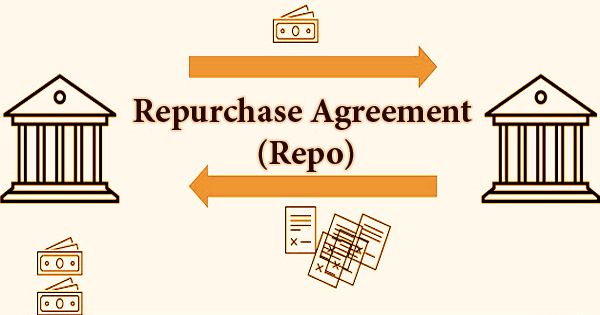

When the buyers buy securities from the seller in return for cash and agree to reverse the deal on a given date, a repurchase agreement, also known as a repo, RP, or sale and repurchase agreement. It operates like a collateralized short-term loan, primarily for government securities. The seller offers the fundamental security to financial specialists and, by an understanding between the two gatherings, repurchases them in a matter of seconds subsequently, normally the next day, at a somewhat more exorbitant cost. Repos are ordinarily used to raise momentary capital. They are likewise a typical instrument of national bank open market tasks. It is a repo for the party selling the security and promising to repurchase it in the future; it is a reverse repurchase deal for the party on the other end of the exchange, purchasing the security and agreeing to sell it in the future.

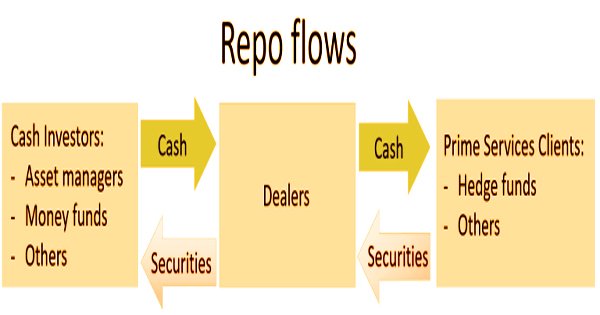

The repo market is a significant wellspring of assets for enormous monetary foundations in the non-store banking area, which has developed to match the customary safe financial area in size. In the United States, the most widely recognized kind of repo is the tri-party understanding. A major commercial bank serves as an intermediary. It negotiates an arrangement between a cash-needing financial institution, usually a bond dealer or hedge fund, and another one with excess loans, such as a money market fund.

Huge institutional speculators, for example, currency market common assets loan cash to monetary establishments, for example, venture banks, either in return for (or made sure about by) insurance, for example, Treasury securities and home loan supported protections held by the borrower monetary foundations. With the guarantee that it will be bought again later at a higher price, repurchase agreements allow the selling of a security to another party. Interest is often received by the consumer. The seller serves as the creditor and the buyer as the lender, with a repurchase agreement being a sell/buy-back kind of loan. The collateral relates to the securities issued, which typically come from the government.

Repurchase arrangements can occur between an assortment of gatherings. The Federal Reserve goes into repurchase arrangements to control the cash supply and bank saves. The gatherings consent to invert the exchange, ordinarily the following day. That exchange is known as a converse repurchase understanding, or opposite repo. The securities dealer posts government short-term securities such as U.S. Bills from the Treasury as leverage. The worth of the collateral is around 2%-3% greater than the money that it earns. That is the money market fund’s benefit for “lending” its cash. The difference in percentage is known as the repo rate.

Repurchase arrangements are carefully transient speculations, and their development period is known as the “rate,” the “term” or the “tenor.” Unlike a made sure about credit, be that as it may, lawful title to the protections passes from the merchant to the purchaser. In fact, coupons (interest payable to the owner of the securities) that are due when the repo buyer owns the securities are generally transferred directly to the repo seller. This may sound counter-intuitive since the legal ownership of the collateral remains with the buyer during the repo agreement. The understanding may rather give that the purchaser gets the coupon, with the money payable on repurchase being acclimated to redress, however, this is more normal of sell/buybacks.

For an overnight repo loan, one day is the negotiated length of the loan. However, the maturity period may be extended by any side, and the agreement sometimes has no maturity date at all. Repos are actual transactions, despite the similarities to collateralized loans. Be that as it may, since the purchaser just has transitory responsibility for security, these arrangements are regularly treated as advances for duty and bookkeeping purposes. Notwithstanding, a vital part of repos is that they are lawfully perceived as a solitary exchange (significant in case of counterparty bankruptcy) and not as removal and repurchase for charge purposes. A repo offers substantial safeguards for lenders from the regular activity of U.S. bankruptcy laws, such as the compulsory stay and avoidance clauses, by structuring the deal as a sale.

On account of liquidation, by and large, repo investors can sell their security. This is another differentiation among repo and collateralized advances; on account of most collateralized advances, bankrupt financial specialists would be dependent upon a programmed stay. The Federal Reserve utilizes in the repo and converses repo exchanges to oversee financing costs. In particular, the federal funds rate is kept within the target range set by the Federal Open Market Committee (FOMC). According to Yale economist Gary Gorton, the repo has developed to provide large non-depositary financial institutions with a form of secured lending similar to the government’s conventional banking depository protection, with the collateral serving as the investor’s guarantee.

A term repo is utilized to put away money or account resources when the gatherings realize how long they should do as such. The New York Times revealed in September 2019 that an expected $1 trillion every day in security esteem is executed in the U.S. repo markets. For distinct types of repo arrangements, the Federal Reserve Bank of New York publishes regular repo collateral amount. If an open repo is not terminated, it rolls over each day automatically. Premium is paid month to month, and the loan cost is occasionally repriced by common understanding. The loan cost on an open repo is for the most part near the government subsidizes rate.

The Federal Reserve and the European Repo and Collateral Council (a body of the International Capital Market Association) have attempted to gauge the size of their separate repo markets. An open repo is used when the parties do not know how long they will need to do so, to spend cash or fund assets. But almost all open agreements are completed in one or two years’ time.

Information Sources: