5.1 Introduction:

International trade involves a flow of goods from seller to buyer in accordance with a contract sale .Different amount of natural resource, while other might have not. Therefore, countries need to exchange goods to satisfy mutual needs and wants.

5.2 INTERNATIONAL TRADE :

International trade involves a flow of goods from seller to buyer in accordance with a contract of scale. It is the exchange of goods and services between peoples of different countries.

5.2.1 Reason for international trade:

Main reason for international trade is as follows :

►Uneven resources distribution:

different countries have different amounts of natural resources, while other might have not. therefore counties need to exchange goods to satisfy mutual needs and wants.

►The lack of self-sufficiency:

Each country can obtain those goods that each alone can not produce or obtain the resources to run them into finished products.

►specialization: the need for trade will arise because a country cannot survive with only one kind of goods (specialization goods )

►Economic principal of comparative advantage:

it is mutually beneficial if each country specializes on producing the goods which is has greater advantage and obtains those goods from other countries that it cannot produce cheaply at home.

►Difference in the demand of goods among countries:

Some countries, which are producers of certain goods, still have to import the same goods from abroad. This may due to the insufficient supply locally to meet the strong demand for the goods.

5.2.2 Benefits of international trade:

Some major benefits of international trade are:

►A gain in output for the participating countries:

international trade enables a country to specialize in the production of goods and services in which it has comparative advantages.

►Better living Standard:

Specialization in production makes goods cheaper, so the Standard of living is improved.

►Economics of scale:

As countries specialize in the production of goods and services, they are able to operate on a large scale, and thus enjoy the benefits arising from the economics of scale.

►Transfer of technology:

The transfer of technology automatically accompanies an exchange of goods because nation can learn from the products of other nations (computer software).

►Improving international relationship:

With more trade activities and closer contact, there comes an exchange of culture and ideas resulting in better understanding among the nation.

►Maintaining price stability:

With international trade, shortage of resources And goods can be solved by imports. Demand and supply can be brought closer together. Price fluctuation can be minimized.

►International trade encourages competitions:

Competition s may help to prevent the growth of domestics monopolies . efficiency in production can be achieved.

5.2.3 Problems in international trade

Risks of goods, credit risk of foreign exchange ,differences in legal systems among countries, differences in political systems among countries, economic divergence. The political and economic condition in one country may deteriorate etc.

5.2.4 The role of banks in enhancing international trade:

►Provision of advances :

The provision of finance to importer (e.g. trust receipt facility, documentary credit facilities ) and exporters (e.g. negotiation of export bills, purchase of bills for collection) encourages enterprise to engage in trade and enhance their liquidity position.

►Provision of alternation payment methods:

Importers may not accept the payment of cash in advance, which gives exporters the greatest protections. On the other hand, the exporters may not accept open account ,which gives Importers the best payment methods. A letter of credit, through bank channels overcomes the disadvantages of these two settlement methods and satisfies to a great extent, both the importer and exporters. So with help of banks volumes can be enlarged.

►Medium of fund transfer:

A bank system allows payment to be made safely and quickly by one part to another, e. g. telegraphic transfer.

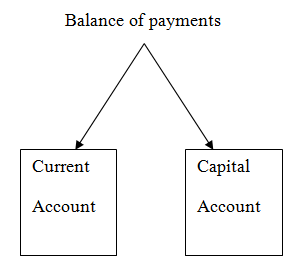

5.3 Balance of payments:

The balance of payments is a bookkeeping system for recording all payments that have as direct bearing on the movement of funds between a nation (private and government) and foreign countries.

Different types of balance of payments:

1)Current Account:

The current account shows international transaction that involve currently produced goods and services. The difference between merchandise export (line 1) and import (line2) is called the trade balance. When merchandise imports are greater than exports, we have a trade deficit. if exports are greater than imports, we have trade surplus. The current account accounts are the net payments or receipts that arise from investment income, the purchase and sale of services and unilateral transfer.

2) Capital Account:

The Capital account describes the flow of capital United States and other countries. Capital outflows are American purchase of foreign assets(a payment item) and capital inflows are foreign purchase s of American assets (a receipts item). The capital outflows are less than the capital inflows.

Balance of payments considerations:

Balance of payments considerations were more important than they are the current management floating regime. When a no reserve currency country is running balance-of-payments deficits. To keep from running out of these reserves, it had to implement concretionary monetary policy to strengthen its currency.

5.4.1 Introduction

Letter of credit can be defined as a credit contact where by the buyers bank is committed (on behalf of the buyer) to place an agreed amount of money at the sellers disposal some agreed conditions. Importer/ seller who applies for opening an l/c and Bank opens/ issues a l/c on behalf of the importer. Bank adds its confirmation to the credit and it is done at request of issuing bank may or may not be the advising bank . advising/notifying bank through which the l/c is advised to the exporters. This bank is actually situated in exports country. It may also assume the role of confirming and/or negotiating bank depending upon the condition of the credit.

5.4.2 Letter of credit:

Letter of credit can be defined as a credit contact where by the buyers bank is committed (on behalf of the buyer ) to place an agreed amount of money at the sellers disposal under some agreed conditions. Since the agreed condition include among other things, the presentation of some specified documents, the letter of credit is called.

5.4.3 Different types of documentary credit (d/c)

A. Red clause credit:

Red clause credit is a special type of credit with a clauses inserted authorized the advising or confirming bank to make advances to the beneficiary before presentation of the documents.

The clause is added in the documentary credit at the request of the applicant for the credit. In other words ,it is a reshipment finance in their form of a loan the advising/confirming bank provides to the beneficiary, with payment of principal and interest guaranteed by the issuing in case the beneficiary fails to ship goods and defaults in payment of the advances.

The credit specified the advances to be given to the beneficiary , which Can be in the form of percentage or a fixed sum .

Finance is given against undertaking from beneficiary certifying that he promise to ship goods and submit documents to advising bank, which has provided him with finance. possible risks in issuing a red clause credit –

■Exporter may use the advance for other purpose

■Documents presented from the exporter may have discrepancies unacceptable to the importer.

B. Revolving credit

A revolving credit is a credit, which provides for the amount of the credit to be renewed automatically after use without the need to renew the credit every time. It can be revolved with respect to either

■ Time or

■ Amount (i.e. total value of the credit)

A revolving credit “with respect to time” can be cumulative or non-cumulative. A cumulative revolving credit allows any unused credit amount of a previous month to be carried forward to the next month. A non-cumulative revolving credit, on the other hand, provides for a maximum amount of credit to be drawn each month. If the exporter fails to draw for the month, the amount in the month (full amount or any utilized balance) will be forfeited automatically.

C. Transferable letter of credit

A transferable letter of credit, which can be transferred in whole or in part by the original beneficiary to one or more “second beneficiaries”. It is normally used when the first beneficiary does not supply the goods himself, but acts as a middleman between the supplier and the ultimate buyer.

D. Back-To-Back letter of credit

A Back-To-Back letter of credit is a new credit, it is different from the original credit based on which the bank undertakes the risk under the back-to-back letter of credit. In this case, the banks main surety/security is the original credit (master l/c). the original credit (selling credit ) and the back-to-back credit (buying credit) are separate instruments independent of each other and in no way legally connected, although they both from part of the same business operation. The suppliers (beneficiary of the back-to-back credit ) ships goods to the importer or suppliers goods to the exporter and present documents to the bank as is specified in the credit. It is intendment that the exporter would substitute his own documents for negotiation under the original credit, his liability under the back-to-back credit would be adjusted out of these proceeds. The exporter L/C is marked lien and no margin is taken. So we can say that back-to-back id term given to an ancillary credit which arises where the seller used the credit granted to him by the issuing bank to his suppliers.

E. Confirmed credit

If a letter of credit is confirmed by a bank (the advising bank ), this means , in addition to the definite undertaking to the issuing bank to honor beneficiary’s draft, the advising bank makes also its promise to pay the beneficiary . such confirmation by the advising bank not only confirms the undertaking if the issuing bank but also constitutes an additional promise on the advising bank (which becomes a confirming bank).

5.4.4 Documentary letter of credit:

documentary credit may be either

1. Revocable credit

2. Irrevocable credit,.

- Revocable credit: A revocable credit is a credit , which can be amended are cancelled by the issuing bank at any time without prior notice to the seller.

- Irrevocable credit : An irrevocable credit constitutes a definite undertaking of the issuing bank(since it cannot be amended or cancelled without the agreement of all parties there to), provided that the stipulated documents are resented and the seller satisfies the terms and conditions. This sort of credit always referred to irrevocable letter of credit.

5.4.5 Parties Related to a Letter of Credit:

The parties are:-

- the issuing bank

- the confirming bank, if any

- the beneficiary .

Others parties, which facilitate the documentary credit, are:

- the applicant

- the advising bank

- the negotiating bank / applicant bank

- The transferring bank, if any.

The parties of letter of credit

Importer: purchaser/buyer who applies for opening L/C.

Issuing bank : it is the bank which opens/issues a L/C on behalf of the importer.

Confirming bank: it is the bank, which adds its confirmation to the credit and it is done at request of issuing bank. Confirming bank may not be the advising bank.

Advising/notifying bank: it is the bank through which the L/C is advised to the exporters. This bank is actually situated in exporter’s country. It may also assume the role of confirming and /or negotiating bank depending upon the condition of the credit.

Negotiating bank: it is the bank that negotiates the bills and pays the amount of the beneficiary. The advising bank and the negotiating bank may or may not be the same. Sometimes it can be confirming bank.

Paying /accepting bank: it is the bank on which the bill will be drawn (as per condition of the credit). Usually it is the issuing bank.

Reimbursing bank: it is the bank that would reimburse the negotiating bank after getting payment instruction from issuing bank.

5.4.6 Securitization of L/C application:

The SBL official scrutinizes the application in the following manner—

- the terms and conditions of the l/c must be complied with UCPDC 600 and exchange control & import trade regulation.

- Eligibility of the goods to be imported.

- The L/C must not be opened in favor of the importer.

- Radioactivity report in case of food item.

- Survey report or certificate in case of old machinery.

- Carrying vessel is not of Israel or of Serbia-Montenegro.

- Certificate declaring that the item is in operation not more than 5 years in case of car.

4.4.7 Accounting Treatment in case of L/C Opening:

Now if the officer thinks fit the application to open an l/c,the following entries are given to realize the l/c commission , charges, postage, l/c margin etc.

Clients account —————————————————————- Dr.

Sundry deposit on L/C ——————————————————- Cr.

Income a/c commission —————————————————— Cr.

Sundry deposit margin foreign currency clearing (F.C.C.) A/C——— Cr.

Vat (15% of commission) on l/c ——————————————– Cr.

After that l/c number and the above entries are given in the l/c register ,the contra entries stating the liability of the bank and the client are as follow.

Customers liability ————————————— ———- Dr.

Bankers liability ————————————————————- Cr.

5.4.8 Transmission of L/C to Beneficiary through advising Bank:

When the transmission of T/C is done through tested telex or fax to advise the l/c to the advising bank. The advising bank verifies the authenticity of the L/C.

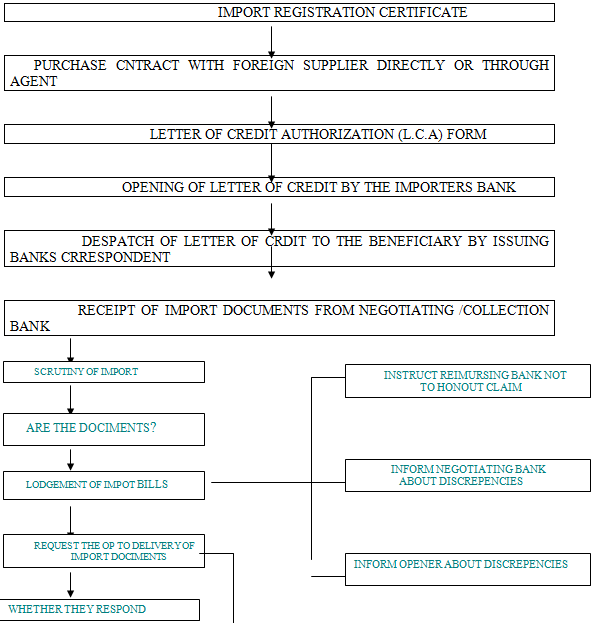

The import procedure can be shown by the following flow chart

SBL has corresponding relationship or arrangement throughout the world by which the L/C is advised. Actually the advising bank does not take any liability if otherwise not required.

5.4.9 Presentation of the document

The seller being satisfied with the terms and the conditions of the credit makes shipment of the goods as per L/C terms.

after making the shipment of the goods in favor of the importer, the exporter submits the documents to the negotiating bank.

After receiving all the documents, the negotiating bank then checks the documents against the credit. If the documents are found in order to. The bank will pay, accept or negotiable to SBL.

Branch & bank received seal to be affixed on the forwarding schedule.

The bill of exchange & transport documents must immediately be crossed to protect loss or fraudulent.

SBL checks the documents. The usual documents are: —

- Invoice.

- Bill of lading.

- Certificate of origin.

- Packing list/weight list.

- Shipping advice.

- Non-negotiable copy of bill of lading.

- Bill of exchange.

- Pre-shipment inspection report.

- Shipment certificate.

5.4.10 Examination of shipping documents

One of the principal of document credit is that all parties deal with document and not with goods (articles 6 of UCPDC-600). That is why; the documents should be scrutinized properly. If any discrepancy in the documents is found that is to be informed to the pity. A checklist may be followed for examining the documents.

5.4.11 Amendment of the letter of credit:

When the parties involved in a L/C, especially the seller want to change the terms and conditions due to some obvious and genuine reasons the credit should be amended. SBL transmits the amendment by tested telex to the advising bank. If the L/C is amended, service charge and telex charge is debited from the account accordingly. According articles 6 of UCPDC 600. amendment must be complete and precise .

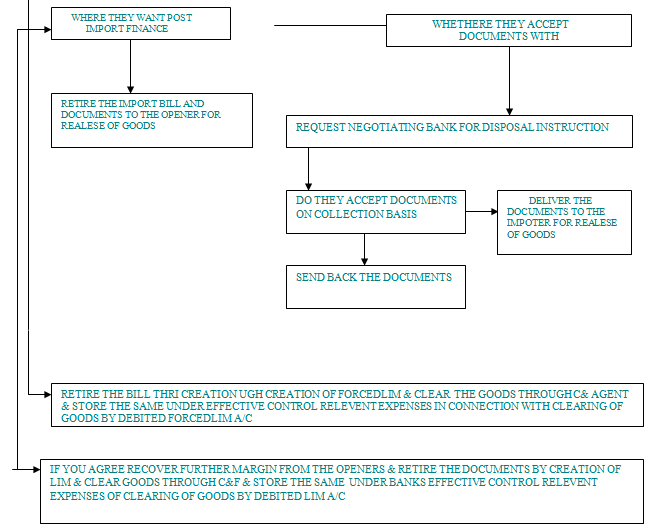

5.4.12 Retirement of shipping document:

On scrutiny , if is found that the document drawn in conformity with the terms of the credit i.e. the documents are in order SBL lodges the documents in pad and following voucher passed.

Accounting treatment

- L/C margin ——————— Dr.

Pad a/c ——————— Cr.

(margin amount transferred to pad a/c)

- Customer a/c ——————– Dr.

Pad a/c —————– Cr.

(customer a/c debited for the remaining account)

- Pad a/c ——————————– Dr.

SBL General a/c ———————- Cr.

Exchange Gains a/c —————— Cr.

(amount given to SBL general a/c and interest credited )

Reversal entries

- Bankers liabilities ————— Dr.

Customer’s liability ———- Cr.

(Lodgments is given)

After realizing the telex charges, services charges, interest (if any), the shipping documents is then stamped with pad numbered and entered in the PAD registered. Intimating is given to the customer calling on the banks counter requesting retirement of the shipping documents. After passing the necessary vouchers, endorsement is made on the back of the bill of exchange as received payment and the bill of lading is endorsed to the effect please delivered to the order of M/S, under two authorized signature of the banks officers(P.A. holder). Then the documents are delivered to the imp.

6. Financial Performance Analysis

With the help of 5 years balance sheet and income statement managed from the Annual Reports of Standard Bank Limited I have done the following ratio analysis.

Financial indicators in the last six years

| Item | Ratio | 2007 | 2006 | 2005 | 2004 | 2003 |

| Earning Ability | Return on Equity | 20.59% | 16.71% | 23.16% | 16.05% | 10.94% |

| Return on Assets | 2.19% | 2.11% | 1.25% | 087% | 0.99% | |

| Net Interest Margin | 3.89% | 3.74% | 2.86% | 2.30% | 3.93% | |

| Earning Base in Assets | 95.21% | 99.42% | 93.94% | 95.70% | 87.49% | |

| Productivity | Deposit Per Branch | 485.00 | 374.16 | 315.50 | 274.91 | 228.23 |

| Deposit Per Employee | 21.56 | 17.32 | 15.65 | 16.82 | 8.41 | |

| Advance Per Branch | 433.38 | 330.14 | 268.90 | 236.52 | 83.53 | |

| Advance Per Employee | 19.26 | 15.28 | 13.34 | 9.85 | 3.08 | |

| Net Profit Per Branch | 13.59 | 10.12 | 5.08 | 3.53 | 2.59 | |

| Net Profit Per Employee | 0.604 | 0.469 | 0.248 | 0.131 | 0.095 | |

| Cost – Efficiency | Manpower Expense to Total Expense | 13.35% | 11.96% | 16.71% | 18.37% | 9.28% |

| Total Interest Expense to Earning Assets | 5.35% | 6.53% | 6.44% | 6.40% | 22.02% | |

| Total Non-Interest Expense to Earning Assets | 2.13% | 2.50% | 2.81% | 2.91% | 7.52% |

Some more parts of this post-

Report On Loan Policies Of Standard Bank Limited (Part-1)