce back with time. Investors are typically grouped into three principal classes dependent on how much danger they can endure. The classes depend on numerous components, not many of which have been talked about above. The three categories are:

- Aggressive: Aggressive risk investors are well versed and take considerable risks in the market. These types of investors are used in their portfolios to see broad upward and downward movements. It is understood that aggressive investors are affluent, experienced, and typically have a large portfolio. They favor resource classes with a powerful value development, for example, values. Because of the measure of the danger they take, they procure prevalent returns when the market is progressing nicely and normally face tremendous misfortunes when the market performs inadequately. However, at times of crisis in the economy, they do not panic because they are used to volatility on a regular basis.

- Moderate: Moderate investors accept a certain risk to the principal but follow a conservative strategy of five to 10 years of intermediate-term time horizons. Consolidating enormous organization shared assets with less unstable securities and riskless protections, moderate financial specialists regularly seek after a 50/50 structure. A traditional approach could entail investing half of the portfolio in a growth fund that pays dividends.

- Conservative: Conservative investors face a minimal challenge on the market. They don’t enjoy dangerous speculations at all and go for the alternatives they feel are most secure. They organize dodging misfortunes above making gains. The asset classes in which they invest are limited to a few where their capital is secured, such as FD and PPF.

Having a lower risk tolerance over their lives may prevent some investors from making investments that will better help their money grow. When the value of investments drops, an investor has to know how to respond. Many investors are leaving the industry and selling nothing in the process. Simultaneously, a market decrease can be an extraordinary chance to purchase. In this way, discovering hazard resistance helps in settling on educated choices and not makes rushed, unjust choices.

Information Sources: